Bitcoin at 120,000: Decisive Breakout or Renewed Consolidation?__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

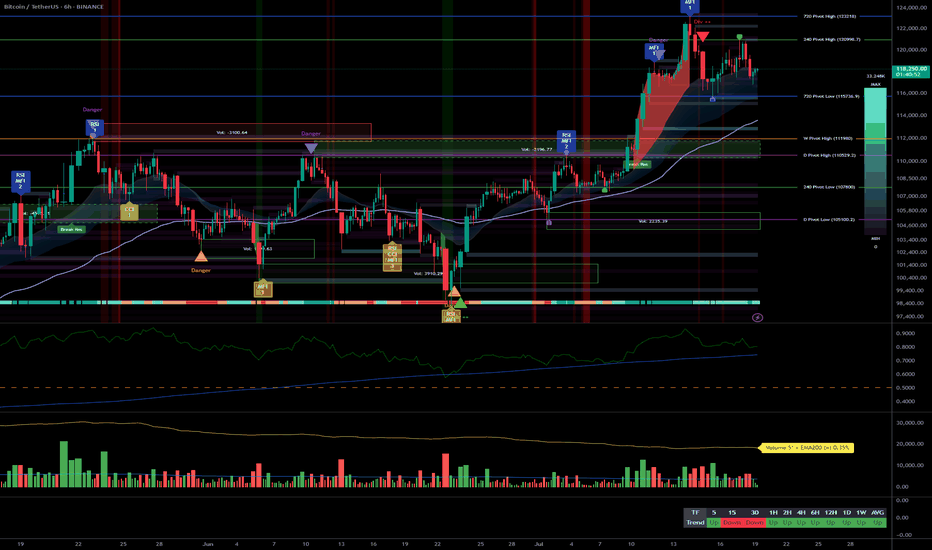

Momentum: Strongly bullish on H1 and above; healthy consolidation below ATH.

Supports/Resistances: 120,000 USDT (pivot resistance), 116,400–117,000 (major support), 104,000–110,000 (long-term support).

Volumes: Normal, no anomaly nor climax detected.

Risk On / Risk Off Indicator: Strong buy signal on all timeframes except very short term. Sectoral health confirmed.

Multi-timeframe: Short-term bearish divergence on 15/30min, but robust technical structure above H1-D1.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Confirmed bullish across all timeframes; no major break detected.

Opportunities: Strategic buys between 116,400–117,000 (pullback); confirmed breakout above 120,000 (target 130,000).

Risk zones: Below 116,000 (potential correction to 112,000–104,000), false breakout at the top.

Macro catalysts: Monitor Fed (next FOMC July 29-30), volatility on risk assets, geopolitical tensions.

Action plan: Prioritize stop management, stay reactive ahead of macro events. Main scenario: buy confirmed pullback or validated breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D / 12H: Bullish structure intact but facing historical resistance (120k), strong supports in place (104–107k).

6H / 4H / 2H: Consolidation below resistance, no signs of exhaustion, tactical supports at 116,000–117,000.

1H / 30min / 15min: Weakness on shorter timeframes (sellers at top), confirmation of range polarization. No emotional excesses (ISPD DIV neutral), standard volumes.

Risk On / Risk Off Indicator: Strong buy except for very short-term fatigue.

Summary:

Multi-horizon bullish bias, technical and sectoral confluence for upside extension if clear breakout >120,000. Key support to hold at 116,400–117,000. Buy dips, ride breakout up to 130,000. Focus on risk management, flexibility advised as macro (Fed) nears.

__________________________________________________________________________________

Key macro events to watch

__________________________________________________________________________________

2025-07-18: Fed rate/volatility debate (Equity, Bonds, BTC).

2025-07-29: FOMC (potential pivot for risk assets).

__________________________________________________________________________________

Strategic decision & final summary

__________________________________________________________________________________

Main bias: Bullish, to be validated at key levels, favor buying dips/breakouts.

Risk management: Stop below 116,000, scale out progressively after 125k, reinforced protection ahead of FOMC.

Opportunities: Pullback 116,400–117,000 (RR >3); H4/D breakout >120,000 targeting 130,000 (RR >2).

Monitoring: Macro (Fed, geopolitics), dynamic management according to market response to news.

Conclusion:

A validated move above 120,000 projects target to 130,000 (next statistical/on-chain extension). Deep dips can be bought above 104,000. Do not loosen risk management as Fed date approaches.

Multitf

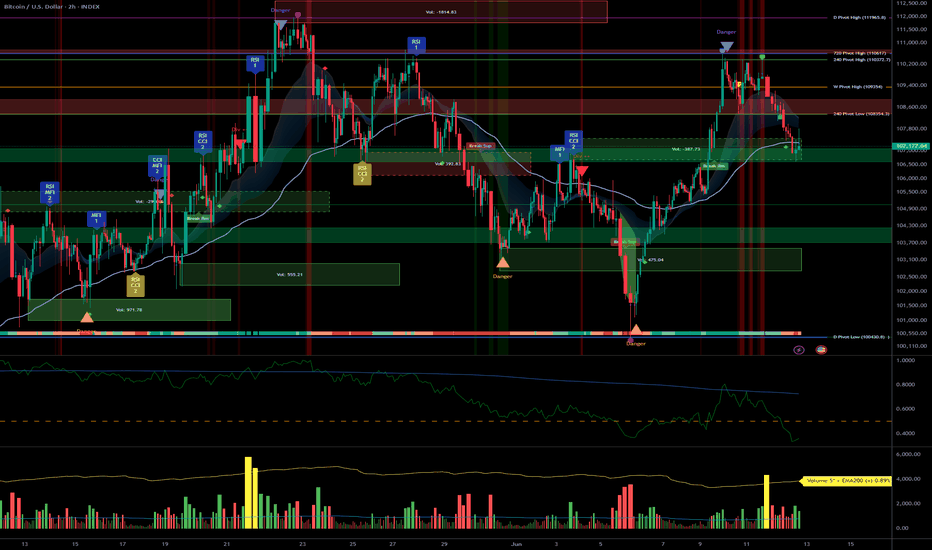

Bitcoin facing breakout, active management recommended__________________________________________________________________________________

Technical Overview – Summary Points

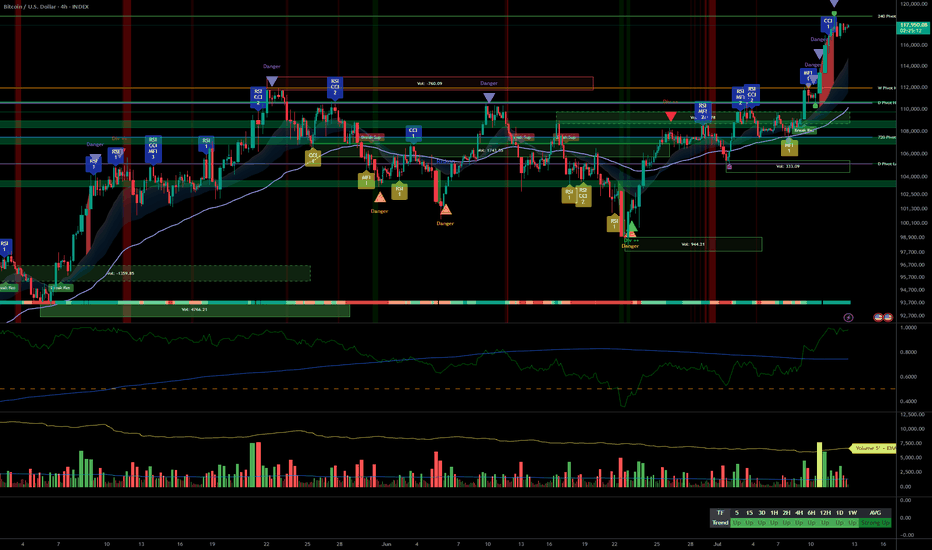

Strong bullish momentum across all timeframes (MTFTI “Strong Up”).

Key supports: 110,483–111,949. Major resistances: 118,689–119,499.

Volumes normal to slightly elevated. No anomaly or climax.

Behaviour: early caution signals on ISPD DIV (4H–2H), sector “sell” trigger on the Risk On / Risk Off Indicator (15min).

__________________________________________________________________________________

Strategic Summary

Overall bullish bias on all timeframes. Structural uptrend confirmed, but early behavioural/sector divergence at short term.

Buy zones: pullback to 110,483–111,949. Stop/alert below 110,483 H4/H6 close.

Opportunities: tight trailing above 118,689 to capture extension. Partial take profit advised in upper range (118,689–119,499) if divergences persist.

Risks: geopolitical risk-off catalysts, start of selling extension, or loss of support.

Plan: active management required, avoid overexposure, plan for key break levels, readiness to exploit imminent breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

1D : Price above all pivots, strong momentum. Key resistance in play (119,499), supports at 110,483/105,054. Volumes normal, bullish alignment.

12H : Confluence of resistances (119,499–115,495), structure intact, buy opportunity on retrace. No major alert.

6H : Strong buying extension, pure momentum. No excess signals.

4H : First divergence (ISPD DIV “sell”). Consolidation on resistance, consider partial profit-taking.

2H : Bullish momentum but ISPD DIV “sell” and moderately high volumes. Localized euphoria risk.

1H : No excess, post-breakout consolidation.

30min : Extreme consolidation, decelerating volumes, possible fatigue.

15min : Sector “sell” trigger (Risk On / Risk Off Indicator “Sell”). Trend remains up, but caution is advised.

Multi-tf summary:

Bullish alignment across all horizons. Short-term behavioural caution, but trend remains unchallenged as long as above 110,483–111,949.

__________________________________________________________________________________

Synthesis & Strategic Bias

Multi-timeframe momentum confirmed, watch supports at 110,483–111,949.

Buy on valid retrace, take profit at highs if behaviour diverges.

Break below 110,483 (H4/H6 close) = invalidation signal.

Key triggers: geopolitical news, broken supports, selling spikes.

Base scenario: likely imminent directional breakout (volatility). Watch for spikes on major headlines.

__________________________________________________________________________________

Fundamentals and Macro News

Uncertain backdrop (Fed, US inflation, bonds & FX), no major macro trigger in 48h but latent volatility.

Crypto: Bitcoin stable, general accumulation, no violent distribution detected.

Geopolitics: rising tensions (Iran, Ukraine). Can prompt sharp risk-off if escalation occurs.

No major macroeconomic event scheduled (empty calendar).

__________________________________________________________________________________

On-chain Analysis

Accumulation phase for all holders, >19k BTC/month absorbed. Extreme volatility compression (coiling).

Realized & implied volatility is exceptionally low, setting up violent move.

ETF (IBIT BlackRock): record accumulation. Downside break could trigger psychological stress.

Baseline: technical & on-chain setup disfavors bears. Any exogenous shock accelerates volatility.

__________________________________________________________________________________

Strategic Recap & Action Plan

Bullish bias validated, risk of market fatigue on short-term signals.

Buy on controlled pullback, tight trailing at highs, partial profit-taking in 118,689–119,499 band.

Swing stop below 110,000 (H4); total invalidation if daily support fails.

Expect directional move + volatility on next impulse (8–48h).

__________________________________________________________________________________

Conclusion

BTC remains in a primary bullish trend, supported by on-chain accumulation and extreme structural compression. Only active management (profit, leverage, stops) optimizes R/R and prepares to respond to an imminent, directional volatility event. Stay proactive and plan!

__________________________________________________________________________________

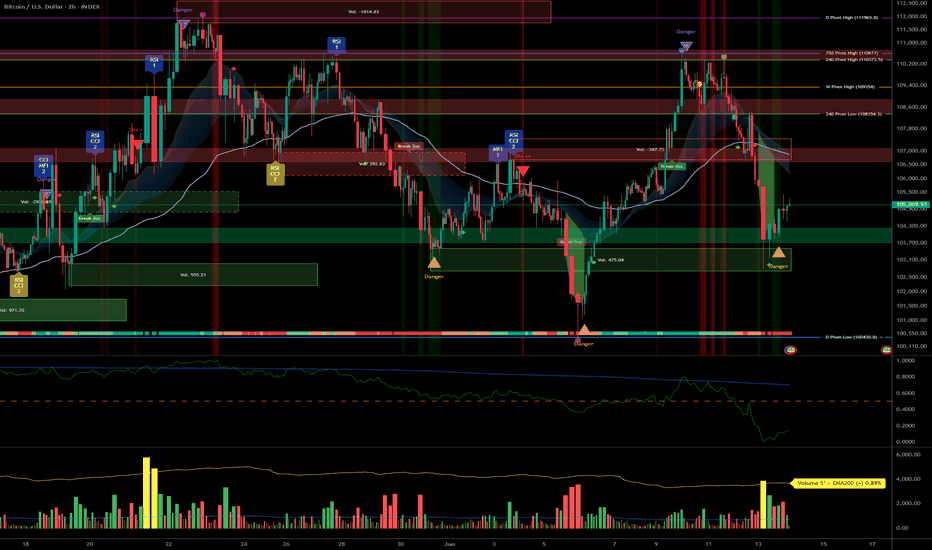

BTC Multi-TF Analysis: Bull Bias Holds, All Eyes on Resistance__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

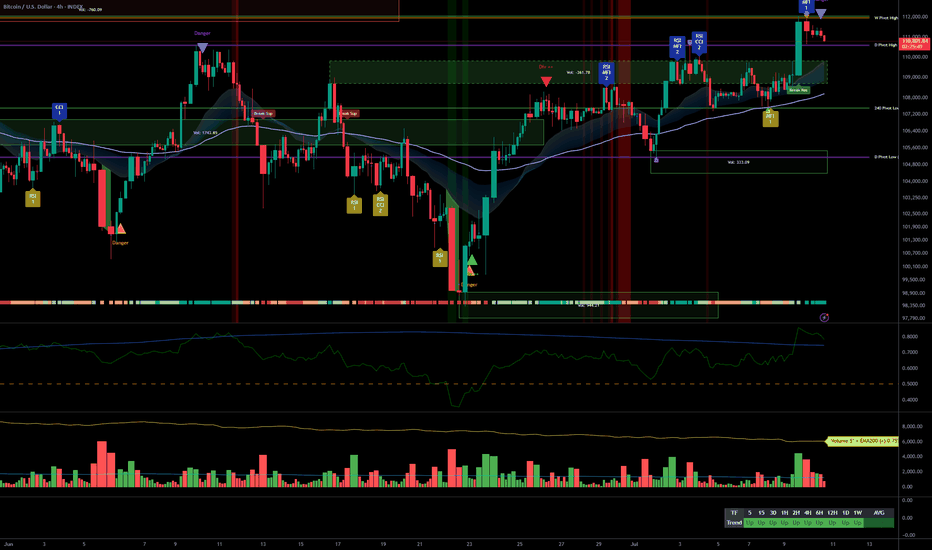

Momentum: Very strong bullish bias across all major timeframes. No selling signal detected; slight micro-pause on 15min.

Key Supports / Resistances: Immediate resistance at 111,000–112,500. Critical supports: 108,000–109,000, then 105,000. Any lasting break below 107,500 is a key alert.

Volume: Healthy, balanced volumes. Some moderate surges on 1H/2H, but no climax.

Risk On / Risk Off Indicator: Strong Buy across all TFs except 15min (partial pause).

Multi-TF behavior: Complete convergence. No sign of distribution. ISPD DIV neutral overall.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Dominant bias: Bullish, confirmed by both technical and on-chain context.

Opportunities: Add on retracements to major supports (108k–109k, potentially 105k). Target breakout >112.5k for extension or further swing adds.

Risk/Alert Zones: Breakdown <107.5k (especially with high volume/macro event). Congestion zone at 111–112.5k: monitor reactions and volumes closely.

Macro catalysts: FOMC, Jobless Claims, Bond Auction (see economic calendar). Adjust sizing before and after.

Action plan: Gradual buys on major supports; heightened monitoring pre-US announcements (avoid overexposure during high-volatility). Structural stop below 107.5k; for swing, <105k ideal.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Structurally solid market above key supports. No divergence or selling signals. Resistances: 111,500–112,500. Main support: 105,050.

12H: Dominant buyer pressure. Key support at 107,500–108,000. No speculative excess.

6H: Marked accumulation. Multi-TF resistance at 111,000–111,500.

4H: All trends aligned; focus on resistance 111–112k.

2H: Ongoing momentum. Moderate volume. Watch 107,400–108,000 for dips.

1H: Reinforced bullish bias; no short-term weakness.

30min: Opportunities on any pullback to supports (110,400, 109,000).

15min: Micro-pause on sector momentum. Potential consolidation below 111k–111,500.

Risk On / Risk Off Indicator: Strong Buy on all TFs except 15min (neutral, no sell).

ISPD DIV: Neutral across the curve, no behavioral excess detected.

__________________________________________________________________________________

Cross Analysis & Executive Summary

__________________________________________________________________________________

Confluences: Major bullish bias. Risk On / Risk Off Indicator in Strong Buy (except 15min). Balanced volumes. ISPD DIV neutral.

Dissonances: Micro-pause on 15min momentum under resistance (possible very short-term consolidation).

Opportunities: Pullbacks to 108k–109k or even 105k, clear breakout above 112.5k.

Risks: Break below 107,500 (key alert), high volume+rejection under 111–112.5k (possible profit-taking).

__________________________________________________________________________________

Macro & On-chain Focus

__________________________________________________________________________________

Macro: Awaiting FOMC (late July), key US macro data (Jobless Claims, 30Y Bond Auction). Neutral to potentially high volatility environment around economic catalysts.

On-chain: Long-term holder supply at ATH. US ETF inflows positive. Healthy on-chain: little short-term top risk. Key on-chain threshold at 98.3k (Short-Term Holder Cost Basis).

Institutional: No panic, ongoing “disciplined accumulation”, no excess euphoria.

__________________________________________________________________________________

Operational Action Plan

__________________________________________________________________________________

Closely monitor 111–112.5k resistance: reactively adapt based on price/volume.

Gradual re-entries on major supports if no behavioral anomaly or excessive selling volume.

Structural stop <107.5k, swing invalidation <105k.

Swing opportunity window post-FOMC if dovish or calm.

Adjust exposure and risk management around key macro dates.

__________________________________________________________________________________

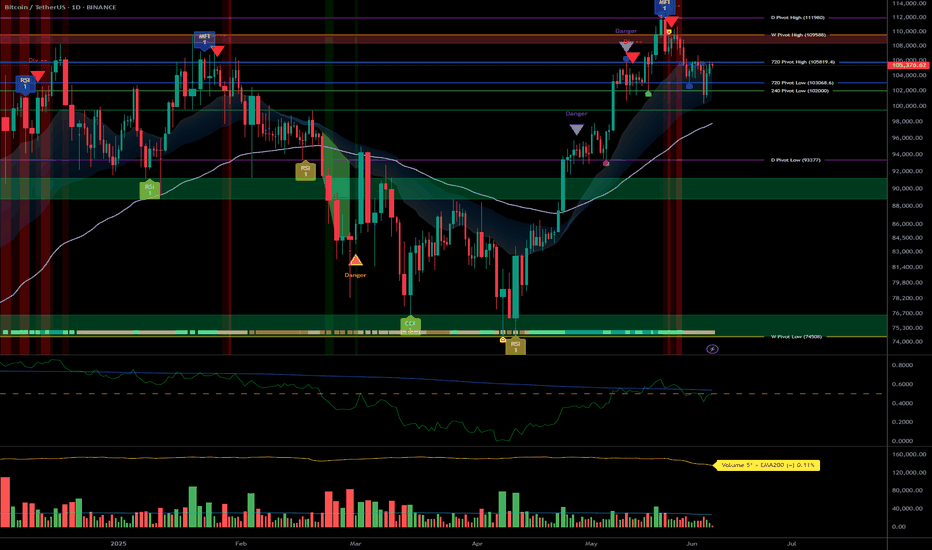

Bitcoin Uptrend Momentum, Key Buy Zone at 106.3K–105.9K__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum : Uptrend confirmed across all timeframes ≥1H; no signs of exhaustion or overheating.

Major supports : 106,319, 99,581, 98,133 USD

Major resistances : 108,239, 108,685, 111,949 USD (ATH)

Volume : Normal on higher TFs, very high on 30min/15min (potential breakout or institutional shake-out).

Behavior : Risk On / Risk Off Indicator = Strong Buy from 1D to 1H, neutral on 15min; ISPD DIV neutral across all TFs (no extreme behaviors).

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Bias : Bullish as long as 98,133 is held on daily closes; structural buying pressure confirmed.

Opportunities : Swing accumulation on pullbacks to 106,319–105,900; targeting 108,700 then 111,949 on breakouts.

Risk : Geopolitical catalyst or break below D Pivot Low 98,133.

Macro catalyst : No major events (Fed, CPI, NFP) over the next 48h. Watch Powell’s speech (2 July).

Action Plan : Long entry on pullback to 106,300–105,900, stop <105,900, targets at 108,700 then 111,900. Exit on daily close below 98,133.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D – Daily : Strong uptrend; balanced volumes; supports at 98,134 / 99,581; resistance at 108,239–111,949.

12H/6H/4H : Positive confluence. Accumulate on any return to support; no behavioral excesses detected.

2H–1H : Rising volumes, no divergences; strong timing for entries on dips.

30min/15min : Very high volume (breakout/shake-out); structure remains bullish. 15min Risk On / Risk Off Indicator =Neutral → watch for short-term consolidation or traps but broader trend holds.

Clear bullish confluence on all TFs ≥1H, with no behavioral or macro warning.

Short-term risks on micro-TFs (extreme volume, possible shake-out).

Accumulation zone on 106,300–105,900 pullbacks, invalidation below 98,133.

__________________________________________________________________________________

Cross-Analysis & Strategic Synthesis

__________________________________________________________________________________

Trend : No reversal signals. All indicators (volume, price action, Risk On / Risk Off Indicator) point to trend continuation.

Macro & newsflow : Monetary status quo, no negative catalyst in the short term. Only open risk: geopolitical tensions, closely monitored.

On-chain & fund flows : Ongoing ETF inflows, stable capitals, strong HODL trend, SSR stable.

Risk management : Stop <105,900, hedge on geopolitical signals.

Summary:

All TFs ≥1H aligned in bullish cycle, corrections = structured long accumulation opportunities.

Key buy zone: 106,300 – 105,900; prudent stop <105,900; main targets 108,700 and ATH.

Closely monitor for Powell/Fed headlines.

__________________________________________________________________________________

HTF Consolidation: Key Alerts, Vital Supports, FOMC & Geopolitic__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish signal across sector indicators (Risk On / Risk Off Indicator), especially on daily and 12H. Momentum remains robust within consolidation.

Support/Resistance : Key zone at 104429–102600 (short- and long-term pivots); major resistance at 106000–109950.

Volume : Normal to high, with peaks at major supports on 1H/2H (potential sign of absorption/defensive buying).

Behavior across timeframes :

ISPD neutral on most TFs, only 2H gives a buy signal (possible tactical bounce).

All LTFs (≤1H) are down, HTFs (≥1D) are up → corrective structure, awaiting catalyst.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias : Underlying bullish, but market consolidates on key technical zones.

Opportunities : Swing buy at 104429/102600, tight stop below 100k, take profit 109950+.

Risk zones : Clear break below 100350/100000 invalidates the setup (risk-off or tactical short).

Macro catalysts : FOMC, Iran–Israel tensions, economic calendar (monitor Jobless Claims, Crude, Fed statement).

Action plan :

Capital preservation before FOMC.

Tactical entries only on key support; tight stops, prudent sizing.

No breakout chasing without macro/fundamental validation.

Hedge/volatility play via options possible (IV low, caution for post-event spike).

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D/12H/6H :

Supports: 104429, 102626, 100353.

Resistances: 106000–109952.

Risk On / Risk Off Indicator = Strong Buy.

No extreme volume, ISPD neutral; mature range.

HTF consolidation, bullish underlying momentum.

4H/2H :

Key zone at 104429–102600 (technical defense); 2H is the first true behavioral buy signal.

Very high volume at support, favoring a "spike bounce" scenario.

“Up” confluence on Risk On / Risk Off Indicator, volume, and ISPD for short-term bounce.

MTFTI: 2H is one of the “Up” TFs; LTFs remain Down.

1H/30min/15min :

Structurally bearish, elevated volume (absorption/protection) on 1H.

No behavioral excesses.

Intraday weakness but supports tested and defended.

__________________________________________________________________________________

Macro / Fundamental analysis

__________________________________________________________________________________

Market in wait-and-see mode : FOMC upcoming, no hike expected but high impact from tone/forward guidance (increased volatility risk).

Geopolitics : Iran–Israel escalation, risk-off climate, nervous risk assets.

On-chain : Supports tested (STH ~97.6k). Persistent LTH accumulation. Low option IV → underpriced volatility risk.

Risk/Reward swing : 2:1/3:1 buying 104429–102600, stop < 100k, take profit 109950+.

__________________________________________________________________________________

Final synthesis: Bias, Opportunities, Risks

__________________________________________________________________________________

Directional bias : Bullish on HTF, neutral/undecided on short-term. Wait-and-see until strong catalyst confirmed (FOMC, geopolitical de-escalation).

Opportunities : Tactical buy on supports, profit-taking on resistance or confirmed breakout.

Risks : Invalidation below 100k; sudden spike in FOMC/Israel–Iran escalation = risk-off or selloff.

Recommended action : Protect capital before FOMC. Swing tactical entry only on confirmed support. No breakout chasing without macro validation. Leverage potential post-FOMC vol spike via options.

BTCUSDT: Pro Analysis, Major Swing Supports, Risk Focus__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum & Trends : Short-term consolidation (<1H frames), dominant uptrend 2H–1W. BTC market structure is “Up” across all higher timeframes.

Supports/Resistances :

Major supports: 100,300 – 101,600 USDT (1D/4H/2H pivots)

Resistances: 109,000 – 111,500 USDT (1D/W/12H pivots)

Volume : Recent bearish climax absorbed, back to normal volumes, no current excess.

Multi-TF Behavioral Read : Behavioral indicators (ISPD DIV) are neutral; no extreme sentiment. Risk On / Risk Off Indicator confirms structural buy-side.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias : Bullish trend on high TFs, technical consolidation short term.

Opportunities : Swing entries on return ≥101.6k, TP at 109k/111.5k. Manage position sizes actively before Fed.

Risk Zones : Invalidation <100.3k daily; key area to monitor. Short-term stop-loss below 99.9k.

Macro Catalysts : FOMC (June 17–18) = expected volatility, no major macro risk now. Watch Mideast tensions. Rising tensions in the Middle East (Israel/Iran): volatile climate, potential risk-off sentiment on certain assets, but no widespread panic; to be monitored in case of rapid escalation (possible increased BTC volatility).

Action Plan : Favor gradual entries on major supports, reduce leverage pre-macro events, active volatility and stops monitoring.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D / 12H: Key support at 100.3k–101.6k, major resistance 109–111.5k. Repeated rejections at resistance, mature range. Normal volume, consolidating momentum.

6H / 4H: Strong lateral structure, ISPD/Volume neutral. Technical play around 101.6k, gradual profit-taking below 109k.

2H / 1H: Start of institutional reaction (moderate to high volumes). Bearish climax absorbed, possible short-term rebound at local support 99.9k–101.6k.

30min / 15min: Micro-range, short-term consolidation, some volume spikes on corrections. Downtrend confirmed on lower TFs, despite macro/swing bullish confluence.

ISPD & Risk On / Risk Off Indicator Summary:

ISPD DIV = Neutral across all timeframes.

Risk On / Risk Off Indicator = STRONG BUY on all horizons (US tech strong).

Cross-timeframe Synthesis : BTC market is accumulating on supports under favorable tech sector influence. Short-term consolidation seen as post-shakeout setup for potential resumed uptrend.

__________________________________________________________________________________

Final Synthesis & Operational Plan

__________________________________________________________________________________

BTC market remains in a dominant swing bullish bias, supported by tech sector momentum and on-chain inflows. Key support zones (100.3–101.6k) offer attractive technical swing entries, with targets at 109–111.5k. However, strict risk management is essential ahead of the upcoming FOMC, rising Middle East tensions (Israel/Iran), and the potential for sudden volatility spikes.

Strategy: Maintain bullish exposure with partial profit-taking and reduced leverage into macro/geopolitical events. Systematic stops remain below 99.9k.

__________________________________________________________________________________

BTCUSDT: Strong bullish trend, 102k–106k supports heavily defend__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum : Bullish trend remains dominant from 1D down to 1H. Corrective consolidation on shorter timeframes (15/30min).

Key supports/resistances : 102,000, 104,800, 106,000 (key supports) – 109,500, 110,800–111,000 (major resistances and ATH zone).

Volume : Normal to moderately high depending on local volatility. No climax or distribution/absorption anomalies.

Multi-TF behaviour : Risk On / Risk Off Indicator at “Strong Buy” across all >2H timeframes, ISPD DIV neutral, no detected capitulation or excess behaviour.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias : Strongly bullish on swing/daily horizon, healthy consolidation on short timeframes.

Opportunities : Favour swing entries on retests of 102k–106k supports, dynamic stops below 102k.

Risk zones : Break and close below 104,800, especially 102,000 = bullish bias invalidated.

Macro triggers : FOMC unchanged, stable US context, focus on upcoming inflation/employment data.

Action plan : Actively monitor pivot zones and on-chain behaviour; act on confirmed breakout signal or deep retest.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D / 12H : Pivot support at 102k–106k, resistance 109.5k–111k. Bullish bias maintained, no excess volume, Risk On / Risk Off Indicator confirmed “Strong Buy.” Market remains mature, no concerning distribution.

6H / 4H : Structured supports 104.8k–106k, resistances 108.3k–110.8k. Healthy consolidation, swing buyers strong.

2H / 1H : Dense supports 105.6k–106.2k, barrier 109.5k–110.8k. Positive momentum, no extreme ISP/volume signals.

30min / 15min : MTFTI “Down” trend—micro-consolidation after extension. No stress, digestion/reload phase.

Multi-TF summary : Strong bullish alignment above 1H. Micro TFs in low-risk consolidation—entry opportunity on clear retracement.

__________________________________________________________________________________

Cross-analysis, synthesis & strategy

__________________________________________________________________________________

Confluences : Stable macro, on-chain & technical supports aligned, no panic or excess volume. Risk On / Risk Off Indicator “Strong Buy” dominates daily/swing horizons.

Risks/unexpected : Potential sharp volatility if breakout >111k or sub-102k support break.

Optimal plan : Defensive buying on support, tight stop <102k, active management post-macro data.

On-chain : Strong recovery since $101k, matured supply, solid STH cost basis at $97.6k.

Caution window : Wait for US data release before heavy positioning; favour scalping/swing on confirmed signal.

Objective : Leverage multi-indicator confluence, stay flexible/reactive if structural break.

BTC market retains strong bullish markers on all ≥1H timeframes. No behavioural or volume stress. Best approach: defensive buys near supports, tight stops, watch for macro releases. Stay reactive to ATH breakout or support break—act on confluence, adjust if structure fails.

__________________________________________________________________________________

BTCUSDT Analysis – Pivot 103k/106k, strategy and key zones__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum : Bullish structure on 1D/12H (MTFTI “Up”), but short-term consolidation (1H-2H “Down”). Momentum exhaustion observed.

Key Supports/Resistances : Resistances: 105287.8 / 106743.9 / 109952.8 / 111949. Supports: 103033.3 / 100333.3 / 93337.4. Repeated rejections below 105-106k, active testing of 103-100k supports.

Volume : Normal or slightly elevated on all timeframes. No capitulation or euphoric extremes detected.

Multi-TF Behaviour : Strong sector leadership (Risk On / Risk Off Indicator = “Strong Buy” across all frames; growth stocks > market). No behavioural anomalies on ISPD DIV. High-cycle consolidation below resistance.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall Bias : Neutral/bullish as long as 103k/100k holds. Bullish momentum intact, but short-term caution warranted.

Opportunities : Defensive buys/technical pullbacks above 103k; scalp/range trading 103-106k.

Risk Zones : Confirmed breakdown below 100k or acceleration in LTH distribution.

Macro Catalysts : Next FOMC June 17-18; no major short-term events identified (recent neutral macro, FOMC is key for swings).

Action Plan : Prioritize strict stops (≥3%) near pivots, consistent monitoring of behaviour/volume. Avoid overexposure pre-FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Structuring range below 109952.8-111949 resistances. Bullish HTF trend, but momentum pausing. Average volume. Risk On / Risk Off Indicator “Strong Buy”. No extreme ISPD signals (neutral).

12H – 6H : Consolidation; supports holding, no euphoric confirmation (normal volumes, ISPD DIV neutral). Sector leadership unchanged.

4H : Compression below 105287.8. Moderate volume. Defensive resumption on supports. MTFTI bullish. Dynamic risk: monitor for sell-side capitulation.

2H – 1H : Technical correction, active retest of 105k (range 103-105k). Absorption volume. MTFTI “Down”.

30min – 15min : Short-term positive bias above 103k. Risk of false break if volume remains low. Risk On / Risk Off Indicator “Buy”/“Strong Buy”.

Cross-Indicators : Market leadership confirmed: Risk On / Risk Off Indicator = Strong Buy on all frames >15min. No excess behaviour or significant divergences detected. Key ranges: 103k-105k. On-chain: heavy LTH profit-taking but no panic.

Summary : BTC market in post-cycle-high congestion phase, structurally robust, but momentum recalibrating with fewer “easy trades.”

__________________________________________________________________________________

Cross insights & on-chain summary

__________________________________________________________________________________

On-chain (Glassnode) : Top at $111.8k, correction to $103.2k by LTH profit-taking. Spot accumulation on $103.7k/$95.6k. Upside limited unless fresh buying flows return.

Macro events : Awaiting FOMC; no recent surprises. Price action and levels dominate short-term strategy.

Stops/invalidation : Swing long defended at 103k/100k (stop <100k H4). Partial short/sell below 106743.9/109952.8. Dynamic targets: 106-109.9k; extension: 111.8k if breakout on volume.

__________________________________________________________________________________

Conclusion & Actionable Plan

__________________________________________________________________________________

Market condition:

- High consolidation, ranging below major resistances.

- Long-term bullish, short-term momentum fading.

- Neutral/bullish if 100-103k holds.

- “No macro — only levels” until FOMC or volatility catalyst.

Tactical decision:

- Trade technically, stops ≥3% under supports.

- Defended buys at 103k (stop <100k), partial profit 106-109k.

- Continuous monitoring of volume/on-chain zone reaction.

- Aggressive exit/hedge below support, target 96k/83k.

__________________________________________________________________________________

100% analysis based on TradingView multi-TF, Glassnode on-chain, macro calendar and risk management.

__________________________________________________________________________________

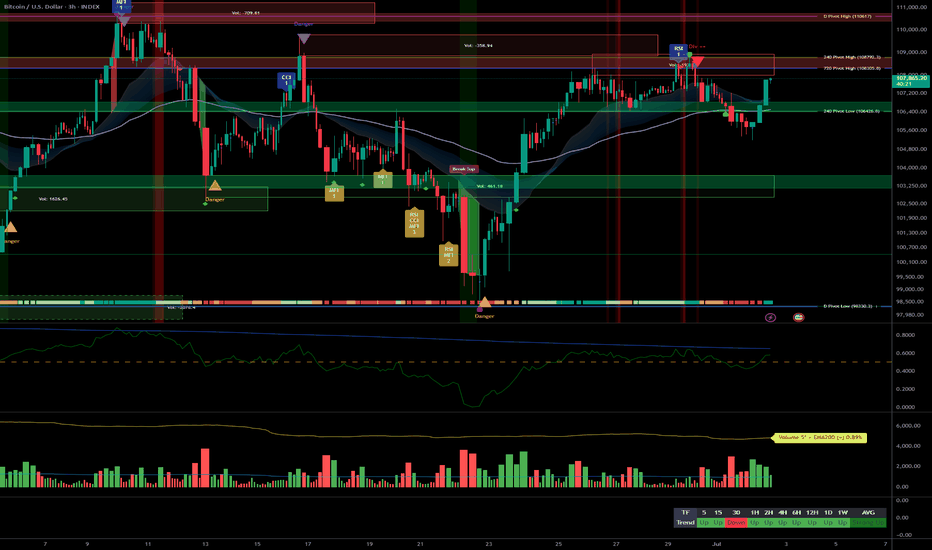

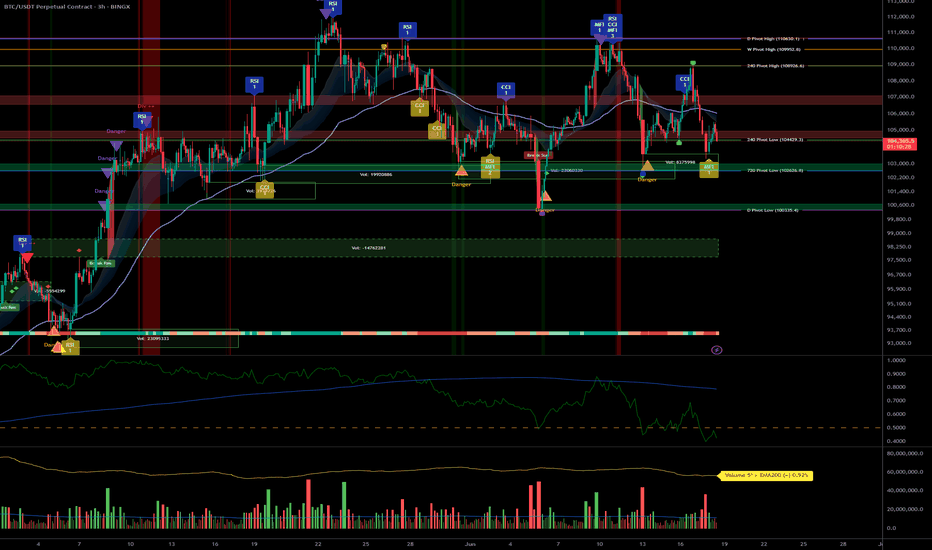

RSI case study - Multi time frame analysisOther time frames listed below

--

2 hour needs to be bounce here

If it doesnt daily time frame RSI will break down

--

Before this we were focused on the 1Hr 50 level, and then the 40 level after the first test of the 50 during this massive up leg

--

General note: All higher timeframes are bullish. Stars are aligned but rejection could take place. THus why were are evaluating the strength readings on multiple timeframes.