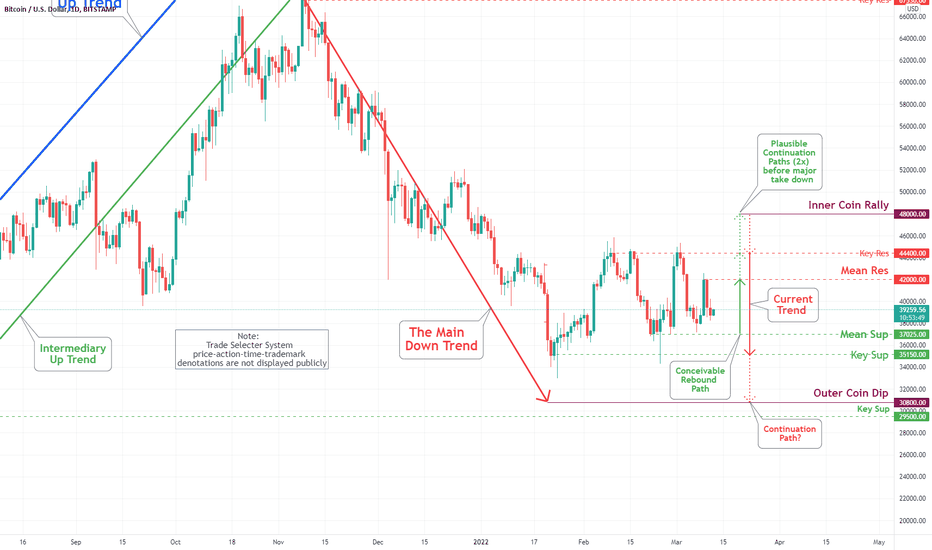

Bitcoin (BTC/USD) Daily Chart Analysis For March 11, 2022Technical Analysis and Outlook:

This week bitcoin soared +10%, but that, unfortunately, did not last. While the bigger picture may indicate a bearish future to Outer Coin Dip $30,800 and few targets in between - some positive short-term upside moves are possible to Mean Res $42,000.

Moneymanagement

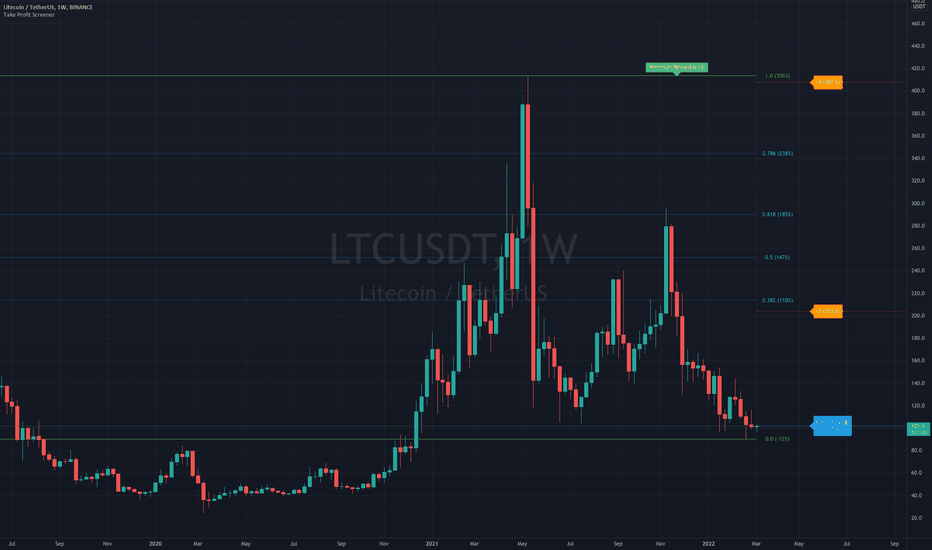

Take Profit Screener tool v2Hi all,

I'm going to introduce you to the Take Profit Screener tool.

It allows you to manually scan your watchlist so to determine at a glance the assets that would give you the best profitability potential.

It is a 2 in 1 tool that allows you to :

identify where your Take Profit ratios are located whether you are in SHAD or Cycle Strategy

identify the potential reward percentages when approaching the key Fibonacci levels

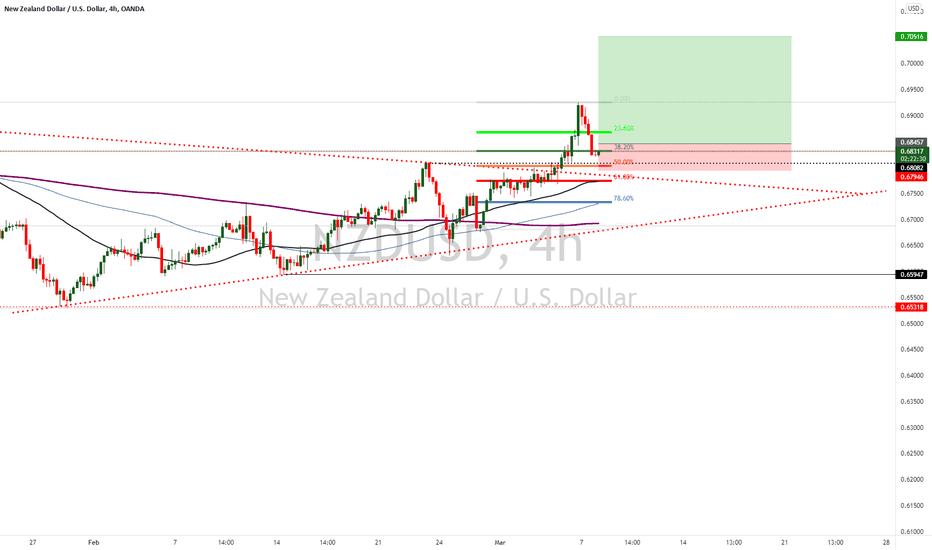

NZD/USD new bullish PhaseAfter waiting for the NZD/USD price to break down and correct with a Fibonacci level of 50% before riding the trend back up.

Now, following the current price Chart, the correction is a little above the 50% fib level, which technically marks an average corrective wave. A buy stop order is already in a position to catch the price up to the next resistance level at 0.7045.

Trading Setup -

A Buy Stop order at 0.6845

Take profit at 0.7045

Stop loss at 06810

Trade with proper money management!

Disclaimer, I am not liable for any loss incurred from this signal, and neither would I claim for any profit, trade the setup at your own discretion.

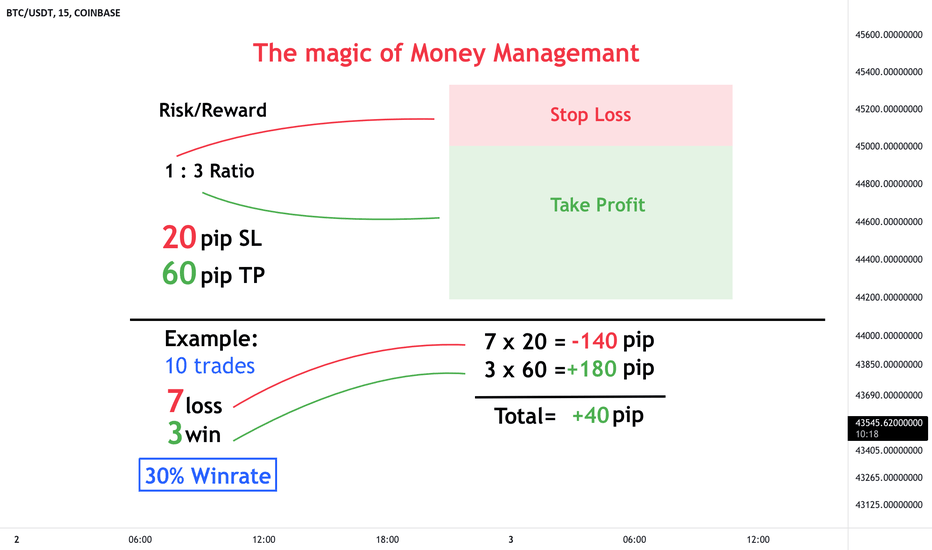

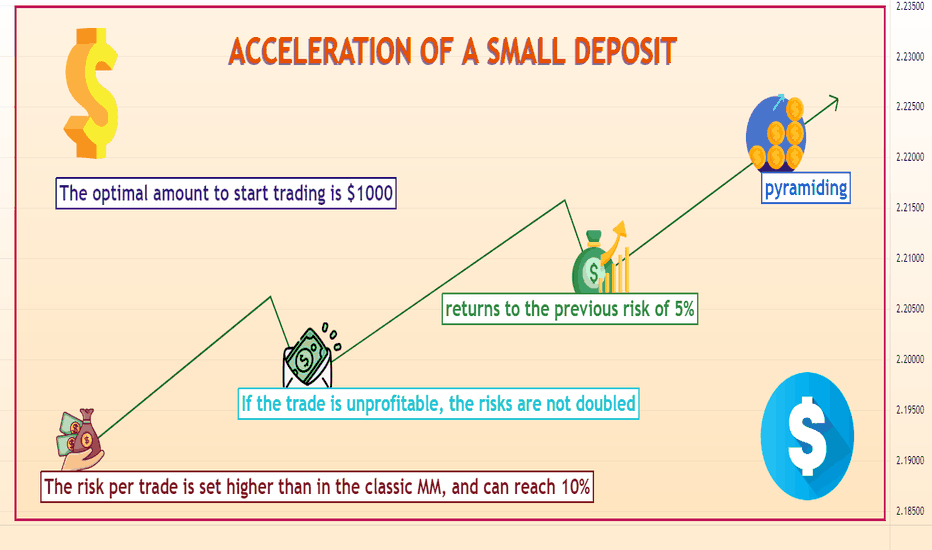

ACCELERATION OF A SMALL DEPOSITToday I want to talk about a topic that every novice trader has to face.

Most beginner traders save up money to make the first deposit and very often this amount is too small for trading, but the broker gives you the opportunity to trade anyway, why is that?

The fact is that the smaller the deposit, the easier it is to lose them, and the broker knows this.

Therefore, for calm trading, you need an amount greater than $100 or $500.

The optimal amount to start trading is $1000

What is the danger of a small deposit?

Beginners can be anyone from a student to a businessman.

And very often the initial funds will be small, because the reason people come to the market is to make money!

A person invests $10, not because he is greedy, but because there are simply no more free funds.

At the same time, the trader is already dreaming of millions, and his head begins to spin from such thoughts.

As a result, deals are opened for $1, then for $2, and in the end all the money is lost.

The market does not bring quick profits.

It is also impossible to deposit the last money or money borrowed.

All this will only lead to the drain of the deposit.

1000$?

Why $1000 is considered the best start?

This question can be answered by the rules of money management.

Everyone remembers the rules of risk, let's say you decide not to risk more than 5% on each trade.

When trading intraday, the position size is 20-50 pp., that is, when trading micro-lots of 0.01, the risk per trade will be $2-$5. Such a risk is acceptable for a $100 account, since then it will be 5%.

When trading on daily timeframes, the average risk is even higher: 50-100 pp. (5-10 pp.). In this case, the account must be at least $200. As you can see, money management clearly indicates the minimum deposit size.

This is when trading micro-lots.

As a rule, traders use standard lots because they want to make quick money and it is very risky.

Therefore, you should not start trading with $10 or $200.

It is better to save and collect the required amount, or at least $500, and then it will be easier to trade.

But what if you can't wait?

How to disperse the deposit?

There are a couple of rules:

A trader must have a working trading strategy that has proven itself well on a demo account and on a real account;

Comply with risk management rules;

Provide a deposit amount of $200-$400.

Subject to these conditions, you can “softly” disperse the deposit.

Overclocking

With a quick acceleration of the deposit, the risks increase, you must understand this.

Here are three principles that make it possible:

The risk per trade is set higher than in the classic MM, and can reach 10%;

If the trade is unprofitable, the risks are not doubled;

When the deposit is broken up to the set limit (for example, from $200 to $500), the trader returns to the previous risk of 5% and trades for several months in compliance with Money Management rules. Then you can repeat the "acceleration".

pyramiding

A popular way to accelerate a deposit is Pyramiding, the meaning of which is to add positions.

Here's how it goes:

You determine the main trend on the daily timeframe and open a position following the trend.

Then wait for another signal indicating the continuation of the trend.

If there is a signal, open another position along the trend. The protective stop-loss order of the first order is transferred to the opening level of the second order, that is, to breakeven.

The size of the take profit on the second trade should be small, because the trend can change direction at any time.

It is important to remember that this strategy only works if there is a trend, so a flat or correction should be avoided.

Outcome

Trading this way is very risky.

The best way is to raise an amount equal to or greater than $1,000.

Then trading will become less dangerous for you, since you can use the standard money management rules.

Before dispersing the deposit, you must set yourself a goal, after reaching which, be ready to use the standard risk rules.

Big risks are rewarded, but even they need to be taken with intelligence and control.

Good luck!

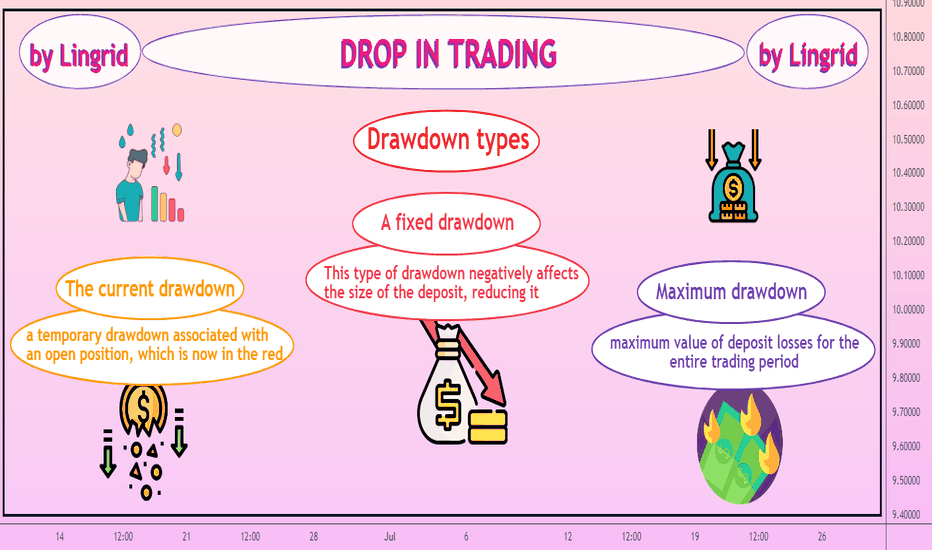

DROP IN TRADINGHello!

Today I want to talk about drawdown in trading.

This topic is very important because it is directly related to the possible loss of all capital.

What is a drawdown?

When trading, you can make profits as well as take losses.

When you lose too much and the account decreases significantly, this is called a drawdown.

Losses in trading are normal and should not be feared.

But you should not lose too much, a minus of 15-20% is considered a moderate minus value, and these losses must be controlled.

Drawdown (DrawDown, DD, drawdown) in the foreign exchange market is a temporary decrease in funds in the trading account as a result of opening a losing trade.

In simple words, a drawdown is a trader's floating or real loss.

Drawdown types

In the Forex currency market, it is customary to classify the following types of drawdown:

The current drawdown is a temporary drawdown associated with an open position, which is now in the red.

The size of the initial deposit does not change until the position is closed.

As a result, the position itself can be closed even in a plus, but if the position goes into a minus, you should think about the rules of money-management.

Because a position not closed in time may end up with a margin call.

A fixed drawdown is a position closed with a loss.

This type of drawdown negatively affects the size of the deposit, reducing it.

If money management is not used correctly, such transactions can significantly reduce your deposit, which is not recommended.

Maximum drawdown - the maximum value of deposit losses for the entire trading period.

It is calculated each time from the previous maximum deposit amount, and the largest value is selected.

For example, there were three big minuses on the account: $300 with a $1000 deposit, $450 with a $2000 deposit and $200 with a $2500 deposit. The maximum drawdown here will be $450.

Relative drawdown - the maximum decrease in the account relative to the initial deposit, expressed as a percentage.

It is often used when analyzing a trading strategy in order to understand after what losses a trader should think about changing the strategy.

For example, if the relative drawdown is 20%, then with an initial deposit of $1000, the speculator will understand that it is necessary to close deals and modify tactics when the current drawdown reaches $200.

The absolute drawdown shows how much the balance has decreased relative to the initial value. These data are similar to the relative drawdown, but are expressed in the deposit currency.

Why analyze losses?

Each trader should know how much he is ready to lose and at what value he needs to change the strategy and start trading a little differently.

The percentage of allowed drawdown is different for each trader, conservative traders try to minimize the maximum drawdown, more aggressive traders take risks much more often and in large volumes.

Large companies keep the maximum loss in the region of 15-20%.

Optimal drawdown size

The optimal drawdown size varies depending on many factors: the type of strategy, the amount of the deposit, the psychology of the trader, the timeframe, and so on.

Drawdown can be divided into three types:

A drawdown of 15-20% is working and quite normal. It can be restored, and it does not make strong adjustments to the trading strategy.

A drawdown of 21-35% is a dangerous level of losses that will require a reduction in the volume of the trade and recovery can be difficult. Closer to the 30% mark, it is important to think about modifying the trading strategy and review it for errors in the risk management system.

A drawdown of 36-55% is an actual harbinger of a loss of a deposit. It is better to close orders and think about what led to such a drawdown, which was not closed forcibly earlier.

Drawdown reduction

Setting a stop loss - and its size should not exceed 5% of the total amount on the trader's account.

Optimal leverage - the use of a large amount of leverage can lead not only to drawdowns, but also to draining the trader's deposit to almost zero.

Refraining from trading in an unstable market - very often a trader, observing even the first two conditions, still manages to lose almost half of his own funds during one session. Therefore, if you have made several unsuccessful transactions in a row, then it is better to give up trading for today and do something else.

Correct assessment of probable profit - one should not be greedy when placing a take profit, its size should always correspond to the market dynamics.

conclusions

Every trader who wants to consistently earn money in the market must understand how much he is ready to lose, while the trader must do everything not to lose all his capital.

You can lose 15% per month and it will not be scary for a trader who follows a trading strategy, money management and monitor losses.

As a result, such a trader can return the lost next month.

But those who do not follow these rules, do not think about a drawdown, do not know how much they are ready to lose and how much they cannot lose, as a result, everyone loses.

Losses are inevitable, but don't let the market take everything.

Good luck!

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩

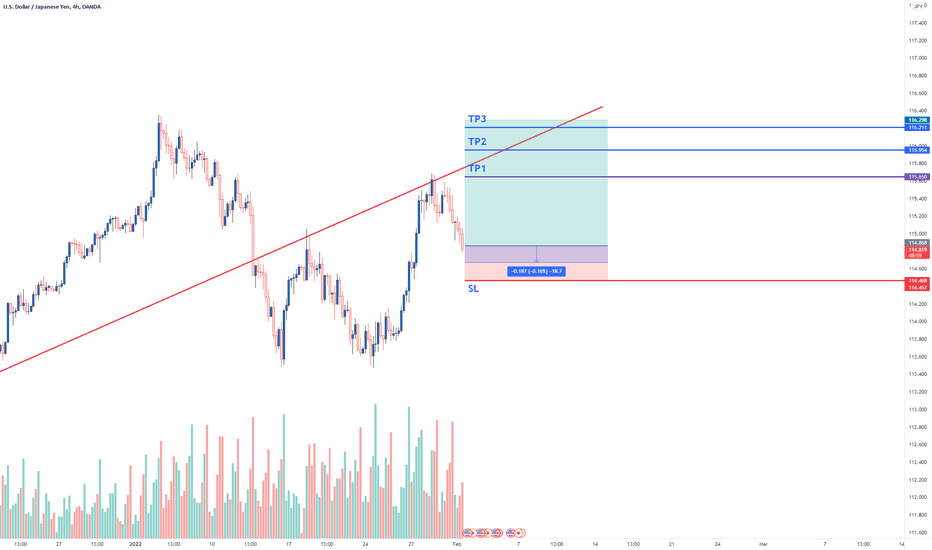

USDJPY 4hI hope all you have a good week in your trades

I want to talk with you about USDJPY , because its on support zone and we can have a correction .

#USDJPY

EP: 114.67 ~ 114.85

TP1 : 115.64

TP2: 115.95

TP3: 116.20

SL:114.46

This is article not financial advice, always do your own research .

If you have any questions, you can write it in comments below and I will answer them.

And please don't forget to support this idea with your like and comment, thank you.

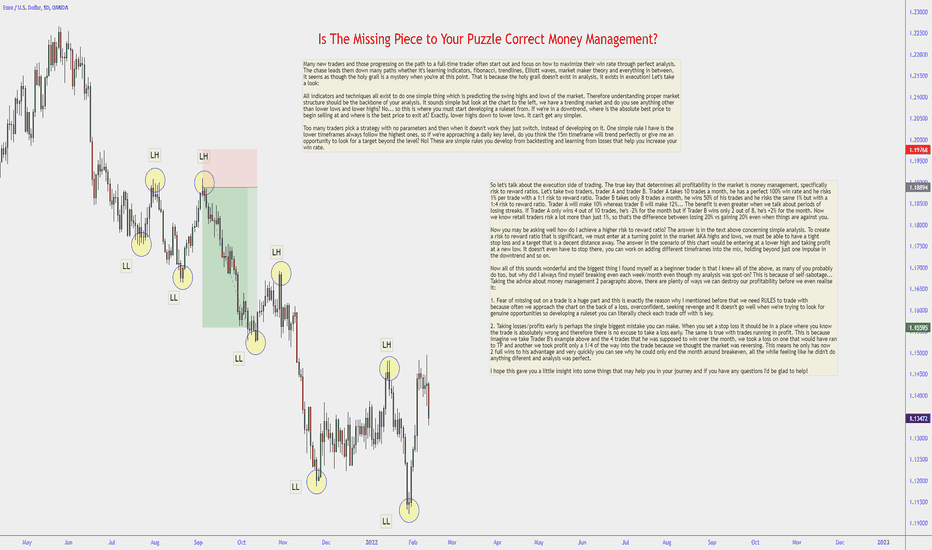

Whats the difference between Risk Management & Money Management?TLDR:

Risk management generally is determining what portion of your capital you are willing to risk in a trade and staying true to that.

Money management is how you would spend the money earned (in this case through trading) .

Eg : Rather that withdrawing all the profits from your account you can let it be there and compound it, or rather than spending it on unnecessary luxuries you can save it for a rainy day .

_________________

Full:

This is something I usually get asked many times by new starters in trading as they are both common terms that you will hear as you learn about trading and investing. They are both vital concepts but it's important that you know the difference between them.

Money management refers to the processes of budgeting, saving, investing, spending, or otherwise overseeing the capital usage of an individual or group. The term can also refer more narrowly to investment management and portfolio management.

Money management broadly refers to the processes utilised to record and administer an individual's, household's, or organisation's finances.

Financial advisors and personal finance platforms such as mobile apps are increasingly common in helping individuals manage their money better.

Poor money management can lead to cycles of debt and financial strain.

In the financial world, risk management is the process of identification, analysis, and acceptance or mitigation of uncertainty in investment decisions. Essentially, risk management occurs when an investor or fund manager analyses and attempts to quantify the potential for losses in an investment, such as a moral hazard, and then takes the appropriate action (or inaction) given the fund's investment objectives and risk tolerance.

Risk is inseparable from return. Every investment involves some degree of risk, which is considered close to zero in the case of a U.S. T-bill or very high for something such as emerging-market equities or real estate in highly inflationary markets. Risk is quantifiable both in absolute and in relative terms. A solid understanding of risk in its different forms can help investors to better understand the opportunities, trade-offs, and costs involved with different investment approaches.

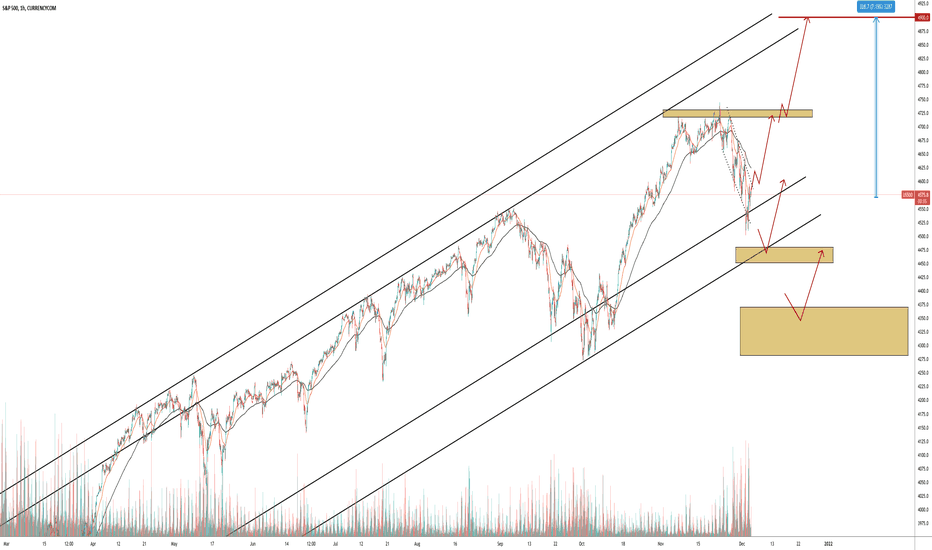

US500 - swing trading plan and technical analysisThe major US index is ''suffering'' a healthy correction from around 4750 ATH set in November roughly 2 weeks ago!

The volatility is quite high, thus the risk has increased in addition to potential return. You know how it works...

...higher risk - higher return.

At the moment my total stock market exposure is around $50k and from current level I am planning to hold at least until 4900, which means around 7.2% profit potential at the time of writing.

Also I am ready to double my total speculative exposure based on the scenarios you can see on the chart.

Fundamentally we have the potential to grow.

Omicron might end the covid pandemic, due to its' not so severe effect. Tapering means that the US economy is healthy and can sustain itself without drug money.

The US yields should not grow extremely. Oil market is in balance right now and backwardation is almost gone.

Reopening economy stocks potentially can be well-bid. Major tech stocks are also having bright future earnings outlook.

Risk and money management is very important.

Patience as well.

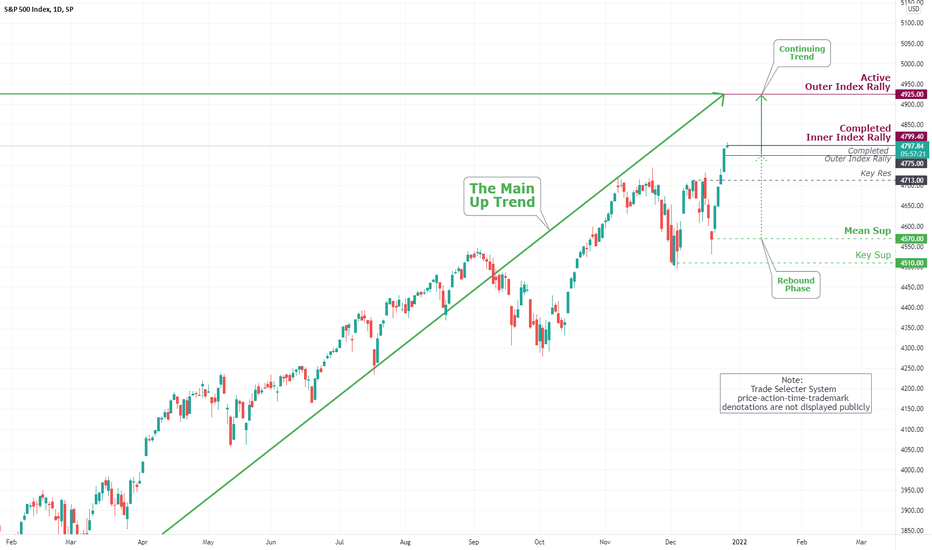

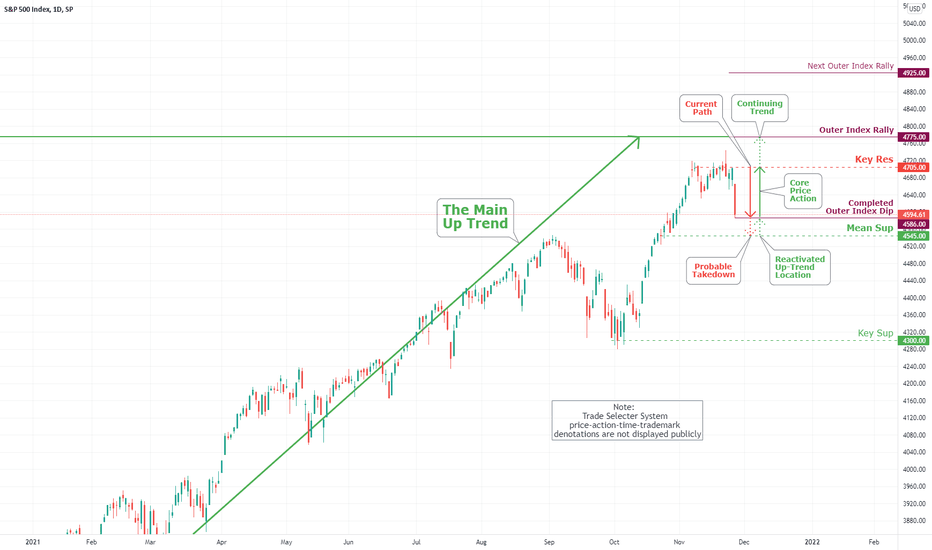

S&P 500 Daily Chart Analysis For November 28, 2021 Technical Analysis and Outlook

The present model shows solid Outer Index Dip completion marked at 4586. The next (moderate probability) destination is marked at Mean Sup 4545. Both Outer Index Dip completion and Mean Sup signify major

upside boost trend.

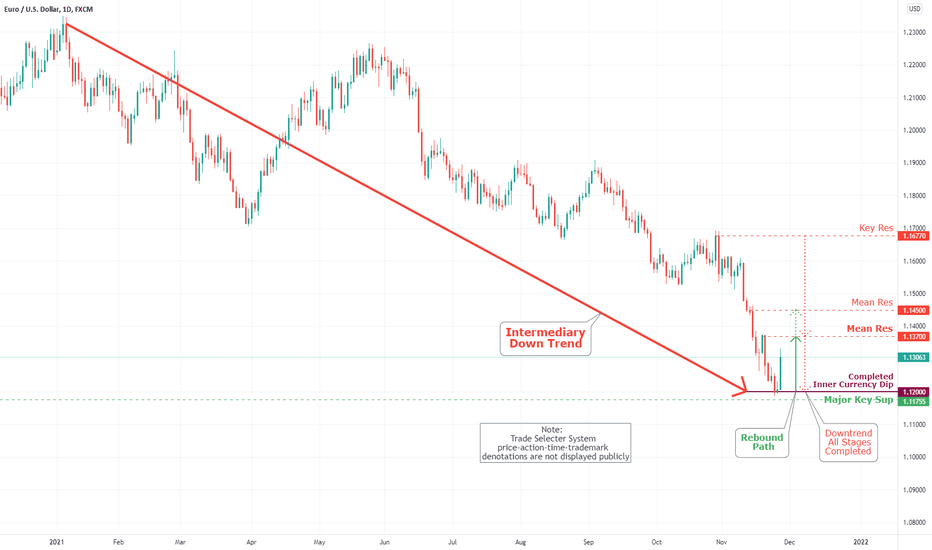

EUR/USD Daily Chart Analysis For November 27, 2021Technical Analysis and Outlook:

When you view this price chart, you can observe that we had substantial completion, so it makes sense to experience a strong bounce eventually. Consequently, we may make a healthy run towards Mean Res 1.137 and possibly even the 1.145 level.

SIZE MATTERS ! ! ! - MONEY/RISK MANAGEMENTThe temptation of bigger lots is something all traders experience in some parts of their journey. Yes the wins can be nice but the losses can be even greater and damaging. The benefits outweigh every time!!!

MOVE BIG RANGE

We cannot emphasize enough the benefits of breaking down lot sizes to micro lots to learn how to move and maneuver the range in a volatile market. Small lots allow you to do this.

MORE FLEXIBILITY

The flexibility to add to positions or get better entries is only possible when account is not exposed. Smaller lots give you the flexibility to chop and change and add to positions. Allowing you to move big ranges and making changes throughout the move.

POWER OVER FEAR

Bigger lots exposes our accounts, which makes decision making very hard due to fear of loss and blown accounts. Small lots allow you to control and manage fear throughout the process.

STRONG PSYCHOLOGY

Having power over your fears is the greatest feeder to a strong psychology for a traders mindset. String psychology allows a trader to build consistent performance and profits.

LIVE TO FIGHT ANOTHER DAY

The ability to get second chances is something everyone can appreciate in life. Smaller lots allow you to make mistakes and try again.

Hope some of our new traders find this information useful. Please do like, comment and follow to support our work. We really appreciate it!

GoldView

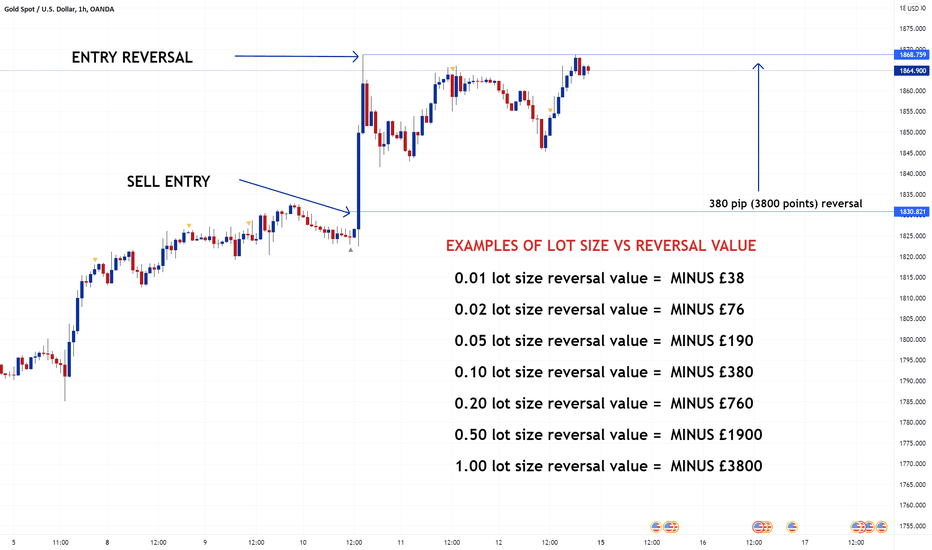

BASIC MONEY MANAGEMENT - LOT SIZE VS REVERSAL AND ACCOUNT SIZEWe see too many new traders trade with random lot sizes with no understanding on the impact it has on account sizes, which result in not only losses but BLOWN accounts. This post is by no means a risk or money management strategy but more so just basics on the movement of reversals and how the lot sizes impact the value of your account during this reversal.

Trading with the right lot sizes allows a trader to manage their account/money when the trade goes against them. The right size allows a trader to move a range without blowing their account and without seeing their account reverse to the point of no equity. This type of trading gives traders anxiety and in return this anxiety impacts trading psychology. This then has a ripple effect and impacts your trading decisions and analysis.

The example we show on the chart is an entry of SELL that reverses by 380 PIPs. This movement happened in literally 2 candles (1hour candles) , so in two hours the price from entry reversed by 380 pips. This example then shows what this equates to in monetary value dependent on lot sizes.

The example shows that anyone with a £500 account trading this movement with a lot size of 0.20 would have blown their account.

Lot size usage should be based on the size of your account for example;

£500 size account - we will only use 0.01 size lot sizes with maximum deployed total no more than 0.05. This will allow an account to survive volatile movements. Also using stop losses ontop of this setup further strengthens the risk management.

£1000 size account - we will use 0.02 lot sizes with maximum deployed total no more then 0.10 any given time.

£2000 size account - we will use 0.03 lot sizes with maximum deployed total no more then 0.30 any given time.

£5000 size account - we will use 0.06 sizes with maximum deployed total no more then 0.50 any given time.

Basically 0.10 for every £!000, as the total deployed usage allows us enough flexibility of movement on the chart and then using stop losses ontop of this, gives us further control of our money management.

We hope this quick basic insight helps some of the newbies better manage their lot size usage.

Please like, comment and follow us to support our work, we really appreciate it!

GoldView

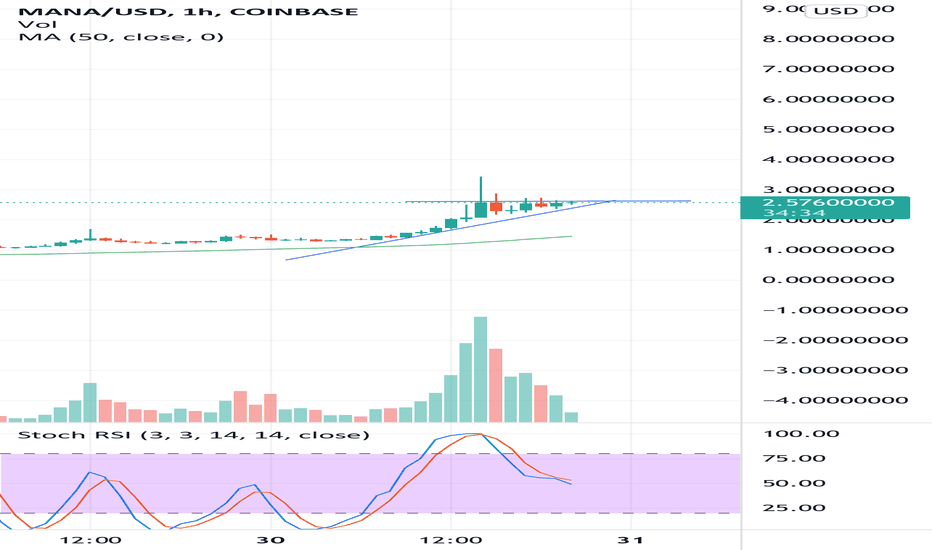

MANA! Swing set up MANA,

With fb news we might see this bad boy going up to 35$. Long term even higher.

This long term Investment. Don’t miss out.

Falls In our research on swing set ups with a good ratio of Risk and Reward.

As always we put quality over quantity, don’t forget to follow us for SWING trades research on risk and Reward Ratio.

Subscribe and don’t miss out next research.

Swing trading is great because you can create a lot wealth in % by risking less $$. Compound Gains.

Thank you for the Love, I really appreciate those likes, makes a difference.