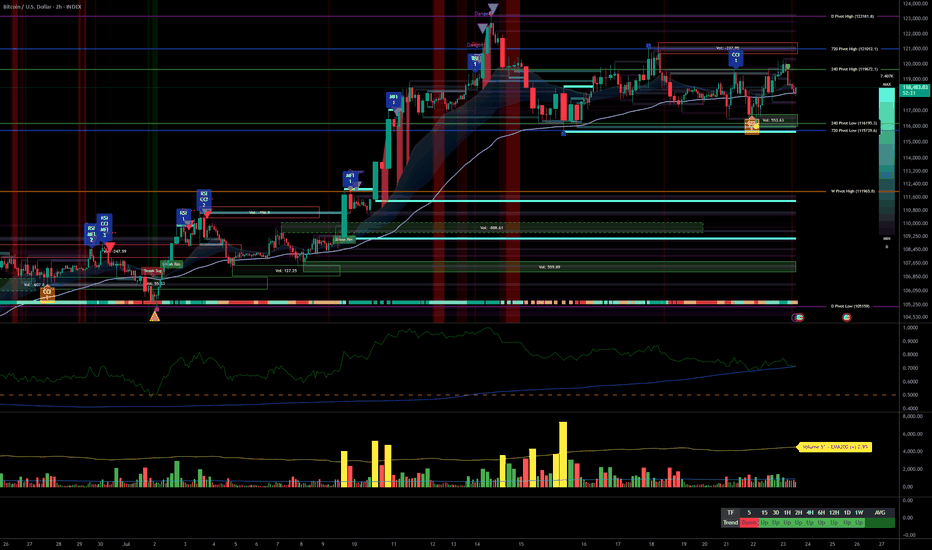

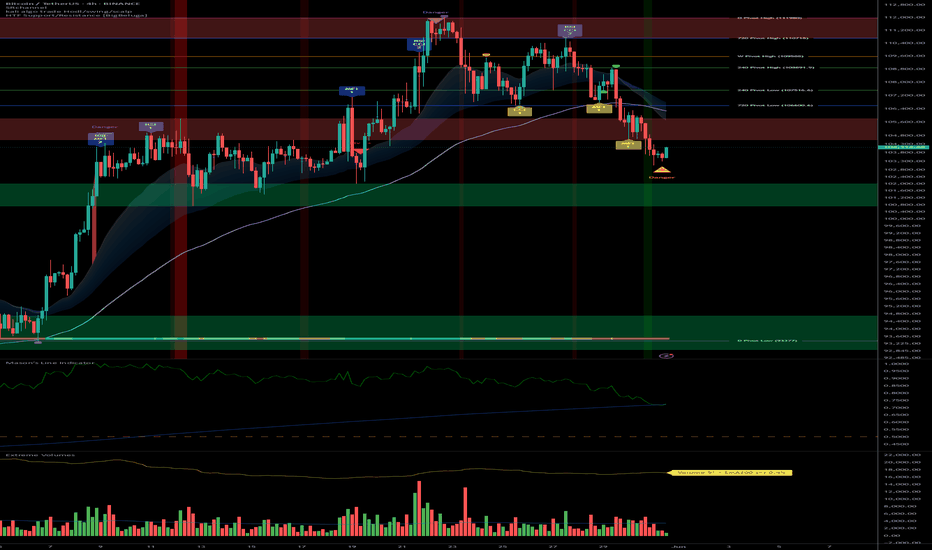

Bitcoin Reinforced Bullish Trend, Range Focus & Key Volumes__________________________________________________________________________________

Technical Overview – Summary Points

➤ Strong bullish momentum across all main timeframes

➤ Key supports: 117600–116500 (short term), 115736/114000 (swing pivot)

➤ Major resistances: 119676, 120998, 123218 (potential short-term distribution risk)

➤ Volumes normal, no climax nor flush

➤ Risk On / Risk Off Indicator: "Strong Buy" bias (all TFs except 30min/15min neutral)

➤ ISPD DIV: No significant divergences

➤ Market consolidating in tight range below immediate resistance

__________________________________________________________________________________

Strategic Summary

➤ Dominant bias: strong bullish on all major TFs

➤ Opportunities: buy on pullback to 117600–116500 support, or on confirmed breakout 119676/120998, targets: 123218–130000

➤ Risk zones: clear break below 115736/114000 or extreme bearish volume

➤ Macro catalyst: No major impact expected short term. Watch Powell/Fed news, possible volatility without trend shift.

➤ Action plan: Prioritize long entries with stops (~2% below support pivot), partial profit taking above 123k, strict risk management in case of behavioral reversal or abnormal volume.

__________________________________________________________________________________

Multi-Timeframe Analysis

Daily/12H/6H/4H/2H/1H :

- All trend signals bullish (Risk On / Risk Off Indicator "Strong Buy", MTFTI "Strong Up")

- All major supports below price

- No structural weakness

- Consolidation range just below 119676–120998 resistance

30min/15min :

- Neutral setup, lack of directional momentum

- Normal volumes, no excessive activity

- Flat consolidation, market awaiting catalyst

Risk On / Risk Off Indicator : Fully confirms momentum. Shifts neutral short-term, no sell or reversal signal.

Key summary :

- Bullish trend dominant

- Major supports well below, immediate risk is low unless flash volume spike or sudden news

- Closely monitor the market under major resistance clusters

__________________________________________________________________________________

Cross-Analysis & Strategic Synthesis

Perfect convergence Daily to 1H: "Strong Up" momentum, bullish Risk On / Risk Off Indicator, healthy volumes

Active consolidation on 30min/15min: market awaits catalyst, no notable bearish strength

Structured pivot supports: 117600–116500, 115736/114000

Key resistances: 119676, 120998, 123218 (potential distribution/resistance zone)

Preferred entries: support pullback or confirmed breakout above 120k

Limited macro risk short term. Focus on Powell/Fed news and US calendar events (see table)

On-chain: Short-term holders profit-taking in progress, alert if deterioration accelerates

Plan: Partial profit taking above 123k extension, systematic stops below 115736 on invalidation

__________________________________________________________________________________

Professional Summary

BTC market shows a strong multi-timeframe bullish impulse, underpinned by robust sector and trend signals. Maintain risk discipline: key supports remain solid, but major resistance cluster requires increased vigilance for volume spikes or air pockets. Partial profit-taking recommended above 123–130k. R/R >2:1 for buys on pullback, strict stop loss in case of technical or behavioral invalidation.

__________________________________________________________________________________

Multitimeframes

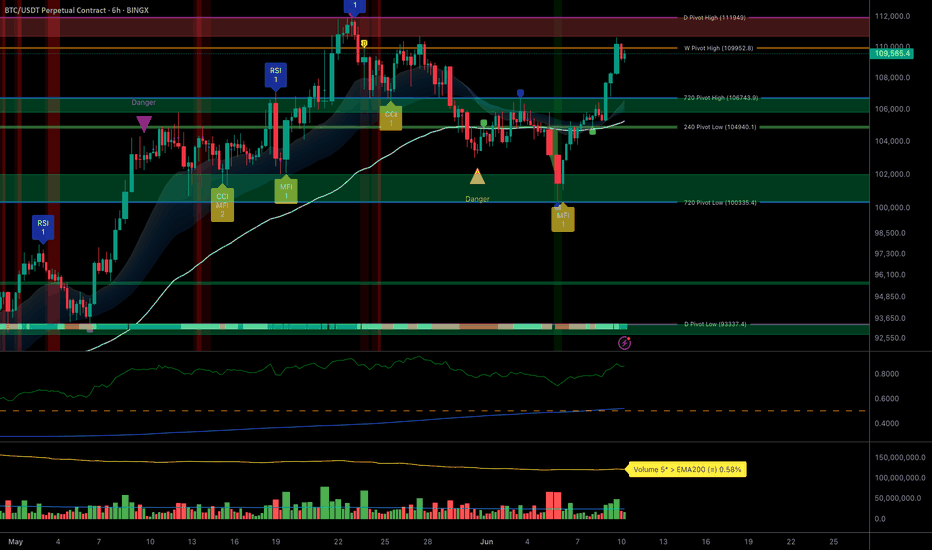

BTC: Strong bullish trend, key resistance 111–112k in focus__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Strong bullish momentum across all timeframes (1D to 15min).

Major supports: 100335, 104940, 106743 – multi-timeframe confluence, natural risk management levels.

Key resistances: 109952 – 111949 (historical pivot zones).

Risk On / Risk Off Indicator clearly favoring "Risk On" (strong buy). Tech sector in leadership mode, favorable context.

Volumes normal to moderately elevated, no major behavioral anomalies (ISPD DIV neutral).

No significant divergence between technical and behavioral indicators detected.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias : firmly bullish, but tactical caution just below 111,000–112,000.

Opportunities : prioritize buys/reloads on pullbacks to 104,900–100,300.

Risk zones : clean break below 103.7k ⇒ risk of acceleration to 95.6k; invalidation if daily close <103,700$ or >2 sessions <97,100$.

Macro catalysts : Fed decision (06/18), US CPI (06/12), Trump speech (06/10); anticipate higher volatility.

Action plan : engage tactically below resistance; recommended swing stop-loss at $97,000; active management after each catalyst event.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D : Massive support 100k-103k, critical resistance 111–112k. Robust momentum and context, no behavioral overheating.

12H : Steady staircase progression, intermediate supports respected (104940–106743), healthy volumes, ongoing up-trend.

6H : Bullish background, no excessive flow or defensive behavioral signals.

4H : Resistance zone test (111949–109952), structure remains solidly up, no reversal detected.

2H : Slightly rising volumes on resistance test, no behavioral excess. Positive momentum.

1H : Active resistance test, moderate volumes. Bullish structure intact.

30min : Micro-consolidation below resistance, no excessive volume/behavior. Trend up.

15min : Volume spike on last upward move, rapid normalization. Reload possible if breakout above 110k is confirmed.

Multi-timeframe summary : Bullish confluence, no strong reversal signal as long as support at 103.7k holds.

Risk On / Risk Off Indicator : Strong buy, tech sector leading, no structural risk detected in capital rotation.

__________________________________________________________________________________

Synthesis & Decision-Making

__________________________________________________________________________________

Dominant structure : BTC market structurally bullish, supported by multi-timeframe converging supports and solid tech sector.

No behavioral anomaly (ISPD DIV neutral); volumes under control; only vigilance below 111–112k due to matured seller pressure.

Macro context : Fed’s rates unchanged expected, major catalysts nearing with potential for significant volatility.

On-chain analysis : active distribution from long-term holders, critical area 103.7k–97.1k, demand must absorb “long-duration” supply.

Trading recommendation : favor buys/reloads on pullback (104,900–100,300); tactical caution under 111–112k; swing stop-loss at $97,000 advised.

BTC structurally bullish, but approaches a critical phase: robust multi-timeframe supports, positive macro momentum, no excessive behavioral exuberance. Heightened vigilance required below 111–112k due to pressure from long-term holders; dynamic risk management needed around major macro events.

__________________________________________________________________________________

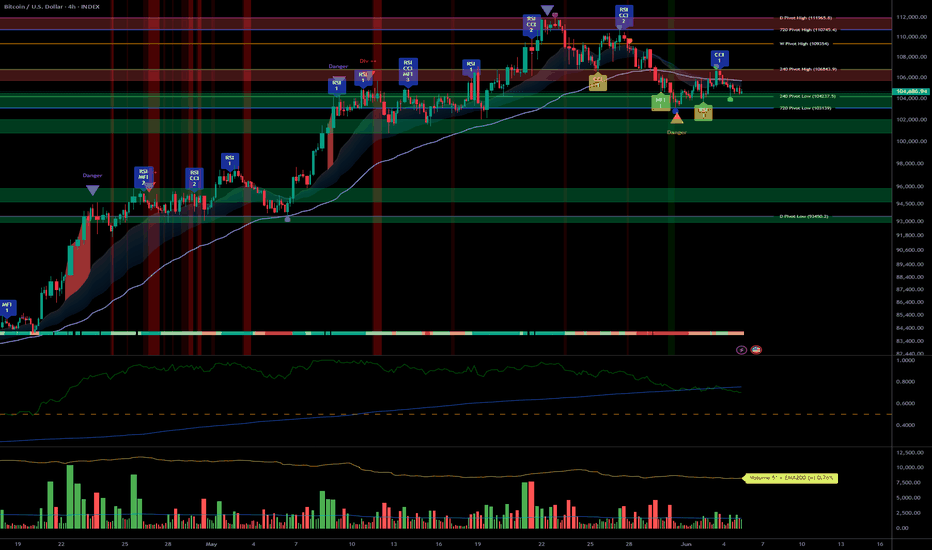

Tactical BTCUSDT Swing: Persistent Risk On, Key Stop at 103,000__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish sectoral momentum (Risk On / Risk Off Indicator on strong buy across all timeframes), but momentum is fading just below key resistances.

Supports/resistances: Key 104,179–103,086 area tested on every timeframe, consolidating a major price floor. Upside targets: 109,588 then 111,980.

Volume: Stable liquidity, no anomaly spike or structural rupture. Volumes consistent with trend; moderate pickup in activity near supports, no climax.

Market behavior: Investor Satisfaction Indicator is neutral on all timeframes except 1H (behavioral buy signal to monitor). No euphoria or panic, no aggressive accumulation.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Cautiously bullish as long as 104,179–103,086 pivot support holds. Risk On / Risk Off Indicator gives a strong bullish sector signal. Macro backdrop neutral, low volatility.

Opportunities: Swing timing on pullback to support confirmed on 1H/4H, targets 109,500/111,980. Wait for daily/4H confirmation before full allocation.

Risk zones: Strong invalidation under 103,086, alert under 104,179. Suggested technical stop-loss below 103,000 USDT.

Macro catalysts: Watch ECB and Fed (8:30–9:45 UTC, Thursday). Expect possible volatility spike, adjust sizing and stop accordingly.

Action plan: Active swing trading off support, dynamic stops, partial exposure ahead of major events. Active risk/reward management (>2.5), upside targets on technical pivots, liquidity is normal.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

: Global uptrend but fading momentum below ATH. Major support 104,179–103,086, no clear behavioral signals. Risk On / Risk Off Indicator strong buy, volumes stable.

: Strong tech sector bias (Risk On / Risk Off Indicator strong buy), support at 104,179. ISPD DIV neutral, volumes normal.

: Pause/consolidation above multidimensional support (104,179). Healthy but cautious structure.

: Consolidation >104,179, long positioning remains valid as long as support holds; no clear short-term behavioral inflow.

: Testing key support, first signs of indecision. Increased watchfulness recommended.

: First short-term behavioral buy signal (ISPD DIV/mason's), optimal tactical allocation timing if 104,179 support is defended.

: Intraday range on support, no emotional spike or break volume.

: Local flush, defensive rebound off support, short-term range scenario; potential technical bounce.

Cross-timeframe summary:

- 104,179 is the key defensive multi-support area, tested across all TFs.

- Risk On / Risk Off Indicator is bullish across the board, except behavioral divergence (ISPD DIV Buy on 1H only).

- No panic or rupture volumes detected.

- Immediate risk if breakdown below 104,179 and/or 103,086: opens door to intraday bearish extension toward 93,377.

__________________________________________________________________________________

STRATEGIC OUTLOOK – Final Summary

__________________________________________________________________________________

Technical setup: Solid consolidation above 104,179/103,086 supports, sectoral buying confirmed. No major deterioration unless a clear breakdown occurs.

Opportunity: Short-term swing entry on 1H/4H signal, target 109,500–111,980. Stop-loss below 103,000 advised.

Risk: Downside acceleration if support breaks, especially if LTH profit taking continues or spot demand fades.

Macro: Calm backdrop, ECB and Fed decisive for short-term volatility. Watch post-announcement market action.

On-chain: Significant profit-taking near highs, no euphoria, positive risk/reward if stops are respected.

Operational summary:

Cautiously bullish while 104,179/103,086 hold.

Tactical swing entry possible on pullback and confirmed signal (1H or 4H).

Strict stop management below 103,000, reduced exposure before key ECB/Fed events.

Upside targets: 109,588 – 111,980.

Monitor volumes and behavioral signals post-news.

Key levels to watch:

Supports: 104,179, 103,086

Resistances: 109,588, 111,980

Macro alerts: ECB/Fed (Thursday morning, 8:30–9:45 UTC)

Behavioral ISPD DIV signal after news

Suggested stop-loss : < 103,000 USDT (as of 01/06/2025, 22:56 CEST)

Comprehensive analysis based on multi-timeframe technical structure, Risk On / Risk Off Indicator and ISPD DIV behavioral/mason's confirmations. Remain disciplined and flexible in risk management.

__________________________________________________________________________________

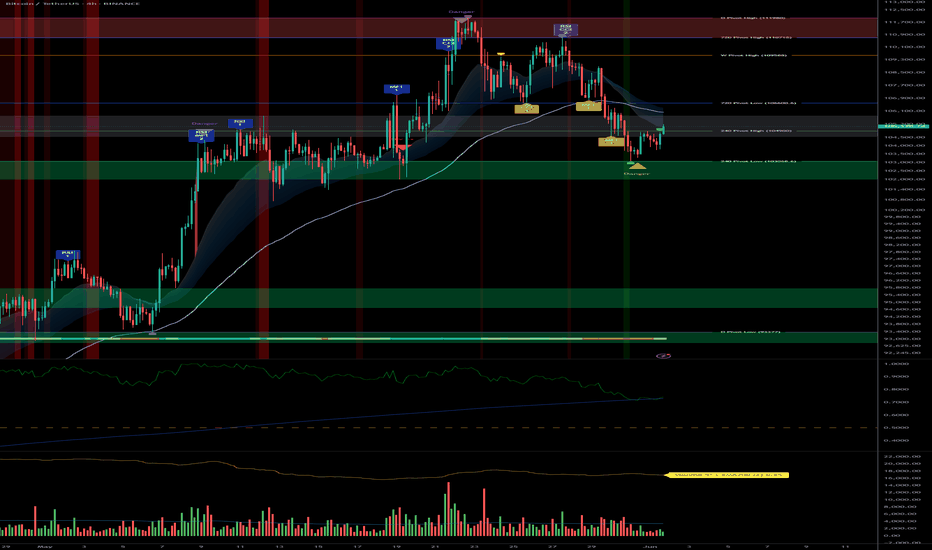

BTC/USDT: Strong Bullish Alignment, All Signals Green (01/06/25)__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Bullish structure confirmed by Risk On / Risk Off Indicator (“BUY” across all timeframes).

Key Supports: 103k–104k, consolidated on every horizon (1D to 15min).

Resistances: 105.5k–108k (short-term), 110k as a main pivot.

Volume: Moderately high, with no climax or distribution signals.

Behaviour: Proprietary indicators (ISPD DIV) show strong bullish confluence across timeframes; no divergences or significant bearish signals.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Directional Bias: Dominant bullish bias across all timeframes.

Opportunities: Tactical entries on pullbacks to 103k–104k, main exits >108/110k.

Risk: Invalidation below 101k; watch for extreme volumes or major macro catalysts.

Catalysts: Strong global risk-on dynamics (tech rally, institutional flows, weak USD); monitoring SEC regulation and macro events (NFP, CPI, FED).

Plan of action: Buy defended support zones, reduce on exuberance >110k, dynamic stop below 101k, stay reactive ahead of major events.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Major resistance at 110k (Pivot High), strong support 101–104k, Risk On / Risk Off Indicator “BUY,” healthy volume; maintained momentum.

12H: Confluent resistance 105.5–110k, support 102.5–104k, bullish indicators, no divergence or volume climax.

6H: Resistances 105.5/108k, solid support 103–104k, strict bullish confirmations.

4H: Clustered resistances 105.5/108k, dense support 103–104k, digestion phase in volume (healthy consolidation).

2H: Major pivots 105–108k, supports 103k/101.5k, strong demand on pullback.

1H: Barriers 105.5–106k, support 103.4–104.2k, no bearish signals.

30min: Spot resistance at 105.5k+, support 103.8–104.2k, microstructure favors buying, weak selling pressure.

15min: Support 104k, resistance 105.5–106k, intraday flow remains pro-buy on weakness.

Risk On / Risk Off Indicator: Consistent “BUY” signal across all timeframes — sector and behavioural momentum alignment.

ISPD DIV: Positive histogram, no red zones or distribution alerts.

Volumes: Normal to moderately high, no climax suggesting trend end.

Summary: Strong multi-timeframe technical alignment. Bullish momentum, firmly defended supports. No imminent reversal signals, healthy consolidation within dominant risk-on trend.

__________________________________________________________________________________

Strategic & Fundamental Synthesis

__________________________________________________________________________________

Technical bias: Strong bullish conviction as long as 103–104k is defended, supported by Risk On / Risk Off Indicator/ISPD.

Fundamentals: Macro momentum (Nasdaq/US tech rally, weak USD), OI and spot dominance high, growing euphoria (ATH ~111k), watch for potential distribution if buyer exuberance peaks (P/L ratio 12:1).

Scenarios: Buy on defended flows 103–104k, TP >108–110k; caution on extreme volume at support.

Macro: Anticipate reactions to major events (NFP, CPI, FED). If a key event is due within 48h: prudence, adapt post-release.

Opportunities: Potential rotation to altcoins (SOL/ETH), short-term swing as BTC momentum pauses.

Momentum prevails, but caution warranted on any volume spikes or major macro headlines. Market remains a buy at support, optimal strategy is dynamic pullback/TP management, strict discipline in case of high-volume sell-off.

__________________________________________________________________________________

Actionable Summary

__________________________________________________________________________________

Entry: Buy securely on 103–104.2k zone

Stop: Hard invalidation if <101k (on volume)

Take Profit: 108–110k+

Risk: Excessive on-chain euphoria, violent support break

Stay agile near major releases and watch flow rotations (BTC/ALT)

__________________________________________________________________________________

BTC/USDT – Tactical Bullish Consolidation__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum : STRONG BUY signal confirmed across all timeframes via the Risk On / Risk Off Indicator (stable green line, dominant bullish momentum).

Support & Resistance : Major multi-timeframe support at 104,000 USDT , with key resistance between 108,000–111,000 USDT .

Volume : No extreme spikes, below EMA – no panic-buy or selling climax detected.

Behavioral Indicators (ISPD) : Neutral sentiment across the board – no signs of overheating or capitulation.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall Bias : Bullish. Technical momentum is aligned with supportive macro drivers and resilient on-chain dynamics.

Trade Opportunities : Tactical buys on confirmed re-tests of 104k support; upside targets at 107k, 108k, with potential extension to 111k.

Risk / Invalidation : Strong rejection below 104k combined with fading Risk On / Risk Off Indicator → could trigger a flush toward 100k or even 94k–97k.

Macro Catalysts : US/China tensions (volatility), altcoin breakouts (risk appetite), on-chain data in euphoric phase.

Action Plan : Active monitoring, scalp bullish impulses, partial TPs under resistance, hedge on volume spikes to the downside.

__________________________________________________________________________________

Multi-Timeframe Analysis – BTC/USDT

__________________________________________________________________________________

1D : Consolidating below major resistance (108k–111k), with key support at 104k. Bullish momentum, neutral volume. Risk On / Risk Off Indicator : STRONG BUY .

12H : Technical rejection at 104k–108k clusters, firm support at 100k–104k. Momentum holds, no behavioral excess.

6H : Same price levels as higher TFs. Strong momentum and neutral sentiment, no anomalies detected.

4H : Bullish rebound off 104k, facing resistance at 108k+. STRONG BUY signal intact, normal volume.

2H : Support holding firm, bulls in control. No weakness observed.

1H : Price compressing within 104k–107k. Underlying bullish momentum remains solid.

30min : Consolidation under 105.5–107k resistance. Indicator remains bullish. No sign of capitulation.

15min : Repeated tests of 104k support, slight softening in signal but bullish bias remains.

__________________________________________________________________________________

Conclusion – Execution & Position Management

__________________________________________________________________________________

Directional Bias : Bullish. Constructive consolidation with strong sector momentum.

Key Levels : 104k (support) and 108k–111k (resistance).

Strategy : Buy dips on validated re-tests, scalp breakouts, swing above 108k.

Risk Triggers : Breakdown below 104k with volume spike, or bearish reversal in Risk On / Risk Off Indicator .

Watchlist : Unusual volume spikes, ISPD turning red, abrupt macro changes.

__________________________________________________________________________________

BTC/USDT – Bullish Bias with Short-Term Accumulation Signals __________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum (Risk On / Risk Off Indicator): Persistent strong buy signal across all timeframes (1D to 15min), reflecting a sustained bullish bias and tech sector outperformance.

Support/Resistance Zones: Major support at 99.5–103k repeatedly tested across intraday charts; resistance cluster between 108–112k continues to act as a strong technical ceiling.

Behavioral Indicator (ISPD): Neutral on HTF (1D/12H), but shows buy signal on 1H–30min with strong accumulation patterns. Flat readings on other frames indicate no panic or euphoria.

Volume Profile: Normal volume across all timeframes, absence of climactic spikes or signs of local capitulation/euphoria.

Behavior Summary: Bullish structure remains intact, but market is at an inflection point. Short-term accumulation visible, especially below 104k.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Bias: Clearly bullish, supported by strong momentum and institutional flows into Bitcoin and the tech sector.

Opportunities: Tactical buy zone on retracements toward 99.5–103k. Intraday scalping possible with tight stops below 99.5k, targeting resistance zone at 108–112k.

Risk Zones: Break below 99.5k could trigger high-volatility liquidation down to 91k. Multiple resistance failures under 108–112k may prompt a sharp pullback.

Macro Catalysts: ETF inflows and equity risk-on backdrop boost technical signals. Lack of macro news shifts dominance to technicals and crypto narratives.

Execution Plan: Accumulate near 103k on dips. Manage trades actively under resistance. Avoid chasing breakouts without confirmation. Monitor ISPD for behavioral shifts.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D – Macro Context

- Resistance: Strong cluster between 108–112k from daily/weekly pivots.

- Support: Long-term structural base down at 74–92k.

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Neutral – no extremes.

- Volume: Normal.

- Summary: Market is stretched above its macro base but retains strength; no acceleration or behavioral stress.

12H – Inflection Zone

- Resistance: 104–112k cluster.

- Support: Secondary pivots (240–720min).

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Neutral.

- Volume: Normal.

- Summary: At a decision zone; momentum intact, awaiting directional confirmation.

6H – Lateral Strength

- Resistance: 104–112k convergence.

- Support: 99.5k key.

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Neutral.

- Volume: Normal.

- Summary: Short-term consolidation inside a rising structure.

4H – Under Pressure

- Resistance: 108–112k confluence.

- Support: 99.5k.

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Neutral.

- Volume: Normal.

- Summary: Risk of false breakout. Tactical caution needed.

2H – Trading Range

- Resistance: 104–108k.

- Support: 99.5k.

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Neutral.

- Volume: Normal.

- Summary: Consider tactical entries near range base; no seller climax detected.

1H – Emerging Reversal

- Resistance: 108–112k.

- Support: 103k, 99.5k.

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Buy – signal of behavioral accumulation.

- Volume: Normal.

- Summary: Signs of reversal from bearish accumulation; watch for confirmation above 104k.

30min – Low-Risk Entry Setup

- Resistance: 105k–108k.

- Support: 103k.

- Risk On / Risk Off Indicator: Strong Buy

- ISPD: Buy – strong behavioral signal.

- Volume: Normal.

- Summary: Contrarian long setups favored; tight stop strategy under 103k.

15min – Caution on Fade

- Range: 103–105k.

- Risk On / Risk Off Indicator: Buy.

- ISPD: Neutral.

- Volume: Calm.

- Summary: Market in cleansing phase; scalps possible, but avoid overconfidence due to short-term softness.

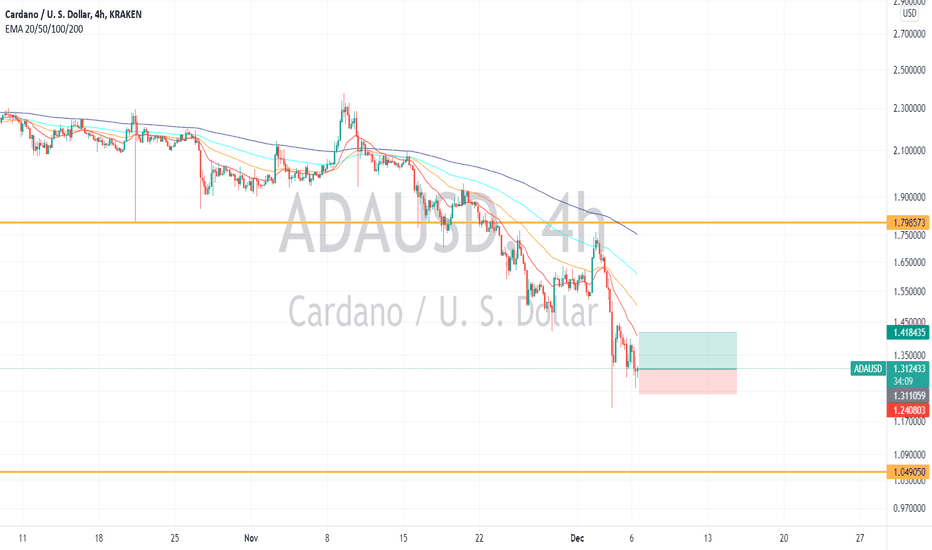

Ada - Short termcheck the price in short term like as 4H Timeframe for the Long position.

R/R is good and logical.

Just for Daily traderssssss

Disclaimer: Information is provided only for educational and exchange purposes only.

Do your research before taking any action or decision in the real market.