MSTR Options Flow Screams Bullish — Can $345C Print This Week?

# ⚡ MSTR Weekly Trade Setup (2025-09-07)

**Bias:** 🎯 Mixed → speculative bullish bounce

**Conviction:** ⭐⭐⭐ (60%)

---

### 📊 Key Takeaways

* ✅ **Options flow:** Strongly bullish (C/P = 2.21)

* ❌ **Trend:** Still bearish (-16.45% monthly, RSI weak)

* ⚠️ **Volume:** Flat (1.0x avg) → no institutional conviction

* 🌐 **Volatility:** Low (VIX \~15) → cheap calls

* 🧱 **OI Walls:** \$340C & \$345C = resistance / gamma levels

---

### 🎯 Trade Plan (Speculative Play)

* **Instrument:** \ NASDAQ:MSTR

* **Direction:** CALL (naked)

* **Strike:** \$345.00

* **Expiry:** 2025-09-12 (weekly)

* **Entry Price:** \$8.60 (ask)

* **Profit Target:** \$12.90 (≈1.5×)

* **Stop Loss:** \$5.59 (\~35% risk)

* **Size:** 1 contract (small, punt-sized)

* **Entry Timing:** Open (prefer limit near ask)

---

### 🧠 Rationale

* Flow is unambiguously bullish, but **price trend & RSI weak** → treat as a bounce, not reversal.

* \$345C offers liquidity (OI 14,439) + better risk balance than \$340C.

* 5 DTE = **theta risk**, so trade is **binary/speculative**.

---

### ⚠️ Key Risks

* 📉 Trend is down → bounce may fail quickly.

* ⏳ Time decay fast with only 5 DTE.

* 🧱 Gamma/OI walls may cap upside near \$345.

* 📰 Macro/news can swamp bullish flow.

---

## 📌 TRADE DETAILS (JSON)

```json

{

"instrument": "MSTR",

"direction": "call",

"strike": 345.0,

"expiry": "2025-09-12",

"confidence": 0.60,

"profit_target": 12.90,

"stop_loss": 5.59,

"size": 1,

"entry_price": 8.60,

"entry_timing": "open",

"signal_publish_time": "2025-09-07 07:45:34 EDT"

}

```

---

🔥 **Summary:**

This is a **flow-driven speculative call punt** — risk small, size small, exit fast.

If flow + price action confirm, \ NASDAQ:MSTR \$345C has upside.

If not → cut quick.

Mstrcoin

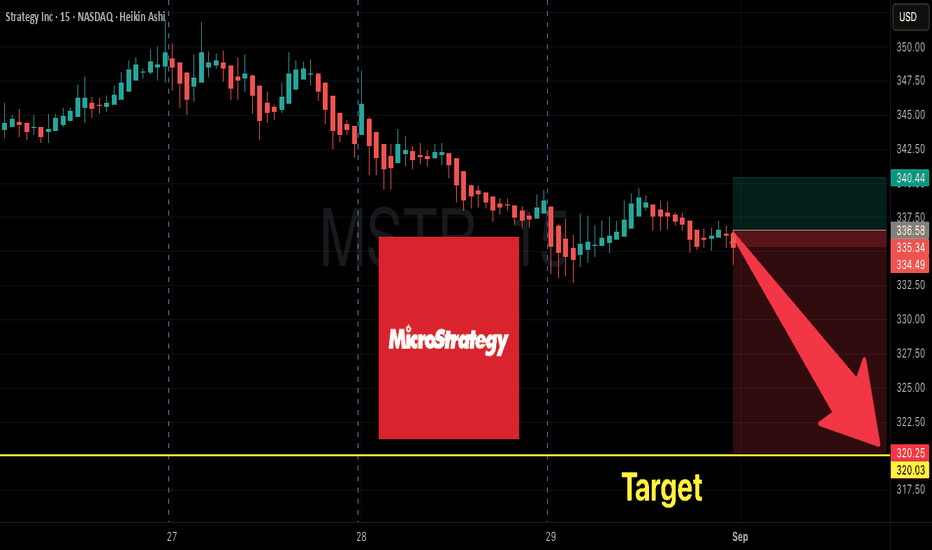

MSTR Short Alert | Lean Short Bias at $335

# ⚡ MSTR Short Alert | Lean Short Bias (Sep 2, 2025) 🪙📉

📊 **Market Summary:**

* Daily/Intraday: Bearish (Price < daily EMAs, RSI \~35, MACD negative) 🔻

* Weekly: Weakening but not decisively broken (near/above 50-week EMA) 📈

* Volume: Light — low participation on recent declines ⚖️

* Headlines: Neutral; watch BTC correlation & macro events 📰

**Net Bias:** Lean short on daily timeframe; small position recommended 🐻

---

## ✅ Trade Plan

* 🎯 **Instrument:** MSTR

* 🔀 **Direction:** SHORT

* 💵 **Entry Price:** \~335.0 (acceptable 333–336)

* 🛑 **Stop Loss:** 341.13 (daily resistance / pivot)

* 🎯 **Take Profit:** 320.00 (scale 60%), trail remaining 40% to 310.00

* 📊 **Position Size:** 1.5% of portfolio

* 📈 **Confidence:** 60%

* ⏰ **Entry Timing:** Market Open

---

## ⚠️ Key Risks

* Low volume → false break / short-squeeze risk ⚡

* MSTR-BTC correlation or S\&P rumors could gap price higher 🪙

* Weekly support \~322–325 may limit downside 🛑

---

## 💡 Trade Rationale

* Daily + 30m confluence: short-term bounce attempts stalling under intraday resistances (336–339)

* Weekly momentum weakening → controlled small-size short

* Stop above 341.13 → disciplined risk management

---

\#️⃣ **Tags / Hashtags:**

\#MSTR #ShortTrade #StockTrading #SwingTrade #CryptoCorrelation #DailyRSI #TradingSignal #RiskManagement 🐻🔥