Natural Gas Forecast: Working Off Selling PressureThe natural gas markets have gone back and forth during the session on Thursday, hanging about the $3.80 level. Over the last year or so, I have been asked to do less analysis on natural gas, but quite frankly my email box has been full of questions as to what is going to happen with natural gas next. Retail traders have no idea, nor do some professional traders for that matter, that this contract is based solely upon the United States, meaning that what is going on in Europe or Asia has very little effect. In fact, the United States only exports 12,000,000,000 ft.³ a year, which seems like a lot but it is not.

Currently, Rotterdam gas futures are trading at about nine times what the Henry Hub contract is. That can bring in a little bit of demand but transporting natural gas across the ocean is not easy. Because of this, a lot of retail traders that I have been contacted from have lost a fortune in this contract over the last month or so. It is because they do not understand that they need to pay attention to US weather patterns, and basically ignore what is going on in their own backyard.

If you did not know this, do not be ashamed. I have recently had a conversation with somebody who runs a larger commodity fund who had no idea that natural gas contracts were so localized. He trades millions of dollars, which tells you just how uninformed some people can be. That being said, I felt the need to do this video due to the fact that somebody of you have been losing money as you are watching problems with Vladimir Putin delivering gas to the EU, etc.

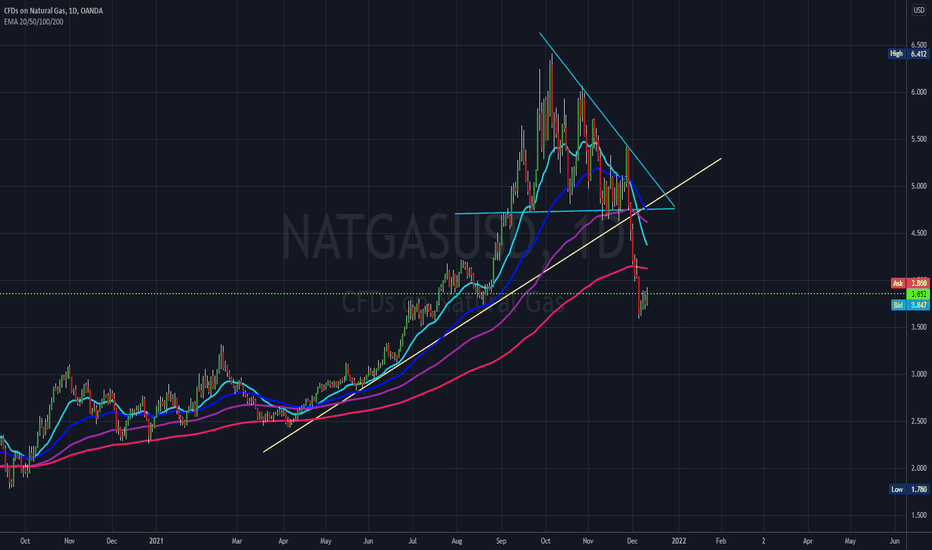

Temperatures in the United States should be much milder than initially thought for most of the winter, meaning that the United States, which is absolutely swimming in natural gas, will continue to see lower pricing. We have recently gapped lower, and I do think that we will try to fill that gap as most futures markets will tend to do. I will be shorting this contract of the first signs of exhaustion near the 200 day EMA which happens to be at the top of the gap, right around $4.16. We have seen the high for the winter, as we are trading the January contract already, meaning that before you know it will be trading springtime contracts.

NATURAL GAS

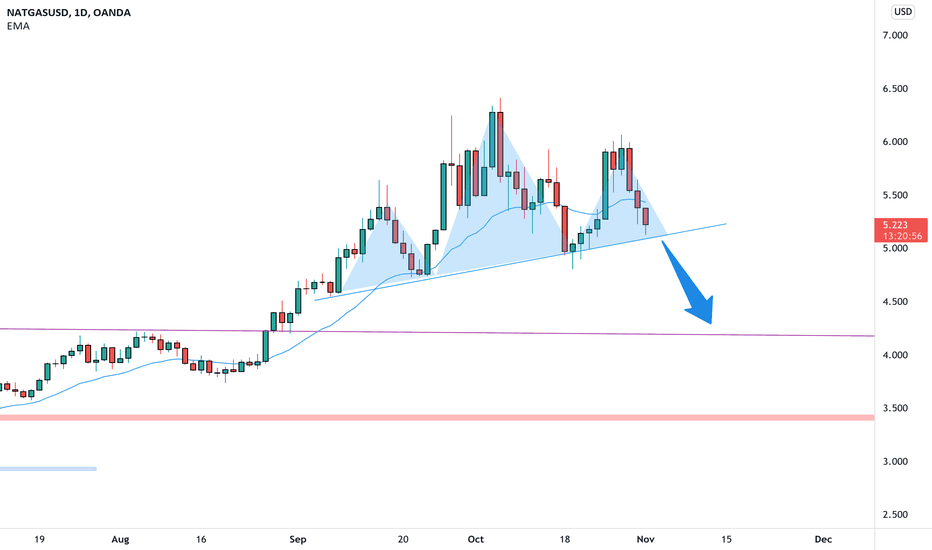

NATGAS a head & shoulder at the top 🦐NATURAL GAS after the bull run is losing momentum.

The price on the daily chart is creating a heads and shoulder and according to Plancton's strategy if the price will break below the neckline and satisfy the A ACADEMY rules we will set a nice short order.

–––––

Follow the Shrimp 🦐

Keep in mind.

🟣 Purple structure -> Monthly structure.

🔴 Red structure -> Weekly structure.

🔵 Blue structure -> Daily structure.

🟡 Yellow structure -> 4h structure.

⚫️ Black structure -> <4h structure.

Here is the Plancton0618 technical analysis , please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of the Plancton0618 strategy will trigger.

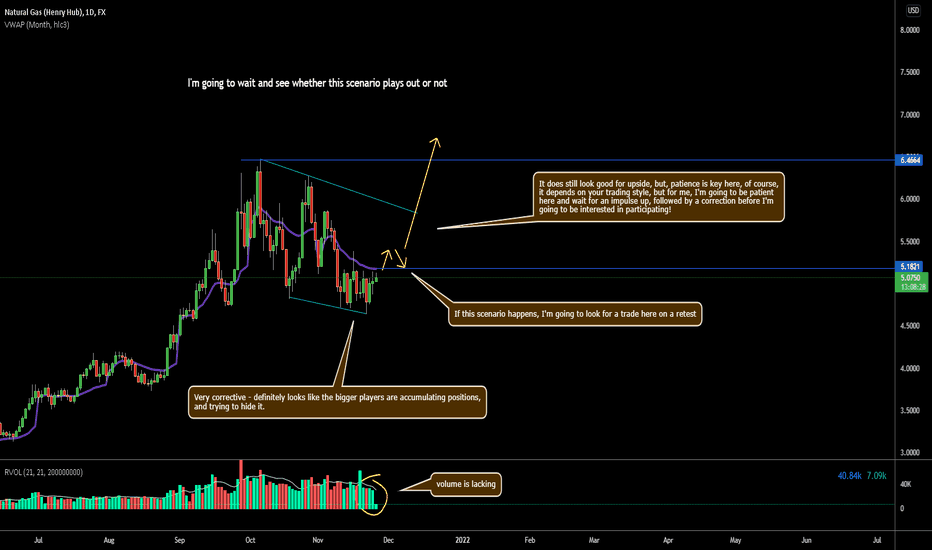

natural gas- daily/weeklyNatural broke the head and shoulder pattern and it had to gave a move of 3$.

With weekly COT data, larger trader are slowly increasing their position.

At this juncture, going for short is not a recommendation.

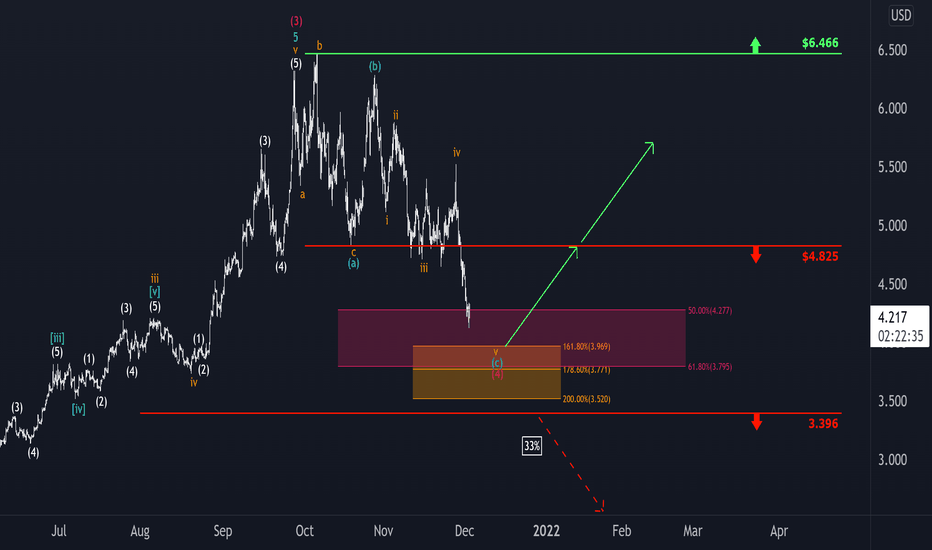

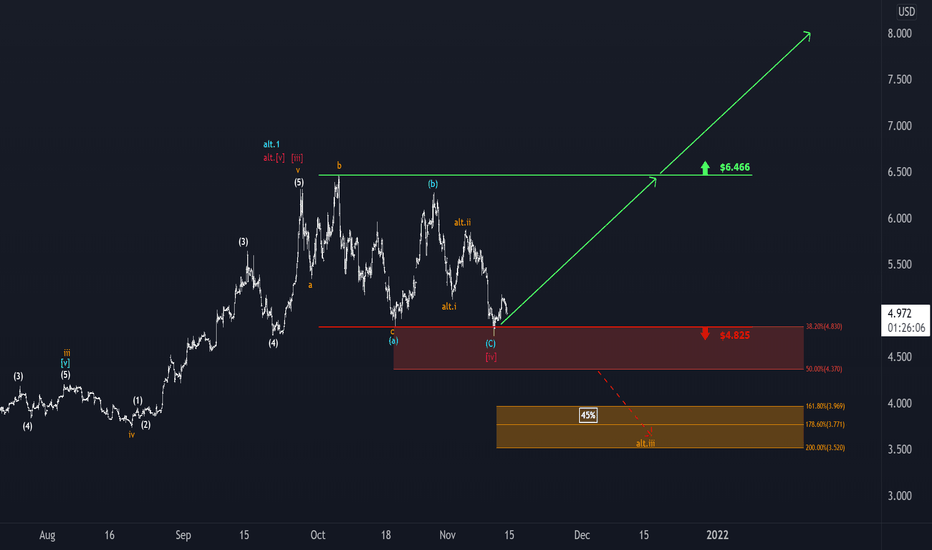

NatGas: There is Room! 🔥🔥🔥NatGas is extending the correction way below the mark at $4.825. Now, there is still some more room left at the bottom. In total, we expect the course to fall between $3.969 and $3.795. Ideally, the turnaround will happen here. If we, however, fall below $3.396, greater corrections will be realized here.

It's getting close!

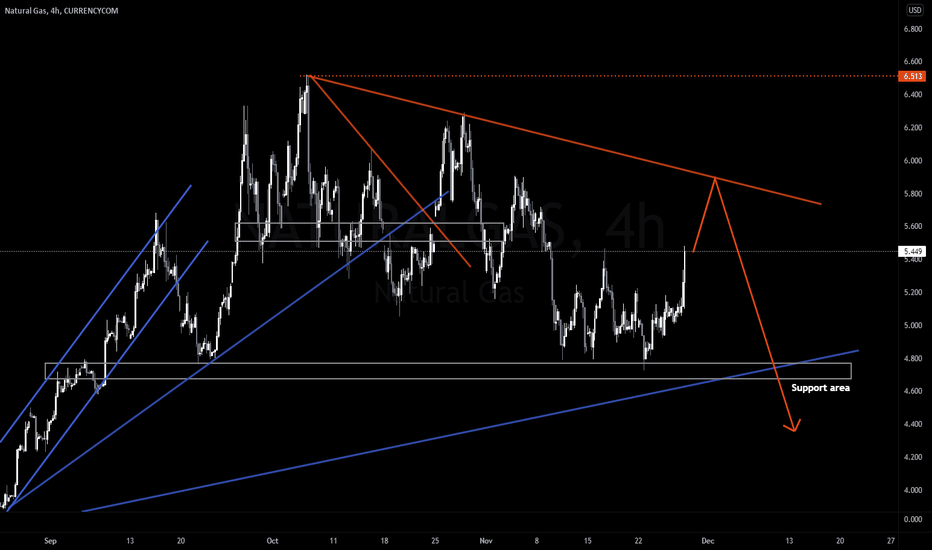

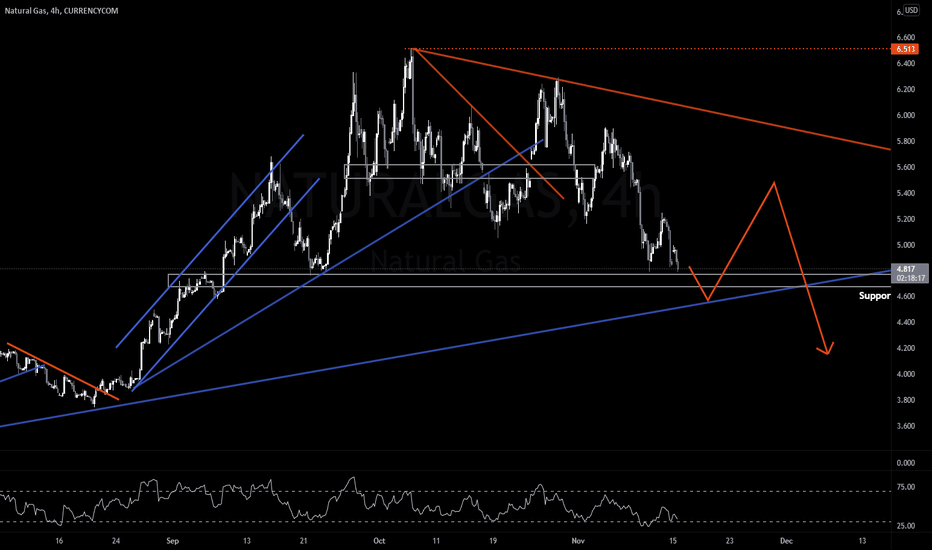

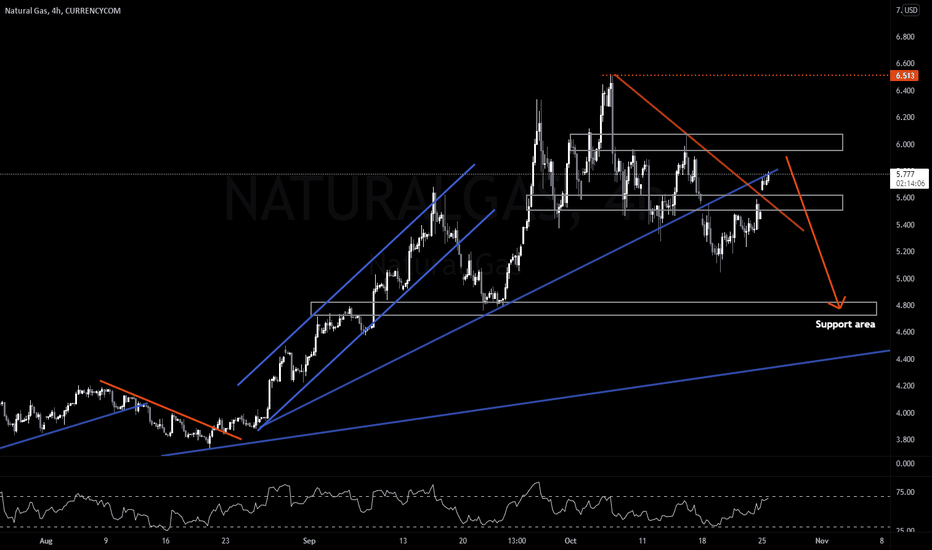

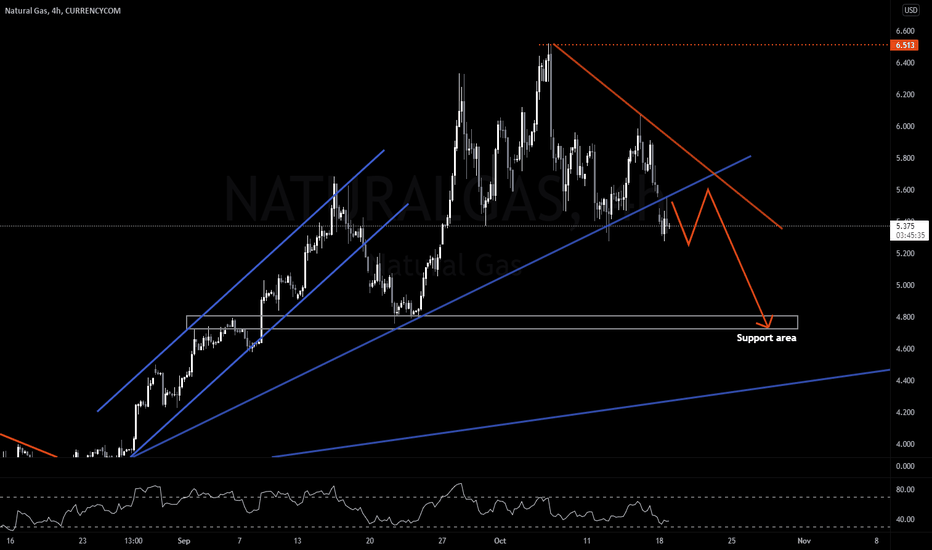

NATURAL GAS – Week 48 – Expecting a trendline rejection.Hello traders,

For this week we are expecting Natgas to start on a high and reach the trendline, before making another drop and break the support area highlighted on the chart.

On the bigger picture (Daily / Weekly timeframe) this will only act as a correction for more bullish momentum.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

Complex analysis of "Natural Gas", the strongest analysis Complex analysis of "natural gas", the strongest analysis - know the upcoming price movement

Analyze natural gas prices in the short or medium term

The target is shown in the drawing. If Target 2 is breached upwards and stability, we will take off to the top

The analysis fails if it falls below $4.75

Several schools of technical analysis were used in this drawing. I hope you like it

Like - follow me

Thursday: Natural Gas - Week 47Hello Traders! Check Related Idea for market context!!

I will update my idea as the trade progresses if any changes occur and my analysis is wrong, or need to be adapted to the new development of price-action.

Thanks for the support!

-----------------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------------------------------------------

SMASH that follow button! 👍

💡 Leave a comment and/or message me on how I can improve and provide better content, I'm open to suggestions to create a better experience for you!

RISK DISCLAIMER: Please be advised that I am not telling anyone how to spend or invest their money. Take all of my videos as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this channel. This content is for educational purposes only and is not tax, legal, financial, or professional advice. Any action you take on the information in this video is strictly at your own risk. We, therefore, recommend that you contact a personal financial advisor before carrying out specific transactions and investments. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Inotfancy.com and all individuals affiliated with this channel assume no responsibility for your trading and investment results.

Saturday: NGAS - Week 46Hello Traders! Check Related Idea for market context!!

I will update my idea as the trade progresses if any changes occur and my analysis is wrong, or need to be adapted to the new development of price-action.

Thanks for the support!

-----------------------------------------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------------------------------------------

SMASH that follow button! 👍

💡 Leave a comment and/or message me on how I can improve and provide better content, I'm open to suggestions to create a better experience for you!

RISK DISCLAIMER: Please be advised that I am not telling anyone how to spend or invest their money. Take all of my videos as my own opinion, as entertainment, and at your own risk. I assume no responsibility or liability for any errors or omissions in the content of this channel. This content is for educational purposes only and is not tax, legal, financial, or professional advice. Any action you take on the information in this video is strictly at your own risk. We, therefore, recommend that you contact a personal financial advisor before carrying out specific transactions and investments. There is a very high degree of risk involved in trading. Past results are not indicative of future returns. Inotfancy.com and all individuals affiliated with this channel assume no responsibility for your trading and investment results.

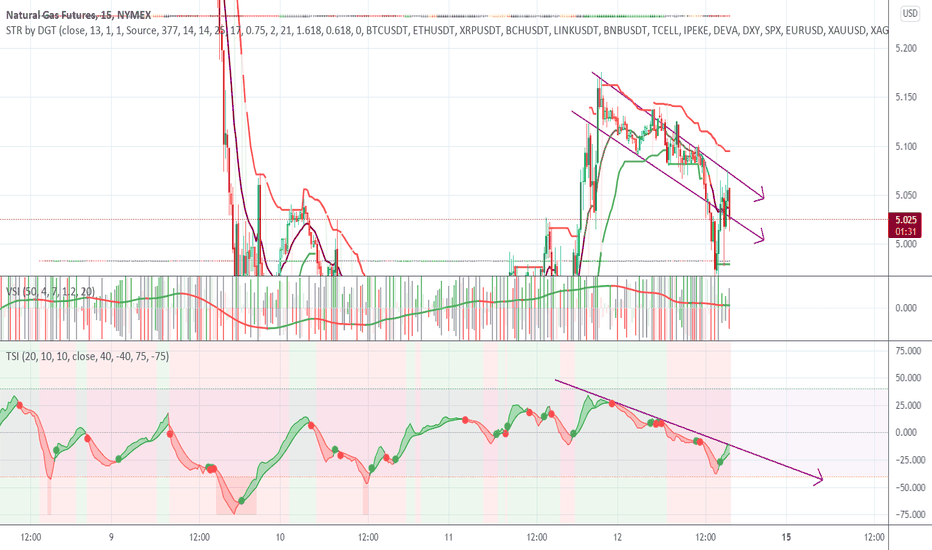

NG short option There were no major changes to the temperature outlook overnight, with the American and European weather models trending warmer around the middle of next week but shifting slightly cooler for the Nov. 19-21 time frame, according to the firm.

Forecasts continued to show “exceptionally light demand” for the remainder of the current week before a transition to higher demand this weekend into next week as chillier temperatures move over the Great Lakes and Northeast, the firm said.

“The forecast reflects this typical response,” the firm said. “However, lower confidence is in the South and East versus elsewhere, as associated pattern correlations lack directional significance here.”

NATURAL GAS – Week 46 – Pullback to follow.In the coming week, we anticipate the price to continue the downtrend towards the blue trendline. Afterward, we expect a pullback to occur that will only act as a trigger for a future bearish impulse. (see orange arrow)

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

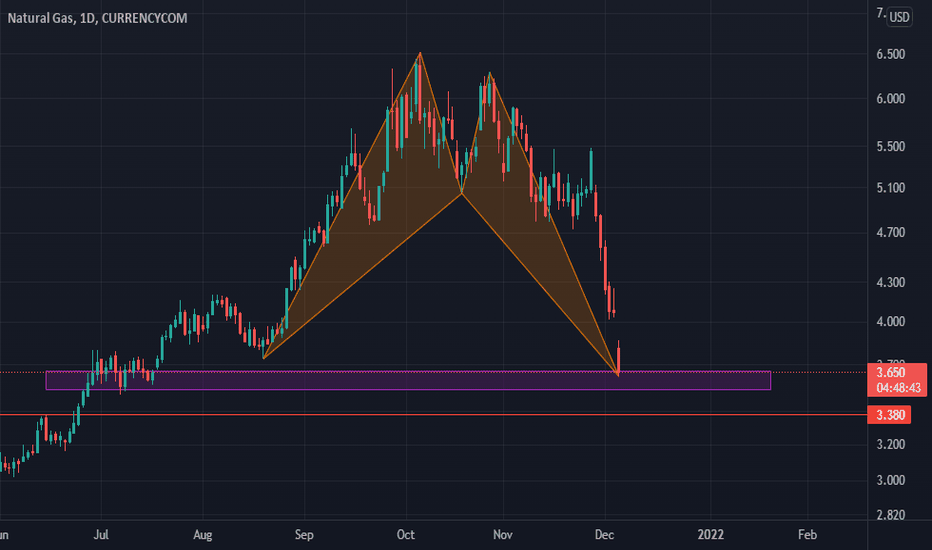

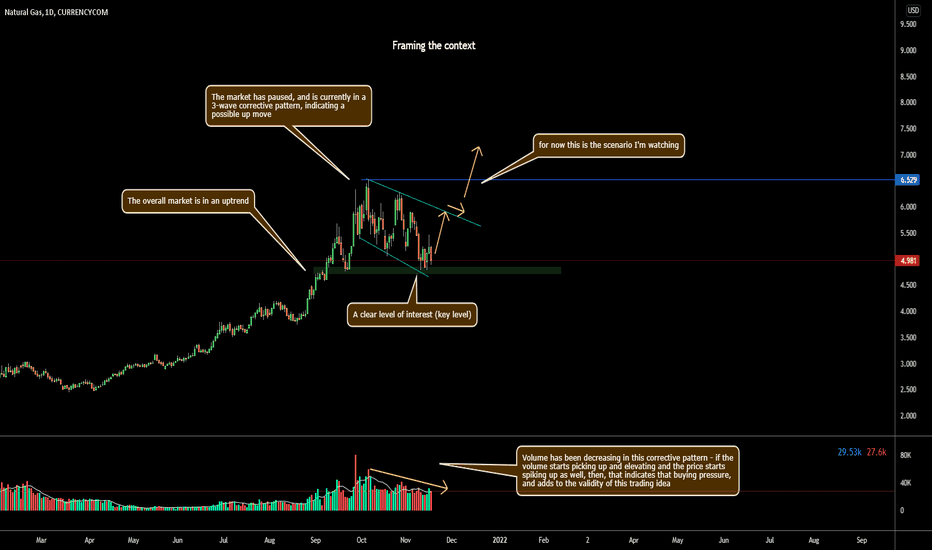

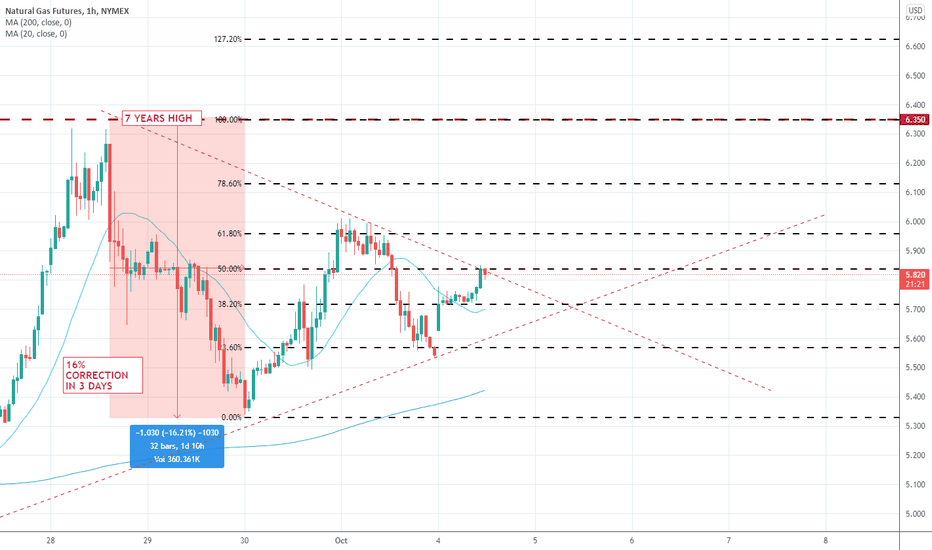

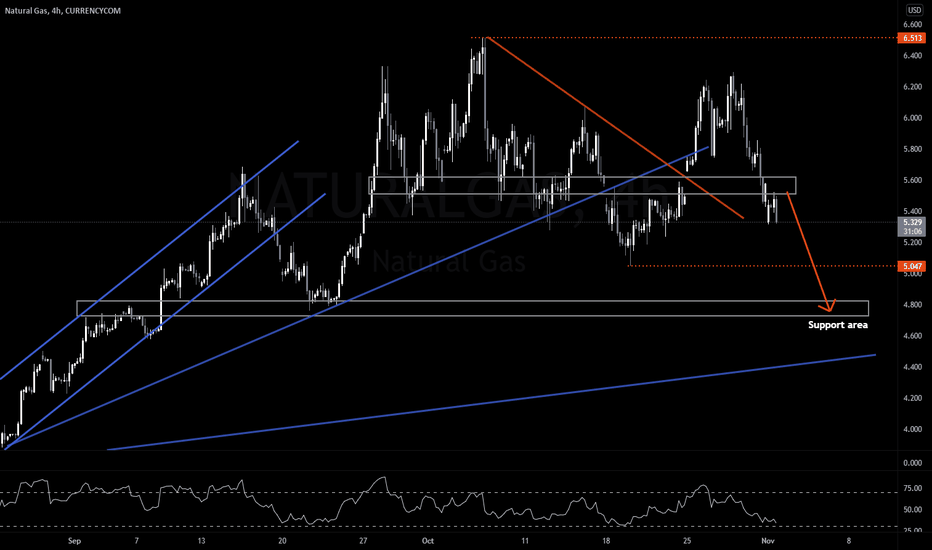

NATURAL GAS TESTING THE 7 YEAR HIGH RESISTANCENatural Gas has reached 7-year high resistance on 28th of September. As soon as reached that level a major 16% correction noticed in just 3 days, which found a resistance at the bottom of a symmetrical triangle.

It's been following that descending triangle since then.

Key date is today or tommorow to see if the uptrend will continue or we will see a trend reversal.

Here are the scenarios:

LONG:

If price breaks above 50% of the correction retracement (appr. 5.85) then we expect to retest the 7-year high. Just wait for the break to be confirmed.

OPEN POSITION: 5.85

STOP LOSS: 5.7

TAKE PROFIT: 6.1 minor OR 6.35 major

SHORT:

If price break below the bottom of the triangel (appr. 5.65) then we expect the price to retest the bottom of the correction at 5.30

OPEN POSITION: 5.65

STOP LOSS: 5.7

TAKE PROFIT: 5.6 minor OR 5.3 major

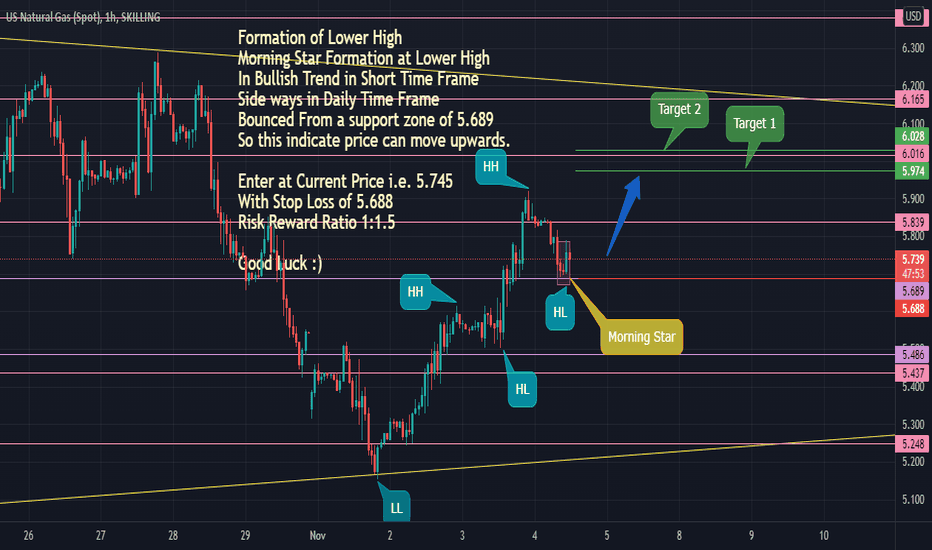

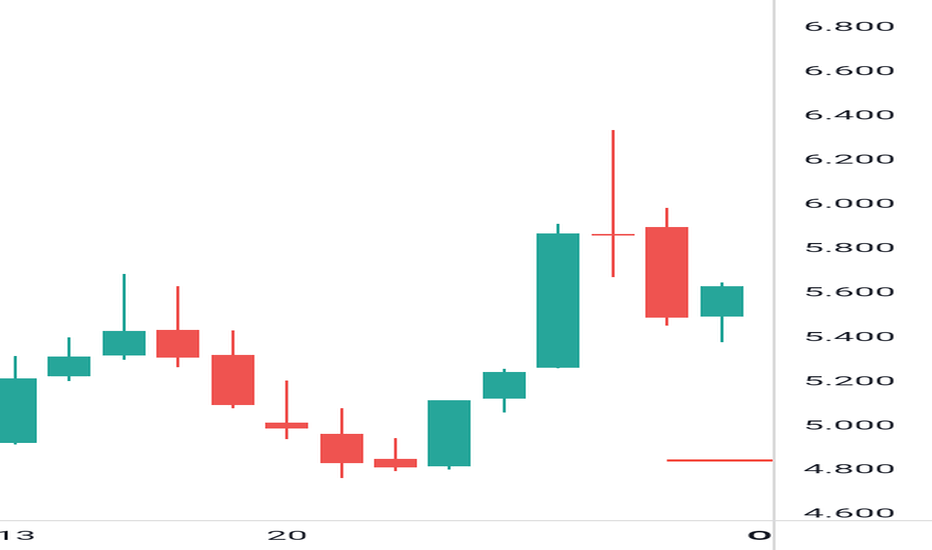

NATGASFormation of Lower High

Morning Star Formation at Lower High

In Bullish Trend in Short Time Frame

Side ways in Daily Time Frame

Bounced From a support zone of 5.689

So this indicate price can move upwards.

Enter at Current Price i.e. 5.745

With Stop Loss of 5.688

Risk Reward Ratio 1:1.5

Good Luck :)

SKILLING:NATGAS

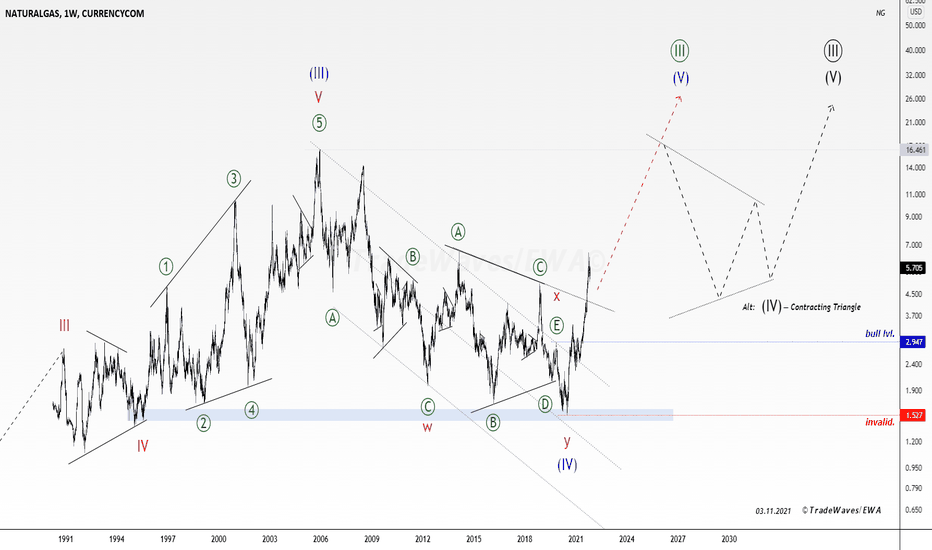

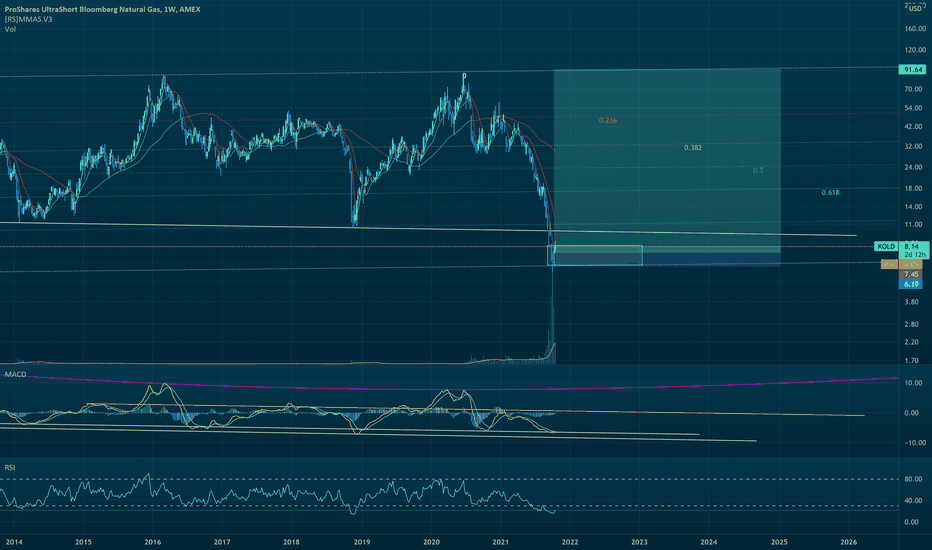

🔥 Natural gas will rise in price three times 🥶●● Preferred count

● NATURALGAS ( Currency.com ) 🕐TF:1W

Globally, the price of natural gas is driven by the third wave of the Grand Supercycle , within which the final wave (V) is developing. Wave (IV) that preceded it took the shape of a w-x-y double zigzag , although one should not exclude further complication before a sideways correction.

● NATGASUSD ( OANDA )🕐TF:1D

Behind the most powerful part of the wave ① of I — Third of a Third — 3 of (3) , on the horizon — a less rapid growth in the fifth waves, followed by a series of downward corrections.

● NATGASUSD ( OANDA )🕐TF:4h

A correction by wave 4 is expected in the form of an expanded flat , the target for which may be the area of the previous fourth .

● NATGASUSD ( OANDA )🕐TF:2h

Wave ⓒ of 4 , presumably, is unfolding the ending diagonal .

●● Alternative count

● NATGASUSD ( OANDA )🕐TF:2h

As an alternative count — wave 4 of (3) is a running contracting triangle . This interpretation implies the resumption of growth within wave 5 from the current levels.

Long position under the conditions of the implementation of the main scenario seems to me less risky, but the alternative count also offers good opportunities for long at current prices.

NATURAL GAS – Week 44 – New low inbound.In the previous week, the price broke the trendline and made a sharp bullish move without breaking the top and then it started to reverse.

In the coming days, we are expecting the price to make a small pullback and head towards the support level.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

NATURAL GAS – Week 43 – Will the support hold?In the previous week, the price corrected without giving us the bearish wave that we anticipated.

In the coming days, we are expecting the price to fall from the confluence between the trendline and the resistance level and reach the support.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

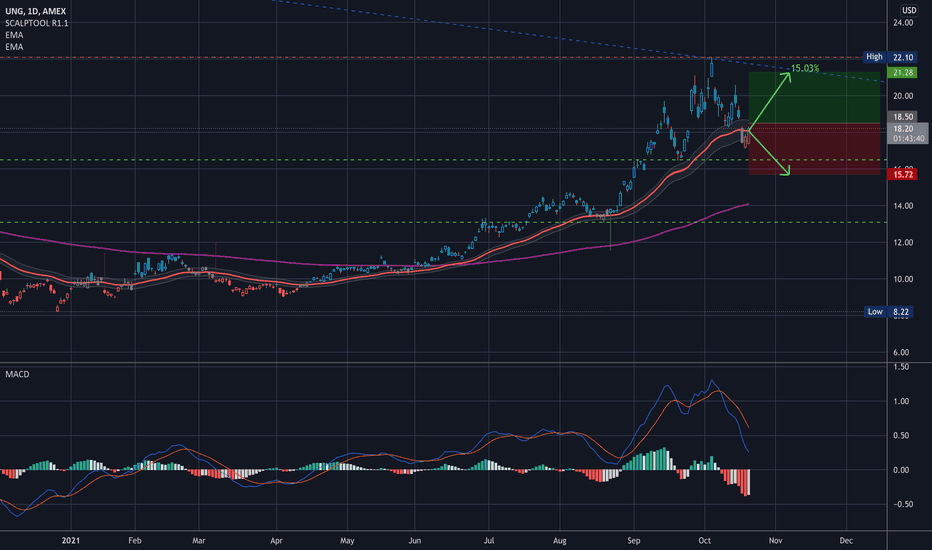

$UNG - Key Levels and Analysis$UNG - Key Levels and Analysis

Would love to get one more good natty swing…

Sell target 21.28

Or

Double target 15.72

——————

I am not your financial advisor, but I will happily answer questions and analyze to the best of my ability but ultimately the risk is on you. Check out my ideas, but also do your due diligence.

If you want me to analyze any stock or ETF just leave me a comment and I’ll do it if I can.

Have fun, y’all!!

Nat Gas. Short ▶ Targets on Chart Options play for a short on natural gas. If you are trading there is an obvious place to put your stop-loss above Tuesday's high. With the way Nat Gas has been volatile the past few days I also have a second sell limit entry just below 5.7. Targets are set out on the chart.

Please see the other ideas below as I am still holding (options) and i am also confident that they will come to fruition.

These thoughts are my own ideas based off my own analysis. Please do your own research before putting your own money into the markets.

NATURAL GAS – Week 42 – Short-term depreciation.In the previous week, the price moved slowly as it entered a deeper consolidation phase.

In the coming days, we are expecting a trendline breakout followed by a small correction that will increase the chances for the market to drop into a bigger degree correction.

Trade with care.

Best regards,

Financial Flagship

Disclaimer: The analysis provided is purely informative and it should not be used as financial advice. Remember that you need a plan before you start trading; so, take this knowledge and use it as a guidebook that will ultimately help you understand the market and easily predict your next move.

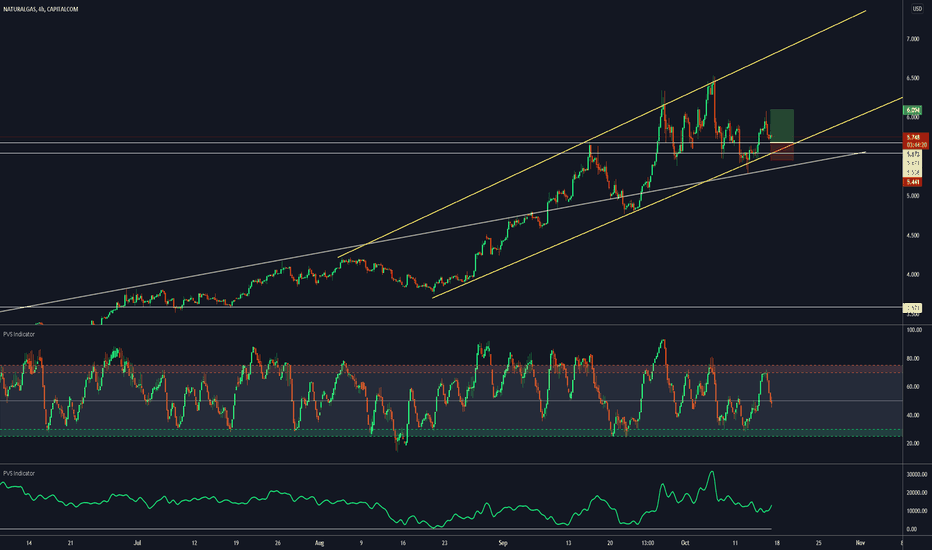

Gas Long SetupGAS Long Setup

🔵 Entry Level: $5.673

🟢 Take Profit: $6.094

⛔ Stop Loss: $5.441

Reasons:

- So far the price is respecting the ascending channel;

- I believe the price may bounce off the lower trendline in the area between $5.535 and $5.670.

Game Plan: If the price goes through the lower trendline (yellow), which at the moment acts as a support level, then I will be looking to open a short position on a retracement unless the 2nd trendline (white) acts as another support level.

NATURAL GAS : LONG POSITIONS SETUP | PRICE WILL GROW...Welcome back Traders, Investors, and Community!

Check the Links on BIO and If you LIKE this analysis, Please support our Idea by hitting the LIKE 👍 button

Traders, if you like this idea or have your own opinion about it, please write your own in the comment box . We will be glad for this.

Feel free to request any pair/instrument analysis or ask any questions in the comment section below.

Have a Good Day Trading !