NATURAL GAS

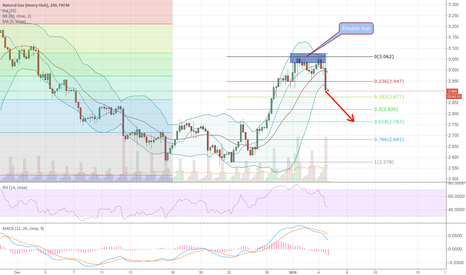

NATGAS Bullish Once MoreNATGAS has has both a strong local and general double bottom and is looking to retest 3.0-3.1 and higher before it sees 2.5 again. Strong gap up over weekend was very predictable as is evidenced from my idea last week.

With both strong fundamentals (bullish report) and strong technicals (respected double bottoms) shorts would be wise to wait and watch for a while.

For those who are getting in late, UGAZ should still be a good buy come market open on Tuesday with a safe selling target of 3.05 (in the NATGAS index) or possibly even higher should we break into the fib channel at 3.1 or so.

Stay safe and good luck!

EDIT:

Attached is an image of the local double bottom in case you can't see it because of my text bubble.

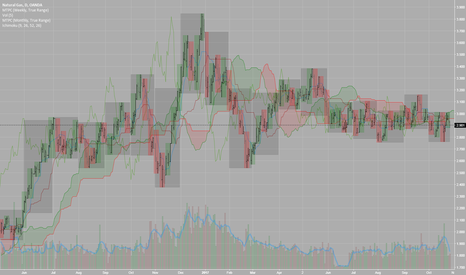

NatGas - NutGasIn my last idea I sugggested try to get in the trade somehow because the consolidation is over sooner or later and we are breaking out.

Though we couldn't catch the exact bottom and the position got risky as we broke down of the range all who were able to hold through the panic are in profit today. There was an undercut low with a false breakdown of the range but today it just seems it was a final shakeout .

My only concern : is that possible we had a mild ICL? Triangles and ranges are screwing the cycles so it's almost impossible to trade them based on cycles. We have to assume that the ICL is behind us on the 1st of November. We broke out of the range last week Thursday and the next resistance ahead of us at 3.161$.

When a multi month consolidation like this breaks it bounces hard. So all who are not in the train will have to buy into the overbought conditions or wait for the never coming pullback. I still got many messages how to enter into a NatGas or UGAZ trade right now.

It's really hard to help when the train is leaving the station. We entered early and had to bear a drawdawn where price seemed to go much lower. Contrarians didn't help us to hold the position, too... But it was still easier to enter early than to enter a position at the exact bottom. I saw a few people below my post who entered near to the exact bottom or added to the position at the lows. You can still check who had the balls to enter there and also post in real time .

But the hardest part is just coming in the following weeks. Sit tight and let the winners run. It doesn't matter if you caught the exact bottom or not. The big money will be in the uptrend in the next 2 month.

I still think that commodities are in a new bull market. Natty also holding above the 2015 and 2016 yearly lows . The pattern has the characteristic of accumulation which wants to break to the upside.( Volume is supporting the accumulation)

I set the 200 SMA on the chart. We might or might not have a pullback to the 200 SMA from the next resistance level before breaking higher.

Last year the seasonal rally was relentless. There was not much of a pullback. Though the ICL a few days ago was not that deep like last year: the consolidation was long enough to have a big rally into year end. RSI is already overbought so it's possible we will have a pullback, but it can also run for weeks in the overbought territory and before the daily cycle tops it will print an RSI divergence with higher high in the price. MACD still has a long way to run.

LONG follow through idea. We are long from 2.855.

We traded successfully last year's winter rally:

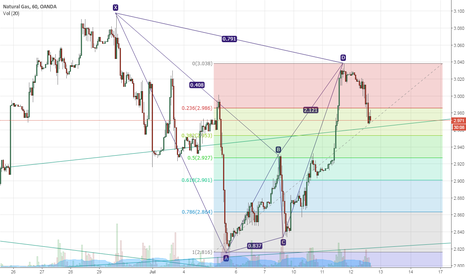

NatGas: An overviewThe new low of 31/10/17 made a new probable path for NatGas to take in the coming time forward.

While this recent low may have been the low, we might risk going a bit lower.

Based on monthly supports/resistances, a visit to approx 2.589 seems quite reasonable before reversing.

Invalidated in case of lower than 2.540.

Good luck.

SHORT: NATGASUSDI've been short for a while...

Two scenarios for next week:

1. Natural Gas continues its sell-off and heads towards ATL, if three conditions are met:

1. Daily breaks price range

2. Daily RSI manages to go sub 30 with adequate volume

3. Daily STOCHRSI breaks 30 with adequate force

2. Natural gas violently rebounds Friday or Monday and heads for top of given price range if:

1. Daily RSI rebounds ABOVE 30 (should not cross)

2. STOCHRSI rebounds at 30 or above

Good luck

NatGas - Sun of the BeachI think most of you who were trading Natty in the last few months had mentioned the title at least once or twice.

It's toying with us. So there are 2 options :

1. Get out and find some other vehicle.

2. Try to trade it somehow because the consolidation will be over sooner or later.

Those who follow me for a while know which pill I have chosen.

At the last NatGas idea I suggested a buying at or before 9/11 based on the cycles. For a few days it looked good but after a breakout of the triangle we broke down from the triangle. Triangles are screwing the cycles so it's almost impossible to trade them based on cycles.

Most probably we printed the ICL on the 4th of August and the 9th of October was a the new intermediate cycle's first daily cycle low.

When the triangle breaks up and down in a few days the pattern becomes almost impossible to trade.

I assume that commodities are in a new bull market. Natty also holding above the 2015 and 2016 yearly lows and day after day it's losing the chance to break lower. This pattern is a sign of accumulation which wants to break to the upside.(Volume is supporting the accumulation idea)

When? Maybe tomorrow , maybe next week, maybe only January. But when a consolidation like this breaks it bounces hard. So all who are not in the train will have to buy into the overbought condition or wait for the never coming pullback.

So my suggestion is here to have some kind of starting position. What I think even if we are breaking down we will not break below 2.387$.

2.387$ is 17% lower than today's price . So all who takes this trade will have to prepare for one more drawdown .There might or might not be a drawdown but if it comes I will be buying there also.

The break above the 200 SMA will be an important sign that the party is starting. Notice how the 200 SMA stopped the rally again and again. The next significant breakout above it will hold.

Instead of watching the triangle I will watch the above range from today.

Natgas: 25-26Natgas hasn't impressed much in this intermediate cycle, trend has been downwards, sideways.

The last 25-26 days of an intermediate cycle are normally rough for natgas. My main trend-change I expect approx Sept 27. This chart would place a low in at Sept 15th, so in the later half of September, I expect a trend-change to occur to the upside.

I will hold my short positions until Sept 15th and start with long entries from around that date.

NAtGas - Buying before 9/11We had our convincing bounce from the lower trendline near to the 400 SMA.

I was close to call the bottom a few days ago. But it's still not ready yet.

The last bounce was showing weakness. We weren't able to tag nor the upper trendline of the triangle nor the 200 SMA.

We are waiting for an intermediate low at this point in Natty. A rally out of an intermediate low is almost always strong, price should not hesitate to break the trendline or the 200 SMA.

After Friday's close it seems we are attacking the lower trendline again.

The plan is the same as it was in the previous idea. The difference is the time frame: we need to buy before 9.11.

The cycle cannot stretch longer than that date.

The plan is to Buy between 2.73 and 2.5$.

I still would like to see the RSI and SlowStoch become oversold extremely . And we still mustn't break below 2.387$ ( the previous ICL).

I modified a little bit the lower trendline : the last drop was just a false breakdown.

Bearish for 1 month NATGASUSD NATGASUSD already broke big wedge pattern, and trap inside parallel channel down,

this is a good moment to follow nearish after bearish flag breakdown yesterday, with target at double bottom ( 2.591 )

Disclaimer :

This analysis not include personal feeling/opinion, and pure base on technical analysis

Trading foreign currencies can be a challenging and potentially profitable opportunity for investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk appetite. Most importantly, do not invest money you cannot afford to lose.

please inform me with post a comment if it reach some critical point/break pattern, reach target/reach stop level, or if there is any question about this analysis/need new update.