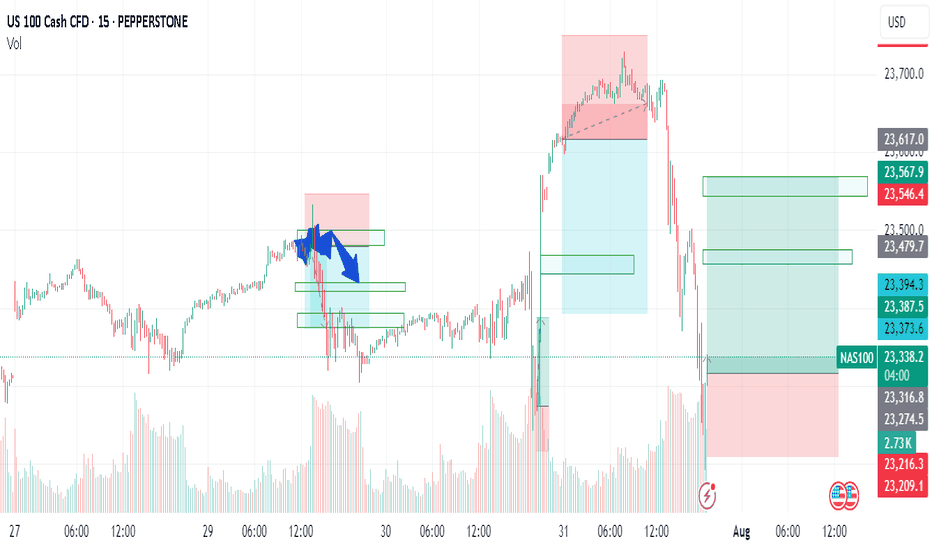

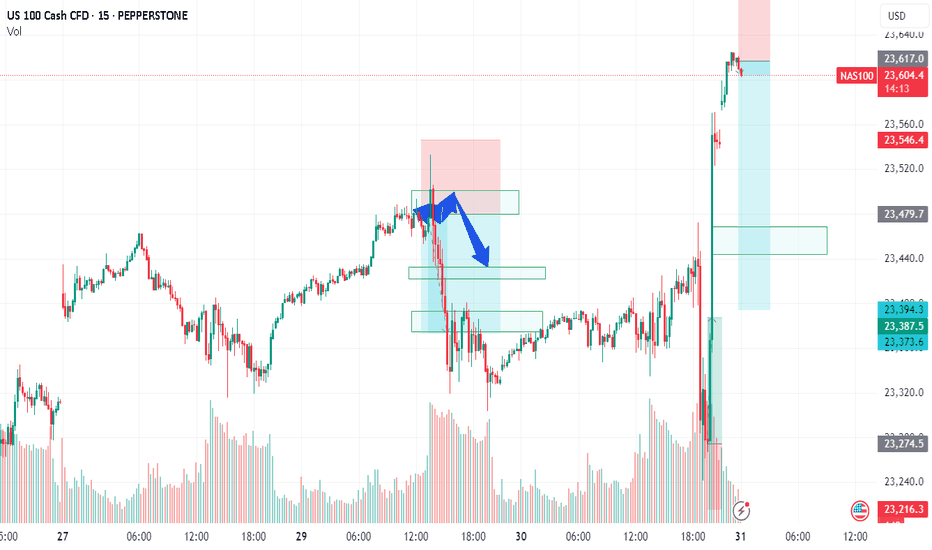

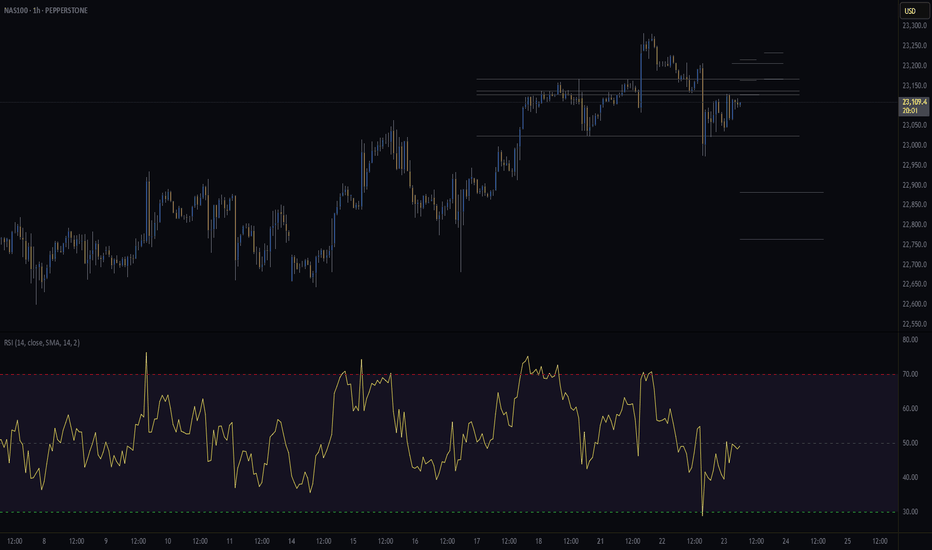

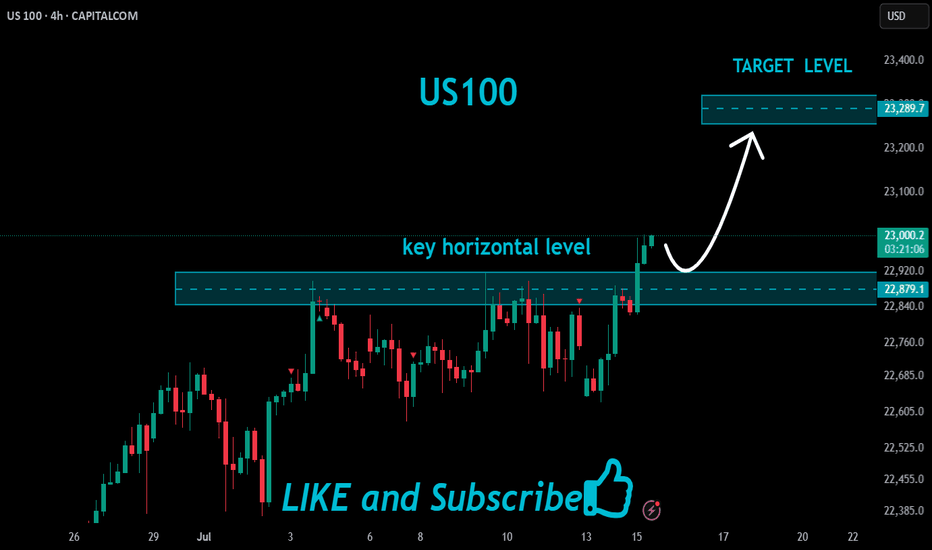

NAS - TIME FOR JUICYTeam, hope you all making a killing on SHORT tonight.

as we expected. Thank you for asking and be patience

TIME TO MAKE NAS100 GREAT AGAIN.

Sorry my entry was 23240, but now the market is 23332

you should entry small volume at the current price 23332 - if a little pull back below 23300 add more

STOP LOSS at 23230-50

TARGET 1 at 23385-23400

TARGET 2 at 23475-23515

LETS go - time to make ACTIVE TRADER ROOM GREAT AGAIN.!

Nasdaqidea

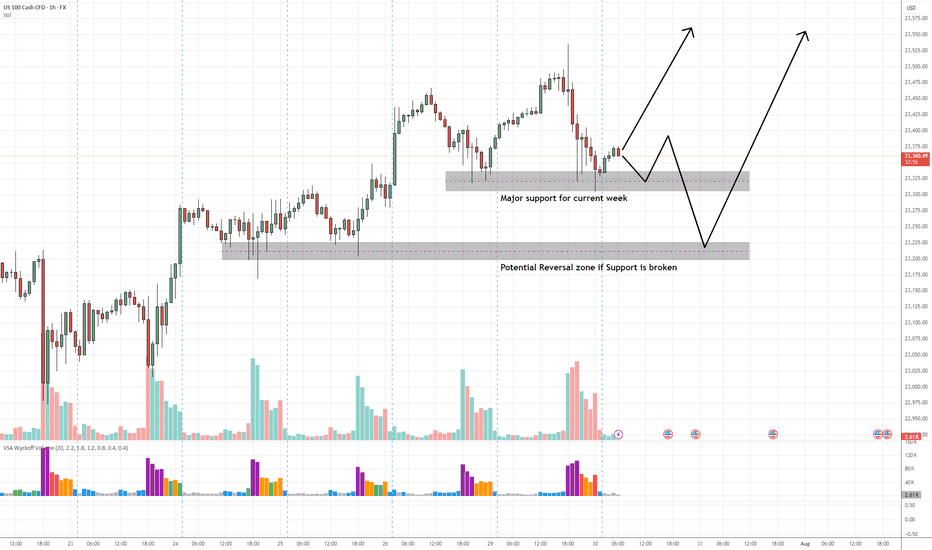

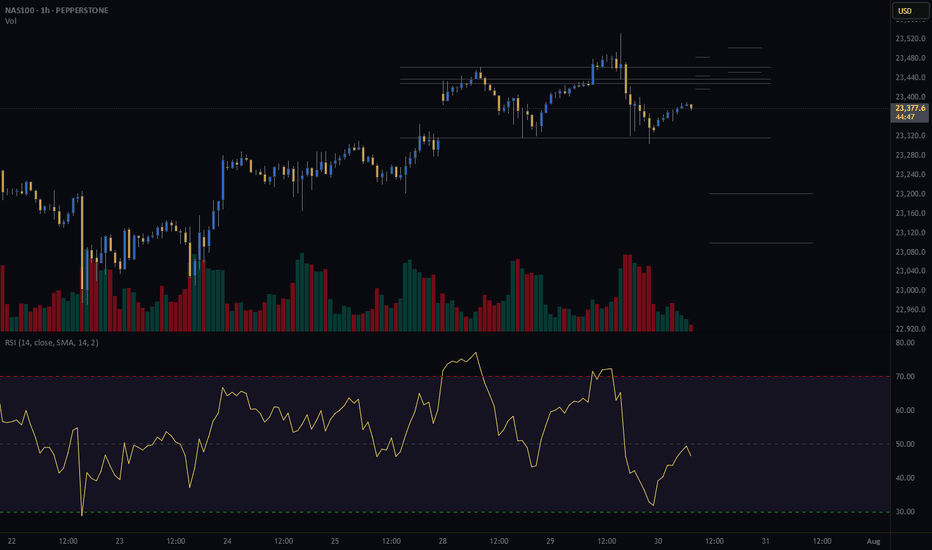

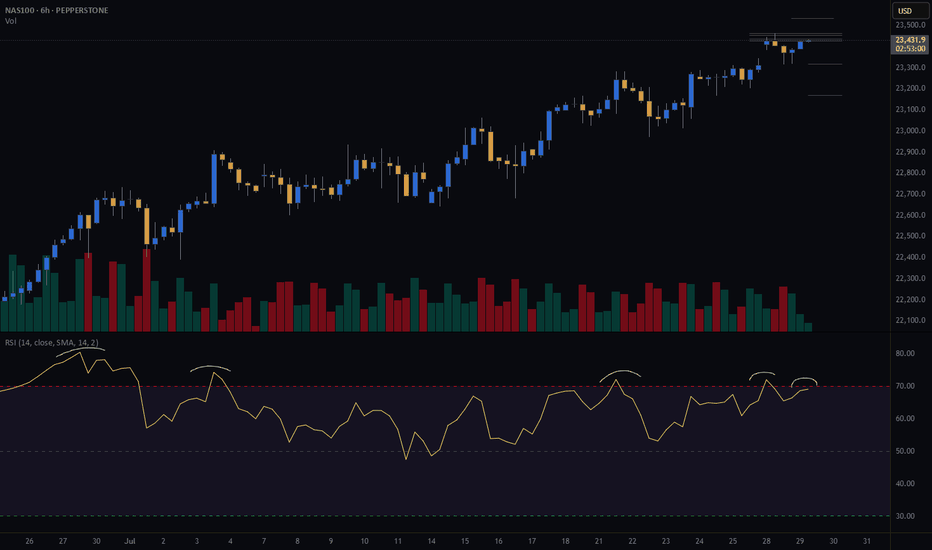

NAS100 Buy Setup – VSA & Multi-Zone Demand Analysis✅ Primary Entry Zone: Major support for current week (around 23,325–23,350)

✅ Secondary Entry Zone: Potential reversal zone if primary support is broken (around 23,200–23,230)

🎯 Target 1 (TP1): Previous swing high near 23,500

🎯 Target 2 (TP2): Extension above 23,550

🛑 Stop Loss (SL): Below 23,170 (beyond secondary reversal zone to avoid false breaks)

📊 Technical Insight (VSA & Price Action Structure)

Support Structure:

The current major support zone has been tested multiple times with no follow-through selling, indicating strong buying interest from larger players.

Volume Spread Analysis Observations:

On the recent decline into the major support zone, we see wider spreads on high volume followed by narrow range candles on lower volume, a classic sign of stopping volume and supply exhaustion.

Within the secondary reversal zone, historical reactions show climactic volume spikes leading to sharp reversals, suggesting this level is watched closely by smart money.

Any test back into the zone on low volume would confirm the No Supply (NS) condition.

Trade Pathways:

Scenario 1: Price respects the major support and begins to climb, confirming demand dominance → target TP1 then TP2.

Scenario 2: Support is temporarily breached, triggering a liquidity grab into the secondary reversal zone, followed by a bullish reversal bar on high volume → strong buy signal with potentially faster move toward TP levels.

📍 Bias: Bullish as long as price holds above the secondary reversal zone.

📌 Execution Tip: Wait for a wide spread up-bar on increased volume from either zone to confirm the start of the markup phase.

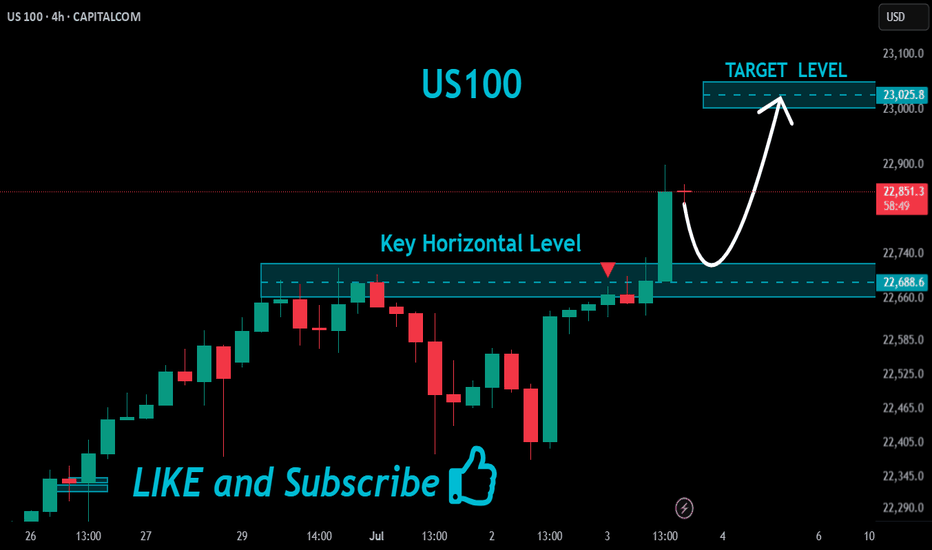

NAS - LET'S MAKE MILLIONS Team, last night NAS I was expect the FALL BACK as I predicted rate un-change will get NASTY on both DOW AND NAS.

So I have a set up entry LONG, i didnt expect the NAS flying to the moon.

both target hit so fast in 15 minutes

However, today is another opportunity to SHORT NAS on the current market at 23613-23625

STOP LOSS AT 23720

Once the NAS pull back toward 23580-65 - BRING STOP LOSS TO BE

TARGET 1: at 23540-20

TARGET 2: at 23480-65

LETS GO

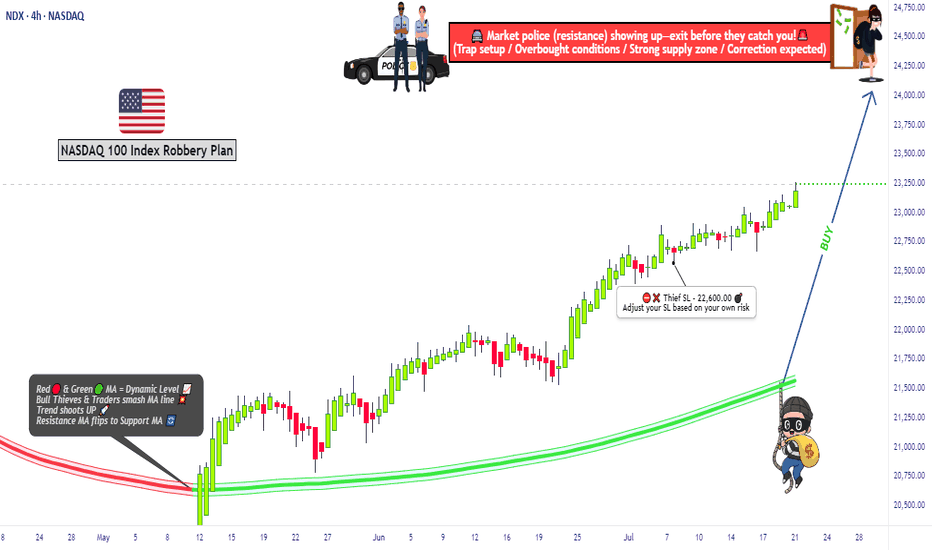

"NASDAQ 100 Heist – Scalp, Swing, or Hold? (Full Plan)🔥 NASDAQ 100 HEIST PLAN – BULLISH LOOT AWAITS! 🔥

🚨 Attention Market Robbers & Money Makers! 🚨

(Swing/Day Trade Strategy – High-Risk, High-Reward Play)

🎯 Mission Objective: Loot the NDX100/US100 (NASDAQ 100) Like a Pro!

Based on Thief Trading’s ruthless technical & fundamental analysis, we’re executing a bullish heist—targeting the Red Zone (high-risk, high-reward area).

⚠️ WARNING: Overbought market, consolidation zone, potential bear traps—weak bears may get slaughtered! Strong hands only!

🔐 ENTRY: The Vault is OPEN!

"SWIPE THE BULLISH LOOT!" – Any price is a steal, but smart thieves use:

Buy Limit Orders (15m-30m TF) near recent swing lows/highs.

DCA/Layering Strategy – Multiple limit orders for max loot.

Breakout Confirmation – Don’t jump in early; wait for the real move!

🛑 STOP LOSS: Protect Your Stash!

Thief’s SL Rule: Nearest 4H swing low (22,600) – WICK LEVEL ONLY!

DO NOT place SL before breakout! (Patience = Profit.)

Adjust SL based on risk, lot size, and number of orders.

🎯 TARGETS: Escape Before the Cops Arrive!

Main Take-Profit: 24,400 (or exit early if momentum fades).

Scalpers: Longs ONLY! Use trailing SL to lock in profits.

Swing Traders: Ride the wave like a true market pirate!

📰 FUNDAMENTAL BACKUP: Why This Heist Will Work

Bullish momentum in NDX100 driven by:

Macro trends (Fed, inflation, tech earnings).

COT Report & Institutional positioning.

Geopolitical & Sentiment Shifts.

Intermarket correlations (USD, Bonds, Tech Sector).

(Stay updated—markets change FAST!)

⚠️ TRADING ALERT: News = Danger Zone!

Avoid new trades during high-impact news.

Trailing SL = Your best friend.

Lock profits early if volatility spikes!

💥 BOOST THIS HEIST! 💥

👉 Hit LIKE & FOLLOW to strengthen our robbery crew!

🚀 More heists coming soon—stay tuned, thieves! 🚀

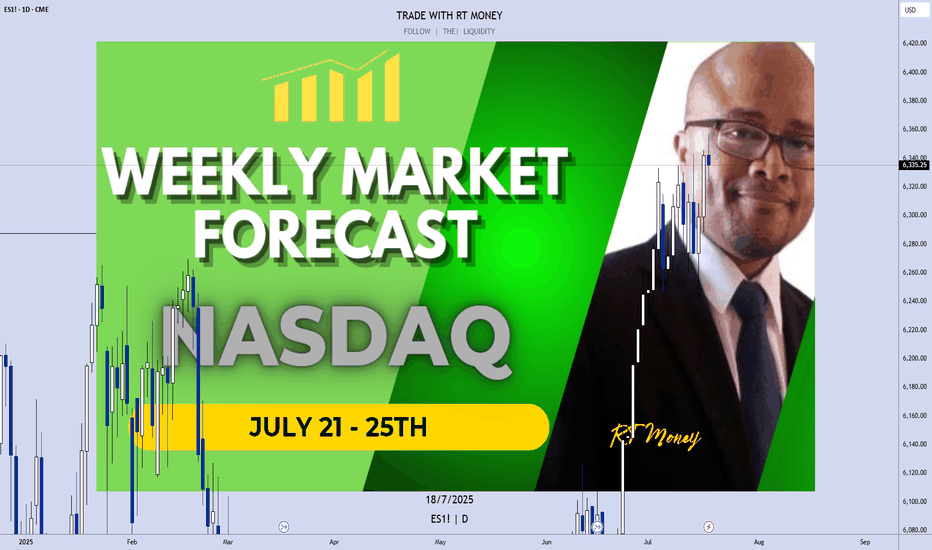

NASDAQ: Still Bullish! Look For Valid Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

NASDAQ (NQ1!) NAS100

The Stock Indices are strong, and showing no signs of selling off. Buy it until there is a bearish BOS.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NASDAQ: Still Bullish! Look For Valid Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

NASDAQ (NQ1!) NAS100

The Stock Indices are strong, and showing no signs of selling off. Buy it until there is a bearish BOS.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

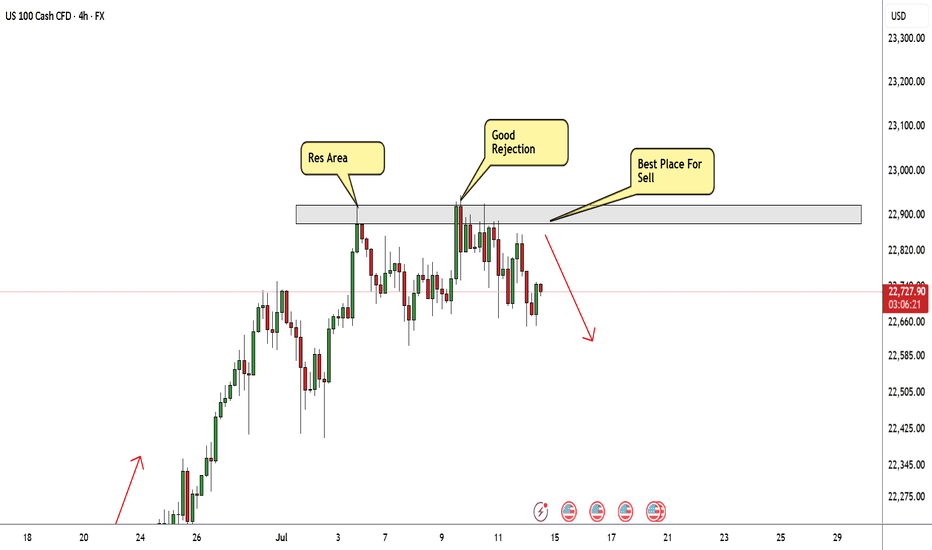

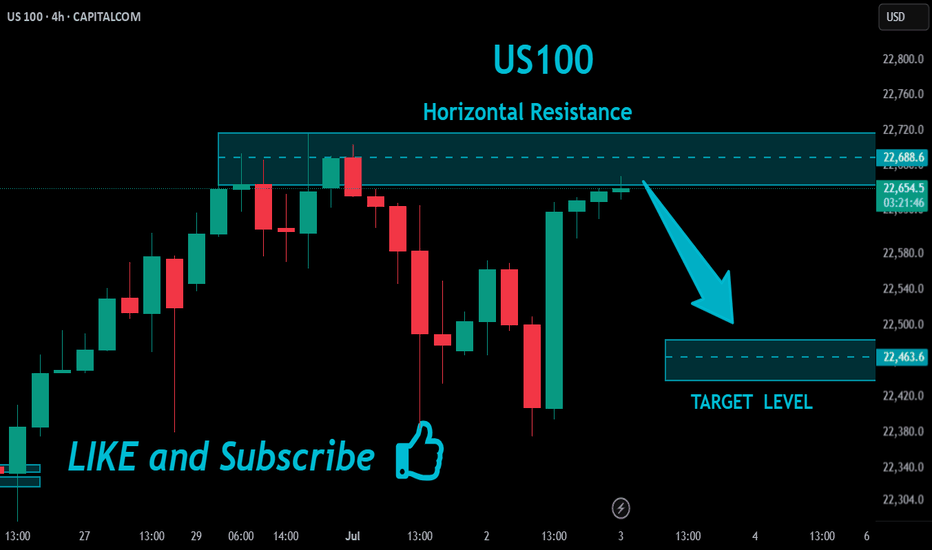

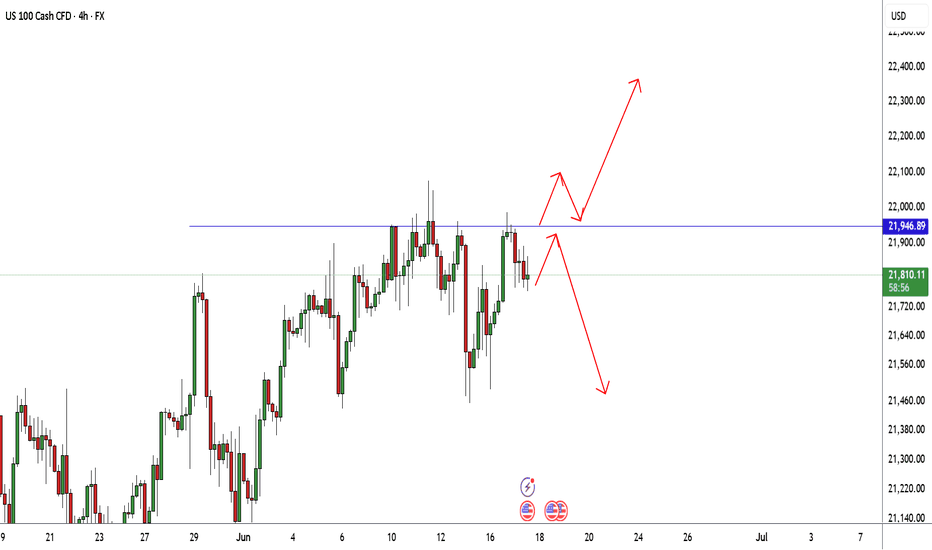

NASDAQ At Good Res , Is It A Chance To Sell To Get 200 Pips ?Here is my 4H Nasdaq Chart and my opinion is the price at very interesting selling area for me , this Res Area forced the prices to go down 2 times and i think this third time will be the best one , so i`m waiting the price to go up a little to retest the res one more time and then we can enter a sell trade and targeting from 100 to 200 pips . the only reason to cancel this idea if we have a clear daily closure above my res area .

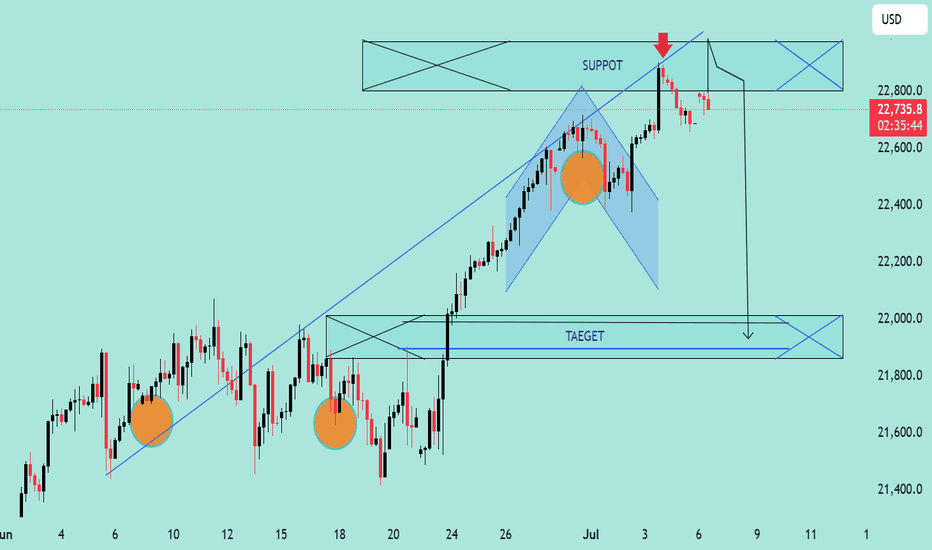

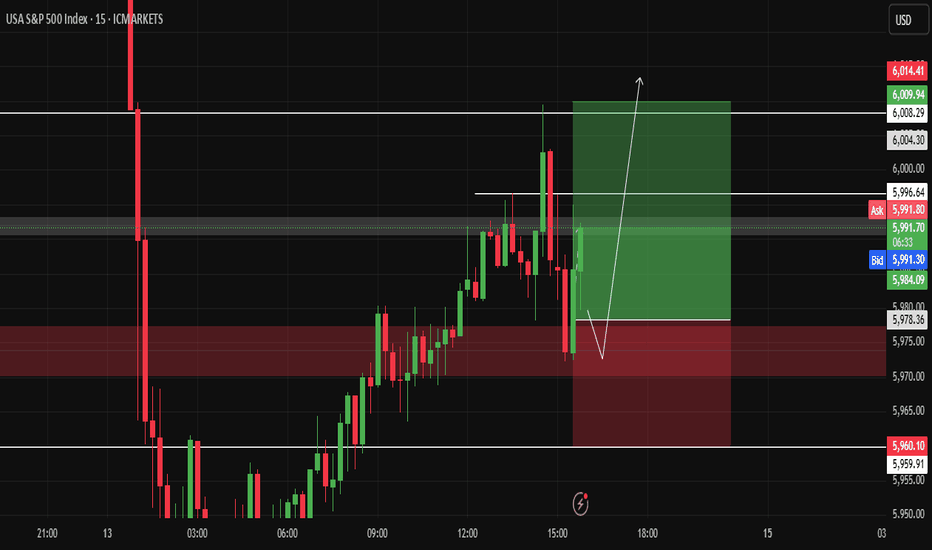

NASDAQ Potential Bearish Reversal Analysis NASDAQ Potential Bearish Reversal Analysis 🧠🔻

The chart illustrates a potential bearish setup forming after a recent uptrend in NASDAQ. Let's break it down professionally:

🔍 Technical Overview:

Ascending Trendline Break ✅

Price had been respecting a steady ascending trendline.

A break below this trendline indicates a possible momentum shift from bullish to bearish.

Bearish Pattern Formation 🔷

A bearish flag/pennant-like formation can be observed after the sharp rise.

This consolidation followed by a breakdown could be a continuation pattern, hinting at further downside.

Resistance Rejection 🔴

A red arrow marks a clear rejection from the resistance zone near 22,800 USD.

Strong wick rejections and bearish candles suggest selling pressure at that level.

Support Turned Resistance (SUPPOT 🛑)

The previously broken support zone is now acting as resistance (note: "SUPPOT" appears misspelled—should be "SUPPORT").

Bearish Target Zone 🎯

The chart marks a "TAEGET" zone (should be "TARGET") near the 21,900 – 22,000 USD range.

This aligns with prior consolidation and demand zones, making it a likely area for price to retrace.

📌 Key Zones:

Resistance (Rejection Area): 22,800 USD

Current Price: 22,739.7 USD

Bearish Target Zone: 21,900 – 22,000 USD

⚠️ Conclusion:

The market shows signs of a bearish reversal with a confirmed trendline break, resistance rejection, and bearish pattern formation. If the price fails to reclaim the 22,800 level, there’s a high probability of downward continuation toward the 22,000 target.

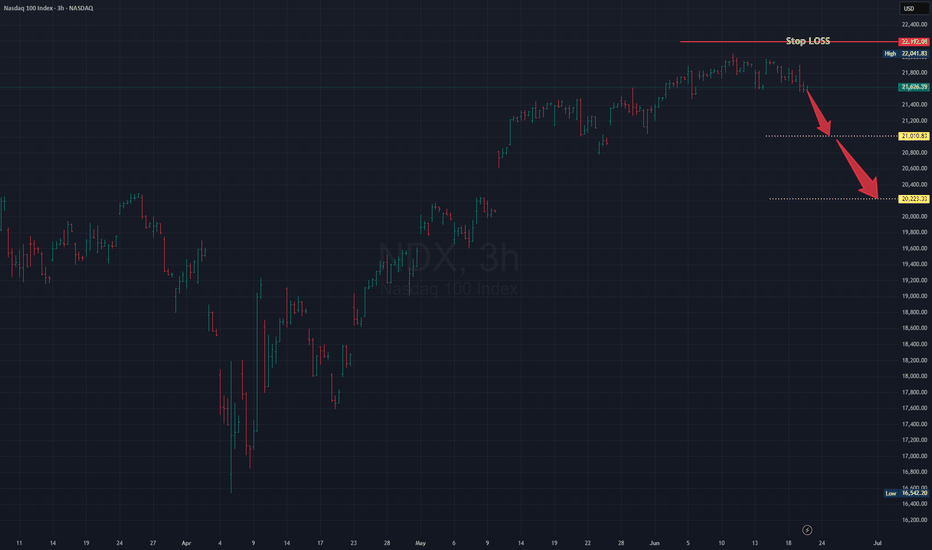

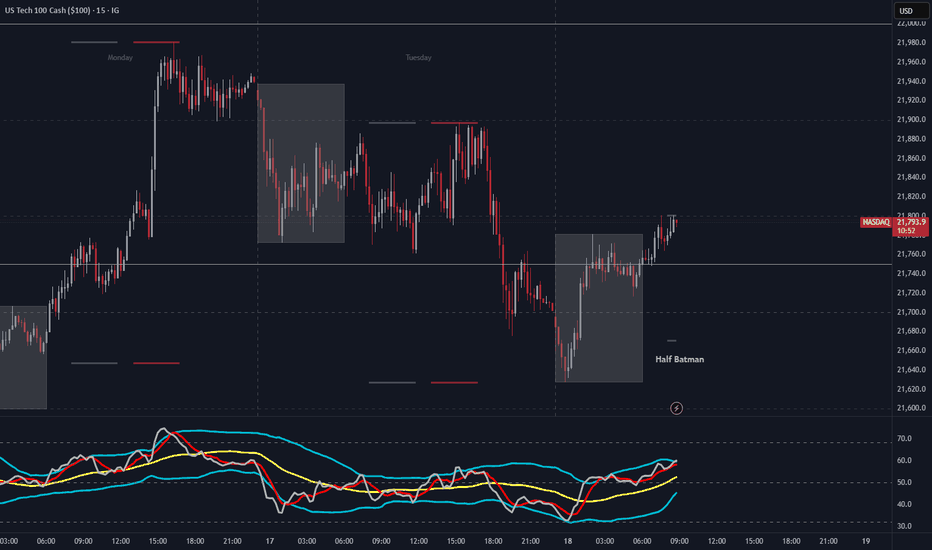

NASDAQ Short-Term Outlook (Study Purpose Only)The NASDAQ index is showing signs of short-term weakness following a rejection near the 22,000–22,200 resistance zone. The recent breakdown from the consolidation range suggests bearish sentiment is building.

🔻 Key Observations:

Stop Loss Zone: 22,192

Price should ideally remain below this level for a bearish setup to remain valid. A move above this zone may invalidate the downside scenario.

Immediate Support Level: 21,010

If selling pressure continues, this is the first potential bounce zone. Watch price behavior closely here.

Deeper Support Target: 20,223

A break below 21,000 could open the door for a drop toward the 20,200 area — a previous accumulation/support level.

⚠️ Risk Management:

Traders may consider this type of setup if looking for short positions, but only with tight risk controls and clear confirmation of trend continuation.

📝 Disclaimer:

This analysis is strictly for study and educational purposes. It is not financial advice or a recommendation to take a trading position. Please consult a licensed financial advisor before making any investment decisions.

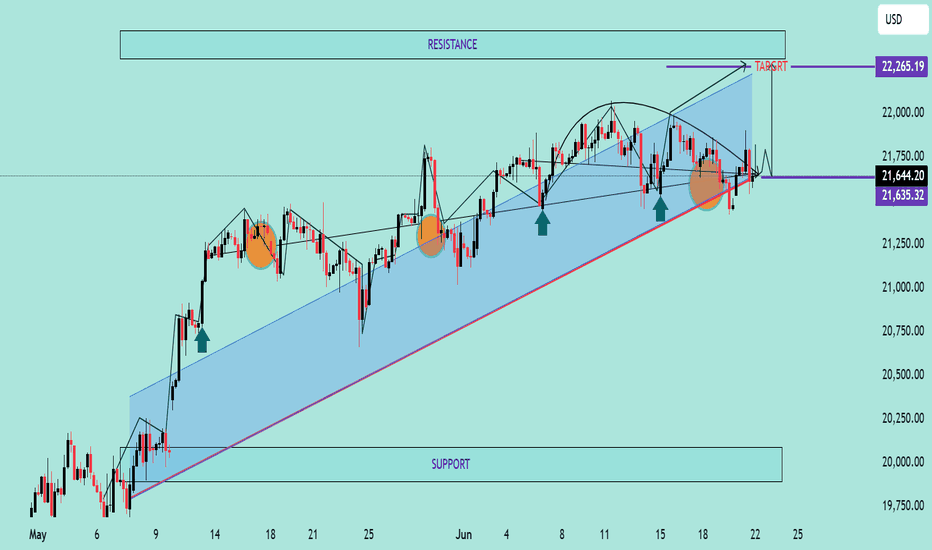

NAS100 Bullish Breakout SetupNAS100 Bullish Breakout Setup 🚀

🧠 Chart Analysis (H4 timeframe)

🔹 Ascending Channel:

Price has been trending inside a clear ascending channel (blue zone), supported by higher highs and higher lows.

🔹 Support & Resistance:

Support: Around 21,635.32 – tested multiple times (highlighted by 🔵 arrows).

Resistance: Around 22,265.19 – recent highs and psychological barrier.

🔹 Double Bottom Formation 👣:

Near support zone, a potential double bottom (bullish reversal pattern) is visible. The neckline has been challenged.

🔹 Breakout Confirmation 🟢:

Price has broken above the descending neckline of the double bottom and is hovering near 21,644, indicating potential bullish continuation if sustained.

🔹 Target 🎯:

Projected breakout target lies at 22,265.19, aligning with the previous resistance zone.

🔹 Volume & Momentum 📊:

While not shown, a breakout above the neckline generally needs strong volume confirmation to validate the move.

📌 Conclusion:

If price sustains above the 21,635 – 21,644 area and gains momentum, the path to 22,265 looks likely ✅. However, a false breakout could drag the price back into the channel.

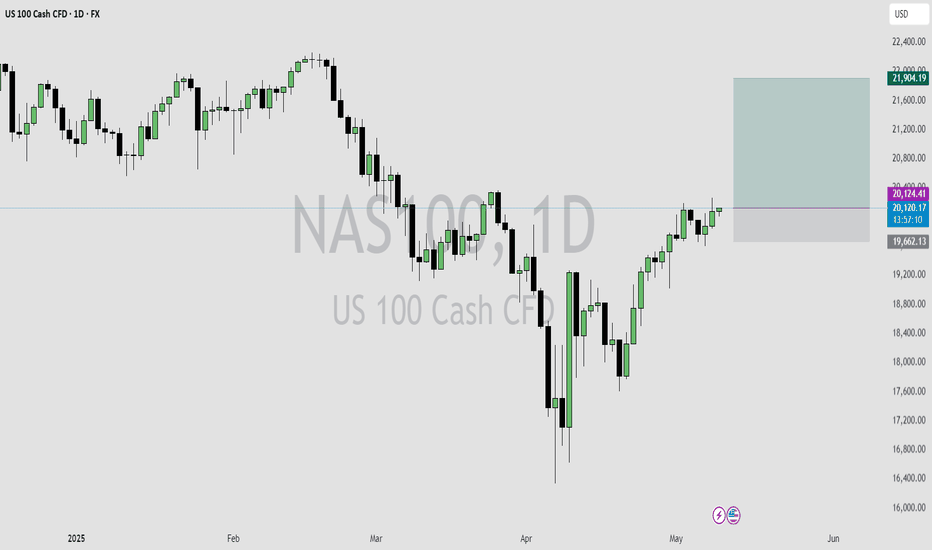

NASDAQ READY TO CONTINUE THE LONG-TERM WEEKLY BULLISH RUN

FX:NAS100

I just entered this buy trade on Nasdaq on the daily time frame.

The trade setup is a Swing trade following the monthly and weekly orderflow.

The Monthly is bullish, the weekly is also bullish, so I entered on the daily time frame retracement.

My overall take profit is a risk reward of 1:4.

NASDAQ 2 Expected Scenarios Very Clear , Which One You Prefer ?Here is my opinion on Nasdaq on 4H T.F , The price still below my res so we can sell it if the price touch the res level again , and if we have a daily closure above my res then we can buy it with retest for the broken res , so it`s very easy if we still below the res we can sell and if we going up it we can buy it . but we need a daily closure above first .

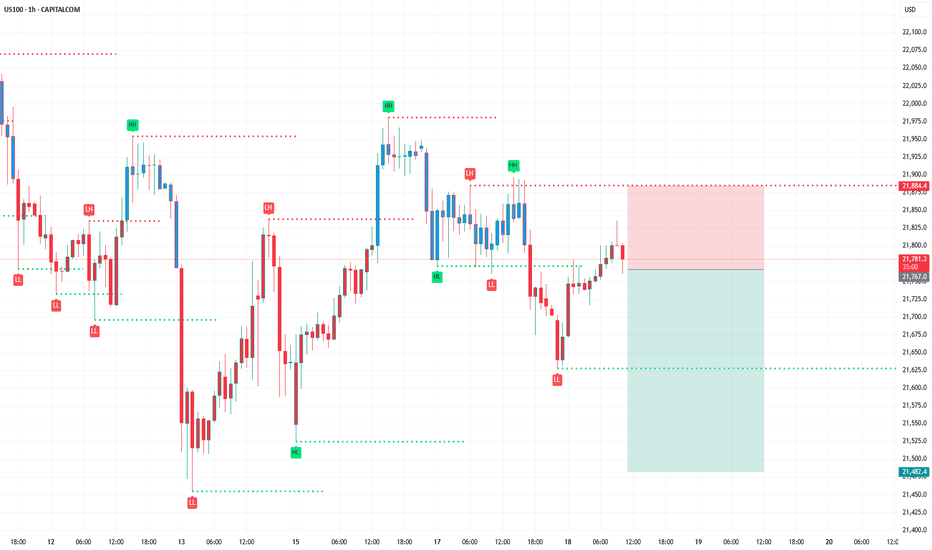

NAS - ACTIVE TRADE COMMUNITY - PLEASE BRING TO THE MOONTeam, we have successfully trade both LIVE trading on UK100 short yesterday and LONG both NAS AND DOWN yesterday.

Today we are entry small portion LONG for NAS.

WILL DOUBLE LONG if market drop low at 21650-21600

Target 1 - at 21850-21875

TAKE 50-70% volume on profit and bring stop loss to BE once target 1 hit

Target 2 remaining at 21900-21950

GOOD LUCK AND LET KILL THE BEAST TOGETHER

NASDAQ Analysis: Navigating Uncertainty in a Shifting LandscapeThe NASDAQ has been on a rollercoaster ride lately 🎢, reflecting both global macro shifts and sector-specific dynamics. After dipping into bear market territory earlier in the year, the index has rebounded strongly, powered by mega-cap tech and the ongoing AI boom 🤖. However, the mood remains cautious as investors weigh political and economic cross-currents. Note how price action is stalling at the current level.

Fundamentals & Earnings 💼

Earnings Resilience: Q1 2025 earnings for NASDAQ heavyweights were robust, with tech giants posting double-digit growth. Yet, forward guidance is more muted, as companies brace for the impact of higher tariffs and global supply chain adjustments.

Valuations: The recent rally has pushed forward P/E ratios well above long-term averages, making the market more sensitive to any negative surprises 📈.

AI & Innovation: Capital expenditure on AI is set to exceed$300 billion this year, keeping the sector in the spotlight and fueling optimism for long-term growth.

Political & Geopolitical Factors 🌍

Trade Policy: The U.S. and China have agreed to a temporary pause on new tariffs, easing some immediate concerns. However, the average effective tariff rate remains much higher than last year, and uncertainty lingers as legal challenges and further negotiations loom.

Fiscal Policy: U.S. deficit worries are back in focus, with new legislation projected to add trillions to the national debt over the next decade. This has contributed to higher Treasury yields and a weaker dollar 💵.

Global Competition: International equities have outperformed U.S. stocks over the past six months, but history suggests this may be stretched, and a reversal could be on the horizon.

Market Sentiment & Technicals 📊

Volatility: While volatility has eased from its spring highs, sentiment remains fragile. Consumer and business confidence indices are at multi-year lows, even as hard economic data (like jobless claims) remains resilient.

Sector Rotation: Growth and cyclical sectors—especially tech, consumer discretionary, and industrials—have led the rebound, but investors are increasingly selective, favoring companies with strong fundamentals and global reach.

Outlook: The NASDAQ is cautiously optimistic for the second half of 2025. The market is pricing in a couple of Fed rate cuts by year-end, but the path forward depends on inflation trends, trade clarity, and corporate earnings.

Key Takeaways 🚦

The NASDAQ is in recovery mode, but faces headwinds from trade policy, fiscal uncertainty, and stretched valuations.

Political developments—especially around tariffs and fiscal policy—will be key drivers of volatility.

Long-term, the AI and tech innovation wave remains a powerful tailwind, but near-term caution is warranted.

Disclaimer:

This analysis is for informational purposes only and does not constitute investment advice. Markets are volatile and subject to rapid change. Always do your own research and consult a financial advisor before making investment decisions.