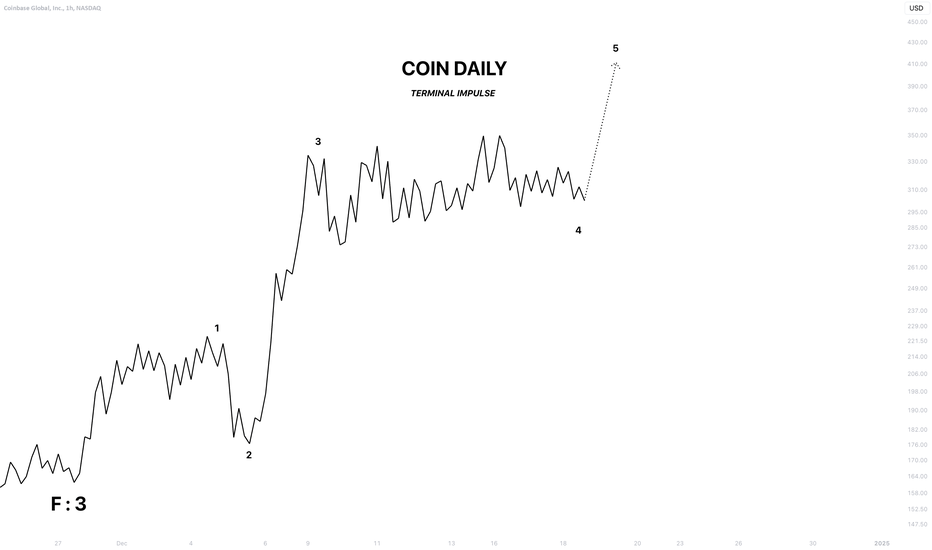

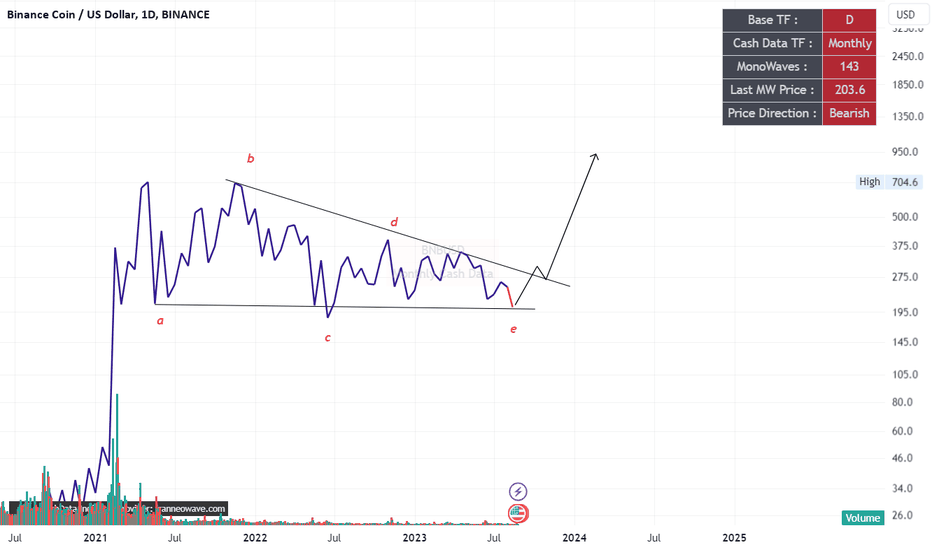

COIN NEOWAVE ANALYSIS (DAILY)Experimental analysis with the intention to follow back later on as I am still learning

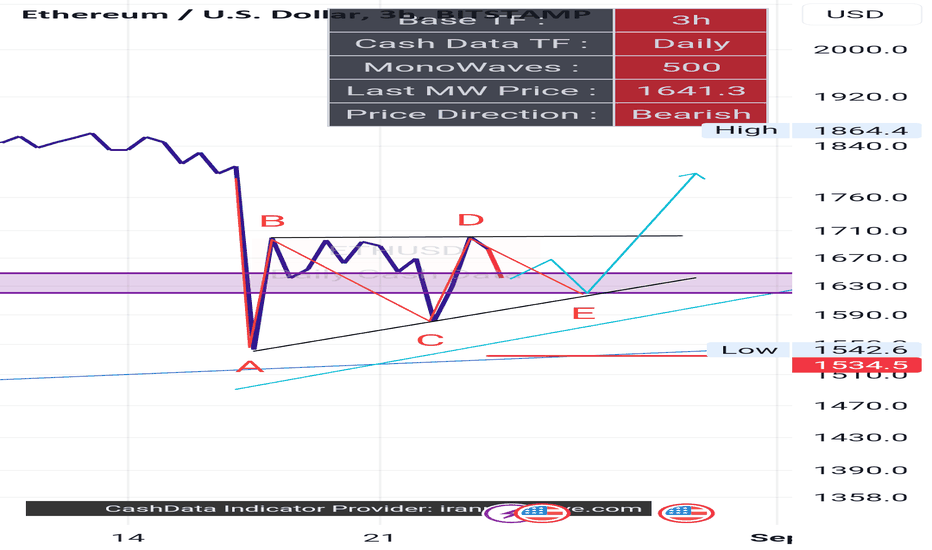

After posting the weekly chart, I decided to take a look at the daily chart to see if I could spot any clues,

Initially, it looked like an expanding triangle, but after reviewing it thoroughly, it did not meet the requirements.

The only other formation that could fit this structure is a terminal impulse.

In this scenario, Wave 3 is the extended wave, doubling the size of Wave 1.

Typically, when Wave 3 is extended, Wave 5 tends to equal the length of Wave 1. If not, then Wave 1 will usually be either 61.8% or 161.8% of Wave 5.

With this in mind, I would anticipate a minimum 20% upside, a 35% medium target, and a maximum target around 65%.

Obviously, we can only get a real target once wave 4 is over.

I do expect this terminal pattern to be part of a complex correction featuring an X wave, or to be the first leg of a larger corrective structure.

If you read my weekly analysis, you will understand that this complex correction will end wave G, which would end the B wave. This daily chart hints at a stronger B wave, which would put COIN in a bullish long-term trend.

Note: Since this is a daily chart, the probabilities of failure are even.

Neowaveinvesting

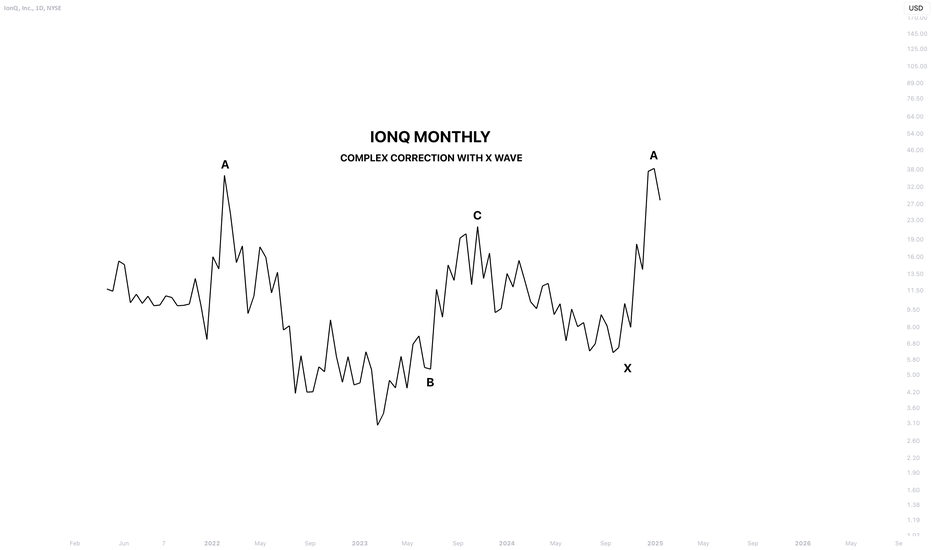

IONQ NEOWAVE ANALYSISExperimental analysis with the intention to follow back later on as I am still learning

My dad actually shared this ticker with me since he was holding it. I tried my best to analyze it and come up with a conclusive statement at that time, although I couldn’t, and what I did come up with was completely invalid. The main reason being that the price data available is very recent, and there is not enough price action to tell what exactly is going on.

Today, I will try my best to let you know what’s happening and where IONQ is headed.

The pattern is a complex correction joined with an X wave. The first part is a running flat correction with a strong B wave.

All trending waves are to the upside, and the recent wave A, being the fastest and strongest wave, tells me that the long-term trend is up.

My only dilemma in this chart was understanding whether the wave after the flat was either an X wave or an A wave. The only reason I decided to call it an X wave is due to its slow price action, whereas the recent move is a better A wave rather than a B wave, which is likely not possible.

I do not know what kind of correction wave A is a part of, but my best guess could be a contracting triangle since wave A was pretty strong, and normally wave A is the largest wave in a contracting triangle. So, this correction would be a double three correction.

I do think wave A is over; however, we should get confirmation soon by the start of January.

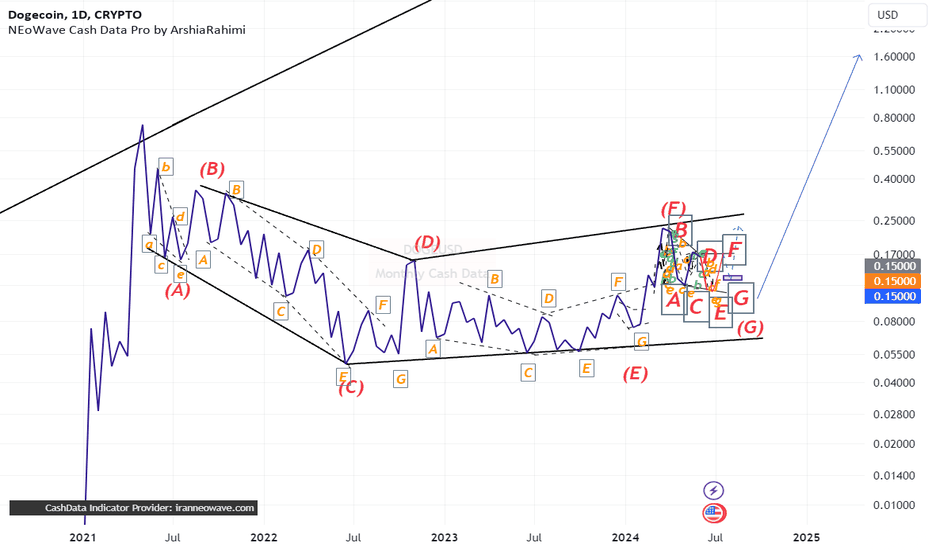

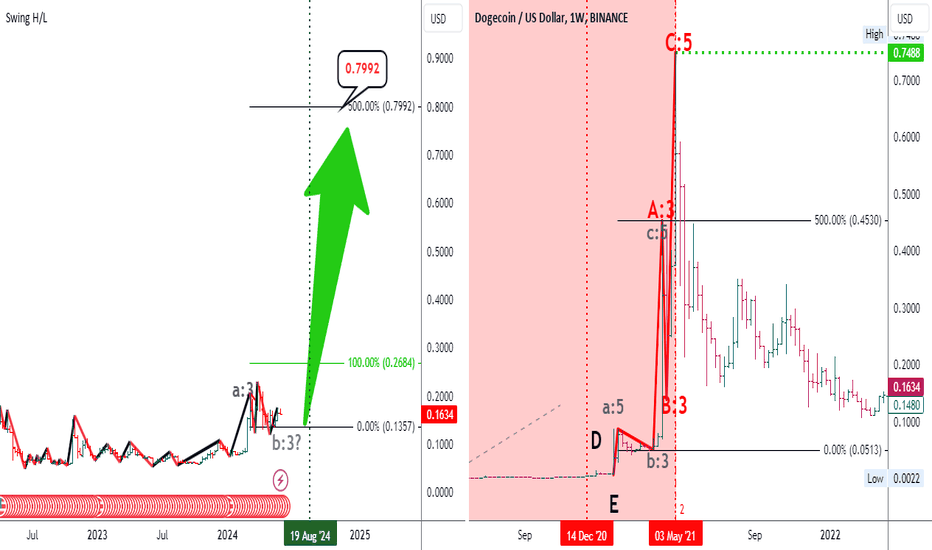

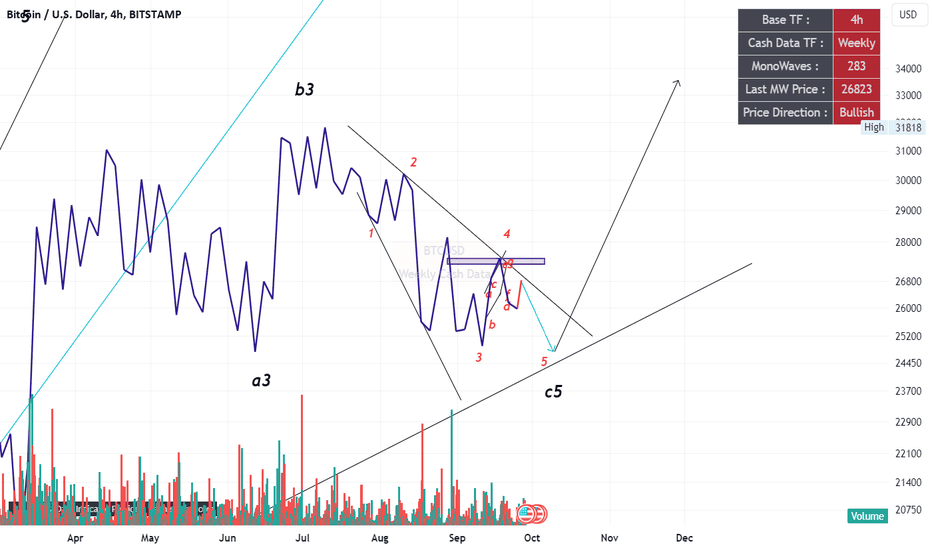

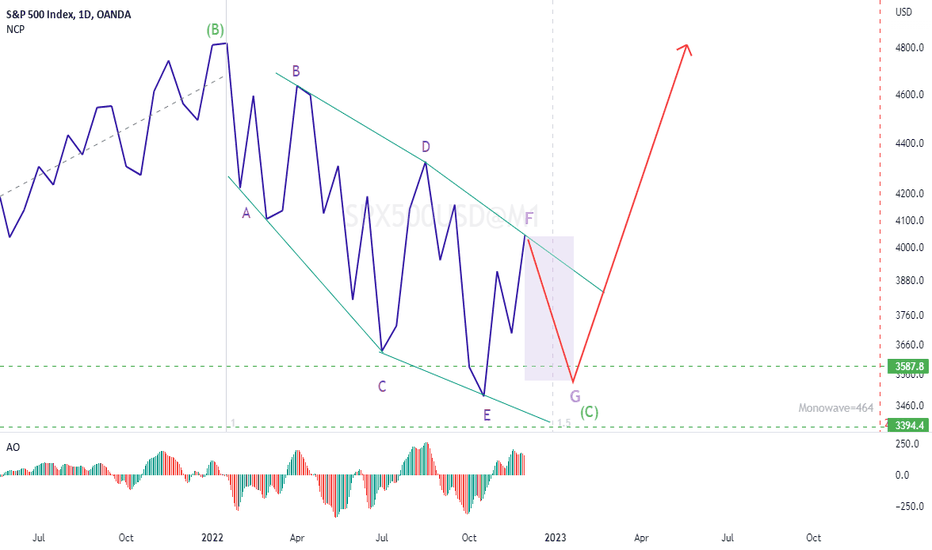

Elliott Wave Modern Analysis: Major Bullish Trends Unveiled!Hello traders! 📈✨ Today, we're diving into a comprehensive Elliott Wave Modern analysis on the DOGEUSD weekly chart (W1). With our two-window setup, we are comparing the current market behavior with a historical bullish trend from December 14, 2020, to May 3, 2021. Let's break it down:

Right Window Analysis:

Period: December 14, 2020 - May 3, 2021

Market Behavior: During this period, DOGEUSD exhibited a massive bullish trend forming an ABC flat pattern.

Key Levels:

Wave A: $0.4530, representing a 500% increase from a lower degree abc Zigzag (marked in grey).

Left Window Analysis:

Current Status: The market is currently forming the early stages of a three-wave pattern (a:3 & b:3).

Future Projection:

- If history repeats, we might see wave c:5 with a potential 500% increase, targeting $0.7992 from the height of a:3.

- Current Price: $0.1650

- Target: Watch for the first major peak around $0.7992!

🚨 Get ready for a potential bullish surge in DOGEUSD! 🚨 With these insights, we could be on the brink of another significant move. Stay tuned and trade wisely! 🚀💸

🔗 Follow for more updates and detailed analyses! 📊📌

#ElliottWaveModern #CryptoAnalysis #DOGEUSD #TechnicalAnalysis #BullishTrends #CryptoTrading #TradingView 🚀📈🌊

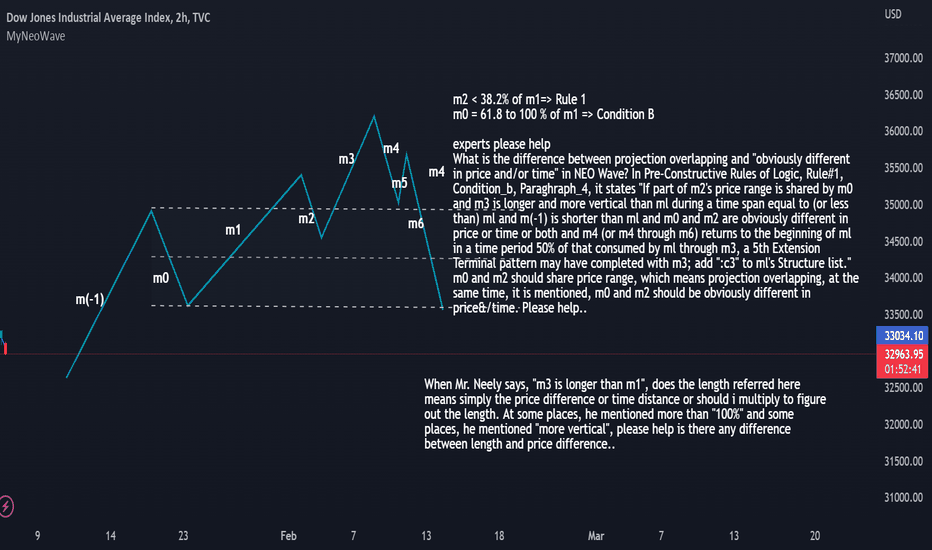

Neo Wave Learner doubtWhat is the difference between projection overlapping and "obviously different in price and/or time" in NEO Wave? In Pre-Constructive Rules of Logic, Rule#1, Condition_b, Paraghraph_4, it states "If part of m2's price range is shared by m0 and m3 is longer and more vertical than ml during a time span equal to (or less than) ml and m(-1) is shorter than ml and m0 and m2 are obviously different in price or time or both and m4 (or m4 through m6) returns to the beginning of ml in a time period 50% of that consumed by ml through m3, a 5th Extension Terminal pattern may have completed with m3; add ":c3" to ml's Structure list."

Here, m0 and m2 should share price range, which means projection overlapping, at the same time, it is mentioned, m0 and m2 should be obviously different in price&/time.

Experts please help..

Also, Mr. Neely mentioned, "m1 is longer than m3" in few other places, does the length means, by means of distance between 2 price points or by means of time distance or should i consider a multiple..