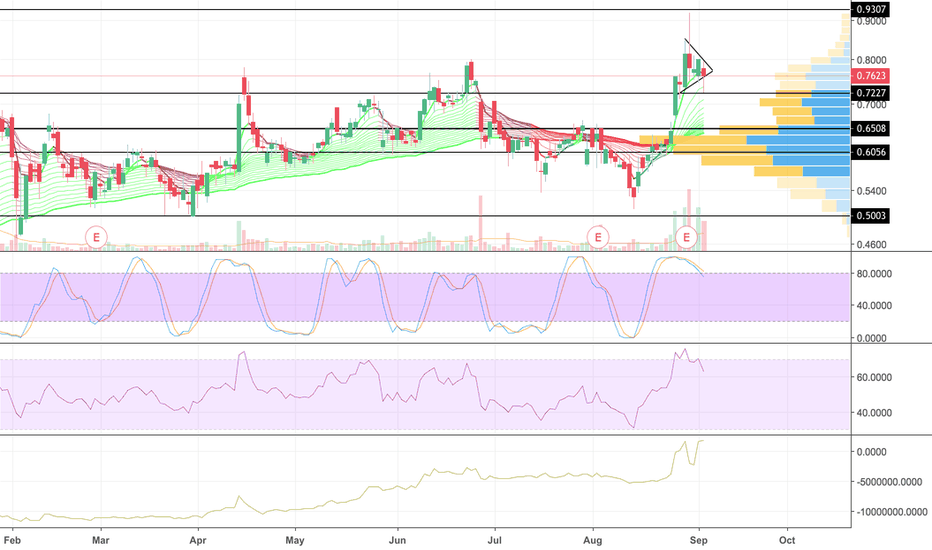

MPXEF is bargain compared to CRON, TLRYMPXEF is now the third largest publicly traded cannabis operation by quarterly sales. Only WEED and ACB have higher sales. It leaves CRON, TLRY, and TRST in the dust when it comes to already-reality sales. It also trades at a nice discount to those other more famous names on a sales-basis. It also has not yet run much this MJ season. If you want something top-notch quality with very real revenues and profits, this seems like a good option.

The pennant on the green flagpole is a continuation pattern. There are a million different ways you can draw this pennant and for some of them, it tried to break downward out of the pennant today. However, I like the strong bounce from that failed attempt by the bears. After taking a look at this, I'm buying some more at open.

Here are a few tweets/articles with useful further info:

- third largest by sales

- comparison to peers price-wise

- investor call and expansion plans

- more peer comparison and SS

- peer comparison

Mjotcs

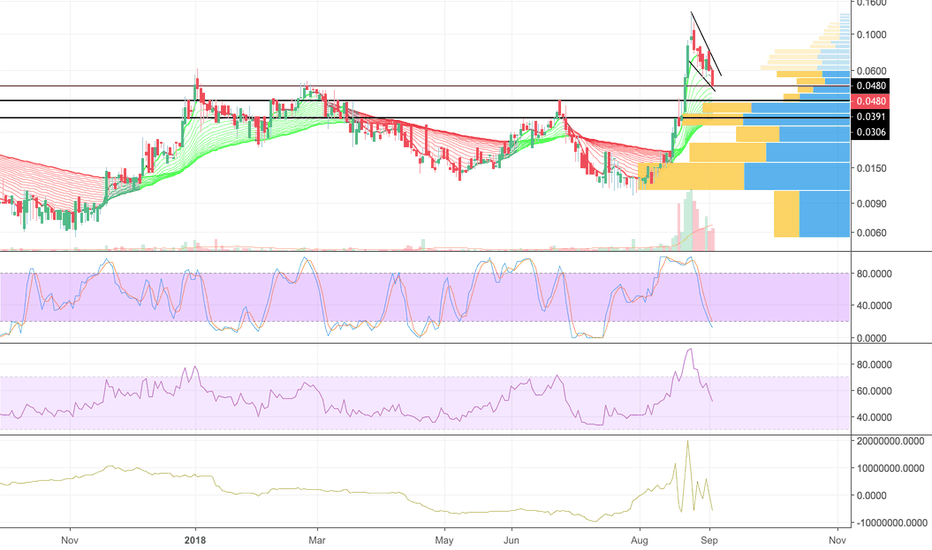

CANB falling wedgeI've warned in multiple venues (here, on Twitter, on iHub, and in private groups) to not chase MJ movements at this extremely early stage of the season. (This is true even during peak mania; the only difference is in peak mania you may be rewarded for making a stupid move rather than being punished, which makes for bad and dangerous habits.) These pops in OTC* are premature, a result of accumulation gone wild or overeager noobs chasing. There are not enough eyeballs and $s to sustain a true MJ season run. Yes, headlines are starting to pop up, but it's not really gotten to the level needed yet. This is the pre-party. I am taking some profits on big spikes and I expect them to retrace and buy back lower. If they don't, I am moving that money into stuff that's still not run.

CANB is a classic example of this. I am very glad I took a big chunk of profits at 10 cents. I've been buying back more and more the lower it gets. Right now the tape is painting a beautiful falling wedge, a generally very bullish pattern that likes to break upward. I have bids sprinkled between $0.041 and $0.046. There's pretty strong horizontal support around the 4 cent mark and I expect that to be a decision point whether it's going to break up out of the falling wedge or whether it needs to retrace further to 3 cent support.

Thanks to @Chuck_Buffet for noticing this falling wedge pattern.

* This is true of OTC. However, because NASDAQ, TSX, et. al. are both more mainstream and have fewer MJ options, this may not be true of MJ tickers on those exchanges. This is basically a first for those larger exchanges having MJ, so no known history to go on. So stuff like TLRY and CRON may be in their real run.