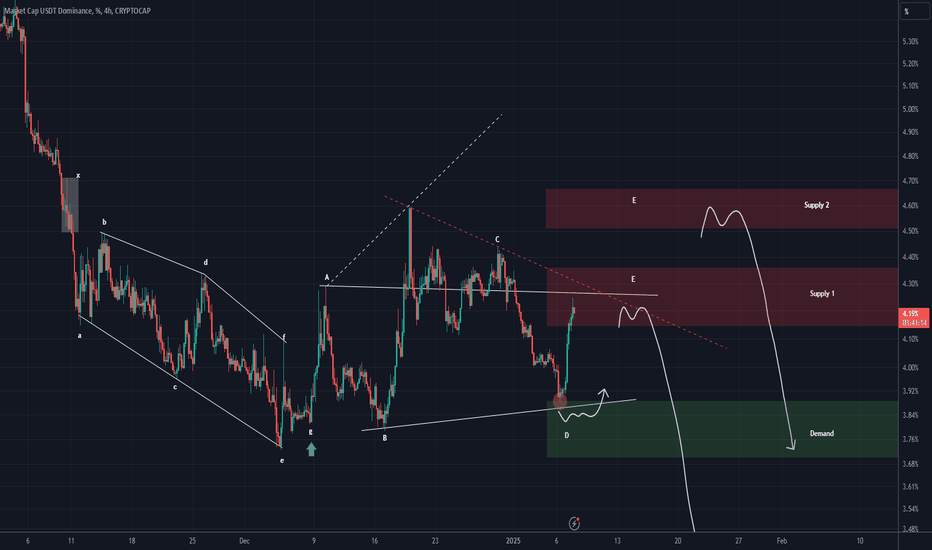

USDT DOMINANCE new update (4H)This analysis is an update of the analysis you see in the "Related publications" section

First of all you should know that "USDT Dominance" is always moving inverse of BTCUSDT .

We have reached the red-marked area from the previous analysis, but the bullish momentum of the candles is strong.

In previous analyses, we considered the triangle as a contracting triangle, but it is possible that Tether dominance is forming an expanding triangle or even a diametric pattern.

We have two zones for the completion of wave e.

If the price breaks through supply zone 1, it will be rejected from supply zone 2.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Neo Wave

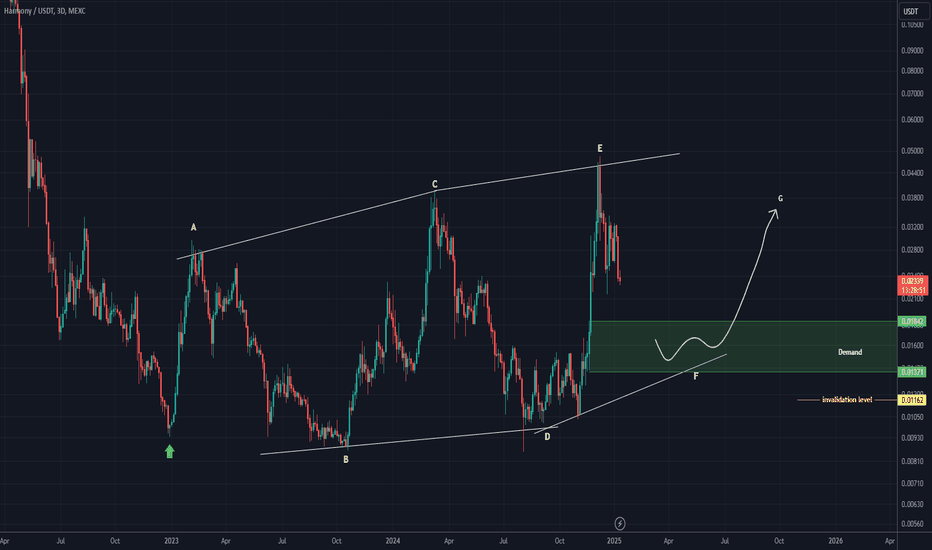

ONE ANALYSIS (3D)Before anything else, pay attention to the analysis timeframe. It is a 3-day timeframe and requires patience.

It appears that from the point marked with the green arrow on the chart, ONE has entered a Diametric pattern.

Currently, it seems to be in wave F of this Diametric. Wave F is bearish.

Within the green zone, buy positions can be considered.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

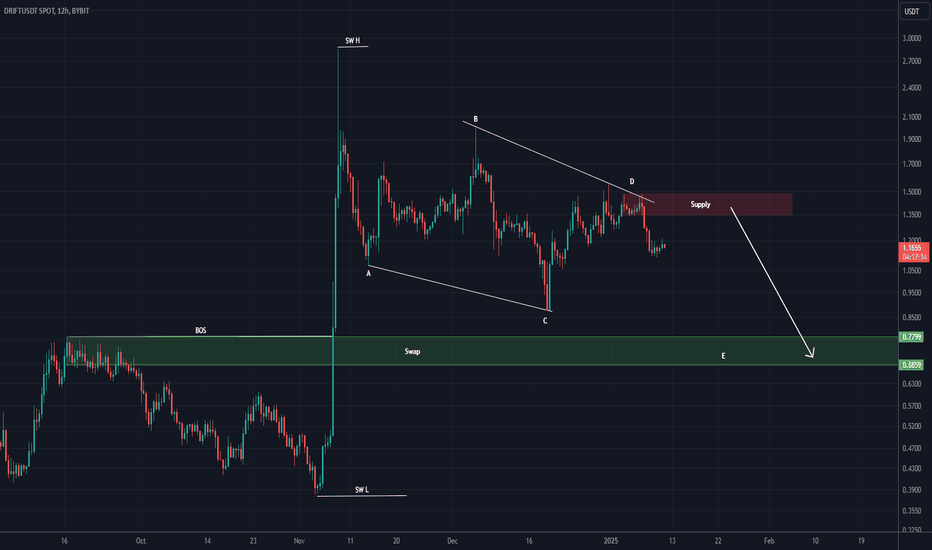

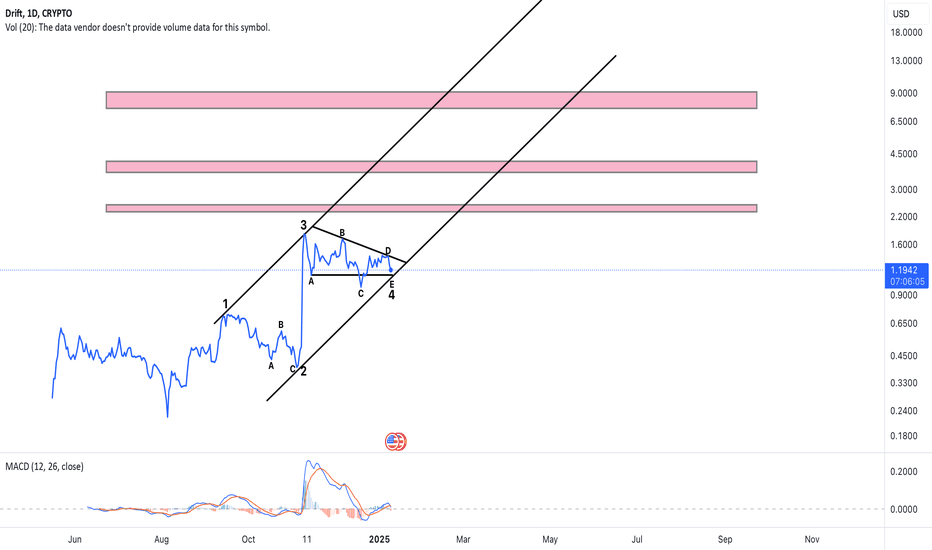

DRIFT new Update (12H)Note: This symbol experiences sharp and volatile price movements. Manage your risk carefully.

Now, it seems that DRIFT intends to move toward the swap zone.

The best area for sell positions is within the supply zone.

Let’s wait and see what happens next.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

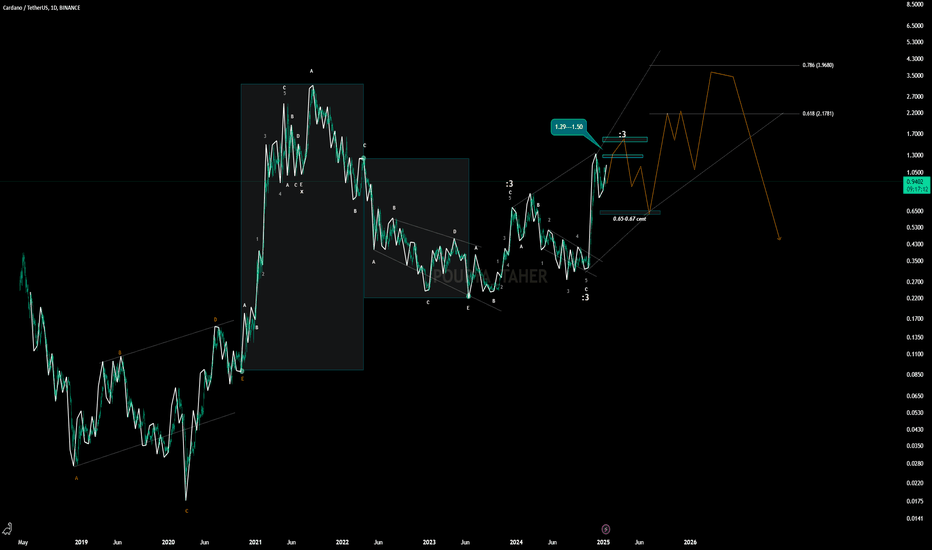

ADAUSDT"In this analysis, I aimed to examine the entire structure of Cardano from the beginning. I identified that we are currently within a corrective structure, and the current position appears to be the third wave of this correction. I anticipate that it may unfold as a Diametric pattern. Follow me to stay updated as we track this structure!"

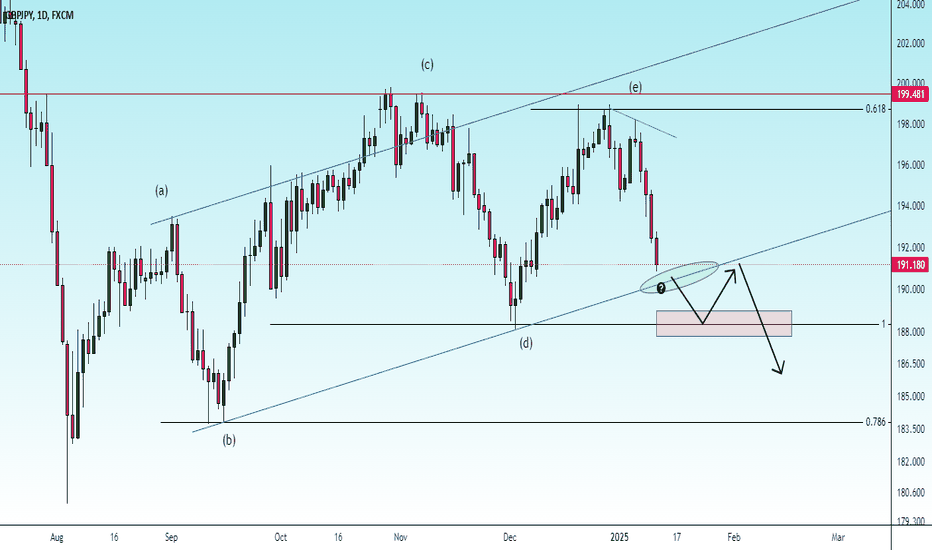

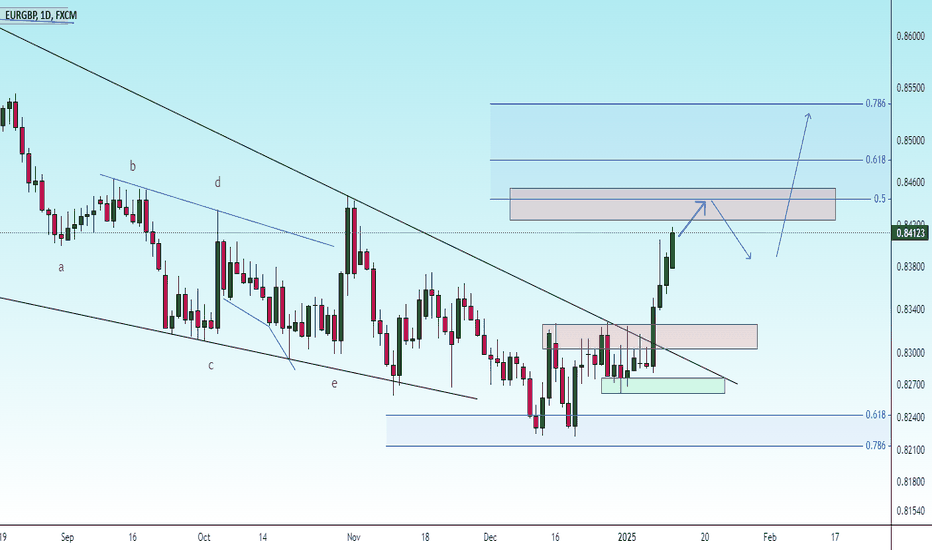

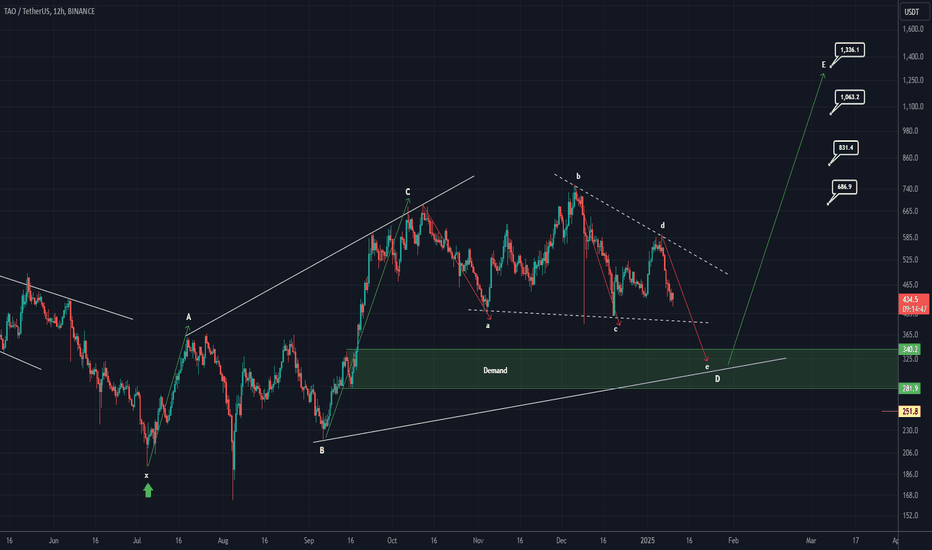

TAO roadmap (12H)It seems that TAO is forming an expanding triangle, currently in wave D of this triangle.

Wave D appears to have itself formed an expanding triangle (inverse expanding triangle).

It is expected that wave e of D will complete within the green zone.

From the green zone, it can move towards its targets.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

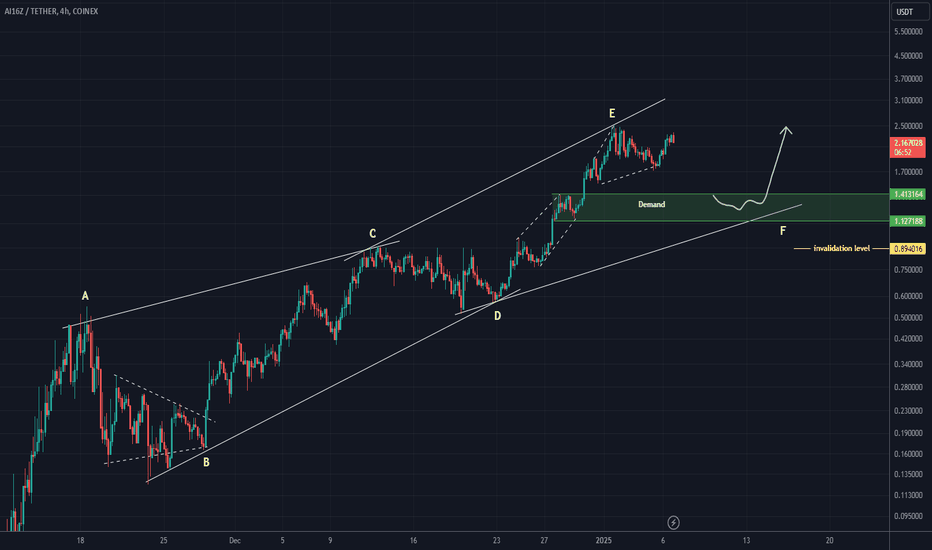

AI16Z ANALYSIS (4H)The AI16Z symbol appears to be within a large diametric pattern, currently at the end of wave E.

For a rebuy, it's crucial to execute this on a support zone, especially for assets that have experienced significant pumps.

Based on the structure, if the price reaches the entry zone, we can look for buy/long positions around the green area.

The target could be the top of wave E, but if you achieve reasonable profit, consider securing your gains.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

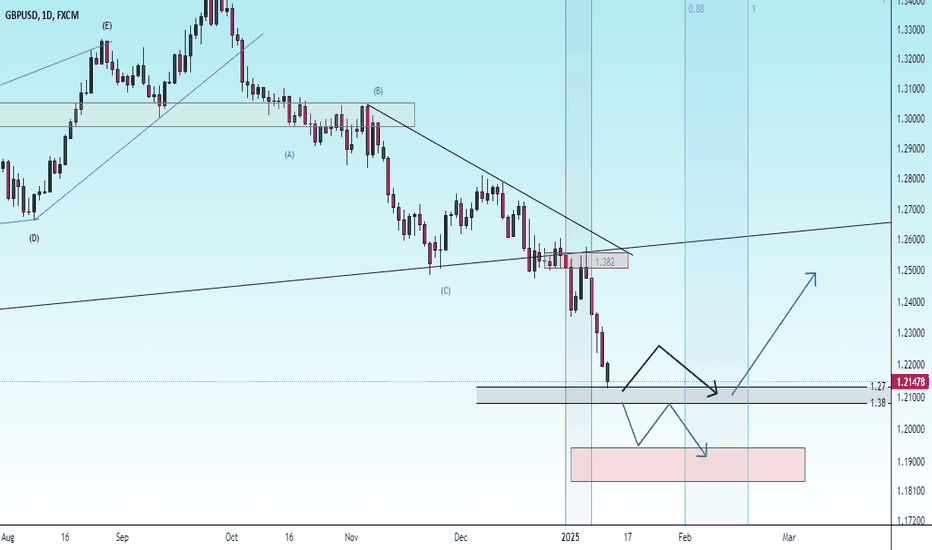

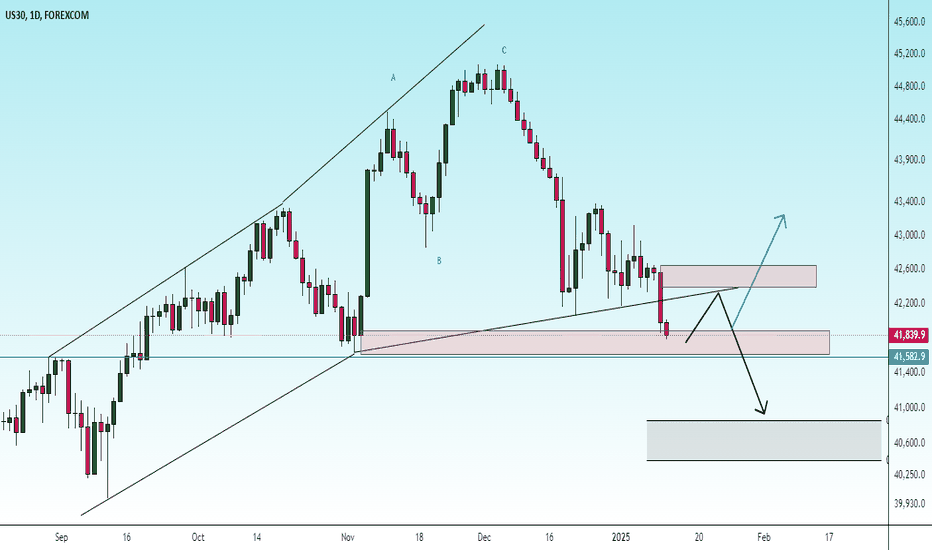

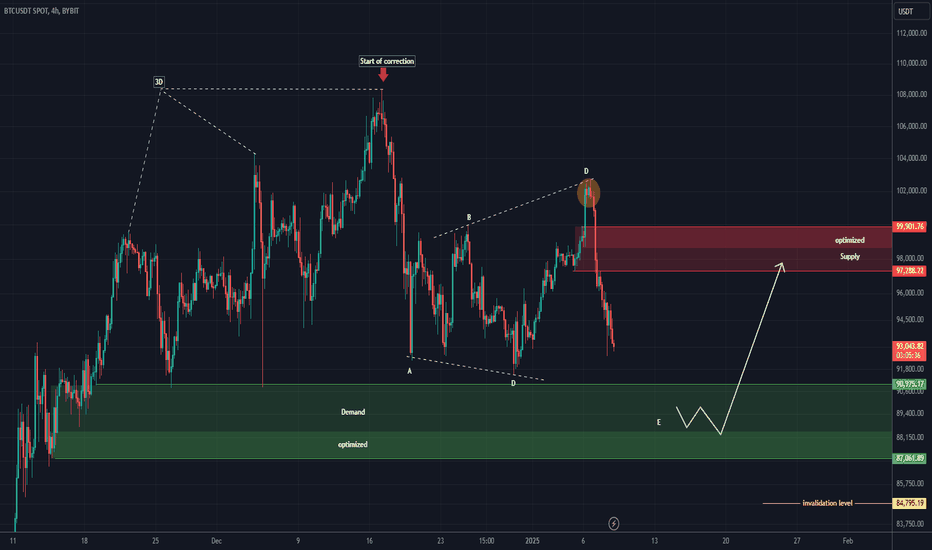

BTC New Update (4H)This analysis is an update of the analysis you see in the "Related publications" section

Please note that we are in complex corrections, and trading in these areas requires thorough analysis. We aim to update our analyses step by step. In such conditions, it’s better to analyze the data rather than make predictions.

According to the previous analysis, we expect the price to reach the green zone.

The demand and supply zones in this analysis have been updated.

On the green zone, the price could potentially bounce upwards.

A daily candle closing below the invalidation level will negate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

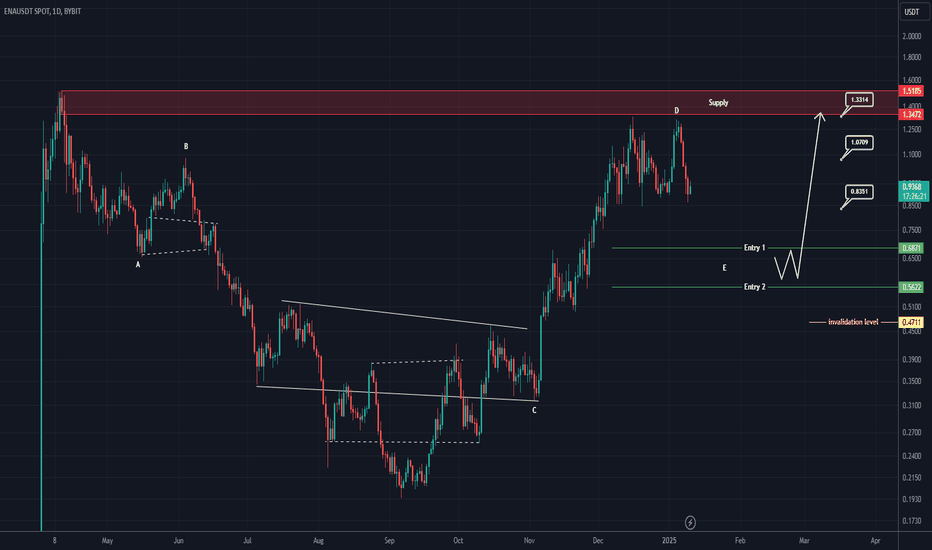

ENA rebuy setup (1D)This is one of the symbols that Trump had invested in. It now appears that a supercycle has completed, and the price has entered a new wave phase (wave E).

The low-risk area for rebuying in spot trading includes the two entries we have highlighted on the chart.

Minimum targets are indicated on the chart. If ENA can stabilize above the supply zone, it may become very bullish again.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

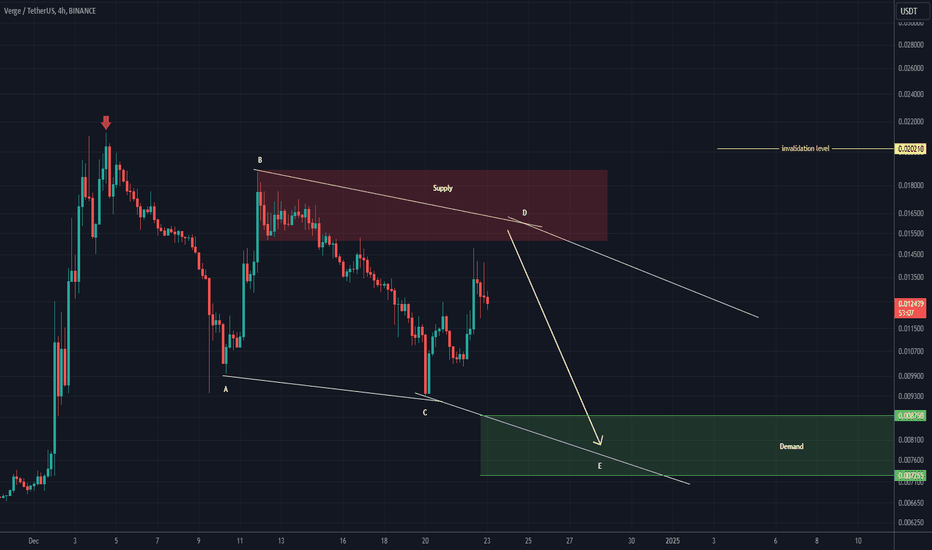

XVG Looks bearish (4H)From where we entered "Start" on the chart, XVG correction seems to have started. This correction seems to be a diametric. By maintaining the red area, it can move towards the green box.

The low risk range for sell/short positions is the red box.

Closing a daily candle above the invalidation level will violate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

PEPE looks bearish (1D)PEPE seems to be completing a diametric pattern and is now entering wave F.

Wave F is bearish. The drop in wave F is expected to continue until it reaches the green zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will negate our buy outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

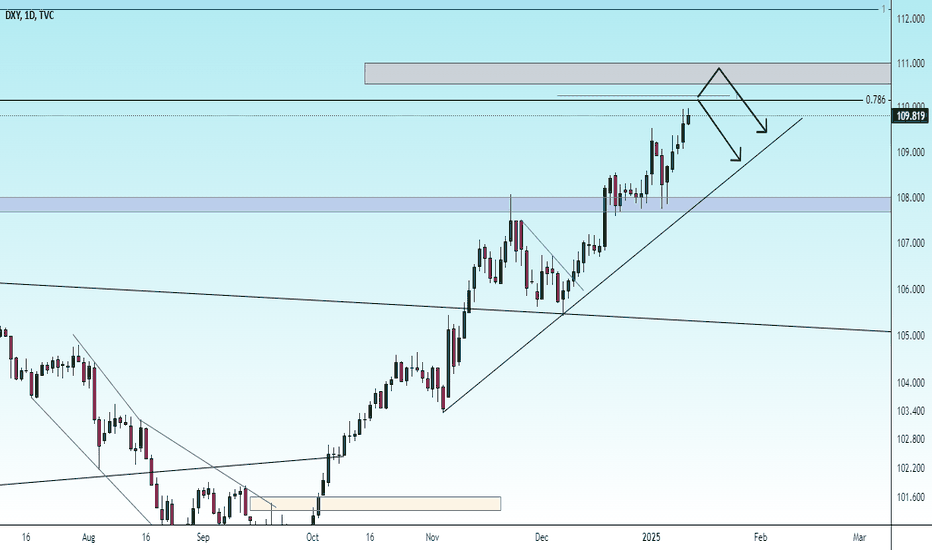

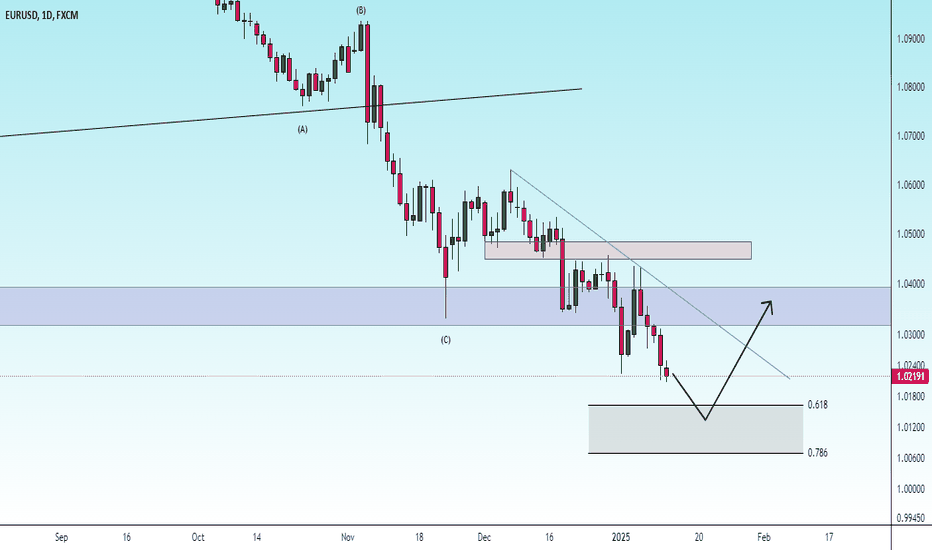

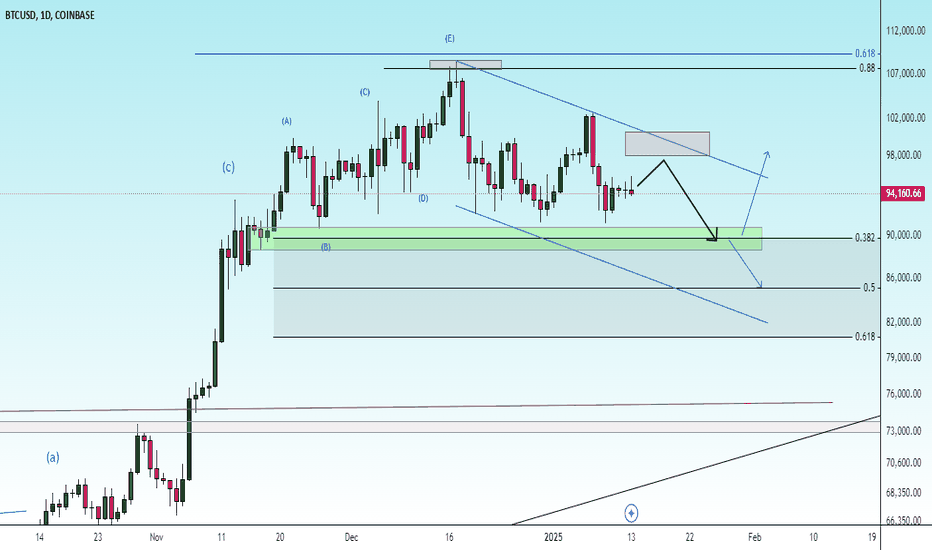

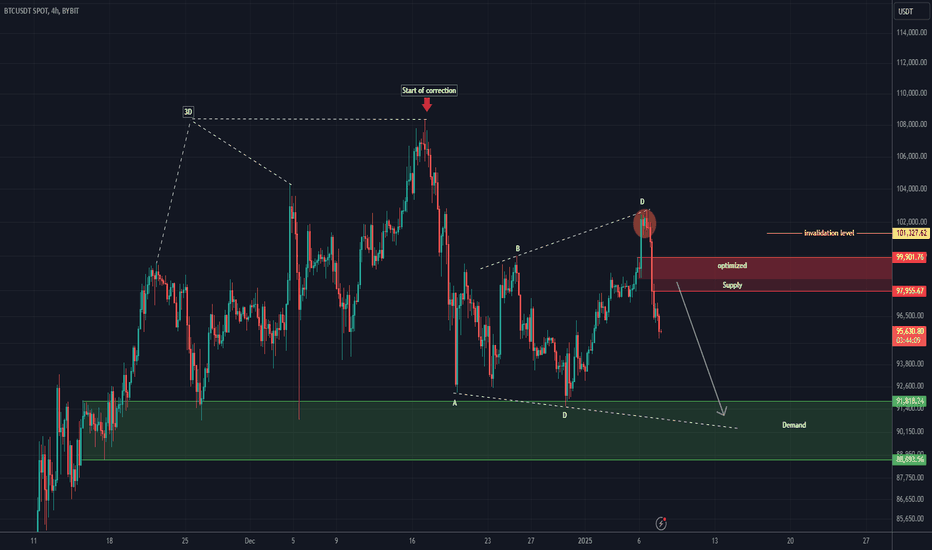

BTC NEW UPDATE (4H)This analysis is an update of the analysis you see in the "Related publications" section

The price dropped from the red-marked area in the previous analysis, and this supply zone worked well.

The correction for BTC started from the point where we placed the red arrow on the chart.

We expect a downward move toward the green-marked area.

If the price reaches the supply zone, we can look for sell/short positions as scalp trades.

Closing a daily candle above the invalidation level will invalidate our bearish outlook.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You