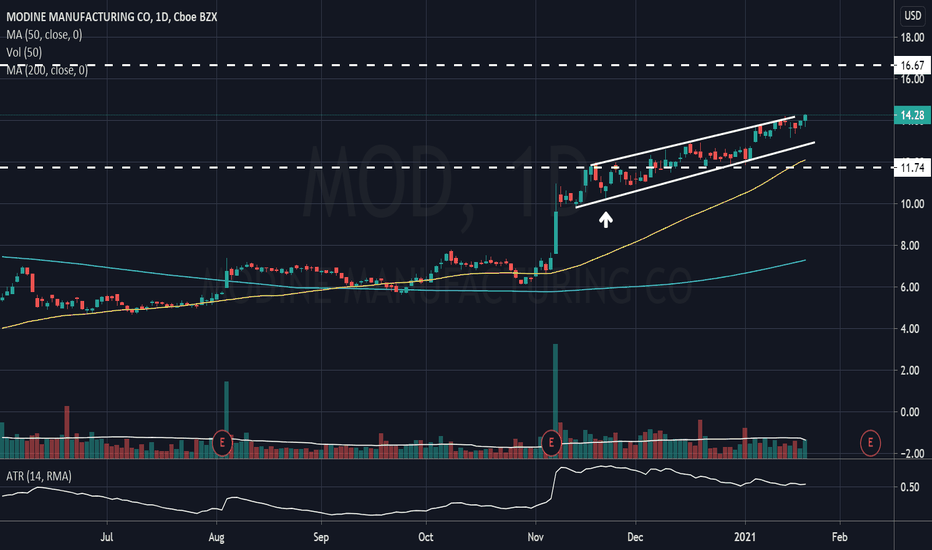

US Stock In Play: $MOD (Modine Manufacturing Inc)$MOD remains resilient within a bullish technical structure that was highlighted earlier this month, averting a potential correction that was experienced by the smaller-cap companies this morning. $MOD closed the earlier session at $14.28, an intraday gain of +2.29%.

First sign of bullish trend resumption for $MOD was signaled with a Bullish Reversal Hammer candlestick pattern on 20th November 2020, with a further continuation breakout on a week’s of consolidated price action on 15th December 2020.

At the current junction, immediate resistance for $MOD is clustered at $14.85 to $15 range. $MOD will be set to attain its 2 years high at $16.67 upon the clearance of the highlighted range.

Share this:

Modine

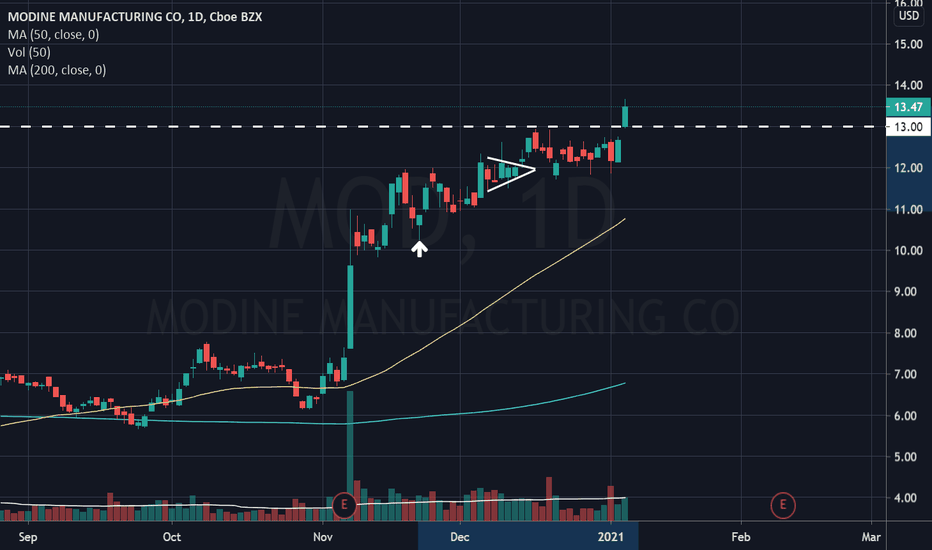

US Stock In Play: $MOD (Modine Manufacturing Inc)$MOD broke out of its 3 weeks consolidated range, trading beyond its $13 major resistance level with a pre-market open runaway gap pattern. It closed this morning at $13.47, representing a intraday gain of +6.40%, a similar breakout was also witnessed in $AMBA that was alerted yesterday.

$MOD first sign of bullish trend resumption was signaled with a Bullish Reversal Hammer candlestick pattern on 20th November 2020, with a further continuation breakout on a week's of consolidated price action on 15th December 2020. The cumulative % gain in this short term rally stance at +23.14%.

As $MOD is currently trading at its 52 weeks high, it is still a distant away from it's all time high (triple peak) established at $36 (180% away) in 1995-2005 period. The first major resistance to watch is at $17.