MSumi Wiring trying to wire up to old levelsMotherson Sumi Wiring India Ltd. engages in the manufacture and sale of wire harnesses, components, and wires to automotive original equipment manufacturers. The company was founded on July 2, 2020 and is headquartered in Mumbai, India.

Motherson Sumi Wiring India Ltd. Closing price is 59.35. The positive aspects of the company are Stocks Outperforming their Industry Price Change in the Quarter, Companies with Zero Promoter Pledge, Companies with Low Debt and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are high Valuation (P.E. = 43.1), Increasing Trend in Non-Core Income, Declining Net Cash Flow : Companies not able to generate net cash, Companies with growing costs YoY for long term projects and MFs decreased their shareholding last quarter.

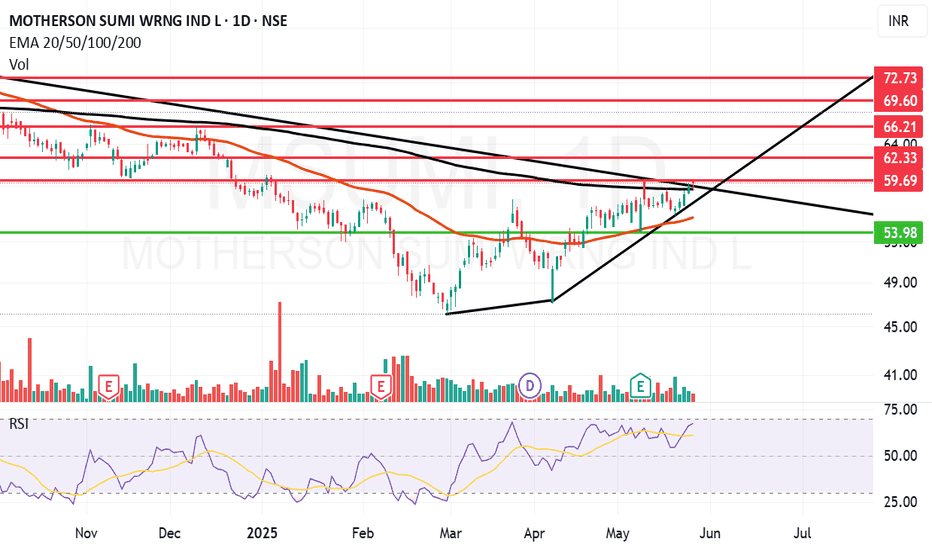

Entry can be taken after closing above 60 Historical Resistance in the stock will be 62.3 and 66.2. PEAK Historic Resistance in the stock will be 69.6 and 72.7. Stop loss in the stock should be maintained at Closing below 55.3 or 53.9 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Mothersonsumiwiring

SWING IDEA - MOTHERSON SUMI WIRING INDThis presents an attractive opportunity for swing traders to capitalize on the potential uptrend in Motherson Sumi Wiring India , a subsidiary of Motherson Sumi Systems Limited and a leading manufacturer of wiring harnesses and other automotive components.

Reasons are listed below :

Strong Resistance Turned Support : The price level of 65-67, previously a strong resistance, has now turned into a support zone, indicating potential bullish momentum.

Cup and Handle Pattern : The formation of a cup and handle pattern suggests a potential continuation of the uptrend, with bullish implications for Motherson Sumi Wiring India.

Bullish Engulfing on Weekly Timeframe : A bullish engulfing candlestick pattern observed on the weekly timeframe indicates strong buying momentum and potential upward movement.

0.5 Fibonacci Support : Finding support at the 0.5 Fibonacci level strengthens the bullish case, providing a solid foundation for potential upward movement.

Higher Highs : Consistent formation of higher highs reflects increasing bullish momentum and reinforces the potential for further gains.

About to Breach All-Time High : The stock is approaching its all-time high, indicating strong bullish sentiment and potential for a breakout to new highs.

Increased Volumes : A notable increase in trading volumes reflects growing market interest and potential accumulation by investors, adding confirmation to the bullish thesis for Motherson Sumi Wiring India.

Target - 85 // 95

StopLoss - weekly close below 61

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights