Nasdaqidea

$NQ1! - Busy week ahead! CME_MINI:NQ1! - Busy week ahead!

We've got a busy calendar ahead of us and remember it's first day of the month - May a Lot of US Data!

1. ISM

2. JOLTS

3. ADP

4. FOMC

5. NFP

Now that's a busy week and I know for some, they will be stepping back and not trading during a hectic week ahead, but I do feel there will be plenty of opportunities. Now, banking sector is at the key spot light ahead of this week mentions of First Republic Bank will be acquired by JPMorgan after rescue efforts fail. It's not first time this year, we've heard a bank go under, and unfortunately that's part of the cycle as rates head higher, a lot of sectors get hurt, look at real estate and this is what I mentioned months prior - I well recommend researching more in depth. Keep in mind FED want a 2% target for inflation...Expectation is for the FOMC to lift rates by 25bps at its May meeting, now the real question is will they pause after this hike or carry on, whilst we got credit tightening...

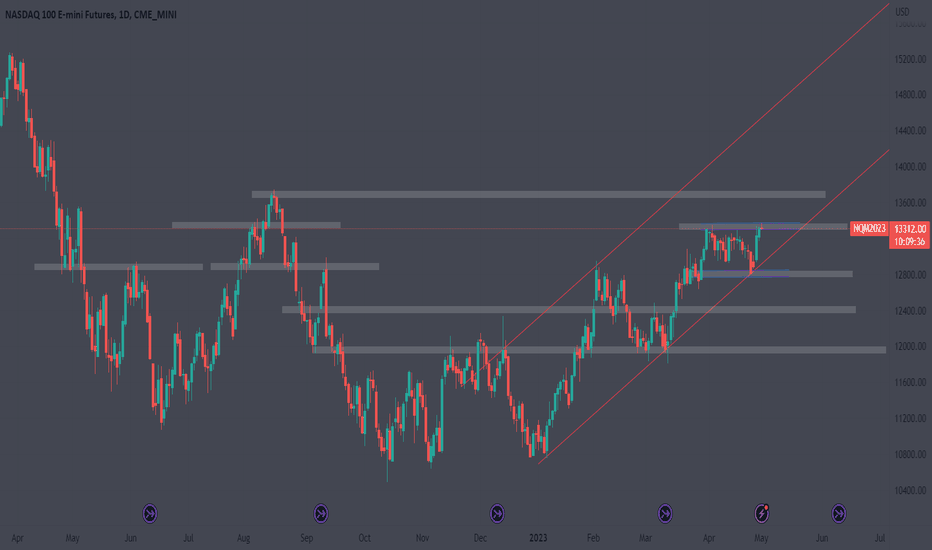

Now technically looking at NQ

Highs: 13391

Lows: 12787

At the moment we've got Kangaroo action until a break to either side - If we are to break the highs, I expect next area of interest to be 13660 areas. However, we are to break the lows, I expect 12481 areas.

NQ has held relatively well within the conditions we are in, interesting times ahead.

Have a great week ahead,

Trade Journal

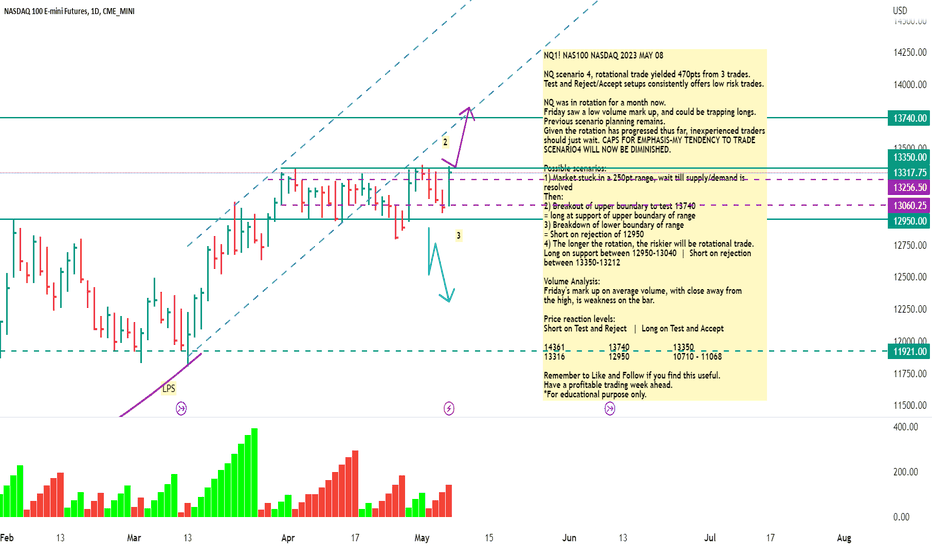

NQ1! NAS100 NASDAQ 2023 MAY 08NQ scenario 4, rotational trade yielded 470pts from 3 trades.

Test and Reject/Accept setups consistently offers low risk trades.

NQ was in rotation for a month now.

Friday saw a low volume mark up, and could be trapping longs.

Previous scenario planning remains.

Given the rotation has progressed thus far, inexperienced traders should just wait.

CAPS FOR EMPHASIS-MY TENDENCY TO TRADE SCENARIO4 WILL NOW BE DIMINISHED.

Possible scenarios:

1) Market stuck in a 250pt range, wait till supply/demand is resolved

Then:

2) Breakout of upper boundary to test 13740 = long at support of upper boundary of range

3) Breakdown of lower boundary of range = Short on rejection of 12950

4) The longer the rotation, the riskier will be rotational trade.

Long on support between 12950-13040 | Short on rejection between 13350-13212

Volume Analysis:

Friday's mark up on average volume, with close away from the high, is weakness on the bar.

Price reaction levels:

Short on Test and Reject | Long on Test and Accept

14361 13740 13350

13316 12950 10710 - 11068

Remember to Like and Follow if you find this useful.

Have a profitable trading week ahead.

*For educational purpose only.

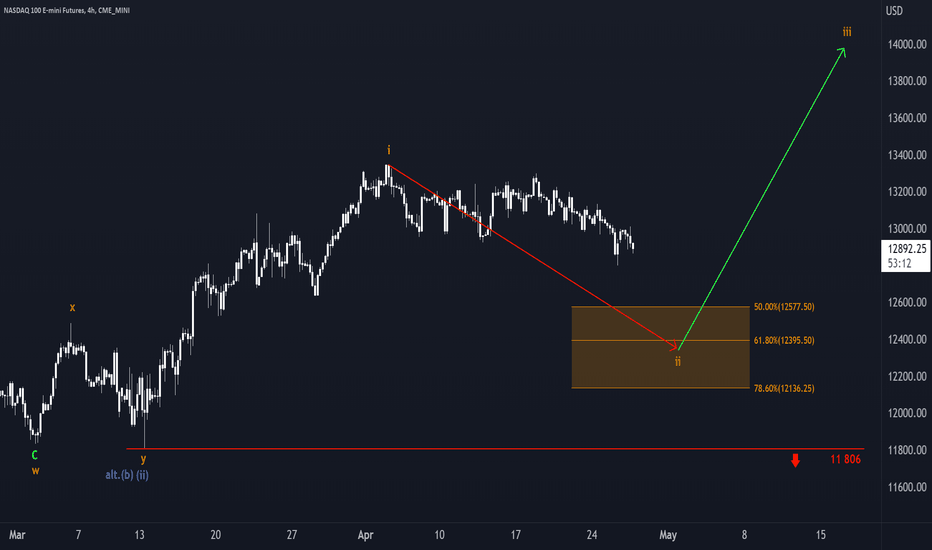

Nasdaq: Tough Sledding 🐌🛷Nasdaq is shuffling on, but the going is tough – to coin a phrase. However, we expect the bears to take more action soon! They should drag the index into the orange zone between 12 577 and 12 136 points, where wave ii in orange should end. Afterward, the bulls should take the helm again, inciting Nasdaq to develop wave iii in orange, which should reach about 14 000 points – providing that the support line at 11 806 points remains intact.

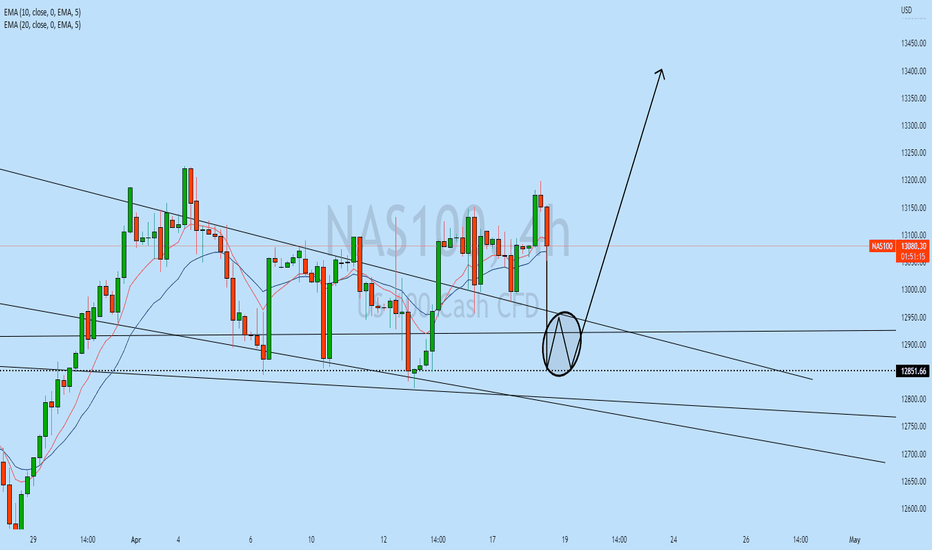

NAS100 top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

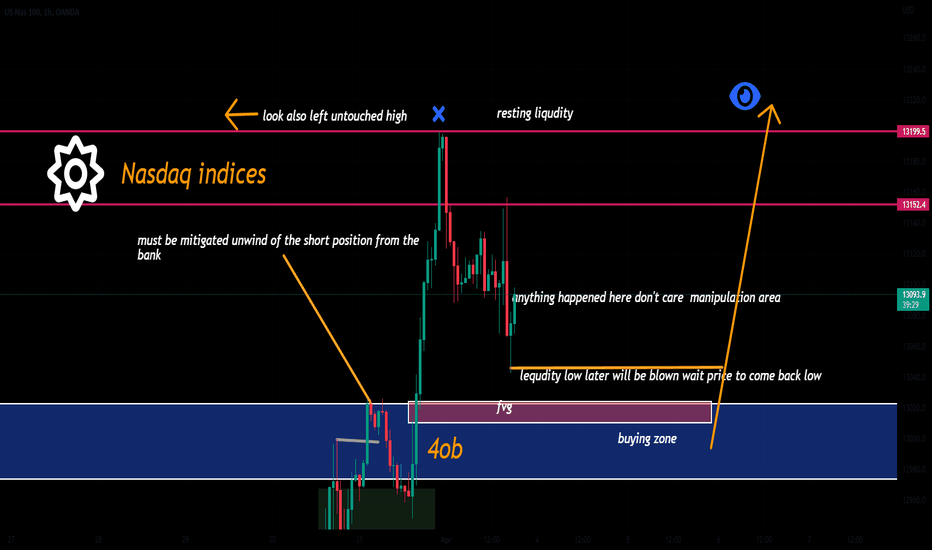

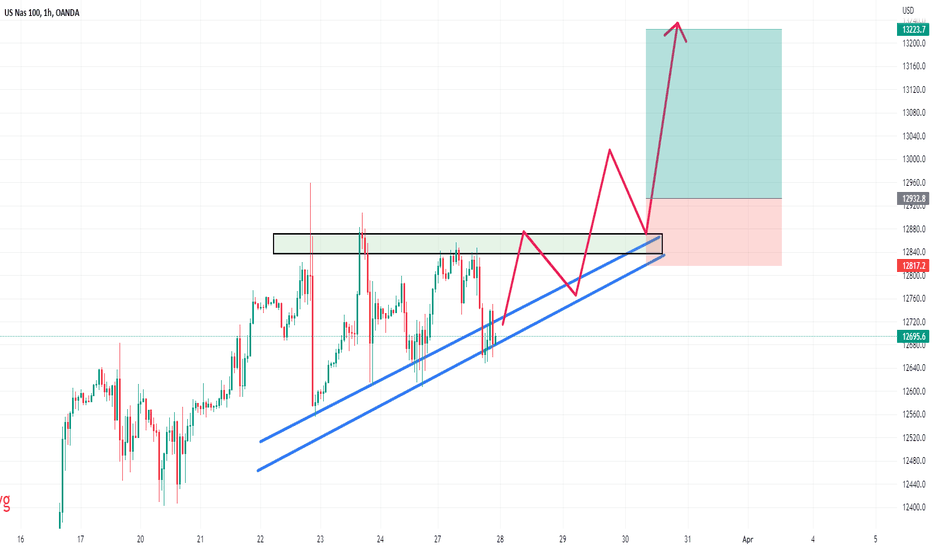

nas100 nasdaq indices nasusd100hello traders nas is setting froming it self for a possible upside can we catch of course it is just being patient to get into our area as far as you know what to look for no fomo no stress wait for session as conflence an execute manage your risk it is a number game good luck with your trading

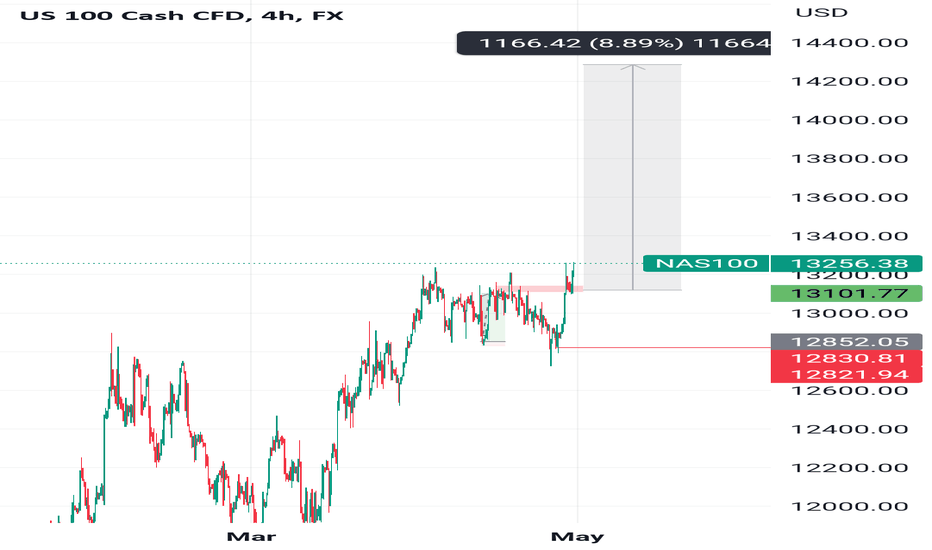

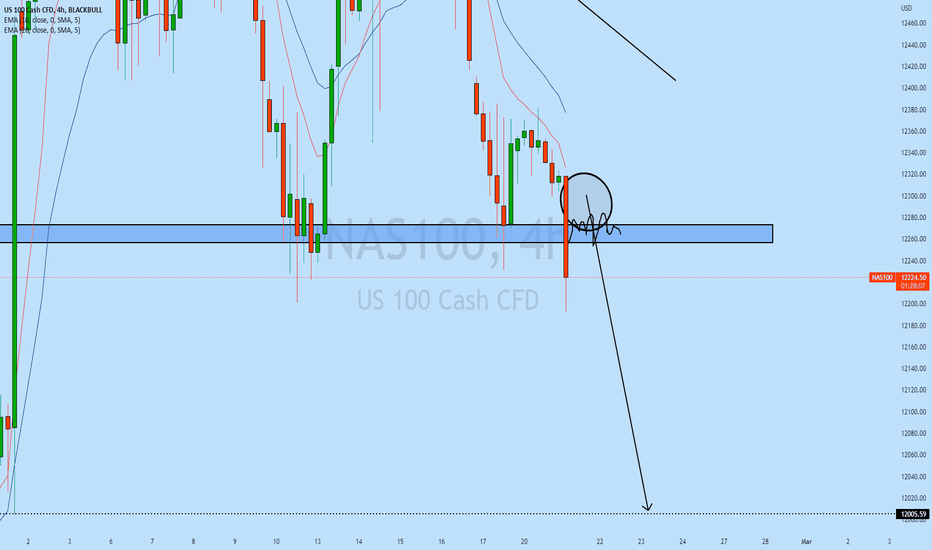

NICE AND SIMPLEComment below if you are seeing what I'm seeing.

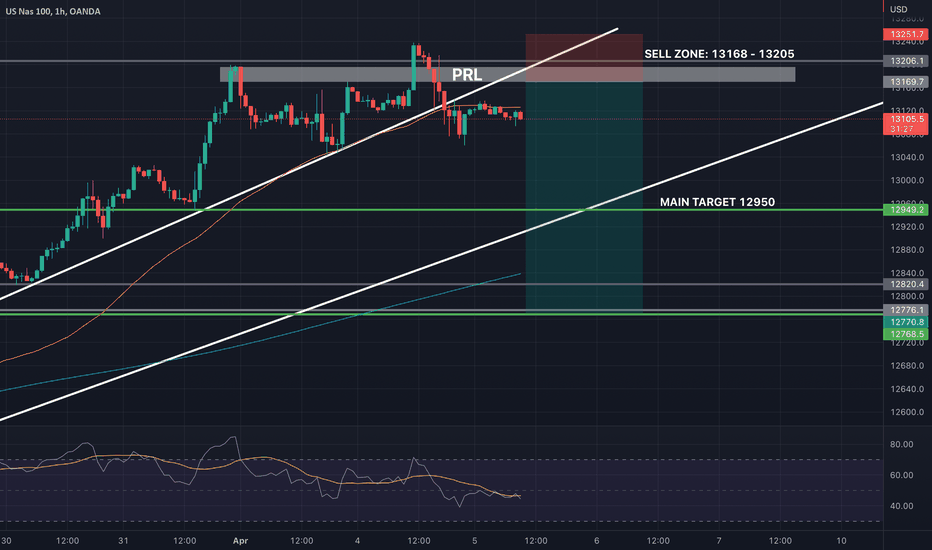

We've been waiting for shorts for multiple reasons, finally we are getting some lovely rejection at resistance 13205 as well as a bearish pattern forming and a break in trend. I am expecting a sell off in our sell zone today to finally break this consolidation zone and take us to 12950.

NASDAQ WEEKLY ANALYSISEIGHTCAP:NDQ100

we are seeing a BULLISH TREND forming on the EIGHTCAP:NDQ100

we can already see that price has already broken resistance and also retesting that area with signs of rejections on that area. So we can possibly anticipate that price could countinue bullish after this

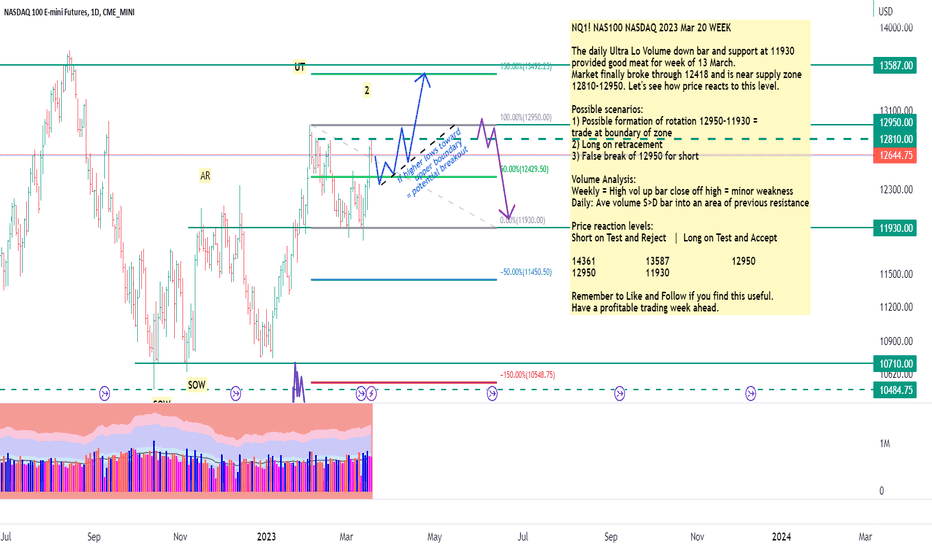

NQ1! NAS100 NASDAQ 2023 Mar 20 WEEK

NQ1! NAS100 NASDAQ 2023 Mar 20 WEEK

The daily Ultra Lo Volume down bar and support at 11930

provided good meat for week of 13 March.

Market finally broke through 12418 and is near supply zone

12810-12950. Let's see how price reacts to this level.

Possible scenarios:

1) Possible formation of rotation 12950-11930 =

trade at boundary of zone

2) Long on retracement

3) False break of 12950 for short

Volume Analysis:

Weekly = High vol up bar close off high = minor weakness

Daily: Ave volume S>D bar into an area of previous resistance

Price reaction levels:

Short on Test and Reject | Long on Test and Accept

14361 13587 12950

12950 11930

Remember to Like and Follow if you find this useful.

Have a profitable trading week ahead.

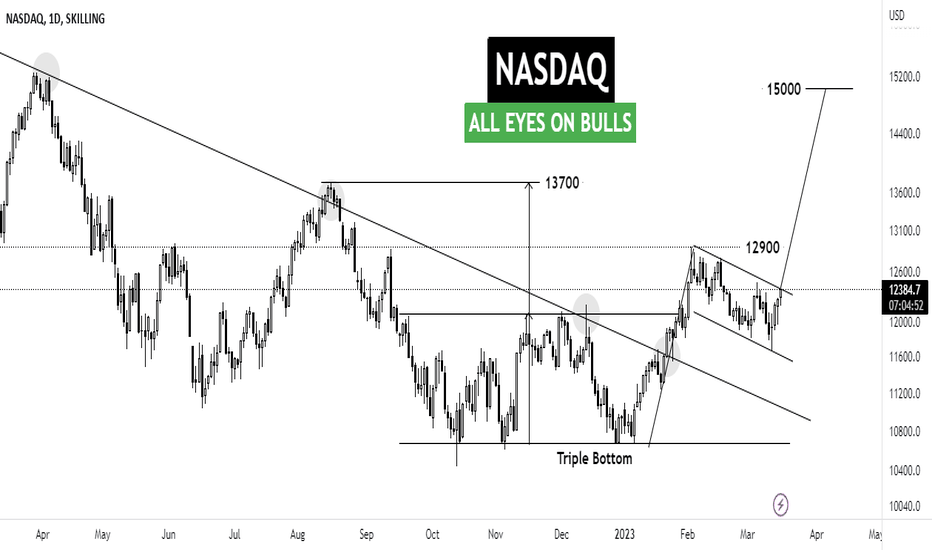

NASDAQ | ALL EYES ON BULLSDespite negativity on banking system default. NASDAQ is on the move with bulls printing new high everyday.

Technically speaking, US100 is trading in bullish flag with the breakout target comes at 15000. But we will move step by step. The upcoming resistance comes at 12900 which is horizontal level.

Previously, NASDAQ printed triple bottom around 10650 where the neckline comes at 12100. The target of triple bottom comes at 13700.

All signs shows strong bullish momentum. Any dip will be buying opportunity with appropiate stoploss.

Let us know what do you think of the idea?

NQ1! NAS100 NASDAQ 2023 Mar 13 WEEK

NQ1! NAS100 NASDAQ 2023 Mar 13 WEEK

Week of 06 March, market gave 300pts from 2 trades.

Market is trapped between 12418 - 11930.

Although daily bar showed little supply for

short term long opportunity, the low volume

means it is cheaper to whipsaw the market.

Trade with caution.

Possible scenarios:

1) Market continues to be range bound between 11930-12418

2) 11930 support long (test of breakout area)

3) 12418 // 11930 continuation short to reach

bottom range of larger rotation zone 10710- 11135

Volume Analysis:

Weekly = Ave supply down bar (non-trend changing)

Daily: No supply ULTRA low vol down

H4 = Supply showed effort no result + Low vol No Supply

down bars

Price reaction levels:

Short on Test and Reject | Long on Test and Accept

13587 12950

12418-11930 11135 - 10710

Remember to Like and Follow if you find this useful.

Have a profitable trading week ahead.

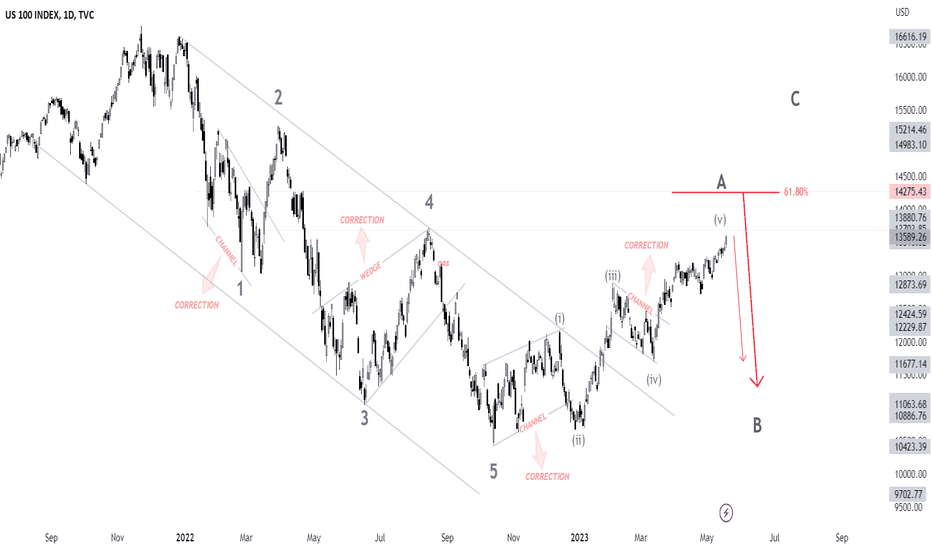

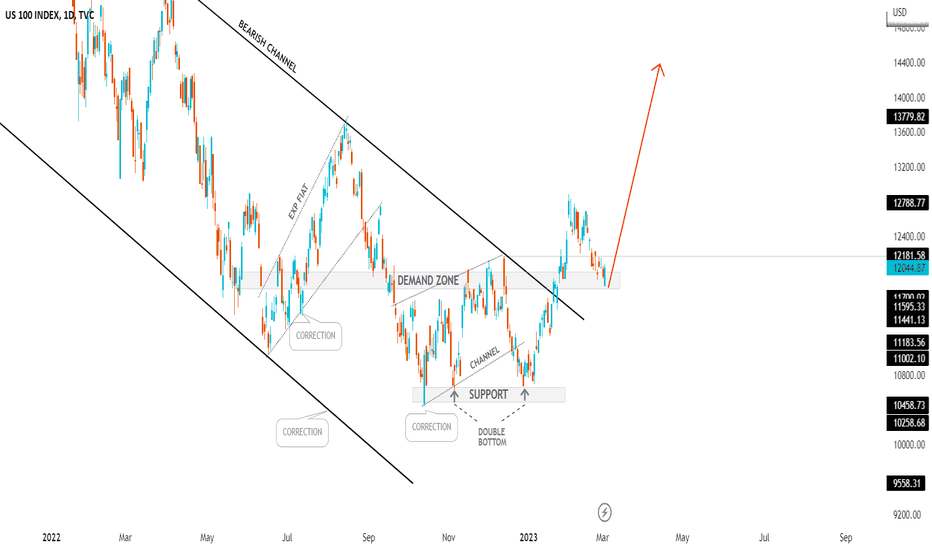

NASDAQ Next Move Pair : US100 - NASDAQ

Description :

Bearish Channel as a Corrective Pattern in Long Time and A Breakout of the Upper Trend Line

Divergence

Break of Structure

Rejecting from the Demand Zone and Retracement Completed

Completed " 12345 " Impulsive Wave and Making its " A - wxyxz " Corrective Wave

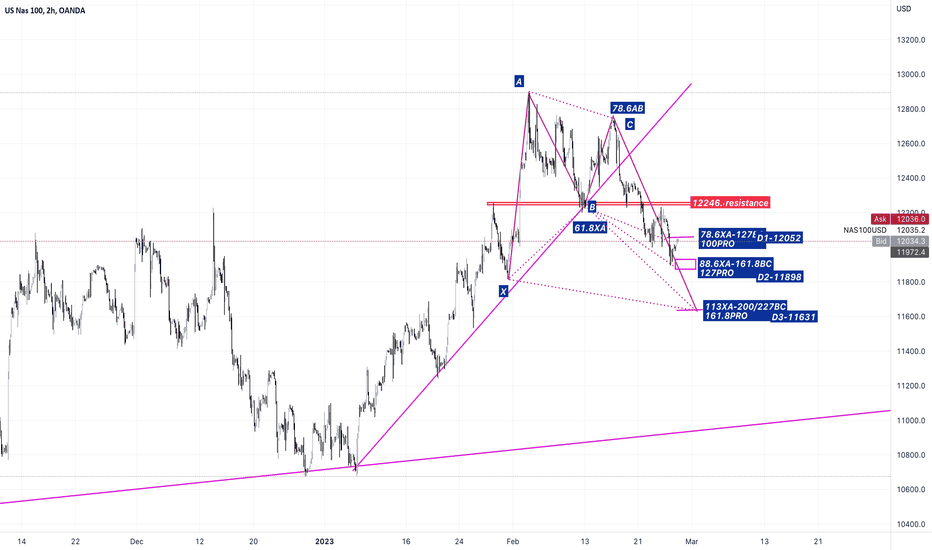

NAS 100After breaking the trend line with a higher slope and breaking the resistance of the B pattern in the range of 12246, it touched two targets in the range of 12052 and 11898. Currently, to reach the third target of D3-11631, the resistance of D2-11898 must be broken.

In general, the trend can decrease to the range of the trend line with a low slope. But the conclusion after the above 3 targets is the best option ahead.

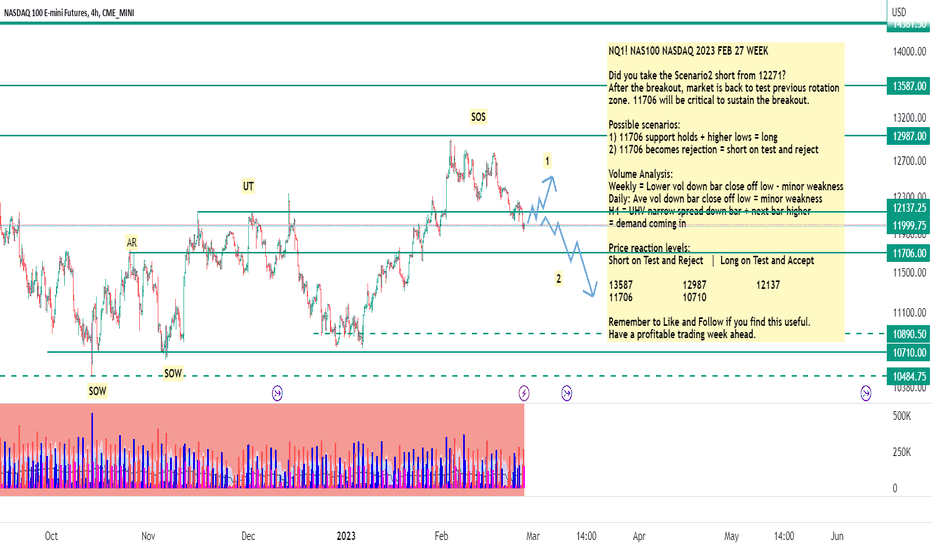

NQ1! NAS100 NASDAQ 2023 FEB 27 WEEKNQ1! NAS100 NASDAQ 2023 FEB 27 WEEK

Did you take the Scenario2 short from 12271?

After the breakout, market is back to test previous rotation

zone. 11706 will be critical to sustain the breakout.

Possible scenarios:

1) 11706 support holds + higher lows = long

2) 11706 becomes rejection = short on test and reject

Volume Analysis:

Weekly = Lower vol down bar close off low - minor weakness

Daily: Ave vol down bar close off low = minor weakness

H4 = UHV narrow spread down bar + next bar higher

= demand coming in

Price reaction levels:

Short on Test and Reject | Long on Test and Accept

13587 12987 12137

11706 10710

Remember to Like and Follow if you find this useful.

Have a profitable trading week ahead.

NAS100 top-down analysisHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.