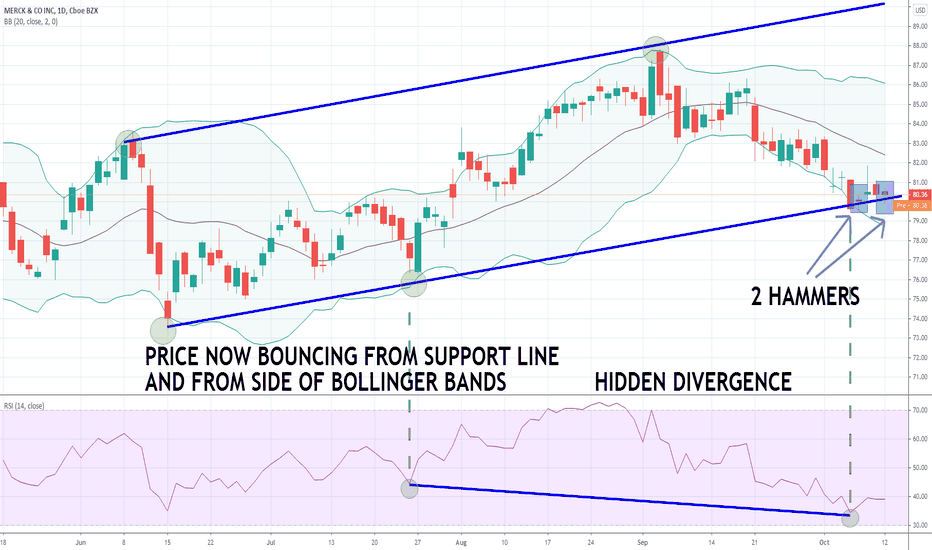

Is MRK Setting Up for a Major Comeback? 🧬Merck & Co. (MRK) is trading around $81.00 down significantly from its 52-week high of $134.63 but this pullback could be your window of opportunity. With a solid forward P/E of 9.02, a 3.9% dividend yield, and a pipeline packed with over 20 potential blockbuster drugs, the fundamentals remain strong despite recent pressure from Gardasil sales in China and looming Keytruda patent concerns.

🎯 Entry Zones:

1) Market price

2) $72.50 (strong historical support)

3) $66 (major accumulation zone)

📈 Profit Targets:

TP1: $87

TP2: $99

TP3: $115+

Technically, MRK is still below its 50- and 200-day SMAs, but the PEG ratio of 0.74 suggests it's deeply undervalued relative to its growth potential. A bounce from current levels or deeper supports could kickstart a strong swing toward triple-digit territory — especially if bullish sentiment returns to the healthcare sector.

🔍 Watch for confirmation around support and volume spikes — this setup could become one of the stealth recovery trades of the year.

🛑 Disclaimer: This is not financial advice. Always do your own research or consult a financial advisor before investing.

Mrklong

MRK Approaching Support, Potential Bounce! MRK is approaching our first support at 66.70 (horizontal overlap support, 100% fibonacci extension, 50% fiboancci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 74.94 (50% fibonacci retracment, 61.8% fiboancci extension).

Stochastic (21,5,3) is also approaching support where we might see a corresponding bounce in price.