MRVL Earnings Play--Don’t Miss Out

# 🚀 MRVL Earnings Play (8/28 AMC) 🚀

💎 **Moderate Bullish | 75% Conviction** 💎

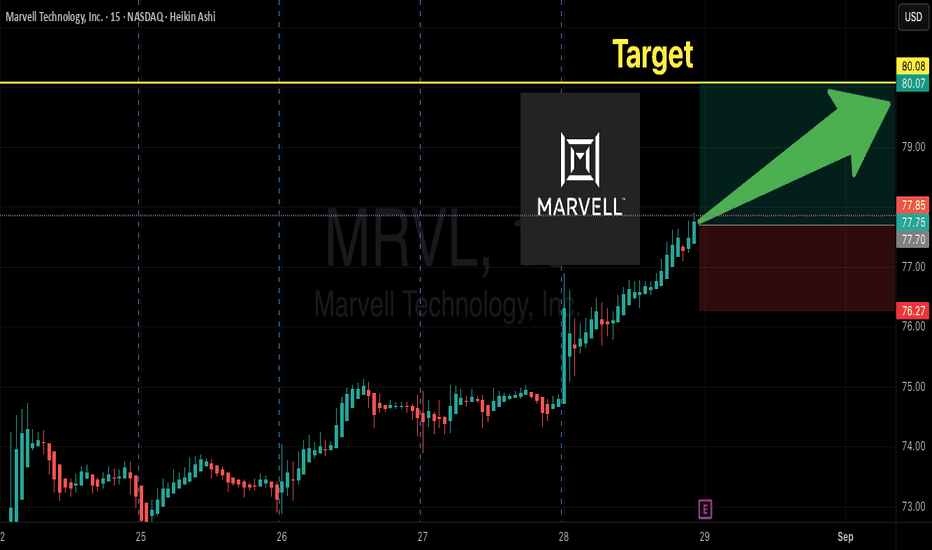

🎯 **Trade Setup**

📊 Ticker: \ NASDAQ:MRVL

🔀 Direction: CALL 📈

🎯 Strike: 80.00

📅 Expiry: 2025-08-29

💵 Entry: 2.23 (ASK)

📦 Size: 1 contract (risk 💸 \$223)

🎯 Profit Target: 6.69 (200%)

🛑 Stop: 1.12 (-50%)

⏰ Timing: Pre-earnings close (8/28 AMC)

⚡️ **Why Bullish?**

* 🚀 AI/data-center sector tailwinds

* 📈 Heavy OTM call OI at \$78–85 (dealer hedging fuel)

* 🔥 Pre-earnings drift (+2.49% today)

* 📊 IV elevated but not extreme → room for upside

✅ **Execution Rule**: In before close, out within 2h post-earnings or at stop/target.

---

### 📌 Suggested TradingView Tags

\#MRVL #Marvell #EarningsPlay #OptionsTrading #CallOptions #WeeklyOptions #BullishSetup #MomentumTrading #TradeIdeas #StockMarket 🚀📊

Mrvllong

MRVL $80 Call: Balanced Risk, High-Reward LEAP Trade!

## 💎 MRVL \$80 LEAP – Long-Term Semiconductor Bullish Play! (Sep 2026 Expiry) 💎

### 🔑 Market Summary

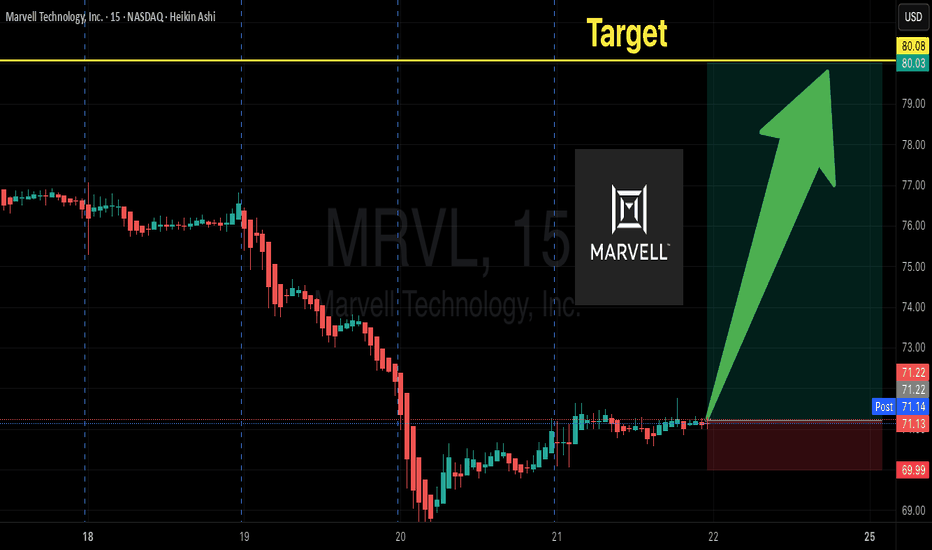

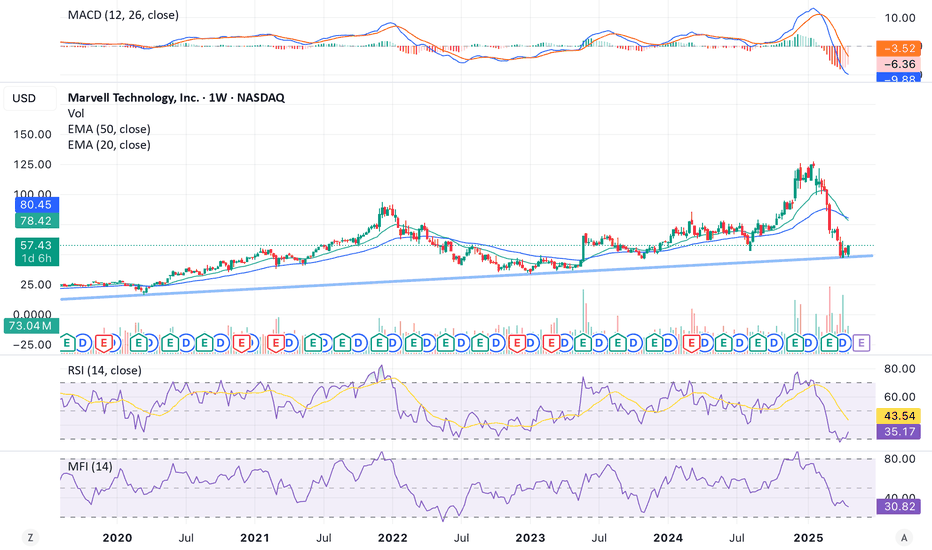

* 📊 **Momentum:** Weekly RSI shows short-term bullish recovery; monthly chart signals caution → mixed to moderately bullish

* ⚖️ **Options Flow:** Favorable volatility environment supports LEAP strategy

* 🏦 **Institutional Sentiment:** Mixed; some accumulation noted, but bearish long-term trend remains a caution

* 🌐 **Sector Context:** Semiconductor market recovery potential, but watch for broader bearish drivers

---

### 📈 Trade Setup

* 🟢 **Direction:** LONG CALL

* 🎯 **Strike:** \$80.00

* 💵 **Entry Price:** \~\$15.50

* 📅 **Expiry:** Sep 18, 2026 (\~13 months)

* 📊 **Size:** 1 contract

* ⏰ **Entry Timing:** Market open

* 📈 **Confidence Level:** 75%

---

### 💥 Risk & Reward

* 🏆 **Profit Target:** \$31.00 (100%+ potential upside; aggressive target \~\$46.00)

* 🛑 **Stop Loss:** \$10.50 (30–40% of entry price)

* ⚡ **Key Risks:** Bearish monthly momentum, semiconductor sector headwinds, potential bull trap

* 🔄 **Recommendation:** Enter cautiously, monitor weekly momentum for continuation signals

---

### 🔥 Hashtags for Viral Sharing

\#MRVLLEAP #MRVLOptions #Semiconductors #LongTermCall #LEAPs #BullishPlay #TradingViewAlerts #WallStreet

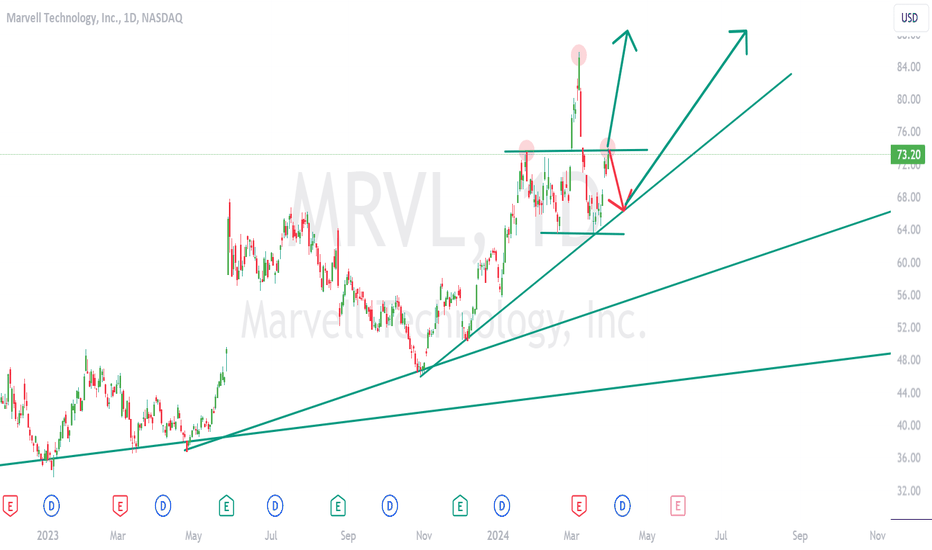

MRVL at turning point; rapid growth; stock price set to doubleMarvell Technology Inc. (MRVL) has recently shown signs of an upward trend, buoyed by positive analyst sentiment and strategic advancements in AI and cloud computing. Despite a challenging start to 2025, with shares down approximately 50% year-to-date (markets.businessinsider.com), analysts maintain a bullish outlook. The average 12-month price target stands at $116.40, suggesting significant potential upside from current levels (StockAnalysis).

Marvell's focus on custom AI silicon and data center solutions is driving optimism. The company's Structera CXL devices have achieved interoperability with AMD and Intel platforms, enhancing performance in next-generation cloud data centers (Benzinga). Additionally, Marvell's AI business now constitutes over half of its revenue, with expectations of 60% year-over-year revenue growth driven by AI and cloud segments (Seeking Alpha).

While short-term volatility persists, these developments position Marvell as a strong contender in the semiconductor sector, with potential for sustained growth as AI and cloud computing demand accelerates.

Marvell Technology, Inc. (MRVL) Dips 16% On Earnings ReportMarvell Technology, Inc. ( NASDAQ:MRVL ) faced a sharp 16% decline in premarket trading on Thursday following the release of its fiscal fourth-quarter earnings report. While the semiconductor giant exceeded Wall Street’s expectations on both revenue and earnings per share (EPS), investor sentiment soured due to an uninspiring outlook.

Strong Growth, Weak Guidance

Despite the stock's decline, Marvell delivered solid earnings results for Q4:

- Revenue: $1.82 billion (+27% YoY), surpassing analyst consensus.

- Adjusted EPS: $0.60 per share, up from $0.46 a year ago.

- Data Center Segment: Revenue surged 78% YoY to $1.37 billion, reflecting strong AI infrastructure demand.

However, the market’s reaction was driven by Marvell’s fiscal Q1 guidance, which projected:

- Revenue of $1.875 billion, within analysts' expectations but lacking significant upside.

- Adjusted EPS forecast of $0.56 - $0.66, failing to excite investors anticipating a stronger AI-driven catalyst.

Technical Analysis

From a technical perspective, NASDAQ:MRVL now trades below key moving averages, reinforcing a bearish short-term trend. The stock’s RSI (Relative Strength Index) currently sits at 38, signaling weakness but not yet oversold territory, suggesting sellers may still have control.