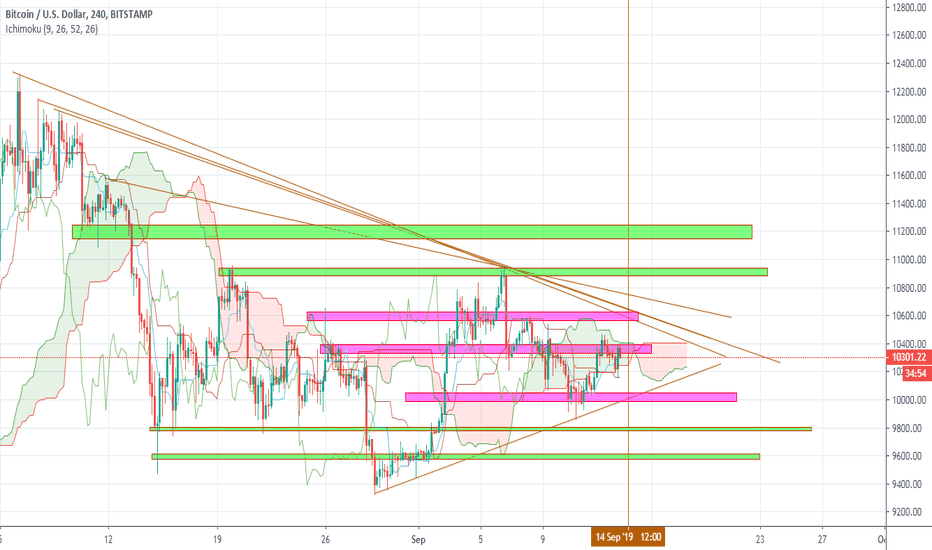

Bitcoin's Real SupportHello Everyone!

I am Donald David Dongalore!

This idea is less of a trade and more of a thesis about BTC!

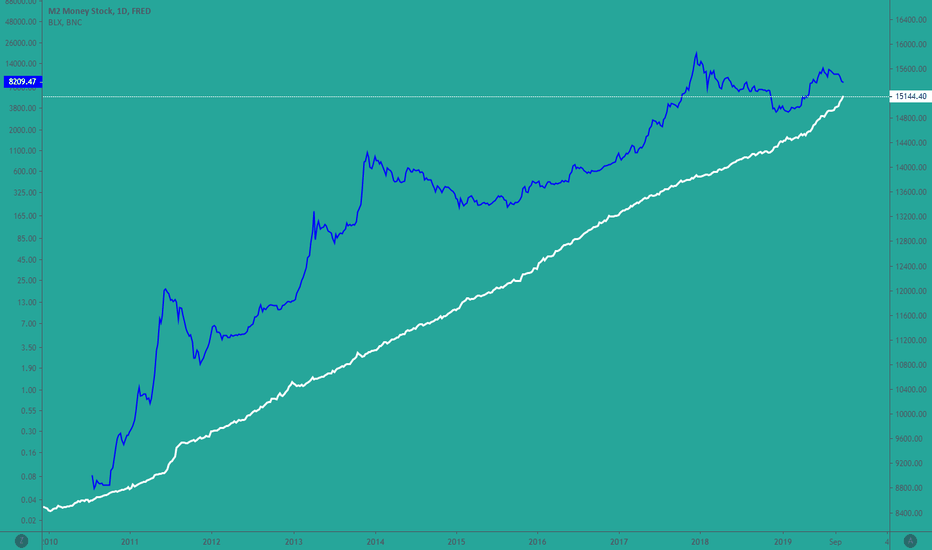

As you can see here, there seems to be a heavy interest in continually increasing the M2 money supply, and by extension...all other money supplies!

The best part about BTC, is that it is finite! Meaning, that the more money that the Federal Reserve and U.S. Treasury make, the more valuable your BTC will be! Hooray for hard money!

This is not financial advice, but it probably could be. But its not.

Yahooooooooo!

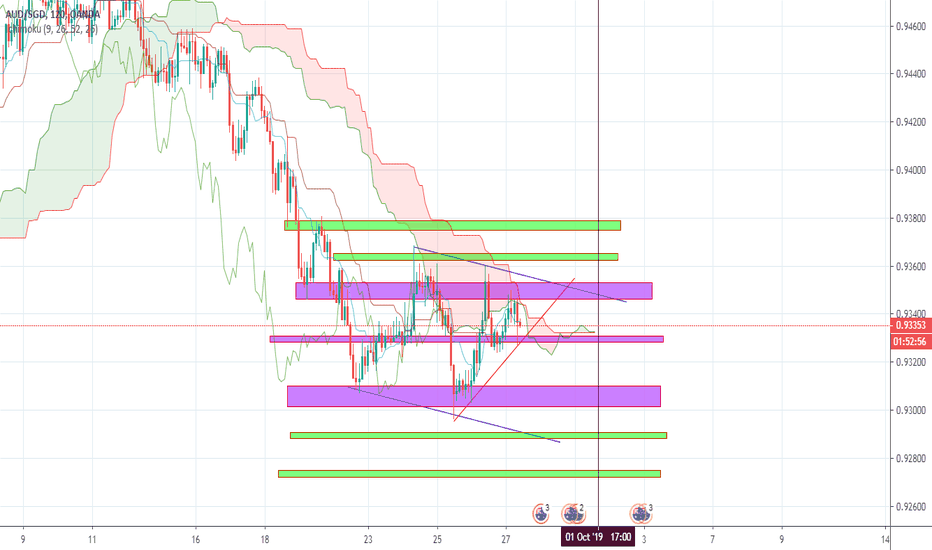

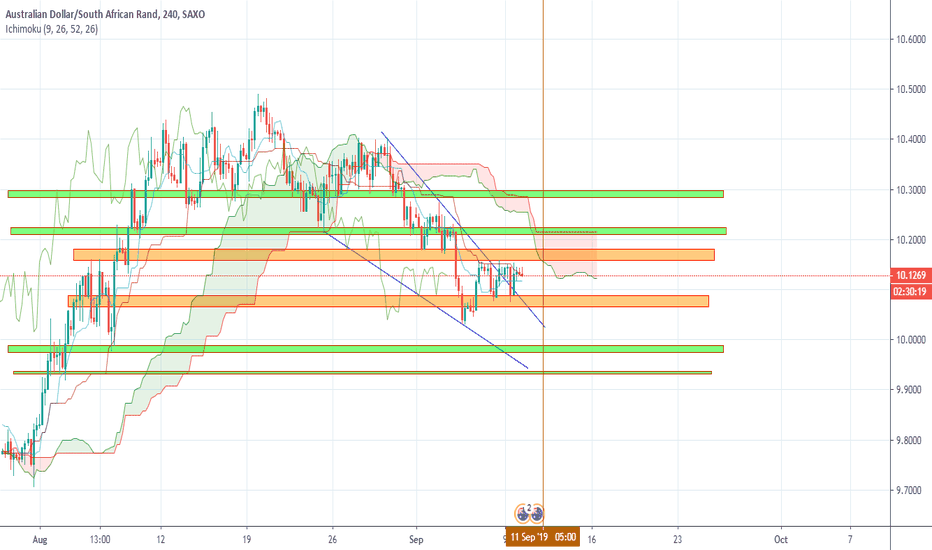

Moneymanagement

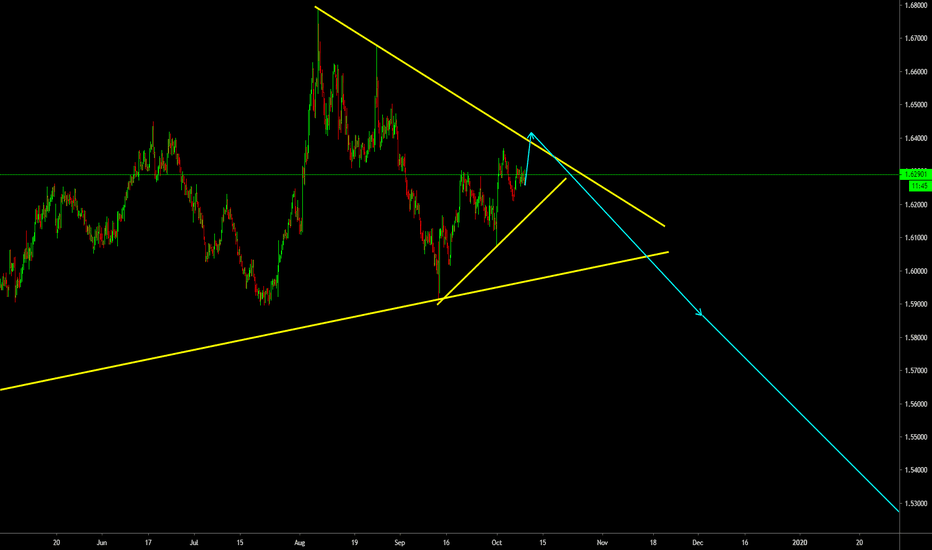

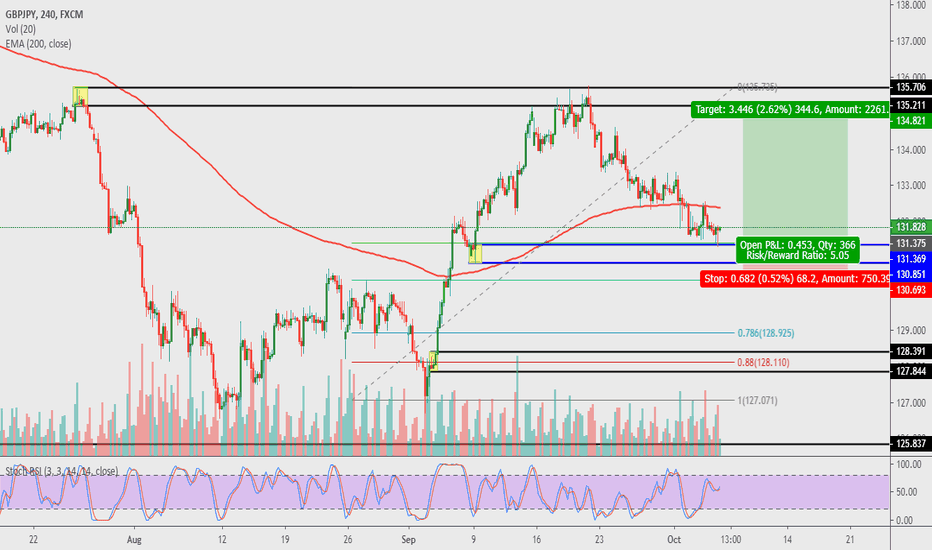

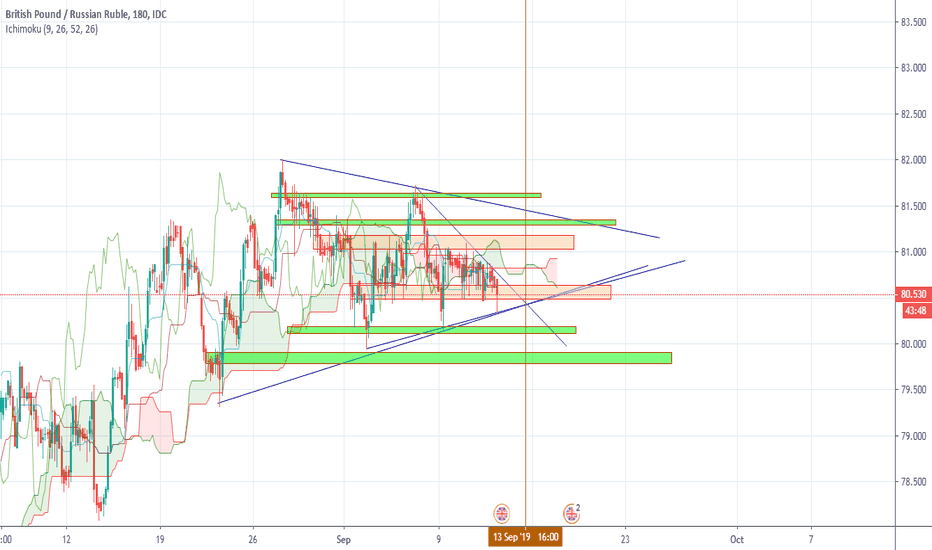

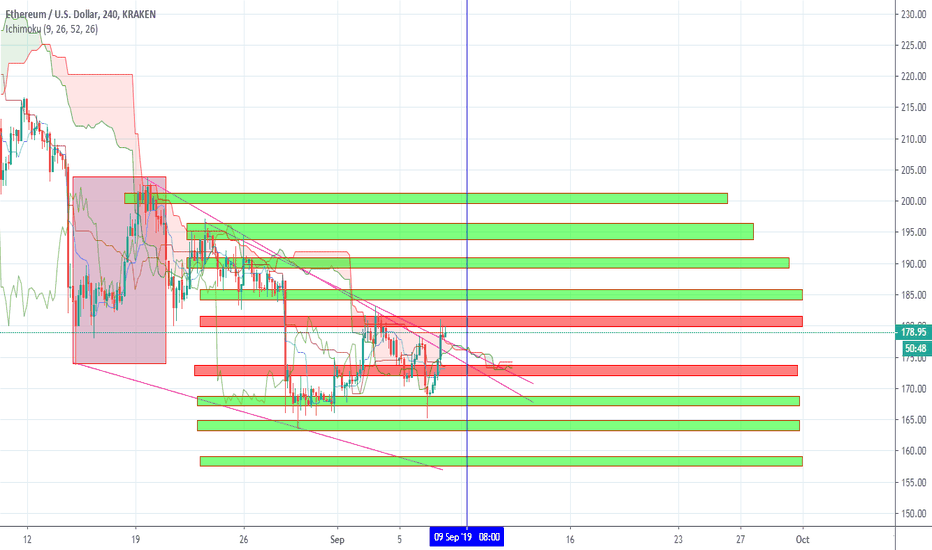

GBPJPYhitting demand zone

fibonacci support area

________________________________________________________________________________________

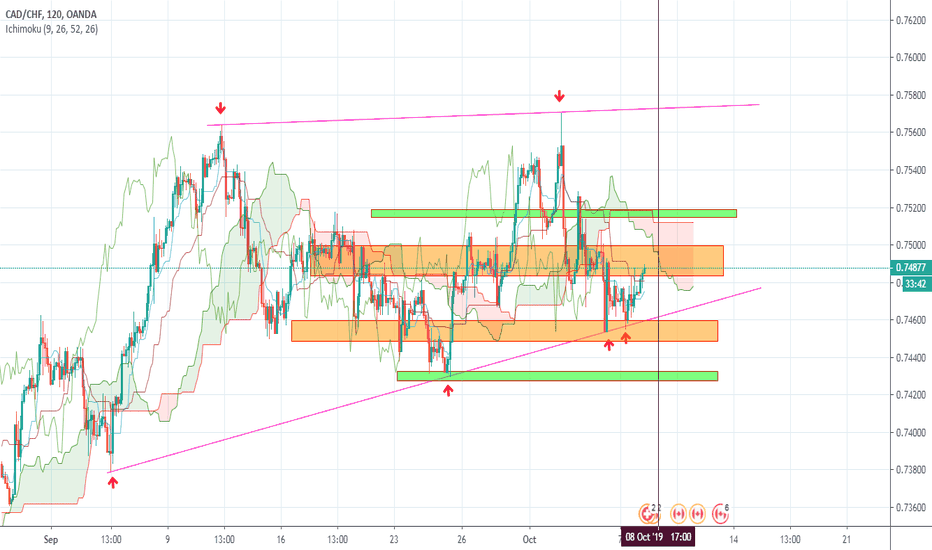

Golden Trading Rules:

Big movements take time to develop

________________________________________________________________________________________

I'll be happy to read your opinion and ideas, and if you like the idea, please give it a like for support, thanks

Remember, we are speculators, not investors ;)

Have a profitable day

Telegram Contact: t.me

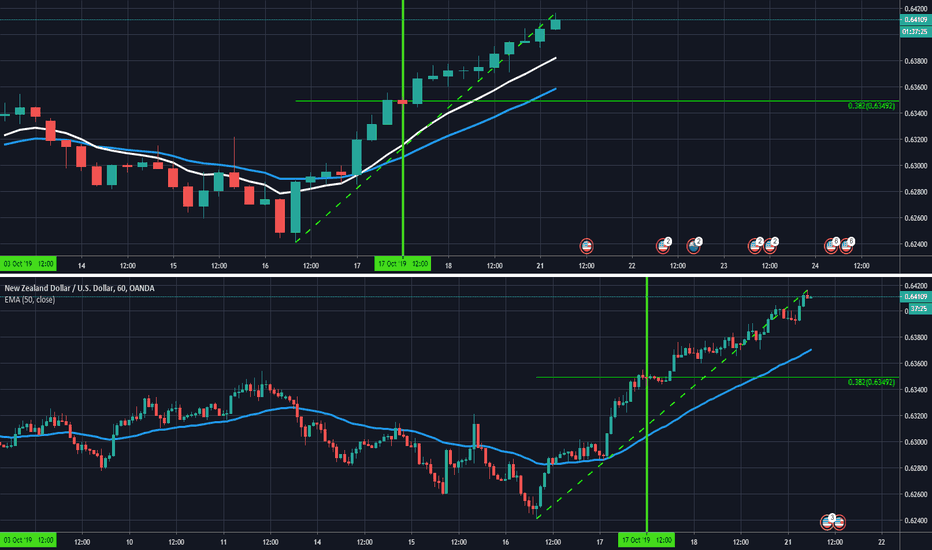

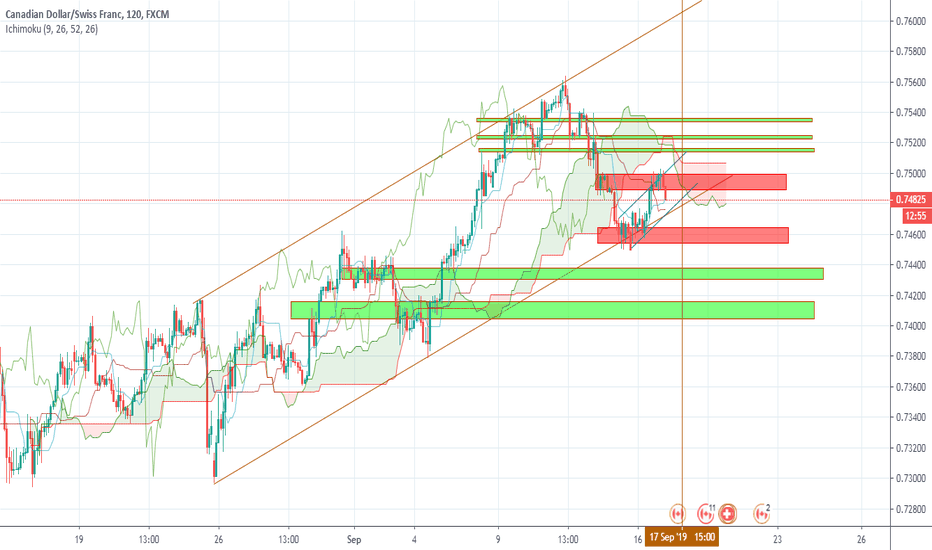

Supply And Demand Strategy

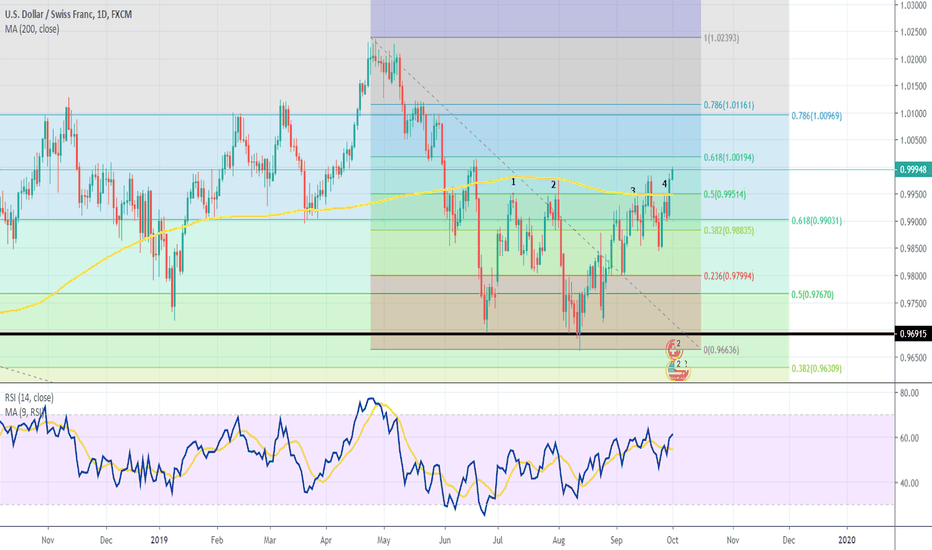

USDCHF what is nextWhenever we have multi lows/tops breaking is stronger than usual, as we have right now. The price has break Fibo and MA200 level and strongly continue to rise. RSI at lower time frames is overbought, which can be some short opportunity to squeeze a bit. As I see Fibonacci 61.8 will remain resistance level ( daily fibo) and Fibo 62.8 ( weekly) will remain support level. After smaller profits with sell action, my play for this will be SELL at 1.00 area and compounding those trades with proper money management. For those who can afford:

10k at 1.00, 25 k at 1.01, 50k at 1.02

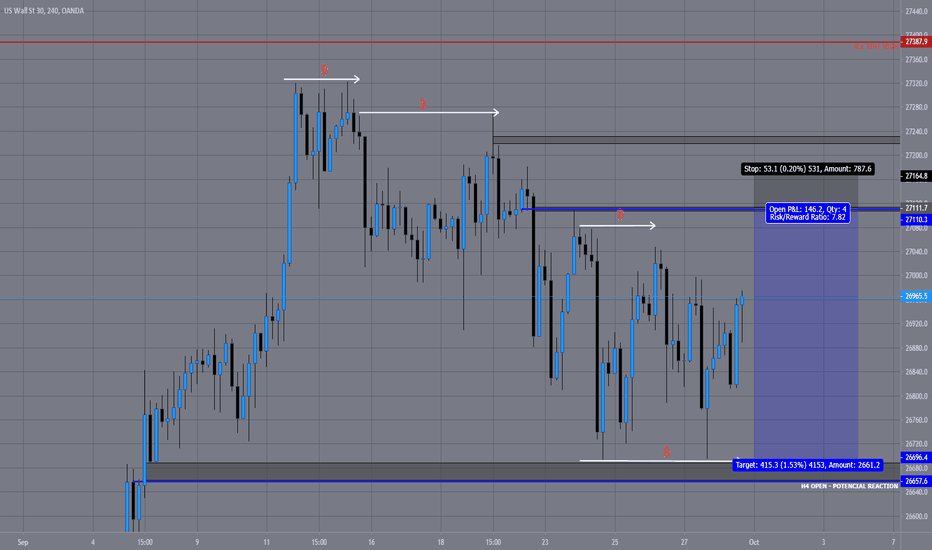

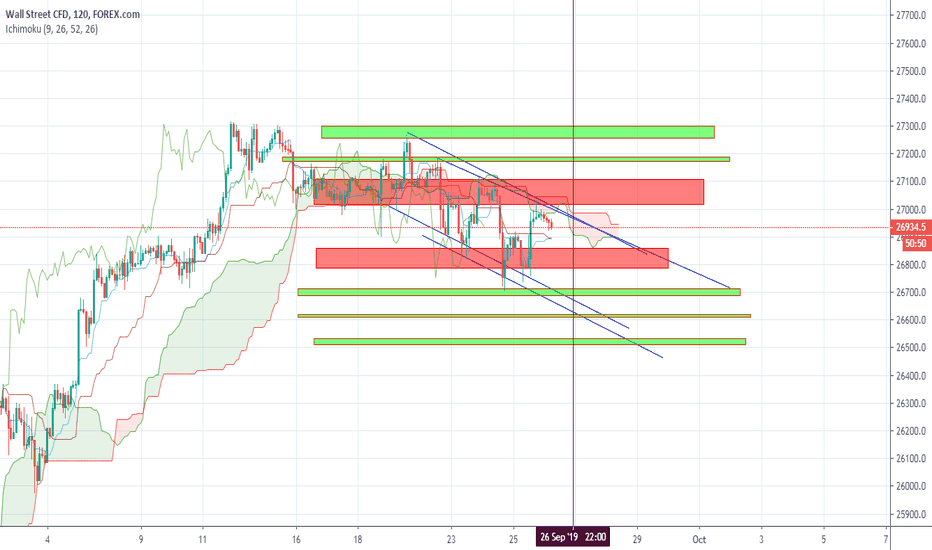

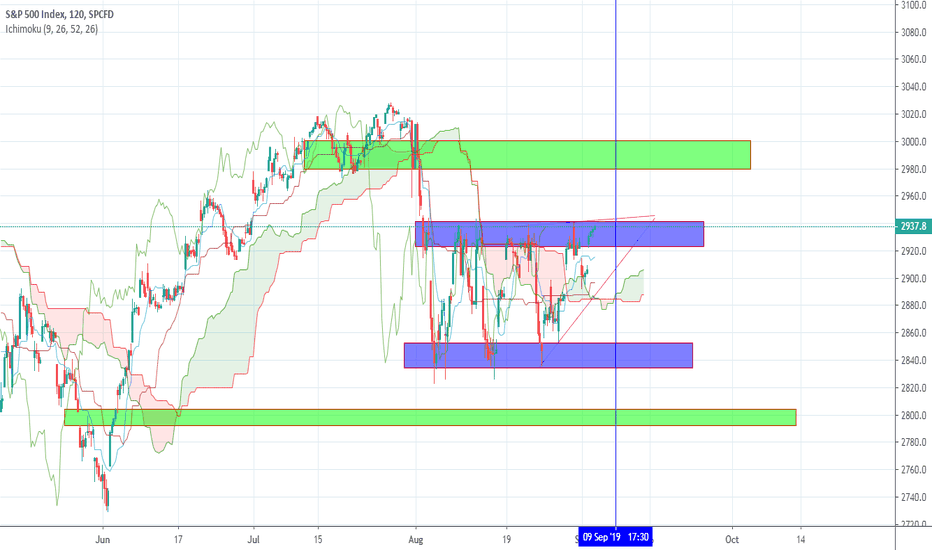

US30 30/09/2019Hello Traders!

We play with Smartmoney concepts, that means that we look mostly on PA to determine what will happen in future.

As we all know, price is moved by BIG players: Banks, Institutional traders, HFT bots (we call them all of them SM).

They can't play as we do, cause of a HUGE lot sizes, so cause of that they need to SELL to BUY and BUY to SELL for positioning them self in the best possible spot.

If u were learn about trading from free and accessible knowledge, u probably heard about BUYing LOW and SELLing HIGH?

So SM must BUY LOWER and SELL HIGHER :)

We as retail traders are just a small fish in this ocean, so we need to catch the waves which are created by SM.

CHARTS AGENDA:

SM - SMART MONEY

PA - PRICE ACTION

BITCOIN SIGN - MONEY POCKET

ARROWS ARE ABOVE AND BELOW OF EQUAL HIGHS AND LOWS

BLUE LINES - ENTRIES WITH SM

MARKED LINES - POTENCIAL ENTRY POINT

BOX - GAP's

GOD BLESS U ALL!

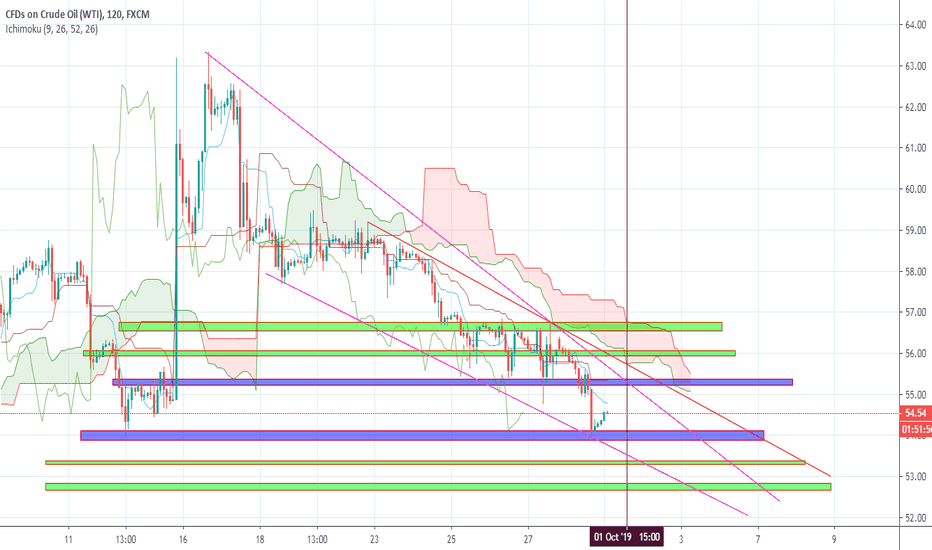

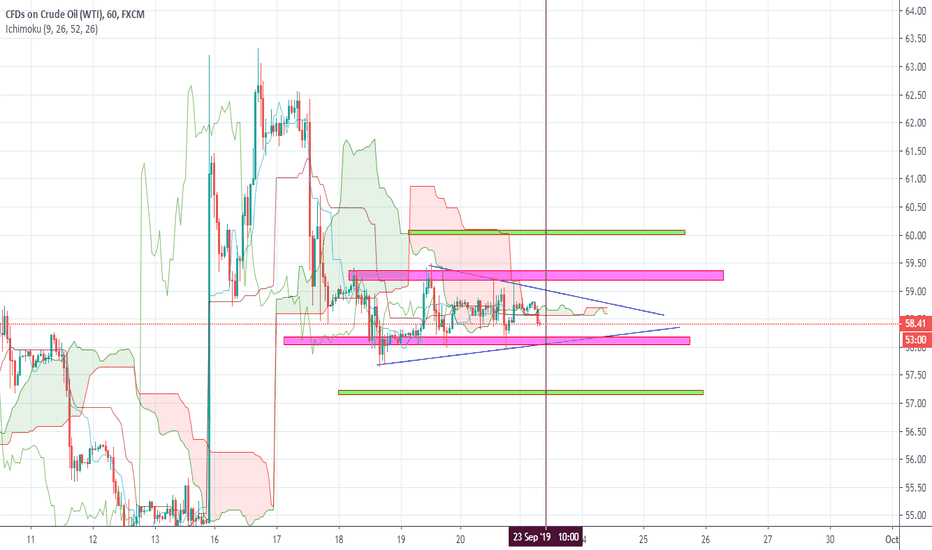

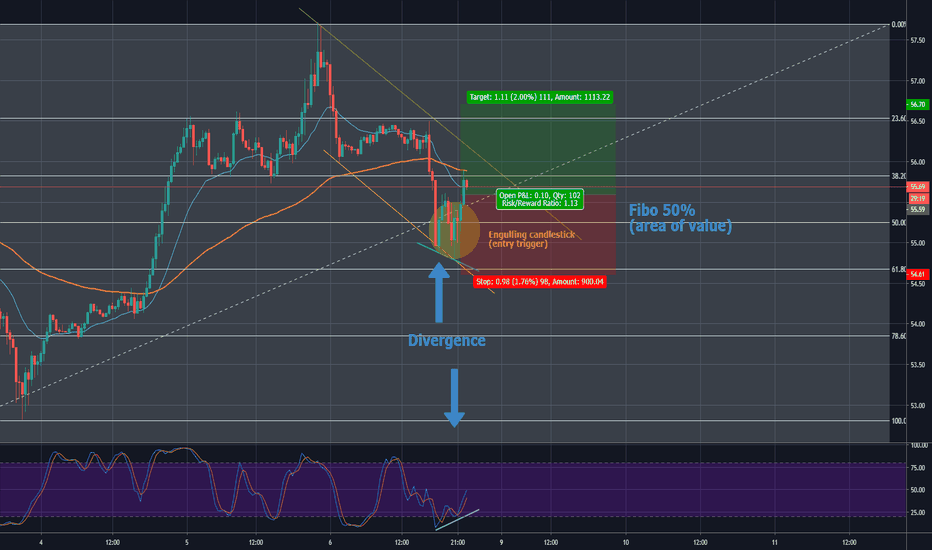

USOIL, Short term long position opportunitiesThe oil has reached its 50% fibonacci retracement level, and making a flag pattern. The entry trigger also presents itself, which is the engulfing candlestick pattern forming around the 50% fibonacci retracements (which i considered as an area of value). The other trigger is with the stochastics oscillator, it turns out that there is a divergence between the price and the oscillator, which indicates a momentarily possibility of a reversals.

To summarize why take a long position;

Pros:

1. The price reach a 50% Fibonacci retracements level while making a flag pattern (considered as an area of value)

2. There are divergence between the stochastics oscillator and the price leve (entry trigger)

3. The candlesticks forming a bullish engulfing pattern (entry trigger)

Cons:

1. 50% Fibonacci retracements area sometimes is not reliable

2. The higher time frame trends still not showing a clear trend

Considering the pros and cons, i made a decisions to go for a long position with small lot to compensate for the cons.