Mushort

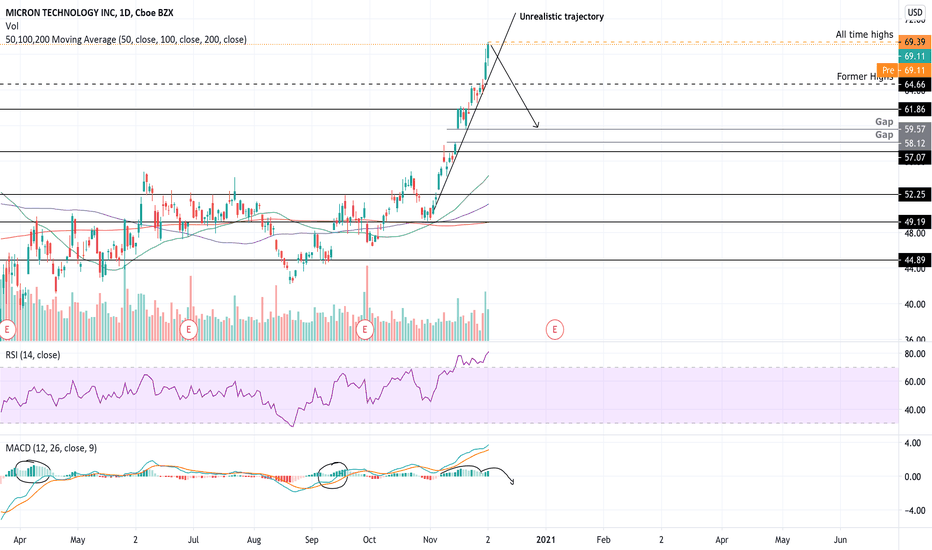

MU ShortAfter a golden cross with the 50 and 200 SMA NASDAQ:MU has pushed up into overbought conditions on the RSI leaving quite a mess as it stretches. Now at all time highs, I believe that it is a good time for a short. With lots of buying pressure in the last couple of days some consolidation is expected. Semi-conductors have been a strong play during 2020, however with a strong bid for Energy yesterday, I believe it is time for past due rotation for the continuation of the unprecedented bull market that has been carried heavily by tech centric stocks. The MAC-D is attempting to double extend to the upside for the first time since September and March lows, and with the overbought conditions it is safe to say that this move will likely be quickly rejected. My first target for MU is support at 61.68 and my second target is the gap up from 58.12 to 59.57. Note that the former highs are at 64.66 and this might serve as a testy area for MU.

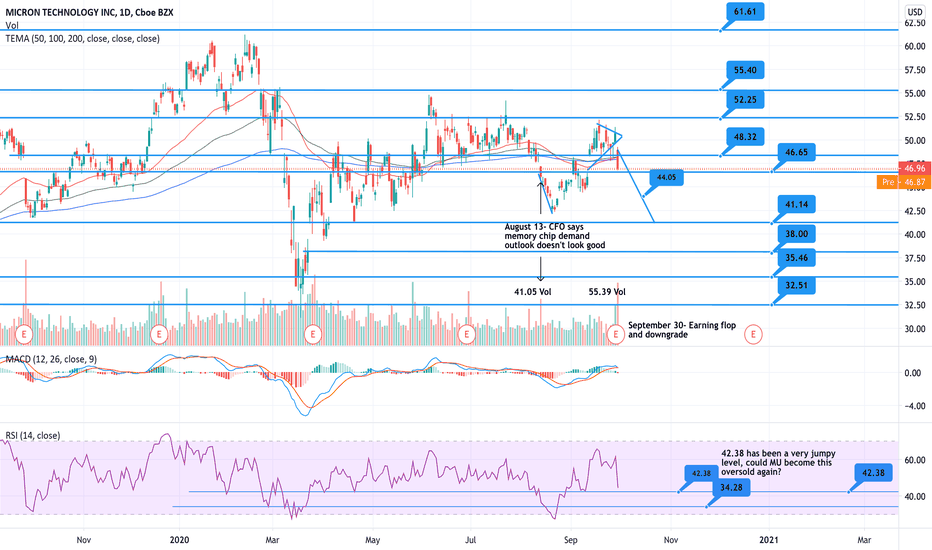

MU Earning Flop/Bearish Pennant ActiveNASDAQ:MU was short 11 cents on its earnings, was downgraded by several groups and began to selloff yesterday, activating bearish pennant with extremely high volume. Earlier in August their CFO stated that the future of memory chips doesn't look good (www.bloomberg.com) and it caused a 9.54% drop from the day's open over the course of a week. After reaching oversold levels on RSI the stock rallied. My target price for is MU is 10% from Wednesday's opening price- roughly 44.05 though I would like to see a break below 46.65 before taking a position. If MU continues to sell my next target would be 41.14