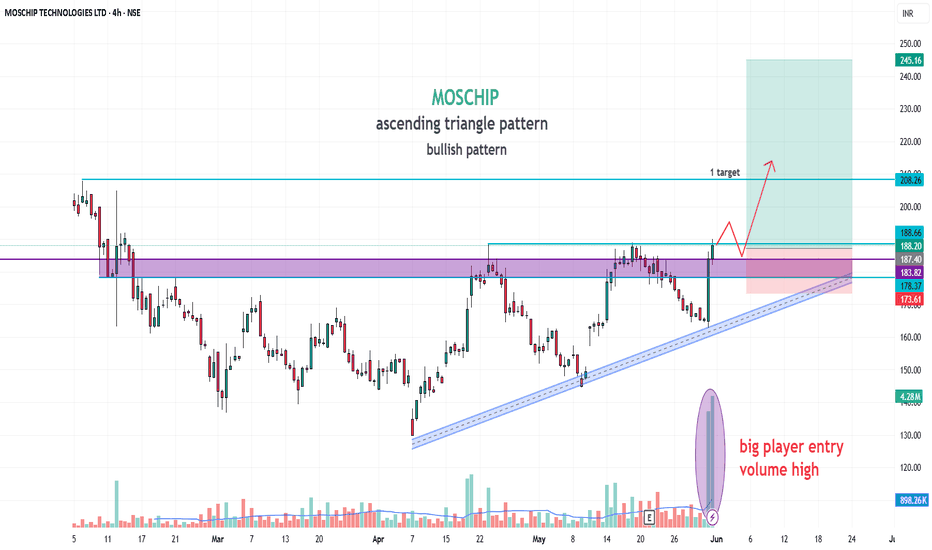

MOSCHIP📊 Stock Analysis: MOSCHIP

The stock has been consolidating within a ascending triangle pattern and is nearing a critical Buy Above level at ₹187 , signaling a potential breakout. The target is set at ₹359, offering a potential gain of 25.90%. Key insights:

Trend: A breakout above the wedge could indicate renewed bullish momentum.

Support Levels: Strong support around ₹170/197, making this a low-risk entry point.

Volume Buzz: The recent increase in volume shows rising investor interest.

🔔 Keep an eye on this setup! Always analyze your risk tolerance before making any decisions.

📢 Disclaimer: This post is for educational purposes and not financial advice. Conduct your research or consult a financial advisor before investing.

What are your thoughts? Share them below! 📝

#StockTrading #TechnicalAnalysis #BreakoutTrading #MOSCHIP

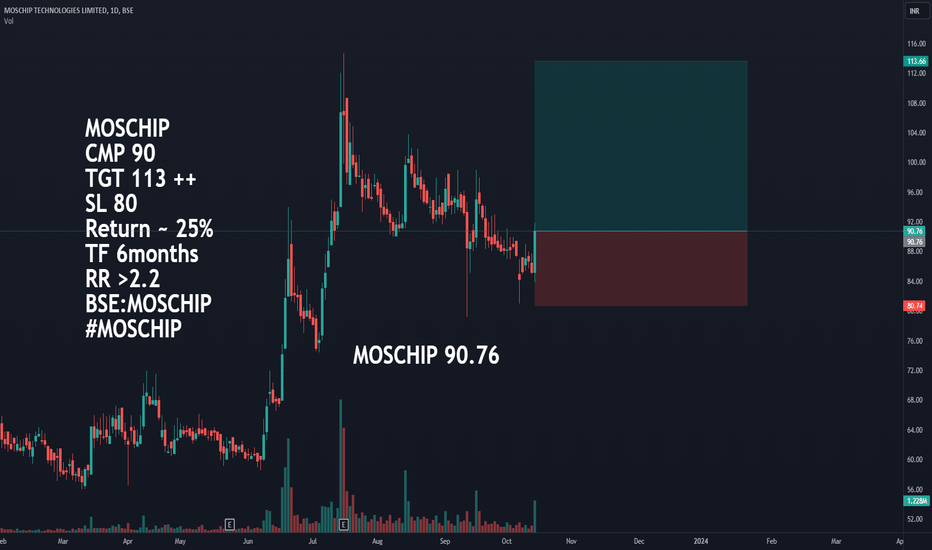

MOSCHIP

#MOSCHIP 90 TGT 113(25%) SL 80 Recommended Buy - Rachit SethiaMOSCHIP CMP 90 TGT 113 ++ SL 80 Return ~ 25% TF 6months RR >2.2 BSE:MOSCHIP #MOSCHIP Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia