Moderna

Is MRNA revealing major upside opportunity? BULL or BEAR? Today we're looking at MRNA aka Moderna, the darling biotech that might be the savior of us all should they produce an mRNA vaccine that could be more easily produced and distributed at scale than a traditional vaccine candidate.

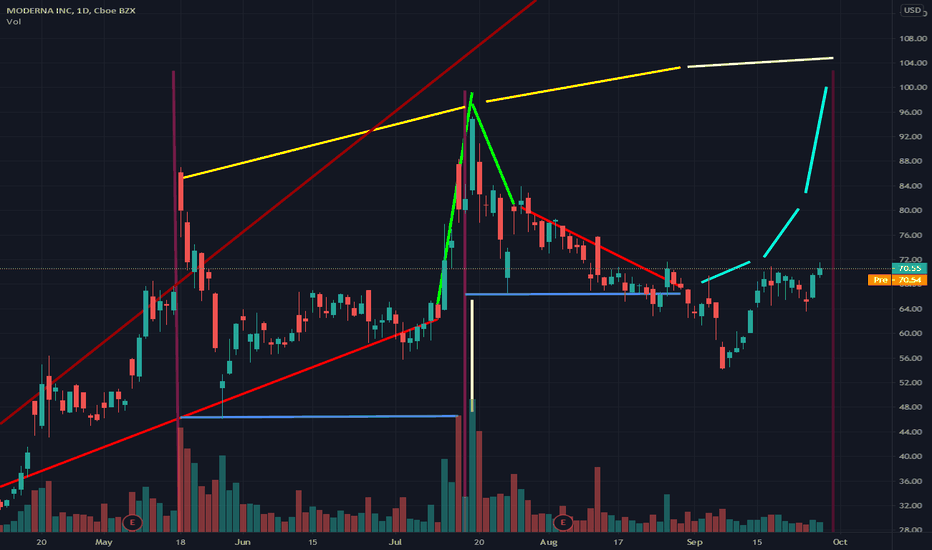

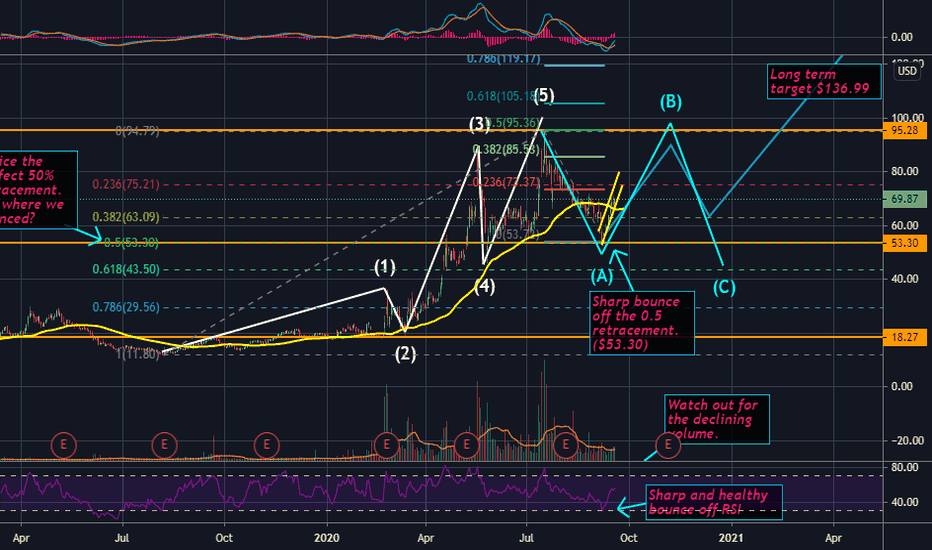

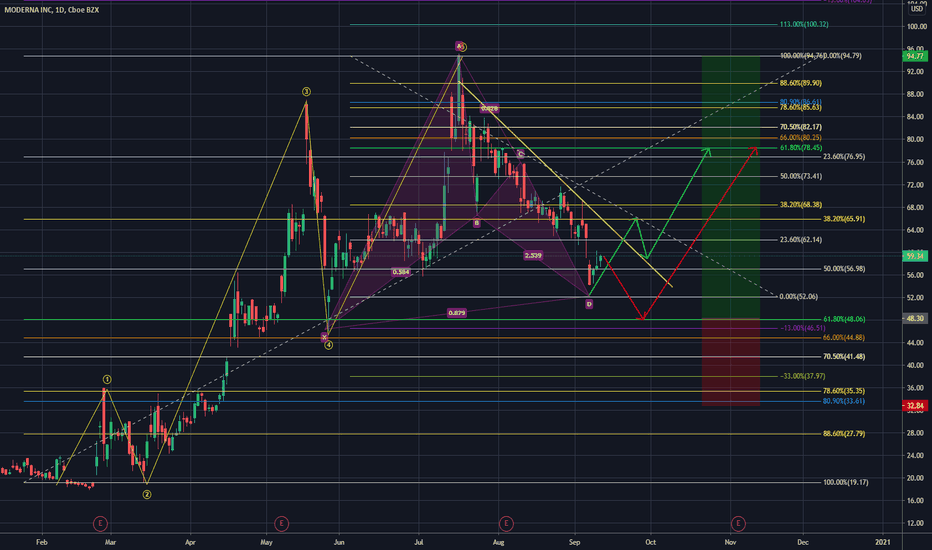

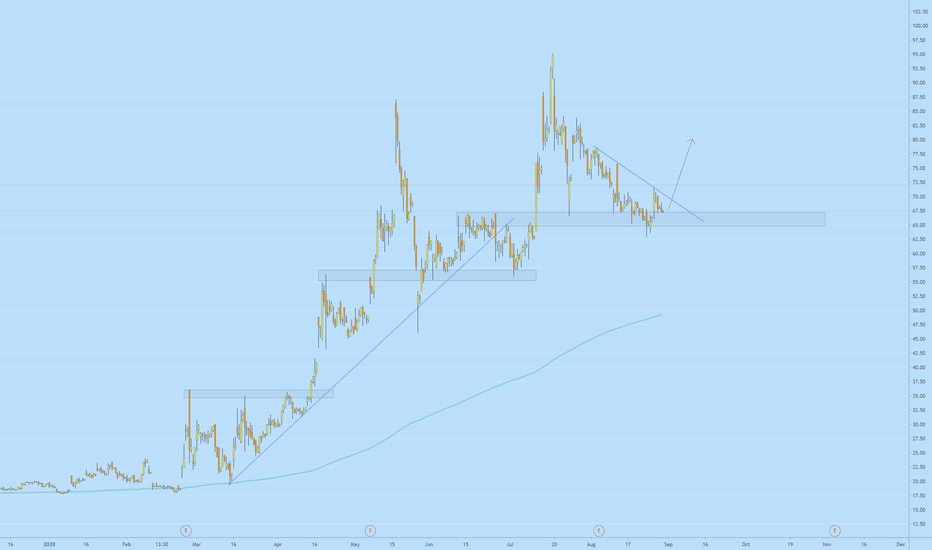

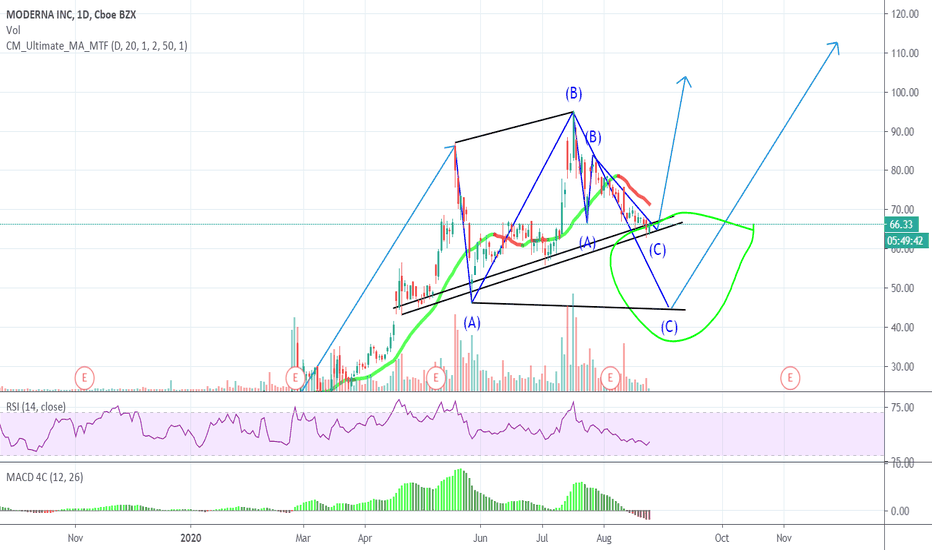

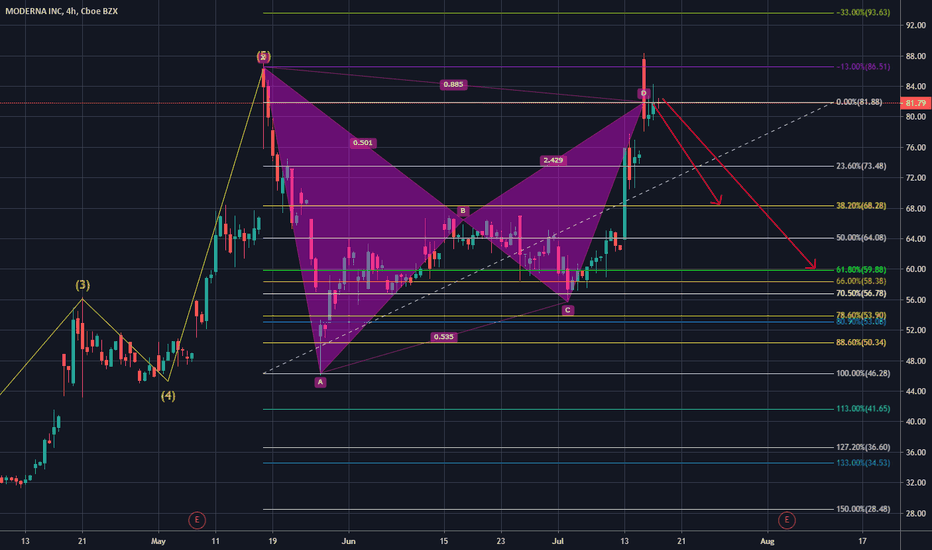

Reading into this story I've been intrigued, especially with the nice patterns forming in this chart with an easy to identify Impulse wave and a correction pattern currently forming. Unfortunately, this is always the riskier proposition and we must consider our Bull and Bear cases objectively so that we have a plan.

As you'll see, we recently bounced off the 0.5 fib retracement from the all-time high of $95 all the way back to $53. Looks like a healthy bounce off that level. But we should almost always expect it. There is nothing to get excited about until we see a more convincing bounce with volume.

While I love the long term pattern being set up in this chart with that hopeful bull target of $136.99, there's a lot of work to make up and resistance to overcome before we get anywhere close. The declining volume is something to watch out for. If you zoom in you'll see the upward channel off the bounce paired with the declining volume. This would indicate that short term we'll retest the low, and if we're lucky we can get a buying opportunity off that low and off the 0.618 at $43.50.

Set your ladders appropriately and always calculate your stop loss according to risk preference fo % loss below average calculated cost. If you plan your buy levels and amount in advance you can easily calculate the average buy price and then subtract 20% for example to reach a reasonable stop loss which shields you from setting a stop loss too high and missing the following run, or setting it too low and losing more than you are willing to.

Meanwhile, looking at the long term trend, we'll have some trading potential on the stock, but need to look for some volatility within the current correction pattern. Given the sharp increase and resulting decrease, one can assume we might see similar moves again in the future, though there's nothing to indicate exactly when at the moment until we see a better channel or a convincing wedge reveal itself.

The longer-term trend bodes well for your everyday investor who's willing to take some loss for a very large potential gain. Should Moderna create their mRNA based vaccine in time and be successful with distribution, the value of this company would quickly skyrocket. I'm willing to bet on an optimistic future and I'm definitely keeping an eye on this opportunity with the buy ladders I've mentioned indicated.

What's your Bull and Bear case on Moderna? How would you play this in the short and long term?

Moderna Stock Analysis - MRNAModerna (NASDAQ: MRNA).

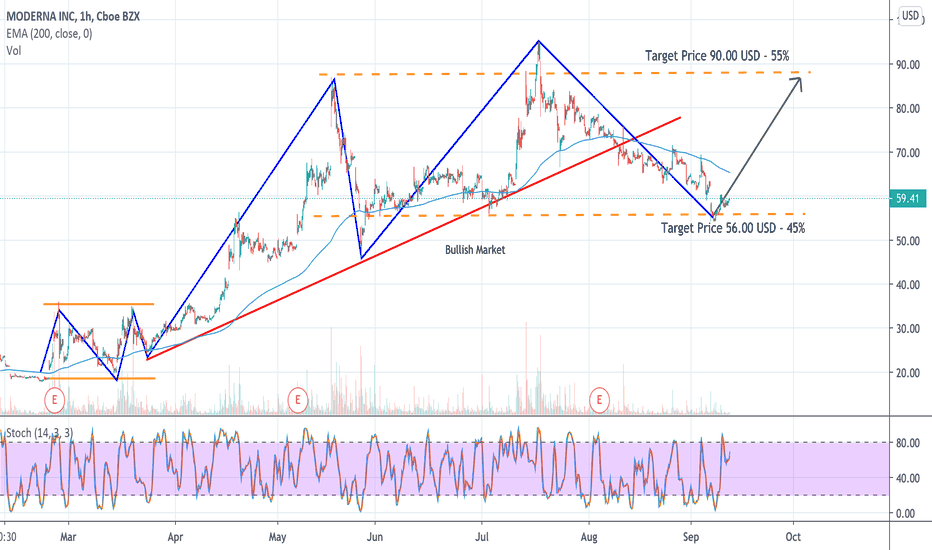

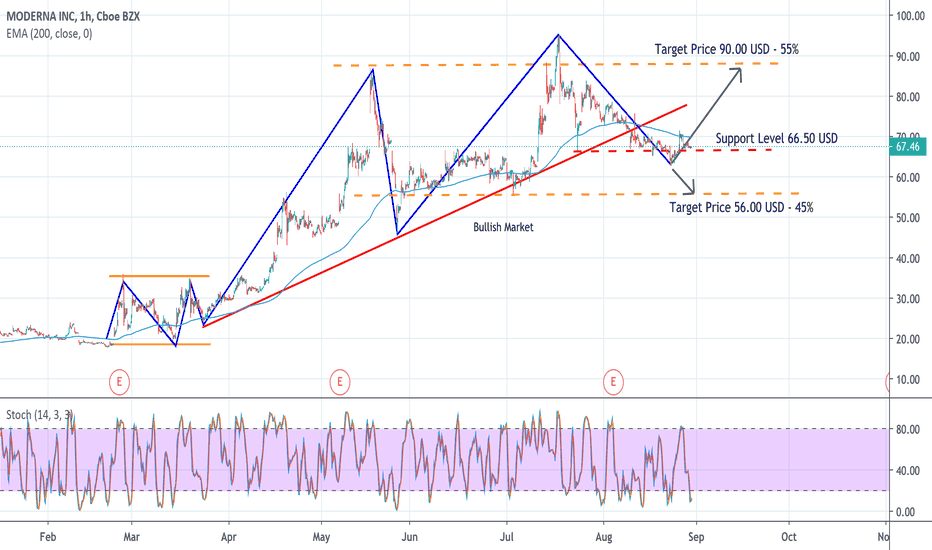

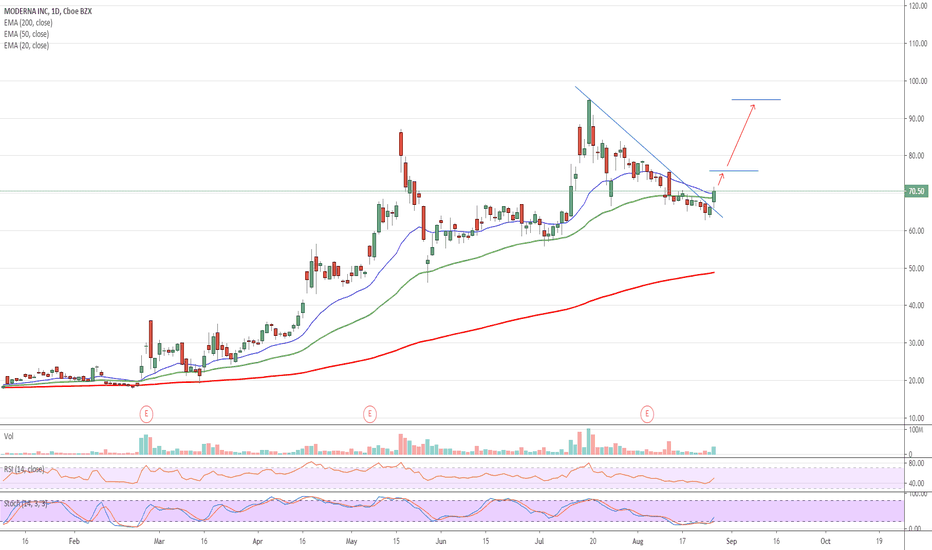

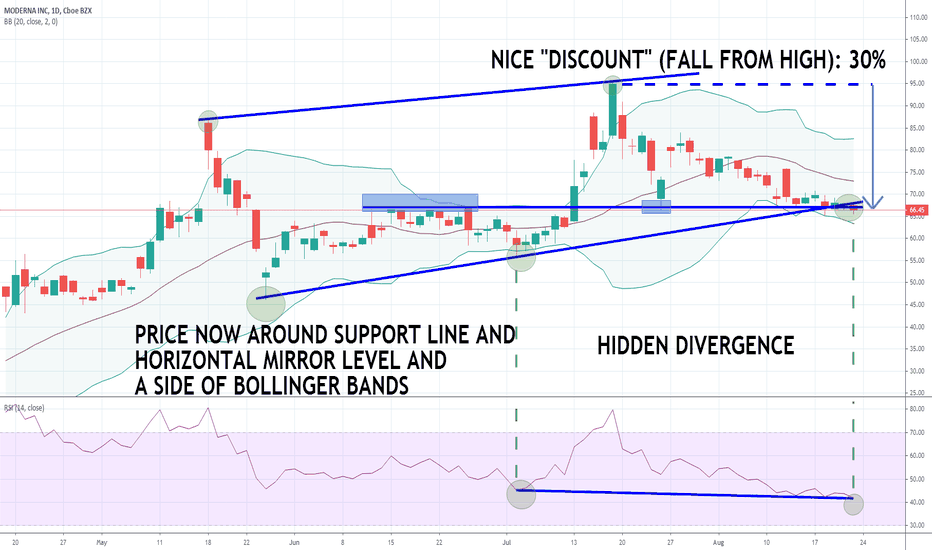

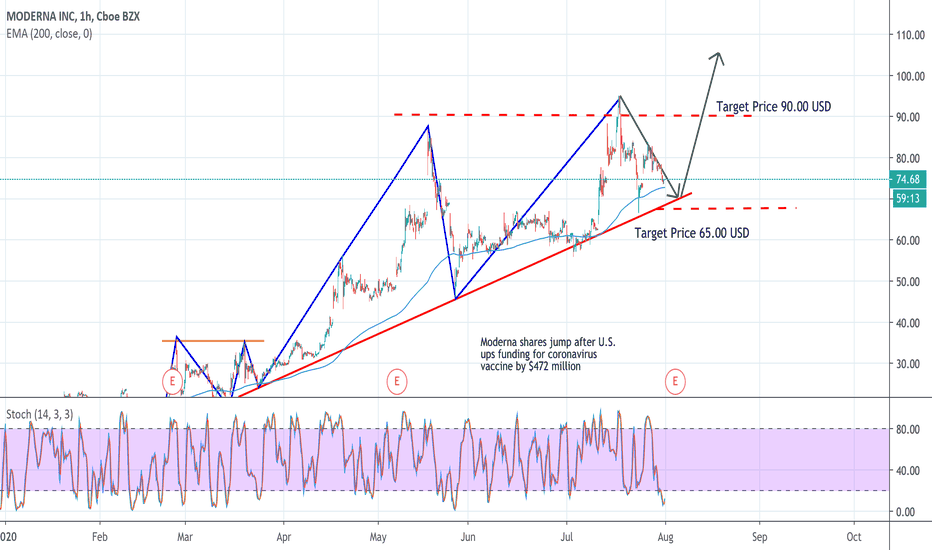

The Major trend is Bullish; The Trendline and EMA (with a length of 200) has been broken giving a signal of weakness of this Market. The idea is always to invest in the trend direction (bullish), but currently there are not a lot of signals to go long.

If 66.5 USD level will not be broken in the next days, perhaps the idea is to go long, or, vice versa, if the support will be broken the idea is to go short (this option is too Risky).

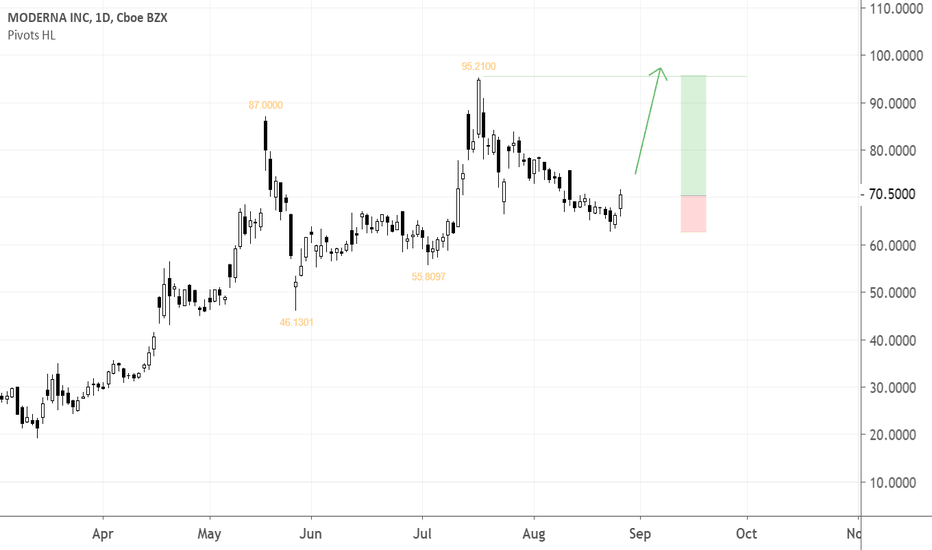

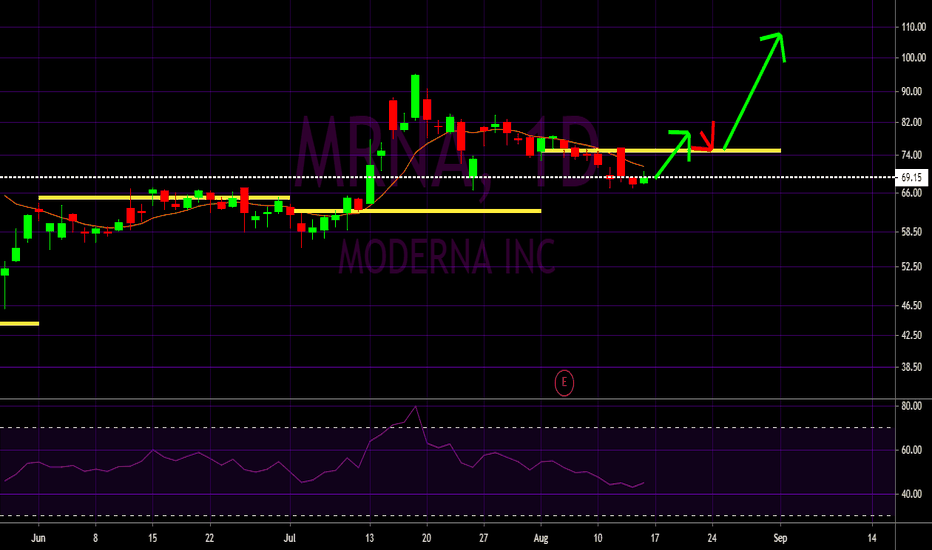

Moderna - more downside before impulse up?Either an expanded or running flat on the current wave C. The most recent impulse up may suggest the smaller wave C is completed and move up is expected.

A $20 dollar range of wave C is not very tradeable and constitutes a very high tolerance that I personally won't be playing with a large position.

Worth a try to put some in now.

MRNA- Leader in the vaccine race. Ladder buy to avoid the riskModerna is the first company to start the phase 3 trial in July and could have the supply ready earliest by Oct and accelerated approval earliest by December, according to Nami Sumida/BioPharma Dive and morningstar.

Other competitors are scheduled to have accelerated approval the earliest around early 2021.

Moderna Stock Analysis - MRNAThe trend is bullish - the idea is to invest in the trend direction - wait the end of the price retracement before going long.

Moderna (MRNA) – Moderna is aiming to price its Covid-19 vaccine at $50 to $60 per dose, according to sources cited by the Financial Times. That would be at least $11 more than the vaccine being developed by Pfizer (PFE) and partner BioNTech (BNTX).

Moderna in Trouble - ABUS Wins Lawsuit Tied to COVID-19 DrugArbutus Biopharma Corporation, a biopharmaceutical company, engages in the discovery, development, and commercialization of a cure for patients suffering from chronic Hepatitis B virus (HBV) infection in the United States. Its HBV product pipeline consists of AB-836, a capsid inhibitor that has the potential to inhibit HBV replication by preventing the assembly of functional viral capsids; and AB-423, which is in pre-clinical studies. The company also develops RNAi drugs, which utilize the RNA interference pathway, allows for a novel approach to treating disease. Its RNAi HBV candidates are designed to reduce hepatitis B surface antigen expression in patients chronically infected with HBV. In addition, it develops AB-729, a second generation RNAi therapeutic targeted to hepatocytes; HBV RNA destabilizer, an orally active agent that cause the destabilization of HBV RNAs, which leads to RNA degradation and to reduction in HBsAg levels. Further, the company engages conducting a Phase 1a/1b clinical trial and several pre-clinical and investigational new drug-enabling studies to evaluate proprietary HBV therapeutic agents, together with standard of care therapies, and in combination with each other. It has strategic alliance, licensing, and research collaboration agreements with Marqibo; Gritstone Oncology, Inc.; and Acuitas Therapeutics, Inc. The company was formerly known as Tekmira Pharmaceuticals Corporation and changed its name to Arbutus Biopharma Corporation in July 2015. Arbutus Biopharma Corporation is headquartered in Warminster, Pennsylvania.

AFTER HOURS BREAKING NEWS

Moderna stock tumbled late Thursday after the biotech lost a patent battle that may jeopardize the financial future of its coronavirus vaccine.

Moderna (MRNA) challenged patents held by Arbutus Biopharma (ABUS) covering lipid nanoparticle, or LNP, technology. Lipid nanoparticles are the delivery system for messenger RNA drugs, including Moderna's coronavirus vaccine, which is known as mRNA-1273.

Despite the company's contention, the ruling could cut into profits on any Moderna drug, including mRNA-1273, says SVB Leerink analyst Mani Foroohar.

"Revenue concentration in (the coronavirus vaccine) is a central feature of the investment case for Moderna shares," Foroohar said. "Any meaningful royalty burden could hamper Moderna's pricing flexibility and margin profile vs. other players in the SARS-CoV-2 vaccine market."

Foroohar called the decision in Arbutus' favor "a disappointing turn for Moderna."

"This decision opens the door to a fascinating (and likely protracted) period of investor controversy and debate around the implications of any potential infringement of claims by Arbutus regarding Moderna's use of Lipid Nanoparticle delivery technology, and any further actions Moderna may take to defend their own (intellectual property) position and freedom to operate," he said.

NEWS: www.investors.com

Where's ABUS going? To $100.00 ...???

On the monthly chart, it looks like $9.00 might be the next stop..? At this point, I am not sure if there is a top right now for ABUS.

The news is huge for ABUS and could entitle ABUS to billions in profits and revenue from the COVID-19 vaccine.

Intelligent comments welcome.

DISCLAIMER

The Content herein is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

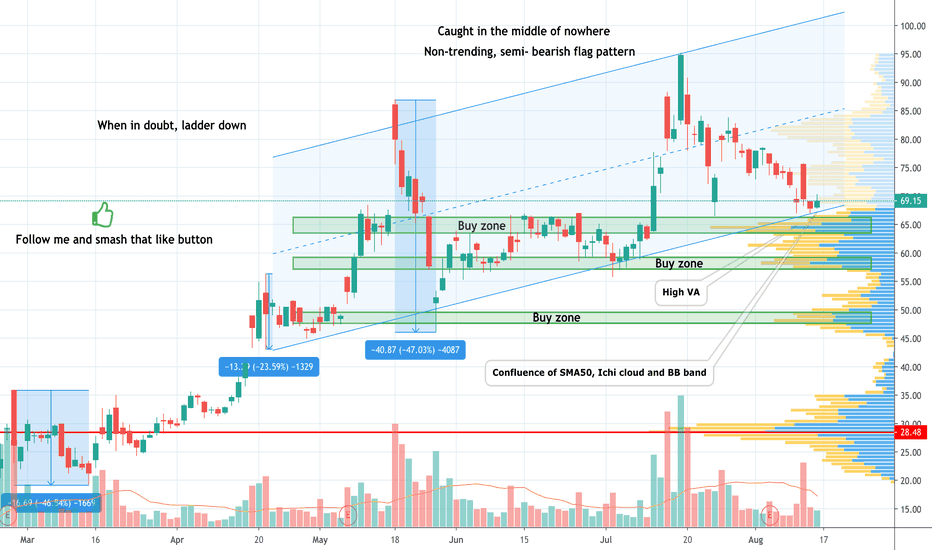

MODERNA PUMP AND DUMP SCAMAnother bullshit "vaccine news" to suck in the gullible bulls.

2 Ellipses drawn above were pops, pump and dumps on supposed "good" vaccine news.

Insiders (including CFO and CEO) have been dumping stock non-stop. If their "vaccine" is so game changing why are they dumping?

Look at candle pattern on day of "vaccine news". We have formed an identical pattern.

Open is being used to sell to gullible "investors."

S&P 500 response to every vaccine news from this company or Pfizer etc is having less and less durable impact and gains being reversed quickly.

S&P wants to go down.

As soon as S&P gets down to critical levels and bears look like about to take over a new bullshit "Vaccine" news comes out.

S&P is top heavy and wants to go down.

Stay short and sell rallies.

Cheers!

Cyrus

Moderna Stock Analysis - MRNAThe market is Bullish and the idea, if it is possible, is to invest always in the trend direction. Stochastic is on overbought meaning that the prices might be ready to start the retracement stage.

Based on Technical analysis, the idea is to hold and wait the end of the price retracement before going long.

Fundametal Analysis

Moderna — Moderna shares jumped 10% after the data released by the New England Journal of Medicine showed the company’s coronavirus vaccine candidate, produced neutralizing antibodies in all 45 patients in its early stage human trial. The data shows the vaccine “elicits a robust immune response across all dose levels,” Moderna Chief Medical Officer Tal Zaks said in a statement.