Mitigation Block in Forex Trading: What It Is and How to Use It?What a Mitigation Block Is, and How You Can Use It When Trading Forex?

Understanding specific market mechanisms like mitigation blocks may enhance strategic decision-making. This article delves into the concept of mitigation blocks, detailing their definition, function, and practical application within forex.

Definition and Function of a Mitigation Block

A mitigation block in forex trading refers to a specific order block on a chart that indicates where previous movements have stalled and reversed, marking it as a potential area for future market turns. This concept within the Smart Money framework is crucial for traders looking to manage their positions by taking advantage of strategic entry and exit points.

The idea behind these areas is rooted in the dynamics of supply and demand within forex. When a currency pair reaches a level where buyers or sellers have previously entered the market in force, causing a reversal, it suggests a potential repeat of such actions when the price returns to the area.

Characteristics and How to Identify a Mitigation Block

Mitigation blocks can be bullish or bearish, each with distinct characteristics:

- Bearish Mitigation Block: This type forms during an uptrend and is identified by a significant peak followed by a decline and a failed attempt to reach or surpass the previous high, creating a lower high. When prices drop below the previous low, the order block above the low becomes mitigation. It may be characterised by an increase in selling volume as the price approaches the level, signalling resistance and a potential downward reversal.

- Bullish Mitigation Block: Conversely, a bullish type is established during a downtrend. It is characterised by a significant trough, followed by a rise to form a higher low, and a failure to drop below the previous low. As the pair moves up, the order block below the high marks mitigation one. This area often shows an increase in buying volume as the price approaches, indicating support and a potential upward reversal.

Mitigation Block vs Breaker Block

Mitigation and breaker blocks are both significant in identifying potential trend reversals in forex trading, but they have distinct characteristics that set them apart. A mitigation block forms after a failure swing, which occurs when the market attempts but fails to surpass a previous peak in an uptrend or a previous trough in a downtrend. The pattern indicates a loss of momentum and a potential reversal as the price fails to sustain its previous direction.

On the other hand, a breaker block is characterised by the formation of a new high or low before the market structure is broken, indicating that liquidity has been taken. This means that although the trend initially looked set to continue, it quickly reverses and breaks structure.

In effect, a breaker appears when the market takes liquidity beyond a swing point before reversing the trend. A mitigation appears when the price doesn’t move beyond the trend’s most recent high or low, instead plotting a lower high or higher low before reversing the trend.

How to Use Mitigation Blocks in Trading

Areas of mitigation in trading can be essential tools for identifying potential trend reversals and entry points. When they align with a trader's analysis that anticipates a reversal at a certain level, it can serve as a robust confirmation for entry.

Traders can effectively utilise these zones by simply placing a limit order within the area once it is considered valid. Validation occurs after a new peak or trough is established following the initial failure swing that forms the mitigation area.

If a liquidity void or fair-value gap is present, the trader may look for such a gap to be filled before their limit order is triggered, potentially offering a tighter entry. Stop losses might be placed beyond the failure swing or the most extreme point.

Furthermore, if a mitigation block is identified on a higher timeframe, traders can refine their entry by switching to a lower timeframe. This approach allows for a tighter entry point and potentially better risk management, as it offers more granular insight into the momentum around the area.

Common Mistakes and Limitations

While these blocks are valuable for forex trading, they come with potential pitfalls and limitations that traders should know.

- Overreliance: Relying solely on mitigation blocks without corroborating with other trading indicators can lead to misjudged entries and exits.

- Ignoring Context: Using these zones without considering the broader market conditions may result in trading against a prevailing strong trend.

- Misinterpretation: Incorrect identification can lead to erroneous trading decisions, especially for less experienced traders.

- False Signals: Mitigation blocks can sometimes appear to signal a reversal but instead lead to a continuation of the trend, trapping traders in unfavourable positions.

The Bottom Line

Understanding mitigation blocks offers traders a strategic edge in navigating the forex market. They can be vital for recognising potential price reversals and improving trading outcomes.

FAQs

What Is a Mitigation Block?

A mitigation block in forex trading is an order block that identifies potential reversal points. It signals where a currency pair has previously stalled, indicating strong buying or selling pressure, suggesting a potential for similar reactions in future encounters with these levels.

How Do You Identify a Mitigation Block?

Mitigation blocks are identified by analysing charts for areas where previous highs or lows were not surpassed, leading to a reversal. Traders look for a sequence of movements, including a swing high or low followed by a retracement that fails to exceed the previous swing.

What Is the Difference Between a Breaker Block and a Mitigation Block?

While both indicate potential reversals, a breaker block forms when the price makes a new high or low before reversing, suggesting a temporary continuation of the trend. In contrast, a mitigation block forms without creating a new extreme, indicating a direct loss of momentum and an immediate potential for reversal.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

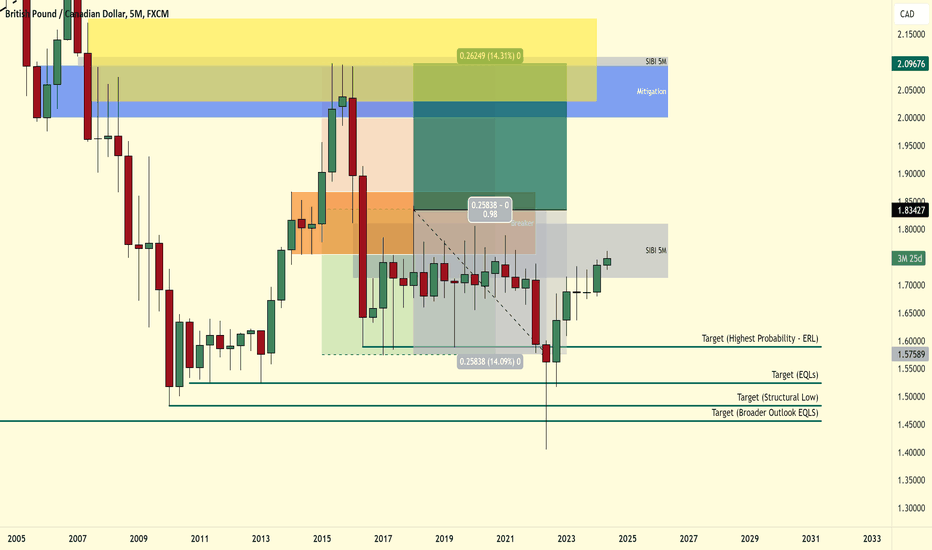

Mitigation

ICT Breaker & Mitigation Blocks EXPLAINEDToday, we’re diving into two powerful concepts from ICT’s toolkit that can give you an edge in your trading: Breaker Blocks and Mitigation Blocks. There are one of my favourite PD Arrays to trade, especially the Breaker Block. I’m going to explain how I interpret them and how I incorporate them into my trading. Stay tuned all the way to the end because I’m going to drop some gold nuggets along the way"

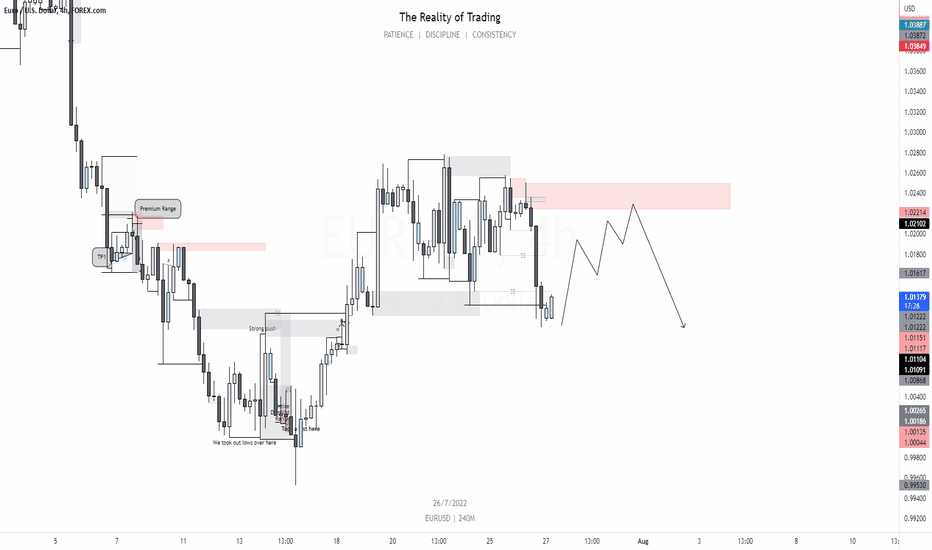

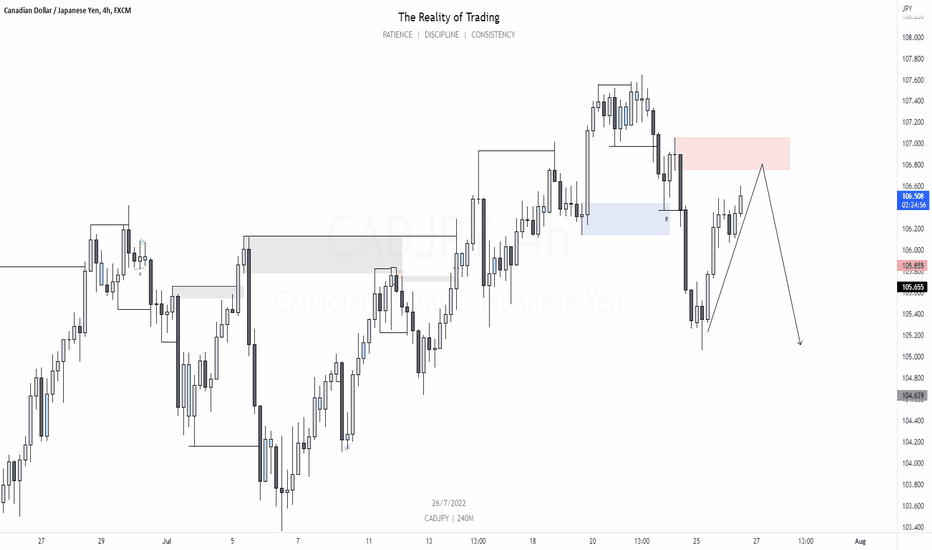

Ok, so first of all let’s go through what both these PD Arrays look like and what differentiates them, because they are relatively similar and how they are used is practically the same.

On the left we have a Breaker Block and on the right a Mitigation Block. They both are reversal profiles on the timeframe you are seeing them on, and they both break market structure as you can see here. The actual zone to take trade from, or even an entry from, in the instance of this bearish example is the nearest down candle or series of down candles after price makes a lower low. When price pulls back to this area, one could plan or take a trade.

The defining difference is that a Breaker raids liquidity on its respective timeframes by making a higher high or lower low before reversing, whilst a Mitigation Block does not do that. For this reason, a Breaker is always a higher probability PD Array to trade off from. As you should know by now if you are already learning about PD Arrays such as these is that the market moves from one area to liquidity to another. If you don’t even know what liquidity is, stop this video and educate yourself about that first or you will just be doing yourself a disservice.

Alright, so let’s go see some real examples on the chart. Later on I’ll give you a simple mechanical way to trade them, as well as a the discretionary approach which I use. And of course, some tips on how to increase the probability of your setups.

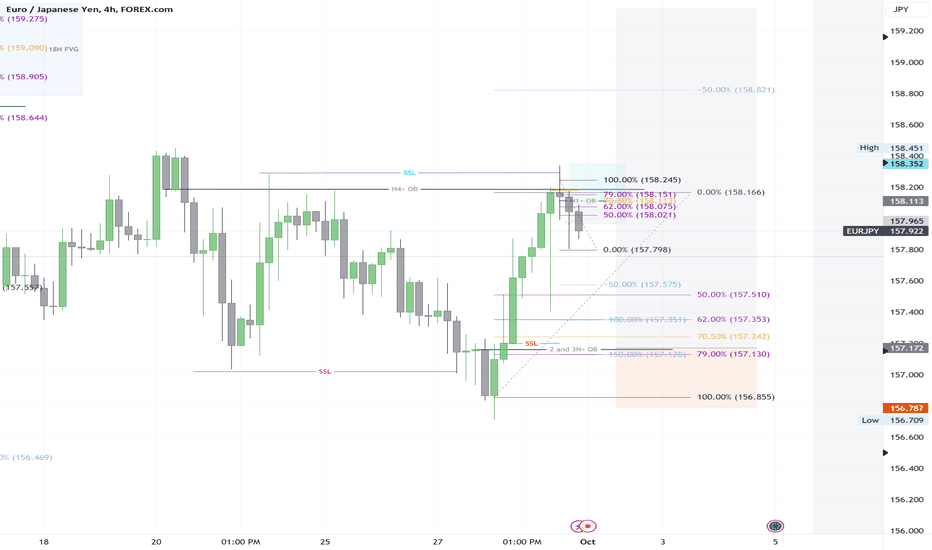

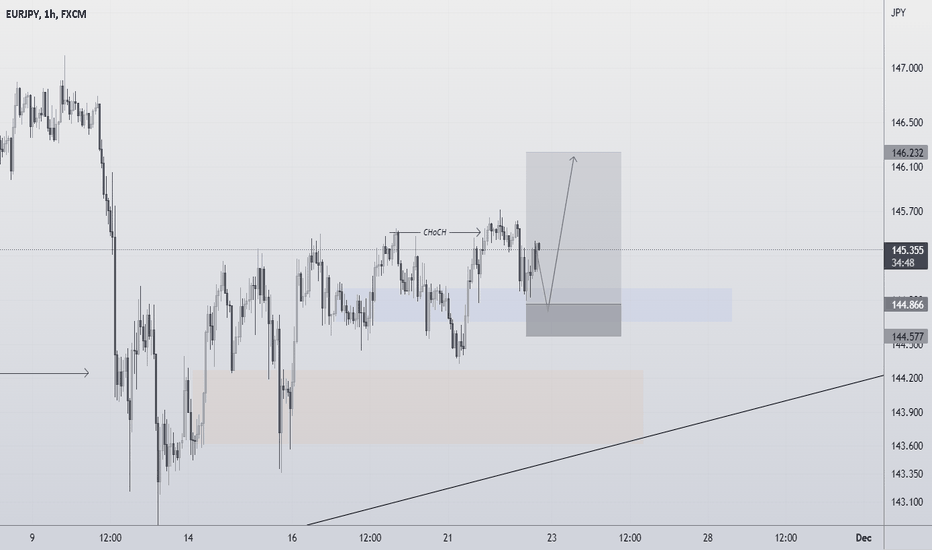

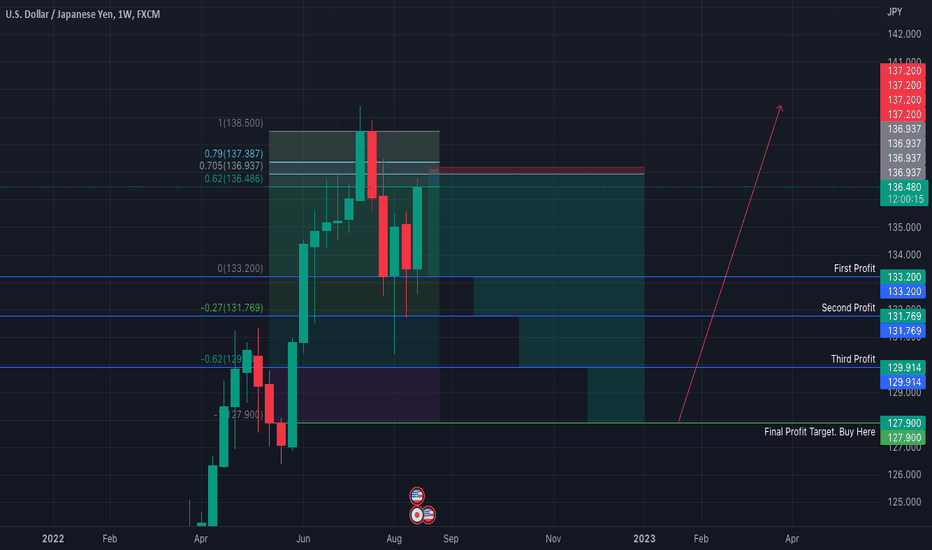

EURJPY "seems" ready to short from BSL/H4 OB mitigationAs price took out not only BSL and mitigated an H4 OB, I do speculate price to sell and find support at the D-OB below / 79% retracement fib level (157.200). There's some news event for JPY coming out Sunday at 7:50 EST to which I wonder if this will drive price down to support at 157.200

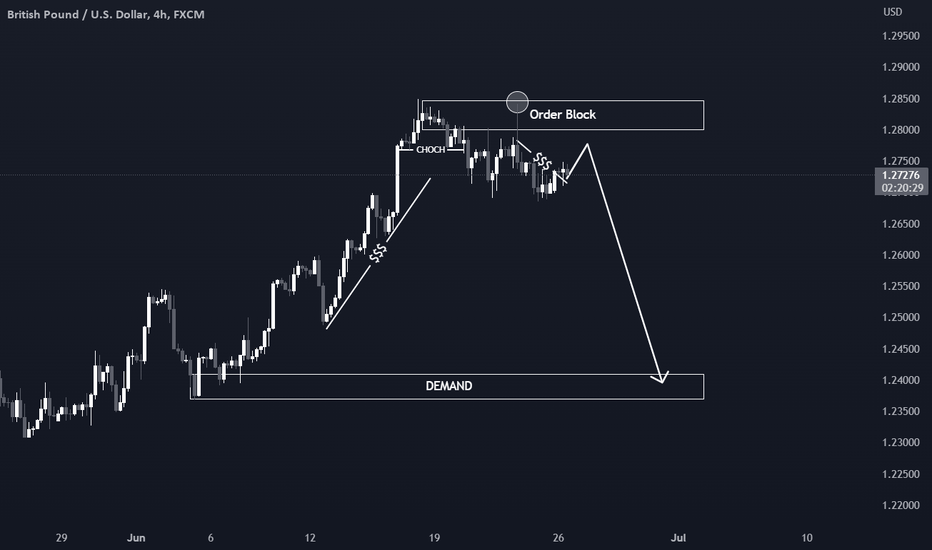

GBPUSD Liquidity Inducement SetupThe price is in Daily Resistance Zones it is wise to be only interested in SELL positions

The price has made a Significant CHOCH at H4 and the ORDER BLOCK that caused this has been MITIGATED

BSL(Buy Side Liquidity) is made below the ORDER BLOCK and it is expected for the price to HUNT the BSL in order to continue it's downward move to reach DEMAND ZONES that were the ORIGINS of previous uptrend

the price obviously has BUY IMBALANCE and this acts like GRAVITY and pulls the price down to re-enter BUY ORDERS

Bearish March for $SPYI have strong belief that it will be a good time to short the market in March. Last month $SPY went up to grab liquidity(short stops) from the recent high of December at $410 with a lack of displacement. AMEX:SPY also came back to test a mitigation block that was formed at the beginning of the bear run in Feb. 2022.

If it closes the month of March below the next recent high, which would be 431.73, I will be looking to short with a target around $348

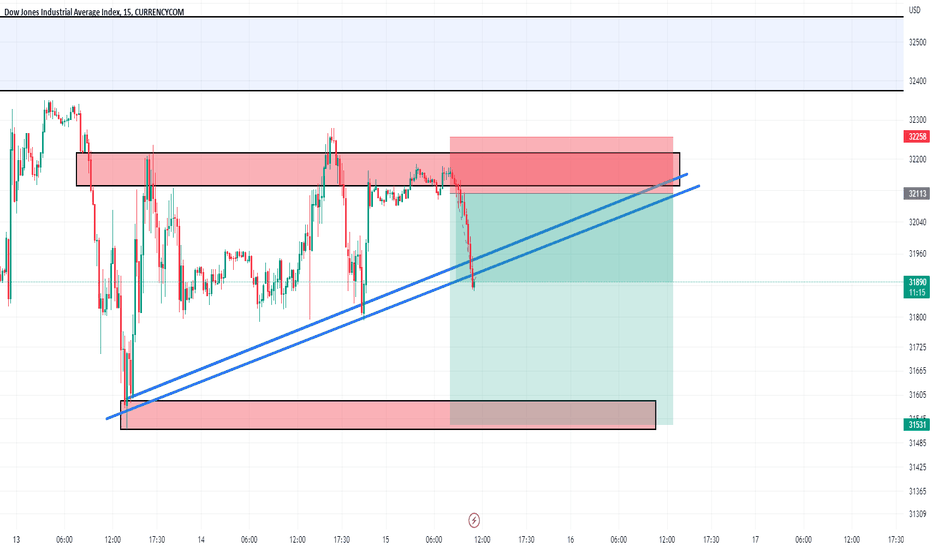

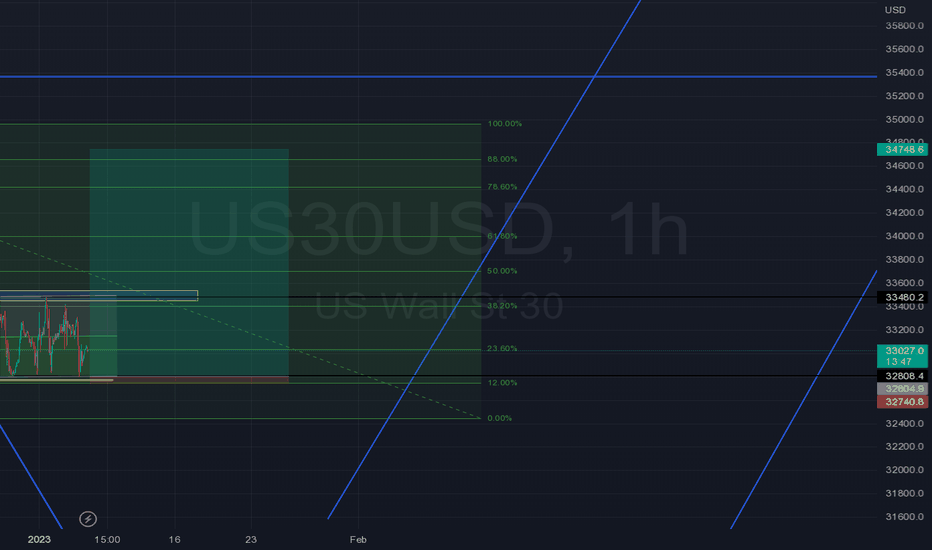

after result us 30 hello tradres i have done a pre breakout strategy if you want to learn follow me it is possible to make money click that follow that

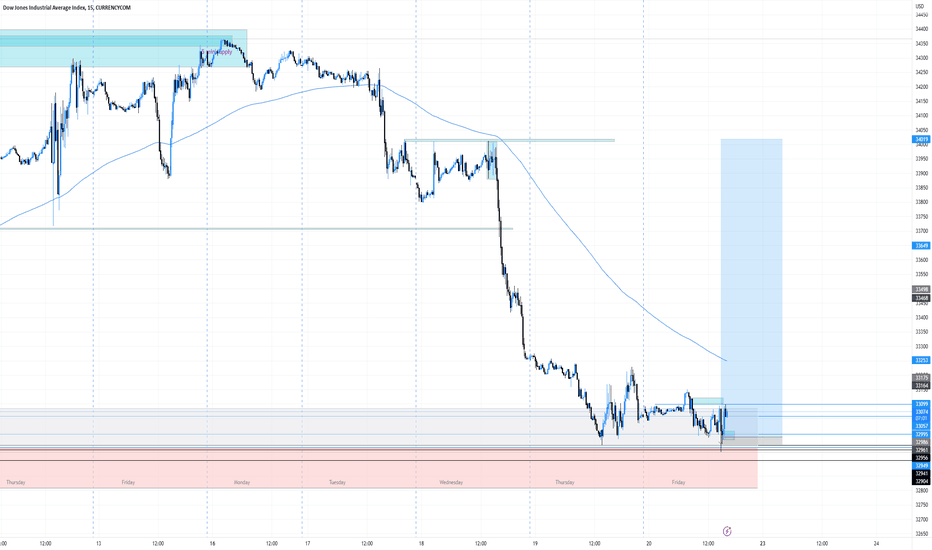

US30 long break downThis is a US30 long that i am currently in. its top down anaylsis from htf to ltf entry with targets. I do belive we are looking at lower pricing on DXY also which helped confluence this trade.

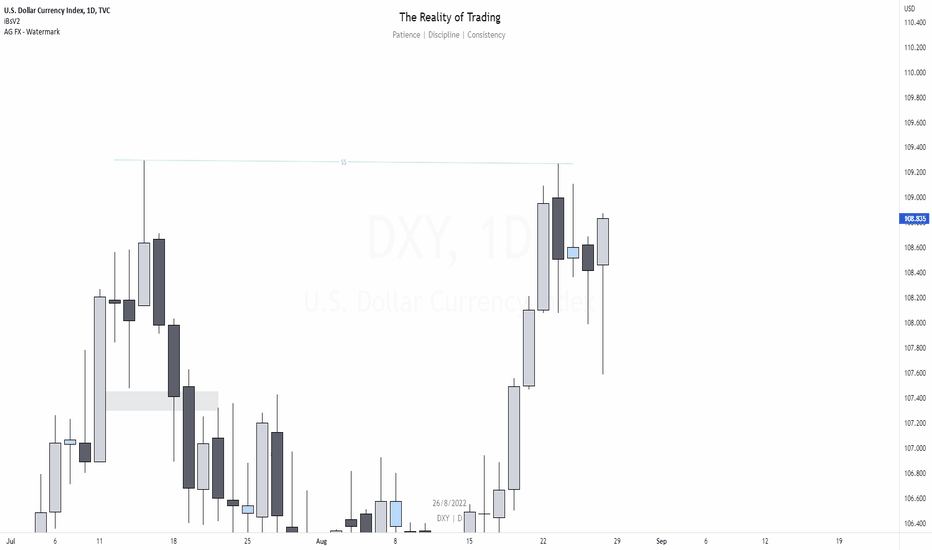

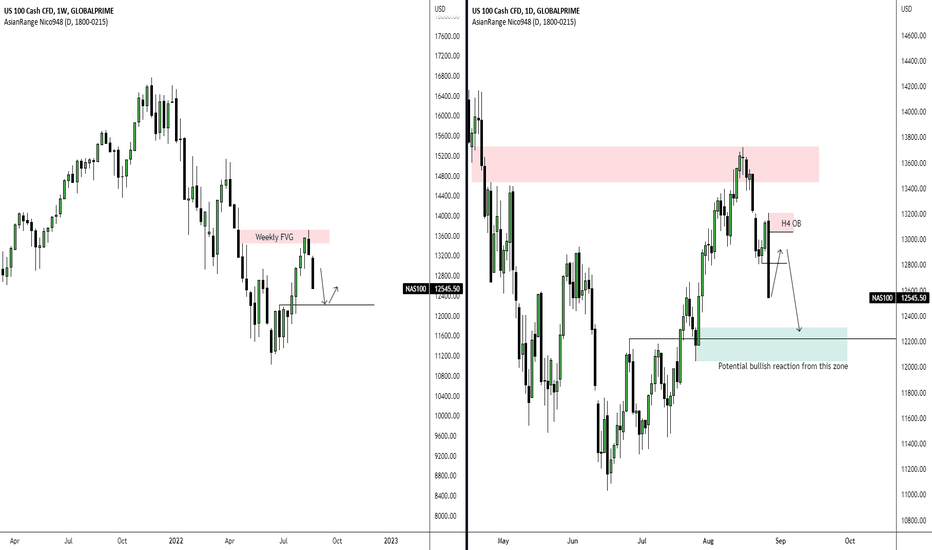

Nasdaq Higher Timeframes AnalysisPrice potentially formed a lower high filling the fair value gap on the weekly timeframe. Potential short from the H4 order block to continue lower and tap into the daily demand zone. Potential bullish reversal on the daily demand.

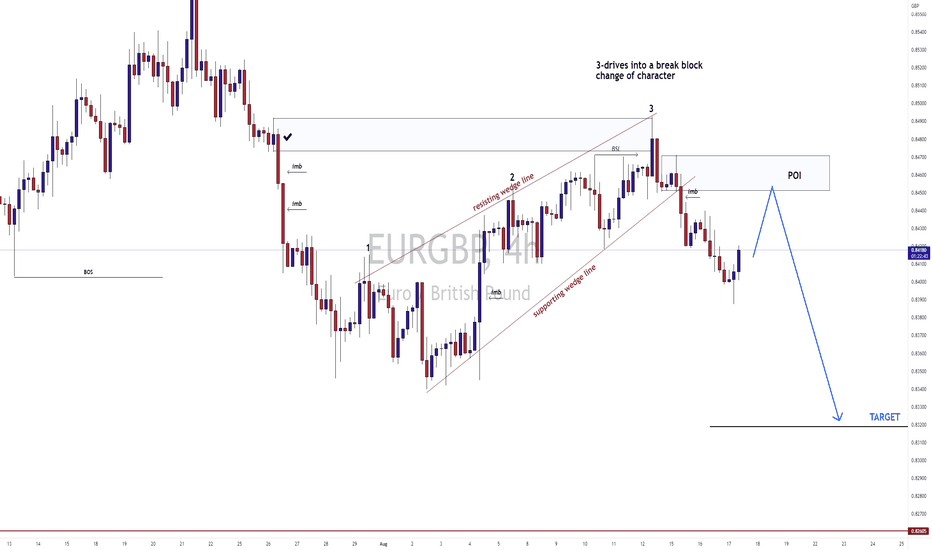

EURGBP SHORT SETUPEURGBP: price was converging in a rising wedge towards the breaker block, after mitigating from this block we got a break of supporting wedge line and change of character to bearish side on local structure, overall trend is bearish. I expect this pair to continue as marked on the chart.

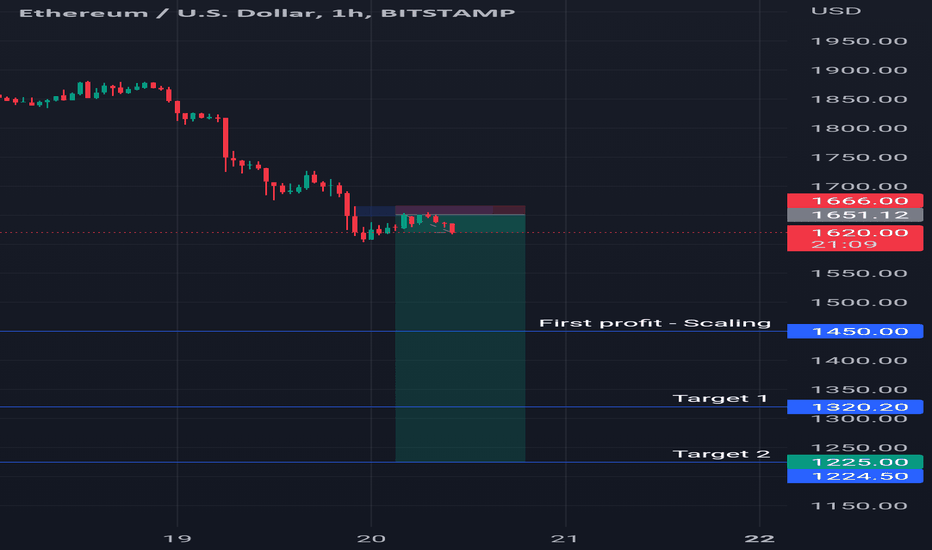

Ethereum Short AnalysisEthereum is bearish for the next couple of weeks until further notice. Price broke structure to the upside on the daily timeframe and is looking to drop heavily to $1200 area. On the weekly timeframe, banks did not yet mitigate their positions at the open price of the last bearish move down, before the up move that broke daily structure. Before ethereum continues the uptrend journey to new all time high prices, we're looking to take this short, all the way to $1200 and then getting into long positions at $1200. This is not financial advice.

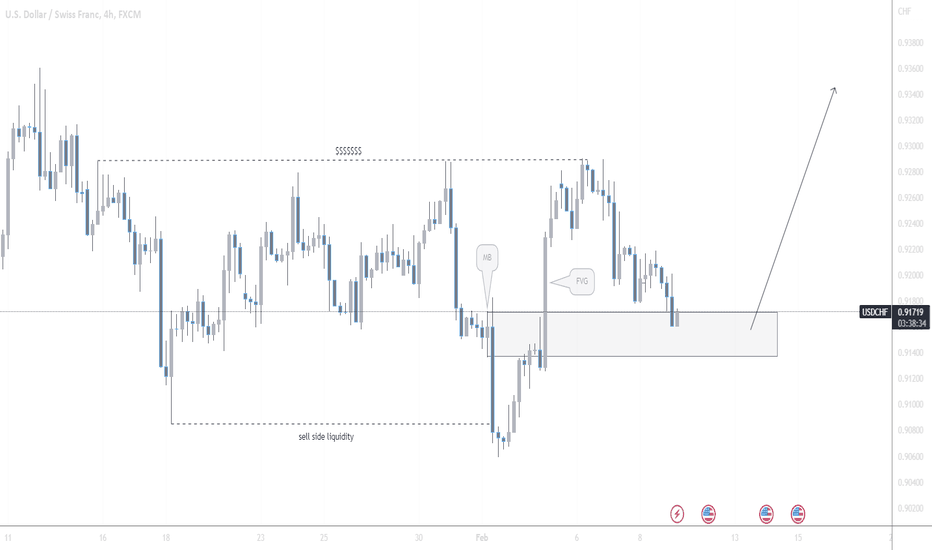

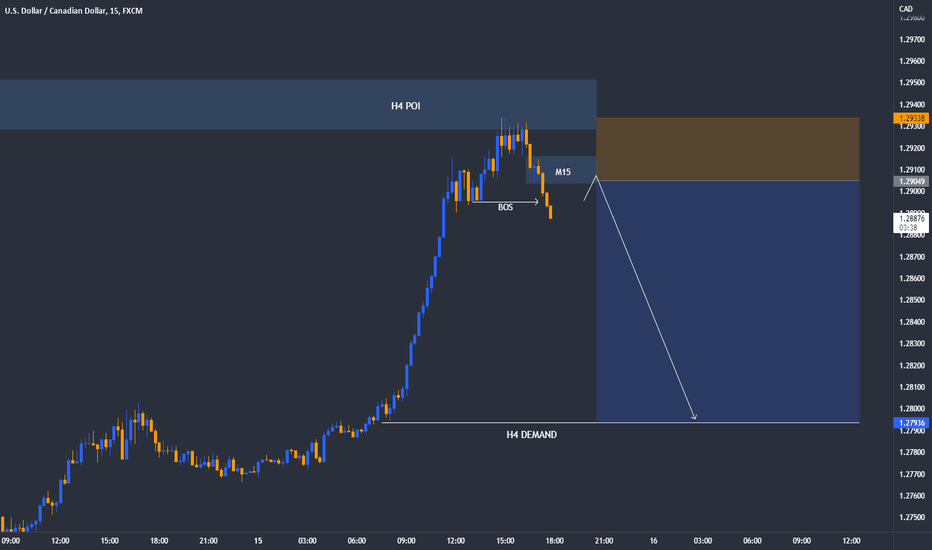

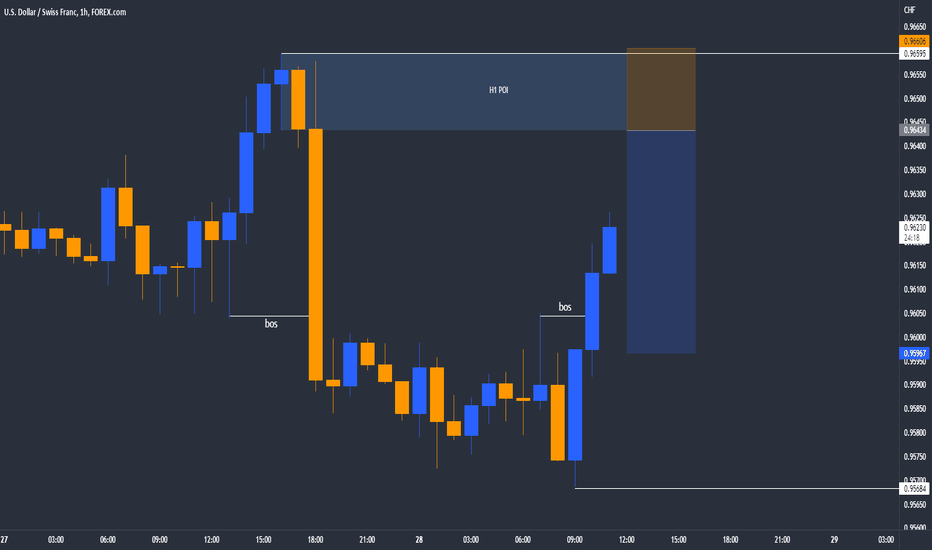

USDCHFprize is in a downtrend. though it has reached a probable Demand zone it has made a new LL. now it is approaching the H1 POI that that broke structure to the downside. once it gets there we will waith for a proper confirmation to go short since it s coming from a demand zone. we will take our profits at the 50 Fib discounted prize zone since there is a high probability of it making a choch

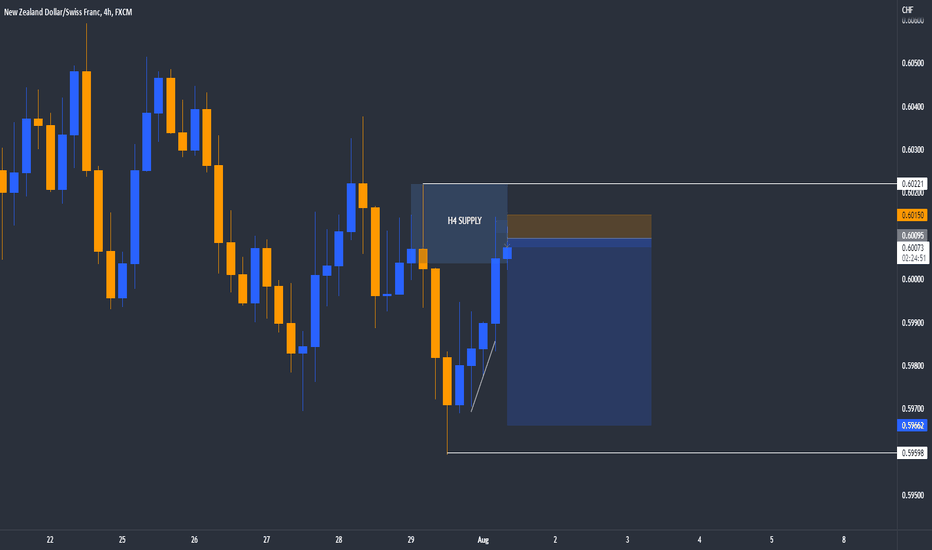

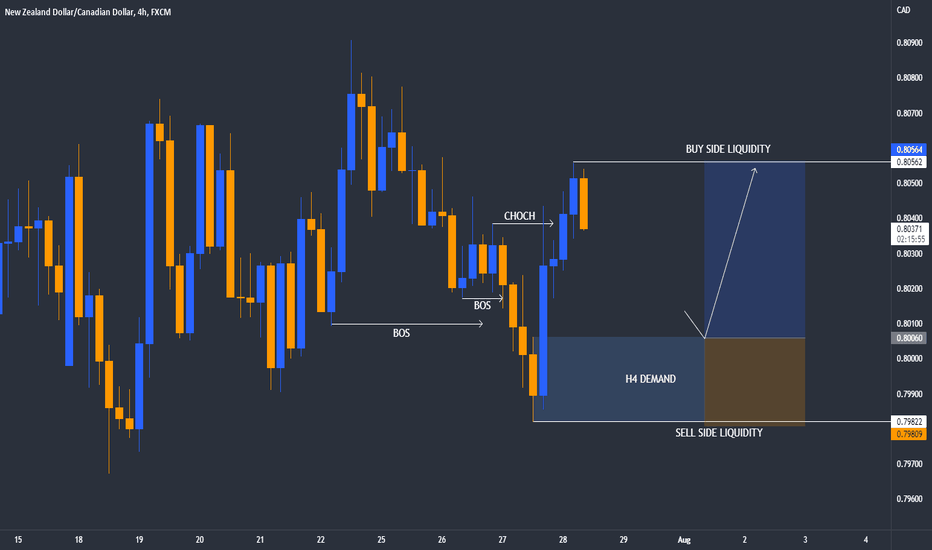

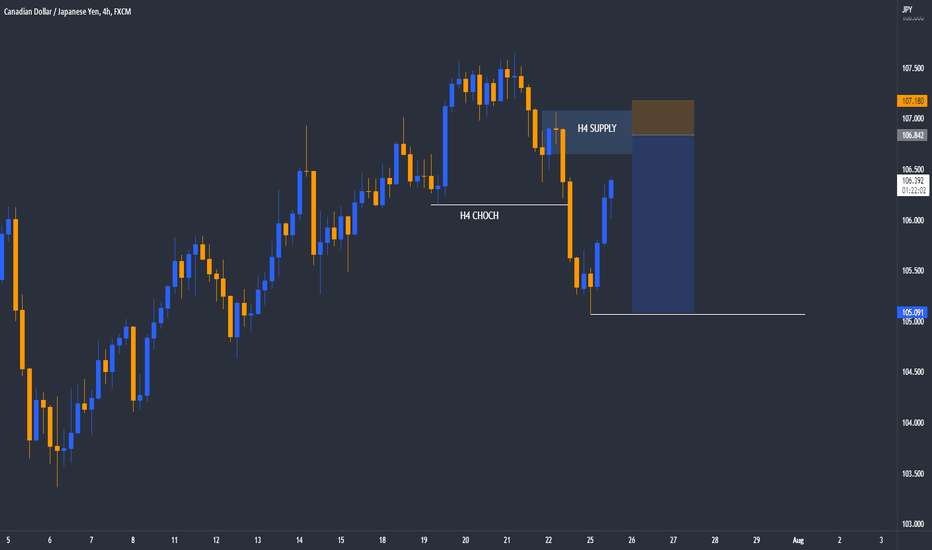

NZDCAD Prize was in a down trend for a couple of days and suddenly changed direction hence breaking the LH . the move that broke the HL is what we marked our H4 demand that caused a CHOCH. we are waiting for prize to come back to fill any imbalance left hence mitigating the order block. once prize come into that H4 demand we are anticipating prize to move up to create a new HH.