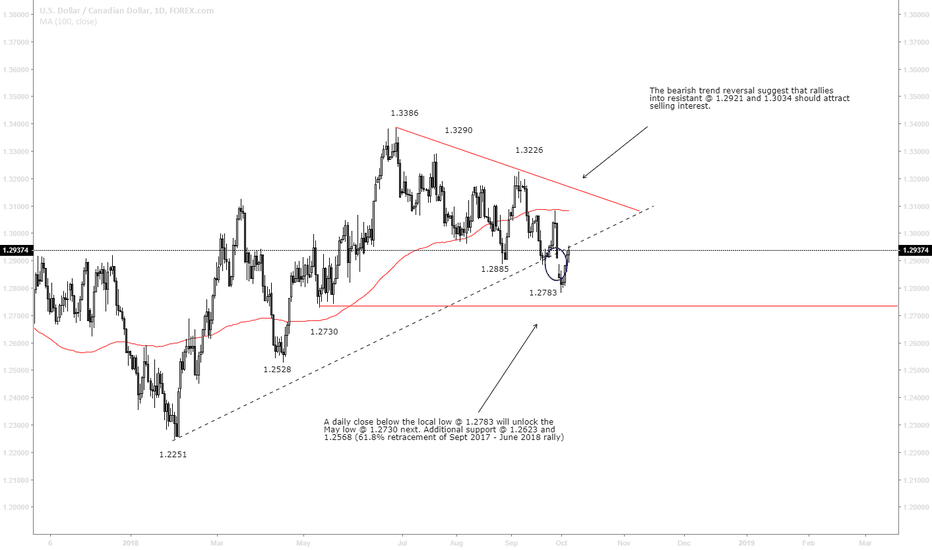

BoC on Deck this month ... fading corrective rallies in USDCAD=> We still maintain our USDCAD short position from earlier in the week and recommend selling all corrective rallies here ahead of the BoC rate hike widely expected this month.

=> Although the rate hike is expected this trade is far from crowded and we see incoming data to keep the BoC on track with tightening monetary policy.

=> Odds of any hikes are close to 90% probability (in other words it is a done deal) which makes complete sense considering that the decreased political uncertainty allows the BoC to completely focus on better fundamentals when setting policy (a rarity in this world...)

=> We are expecting payrolls to reach 195k and average hourly earnings expected to come in at 2.9% YoY.

=> Markets are expecting a better outcome, especially considering the price action we've seen in US yields and the USD via ADP and ISM employment components.

=> Good luck all trading this live

Monetarypolicy

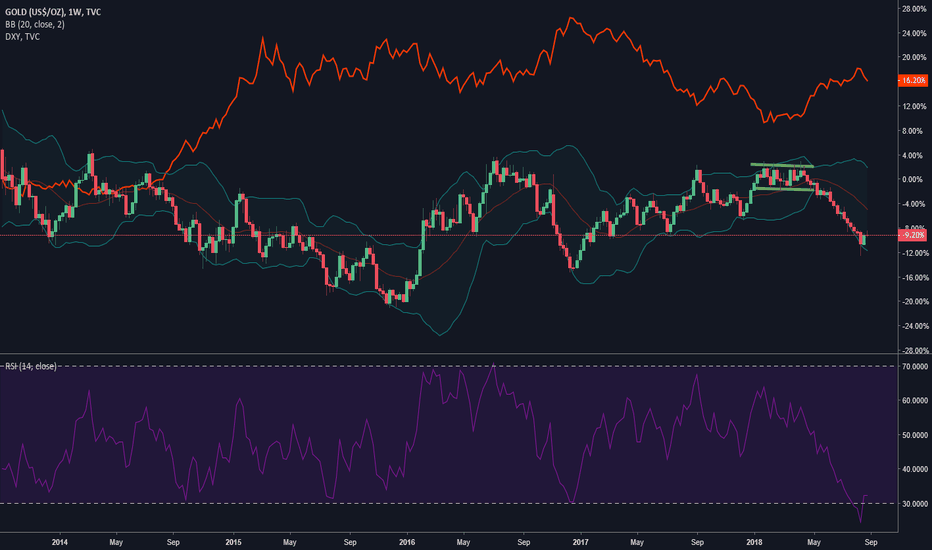

The USD problem with a gold recoveryAll the gold investors have been hoping that people will come to their senses and see the coming economic downturn as a result of the rising interest rates and start buying gold. But this has not been happening, has it. Right now gold is interacting pretty directly with USD and the problem here is that USD is slated to get stronger this year. And this can only be bad news for gold. We are both increasing demand for USD by expanding the deficit and selling more bonds and we are decreasing supply be increasing interest rates. We are also seeing good GDP growth and other positive metrics for the US economy which help support USD as well. Positive consumer sentiment is typically bad for the safe haven metal. There also doesn't seem to be much paranoia about the Fed letting inflation run away on us, in fact that Fed seems intent on tightening the monetary supply with out the requirement of inflation running above 2%. So inflation concerns aren't driving gold either.

So Golds problem is: nothing is going wrong, there's no inflation fears and no economic apocalypse unfolding and the USD is wrenching around Gold at will. Once the yield curve inverts and dries up liquidity and companies have troubling rolling over their massive debt load and start laying people off; then I think you'll see gold roar to life. Not to mention the fact that the Fed has recently expanded the monetary supply by roughly 3 times, did someone say stagflation? and if we're really luck! maybe North Korea will start shooting of ICBMs all over the place :) :)

Will Aussie Dollar Strength Prevail in 2018?The Aussie Dollar experienced strength throughout 2017 against its US counterpart with a strong rally to finish the year before forming a double top last week. Over the past week, AUDUSD has fallen almost 2%, following a CPI miss in Australia and a positive earnings report in the United States. Is this a sign of things to come for the remainder of 2018 or will Aussie Dollar strength prevail?

Throughout 2017, one of the main concerns of the Reserve Bank of Australia was AUD strength that resulted from a rally in metal prices and US Dollar weakness. As Australia is a net exporter, a weaker currency is favoured and with current rates at 1.5%, some analysts feel that it is unlikely for the RBA to raise rates this year. Westpac have also said that they do not see any rate hikes in the near future. However, recent data is showing that the economy is strengthening along with other countries globally which is expected to lead to inflationary pressure. In order to keep up with the global economy, this could result in the possibility of a rate hike later this year. Many asset managers currently have a negative outlook on the Australian Dollar as they believe that AUDUSD has risen on US Dollar weakness rather than Aussie Dollar strength. A key event for this pair will be the upcoming monetary policy statement from the RBA where analysts are expecting a more hawkish tone.

The US dollar, on the other hand, is not having the best of runs despite a strengthening economy. The rate statement released by the Fed earlier this week increased the odds of a March rate hike, with a total of three hikes expected for the year. There is also the possibility of a fourth hike if data continues to improve and inflation begins to catch up with the rest of the economy. In addition, we saw a positive earnings report with NFP and average earnings beating expectations, allowing a strong finish on Friday for the dollar. Bond yields increased throughout the week, with the 10 year treasury yield in particular, heading towards 3% which investors consider a significant level. This was based on the global economy starting to rise, increasing expectations of inflationary pressure. However, the dollar continues to struggle against many other currencies with the dollar index seeing only a small gain last week and weakness is expected to continue in the coming weeks. A large part of this is down to the Eurozone economy, where we saw GDP growth that was larger than that in the US and UK. Analysts are now anticipating that the ECB will unwind its quantitative easing program and tighten monetary policy at a quicker pace than previously expected. Central banks globally are expected to follow on and also begin tightening policies, which should see them catch up with the US.

Based on the current fundamentals, the weakness of AUDUSD seems to simply be a retracement and we should see a bullish run up until March. In March, we will assess the stance of the RBA against the Fed. If the RBA look to hold rates for the majority of the year and the Fed continue hiking, we will get a policy divergence with the Fed rate exceeding the RBA rate, at which point, AUDUSD weakness should kick in. Over the short term, we will be looking for buying opportunities on this pair and from Q2 we could be looking at short positions with long term targets around 0.75. However, traders should keep in mind that the fundamentals and sentiment can change quickly so it is important to frequently reassess long term positions. A prime example of this is the EURUSD currency pair which completely went against analyst expectations in 2017.

TODAY. News trading. ECB reports (EUR) at 12:30 (London time), Good afternoon everybody! Today is going to be my live trading SHOW.

Look at the EURUSD graph, this is my forecast.

I'm waiting for your attendance, look for the link in social by Kate Wess or in the my tradingview profile!

Have a nice and profitable day!

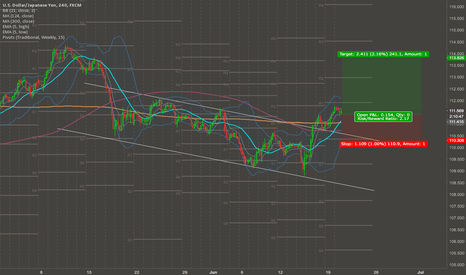

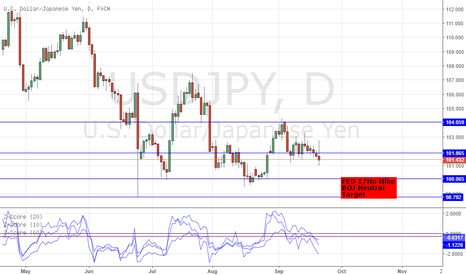

Yen about to suffer or benefit from geopolitical uncertainty?The USDJPY is approaching a key level on the weekly chart at 110.30.

However is this an opportunity to long given the obvious fact that both countries have different monetary policies ?

Or given the fact that Abe's popularity is tanking as a result of the scandal may cause markets to reassess the probability of him seeing his abenomics policies to fruition remains to be seen. Read more about it.

www.bloomberg.com

Thus, probable scenarios moving forward

a. 110.30 supported with stop below 108.00 with target at 113.40 and above (Month end flows and FOMCweek)

b. 110.30 breached and weekly trendline broken but supported at 109.30 (USDOLLAR continues to tank without finding support)

c. Sideways trading between levels 108.40 and 110.30 (Directionless until NFP in August )

Long CADJPY, Monetary Divergence - Inverse H&S breakout Classic Inverse H&S break for CADJPY.

Monetary Divergence in play with BOC turning hawkish and BOJ standing pat as extremely dovish.

Price action suggest a staggering 1300pip upside of this pair.

Long : 88.6

SL : 87.3

TP 1 : 93.2 ( 38.2% expansion )

TP 2 : Open

The US is raising interest rates and selling bonds - go long UJI think the Fed's action, totally ignoring poor economic data, indicates their desperation to normalise monetary policy. This is mainly to ensure they have room for monetary policy stimulus in the future.

There is a channel which has been broken and unsuccessfully retested on the 4H chart. There is also good support from the 21-day and 50-day moving averages underneath price.

AUDUSD Humpty DumptyDespite the RBA leaving its economic policy unchanged, I still have a gut feel that this pair might drop soon (and as any feelings, they're just feelings, so it's highly likely that I might be wrong and I'm just relying on technical analysis too much + my current bias on USD strength). Waiting for confirmation candles to drop at 0.755 or rise to 0.76833 before entering any trade.

www.dailyfx.com

RBA MONETARY POLICY DECISION HIGHLIGHTS - GBPAUD AUSSIEAs expected the RBA deciced to keep the OCR unchanged at 150bps. 30D Aussie bank bills implied only a 2% chance of a cut, down from the 10% we saw several weeks ago. There were few hints as to further policy, and it certainly feels as if the calls/ rhetoric for further cuts has been dampened in recent meetings following the august reduction. As well as in recent weeks, sentiment from the insto/ macro community has also shifted towards 2017 cuts vs 2016 which was previously a consensus view.

I remain bearish on aussie crosses, as I expect another leg lower towards 1.00 for audnzd which should maintain aussie supply across currencies as I expect kiwi to be picked up a the headline G10 yield ccy. The fundamentals (inflation, growth, employment, housing) of aussie and kiwi remain very similar, but the rate differential is 25-50bps in NZDs favour thus imo its difficult to justify audnzd being worth less than parity. up here at 1.05 thus the leg lower towards 1.00 (my 1-2yr average) would realise firm cross market aussie supply.

Short aussie positioning should be taken once AUDNZD has confirmed the leg lower (e.g. this topside correction fades with some daily closes lower/ downside structure forms in lower lows/ lower highs on meaningful timeframe(s). My preferred cross is GBPAUD longs as i have discussed before I feel STG is heavily undervalued in the medium term - though this renewed brexit selling needs to be watched in the immediate term (which works nicely to give time for AUDNZD to restart on the offer). GBPAUD has structure right until 1.40 2013 lows so there is plenty of room for further GBP selling until this trade moves into uncharted territories (unlike GBPNZD which has just cracked all time lows). USD longs are on the risky side going into election & with the finger less fed.

RBA MonPol Decision:

RBA SAYS GLOBAL ECONOMY GROWING AT LOWER THAN AVERAGE PACE

- Judged Steady Rate Consistent With Growth, Inflation Targets

- Pace Of China Growth Appears To Be Moderating

- Rising A$ Could Complicate Economic Adjustment

- Inflation Expected To Remain Low For Some Time

- Australian Economy Growing At Moderate Rate

- Labour Market Data Mixed, Sees Continued Growth In Employment

- Inflation Expected To Remain Low For Some Time

- Lenders Taking More Cautious Attitude To Housing

- Large Decline In Mining Investment Being Offset By Growth In Other Areas

- Says Household Consumption Growing At Reasonable Pace But Appears To Have Slowed Recently

RBA SAYS INFLATION EXPECTED TO REMAIN LOW FOR SOME TIME

RBA SAYS PACE OF CHINA GROWTH APPEARS TO BE MODERATING

RBA SAYS JUDGED STEADY RATE CONSISTENT WITH GROWTH, INFLATION TARGETS

RBA SAYS GLOBAL ECONOMY GROWING AT LOWER THAN AVERAGE PACE

RBA SAYS HOUSEHOLD CONSUMPTION GROWING AT REASONABLE PACE BUT APPEARS TO HAVE SLOWED RECENTLY

RBA SAYS LARGE DECLINE IN MINING INVESTMENT BEING OFFSET BY GROWTH IN OTHER AREAS

RBA SAYS LENDERS TAKING MORE CAUTIOUS ATTITUDE TO HOUSINGRBA SAYS LABOUR MARKET DATA MIXED, SEES CONTINUED GROWTH IN EMPLOYMENT

RBA SAYS AUSTRALIAN ECONOMY GROWING AT MODERATE RATE

RBA SAYS INFLATION EXPECTED TO REMAIN LOW FOR SOME TIME

RBA SAYS RISING A$ COULD COMPLICATE ECONOMIC ADJUSTMENT

RBA MONETARY POLICY DECISION HIGHLIGHTS - GBPAUD AUSSIEAs expected the RBA deciced to keep the OCR unchanged at 150bps. 30D Aussie bank bills implied only a 2% chance of a cut, down from the 10% we saw several weeks ago. There were few hints as to further policy, and it certainly feels as if the calls/ rhetoric for further cuts has been dampened in recent meetings following the august reduction. As well as in recent weeks, sentiment from the insto/ macro community has also shifted towards 2017 cuts vs 2016 which was previously a consensus view.

I remain bearish on aussie crosses, as I expect another leg lower towards 1.00 for audnzd which should maintain aussie supply across currencies as I expect kiwi to be picked up a the headline G10 yield ccy. The fundamentals (inflation, growth, employment, housing) of aussie and kiwi remain very similar, but the rate differential is 25-50bps in NZDs favour thus imo its difficult to justify audnzd being worth less than parity. up here at 1.05 thus the leg lower towards 1.00 (my 1-2yr average) would realise firm cross market aussie supply.

Short aussie positioning should be taken once AUDNZD has confirmed the leg lower (e.g. this topside correction fades with some daily closes lower/ downside structure forms in lower lows/ lower highs on meaningful timeframe(s). My preferred cross is GBPAUD longs as i have discussed before I feel STG is heavily undervalued in the medium term - though this renewed brexit selling needs to be watched in the immediate term (which works nicely to give time for AUDNZD to restart on the offer). GBPAUD has structure right until 1.40 2013 lows so there is plenty of room for further GBP selling until this trade moves into uncharted territories (unlike GBPNZD which has just cracked all time lows). USD longs are on the risky side going into election & with the finger less fed.

RBA MonPol Decision:

RBA SAYS GLOBAL ECONOMY GROWING AT LOWER THAN AVERAGE PACE

- Judged Steady Rate Consistent With Growth, Inflation Targets

- Pace Of China Growth Appears To Be Moderating

- Rising A$ Could Complicate Economic Adjustment

- Inflation Expected To Remain Low For Some Time

- Australian Economy Growing At Moderate Rate

- Labour Market Data Mixed, Sees Continued Growth In Employment

- Inflation Expected To Remain Low For Some Time

- Lenders Taking More Cautious Attitude To Housing

- Large Decline In Mining Investment Being Offset By Growth In Other Areas

- Says Household Consumption Growing At Reasonable Pace But Appears To Have Slowed Recently

RBA SAYS INFLATION EXPECTED TO REMAIN LOW FOR SOME TIME

RBA SAYS PACE OF CHINA GROWTH APPEARS TO BE MODERATING

RBA SAYS JUDGED STEADY RATE CONSISTENT WITH GROWTH, INFLATION TARGETS

RBA SAYS GLOBAL ECONOMY GROWING AT LOWER THAN AVERAGE PACE

RBA SAYS HOUSEHOLD CONSUMPTION GROWING AT REASONABLE PACE BUT APPEARS TO HAVE SLOWED RECENTLY

RBA SAYS LARGE DECLINE IN MINING INVESTMENT BEING OFFSET BY GROWTH IN OTHER AREAS

RBA SAYS LENDERS TAKING MORE CAUTIOUS ATTITUDE TO HOUSINGRBA SAYS LABOUR MARKET DATA MIXED, SEES CONTINUED GROWTH IN EMPLOYMENT

RBA SAYS AUSTRALIAN ECONOMY GROWING AT MODERATE RATE

RBA SAYS INFLATION EXPECTED TO REMAIN LOW FOR SOME TIME

RBA SAYS RISING A$ COULD COMPLICATE ECONOMIC ADJUSTMENT

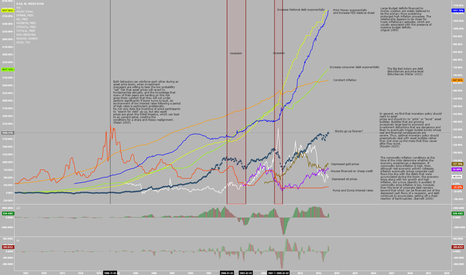

Is Another Financial Crisis Coming to the United States?"In general, we find that monetary policy should react to asset prices and should try to “prick” or “burst” asset bubbles." (Roubini 2005) Though it is clear they have not done so, anyone can see that there is an asset bubble in the stock, bond, and housing markets yet the FED continues their Zero Interest Rate Policy, and continues to print money at unprecedented rates while increasing debt and the deficit. The government's refusal to curb asset prices many years ago has led to a massive asset bubble that is waiting to collapse as soon as they raise interest rates, but now because commodity prices are very depressed as compared to 2007 "then the level of corporate debt remains beyond that which can be financed out of the depressed cash flows of a recession, and debt continues to accumulate, setting off a chain reaction of bankruptcies." (Barnett 2000) This asset bubble has been exasperated by "investment managers are willing to bear the low probability “tail” risk that asset prices will revert to fundamentals abruptly, and the knowledge that many of their peers are herding on this risk" which is particularly problematic in "an environment of low interest rates following a period of high interest rates" and can lead to "sharp and messy realignments" (Rajan 2005)

A "sharp and messy realignment" will lead to massive deflation in asset prices and force the government to increase their deficit spending to maintain their 2% inflation target, and because the primary way to finance a larger deficit in a depressed economy will be to print more money, and because "large budget deficits financed by money creation are widely believed to be the primary force sustaining prolonged high inflation processes." (Kiguel 1989) then this could lead to hyperinflation as deficit spending reaches unsustainable levels and the only way to conceivably pay it back is through hyperinflation or default.

If the FED would have raised interest rates many years ago when an asset bubble was becoming apparent then we could have possibly avoided such a big mess, but since they let this bubble extend out as far as possible without any attempt at curbing it when it does correct the FED is now left with very few tools to stimulate the economy. Interest rates are out. This leaves them primarily with printing money and deficit spending to raise inflation rates. They also have a few other tools, like raising the price of commodities artificially (see Gold Reserve Act). All of these methods will lead to the eventual destruction of the dollar and of any debts that are denominated in dollars, if and when another recession comes the government is left with the only option of destroying the dollar to save the economy. Now a destruction of the dollar is obviously a far off tale right now, but if this next recession comes then it is very likely to be the government's last resort to stimulate the economy and prevent a total financial collapse. Chances are it won't work to prevent a total collapse and the US will lose its position as the reserve currency of the world and we will fall into an extended period of economic turmoil. This will continue until there are "Substantial reductions in the budge deficit, monetary reform, and a fixed exchange rate." (Kiguel 1989) with outright elimination of the deficit being the most important factor.

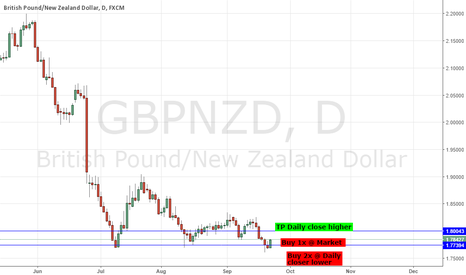

RBNZ MONETARY POLICY STATEMENT - GBPNZD TACTICAL LONG (NZDUSD)RBNZ not adding much new in their September statement, and imo, Gov Wheelers speech highlighting the issues with trying to control a ccy with the cash rate makes the persistent worries regarding kiwi/ nzd strength less of a dovish factor than it may appear. Nonetheless, the statement on the margin was neutral, with perhaps the pressure for a lower kiwi and inflation prints putting it on the dovish side.

Positioning wise, I am tactically long GBPNZD and EURNZD for another day or two (depending on closes - see attached).. this leaning dovish statement may ease these positions into the money but it isnt the key driver I was looking for but ill take any kiwi weakness we can get here. One onus on short kiwi is the tail off in US STIR which may see some more AUDNZD selling (kiwi buying) as USD rates become less attractive - although we have infact seen December fed funds trade flat on the day (though November did soften from 20 to 14%) so this yield seeking cross selling may be limited and under some sort of control for now which should enable these tactical kiwi shorts some running room.

RBNZ: MONETARY POLICY TO REMAIN ACCOMODATIVE

- A Decline In THE NZ$ Is Needed

- Further Easing Will Be Required

- Weak Global Growth And Low Rates Putting Upward Pressure On NZ$

- High NZ$ Makes It Difficult To Reach Inflation Target

- Further Declines In Inflation Expectations Still A Risk

- Domestic Growth Supported By Strong Migration, Tourism, Construction

- Strong Immigration Is Limiting Wages Pressure

- Watching Data Closely

- Volatility In Global Markets Has Increased

- House Price Inflation Remains Excessive, Macropru Having Moderating Influence

- Outlook For Global Growth, Commodity Prices Remains Uncertain

- Annual CPI Inflation Expected To Weaken In Sept Quarter

Full statement is here - www.rbnz.govt.nz

WESTPAC ON THE RBNZ:

-This morning the RBNZ left the OCR unchanged at 2.00%, as was widely expected.

-Much of the language from the August Monetary Policy Statement was retained in today's release, most likely deliberately so. The last paragraph repeated that "further policy easing will be required to ensure that future inflation settles near the middle of the target range" (our emphasis - "will" is about as strong as the RBNZ's language gets).

-The statement acknowledged the economic developments since August, without altering its bottom-line assessment on inflation. Dairy prices have risen strongly, although there is still a great deal of uncertainty around the full season outcome; the NZ dollar has risen more than expected; strong GDP growth was broadly in line with expectations; and there are early signs that the latest round of lending restrictions is having a dampening effect on the housing market.

-The RBNZ again noted that annual inflation is expected to rise from the end of this year, as some temporary factors drop out. Nevertheless, the RBNZ still faces an uncomfortably slow return to the inflation target, with the risk that persistently low inflation leads to a further decline in wage and price expectations.

-In August the RBNZ was fairly explicit that its interest rate projections split the difference between one and two more OCR cuts in coming months, with the first cut most likely to be at the November MPS.

-We suspect that the RBNZ is still committed to at least the first of those rate cuts. Any change in the language of today's statement could have given the false impression that the RBNZ was wavering on further easing.

FED YELLEN SPEECH HIGHLIGHTS - USDJPY DXY SHORTSFed Yellen Speech:

Yellen: Current Policy Should Help Economy Move Toward Goals

Yellen: Welcome Development That More People Seeking Jobs, Unemployment Measures Steady

Yellen: Household Spending Key Source Of Economic Growth

Yellen: Fully Committed To Achieving 2% Inflation Objective

Yellen: Recent Pickup In Growth, Labor Market Strengthen Case For Rate Increase

Yellen: Decision Does Not Reflect Lack of Confidence in Economy

Yellen: Chose to Wait for Further Evidence of Progress Toward Objectives

Yellen: Cautious Approach to Paring Back Monetary Policy Support Is Appropriate

Yellen: Expects Only Gradual Increases In Fed Funds Rate

Yellen: Generally Pleased With How The U.S. Economy Is Doing

Yellen: The Economy Has A Little More Room To Run Than Previously Thought

Yellen: Expect Labor Market Conditions To Continue Strengthening

Yellen: We Don't See The Economy As Overheating Now

Yellen: Most Officials Judged Case for Immediate Increase 'Stronger,' But Sensible to Wait

Yellen: Expects To See One Rate Increase This Year If Economy Stays On Course

Yellen: 180k Jobs a Month is Faster Than Sustainable in the Longer Run

Yellen: Don't Want to 'Significantly Overshoot' 2% Inflation Objective

Yellen: Economy Has Shown More People Being Attracted Back Into Labor Force

Yellen: Meeting Focused on Timing of Rate Increases

Yellen: Less Disagreement Among FOMC Participants Than Speeches Suggest

Yellen: Officials Struggling With 'What is the New Normal' DJ News

Yellen: FOMC Not a Body That Suffers From 'Group Think' DJ News

Yellen: FOMC Debating, Discussing Issues Related To Timing of Rate Increase

Yellen: Partisan Politics Plays No Role in Our Decisions

Yellen: We Do Not Discuss Politics At Our Meetings, Take Politics Into Account

Yellen: Decision Not To Raise Rates Today Largely Based On Judgement Not Seeing Economy Overheating

Yellen: Decision to Wait Based on Economic Factors, Not Political

Yellen: November Is A Live Meeting, Will Assess Incoming Evidence

Yellen: Highly Accommodative Policies Seem Necessary In Most Advanced Economies

Yellen: Aware Of Financial Stability Risks Caused By Low Rates

Yellen: Investment Spending Has Been Quite Weak For Some Time, Not Certain Of Causes

Yellen: Not Aware Of Evidence Political Uncertainty Weakening Investment Spending

Yellen: Concerns About Scope For Monetary Policy, Balance Sheet Large

Yellen: 'Worthwhile' for Fiscal Policy Makers to Prepare for Future Economic Shocks

YELLEN: THE ECONOMIC OUTLOOK IS INHERENTLY UNCERTAIN

FED'S YELLEN: MONPOL NOT ON A PRESET COURSE

FED'S YELLEN: CURRENT MONPOL STANCE SHOULD BE CONSIDERED "MODERATELY ACCOMMODATIVE"

FED'S YELLEN: NEUTRAL FFR RATE QUITE LOW BY HISTORICAL STANDARDS

FED'S YELLEN: LBR MKT SLACK BEING TAKEN UP AT SLOWER PACE, SOFT INFLATION, WE CHOSE TO WAIT FOR FURTHER EVIDENCE

FED'S YELLEN: DECISION TO NOT HIKE NOT A REFLECTION OF LACK OF CONFIDENCE IN THE ECONOMY

FED'S YELLEN: RISKS TO THE OUTLOOK ARE ROUGHLY BALANCED

FED'S YELLEN NOTES INFLATION STILL SHORT OF OBJECTIVE GIVEN BASE EFFECTS

FED'S YELLEN: LBR MKT CONDITIONS WILL STRENGTHEN FURTHER OVER TIME

FED'S YELLEN: MORE PEOPLE ARE SEEKING AND FINDING JOBS - A WELCOME DEVELOPMENT

FED'S YELLEN: SLACK LITTLE CHANGED THIS YEAR

FED'S YELLEN: BIZ INVESTMENT REMAINS SOFT

FED'S YELLEN: GROWTH HAS PICKED UP DRIVEN BY HOUSEHOLD SPENDING

FED'S YELLEN: CASE FOR HIKES HAS STRENGTHENED, BUT DECIDED TO WAIT FOR EVIDENCE OF FURTHER PROGRESS

USDJPY - EDGY BOJ TURNS YEN TURBULENT; KURODA SPEECHUSDJPY:

1. Price action immediately following BOJ this september was more than erratic but at the same time showed some consistency for those of you who can remember back to Julys performance - we moved instantly lower on the decision to 101 flat, before ripping 180pips higher to 102.8 to then lose most of the bids and trade back to the 101 base.

2. The BOJ decision itself, imo, was less than clear compared to July though and almost warranted this kind of whipsaw behaviour - especially given the anticipation (or not so much) of the Fed later today which is likely to mingle with risk sentiment and dollar leg of USDJPY the like at some point.

- The unclearness regarding whether the policy decision was net hawkish or dovish was given that there was no changes to the main policy tools (Depo, LSP, JGB, ETF), it would leave one thinking neutral-hawkish on expecttions - especially given a 5bps cut was the median BBG forecast. However, on the other hand, you had statements from BOJ including, "BOJ expanding its monetary base until it reaches its 2% inflation target" which is somewhat dovish given it puts never ending monthly JGB 80-100trn yen on the table for the next few years (unless the BOJ is delusional that less time is required). But at the same time this dovish statement was met by a bid from the BOJ to "increase yields for 10y JGB to 0%" and steepen the curve - which in itself is highly contradiction of ANY further expansion to the monetary base (given increases in money supply reduces rates). The BOJ knowing this then went on to cover saying "pace of purchases may fluctuate as to meet 0% target". Thus all in all the above, for me at least, left the overall decision uncertain at best. Given we are only 0.2% down it would be fair to say the outcome was infact neutral.

Neutral BOJ and No hike Hawkish Fed was my prediction before (see attached) and i stand behind the 100 level being reached as USD demand is likely to be flushed at some level when the 10-20% priced into USD fed funds is flushed out.

BOJ Decision:

JAPAN BOJ RATE DECISION STAYS FLAT AT -0.1 % (FCAST -0.1 %) VS PREV -0.1 %

BOJ DECIDES TO SET TARGET FOR LONG TERM INTEREST RATES

JAPAN BOJ BASE MONEY TARGET STAYS FLAT AT 80 TLN JPY (FCAST 80.00 TLN JPY) VS PREV 80.00 TLN JPY

BOJ: ADOPTS QQE WITH YIELD CURVE CONTROL

BOJ: TO ABANDON MONETARY BASE TARGET

BOJ SAYS NO OFFICIAL BASE MONEY TARGET, BUT MAINTAINS ANNUAL PACE OF JGB BUYING AT 80 TRLN YEN

BOJ: TO KEEP BUYING JGBS SO BALANCE OF ITS HOLDINGS INCREASES AT ANNUAL PACE OF 80 TRLN YEN

BOJ: INTRODUCES NEW MARKET OPS FOR YIELD CURVE CONTROL

BOJ: TO BUY JGBS SO 10 YR YIELD HOVERS AROUND 0 PCT

BOJ: PURCHASING YIELDS WILL BE SET PER AUCTION BY INDICATING THE SPREAD FROM THE BENCHMARK YIELD WHICH BOJ DETERMINES SEPARATELY

BOJ: DEPENDING ON MARKET CONDITIONS MAY SET JGB PURCHASE SIZE PER AUCTION TO FIXED AMOUNT OR UNLIMITED AMOUNT

BOJ: SCRAPS RANGE FOR DURATION OF JGBS THAT BOJ BUYS

BOJ: BOJ TO CONTINUE EXPANDING MONETARY BASE UNTIL CPI EXCEEDS 2 PCT AND STAYS ABOVE TARGET IN STABLE MANNER

BOJ: ADOPTS COMMITMENT TO LET INFLATION OVERSHOOT ABOVE 2 PCT

BOJ: BOJ CAN CUT SHORT TERM POLICY RATE, TARGET LEVEL OF LONG TERM RATES IN FUTURE EASING

BOJ: BOJ TO CONTINUE EXPANDING MONETARY BASE UNTIL CPI EXCEEDS 2 PCT AND STAYS ABOVE TARGET IN STABLE MANNER

BOJ: BOJ MAY ACCELERATE EXPANSION OF MONETARY BASE AS FUTURE POLICY OPTION

BOJ: PACE OF MONETARY BASE INCREASE MAY FLUCTUATE IN SHORT RUN UNDER MARKET OP THAT AIMS TO CONTROL YIELD CURVE

BOJ: MAINTAINS COMMITMENT TO ACHIEVE 2 PCT INFLATION AT EARLIEST DATE POSSIBLE

BOJ Kuroda:

AUSSIE - AUDUSD: RBA MINUTES HIGHLIGHTSRBA minutes broadly neutral on the margin. Aussie rates (30 day bills) are implying a 5% chance of an October 25bps cut. In general we've seen aussie rates firm up, with 30d bills moving from 7% last week and 9% the week before to now 5%, this firming/ steepening has been the general consensus further along the maturity curve where rate cut hopes are diminishing in AUD as speculation regarding a nearing RBA terminal rate/ housing market issues dampening expectations. Feb/ March 2017 is where we see a "dip" in rates or a spike in cut hopes, with there currently being 12/13bps of cuts into these dates - there seems to be an accumulation of institutional macro expectations of an RBA cut in March. Beyond here we see diminishing basis point cuts:time with the May to July differential being only 1bps (from -16bps in May to -17bps in Jun/ July). The driver for AUDUSD will likely be FED/ USD induced. AUD will provide a firm base, but has continued risk of cross selling from AUDNZD as kiwi at 2.00% remains the leading G10 carry trade. Both kiwi and aussie have the ability to push higher and maintain these higher levels if the fed confirms one hike this year, which puts the fed a hike behind the curve.

RBA MINUTES: JUDGED CURRENT STANCE OF POLICY CONSISTENT WITH GROWTH, INFLATION TARGETS

- Steady Decision Took Into Account Rate Cuts In May And August, Recent Data

- Estimated Around Half Of The August Rate Cut Had Been Passed On To Bank Customers

- Repeats Rising A$ Would Complicate Economic Rebalancing

- Decline In A$ Since 2013 Continued To Support Traded Sector Of Economy

- Data Suggest Economy Growing In Line With Potential

- Forward Indicators Consistent With Little Change In Unemployment Rate In Coming Months

- Cost Pressures, Wage Growth Set To Remain Low For Some Time

- Conditions In Established Housing Market Had Generally Eased, House Price Growth Moderated

- High Home Building Approvals Pointed To Significant Amount Of Work In Pipeline

- Economic Drag From Falling Mining Investment Looked To Have Peaked In 2015/16

AUSSIE - AUDUSD: RBA MINUTES HIGHLIGHTSRBA MINUTES: JUDGED CURRENT STANCE OF POLICY CONSISTENT WITH GROWTH, INFLATION TARGETS

- Steady Decision Took Into Account Rate Cuts In May And August, Recent Data

- Estimated Around Half Of The August Rate Cut Had Been Passed On To Bank Customers

- Repeats Rising A$ Would Complicate Economic Rebalancing

- Decline In A$ Since 2013 Continued To Support Traded Sector Of Economy

- Data Suggest Economy Growing In Line With Potential

- Forward Indicators Consistent With Little Change In Unemployment Rate In Coming Months

- Cost Pressures, Wage Growth Set To Remain Low For Some Time

- Conditions In Established Housing Market Had Generally Eased, House Price Growth Moderated

- High Home Building Approvals Pointed To Significant Amount Of Work In Pipeline

- Economic Drag From Falling Mining Investment Looked To Have Peaked In 2015/16

SHORT GBPNZD ON RALLIES INTO 1.81: RBNZ GOV WHEELER HIGHLIGHTSThe market took RBNZ Wheelers comments as largely hawkish before fading off to neutral after interestingly Wheeler mentioned that the current market rate tracker has 35bps of cuts priced in - illuding to 2 more cuts being likely though he failed to mention how realistic this expectation is past what future data holds.

I like being short GBPNZD into 1.81 rallies with 100pips tp at 1.80 - the market has remained somewhat capped/ rangebound since the RBNZs decision on the 10th between 1.81-79 and 1.81 has held on a number of occasions on the m30 (about 20) so shorts here look firm and i think will continue to be, especially since the GBP rates spike on friday looks to be tamed with the 1.81 and i expect this to fade throughout th eweek giving more reason than not for gbp downside - especially vs NZD since there isnt any data to get in the way this week and last weeks above average employment report was the last say (along with Wheelers comments now). On a side note and for similar reasons I like to be short gbpusd as Fed Yellens speech is largely likely to be skewed to the hawkish side given the other speakers last week trying to reaffirm the Feds control - though durable and GDP data remains the biggest risk imo - a miss here and cable will likely trade into the 1.33 handle, though i would still maintain my fade on rallies and sell here.

RBNZ Gov Wheeler Speech Highlights:

-RBNZ GOVERNOR WHEELER SAYS MONETARY POLICY FACES CHALLENGES IN TURBULENT TIMES

-RBNZ GOVERNOR WHEELER SAYS SCOPE OF MONETARY POLICY CONSTRAINED BY DEVELOPMENTS OUTSIDE COUNTRIES' BORDERS

-RBNZ GOVERNOR WHEELER SAYS CURRENT INTEREST RATE TRACK BALANCES A NUMBER OF RISKS WHILE GENERATING INCREASE IN CPI INFLATION

-RBNZ GOVERNOR WHEELER SAYS TWI FX RATE ALREADY AT HIGH LEVEL

-RBNZ GOVERNOR WHEELER SAYS FLEXIBLE INFLATION TARGETTING MOST APPROPRIATE FRAMEWORK

-RBNZ GOVERNOR WHEELER SAYS CURRENT INTEREST RATE TRACK INVOLVES EXPECTED 35 BASIS POINTS OF CUTS

SELL EUR V AUD, USD, NZD: ECB MONETARY POLICY MINUTES HIGHLIGHTSAfter 5days higher EUR$ Statistically is a 80th percentile sell opportunity - the monetary policy minutes were dovish on the margin reiterating and stressing the ECB's willingness to "Boost stimulus again if needed". This should put downside pressure on EUR given september meeting is coming up (when most likely to add to easing).

EURAUD and EURUSD shorts here look technically the best and fundamentally with EURNZD also possible and an alternative for EURAUD (depends on your preference - higher differential = NZD; weaker monpol fwd guidance/ future rate stability = AUD).

ECB Monetary Policy Minutes Highlights:

ECB SAYS "WIDE AGREEMENT" AMONG COUNCIL MEMBERS NOT TO DISCUSS ANY MONETARY POLICY REACTION AT JULY 20-21 MEETING

-Brexit Vote Created New Headwinds for Eurozone Economy, Heightened Uncertainty-ECB Minutes

-Brexit Vote Could Affect Global Economy in Unpredictable Ways-ECB Minutes

-Policymakers Stressed ECB's Readiness to Boost Stimulus Again if Needed-ECB Minutes

-Policymakers Thought it Was Too Soon to Discuss Fresh Stimulus-ECB Minutes

-ECB Saw Market Impact of Brexit Vote "Contained"-ECB Minutes

-Policymakers Stressed Need To Safeguard Transmission of ECB Policies Through Banks-ECB Minutes

-Policymakers Noted Apparent Link Between Bank Stock Prices, Bank Lending Volumes-ECB Minutes

ECB ACCOUNT OF MONPOL MEETING

-Called For Measures To Address Weak Profitability

-No Clear Upward Trend In Inflation Path

-Premature To Discuss Fresh Stimulus

ECB'S PRAET: CALLS WEAK PRICES AN 'ONGOING SOURCE' OF CONCERN

DXY/ USD: FED LOCKHART SPEECH HIGHLIGHTSFed Lockhart was cautious on the margin stating one rate hike in 2016 only "could" be appropriate rather than should which echoed the sentiment of the earlier Fed Dudley speech which was alot more hawkish imo. This has helped the USD back off its Dudley induced gain, and refocus on the CPI miss as Lockhart reminded the market that " Some Signs Election Uncertainty Slowing Economy" and " 'Not Locked In' To Any Particular Monetary Policy Outlook Right Now" given the data uncertainty which continue to be the two biggest factors for the USD and future hikes going forward. Fed funds currently imply an p18% sept hike, up from 9% yesterday though - where i expect this to come down still into days end as CPI miss is priced and Fed Dudleys sentiment is faded with th ereal hard data left in traders minds (bearish).

This in mind I continue to be bullish AUD with a 0.78 target (apprx 100pips).

Fed Lockhart speech highlights:

Fed's Lockhart: One More Rate Rise In 2016 'Could Be Appropriate'

Lockhart: 'Not Locked In' To Any Particular Monetary Policy Outlook Right Now

Lockhart: Optimistic About Outlook, Views 2Q Gdp With Caution

Lockhart: Economy's Underlying Fundamentals Remain Healthy

Lockhart: Indications 3Q Growth Fixing For A Rebound

Lockhart: Doesn't Believe Economic Momentum Has Stalled

Lockhart: 2% Growth Environment Now Looks More Likely

Lockhart: Uncertainty An Issue For The Economy

Lockhart: Economy Closing In On Full Employment, Wage Gains Rising

Lockhart: Will Achieve 2% Price Target By End Of 2017

Fed's Lockhart: Some Signs Election Uncertainty Slowing Economy

Lockhart: Auto Sales Have Been Going 'Gangbusters'

Lockhart: Even at Full Employment, Economy Still Has Labor to Draw On

AUDUSD LONG: RBA GOV STEVENS SPEECH HIGHLIGHTS"It's a search-for-yield world and this country still looks attractive because other yields look so unattractive," Mr. Stevens said in a joint interview with The Wall Street Journal and the Australian newspaper ahead of his retirement next month. "That's not something that the Reserve Bank can wave a wand and make go away."

The below and above support my bullish AUD$ view, the RBA/ Gov Stevens seems to have accepted and become contempt somewhat that AUD appreciation will continue in an era of low global interest rates as ive said before/ earlier. I continue to like AUD$ to 0.78 12m highs, on the back of weak US CPI.. USD currently seeing some bids on the back of Fed Dudleys hawkish comments (attached), but i nonetheless think CPI will be the lasting word on the USD front and will help AUD$ bid up to the 0.78 level. USD strength comes as a function of the fed funds futures which are up at 18% probability of a sept hike vs 9% yesterday, though this should be faded into days end as the CPI weakness takes over

RBA Gov Stevens Speech Highlights:

RBA Gov. Stevens: World Economy Ready for U.S. Rate Rise

RBA Gov. Stevens: Stronger GDP Growth Rates Would Be Welcomed

RBA Gov. Stevens: Should Be Possible to Expand Budget, Retain AAA-Rating

RBA Gov. Stevens: House Prices Must Still Be Watched Carefully

RBA Gov. Stevens: Worrying Knowledge Gap Around China Economy

RBA Gov. Stevens: Cash Rate Just One Variable for Australian Dollar Level

RBA Gov. Stevens: High Yields in Australia in Infrastructure, Property

RBA Gov. Stevens: Hard to Wave Away Demand for Australian Dolla

RBA Gov. Stevens: Australian Housing Not in Risky Category

RBA Gov. Stevens: Housing Debt Is Significant

RBA Gov. Stevens: No Fresh Surge in Housing Leverage

RBA Gov. Stevens: Housing Slump Would Not Lead to Systemic Risk

RBA Gov. Stevens: Housing Slump Would Not Trigger Bank Failures

DXY/ USD: LONG AUDUSD 0.78TP - FOMC DUDLEY SPEECH HIGHLIGHTSFed dudley was largely hawkish on the margin more than hintin that the Fed should hike this year using plural "rate hikes this year good news" and also saying "fed funds futures under-pricing the rate hike likelihood".

These remarks seem to be the catalyst for USD buying despite the weak CPI data (as expected) - nonetheless i think this is a good opp to add to AUD$ longs at 0.771 (at market) or lower (with 0.78tp) if possible as the remarks are likely to be faded later today once the real hard data (CPI miss) sets in, I dont think these remarks will firm USD for long.

Nonetheless as it stands the opt implied probability of a Sept/Dec hike from fed funds futures trades at 12% and 37.8% marginally up on the day from 9% and 37.4% though i expect this to fade throughout the day along with USD demand.

FOMC Dudley speech highlights:

Fed's Dudley: Sees 2H Economy Stronger Compared with 1H

Fed's Dudley: Economy in `OK Shape'; Income, Jobs Gains `Sturdy'

Fed's Dudley: Economy in `OK Shape'; Income, Jobs Gains `Sturdy'

Fed's Dudley: Premature to Talk About Raising Inflation Target

Fed's Dudley: US Election will not `Weigh' on Fed Decision on Rates

Fed's Dudley: Premature to Talk About Raising Inflation Target

Fed's Dudley: Near-Term Risk from Brexit has Diminished

FED'S DUDLEY: TOO EARLY TO TALK ABOUT RAISING INFLATION TARGET

FED'S DUDLEY: FED FUNDS FUTURES MKT UNDER-PRICING RATE HIKES

FED'S DUDLEY: RATE HIKES THIS YEAR WOULD BE 'GOOD NEWS'

FED'S DUDLEY: US ECONOMY TO BE BETTER IN H2 2016

FED'S DUDLEY: APPROACHING TIME FOR RATE HIKE

- Doesn't Expect 'A Lot Of Tightening Over Time'

- Says His Views Remain Generally Unchanged