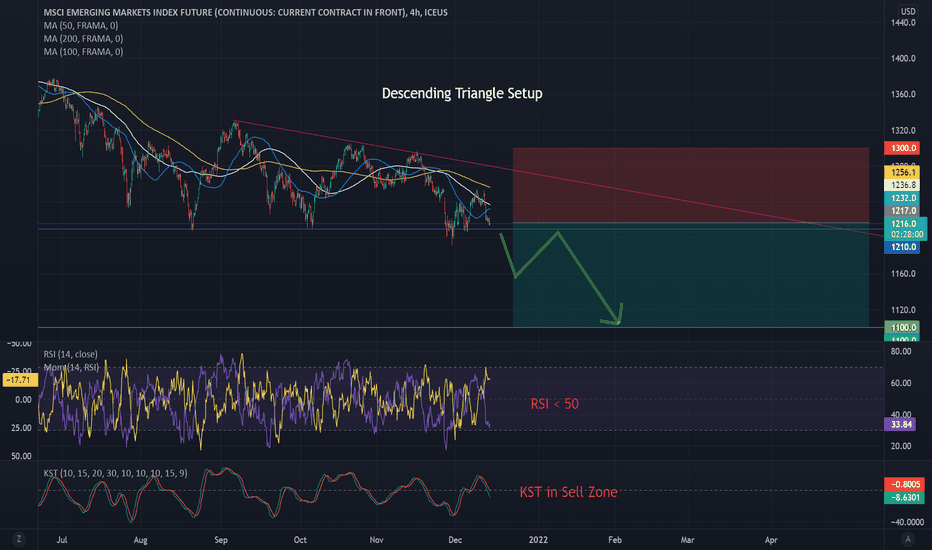

Emerging Market Futures Positioned to Move Towards 1100Trend Analysis

The main view of this trade idea is on the 4-Hour Chart. The Emerging Markets Index Future (MME1!) appears to be in a descending triangle pattern setup. The support line is observed around the 1210 level while the resistance line was created with the lower highs of 1332, 1305 and 1295. Expectations are for a breakdown in MME1! around 1210 which should take the security lower towards 110. A negation of this chart pattern setup will be seen if MME1! Rallies towards 1300.

On the Daily chart MME1! Is making a leg lower towards 1210 support. The overall trend is down.

Technical Indicators

The RSI is currently less than 50 with the KST in a sell mode. The short (50-MA), medium (100-MA) and long (200-MA) fractal moving averages are above MME1!’s price. The Mas also have had negative crossovers over the last month. These are bearish signs from the technical indicators.

Recommendation

The recommendation will be to go short at market, with a stop loss at 1300 and a target of 1100. This produces a risk/reward ratio of 1.41.

Disclaimer

The views expressed are mine and do not represent the views of my employers and business partners. Persons acting on these recommendations are doing so at their own risk. These recommendations are not a solicitation to buy or to sell but are for purely discussion purposes. At the time of publishing I have exposure to MME1!.

MME1!

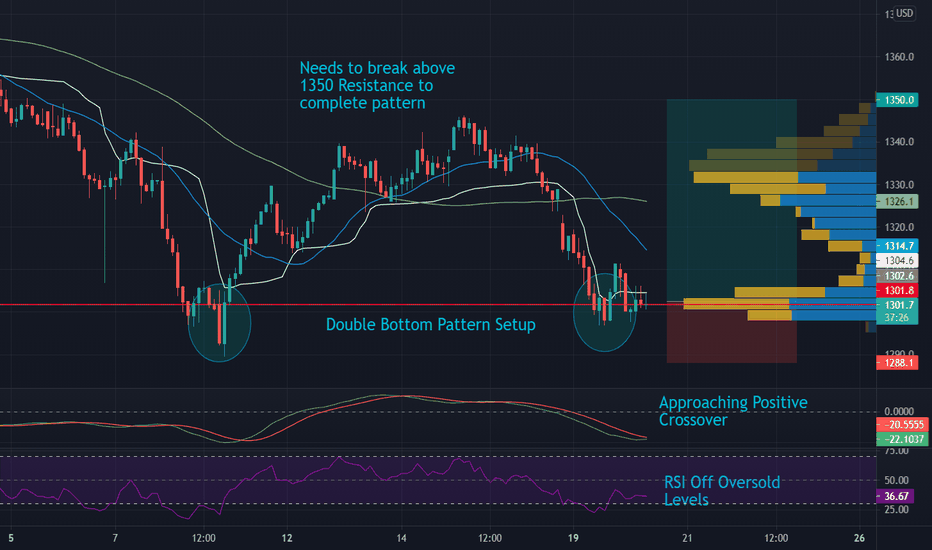

Emerging Market Futures in Double Bottom Setup with 1350 TargetTrend Analysis

The main view of this trade idea is on the 2-Hour chart. MSCI Emerging Market Index Futures (MME1!) appears to be in a double bottom pattern setup, with the price currently trading around the second low of the setup, around the 1300 price level. Expectations are for MME1! to rally towards the top of the double bottom pattern setup, 3.3% away from current levels.

Technical Indicators

MME1! appears to be a couple candles before the completion of the double bottom pattern setup. The futures contract is currently trading around the fractal moving average. However, MME1! is still below its short (25-SMA) and medium (75-SMA) term moving averages. The RSI recently emerged from oversold levels but is still below 50. The KST is approaching a positive crossover. The technical indicators are illustrating that the double bottom is still in a setup mode and can easily fail.

Recommendation

The recommendation will be to go long at market. At the time of publishing MME1! is trading around 1302. The short- term target price is observed around the 1350 price level, expected resistance of the setup. A stop loss is set at 1288. This produces a risk reward ratio of 3.27.

Disclaimer

The views expressed are mine and do not represent the views of my employers and business partners. Persons acting on these recommendations are doing so at their own risk. These recommendations are not a solicitation to buy or to sell but are for purely discussion purposes. At the time publishing, I have a position in MSCI Emerging Market Index Futures ( MME1!).