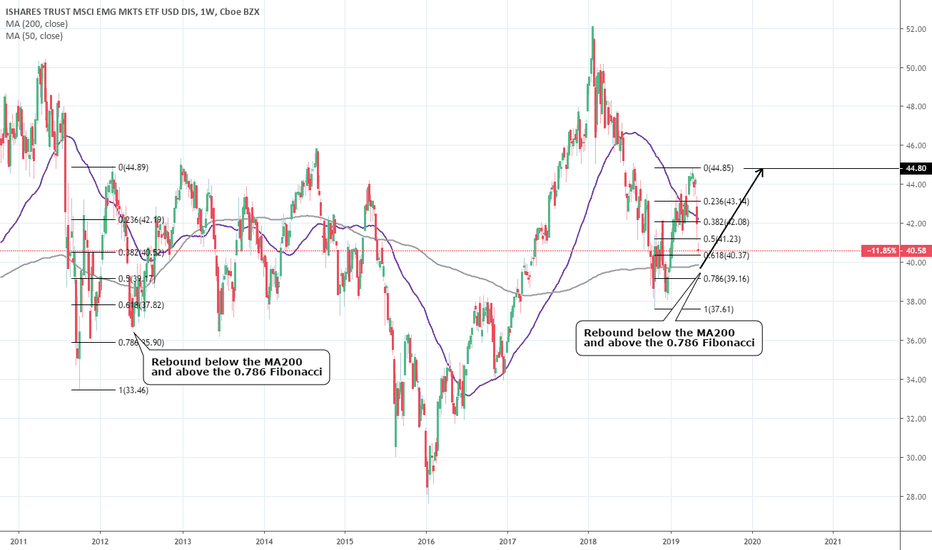

EEM ETF: Lower long term Buy opportunity.The iShares MSCI Emerging Markets ETF (EEM) is on bearish 1W price action (RSI = 41.481, Highs/Lows = -1.8644), repeating a pattern last seen in April 2011 - May 2012. During that period the price was rejected at 44.90, crossed below the MA50 and MA200 and found support just over the 0.786 Fibonacci level before recovering 100%.

We expect a similar price behavior today as the price was rejected at 44.85 and has already crossed below the MA50. The crossing below the MA200 remains and the rebound above the 0.786 Fibonacci retracement level, which puts the support around 39.50 - 39.60. Our target is 44.80.

** If you like our free content follow our profile (tradingview.sweetlogin.com) to get more daily ideas. **

Comments and likes are greatly appreciated.