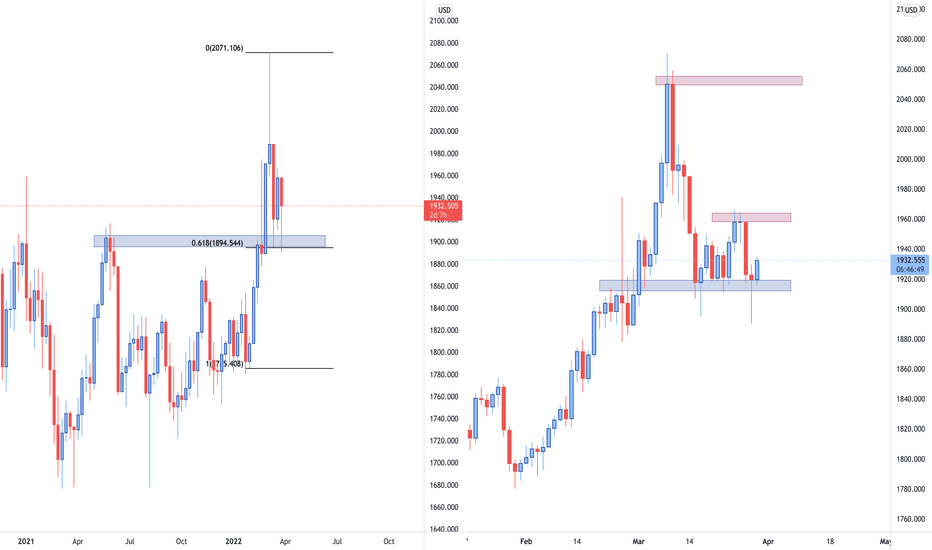

GOLD (XAU/USD): detailed breakdown. Growth will continue?Taking a look at the WEEKLY timeframe chart, it can be inferred that the price has nicely rejected the zone of support that lines up with 0.618 Fibonacci retracement level. Zooming into the DAILY timeframe chart, we can observe that the price has been nicely rejecting the local zone of 1915 support. We are carefully eyeing the price action and looking forward to opening BUY positions. $1960 is our initial target and $2050 is the long-term one.

Happy trading, everyone!

Multitimeframeanalysis

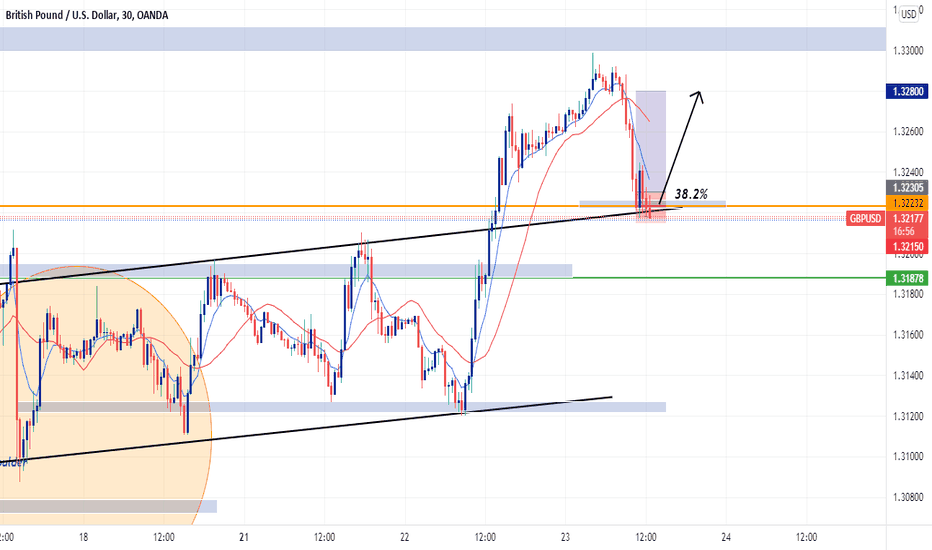

Confluence of supportsIn the 30m chart, price is in a contracting triangle. Momentarily fell to a support and came back up. In the daily, price has broken from a channel and in the weekly, entering into another channel. I expect continuation to male a (d) wave in a contracting triangle of a Wave 4 on the weekly. The d-leg of a Wave 4 is counter trend and make an ABC form. Price is breaking a resistance at the weekly, confirmed by MACD. A pull back is expected in an ABC, if not now then at $53000 which will be supported by the current resistance.

The current support is at $44000.

R/R = 1.71

2% risk of a $30000 is 0.196 Bitcoin

The confirmation to enter comes from the hourly. in 1-hr chart there is pin bar.

Robinhood does not let me!

My account sum has jumped up, it shows only $25'000.00 available to invest, and it dies not let me use it with an error!

Daily:

Weekly:

Ok. Let's wait for the pullback!

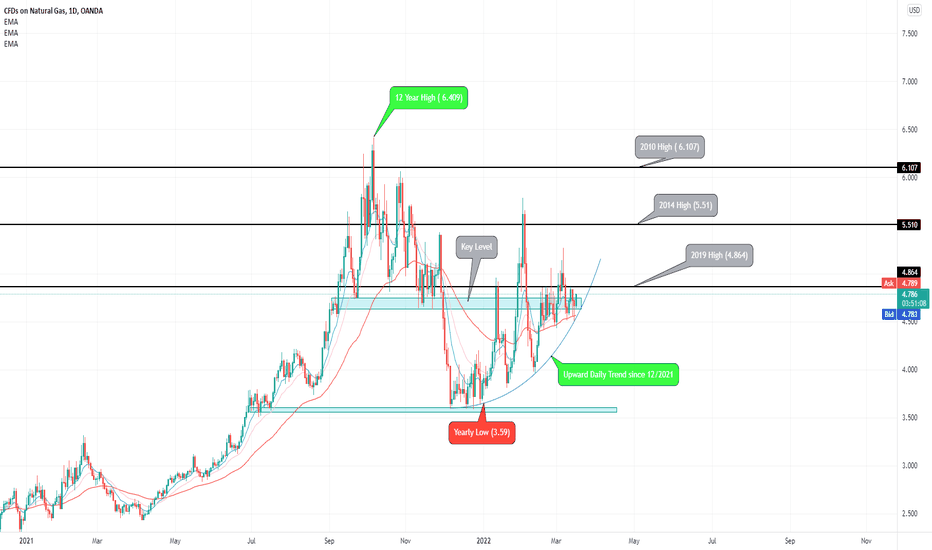

NATGAS/USD Daily Timeframe Price action AnalysisOANDA:NATGASUSD

Hello Traders,

Here is my Daily timeframe price action analysis.

After reaching a 12 year high in October 2021 of 6.409 , the price trended downwards to the current yearly low and key level of 3.6 , which was respected multiple times throughout 2021.

We see a turn around in the daily trend at the key level of 3.6 and have been trending upwards since.

Please note the key level from 4.65 to 4.75 , which again, was respected multiple times in 2021, currently the price is vibrating around this level and has been doing so since 16th Feb 2022.

4 hourly timeframe analysis alongside potential position entries to follow this evening. Please leave a comment and let me know what you like/dislike or agree/disagree with.

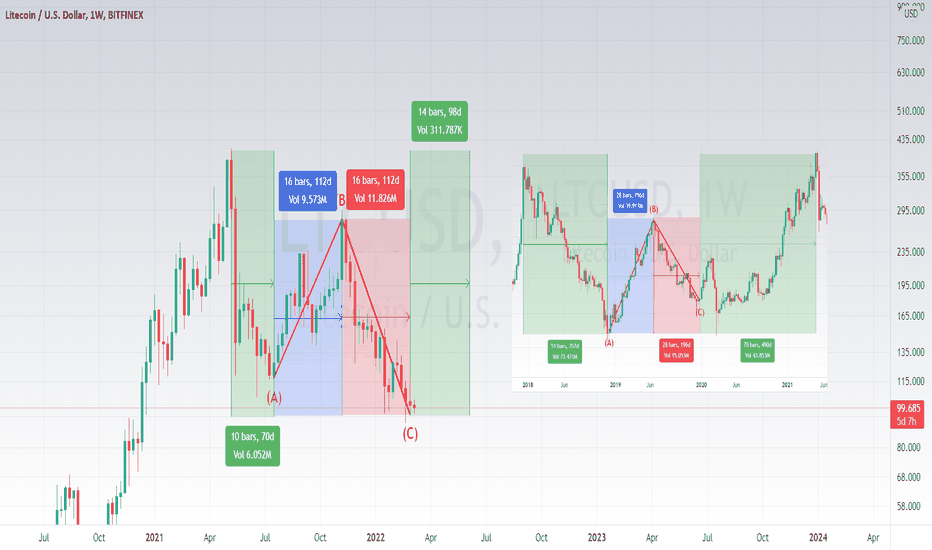

Litecoin will copy 2018-2020's cycleHey guys.

As you can see on the Litecoin charts in the past, a noticeable ABC correction wave is visible. If we take the similarity ratios of 1.375:1 (490D & 357D) and apply it to the current cycle, we can determine the next local top. 70 Days * 1.37 = 96 Days from the C bottom correction wave. These numbers are from the May-July correction, based on the 2018-202 cycle, we can mirror that and possibly find a top. Expect in June for Litecoin to hit around $300-400.

Safe Trading,

-Pulkanator