Multiple Time Frame Analysis

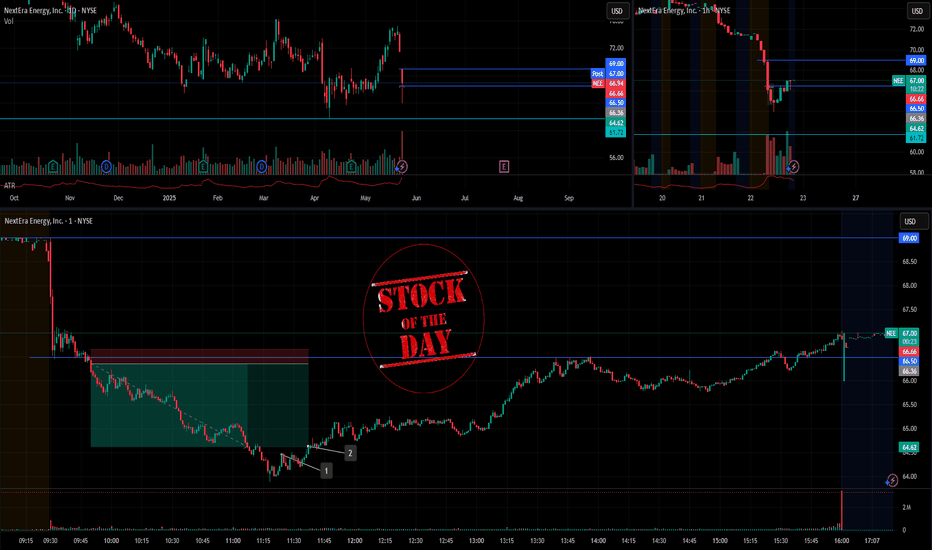

Stock Of The Day / 05.22.25 / NEE05.22.2025 / NYSE:NEE

Fundamentals . Negative background due to the bill to cancel tax benefits for clean energy companies.

Technical analysis.

Daily chart: Downtrend.

Premarket: Gap Down on moderate volume.

Trading session: The primary impulse from the opening of the session was stopped at 66.50. Buyers' strength is insufficient and the price retests the 66.50 level, and the next pullback was significantly smaller than the previous one. We are considering a short trade to continue the downward movement.

Trading scenario: #breakout with retest of the 66.50 level

Entry: 66.36 after the breakdown and holding the price below the level.

Stop: 66.66 we hide it above the high of the last pullback.

Exit: Cover part of the position at 64.46 after a reaction to the round level of 64.00 and when the structure of the downtrend is broken, cover the remaining part of the position at 64.64 upon confirmation that downtrend is changed to uptrend.

Risk Rewards: 1/5

P.S. In order to understand the idea of the Stock Of The Day analysis, please read the following information .

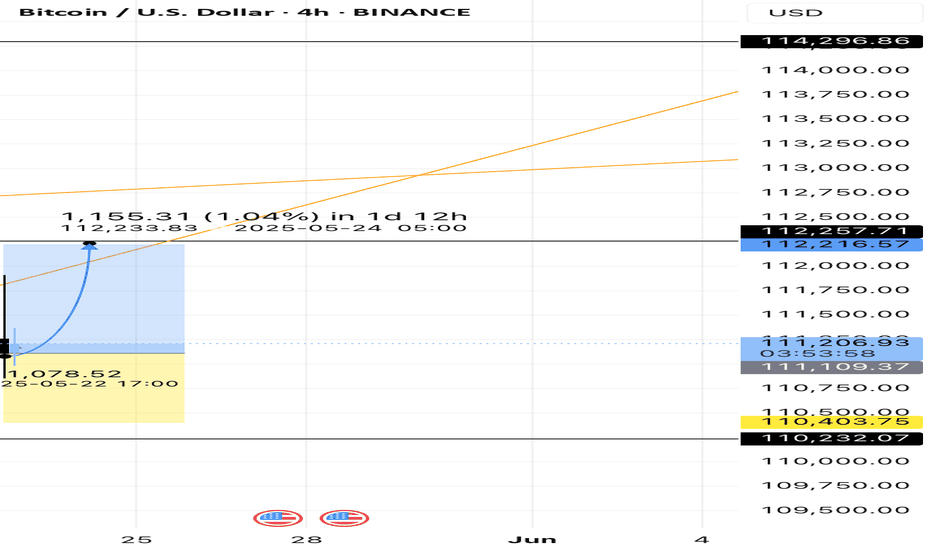

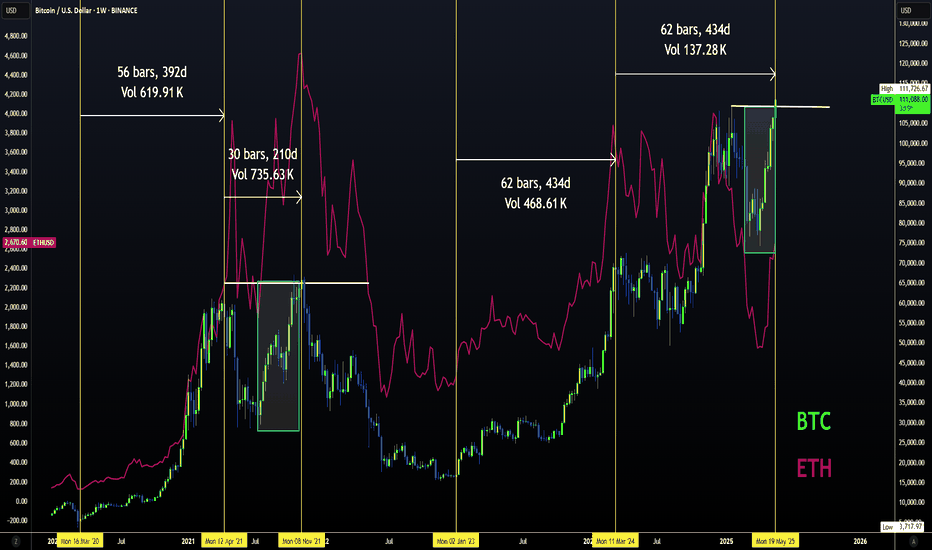

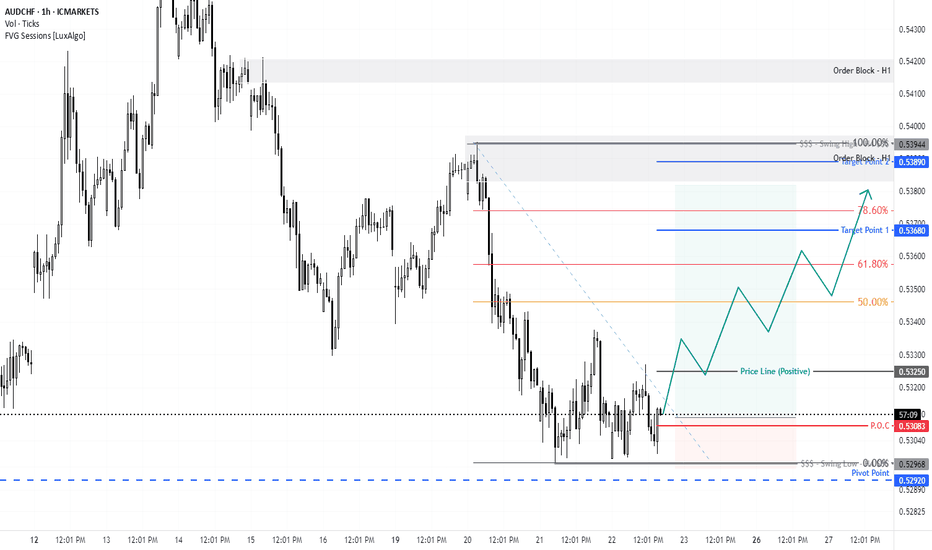

BTC - Why THIS TIME is DIFFERENT (⊙ˍ⊙)This time IS DIFFERENT. Bitcoin has made a new ATH as I predicted in a few previous posts, but something's off...🤔

If we look at BTC from a macro view, the dates for this run up was quite extended. We do see some similarities in terms of the retracement (highlighted in blue) but from a timeframe analysis, there is no comparing this high to the previous:

stretching from March to October where classical bear market symptoms were show - lower highs and lower lows, with a duration unlike any of the previous cycles.

Interestingly, the previous season we increased not even 7% from the previous peak. And if we were to look at the same fractal, that places us around $116k.

But the ONE thing, that has had me suspicious this entire time (🥁) was ETH. Overlaying the ETH chart, we see that historically, ETH peaked a week or two after the BTC ATH - until this time.

The fact that BTC made such a dramatic ATH and Ethereum didn't? That was a new one. And even up to now, ETH is still 80% away only from it's previous ATH - imagine the altseason we will have IF ETH makes a new ATH... or will this time just be , different ?

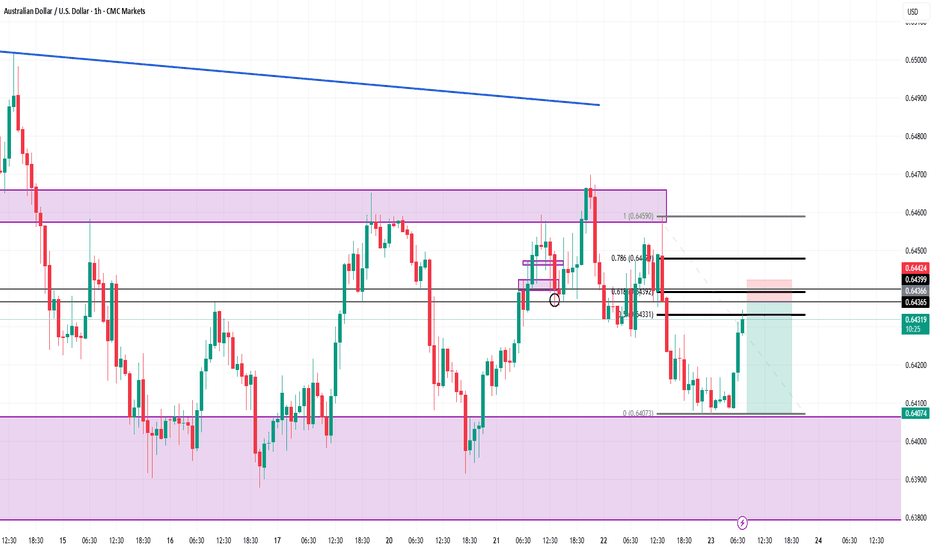

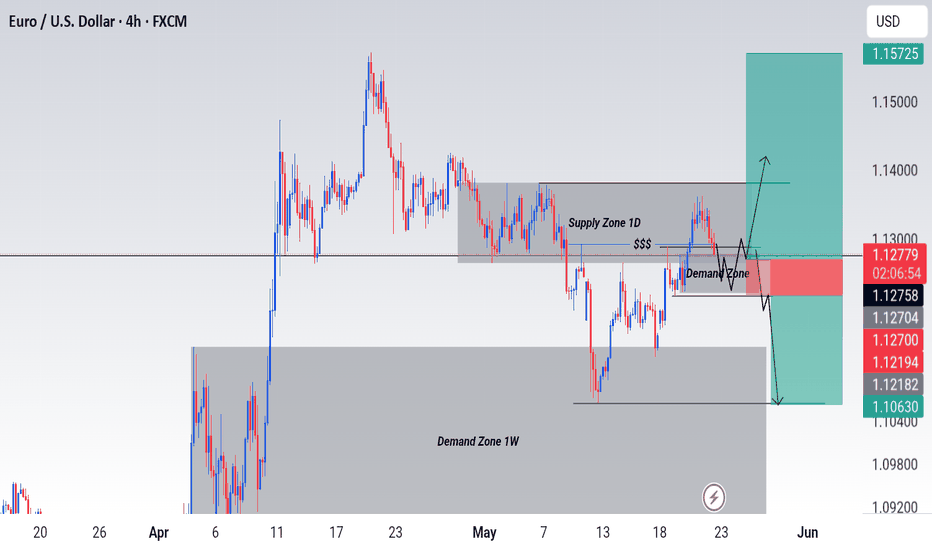

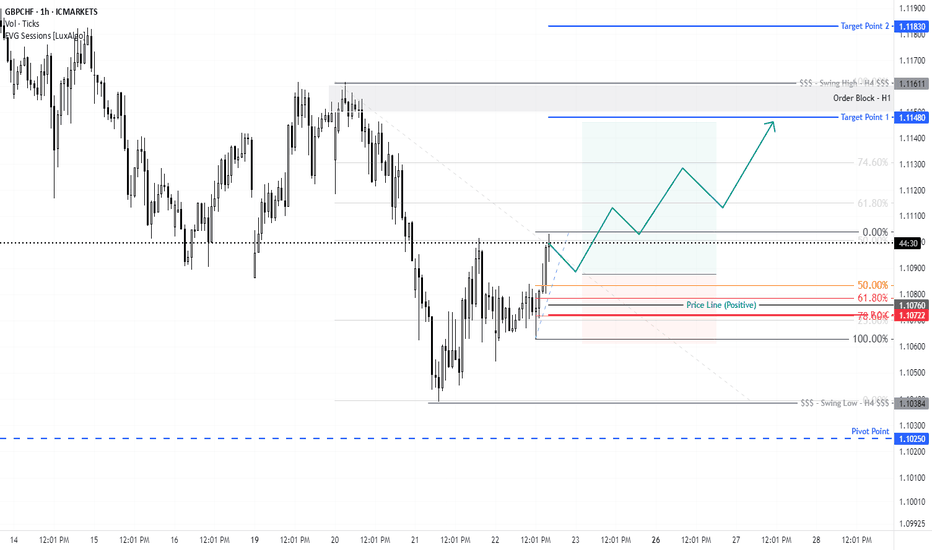

My Thoughts #010I still am waiting for a clear set up but here is my thoughts

The pair could still sell but also buy.

Sells

When we take out the safe low as choch then I will wait for retest then take my entry

Buys

When we reach demand zone and we get a choch

Then I will buy and hold until the all time high

Anything can happen

Use proper risk management

Let's do the most

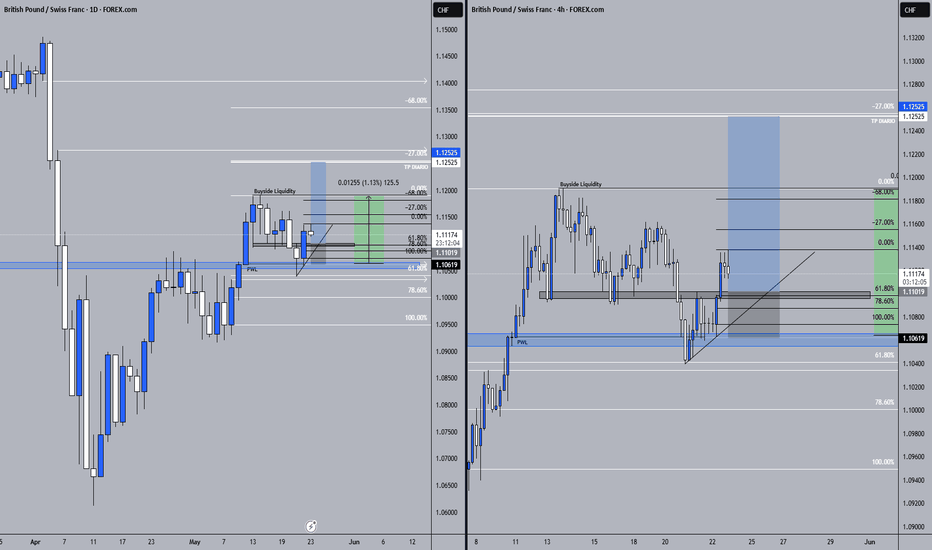

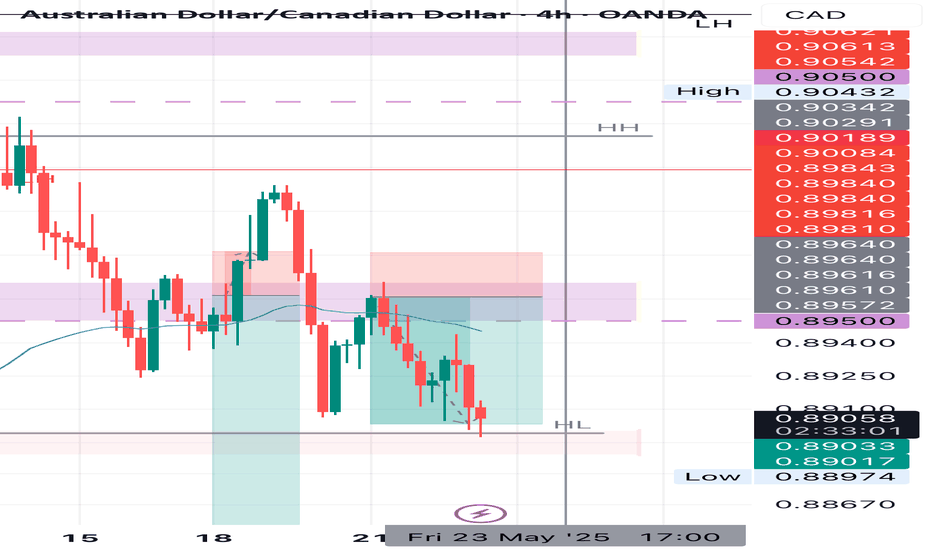

AUDCAD re-entry DocumentationRe-entry on my Monday trade as no confluence was broken;

Market structure bearish on HTFs DW

Entry at Both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Structure point Weekly

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Levels 5.21

Entry 100%

REMEMBER : Trading is a Game Of Probability : Manage Your Risk : Be Patient

: Every Moment Is Unique : Rinse, Wash, Repeat!

: Christ is King.

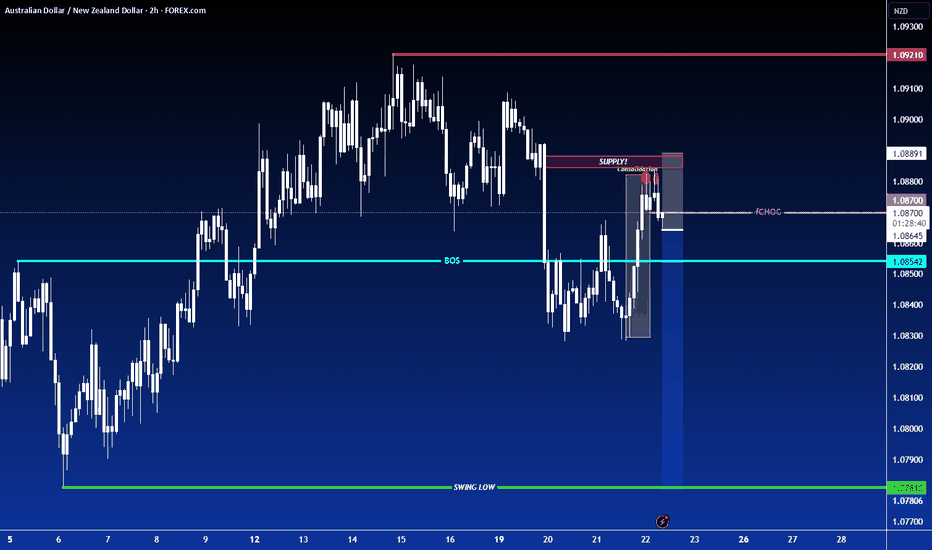

Now this is extremely interesting... and potentially scaryTake this how you like - but eerily similar pattern to what we saw back in 2022 prior to a massive pullback (almost 90% of the previous bullish breakout move).

Does the crypto market want to shock the world and trap every HODLER?

We know what to look out for...

Happy Trading :)

DOW JONES INDEX (US30): Your Plan to Buy Explained

There is a high chance that US30 will resume growth soon.

The index is currently testing a wide daily support cluster.

My signal to buy will be a bullish violation and a candle close above

41920 minor horizontal resistance.

A bullish movement will be anticipated at least to 42200 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

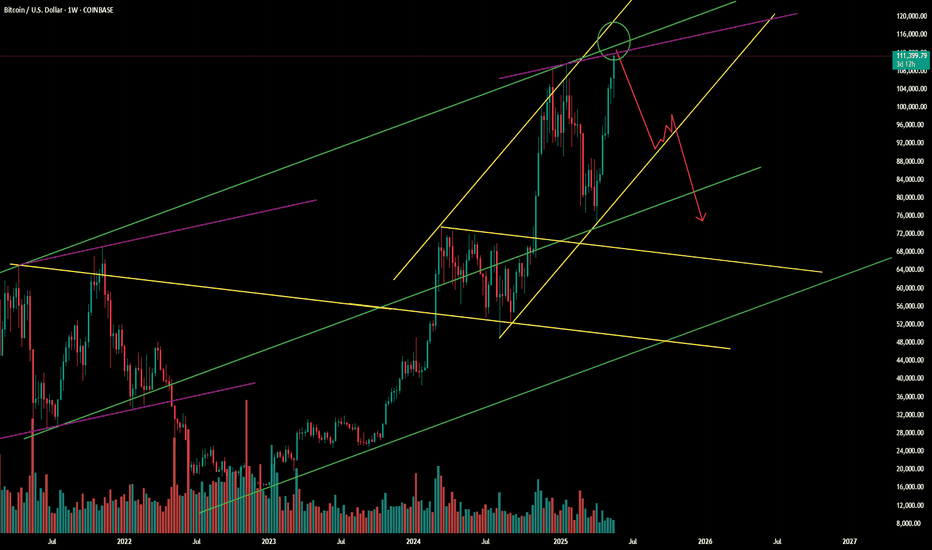

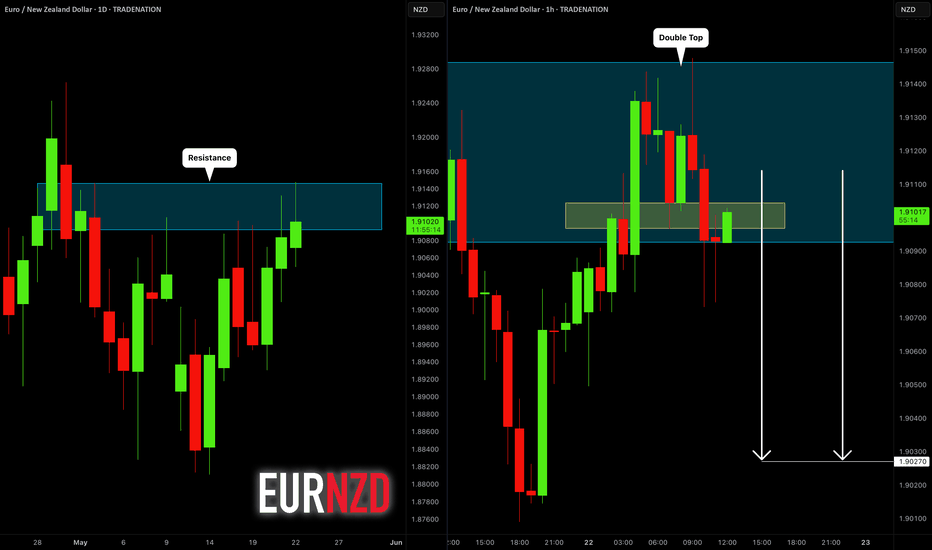

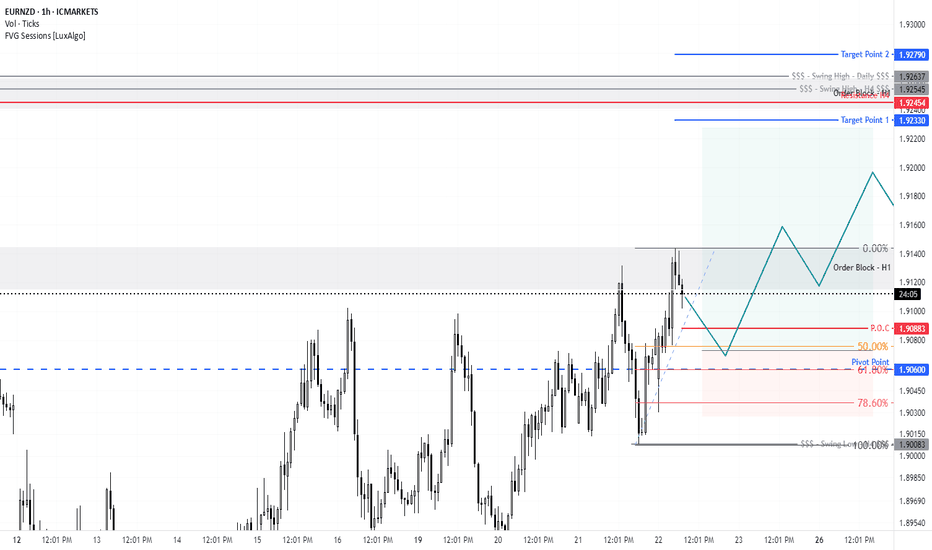

EURNZD: Pullback From Resistance Confirmed?! 🇪🇺🇳🇿

Odds are high that EURNZD will retrace from the underlined blue resistance.

The pair looks bearish from the intraday perspective after a release

of German fundamentals this morning.

I think that the price may drop to 1.9027 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD LONG VIEW.............

Hello Traders, here is the full analysis for this pair,

let me know in the comment section below if you have any questions,

the entry will be taken only if all rules of the strategies will be

satisfied. I suggest you keep this pair on your watch list and see if

the rules of your strategy are satisfied.

Dear Traders,

If you like this idea, do not forget to support it with a like and follow.

PLZ! LIKE COMMAND AND SUBSCRIBE

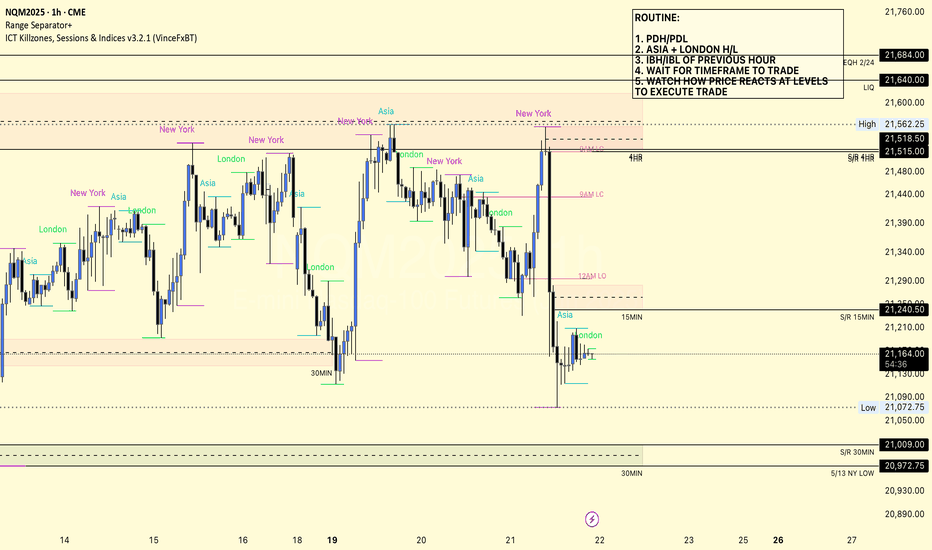

Supply and Demand Zones 5/21/25 $NQLink to chart: tradingview.sweetlogin.com

Bearish: If we break Asia Highs and tap into the 15MIN Supply above (even push up to 21300), then a rejection to break lower into 30MIN demand to take PDL of NY session 5/21 and final target of 5/13 NY low at 20972.75.

Bullish: If we break and hold above the 15MIN supply above (and break and retest holding over 21300 12AM London Open from 5/21), then target longs to reclaim target area of ~21415. This target is based on how past price action from 5/15 and 5/19 responded when we reached into the current level we are in, and bounced back TO roughly 21415 before hitting stronger resistance/rejection.

Keeping note that on the 4HR frame we failed to break the 4HR supply above and we just created a new lower low/high now.