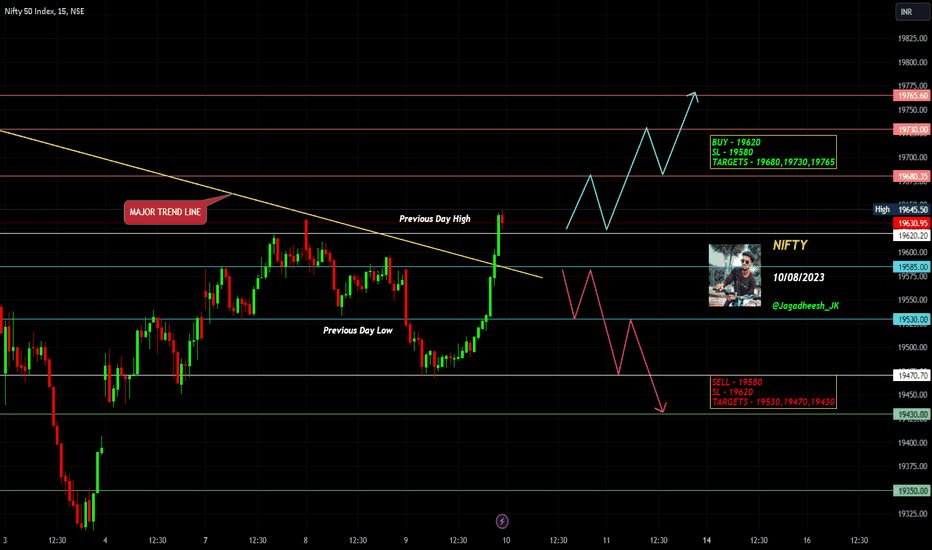

NIFTY INTRADAY LEVELS FOR 10/08/2023BUY ABOVE - 19620

SL - 19580

TARGETS - 19680,19730,19765

SELL BELOW - 19580

SL - 19620

TARGETS - 19530,19470,19430

MAJOR TREND LINE BREAKOUT Completed.... personally I'm Expecting nifty gives a big up move

Previous Day High - 19620

Previous Day Low - 195470

Watch that major trend line... after breakout that trend line only we can expect buying chance in the market

I am sharing NIFTY levels this levels acts as important support & resistance for intraday. if you want to trade with this levels wait for 15 min Candle closing above that levels. You can trade with breakout and reversal both.

In this channel, I share my expertise in trading strategies, technical analysis, and market trends to help you make informed decisions in your trading ventures.

Stay tuned for daily updates, in-depth market analyses, and real-time trading scenarios to witness firsthand how we transform from Zero to Hero in the trading world. My Only aim is to empower you with the knowledge and skills necessary to navigate the complexities of the financial markets successfully.

Based on price action major support & resistance's are here, the red lines acts as resistances, the green lines acts as supports. If the price breaks the support/resistance, it will move to the next support/resistance line. White lines indicates previous day high & low, high acts as a resistance & low acts as a support for next day.

Please NOTE: this levels are for intraday trading only.

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍

Momentumstrategy

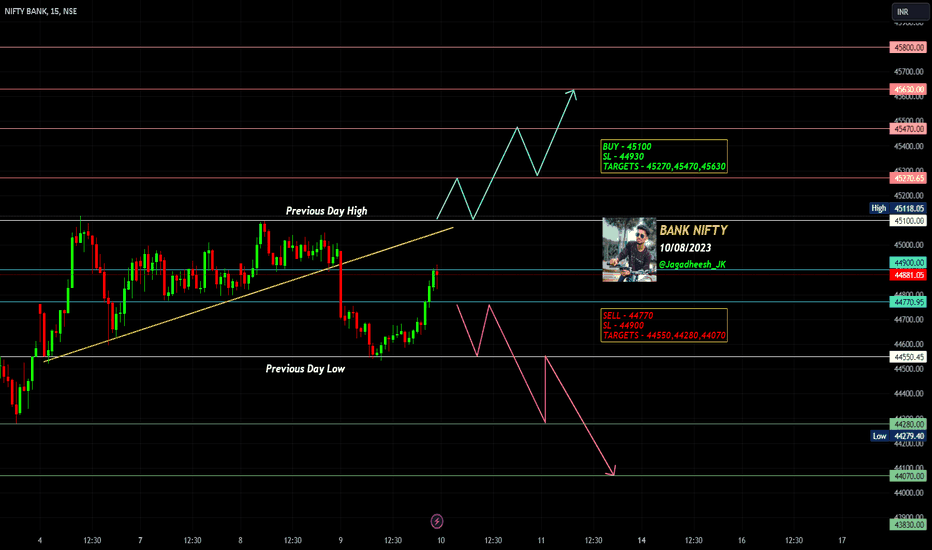

BANK NIFTY ANALYSIS FOR 10/08/2023BUY ABOVE - 45100

SL - 44930

TARGETS - 45270,45470,45630

SELL BELOW - 44770

SL - 44900

TARGETS - 44550,44280,44070

I am sharing BANK NIFTY levels this levels acts as important support & resistance for intraday. if you want to trade with this levels wait for 15 min Candle closing above that levels. You can trade with breakout and reversal both.

In this channel, I share my expertise in trading strategies, technical analysis, and market trends to help you make informed decisions in your trading ventures.

Stay tuned for daily updates, in-depth market analyses, and real-time trading scenarios to witness firsthand how we transform from Zero to Hero in the trading world. My Only aim is to empower you with the knowledge and skills necessary to navigate the complexities of the financial markets successfully.

Based on price action major support & resistance's are here, the red lines acts as resistances, the green lines acts as supports. If the price breaks the support/resistance, it will move to the next support/resistance line. White lines indicates previous day high & low, high acts as a resistance & low acts as a support for next day.

Trendlines are also significant to price action. If the price is above/below the trendlines, can expect an UP/DOWN with aggressive move.

Please NOTE: this levels are for intraday trading only.

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍

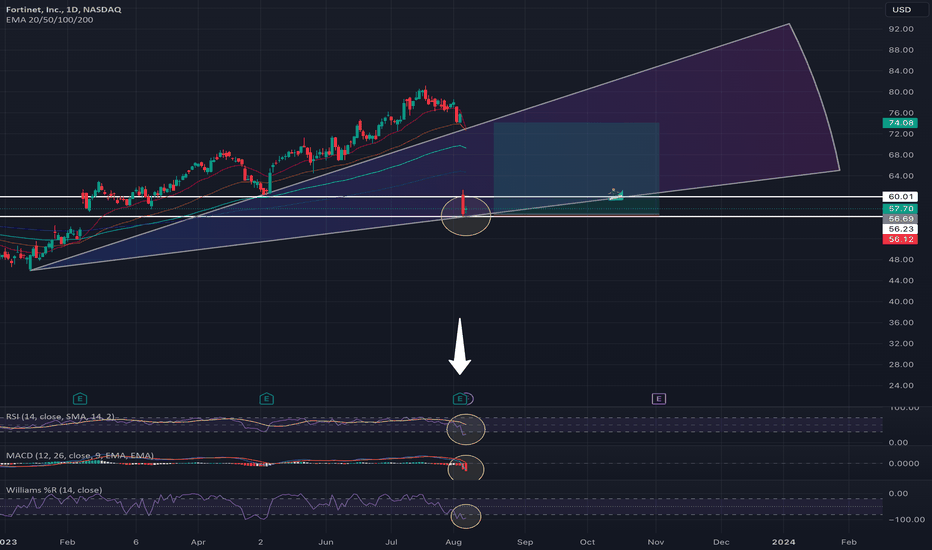

Fortinet FTNT Overreaction - What now?Slightly after earnings Fortinet Gapped down. Which are my favorite kind of stocks to trade because 9 times out of 10 Gaps close.

Fortinet had many analyst reiterate Bullish price targets some up to $70. I'm looking for a retest at $60.

Forecasting out to nov 2nd. The next earnings should be interesting.

Williams, MACD, & RSI are all showing Oversold in this situation. This could be a solid entry for someone to start a small position.

This is not financial advice.

Trade Responsible,

#TradeTheWave 🏄🏽♂️🌊

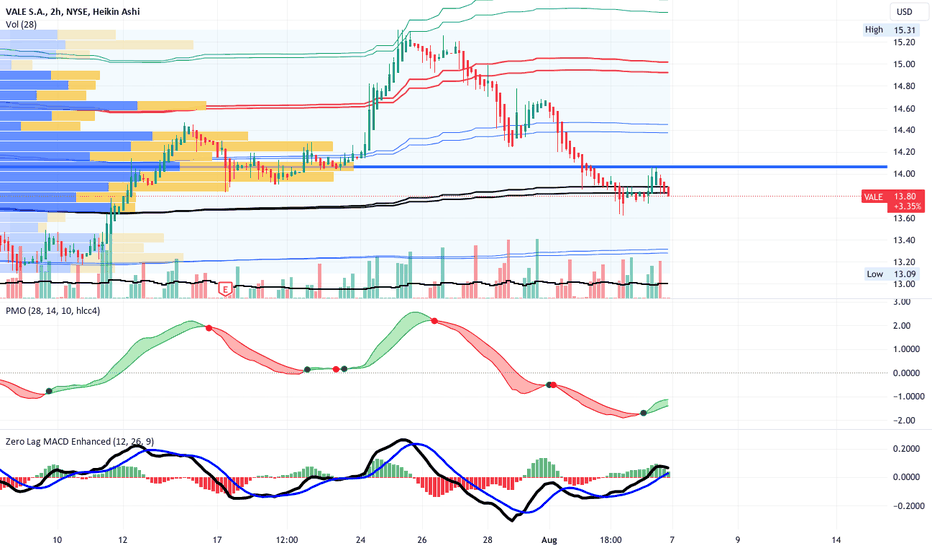

VALE a junior miner can rise on the Gold bullrunNYSE:VALE as a junior miner could be reaosnably expected to follow spot gold.

The bottom line is quite simple. With fixed costs to mine gold, VALE can easily

expect to increase its margins when stop gold rises will above the breakeven

on a spreadsheet. The 2H chart shows price has descended into the support of

the long term anchored mean anchored VWAP line after a VWAP breakdown.

The PMO and ZL MACD are confirmatory for a consolidation sitting on dynamic

support.

Overall, the analysis is that of VALE setup to make a reversal for a bullish move

reflecting the gold run at large. I will take this trade long now.

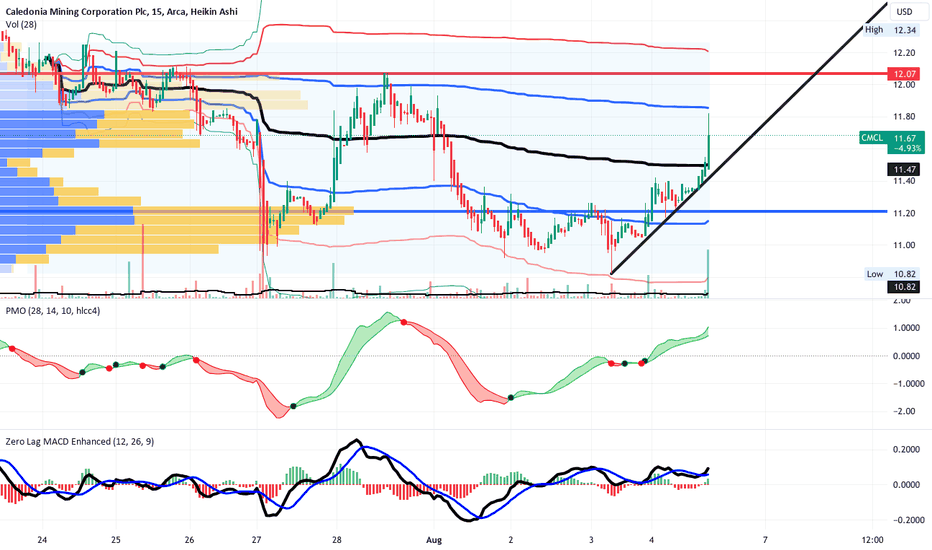

CMCL a junior GOLD miner moves on spot gold uptrendOn a 15 miunte chart. CMCL is seen trending down and then reversing while

traders seek to sync it to the price action of spot gold. The chart demonstrates

price reversing on May 2nd out of an anchored VWAP breakdown into a

rubber band reversal into a cross of the mean aVWAP. The movement of the

PMO ( Price Movement Oscillator) confirms the reversal into a trend up.

The ZL MACD shows a histogram flipping negative to positive with the

signal moving over the mean MACD. The last of the trading week shows

a big engulfing candle with a volume spike for me that spells momentum

straight out and simple

All in the all, I see price moving to a target of 12 over a period of a few days based on the

angle/slope of the trendline. In the context of the gold bullrun and the concept of a rising

tide being capable of lifting all ships, I see this as a very safe trade yielding

potentially 4% over a few days. This is more than acceptable given the chaos

and whipsaw action of the general market. If you find this idea helpful.

please like and follow and perhaps message me for a referred link to

TV pro. Trade well after DYODD !

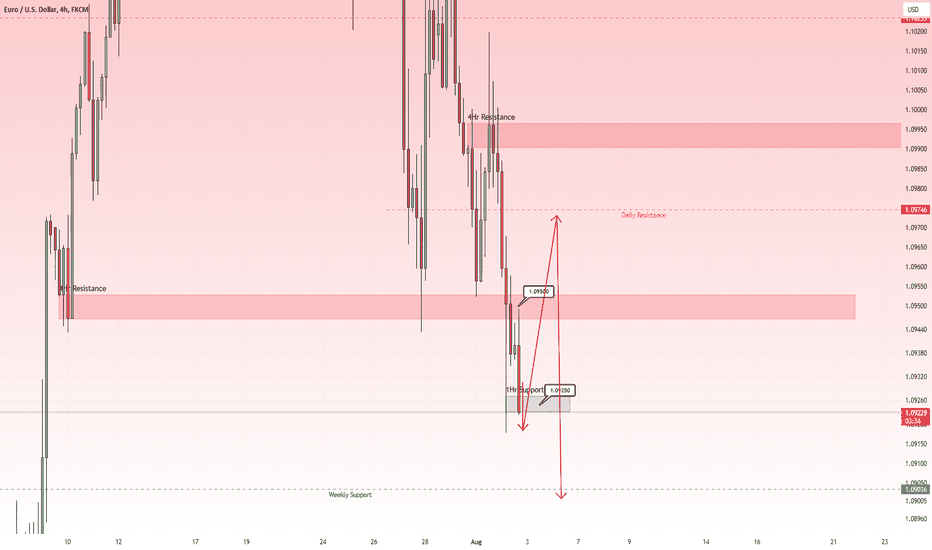

Momentum is Heavy here 👹, But.. We are dropping ! Buy the USD, Buy the USD before there is no more! Buy expensive and chase the market. Hold up! Often times the market will punish those market participants that chase rather than being disciplined like a hunting lion. It stalks and plans and thereby decreases it's risk of not eating. I've learned that trading is more about psychology than anything else. Observing price action can clue you on the next move if you ask why would I buy here? Why would I sell here? who's selling here?

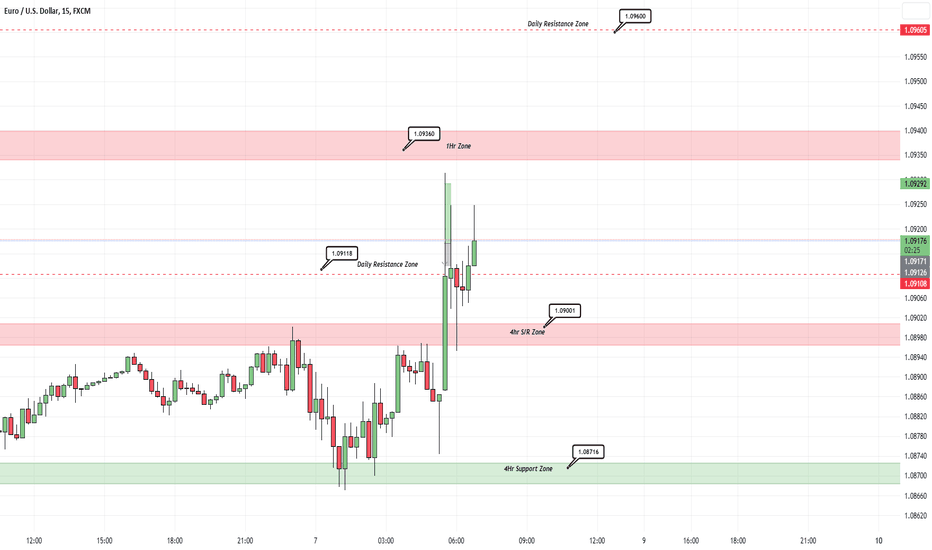

Unemployment claims data and Manufacturing data tomrrow will only act as either a catalyst to continue dropping towards 1.09 or pullback towards 1.099 4hr resistance zone. Either way I'm going to be adaptable as a scalper. This is one thing of my strengths.. flexibility .

I've anticpating a drop into 1.09 weekly support level since the beginning of the week. I'm publishing a long analysis here because we are currently about 20 Pips from where I'm anticpating a short term turning point in the market. market participants are buying the rumor with ADP which is estimated data. I'm anticpating that with NFP market particpants with Sell the news and thus the USD thereby pushing Eurusd up in favor of the Eur. 1.09 may orchestrate that turning point for us. If we happen to completely ignore 1.09 level, then we are headed to 4hr support 1.088.

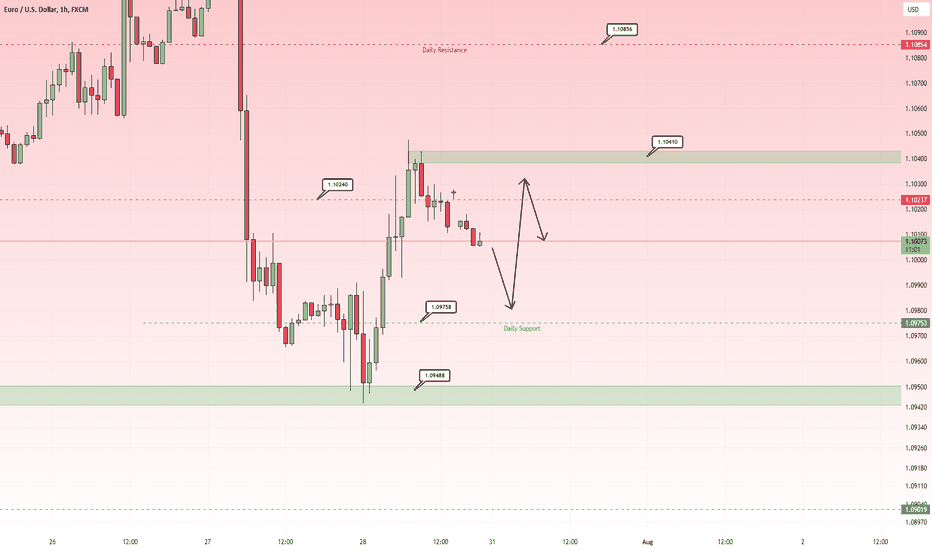

Momentum may carry 🎒us back to 1.0948Welcome back to another Eurusd Analysis!

0:0 Monthly timeframe

1:00 Weekly timeframe

4:32 4hr timeframe

5:47 1hr timeframe

7:15 Bias to begin the week

We have two Bearish weekly candle's back to back as we failed in a great fashion to continue our bullish ascent. The weekly candle last week closed below 1.1024 which was our weekly support level. It is now characterized a as a weekly resistance and may facilatate a selloff back to 1.0975 Daily support which we created on friday and eventually 1.0948 1hr support zone. 1.0948 would also be a weekly wick fill with bearish momentum carried over from the previous week.

Please leave feedback if you enjoyed. Have a great trading week.

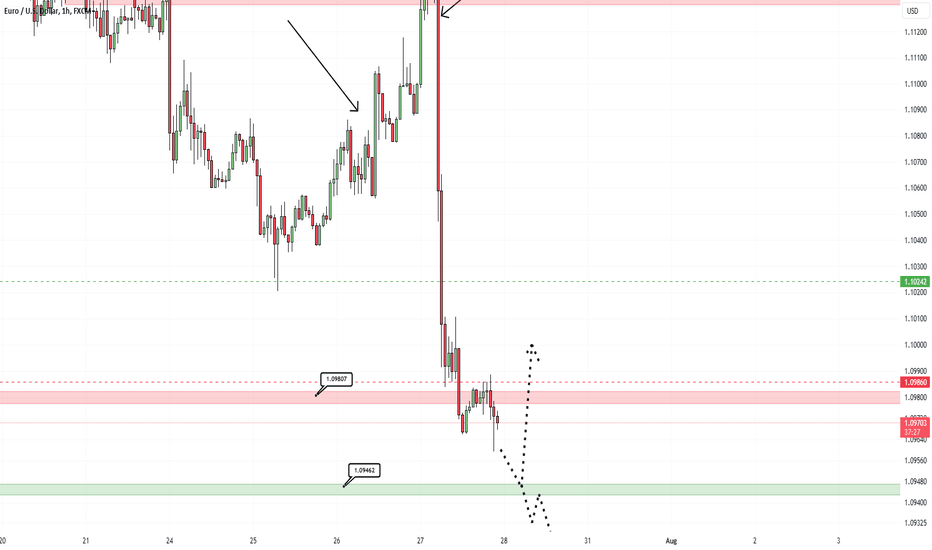

Leftover Momentum to end the Week? 😶🌫️// EurusdCurrent Price 1.097

0:0 Monthly timeframe

1:36 Weekly timeframe

3:51 Daily timeframe

5:10 Bias for friday

6:14 4hr timeframe

10:15 1hr timeframe

Hello Everyone welcome back to another analysis. Eurusd increased 30 pips against us before dropping 130 Pips in our favor today after we called out a short analysis prior to the last london session 24 hours ago. Quite the engulfing candle created today with expected and priced in EUR interest rates and 2 better than expected USD data points, GDP and Unemployment putting the nail in the coffin so to speak for USD bulls. Alot of momentum today and I'm antincipating some to be left over and continue on to friday. I'm thinking we can get a touch into the 1.09462 4hr support zone but unsure what'll occur after that. Inflation data may act as a catalsyt to keep dropping in favor of USD or we will see the Weekly candle pullback up and create a bottom wick as we close out the week. The latter implies a bullish NY session tomorrow to end the week.

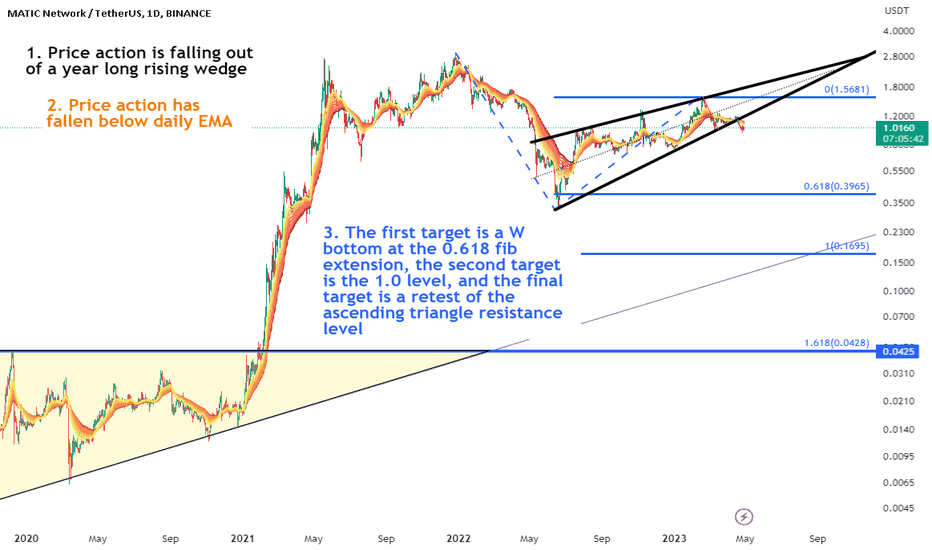

Short on Matic; long on SolanaIntroduction

I am biased short for the Ethereum ecosystem as a whole due to all the efforts made to have the system run more efficiently and at a lower cost. Price action will work its way down initially and severely before eth benefits again from the "adoption" trade.

A similar concept is water purification. Imagine water is very expensive to obtain and make potable. Efforts are made to get potable water cheaper and a new system is created that produces drinkable water at 1/10th of the price. The old systems that were in place before the development are going to crash in value as people move to the new system. The price of water is cheap and more people use it than ever before.

Matic is one of the old systems through no fault of its own or its developers. The price of Matic is due for quite a drop and the new Ethereum systems are poised to benefit if they can survive. And then there is the alternative to drinking water. I guess for this example we are talking about having a nice Mexican beer (a very overused pun for SOL). Hell, Cinco De Mayo is around the corner as well

Main Chart

This is technically a very simple play. Which is why I hope it is so powerful. We have a simple chart formation, a rising wedge creating a bull trap. That bull trap is a macro lower high from the all time high. We have a EMA ribbon that was support, and now it is poised to act as resistance. The targeting is likewise very simple. We can set a roughly equal W bottom which would be over a 60% loss from current levels.

Other Charts

I have cobbled together a set of indicators to develop a system to benefit from impulse as much as possible. It is decent on multiple time frames but I an trying to make less trades but bigger moves and tighter stops.

This set up is about 85% complete for a entry. It is a Heiken Ashi momentum strategy that looks to go short when indicators have a "bearish stack" and long when they have a "bullish stack. Ideally I would have waited until the SMAs were bearishly stacked and shorted rallys but shorting a break of the wedge is good enough.

Maticbtc versus LunaBTC

To be blunt, the MATICBTC chart looks like hell. There is a macro double top in blue and a nested double top making up the right top. These two formations cascade to a full target of Matic loosing 80% of its value against bitcoin from here. Absolutely devastating.

One thing scratching in the back of my head is how LunaBTC had a chart that predicted a simuar drawdown but the whole project got obliterated. One target for a rising wedge is the bottom of the wedge. So LunaBTC should have "only" dropped some 80% as well. I am wondering if some similar catastrophe could bit Matic. If not, and it merely loses 80% in a orderly fashion then I will be around to long the W pattern if it is confirmed.

My Trade

I have a pretty good entry. I was very tempted to take an entry in at a break of the purple trendline but the chance that price could have recovered at the wedge for another pump was too high and not enough of my conditions to go short were met. I am closing my trade at the first target and waiting to see if a continuation or reversal pattern develop. It could be a multi-month process.

I have a chart I use for reversals that uses daily and weekly SAR as well as the ADX, volume and stochastics. Taking profit around the monthly SAR usually a good idea and taking profits never made a man poor.

This strategy, but in reverse

Solana has taken on a fully bullish stack to its daily SMAs and is above both clouds. Both clouds have twisted bullish. The MACD is positive and looking to cross bullishly over the signal line. the 9SR is bullish on most time frames. This set up is appropriate as Solana has positions itself as a "Ethereum killer."

Here is ETH from 2019. I expect it SOL to have a similar rally because it is in a similar situation with regards to previous losses and current strength.

As such, I will be looking to take profit on a Solana trade as shown. Same strategy in reverse. It works long and short if you are patient enough.

MATICSOL

Here is an ABC correction draw on MATICSOL (actually maticbtc/solbtc) with EMAs on the weekly

And here is the draw on the daily set up for momentum. This chart is 100% fully bearish based on the system.

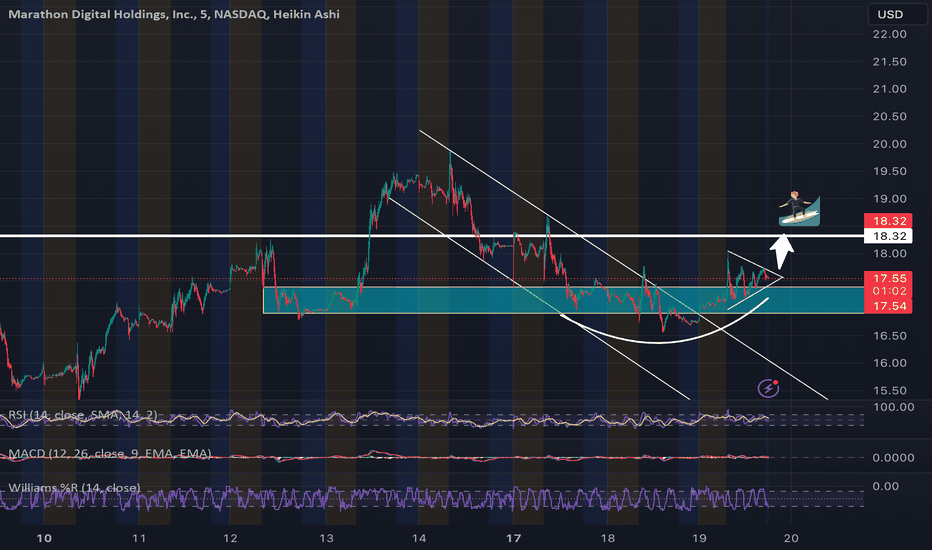

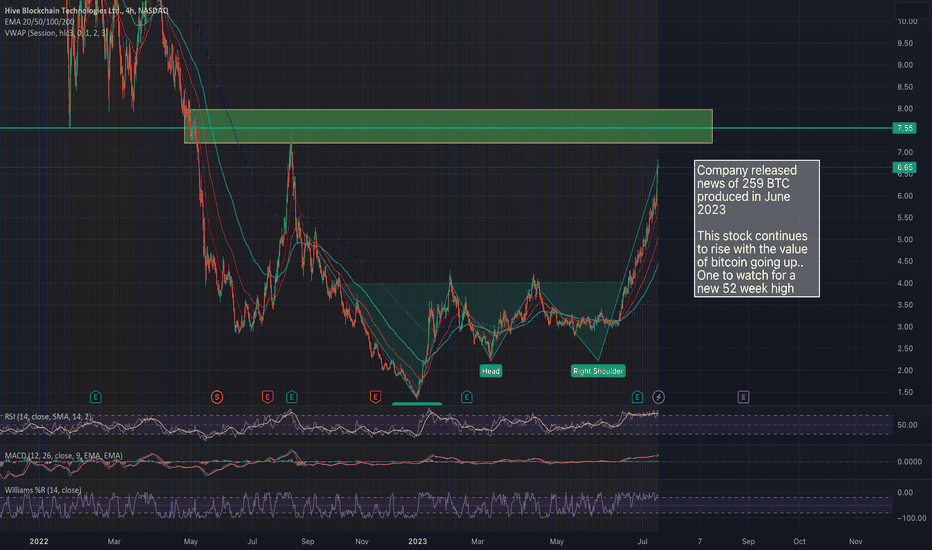

Marathon Digital Symmetrical Breakout?Mara reached a new high and fell as expected. It started trading into a wide falling wedge out of a bullish uptrend. I would think other than Bullish if it was knifing down.

Found consolidation level at 17-17.60 area after double bottom bounce at 16.50ish and looking for a possible break to the upside out of a bullish symmetrical triangle.

With bit coin holding 30,000 level.

We could see it retest and/or reclaim $20 soon.

Trade Responsible,

#TradeTheWave 🏄🏽♂️🌊

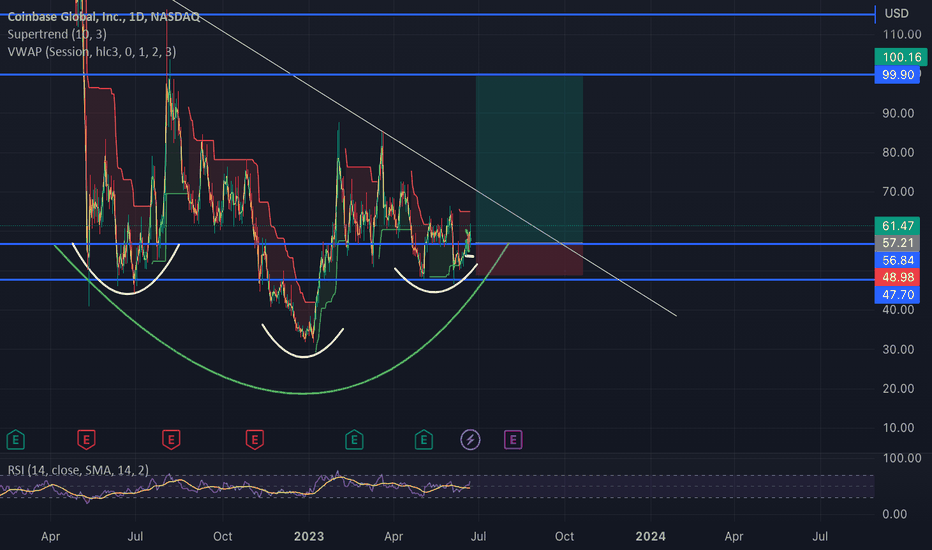

COINBASE Victory lapCoinbase wins decision over SEC lawsuit pushing the stock here this is a big accomplishment and win for the company. With blackrock wanting to create a bitcoin ETF and coinbase being a potential part of that and Earnings coming up this can ROCKET!

Short term watching for a break out of the wedge and a 59% gain up to $100.

This stock was once at a high at $430

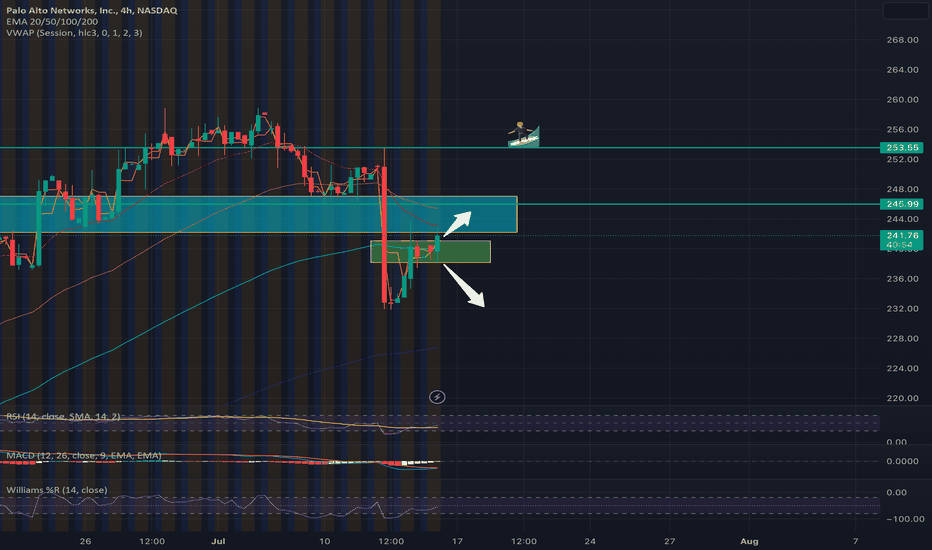

PANW Cyber SectorPalo Alto Networks is a cybersecurity company that provides advanced security solutions to organizations worldwide.

I don't think they're going anywhere for a while and are very established already with multiple deals and have been on point with their financials and earnings.

We're looking for a break out of the consolidating 238-240 range which already happened as im typing this.

huge gap down on july 12th looking for a retest to 253. If it falls below 238 it needs to hold 236 level or will retest 232.

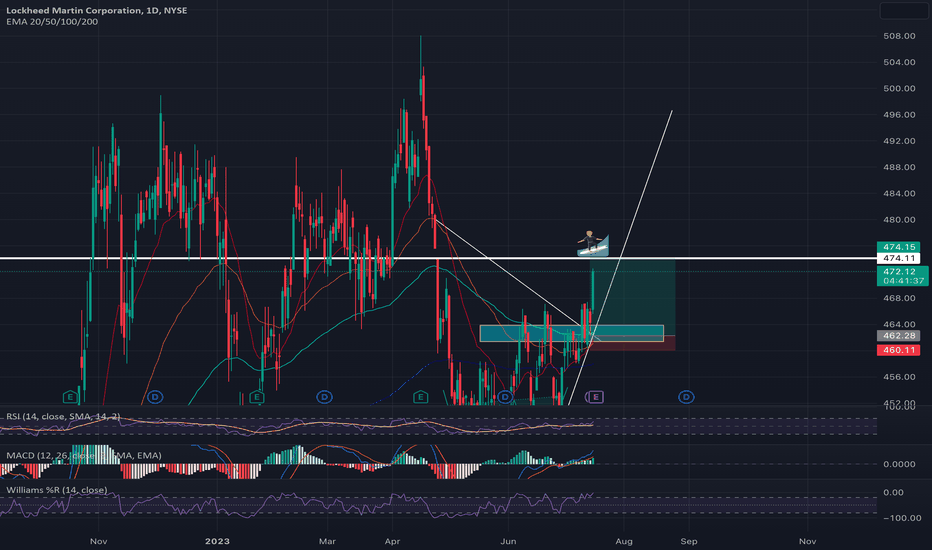

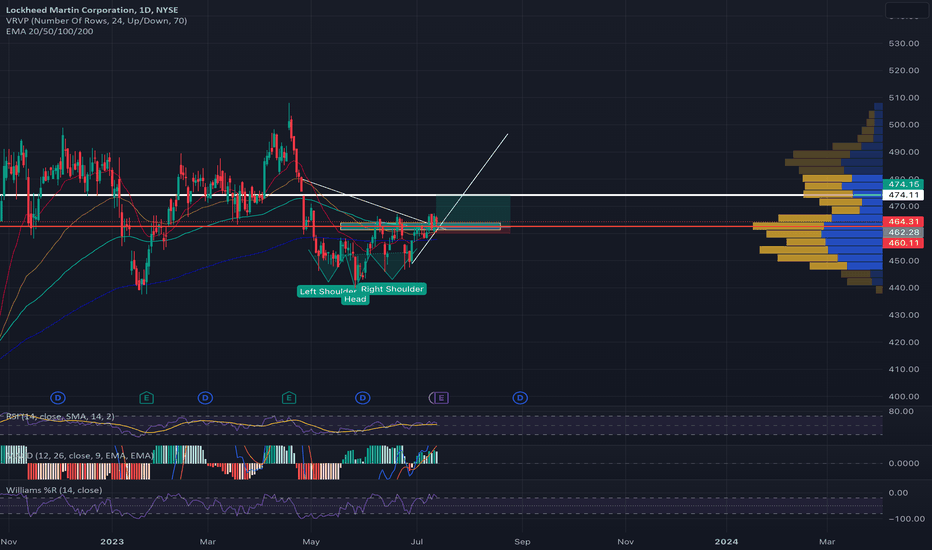

LMT Looks BULLISHWith earnings coming up lockheed martin remains bullish and seems to have broke toward the upside out of consolidation. My immediate PT was for it to close gap at least around 475 area.

If LMT has a great earnings this can possibly test next resistance at 480 as its still trading and trending up.

Trade Responsible,

#TradeTheWave 🏄🏽♂️🌊

Lockheed Martin Closing Gap?Lockheed martin earnings play. This stock has my interest with multiple contracts with the government and missing 1 of the last 5 earnings.

Lockheed is no stranger to getting multiple contracts. A lot of constant contracts coming in with government agencies and commercial airlines.

For a month it has been consolidating jun-jul and recently broke out of consolidation.

coming up on earnings July 18th with price targets ranging from 498 to 579 and a strong out look from 1- 5 out of 5 its sitting at a 5 for earnings beat from Earnings whispers.

Im Bullish looking for at least a gap fill at $475

Trade responsible,

#TradeTheWave

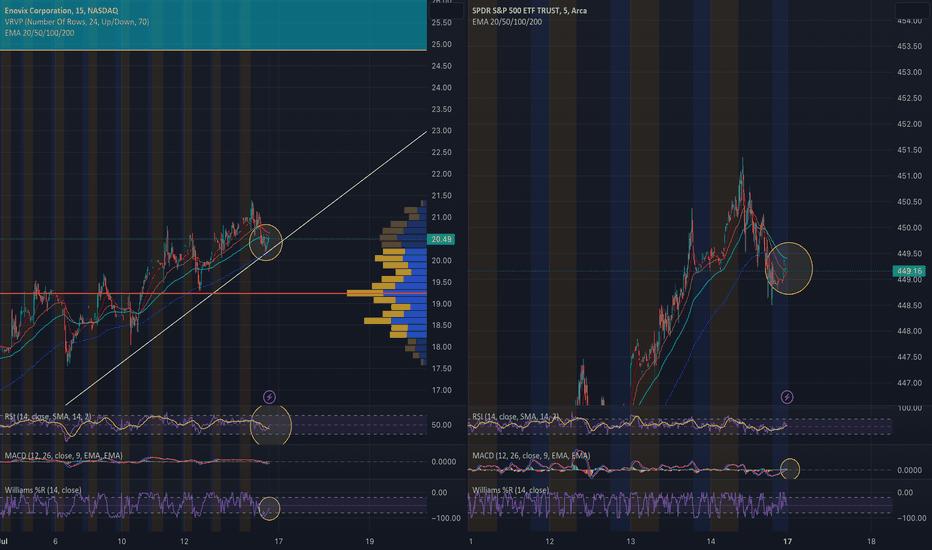

ENVX - Army Swiss Knife X FactorA Couple things to note is Enovix has been on a steady rise and has had bullish catalyst released. It's on the hook to hit the next leg. Lame pun for the Hook showing on the chart pattern

"The advanced silicon battery company said the deal is for it to produce commercial cells for use within U.S. Army soldier's central power source, called the Conformal Wearable Battery.

Enovix said the agreement moves the program toward full volume production. The cells will be used to build pre-production CWB packs." - MarketBeat

This launched the stock price to $19 ON JULY 6TH.

It helps that spy has been pumping making new highs. I feel it will rise in the next few weeks with spy being on an extreme bull run and ENVX following a similar pattern.

ENVX, RSI on close to oversold, Williams showing the stock is curling. ENVX is currently aligned with SPY and have the same exact pattern It may run up with SPY so long as it remains bullish.

Expect it to touch at least $25 but theres a lot of turbulance up there as thats where it's been consolidating in the past. General consensus PT is $38. Others have placed as high as $100.

has an average rating of buy and price targets ranging from $15 to $100, according to analysts polled by Capital IQ.

Trade Responsible,

#TradeTheWave

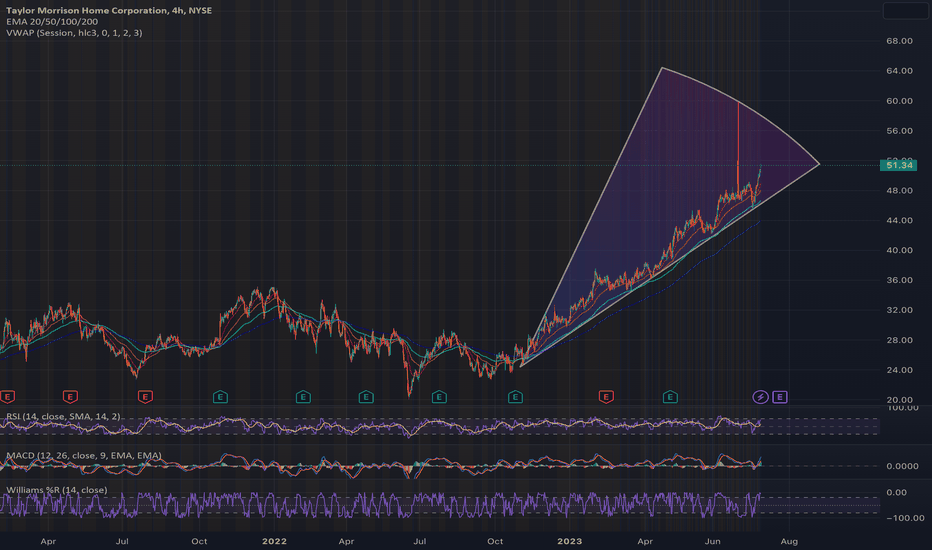

TMHC A Steady Gainer - worth the time?Stock has been on a steady rise since oct 22. Out of the 7 earnings it only missed one.

This leads me to believe were looking at a run up before their earnings call on July 23rd ( Right before market open ) & If it falls it continuosly bounces off the 100 EMA.

It already showed it has potential to touch 60 on jun 23rd.. Retest prior to earnings?

To be continued..

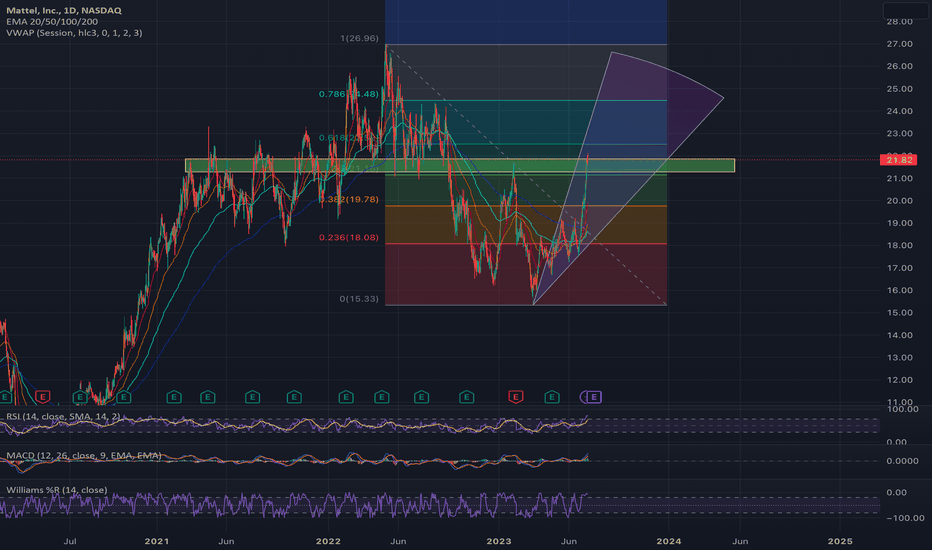

BARBIE Movie and hot wheels about to RIPWhat interested me in this is this company has mutliple brands under them ( UNO brand, Barbie & Hot Wheels ) .

Yellow box is previous resistance and support zones)

Looking for it to consolidate around these levels tomorrow and continue to push higher. Also this company rarely misses earnings coming up July 26th. 👀

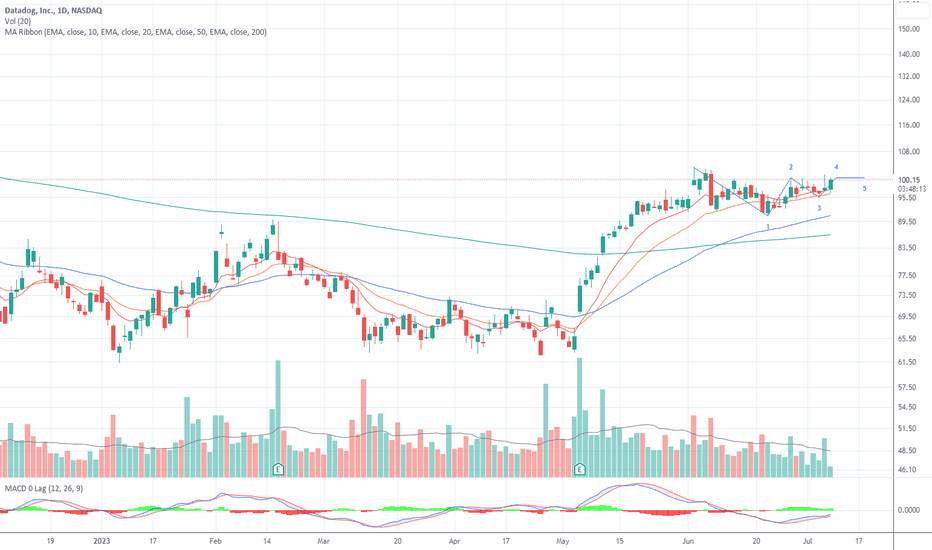

Datadog DDOGHi Folks,

DDOG start to draw an orderly consolidation. the consolidation is not yet mature, but worth to keep under surveillance.

• A big move in the past 1-3 months anywhere from 30%-100% the rally last for a few days to weeks.

• Orderly consolidation with higher lows & tightening range

• RDM, VCP

• Stocks surfs the rising EMA 10 or the EMA 20

• Volumes are significative compared to previous phase - NO

• Volumes dry up at the end of the consolidation

• Volumes are strong during the breakout - NO

• ADR is high, 3.8 - OK

• Revenues are really strong, but earnings needs to improve.

Go DDOG Wouf Wouf !!!

Eurusd Pulls up to end the week 📺The Weekly candle has flipped bullish with NFP data as I outlined as a possible scenario in yesterday's publishing and appears to be now headed towards 1.096 Daily resistance zone( Also the other side of the daily range). We are currently above 1.091 daily resistance zone and closed at this level with the 4hr candle. The 4hr candle closed quite strongly bullish. We have done a retest at our previous 4h resistance zone(1.09) which has just acted as a support level 40 minutes ago. We are seeing a bullish push to end off the week here and I think it may continue towards 1.0936 and 1.096 Daily resistance zone. We are consistently holing above 1.091 daily resistance zone and the 4hr close has given us confirmation that we may continue up. We have now gotten 2 1hr candles and 1 4hr candle close above 1.091 daily resistance zone. It may act as a support now after we have recieved candle closure confirmation on the 1hr/4hr timeframes.

I was originally looking for sell positions on Eurusd with NFP. Instead we saw that —> 1) I Identified that NFP data was expected to decrease overall from the prior period ( Not a positive for USD) 2) The data was worse than what was forecasted by analysts' ( Not good for USD) 3) Price printed a strong daily candle closure back inside our daily timeframe range with yesterday's daily candle. Our daily timeframe range being between 1.085-6 Daily Support and 1.096 Daily Resistance

1 Trade today. Buy Stops with NFP

Explanation :

So price created a Daily resistance zone on Monday. On Tuesday it respected the daily resistance zone and moved down accordingly. I placed my buy stop position above this high of Tuesday's price. One position closed for +8 Pips, Other position closed for +9.3 Pips 💰. My target was the next 1hr resistance zone as we noted in yesterday's publishing at 1.0936. I secured partial positions and extend my Take Profit to 8-10 Pips during news trading and Lowered my position size accordingly.

Data

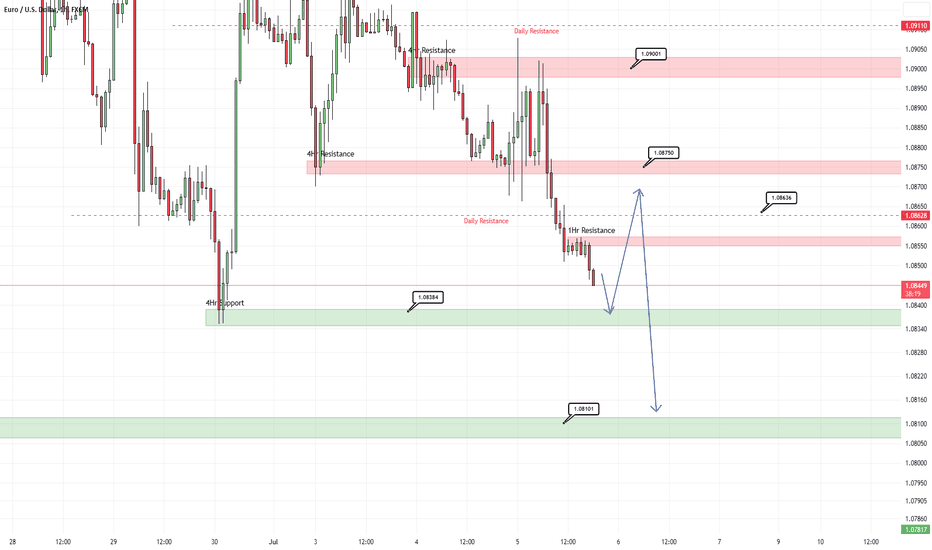

Thursday Daily Candle Incoming 🤯--> Continuation ( 6 minutes video 😎 ) As We approach the end of the week, We may observe alot of momentum! My mentors always told me that the market is setting up early in the week. The avalanche later in the week will provide plenty of opportunity for the disciplined trader to implement a trading system.

Price was at 1.08892 during our last publishing 24 hours ago. Price consolidated during Asian and London Sessions before gaining enough liquidity to see a breakout to the downside. Price is currently headed towards 1.08384 where we may see a bounce as we head into london session. If not then price is headed towards 1.081 4hr support zone as our next bearish target. Price has confirmed a breakout to the downside and I'm anticipating a pullback before my sells. If not then I anticpate a pullback with our 4 news releases tomorrow durng new york session. We could see all three sessions be bearish and it s thursday so I wouldn't be surprises. Must keep this in mind and plan for every scenario. I've outlined that good pullback prices look to me to be arouns 1.08628-1.0875

I've already met my weekly goal of 2% and I am quite a happy camper. 2 Weeks ago I recall I was up about 2.5% (.5% more than my goal) and I trade on a friday where I proceeded to give back 1/3 of my profits on the week. What a sour taste it left in my mouth to end off the week! Don't want to do that again so I will be publishing ideas and content for my channels to end off the week.

If you enjoyed the Video Analysis, please let me know by leaving a Rocket or comment!

-- ShrewdCatFx