Fed Set to Cut 50bps: Gold Benefits as the Bullish Wave Reforms📌 Market Overview

Gold surged as high as $3,370/oz before closing at $3,355.9 (+0.24%), fuelled by growing expectations that the Federal Reserve could deliver a 50bps rate cut in September.

US Treasury Secretary Bessent signalled strong support for such a move, while July CPI remained soft — weighing on the USD and pushing bond yields lower, giving gold a clear upside path.

However, upside momentum was capped by US equities hitting fresh record highs and a cooling in geopolitical tensions.

Markets now turn their focus to the upcoming PPI data, jobless claims, and the Trump–Putin meeting to gauge gold’s next move.

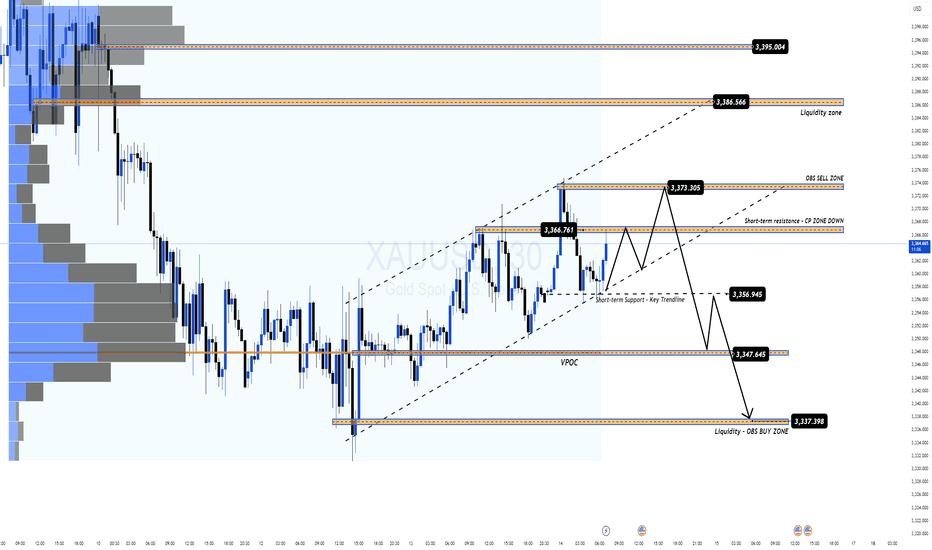

🧐 Technical Outlook – MMFLOW Perspective

The recovery wave is becoming increasingly evident after recent corrective moves. Price action is now poised to revisit liquidity zones from previous pullbacks.

Strategy remains to:

Buy early in pre-identified liquidity zones to ride the bullish wave within the current channel.

Sell from continuation or exhaustion zones once the next liquidity sweep is in play.

🎯 Trading Plan – MMFLOW

🔹 BUY ZONE – Early Long Setup

Entry: 3336 – 3334

Stop Loss: 3330

Take Profit: 3340 – 3345 – 3350 – 3355 – 3360 – 3365 – 3370 – 3380 – ???

🔹 SELL ZONE – Liquidity Grab Short Setup

Entry: 3394 – 3396

Stop Loss: 3400

Take Profit: 3390 – 3385 – 3380 – 3370 – 3360

📊 Key Levels

Resistance: 3365 – 3370 – 3395

Support: 3334 – 3330 – 3315

💡 MMFLOW Comment:

The technical structure supports a tactical buy-on-dip approach, with 334x being a key pivot zone for the bulls. If price accelerates towards 339x, watch for a liquidity sweep to trigger high-probability short setups.

Mmflowtrading

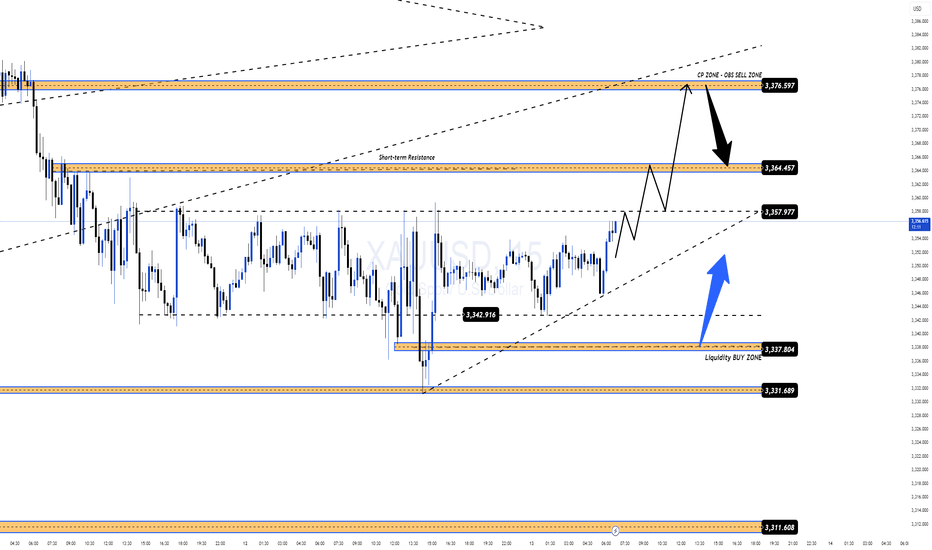

GOLD ON FIRE – 3358 WALL ABOUT TO CRACK, 337x NEXT STOP!📌 Market Overview

Following the CPI release, Gold is showing strong buying momentum, with a clear aim to break the 3358 resistance and push quickly towards the 337x zone – a key equilibrium level where SELL pressure is expected to react.

Price bounced sharply from the 333x area back into the 335x range. If 3358 breaks, there’s a high probability we will test 337x within the day, triggering SELL volume.

Today’s market is expected to be relatively quiet, with no major news scheduled. The daily range could stay around 35–40 dollars.

With the current bullish momentum, the preferred strategy is to wait for price to retest early BUY support zones around 334x to catch the next upside wave in line with the primary trend.

🎯 Key Trading Zones

🔹 BUY ZONE

Entry: 3338 – 3336

SL: 3332

TP: 3342 – 3346 – 3350 – 3355 – 3360 – 3370 – 3380

🔹 SELL ZONE

Entry: 3375 – 3377

SL: 3382

TP: 3370 – 3365 – 3360 – 3355 – 3350 – 3340

📊 Key Levels

Resistance: 3358 – 3365 – 3376

Support: 3342 – 3337 – 3330 – 3310

⚠ Risk Note

No major economic releases today, so intraday moves may rely heavily on technical reaction points. Watch MMFLOW Key Levels closely – a break of 3358 could accelerate the move to 337x, while holding below may trigger short-term pullbacks.

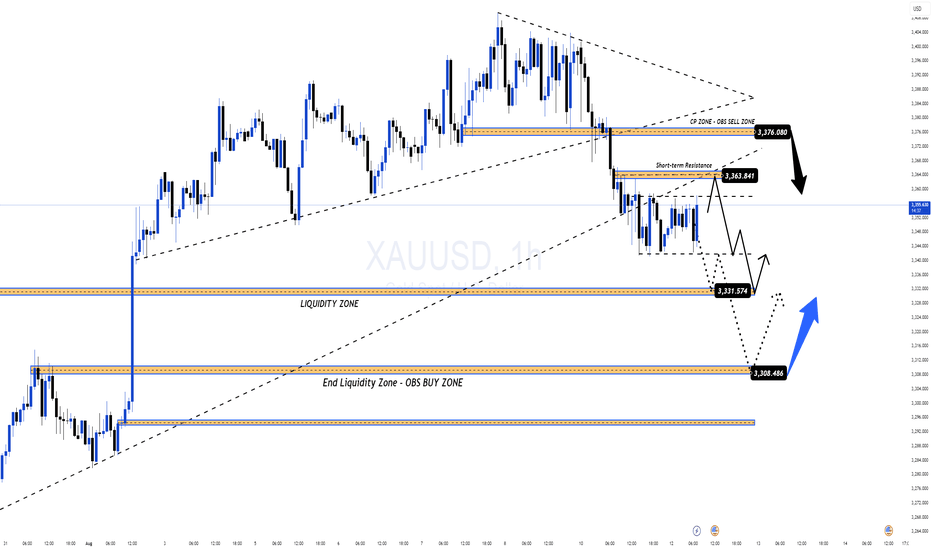

GOLD DUMPS $50 – LIQUIDITY ZONE AHEAD | CPI IN FOCUS! GOLD DUMPS $50 – LIQUIDITY ZONE AHEAD | CPI IN FOCUS!

📌 MARKET RECAP

Gold kicked off the week with a sharp $50 drop, breaking multiple key trendlines and nearby support levels in quick succession.

Main drivers behind the move:

Profit-taking after the recent strong rally.

Stronger USD expectations ahead of CPI data (forecast +0.1% vs previous).

Geopolitical factors – Ukraine–Russia ceasefire talks approaching their conclusion, adding to risk-off sentiment.

🧐 WHAT’S NEXT?

If CPI comes in strong → USD strengthens → Gold could slide further into the 333x – 330x liquidity zone.

If CPI disappoints → USD weakens → Gold may quickly bounce back toward the 337x key level (previous breakdown area) for a retest before deciding direction.

🎯 MMFLOW GAME PLAN

1️⃣ BUY SCALP

📌 Entry: 3331 – 3329

📌 SL: 3325

📌 TP: 3335 – 3340 – 3345 – 3350 – 3360 – 3370 – 3380

2️⃣ BUY ZONE

📌 Entry: 3310 – 3308

📌 SL: 3304

📌 TP: 3314 – 3318 – 3322 – 3326 – 3330 – 3335 – 3340 – 3350 – 3360 – ???

3️⃣ SELL SCALP

📌 Entry: 3363 – 3365

📌 SL: 3370

📌 TP: 3360 – 3356 – 3352 – 3348 – 3344 – 3340

4️⃣ SELL ZONE

📌 Entry: 3376 – 3378

📌 SL: 3382

📌 TP: 3372 – 3368 – 3364 – 3360 – 3355 – 3350 – 3340

⚠️ RISK NOTE

CPI is a potential game-changer – even a small deviation from forecasts can trigger a massive one-way move.

Always keep an eye on AD-marked Key Levels on the chart before pulling the trigger.

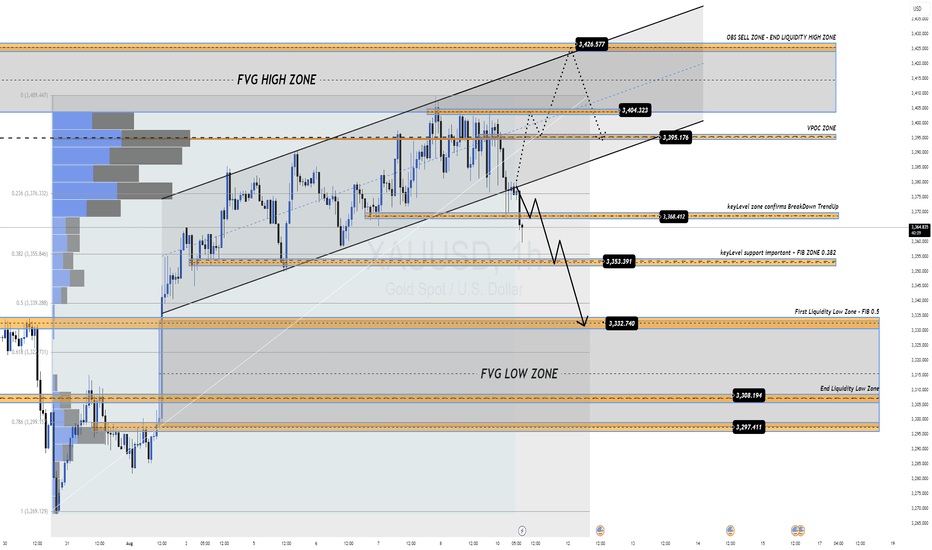

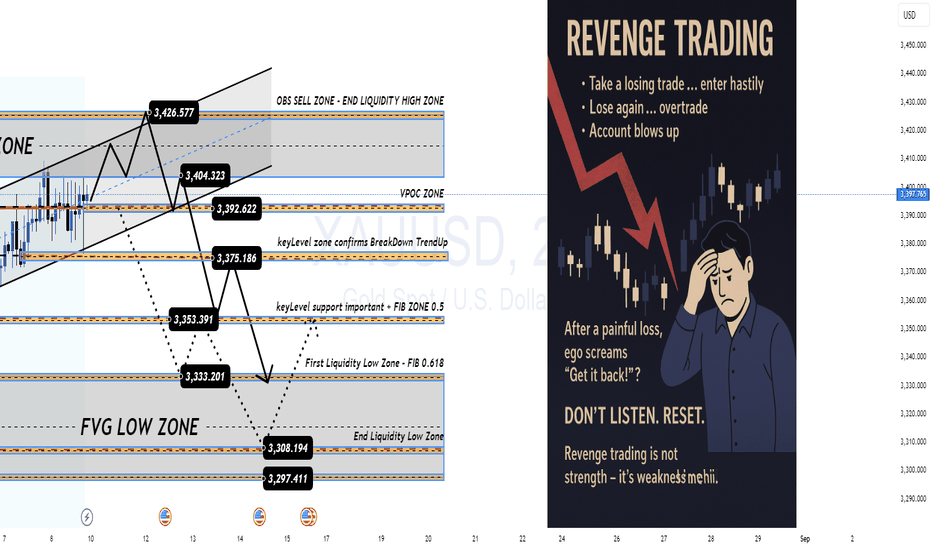

Will We See a Break Down or a Sharp Rebound to Key Resistance?XAUUSD – Will We See a Break Down or a Sharp Rebound to Key Resistance? | MMFlow Trading 🔥

Market Overview

Gold dropped sharply at the start of the week as profit-taking hit the market and late-week FOMO buyers from last week were stopped out.

Buy-side momentum has clearly slowed, and sellers are waiting for a confirmed breakdown from the rising channel to target lower liquidity zones around 335x and 333x.

At present, price is reacting around the 336x – 337x key support with an H1 long-wick candle showing buying pressure.

Trading Outlook

We need a clear breakdown confirmation (candle close with volume) before executing a short entry.

If price holds and fails to break, we could see a rebound back towards major resistance zones 339x – 340x – 342x.

This week is loaded with high-impact USD data – CPI & PPI – both strong inflation indicators that could put short-term pressure on gold if data comes out USD-positive.

📌 Trading Plan

BUY SCALP

Entry: 3353 – 3351

Stop Loss: 3345

Targets: 3358 → 3362 → 3366 → 3370 → 3375 → 3380

BUY ZONE

Entry: 3332 – 3330

Stop Loss: 3325

Targets: 3336 → 3340 → 3345 → 3350 → 3360 → 3370 → 3380

SELL SCALP

Entry: 3394 – 3396

Stop Loss: 3400

Targets: 3390 → 3385 → 3380 → 3370 → 3360

SELL ZONE

Entry: 3425 – 3427

Stop Loss: 3430

Targets: 3420 → 3415 → 3410 → 3405 → 3400 → 3390 → 3380

⚠ Risk Management Notes

This is a high-impact news week – expect false breakouts before and after CPI/PPI releases.

Avoid oversized positions into news; keep risk tight.

If price breaks above 3430 with strong volume, the current sell setup is invalid → wait for a new market structure before re-entering.

When Ego Takes Over, Your Account Pays the Price Revenge Trading – When Ego Takes Over, Your Account Pays the Price 💔

Traders, be honest…

How many times have you taken a painful SL, and before you could even breathe, your finger was already clicking “Buy/Sell” without a second thought?

In your head: “I’ll get it back right now… the market can’t do this to me!”

And then…

🔻 A candle goes straight against your position.

🔻 SL beeps again.

🔻 Your account balance drops faster than your mood.

That’s Revenge Trading – it sounds fierce, but in reality, it’s just an emotional storm pulling you further away from shore.

1️⃣ The Sweet but Deadly Psychological Trap

After a loss, your brain refuses to accept reality. It pushes you into the “must recover immediately” mode.

You throw discipline out the window – no setup, no plan.

You increase your lot size recklessly – “Just one win and I’ll be back.”

And… the market doesn’t care if you’re mad or not.

The danger is, at that moment, you’re no longer trading with logic — you’re trading with a wounded ego.

2️⃣ The Downward Spiral

Lose one trade → frustration.

Jump into a revenge trade → bigger lot size.

Lose again → account drains faster.

Emotions spiral out of control → random clicking.

Account blown.

It’s like standing at the edge of a cliff — you could step back and be safe… but you jump, thinking there’s a cushion down there.

3️⃣ How to Cut the Revenge Trading Cycle Before It Eats You Alive

Step away from the charts immediately after a losing streak — go for a walk, exercise, do something unrelated to trading.

Set a daily/weekly loss limit (e.g., -2R) and stick to it.

Journal your emotions after each trade to spot when revenge impulses start creeping in.

Trade smaller when you return — the goal now is to recover your mindset, not your money.

Remind yourself: “The market will always be here. My capital and mental state won’t wait for me.”

4️⃣ MMF’s Note to You

Revenge trading is not strength — it’s weakness in disguise.

It doesn’t help you beat the market; it just helps the market beat you faster.

Keeping a cool head is what keeps a trader alive in the long run.