Ndxlong

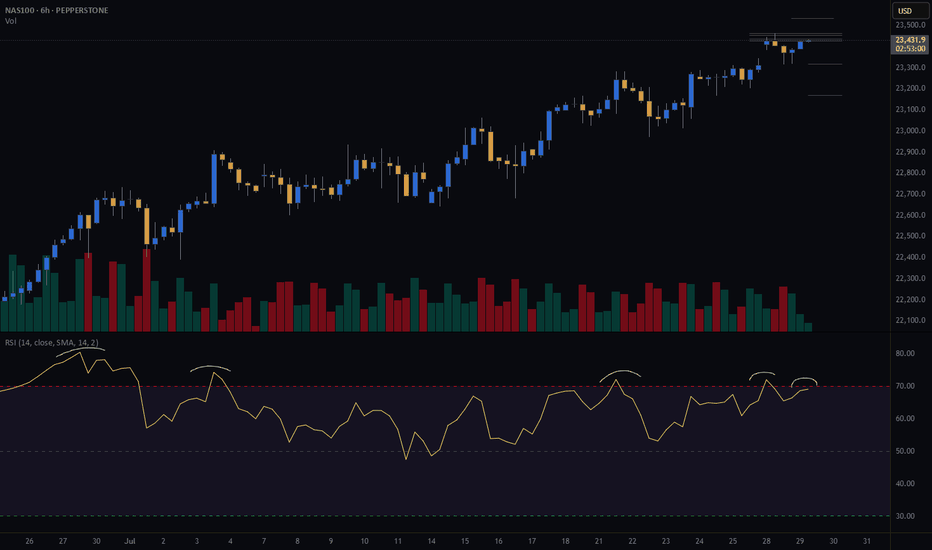

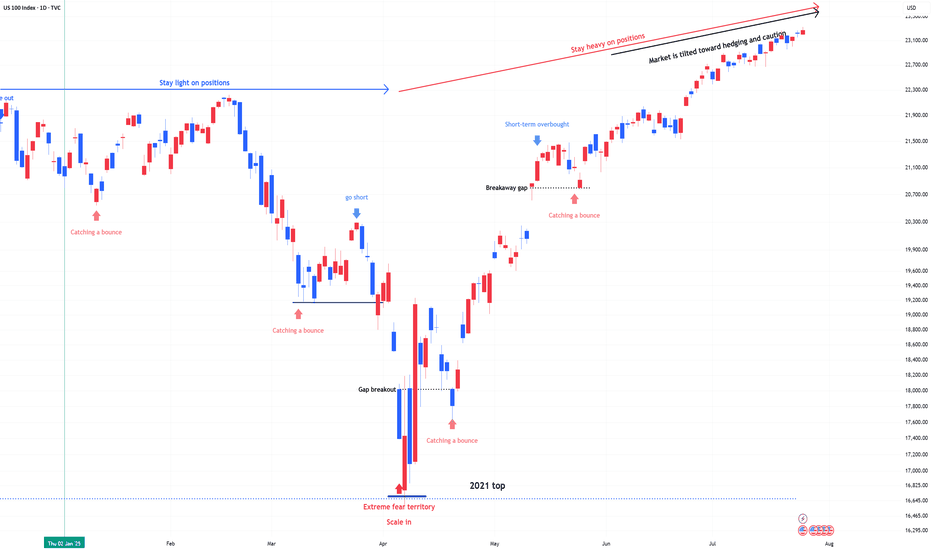

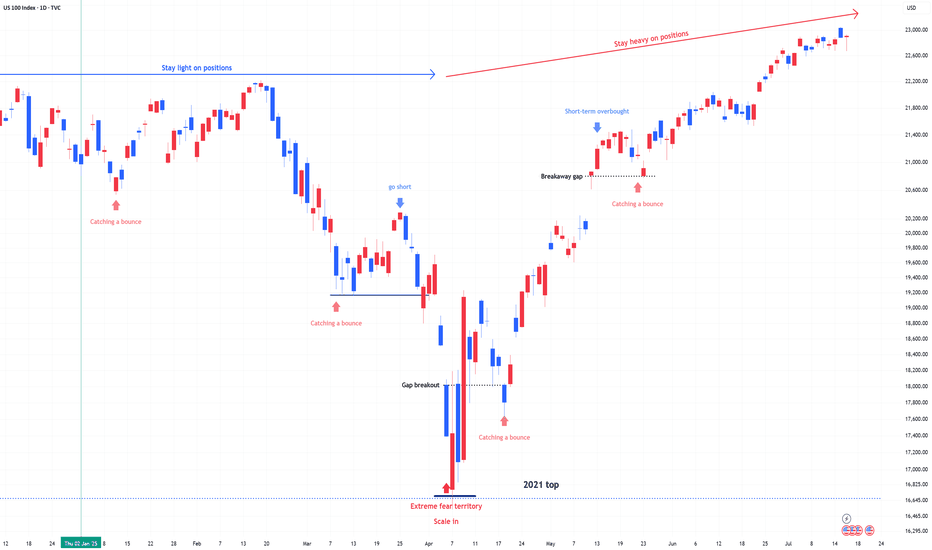

US 100 (NDQ) : Stay Heavy on Positions1) April Fear & Buy Signals

In early April, the Nasdaq 100 experienced a sharp sell-off, triggering extreme fear sentiment across the market.

At that point, scale-in buy signals appeared—classic "buy the fear" conditions.

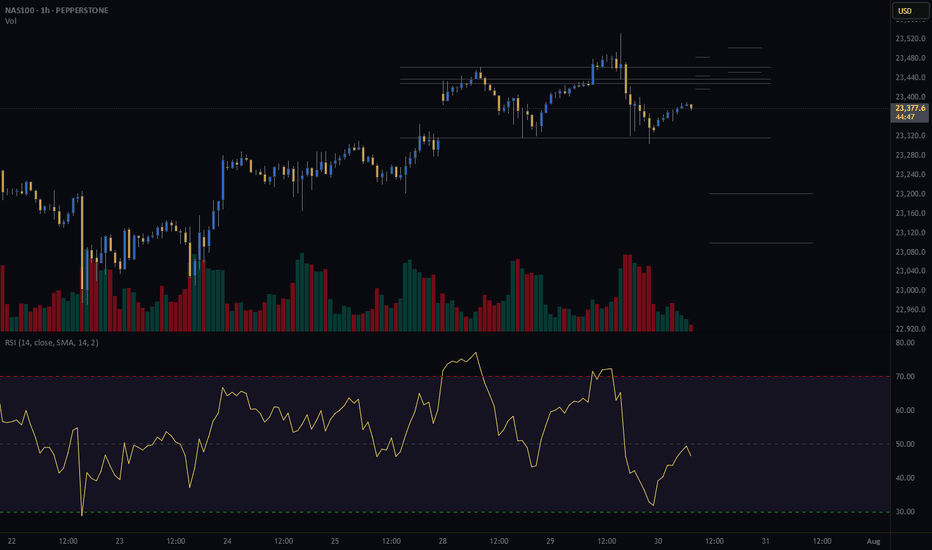

2) Current Market State: No More Fear, but Watching

Since then, the market has stabilized.

The fear has disappeared, but we are still in a wait-and-see mode as traders assess the next move.

Momentum is holding, but participation remains cautious.

3) Stay Heavy on Positions

Despite short-term uncertainty, I’m maintaining an overweight position on the Nasdaq 100.

As long as we don’t see a major breakdown, the bias remains bullish.

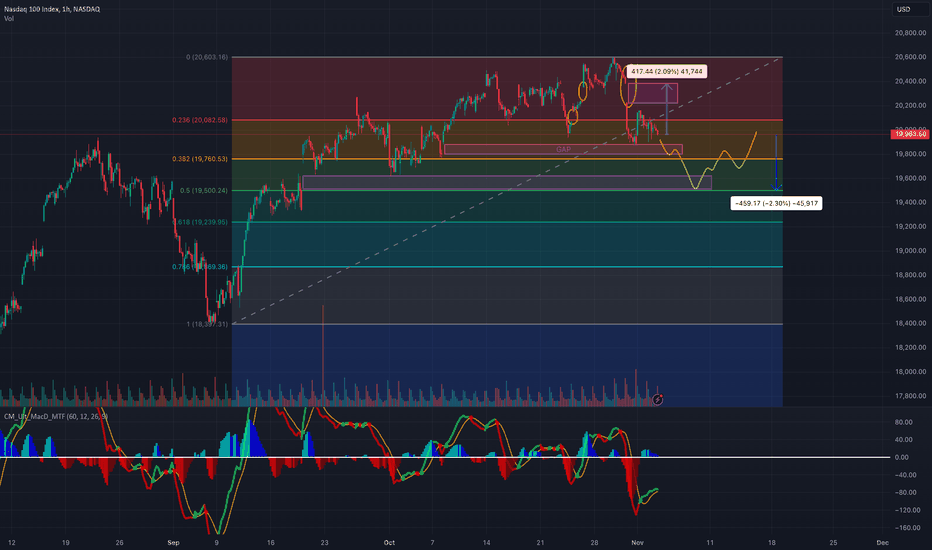

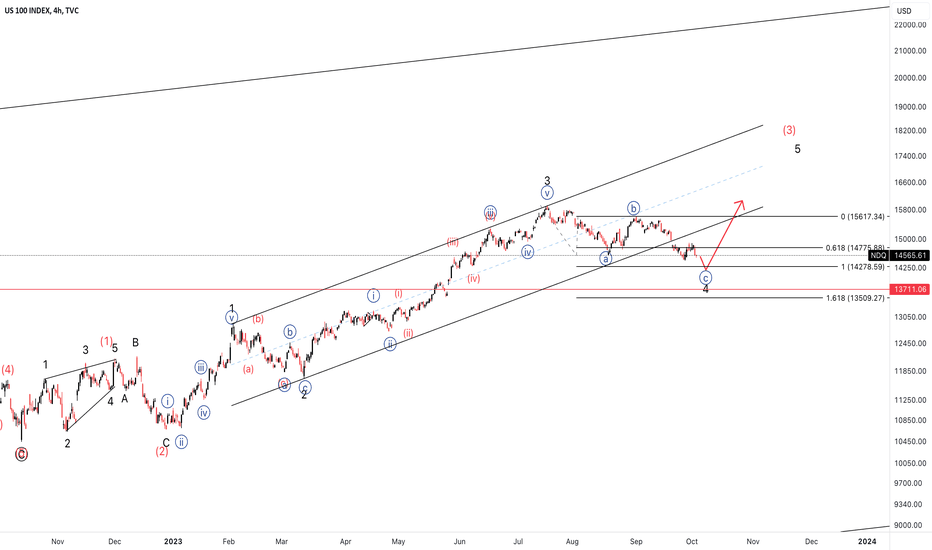

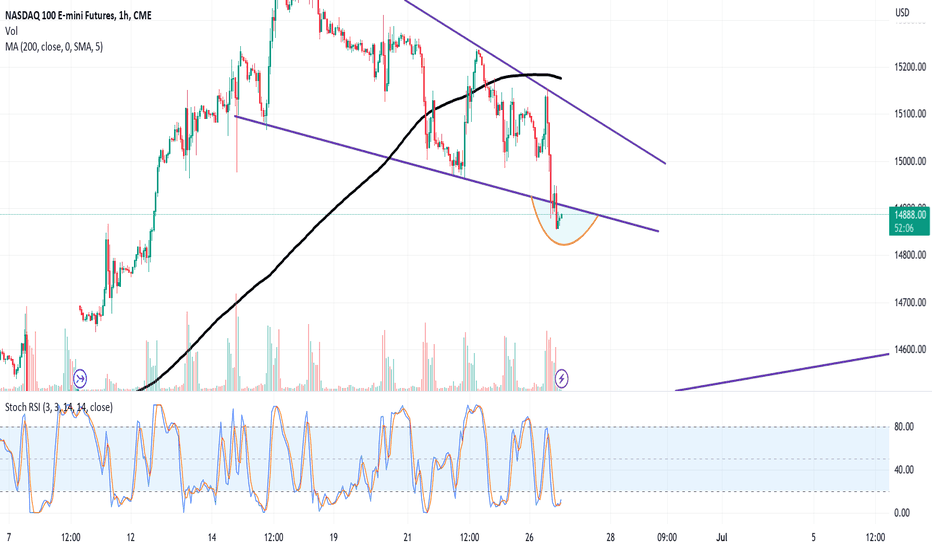

NASDAQ ~ US100 NASDAQ100 Prediction: Potential Return to Buy Area

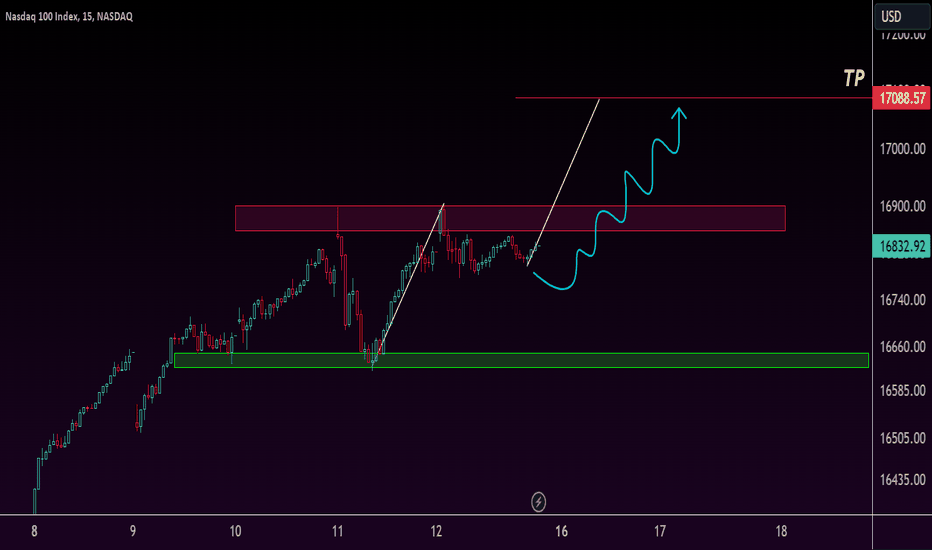

Based on recent market analysis, the NASDAQ100 appears to be forming a pattern of lower lows and lower highs. Considering various technical factors, it seems likely that the index will make another attempt to reach the buy area. Over the past few weeks, there have been gaps that remain unfilled and liquidity that needs to be collected. This confluence of signals suggests a potential move upwards in the near term. Traders should watch for key support levels and be prepared for potential bullish opportunities as the market seeks to correct and fill these gaps.

Take profit 1 - 19450-19500 Area

Take profit 2 - 19650-19700 Area

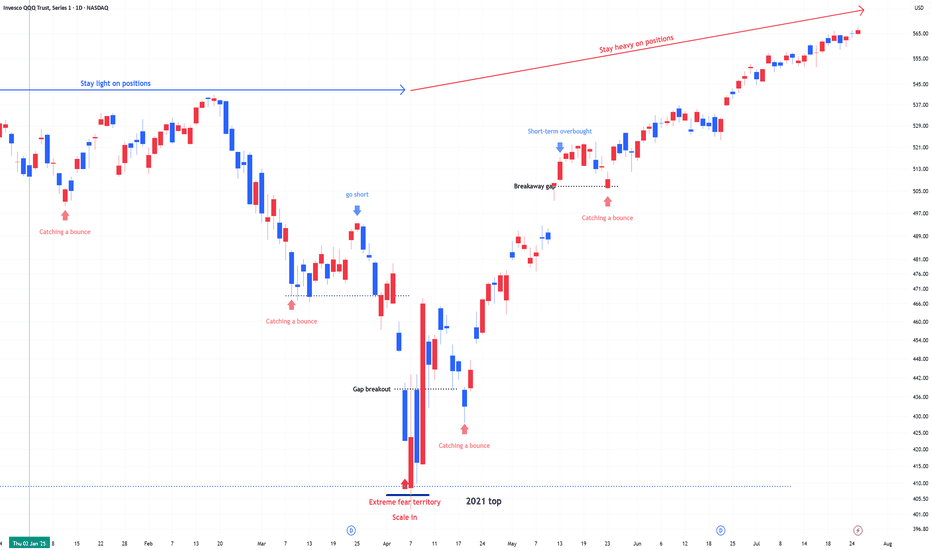

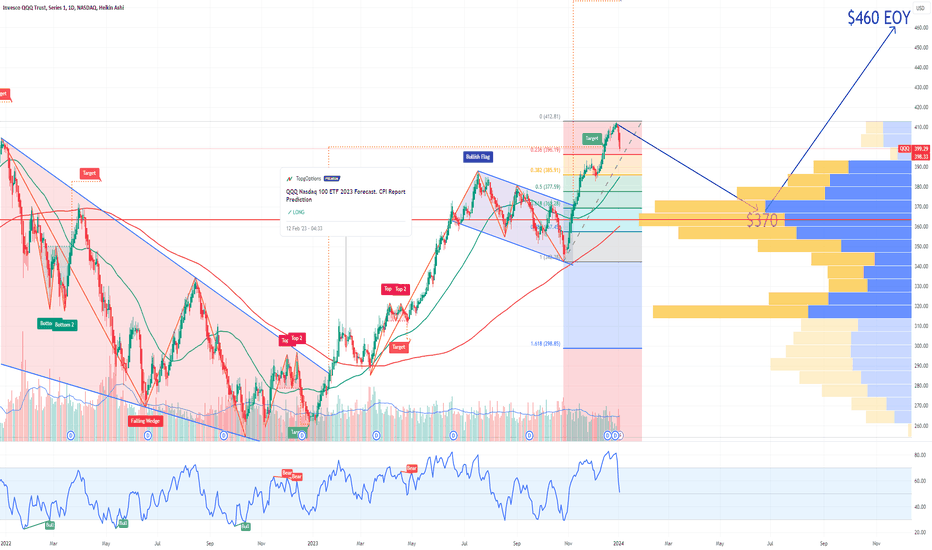

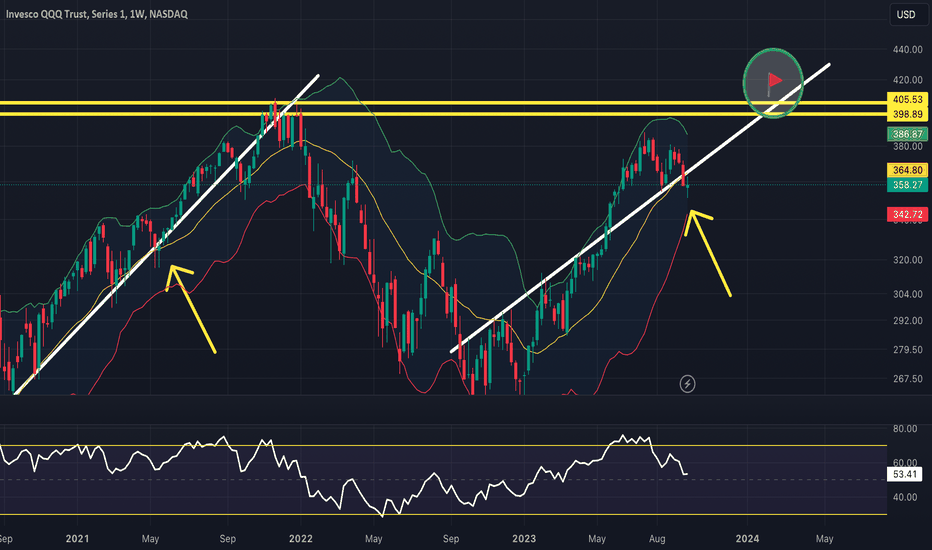

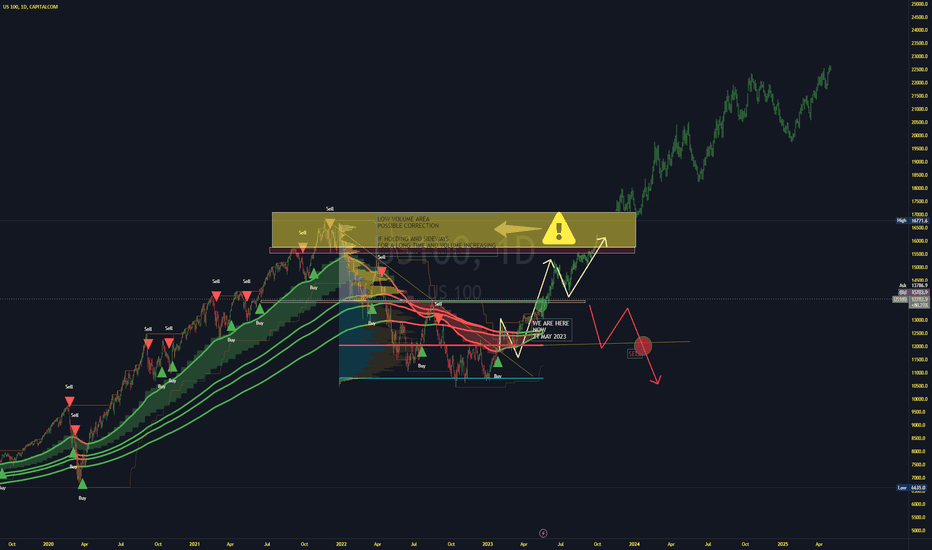

QQQ Nasdaq 100 ETF Price Prediction for 2024This was my price prediction for QQQ in 2023. I was bullish, but not enough:

Considerations about 2024:

In the July 2023 meeting, the FOMC chose to raise interest rates to a range of 5.25%–5.50%, marking the 11th rate hike in the current cycle aimed at mitigating heightened inflation. The prevailing consensus among market experts hints at a potential shift in strategy, suggesting that the Fed might commence rate cuts later in 2024 as inflation gradually aligns with the Fed's 2% target. Statistically, historical data indicates that approximately 11 months after the cessation of interest rate increases, a recession tends to manifest. This pattern places us around June 2024, aligning with my prediction of a dip in the QQQ to approximately $370.

Given that 2024 is an election year, there's an additional layer of complexity in predicting market behavior. Despite the anticipated mid-year dip, my inclination is that the QQQ will conclude the year on a bullish note. This optimistic outlook hints at the onset of a 3-5 year AI bubble cycle, with the QQQ boasting a year-end price target of $460.

The integration of artificial intelligence into various sectors is expected to catalyze market growth and innovation, propelling the QQQ to new heights by the close of 2024.

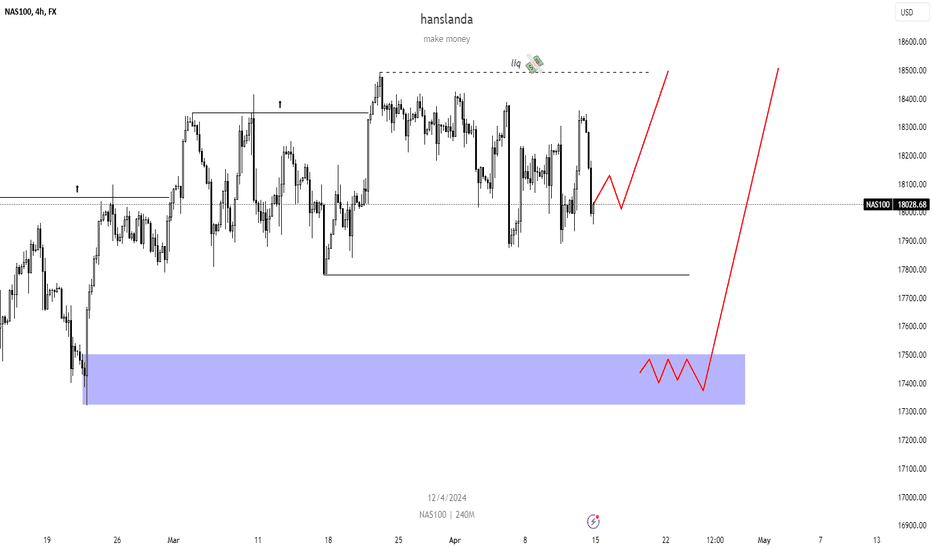

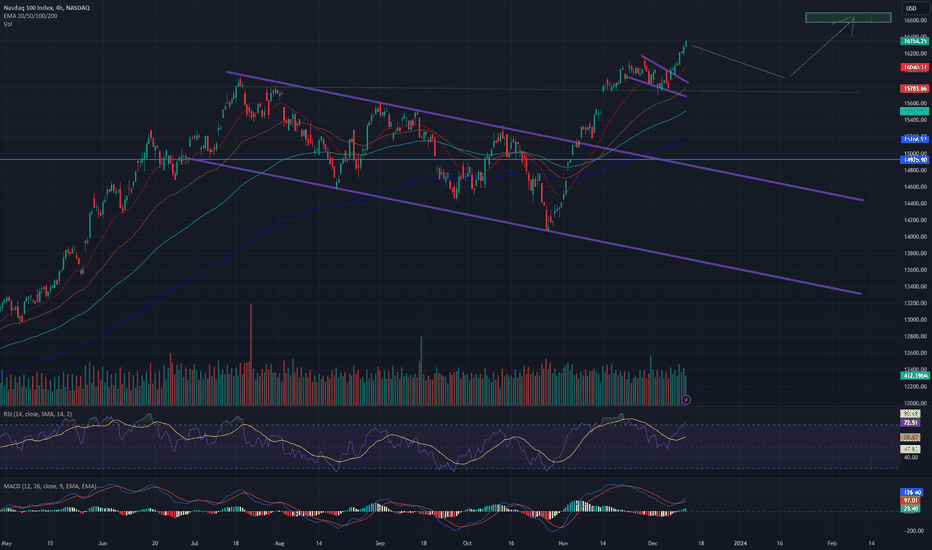

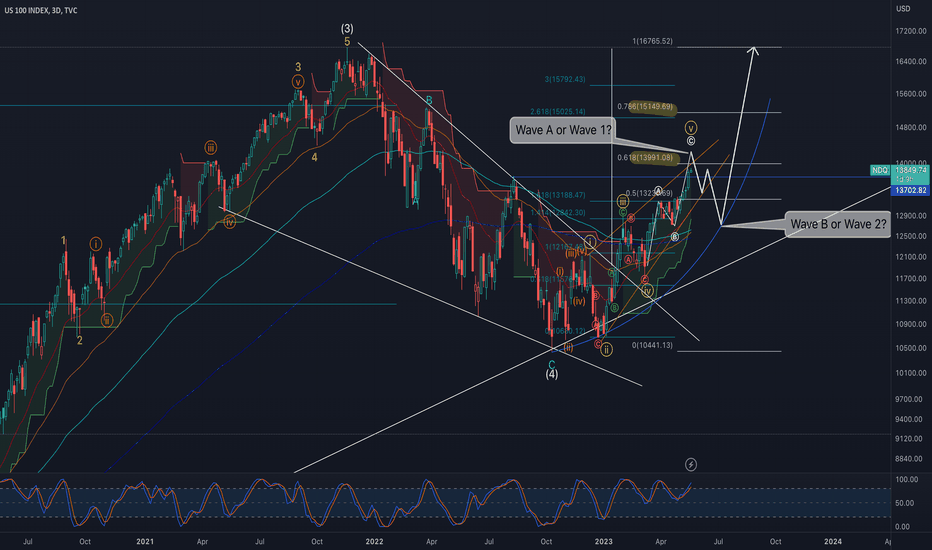

NDX Broke Double Bullish Pattern, 16600 SoonDear Traders,

NDX broke the falling channel (long purple trendlines) and then repeated a breakout from the falling wedge (short purple trendlines).

I believe NDX can continue its rally because MACD turned bullish, and I can see a confirmed bullish cross on the RSI. The price is above EMAs, and the volume is high enough for the continuation. I believe the target could be around 16600.

NDX is also overbought. While I expect further upside, traders without an existing position from lower target prices could wait for a corrective retracement to enter.

Kind regards,

Ely

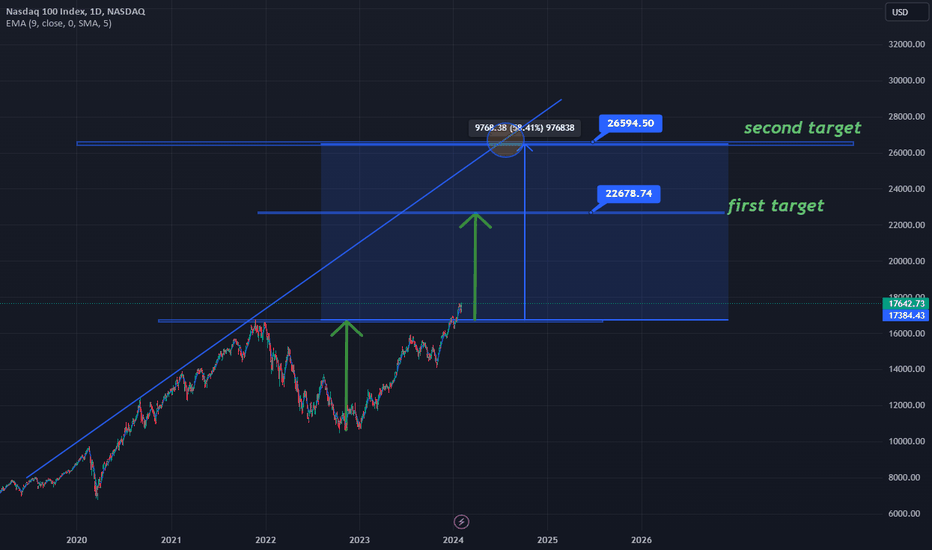

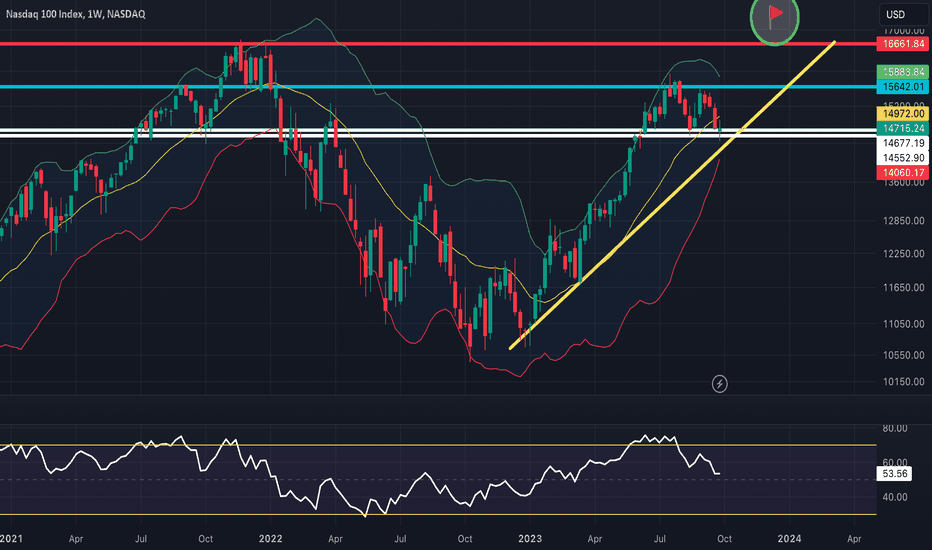

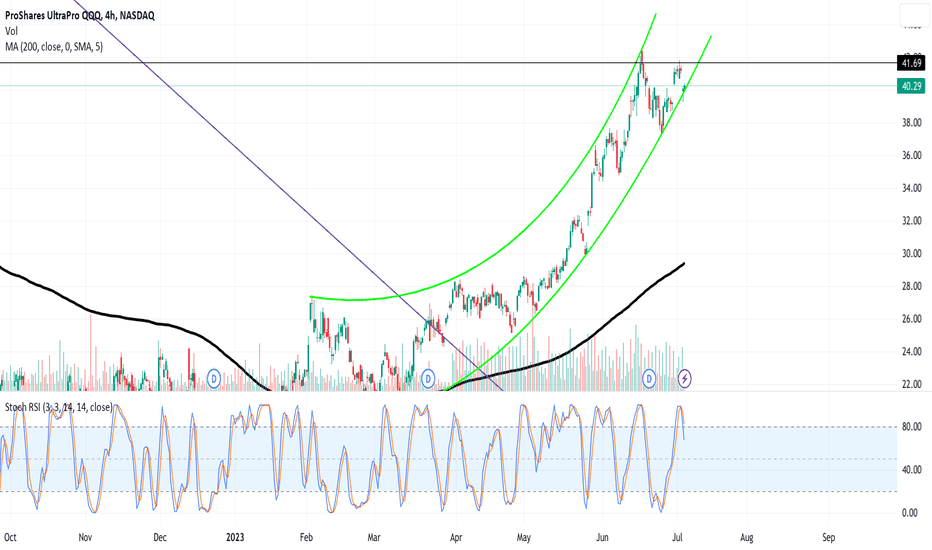

$NDX Quarter 3 (Q3) AnalysisThe NASDAQ has been performing extremely well for the year, and a special rebalance was put into effect in July to slow down the NASDAQ’s growth. Currently the NASDAQ has support in the EMA ribbon, which also intersects with the white support zone and yellow support line. This yellow support line has been acting as a support level since January 2023. I think the NASDAQ will have a bullish Q4 and will trend towards a new all-time high (green circle). However, I think this new all-time high could get delayed until Q1 and Q2 of next year, but I do expect a strong performance for the NASDAQ in Q4.

$QQQ Quarter 3 (Q3) AnalysisQQQ lost a support level during the last week of Q3. The last time this happened QQQ climbed up to a new all-time high in 2021 (shown by the yellow arrows). I believe the NASDAQ and its leverage-related ETFs are trending up to a new all-time high over the next few months (marked by the green circle). However, there was a special rebalance that occurred in July that is designed to slow the NASDAQ’s growth since the NASDAQ has been very strong this year. We still haven’t observed this effect yet since the stock market has been in a correction since the rebalance, but I’d imagine it will lead to a slower growth.

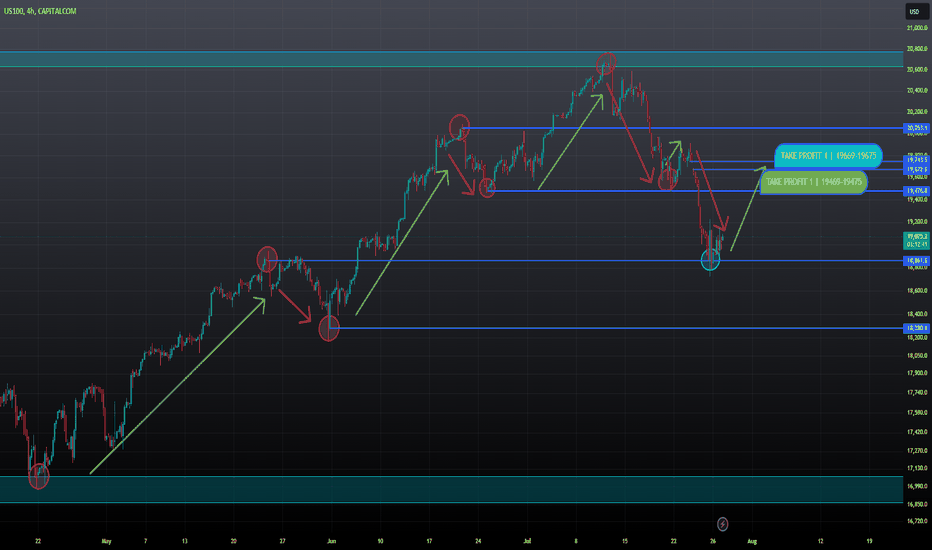

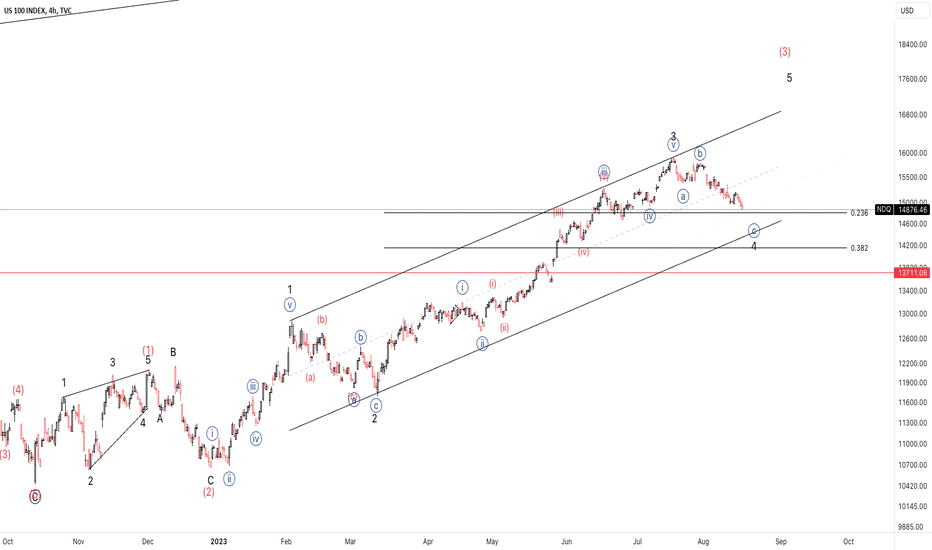

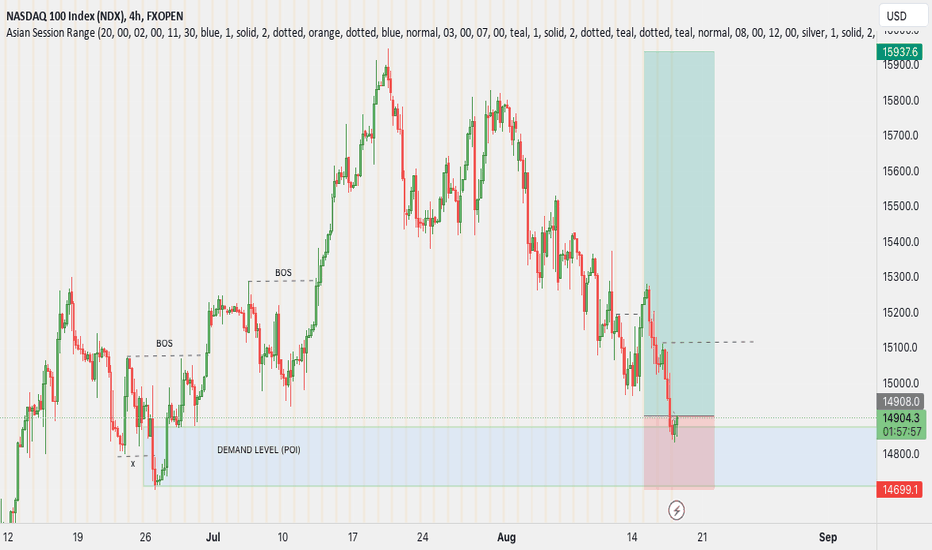

NASDAQ 100 LONG SET UP SWING TRADE (1000 PIPS INCOMING)Hey folks! hope you have all been bagging some green pips. Interesting times are lying ahead of us as some juicy set ups are cooking and we just need to continuously be disciplined and patient. On the menu today is NASDAQ 100 swing trade that has been in a Multi year uptrend.

looking at the 4 hour chart, we see that price broke structure to the upside indicated (BOS).

Price has now made its way back down to the origin demand level that caused the break of structure.

This makes demand level a point of interest and may mean potentially price can mitigate the zone and can begin to accumulate positions around the zone to begin travelling back up north of about 1000 pips. Am already in with a small position and will only be adding more positions when price has given more confirmations but for now its still a risky set up. Overall this could be a set up of about 1:6 risk reward ratio.

Remember to always apply proper money and risk management in your trade set ups.

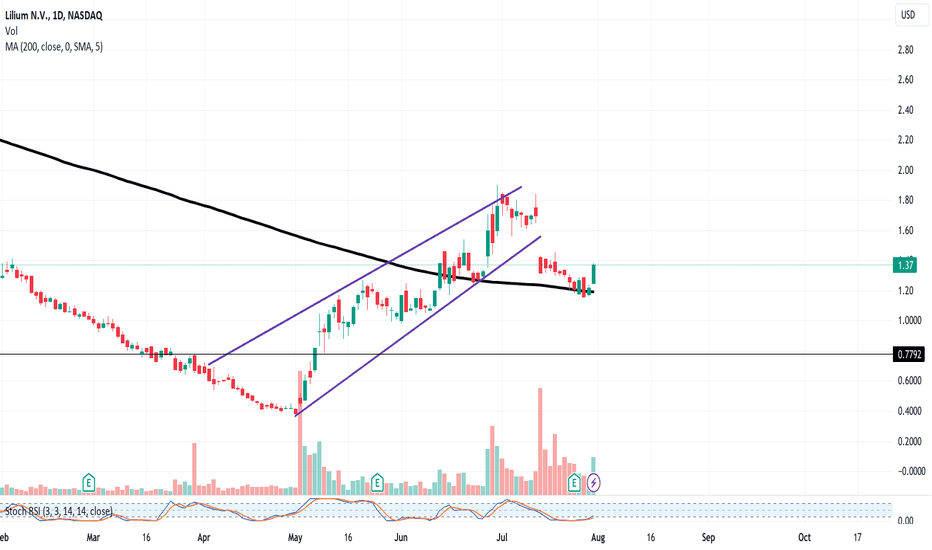

Long LILM No clue what these people do. had a great long off the lows. got my hand burnt shorting, but positive profit so far. Buying here, small size, no stop. Not advise

US100 Long U.S. Debt Deal Optimism Boosts SentimentI have marked the Bullish Bearish scenarios of the next 2 weeks(Possible Potential Long)

Green Bullish

Golden Cross

High Bullish Volume

Technically: HH HL

Donchian Long

June S&P 500 futures

ESM2023

are trending up +0.18% this morning as market participants weighed the latest updates on negotiations in Washington to reach a debt-ceiling deal while awaiting a key speech from Fed Chair Jerome Powell.

In Thursday’s trading session, the tech-heavy Nasdaq 100 notched a 1-year high, boosted by gains in chip stocks and a more than +9% jump in Netflix Inc

NFLX

after the streaming giant said its recently launched ad-supported tier reached about 5 million active users per month. Also, the benchmark S&P 500 rose to a 9-month high, helped in part by an over +11% surge in Take-Two Interactive Software Inc

TTWO

after the company reported above-consensus Q4 net bookings. In addition, Walmart Inc

WMT

rose more than +1% after the retail giant reported upbeat Q1 results and raised its full-year guidance, helping keep the blue-chip Dow in positive territory.