Miningstocks

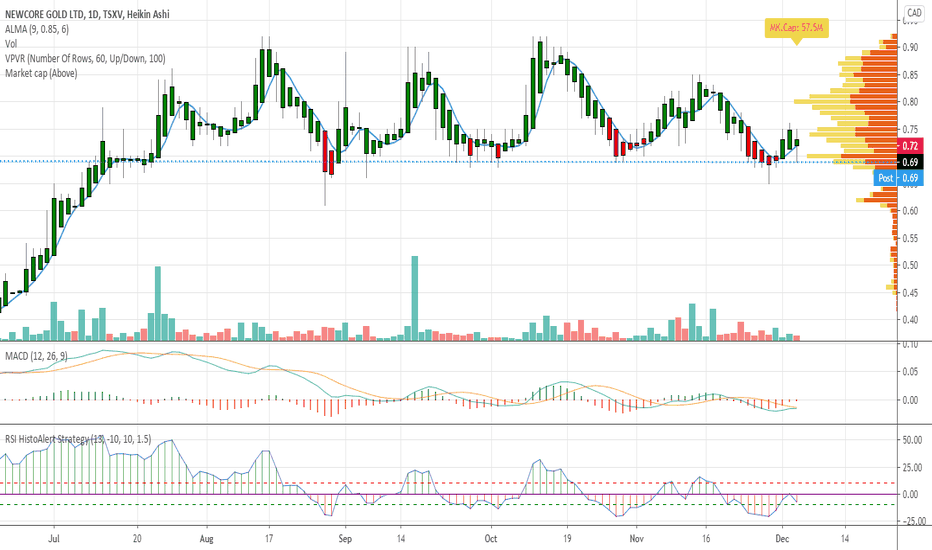

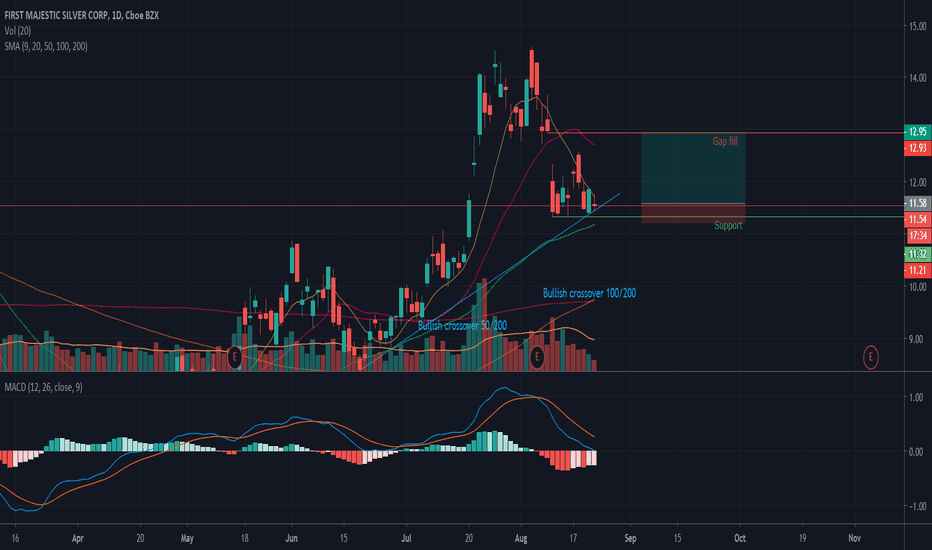

Newcore GOLD LTD - Ghana explorer - DailyNewcore GOLD LTD - Ghana explorer - Daily

last news:

that effective Monday, August 10th, 2020, the Company’s common shares will commence trading on the TSX Venture Exchange under the Company's new name, Newcore Gold Ltd. (“Newcore”) and its new trading symbol "NCAU". Newcore will have 79.9 million shares issued and outstanding with Management and Directors owning a 39% equity interest and institutional shareholders owning an approximate 20% stake.

The new name reflects a turning point and a renewed commitment to realizing the value of the Company’s 100% owned Enchi Project by advancing the current 1.1 million ounce inferred1 gold resource (37.4 million tonnes grading 0.90 g/t Au) located in Ghana, Africa’s largest gold producer. Newcore Gold offers investors a unique combination of top-tier leadership, who are aligned with shareholders through their 39% ownership, and prime district scale exploration opportunities. Enchi’s 216 square kilometre land package covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold belt which hosts several 5 million-ounce gold deposits, including Kinross’ Chirano mine 50 kilometers to the north. Newcore’s vision is to build a responsive, creative and powerful gold enterprise that maximizes returns for shareholders.

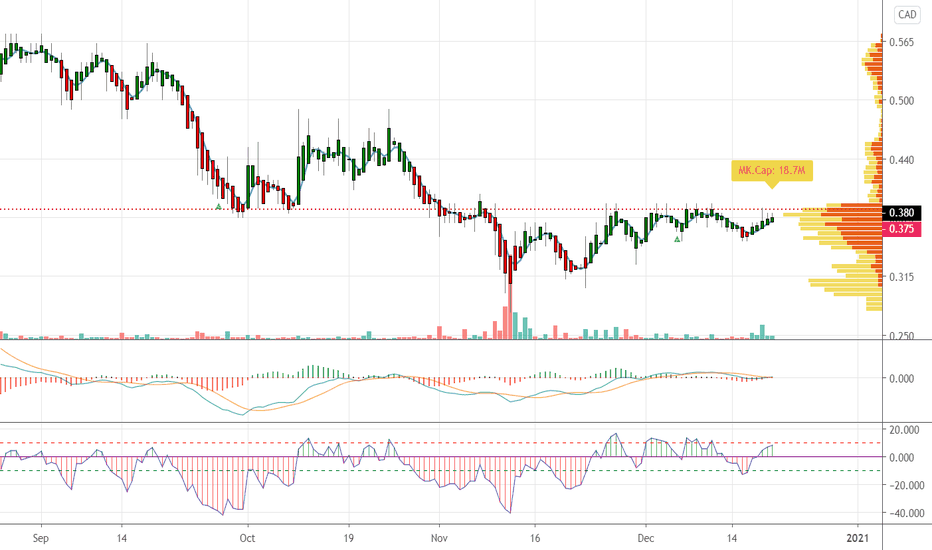

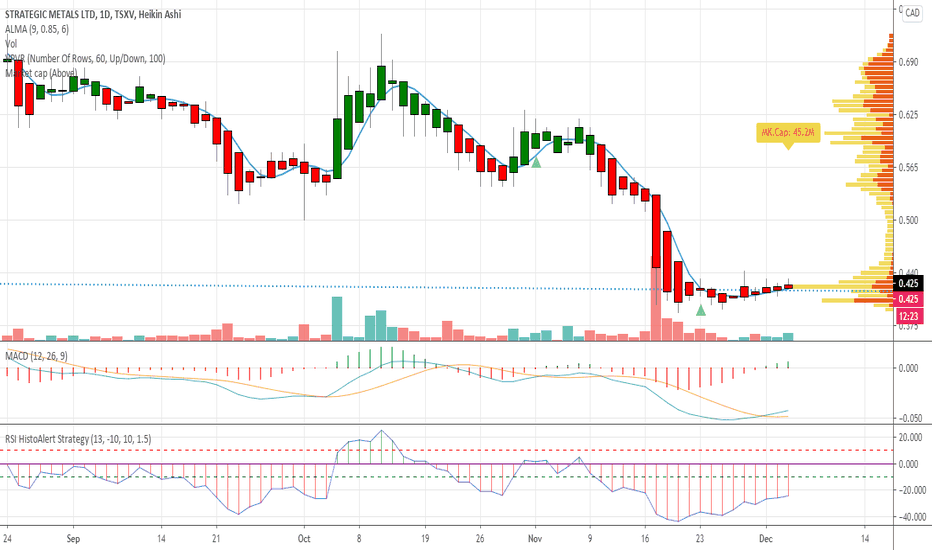

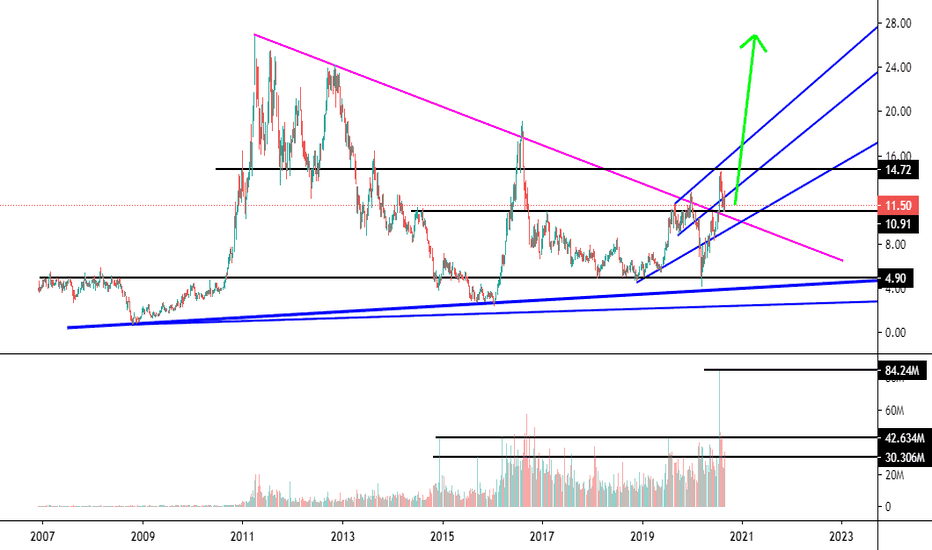

Strategic Metals waiting Drill result - Daily decemberStrategic Metals waiting Drill result - Daily december

Last news:

Strategic has purchased no shares under the Old Bid, which will expire on December 2, 2020. The New Bid will consist of the acquisition by Strategic of up to 8,700,000 common shares of its capital stock, representing approximately 10% of the "public float" of 87,599,346 common shares upon the date of commencement of the New Bid. (There are currently 106,705,767 common shares of Strategic issued and outstanding.) The New Bid will commence on December 3, 2020, and will expire on December 2, 2021.

Strategic is making the New Bid, to succeed the Old Bid (which was limited to an aggregate of 6,600,000 common shares), because it is of the opinion that fluctuating global market conditions periodically (and currently) may result in unwarranted reductions in Strategic's share price that do not reflect the underlying value of its assets. Strategic will utilize unallocated cash resources to effect purchases under the New Bid with a view to capitalizing on these potential price weaknesses. Shares purchased under the New Bid will be made at Management's discretion based on market conditions, and will be returned to Strategic's treasury for cancellation.

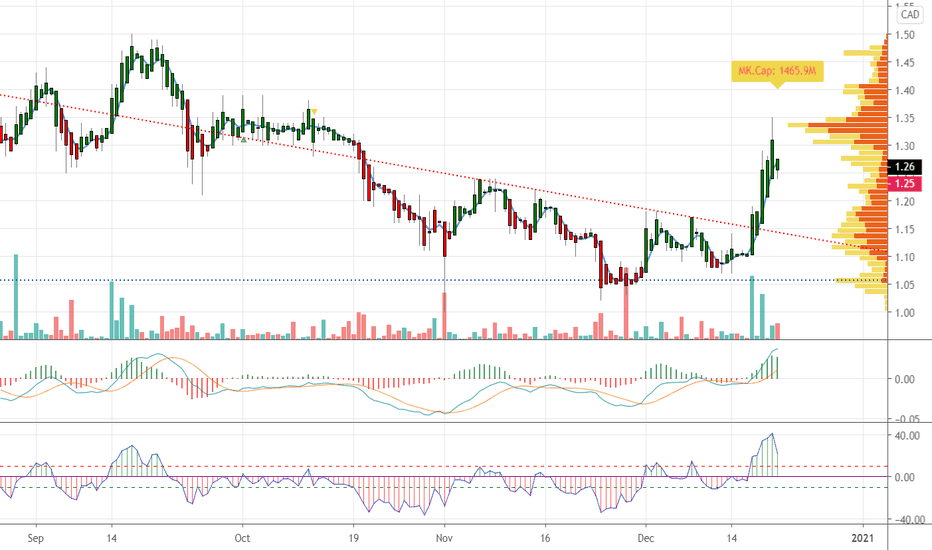

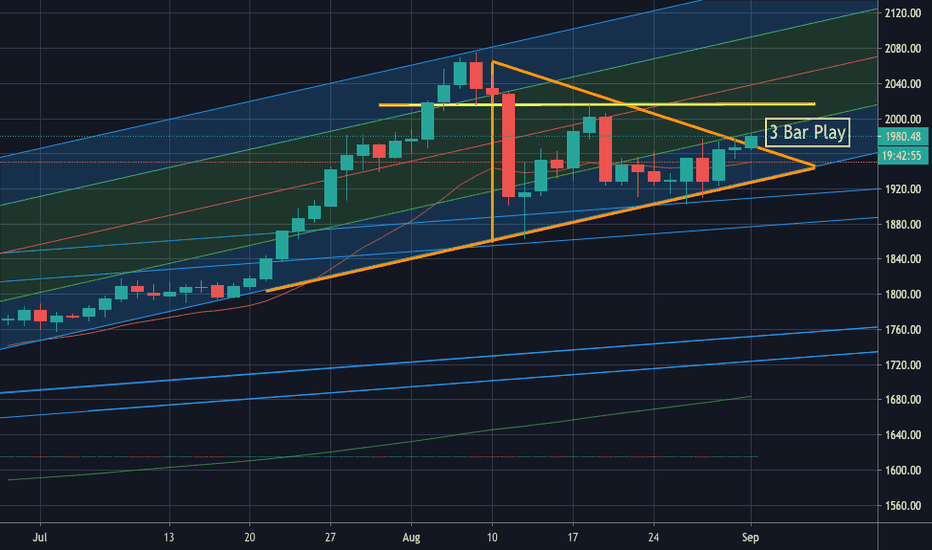

AX.NST Northern Star ResourcesHey investors

Setup in the GDX and GLD at the moment is begging for gold miners to revert back into an upward cycle

Technically we have enough waves down to consider the formation complete and divergence is coming through stronger as the days pass

NST is one of those stocks. ASX listed

All the best. Please hit like and support the ASX listed traders on TradingView

Regards,

Limitlesss

Find us on facebook Limitlesss

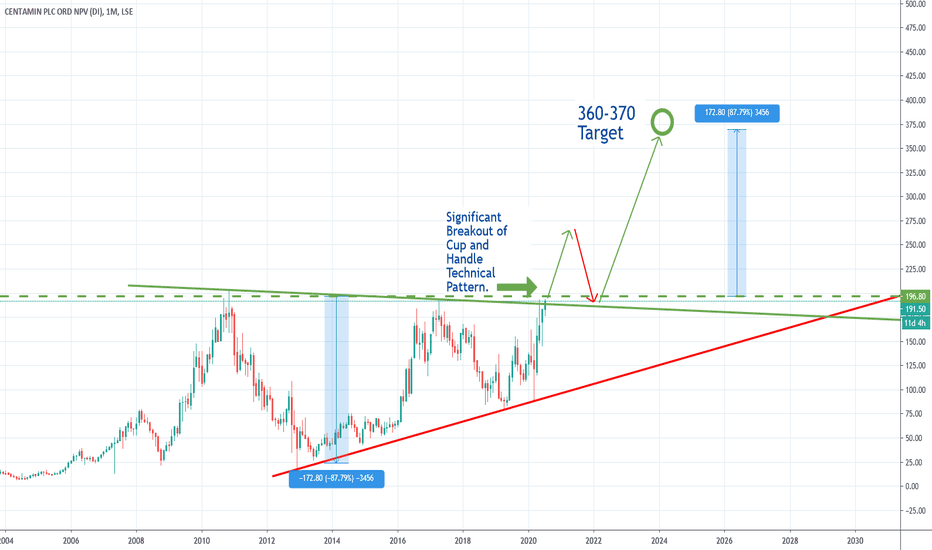

Centamin Breakout of Cup and Handle Technical PatternLong term target of 360-370 over the coming years.

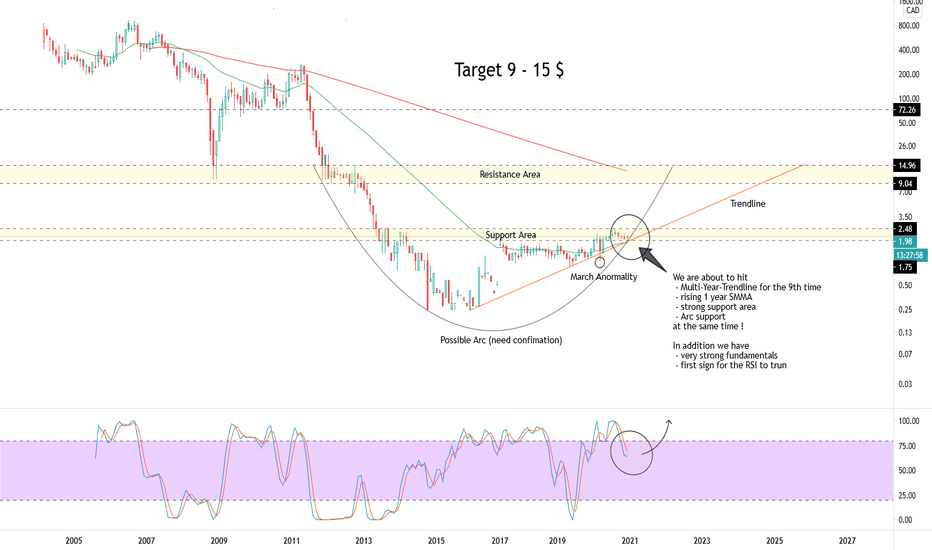

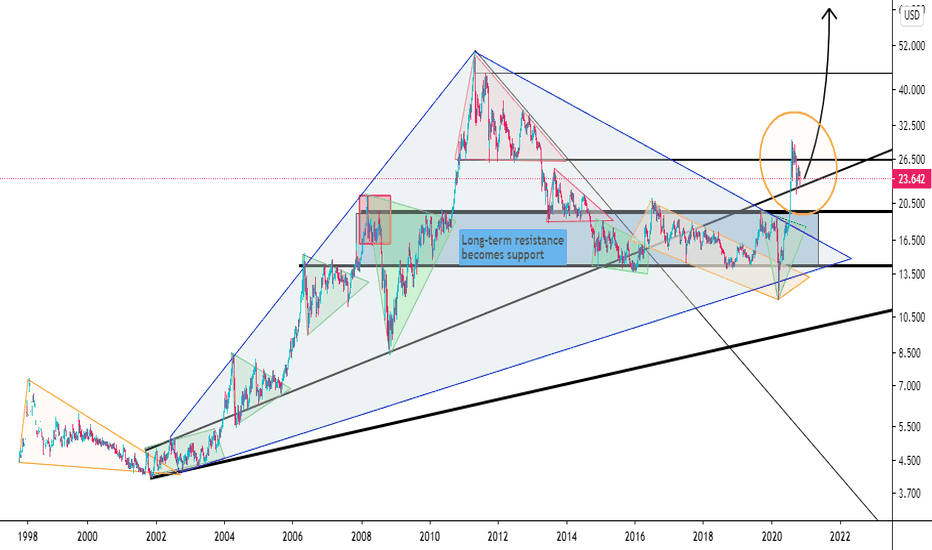

Silver Trend OutlookSilver technicals and structure has an intact bullish makeup

The long-term analysis shows that silver has cleared all major resistance and should follow gold to a new all-time high within the next 6-12 months, possibly much faster.

The macro fundamentals are supremely bullish:

Negative interest rates and the beginning of a global currency war/easing cycle/competition to devalue.

Massive fiscal stimulus is on the horizon in the next 3-5 months, and not just in the US. Rest of the world is starting to catchup.

The long-term global trend towards electric, clean, and renewable energy and the sheer amount of investment required to change our energy infrastructure will require that silver goes parabolic, along with many other commodities.

There's not a lot of silver in the world. New production takes time, cannot happen overnight.

A Biden win / blue wave will mean marginally more open global trade, which is bullish commodities. It will also mean something like a green new deal, infrastructure spending, and stimulus that could cause the US economy to overdose.

FX_IDC:XAGUSD TVC:SILVER

FCX - Technicals + Fundamentals lining upHigh probabilty trade here. On the technical side the FCX chart is showing a bullish ascending triangle, whilst on the fundamental side FCX's primary product both copper and gold continue to be very bullish . Should be some tailwinds with recent market volatility and possible rotation over the next little bit as well.

Hudbay Minerals: China's imports of metals are boomingHudbay Minerals (HBM) is an under-the-radar miner of a variety of metals - ranging from gold and silver to copper, zinc and molydenum. As metals prices continue to strengthen with the global economic recover, the company is ideally positioned to benefit.