Neo Wave

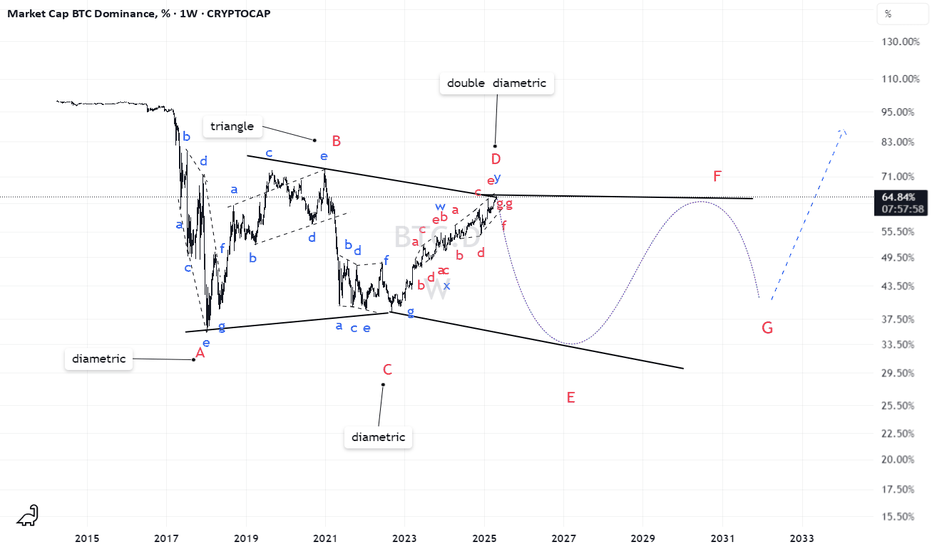

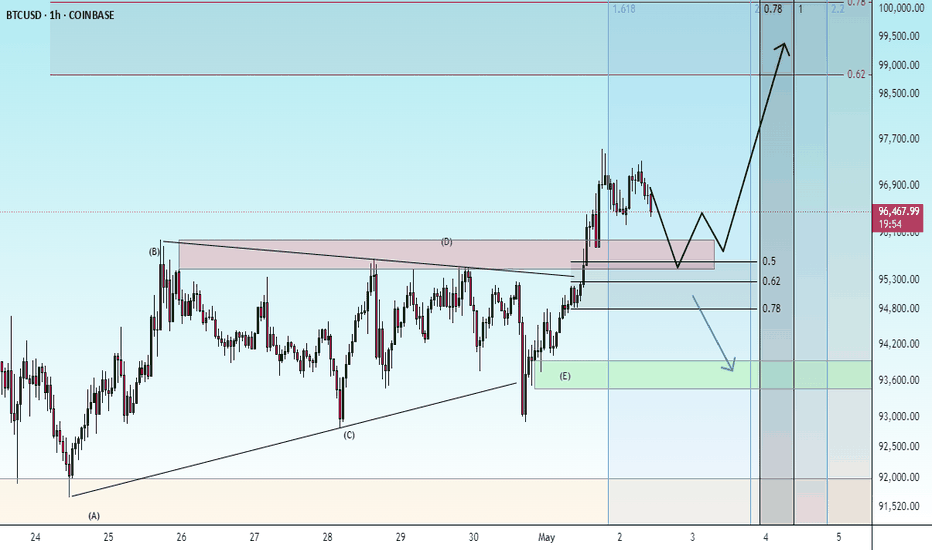

BTC New Update (8H)This analysis is an update of the analysis you see in the "Related publications" section

In the previous scenario, we considered that Bitcoin was in a diametric where wave E had extended. However, after reviewing the charts and analyzing various scenarios, we decided to revise the wave count as shown in this update, since wave E of the previous diametric scenario became overly extended.

You can see the complete wave count of the chart in this update. The correction in Bitcoin started from the point where we placed the red arrow on the chart. This correction was a diametric and ended where the green arrow is placed.

From the point where the green arrow is shown on the chart, Bitcoin's bullish wave has started, which is either wave A or W.

According to this scenario, the expected rejection zone should be between 98K and 103K.

The lowest-risk area for price rejection is the red box.

A daily candle close above the invalidation level will invalidate this analysis.

Let’s see what happens.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

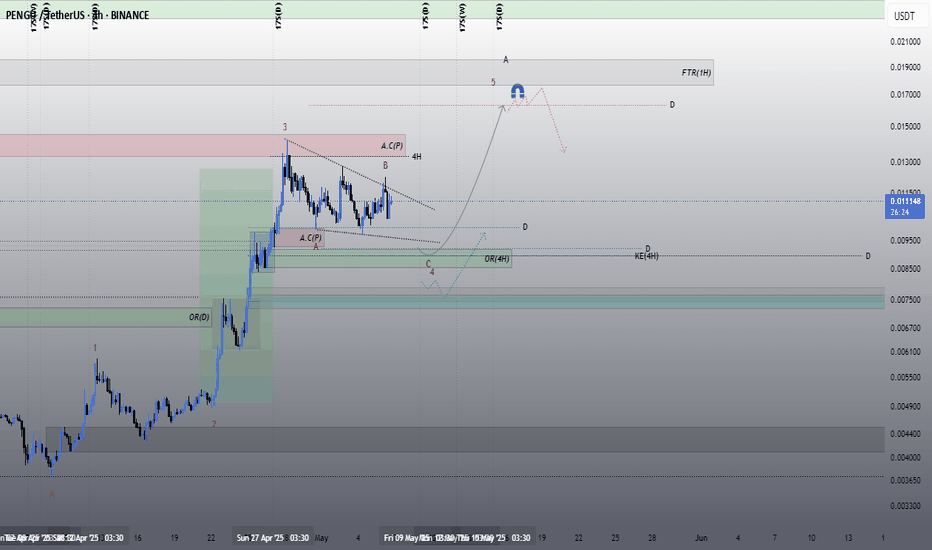

PENGUUSDTA risky analysis of a popular meme coin..

Based on this analysis, we are in wave 4 and it is expected to end soon and enter wave 5..

Around 0.091 to 0.085, if the price reaches it, it will be suitable for a short swing to the target of 0.0163 and 0.0175..

Ideal time zones are also marked with low tolerance..

This analysis can be easily filled..

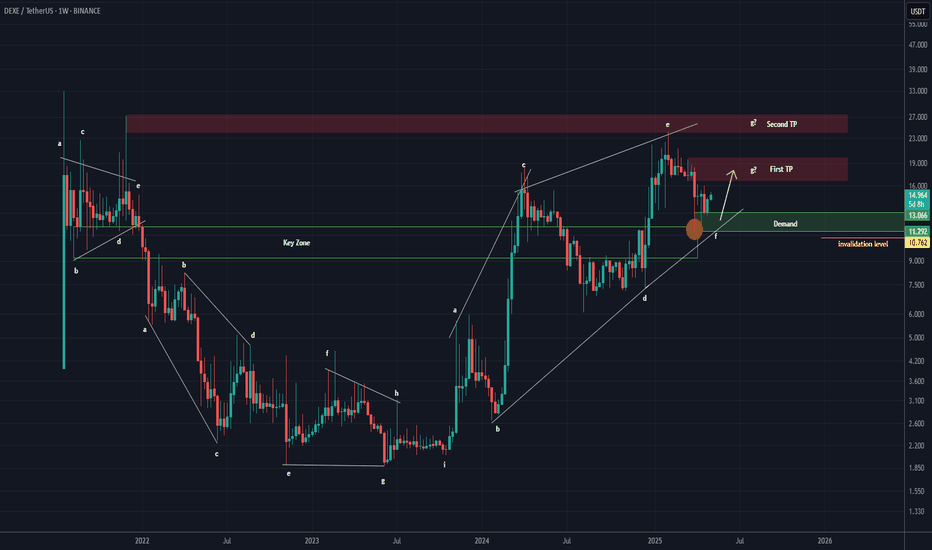

DEXE Analysis (1W)It appears to be in a bullish diametric pattern, and we are likely approaching the end of wave F.

If the price returns to the green zone, we will be looking for buy/long positions there.

We’ve marked two main targets on the chart, which represent the potential objectives for wave G.

A weekly candle closing below the invalidation level will invalidate this view.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

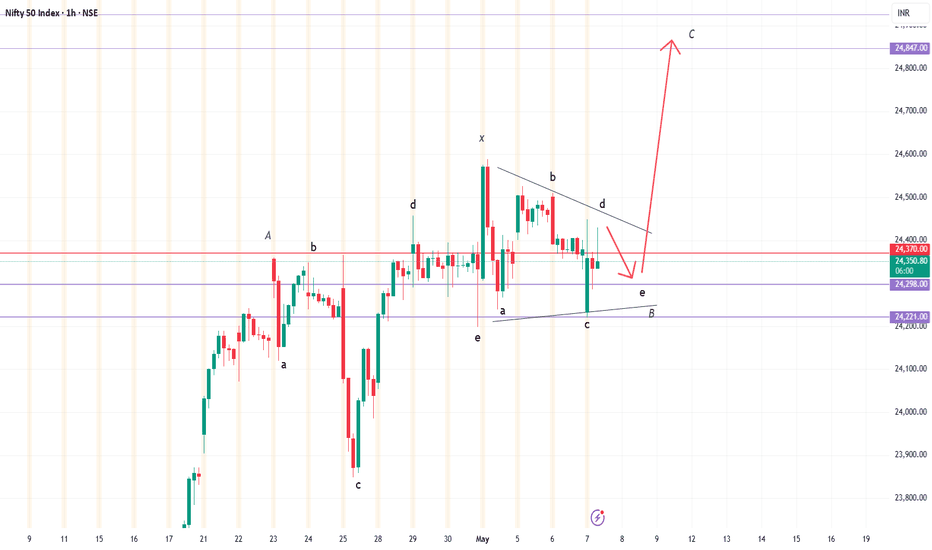

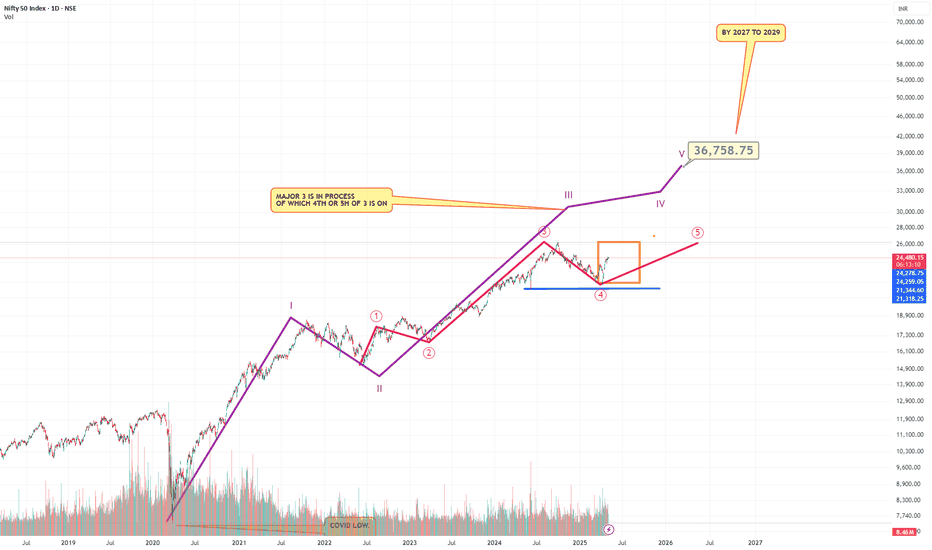

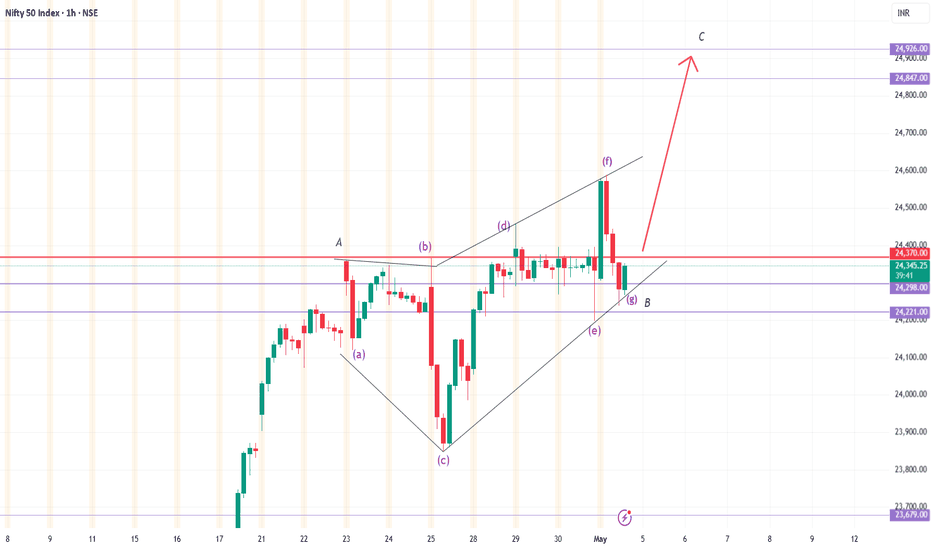

NIFTY Future Marked on chart...And its good News.I did the count of Neo waves on the Nifty...I have marked the larger cycle and the tgt by 2029 is around 37000...If all 5 waves are completed..right now we are in the 5th wave of the 3rd wave ..Please refer to chart....Also the Indian demographics support this..So please enter your favorate frontline blue chip stocks and sit tight...Please feel free to challenge this chart..I would be happy

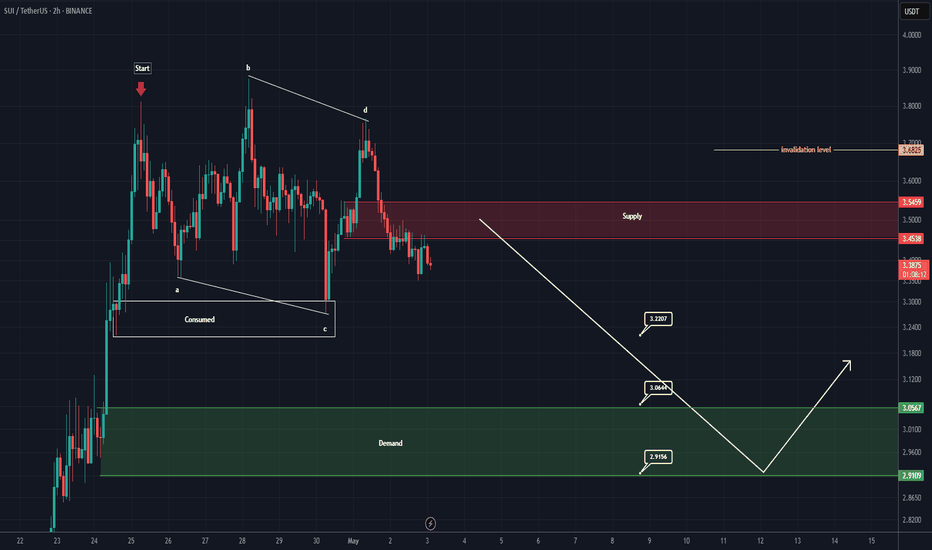

SUI Looks Bearish (2H)From the point where we placed the red arrow on the chart, it appears that the correction in SUI has begun.

An expansionary wave structure is visible, which could potentially push SUI toward the green zone.

Targets are marked on the chart. As long as the supply zone holds, the price may move toward the targets and the green box.

A 4-hour candle closing above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

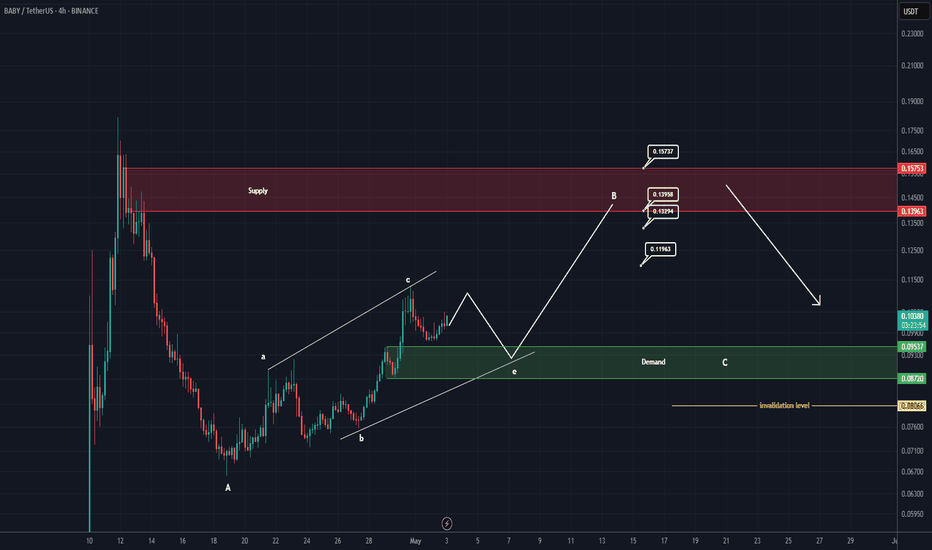

BABY Looks Bullish (4H)Note: Given the corrective nature of the market, only consider entering this symbol within the green zone. Move to break-even at the first target.

According to the Baby structure, this symbol appears to be aiming to remain bullish.

From the point where we placed the (A) on the chart, expansion waves have started on this symbol.

As long as the green zone is maintained, the price can move toward the targets.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

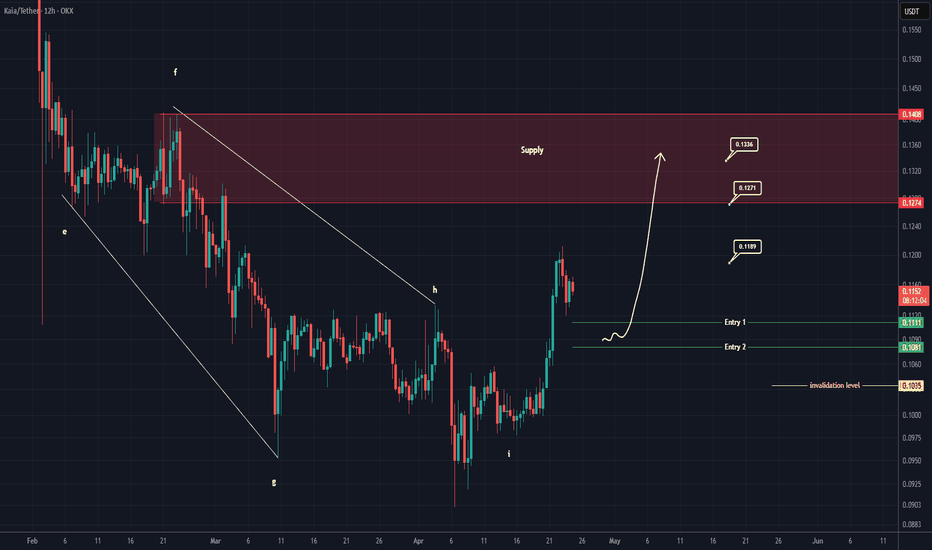

KAIA Buy/Long Setup (12H)It seems that a large symmetrical pattern has completed, and the price has broken out above the resistance line. We are looking for Buy/Long positions on pullbacks.

We have identified two entry points for this asset. If the price reaches these entry zones, we will enter a position.

The targets are also marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You