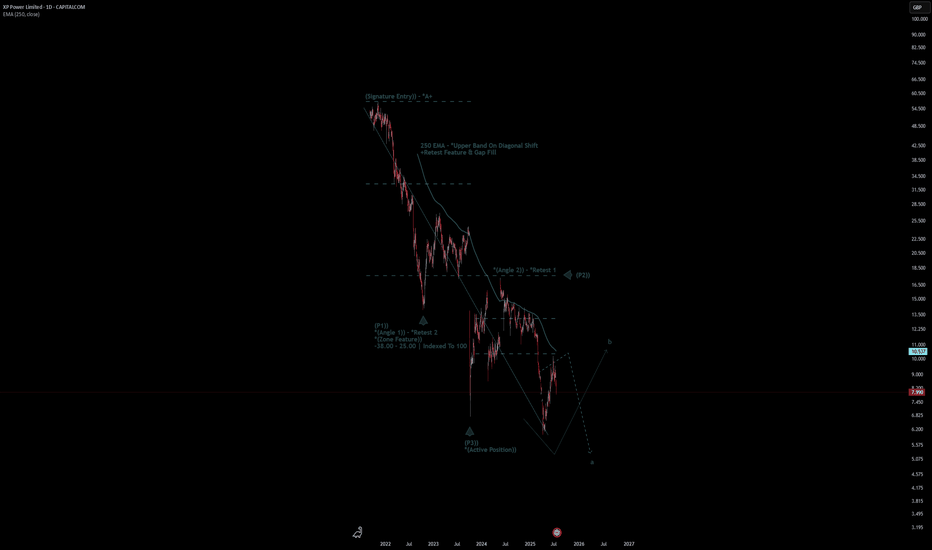

XP Power Limited Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# XP Power Limited Quote

- Double Formation

* (Signature Entry)) - *A+ | Completed Survey

* (Angle 2)) - *Retest 1 | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* (TP1) = a / Long Consecutive Range

* (TP2) = b / Short Consecutive Pullback | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 20.00 GBP

* Entry At 15.00 GBP

* Take Profit At 5.00 GBP

* (Downtrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Moving Averages

Solana and BNB Chain Lead Blockchain Growth: Weekly HighlightsRecord Activity: 342 Million Transactions in Just 7 Days

July 2025 marks a historic milestone for the crypto industry: in a single week, public blockchains processed more than 342 million transactions — the highest figure in the history of decentralized networks. Two platforms stood out the most: Solana and BNB Chain, ranking at the top in network activity and showcasing both technological maturity and growing user demand.

Solana — The Engine of Hyperactive Web3

Solana continues to prove its reputation as one of the most high-performance blockchains. Over the past week, the network processed over 200 million transactions, accounting for more than 58% of total activity. This achievement is driven by Solana’s high throughput and ultra-low fees, making it highly attractive for mass adoption and retail developers.

One of the main growth drivers has been the surge in meme coins and simple tokens created on Solana through platforms like Pump.fun. While these assets are often speculative, they generate massive traffic — tens of millions of transactions daily from thousands of users. This in turn boosts TVL and DEX activity.

But Solana is no longer just about gamified tokens. Increasingly, serious projects in DeFi, infrastructure, and Web3 gaming are launching on the network. New NFT platforms, liquid staking services, and retail investment apps are transforming Solana into a hub for both speculators and long-term participants.

BNB Chain — Stability, Infrastructure, and Maturity

While Solana grabs attention with viral growth and hype, BNB Chain demonstrates the steady strength of a mature ecosystem. The network handled approximately 65 million transactions, securing second place in the weekly rankings. User and developer activity remains consistently high, while tools for building DApps and DeFi products continue to expand.

Recent upgrades, including faster block finality and support for new standardized smart contracts, have enhanced user experience and transaction speed. In 2025, BNB Chain is targeting throughput of up to 20,000 transactions per second, aiming for scalability on par with centralized exchanges.

BNB Chain also plays a strong role in GameFi, logistics solutions, stablecoins, and cross-chain interoperability, positioning itself as a foundation for integrating traditional business models into the crypto ecosystem.

Why This Growth Matters

This record-breaking week signals that crypto has moved far beyond speculative trading. Blockchains are becoming operational environments where millions of value-driven transactions occur daily.

The surge in activity on Solana and BNB Chain underscores a key trend: platforms that combine high traffic capacity with usability and cost efficiency are taking center stage.

Risks and Challenges

Despite the positive outlook, vulnerabilities remain:

Solana could overheat. Activity driven by meme coins is volatile — if hype fades, engagement could plummet.

BNB faces competition from Ethereum L2. Fast, low-cost L2 solutions like Arbitrum and Optimism could lure users away.

Regulatory threats. Any sanctions or restrictions, especially in the U.S., could negatively impact both networks.

Conclusion

Solana and BNB Chain represent two distinct strategies for success:

Solana: speed, scale, and viral engagement.

BNB Chain: stability, ecosystem depth, and infrastructural strength.

Their dominance during the biggest week in blockchain history proves they are among the key architects of the new digital economy. Which one will maintain leadership in the second half of the year remains to be seen — but one thing is clear: the fight for the heart of Web3 is on.

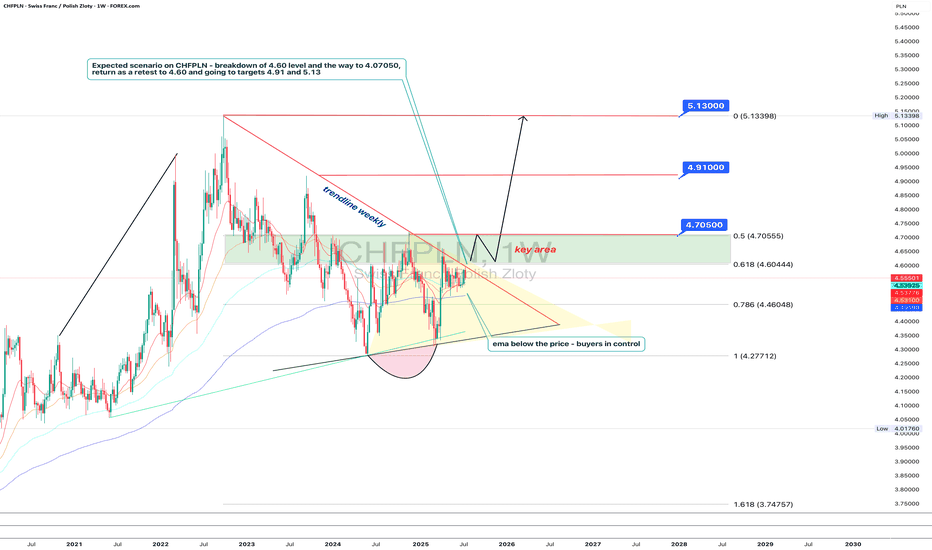

Polish zloty in trouble: Swiss franc is sharpening its teethTechnically, CHFPLN has completed a consolidation phase within a narrowing triangle and broke to the upside. The pair is now testing the 4.60 level (the 0.618 Fibonacci retracement) from below — a decisive zone. A breakout and confirmation above this area opens the path toward 4.705, which coincides with the 0.5 Fibo level and a local resistance. A pullback from that zone back to 4.60 is possible, but this time as a support retest. If the level holds, the targets remain: 4.91 and 5.13 - both marked by Fibonacci extensions and major long-term horizontal resistance. The EMAs are aligned in support of further upside, with price consistently trading above them.

Fundamentally, the Swiss franc remains a safe-haven currency, especially amidst increasing instability in the Eurozone. Weak growth in Germany, looming ECB policy easing, and rising inflationary pressures are all tilting investor interest toward CHF. Meanwhile, Poland faces political uncertainty, budgetary debates, and volatility in the agricultural and energy sectors. All of this strengthens the case for the franc in this pair.

Tactically, the game plan is straightforward: a confirmed breakout above 4.60 signals the start of a bullish impulse. The 4.60–4.705 zone is the key area of interest for buyers. If this zone is reclaimed and held, the next targets - 4.91 and 5.13 - remain valid, where large players may look to take profits.

If this scenario plays out, the zloty may soon be tuning into Polish radio to sing nostalgic songs about the golden days of its strength.

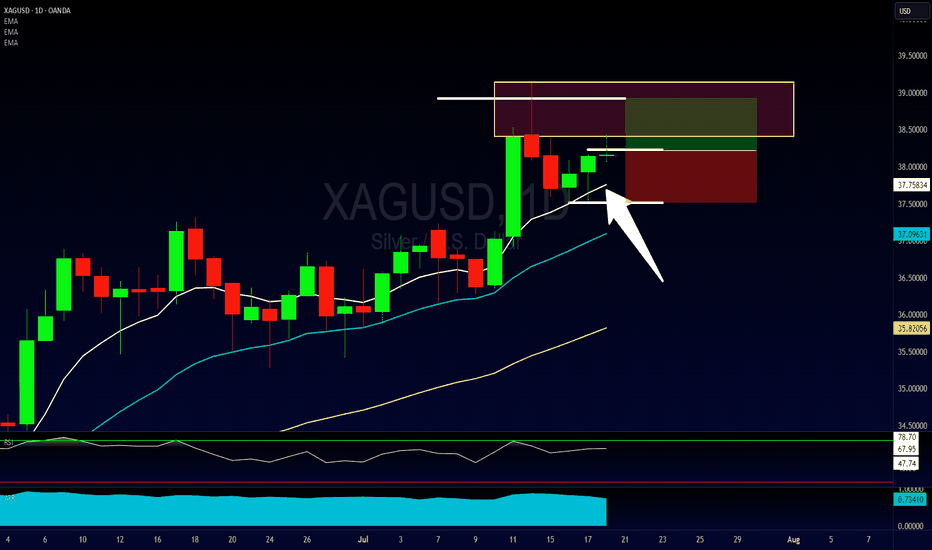

Bullish Daily Chore Strategy Entry on SilverFirst time I've spoken about this strategy here (as I don't personally trade it myself), but the "Daily Chore" is a very popular one amongst the traders I work with.

Essentially what we're looking for is for price action to be on the correct side of our 3 EMA's (8, 20 & 50), and for those EMA's to be running in the correct order.

If so, we are then looking for a pullback into the EMA's and for a pin bar rejection candles to give us a sign for entry.

This is a very difficult strategy to figure out as it requires a lot of testing and tweaks to optimize, but it also allows for a lot for freedom as it only requires a few minutes a day to check up on.

Please leave any questions or comments below and make sure to give me a follow so you don't miss my next shared trading idea.

Akil

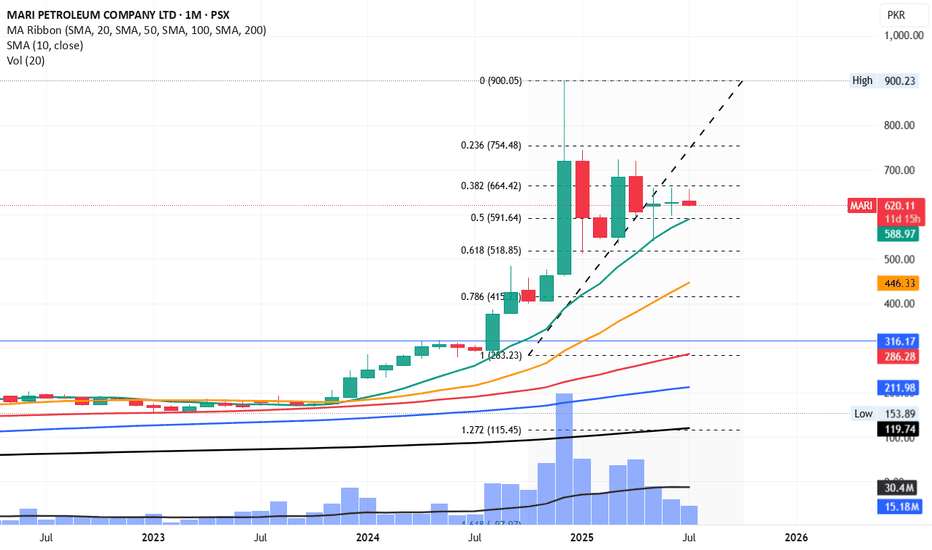

MARI ShortSince July 2023, Mari has never breached and closed below SMA10 on monthly timeframe.

If it breaches it and closes below 588, the downfall will be sharp.

Its first stop would be 519 and then 446 and 415 can also be on cards.

Sorry for Mari lovers but it can become a harsh reality.

However, 415 to 446 can be an ideal time for accumulation for long term investment purpose.

its not a buy / sell call, just my personal opinion.

Small cap is the flavor of the day - Long at 4.05I decided to do a small cap stock today. I don't use too many of these as ideas, though I do trade them on my own. I don't usually publish about them because they are inherently more risky than large cap, established stocks. And to be fair, RBBN has a spotty history from a chart perspective.

Go ahead and zoom on out all the way. See that? That's what danger looks like. This stock has lost 80% of its value in the last 10 years, and 50% in the last 4. However, in its defense, it is profitable on a reported earnings basis over the last 12 months, and has held its own for several years now, and that's why I'm not AS nervous as I might otherwise be publishing this.

Additionally, it's solidly above its 200MA and in both a 1 year and 2 month uptrend, so its recent strength is good. I haven't dug down all the way back to its debut, but I suspect I'd have at the very least had a challenge making money on this one over its entire existence. But I am not trading its entire existence today. 75% of the trades in this stock in the last year would have closed in under 2 weeks, so the short term picture is what I'm mostly looking at here, and over the last month or so this has been a very solid stock. Could that change tomorrow? Yup. But I don't have that crystal ball. All I can do is rely on the system that has of late produced excellent results here.

In the last 12 months, there have been 27 buy signals here. 25 closed profitably and 2 are still open and down 18% and 9%, respectively. INCLUDING the losers, however, the median daily return on those trades has been .48% (>10x the market avg) and the average daily return is 1.02% (> 23x the avg daily market return).

Trading is about balancing risks and rewards. This stock is riskier than most, but the rewards are a lot better, too. I don't put all my money into any one trade - that's a TERRIBLE idea. The vast majority of my open trades are relatively safe, large cap stocks. But risky has its place in a portfolio. I made 15% in 2 days recently on QUBT (I posted that trade here) and made almost 18% on NUTX in the last 2 days - just closed that trade today. As a % of my portfolio of trades, ones like that can be small positions, but make a meaningful impact. That's my hope for RBBN here.

Of the 25 winning trades in the last year, over half produced a gain of 4% or more. And the average holding periods of the winners was only 8 days, with 15 of the 25 closing in a week or less. That rapid return also reduces the risk in a stock like this one. Wnen you only stick around for a few days most of the time, it's harder (not impossible) to get caught holding the bag during a drop.

My close will be signal based, and not a particular price target, but the trades I referred to above on RBBN give a good outline. However, the 2 losers have been open since February, so be forewarned that IF you follow me on this one, you might need to buckle your chinstrap. It could get bumpy.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing and why, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

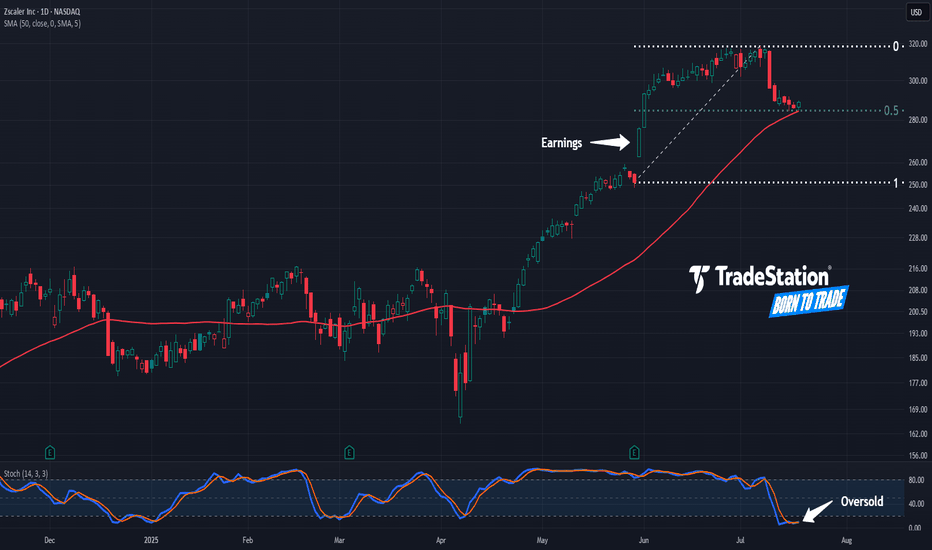

Zscaler May Be OversoldZscaler recently climbed to a three-year high, and now it’s pulled back.

The first pattern on today’s chart is the May 30 gap after earnings and revenue beat estimates. That may reflect positive fundamentals.

Second, the cybersecurity stock has retraced half the move following results. Stabilizing here may confirm direction is pointing higher.

Third, prices are trying to stabilize near the rising 50-day simple moving average.

Fourth, stochastics have dipped to an oversold condition.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

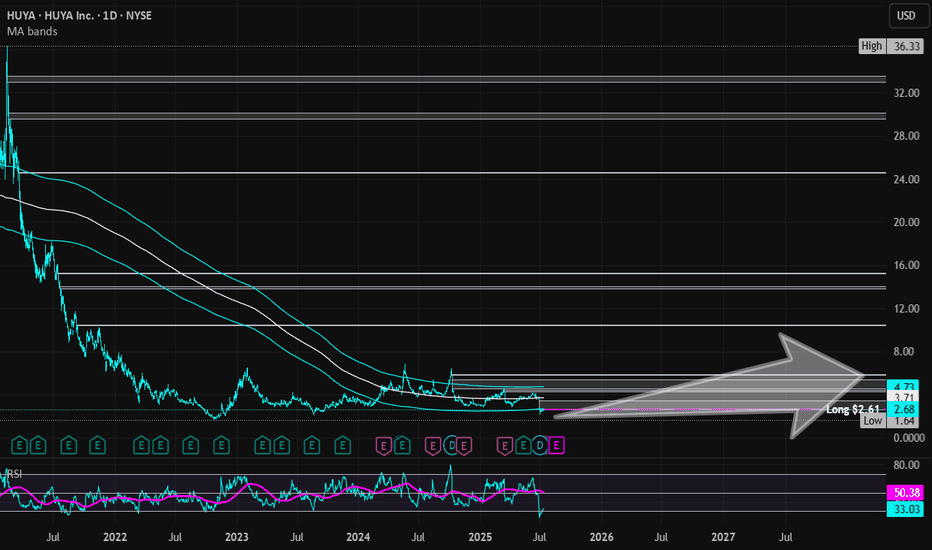

HUYA | HUYA | Long at $2.61HUYA NYSE:HUYA operates game live streaming platforms in China. This stock got my attention based on the reported fundamentals and price position, but moderate "Chinese delisting" risks exist given the US's new political administration.

Book Value = $3.23 (Undervalued)

Forward P/E = 4.1x (Growth)

Debt-to-equity = 0x (Healthy)

Quick Ratio = 1.56x (Healthy)

Altman's Z Score = <1.8 (Bankruptcy risk is relatively high)

From a technical analysis perspective, the stock price momentum has shifted upward based on the historical simple moving average. The price often consolidates within and slightly outside of this simple moving average band before progressing higher (after a long period of selling). While near term-declines are a risk, a longer-term hold (if the fundamentals do not change and delisting doesn't occur) may pay off given the value, growth, and overall health of the company.

Thus, at $2.61, NYSE:HUYA is in a personal buy zone.

Targets into 2028:

$3.45 (+32.2%)

$5.80 (+122.2%)

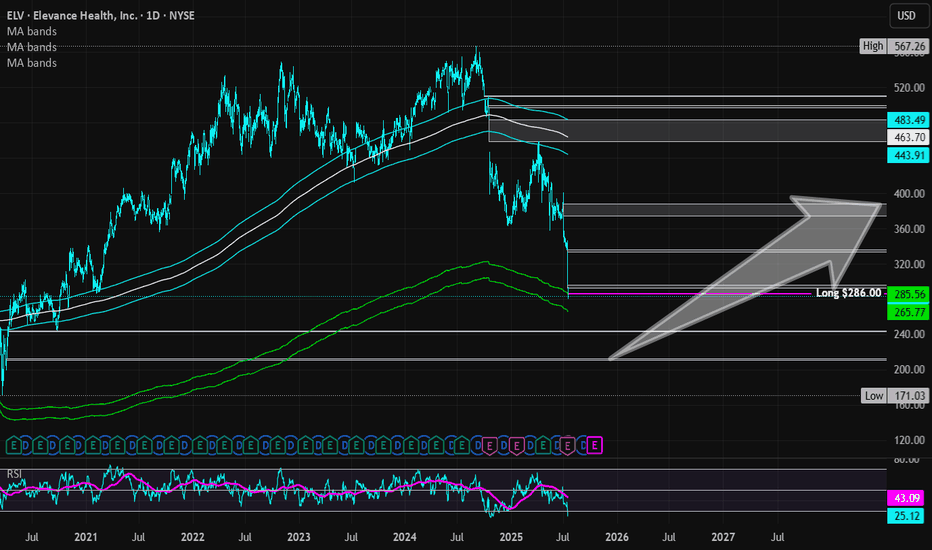

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions are crushing them to get in - it's just near-term noise, in my opinion. My personal strategy is buy and hold every healthcare opportunity (i.e. NYSE:CNC , NYSE:UNH , NYSE:HUM etc).

Elevance Health NYSE:ELV just dropped heavily due to lower-than-expected Q2 2025 earnings, a cut in full-year profit guidance from $34.15-$34.85 to ~$30 EPS, and elevated medical costs in Medicaid and ACA plans. It's near-term pain (may last 1-2 years) which will highly likely lead to long-term growth. The price has touched my historical simple moving average "crash" band. I would not be shocked to see the price drop further into the $260s before a rise. However, the near-term doom could go further into the year. I am anticipating another drop to the "major crash" simple moving average band into the $190s and $220s to close out the remaining price gaps on the daily chart that occurred during the COVID crash. Not to say it will absolutely reach that area, but it's locations on the chart I have for additional buys.

Thus, at $286.00, NYSE:ELV is in a personal buy zone (starter position) with more opportunities to gather shares likely near $260 before a bounce. However, if the market or healthcare industry really turns, additional buys planned for $245 and $212 for a long-term hold.

Targets into 2028:

$335.00 (+17.1%)

$386.00 (+35.0%)

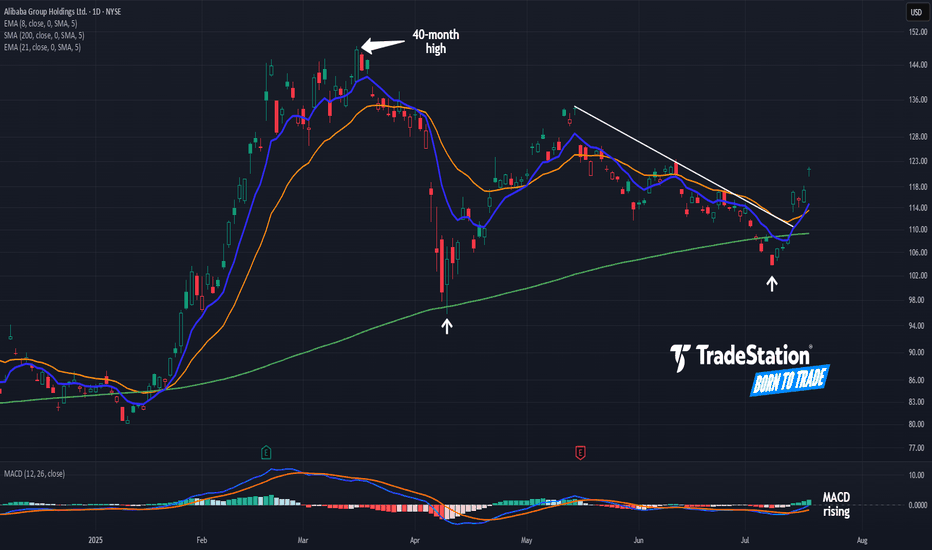

Alibaba Breaks a TrendlineAlibaba began 2025 with a big rally. Now, after a long pullback, some traders may see further upside in the Chinese tech giant.

The first pattern on today’s chart is the pair of higher lows (marked with white arrows) along the rising 200-day simple moving average. Those may reflect the development of a longer-term uptrend.

Second, BABA peaked above $148 in March. It was the highest price since November 2021. That may suggest a long-term downtrend is fading.

Third is the series of lower highs in May and June. The stock broke that falling trendline this week, a potential sign of improving price action in the short term.

Next, MACD is rising and the 8-day exponential moving average is nearing a potential cross above the 21-day EMA. Those could be viewed as further positive short-term signals.

Finally, BABA is an active underlier in the options market. (Volumes have averaged more than 200,000 contracts per session in the last month, according to TradeStation data.) That may help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

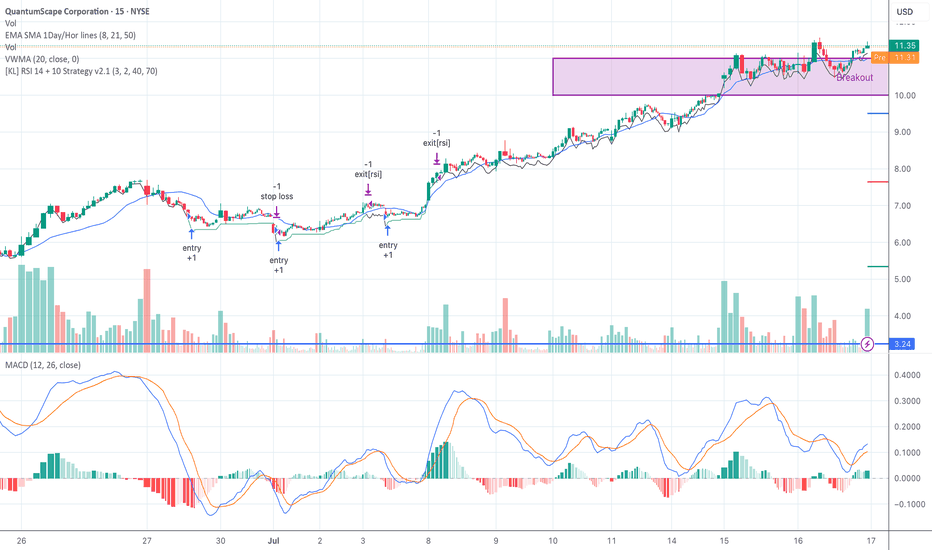

QS Breakout Setting Up — Entries Triggered, Waiting for ConfirmSeed System entries are printing on QS with trailing profit zones holding firm.

MACD crossovers confirming the move. Watching RSI cooling just under breakout resistance at $11.35.

A push through $11.50 with volume and I’m adding — slowly.

Support at $10.03, cut fast if price shows weakness.

Let the market do the heavy lifting.

#QS #SeedSystem #SwingTrading #TrendFollowing #LivermoreStyle #BreakoutWatch

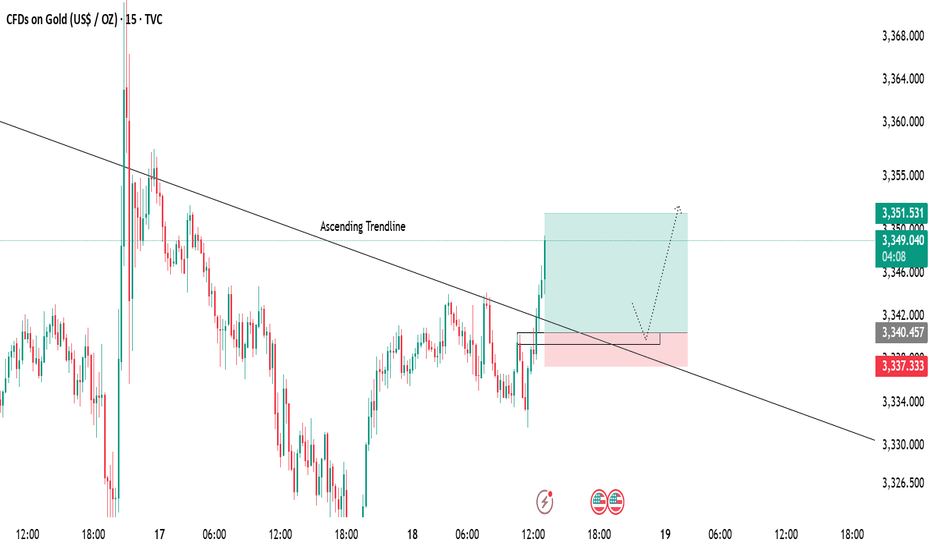

Gold 15-Min Chart Analysis Alert!Gold has successfully broken above the descending trendline, showing early signs of bullish momentum. Price has reclaimed structure and is now trading above the breakout level.

📌 Retest Zone:

We can expect a possible pullback towards the marked zone for a healthy retest before continuing the upward move.

🎯 Bullish Target:

As long as price holds above the support area, the bullish bias remains intact with targets around 3351+.

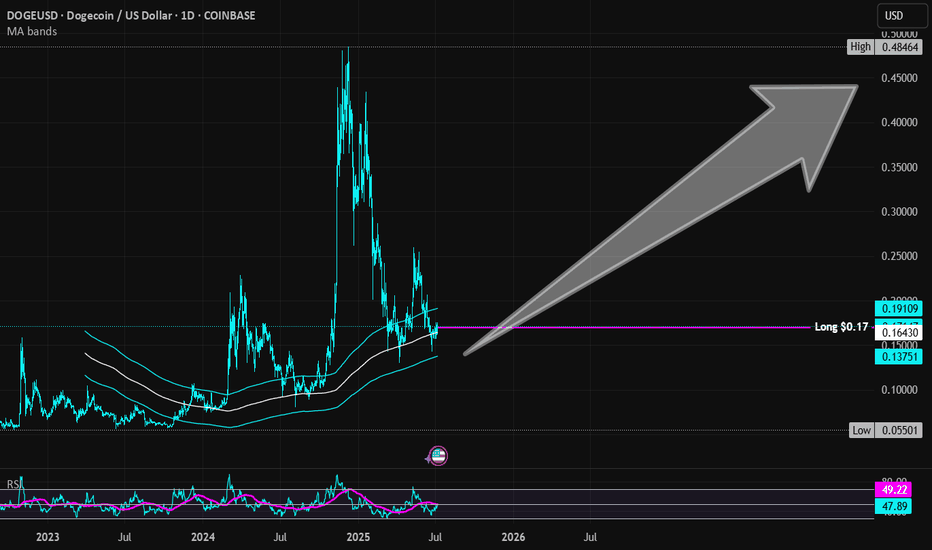

ATOM Sleeping GIANT ALT | Moving Averages BULLISH like NOV24'ATOM is slowly but surely making a turn up towards the first Take Profit point.

From the bottom, Cosmos has already increased a whopping 52% , with even more room to grow:

In my previous update, the 4 was still bearish when looking at trend lines and moving averages.

However, this has flipped to bullish from the 4h upward, with the price trading high above the moving averages in the 4h and in the daily timeframe:

4H:

Daily:

Note how previously, the big increases started as soon as the price regained the moving averages as support.

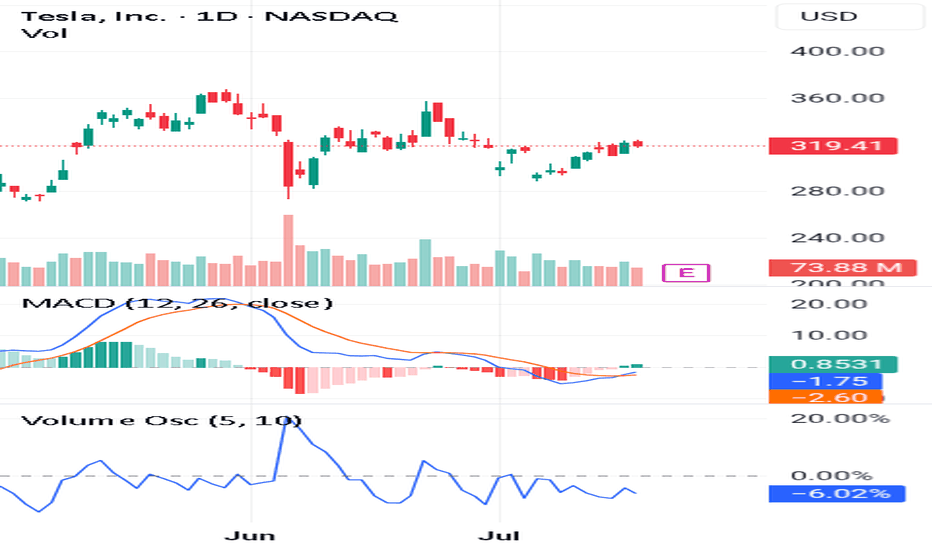

(Learn More)Use These 3 Steps To Spot Long-Lasting Trends👉Trade before the earnings report

👉Make sure the volume oscillator is below zero

👉Make sure the MACD lines give you a Bullish signal

If you look at this chart you can see all the steps alignment.

This is very important because you want to catch a long term trend.

Also it has to follow the 3step rocket booster strategy.

In order for you to learn more about this strategy 🚀 Rocket Boost This Content.

Disclaimer ⚠️ Trading is risky please learn how to use Risk Management And Profit Taking Strategies. Also feel free to use a simulation trading account before you use real money.

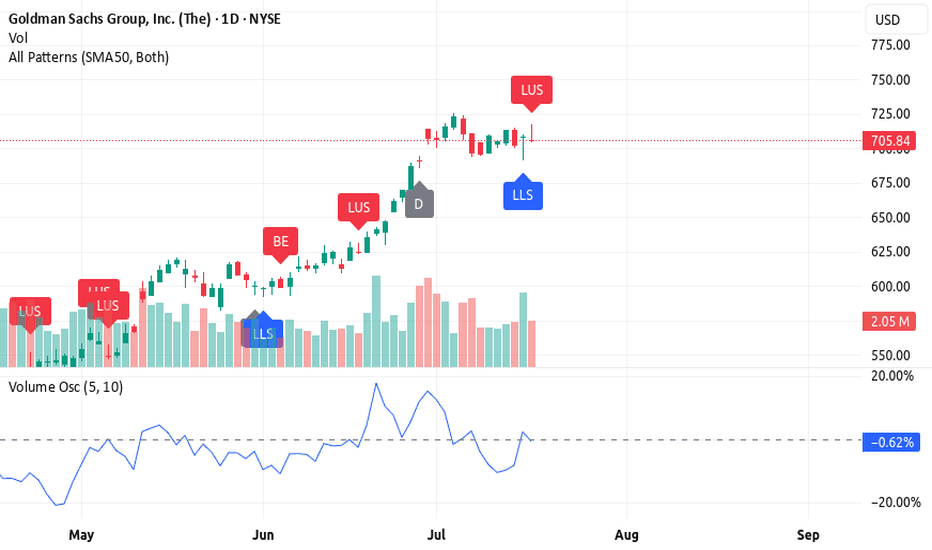

3 Reasons Why Goldman Sachs (GS) Still Looks Bullish🚀 3 Reasons Why Goldman Sachs (GS) Still Looks Bullish (Despite a Bearish Candle)

Goldman Sachs is in a bullish trend, but the latest candlestick is flashing a warning. Here's why GS still looks strong — and what to watch for next 📈

1️⃣ Candlestick pattern – long upper shadow

The long upper shadow shows sellers pushed the price down from the highs, signaling resistance. While bearish short-term, it often happens during strong trends as the market breathes before pushing higher.

2️⃣ High volume on a bearish candle

The negative volume shows resistance, but it may actually represent bear exhaustion. High volume without a breakdown

suggests bears tried to push it down — and failed. Classic fake-out.

3️⃣ Volume oscillator still rising

Despite the pullback candle, the volume oscillator is holding above zero and trending up, showing momentum is still on the bulls' side.

🔥 Rocket Booster Strategy still intact

✅ Price above 50 EMA

✅ Price above 200 EMA

⚠️ Just a temporary shakeout? If the next candle confirms support, GS may continue the bullish push.

⚠️ Disclaimer: Always use a simulation (demo) account before trading with real money. Learn proper risk management and profit-taking strategies to protect your capital.

ATAI bulls look primed for another leg upATAI gave us the highest close we've seen in nearly 3 years today as bulls closed at high of the day approaching resistances from the gap up on July 1st. Today saw 2x the volume traded yesterday which is a great sign when looking for daily continuation.

Anticipate resistance at 2.81. 3.00, 3.01, and weekly 200 SMA

Red flag from here would be to fail at 3.00 and reverse to break below 2.53.

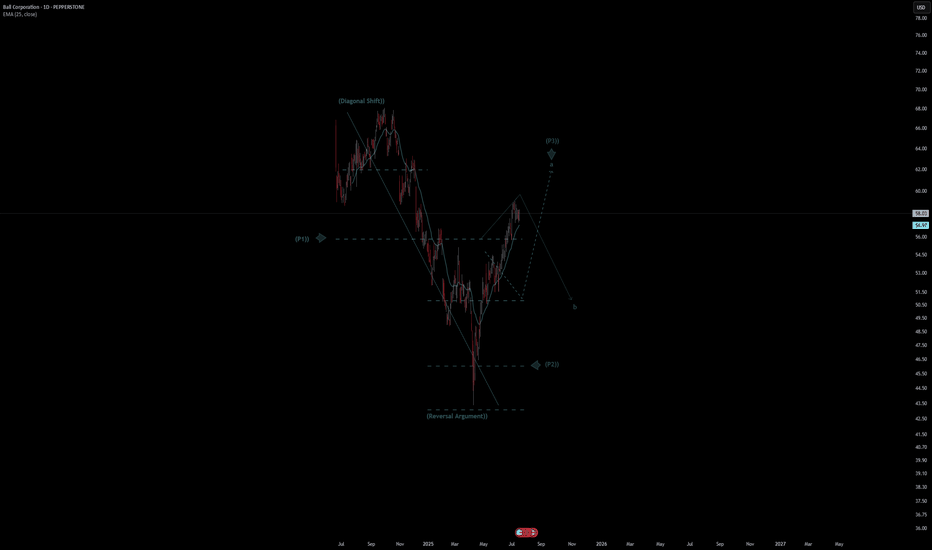

Ball Corporation Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Ball Corporation Quote

- Double Formation

* (Diagonal Shift)) At 67.00 USD | Completed Survey

* (Reversal Argument)) - *Fractional Spike | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* (TP1) = a / Long Consecutive Range

* (TP2) = b / Short Consecutive Pullback | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Regular Settings

- Position On A 1.5RR

* Stop Loss At 53.00 USD

* Entry At 58.00 USD

* Take Profit At 65.00 USD

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy