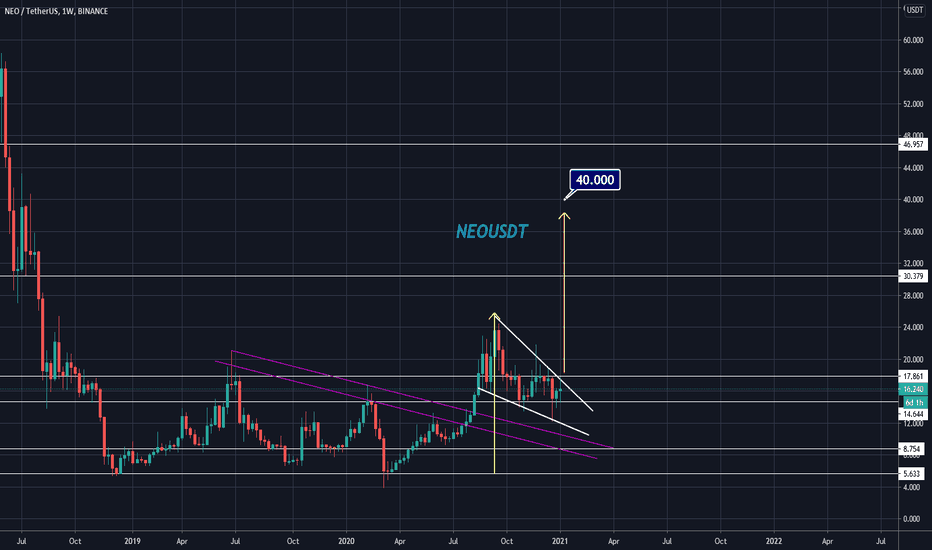

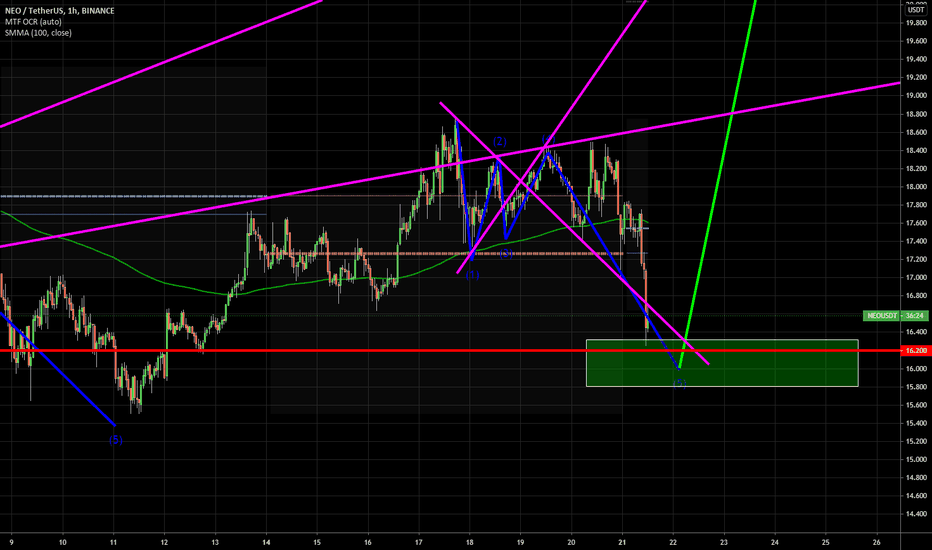

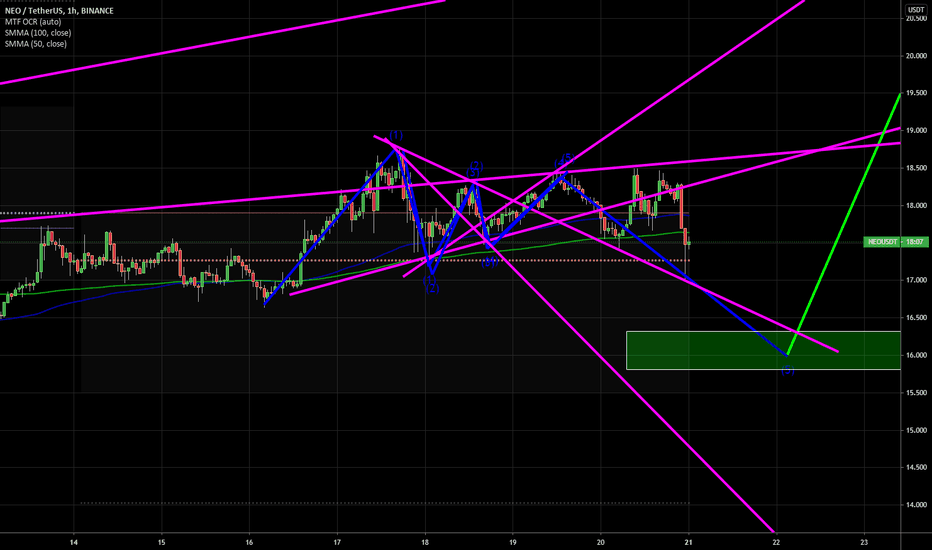

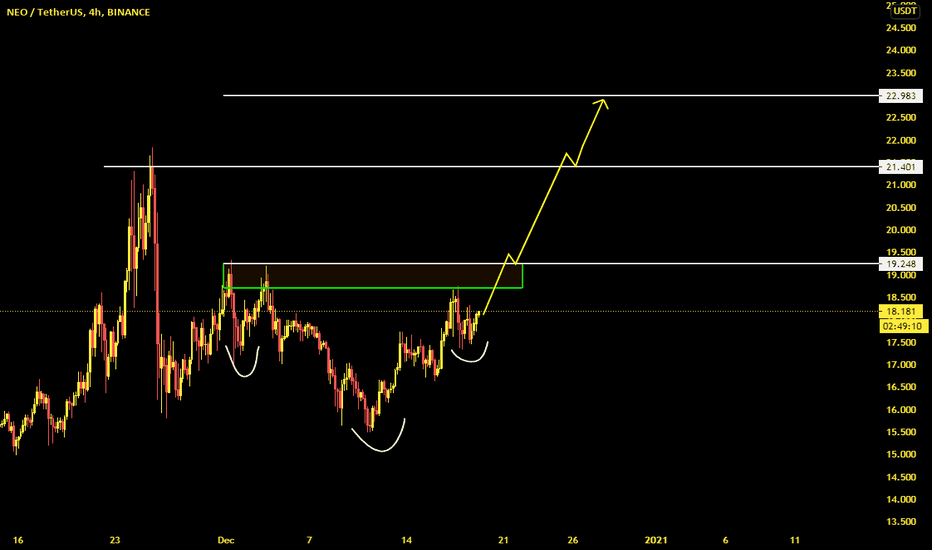

NEOUSDT

NEO - Big Pump is coming!Hi,

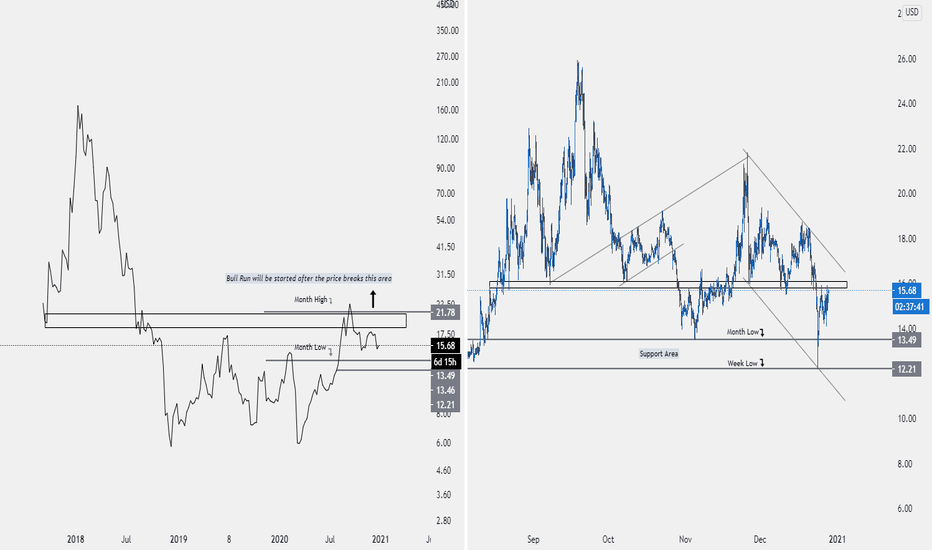

We know all that NEO follows Ethereum (obvious as it's the Chinese Ethereum ) and we can notice that there is still a delay between a pump from Ethereum and that of Neo.

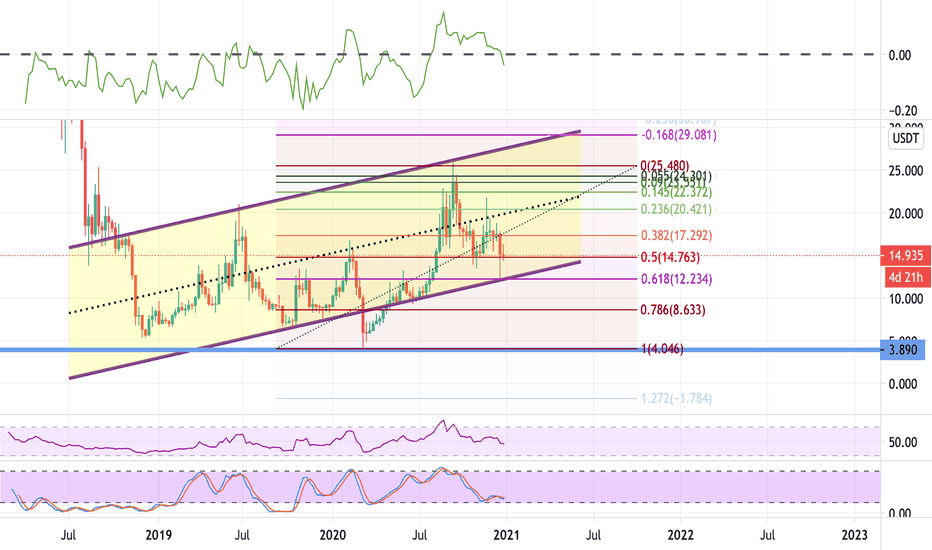

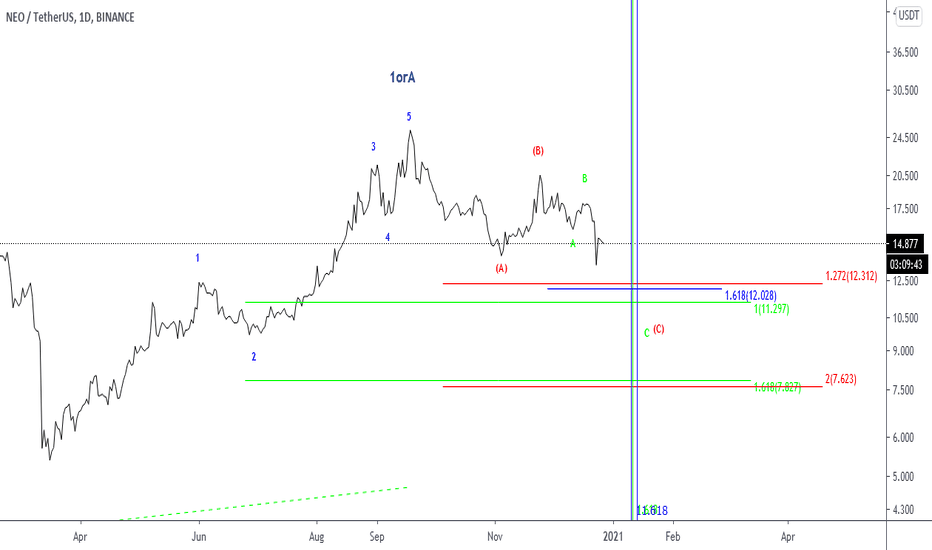

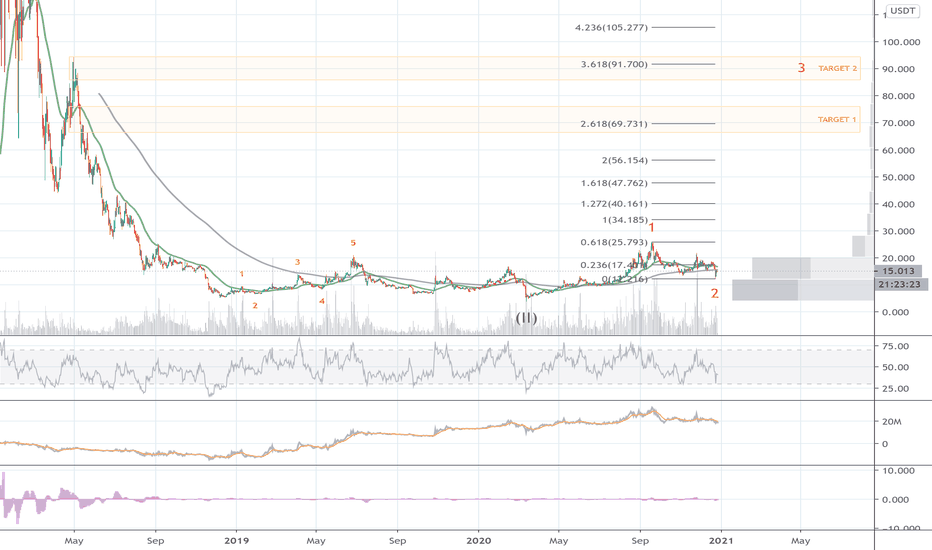

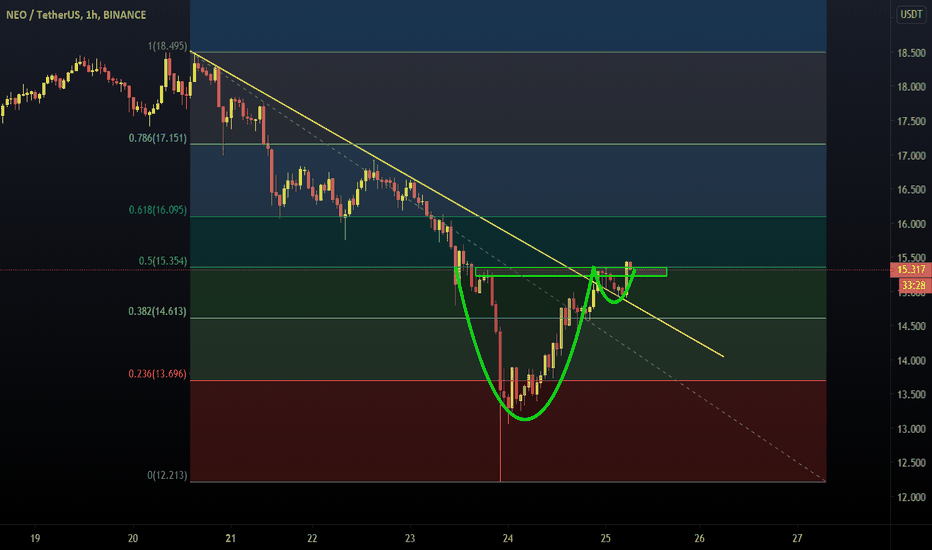

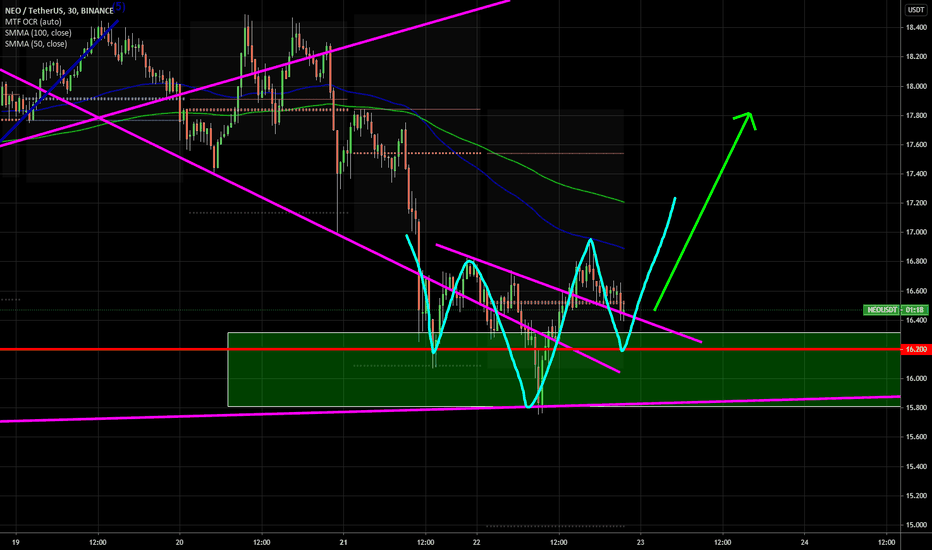

My analysis makes it clear that we are done about the second wave (orange color). It means we'll get shortly a strong impulsive wave .

I expect to see again a Neo to 90$.

It's a long for me!

Trade safe and not with your emotions...!

Cheers,

PS: it's not a Financial Advice.