Elements of a Successful Trading Plan 102SELF DEVELOPMENT/METHODOLOGY/PSYCHOLOGY

Elements of a Successful Trading Plan 102

2. Risk Level

Managing a risk in trading is essential if a person wishes to make profitable investments. As a

trader, one cannot control the market but he/ she do have the capacity to change what can be

done as circumstances require. They need to adapt the changes as the market conditions evolve.

A person does not take a position and hopes the market acts in your favour. Managing trading

risk will be a key factor in an individual’s long term success as a trader. As the market, structure

changes, the risk profile of trade will also change.

Risk will vary at different points of a trade and needs to be managed in a manner, which is

consistent with the individual style of each trader. This will be dependent on each trader’s

personality and time frame. Assessing market conditions can be categorised into core areas

where one need to consider the risk profile in his/ her trade. This risk needs to be assessed also in

line with your trading objectives. Active traders will tend to add and take off risk for each new

swing in the market, whilst passive investors will ride minor retracements looking to achieve

larger reward targets. Following are some areas where risk can be managed throughout a trade as

well as what to look out for at these points that indicate that the risk is increasing;

• At Entry: Stop loss risk.

• Distance from Moving Average: Price exhaustion risk.

• “M” Pattern: Price retest failure risk.

• Candlestick Tails and Shadows: Price rejection risk.

• Period Close: Price rejection risk.

• Reducing Range: Trend momentum risk.

• Support or Resistance: Price level failure risk.

It is necessary that how an individual plan to address the risk management needs to be included

as a critical part of the trading plan in order to protect the invested capital and preserve the

profits. One need to have strategies in place for how he will deal with the different areas

throughout a trade and how he will know when risk is increasing to a point where action needs to

be taken either to protect profits or capital.

Follow your trading plan, Remain disciplined and keep learning :)

More elements will follow... Like, share, Comment and follow us to keep updated on our professional trading ideas and education :)

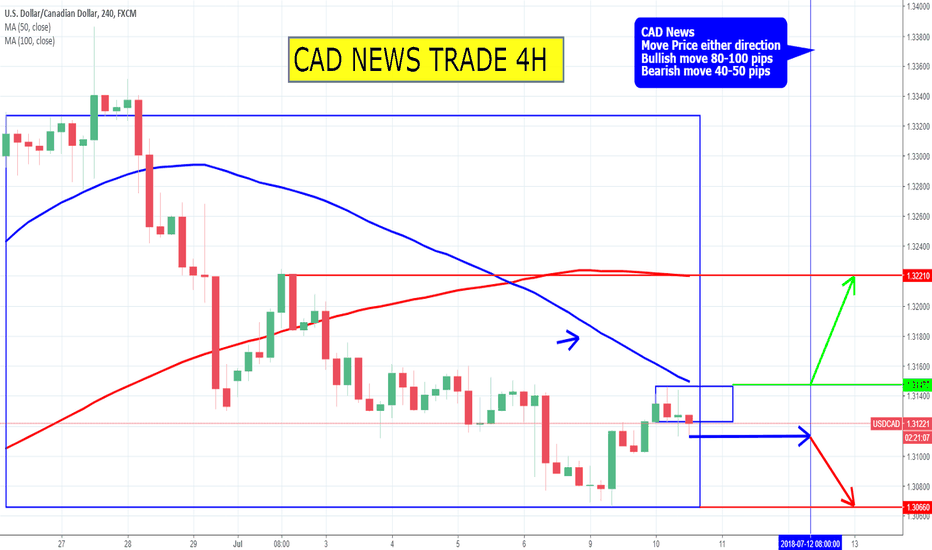

Newstrading

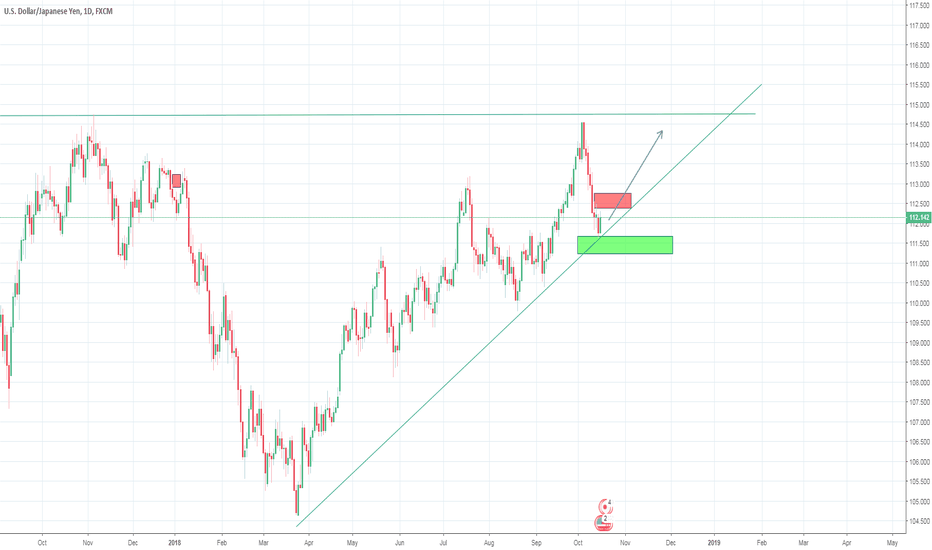

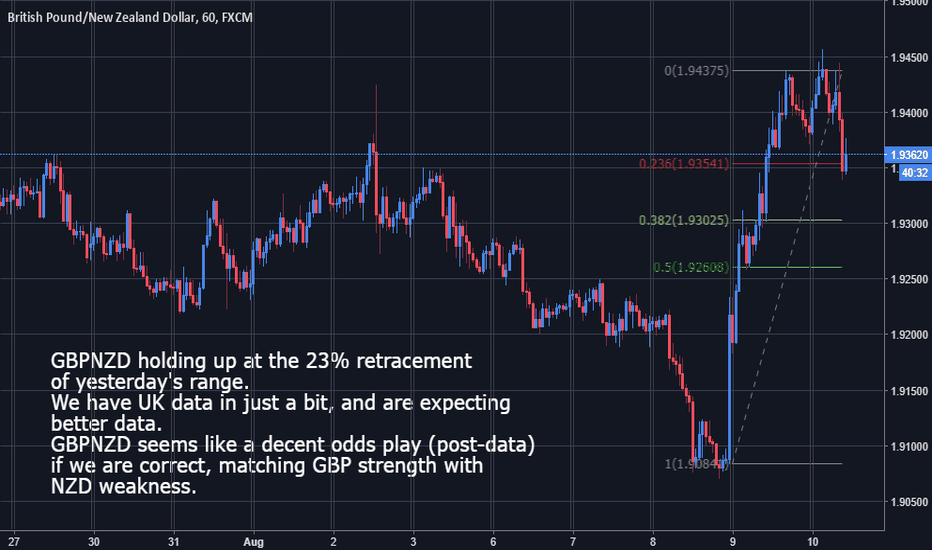

Still an upsideGiven the recent weakness for the USD we believe this may just be a retracement, looks like Buyers are still lurking at around the 111.500 area and ready to add strength to take price further possibly overcoming the sellers remaining at the 112.550 area and carry on further to reach the recent highs of around 114.00

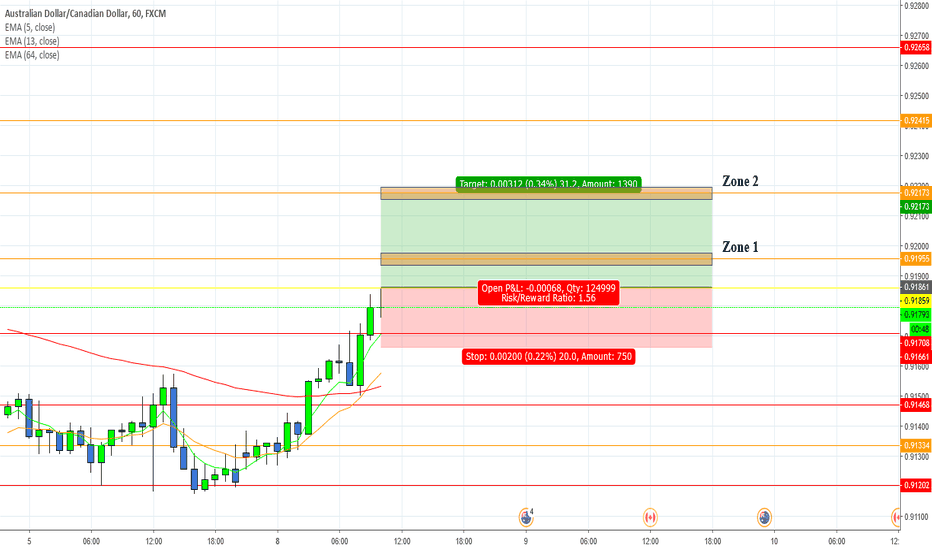

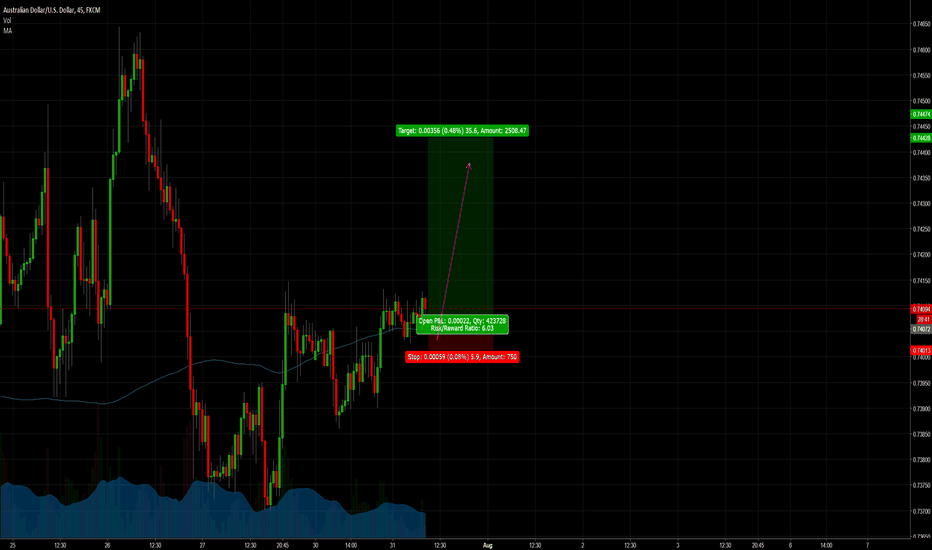

Potential Buy on AUDCADCAD experiencing very little activity today as it is also a holiday in Canada leaves room for stronger currencies to gain some ground. AUD has had a lovely start to the week with a strong bullish push in the early hours of the day. If price breaks 0.91859 and closes above that zone it would be a great opportunity to enter the market to grab 30 pips at the Zone 2. Share your thoughts, comment what you think awaits AUDCAD!

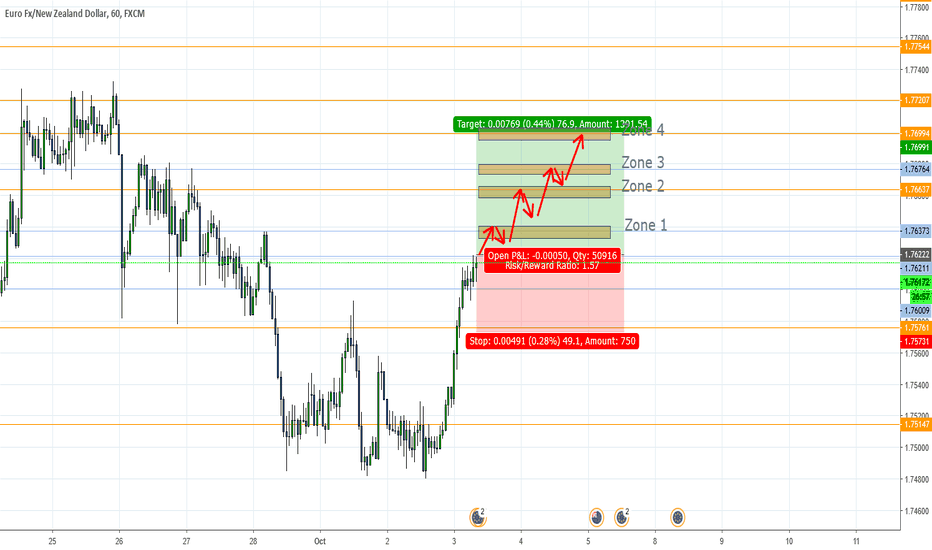

EUR Gaining Strength amidst NZD weaknessEur has gained considerable strength in the last couple of hours. With Eur expecting positive news we should see a considerable rise. There are 4 zones that i expect to be crossed in the next 24 hours. The orange zones are on the daily time frame while the blue zones are on the four hour time frame. Trade with caution! ;)

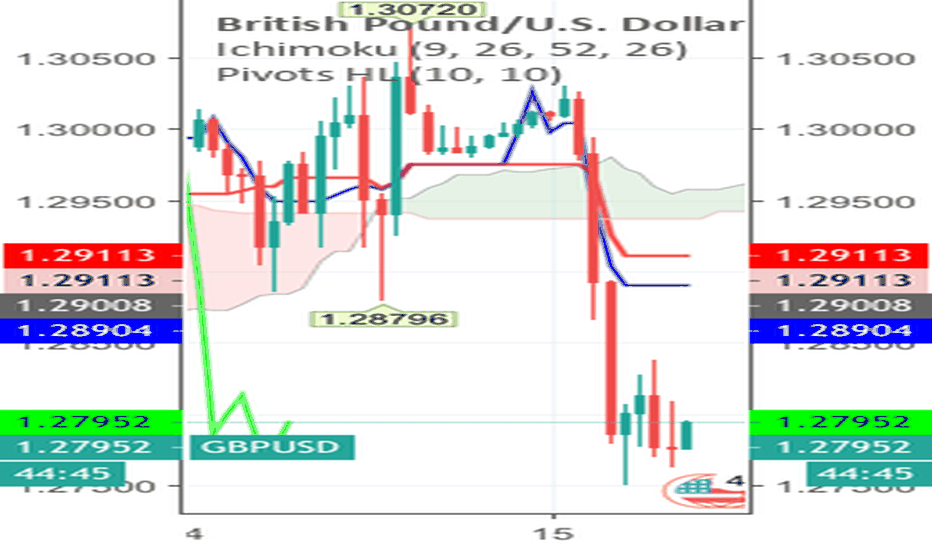

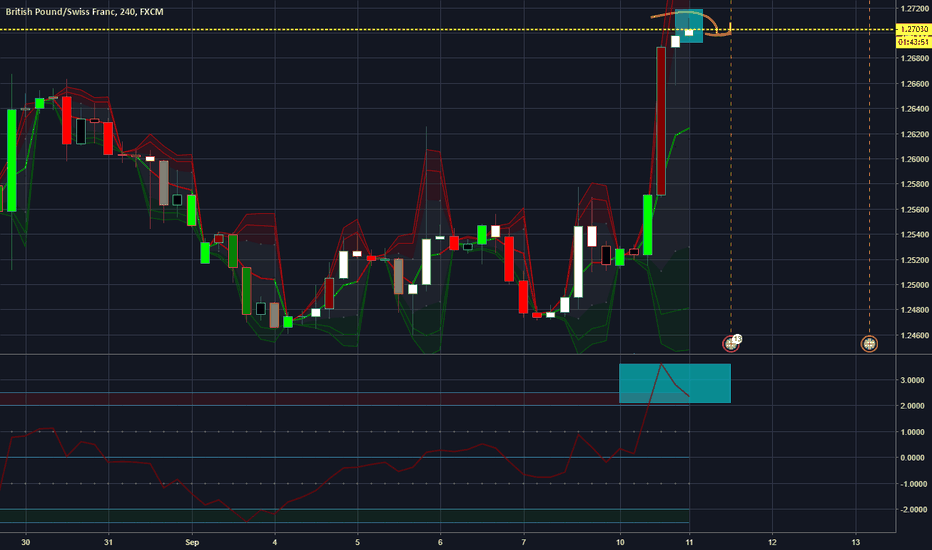

GC (GBP/CHF) Inverted hammer building entry Vwap GC (GBP/CHF) is building Inverted hammer in 4hr Tf Vwap good for entry, Z distance from Vwap is highly overbougt

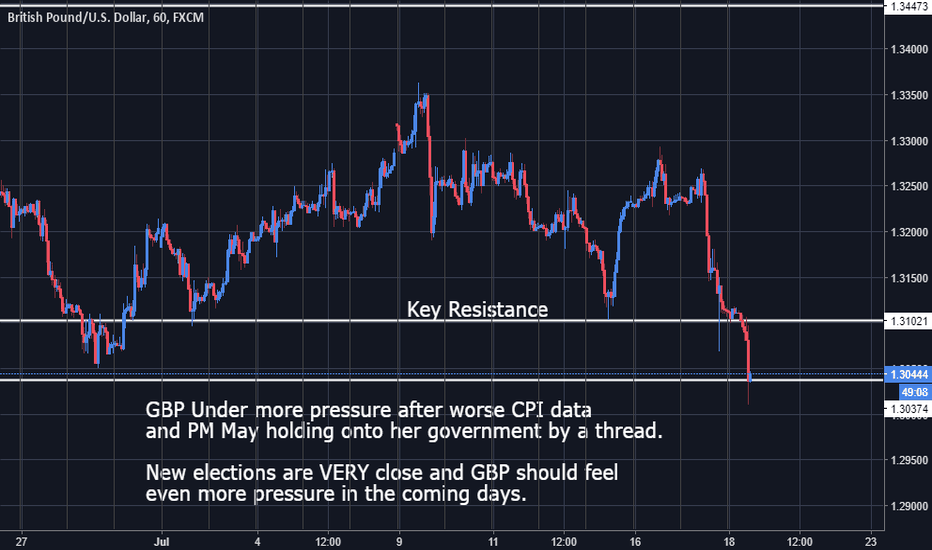

Day Range is +200 pips so be very careful and mindful. Sterling falls below 1.30 in 10 months.

Tomorrow Economic calendar event & news can affect pound heavily!!

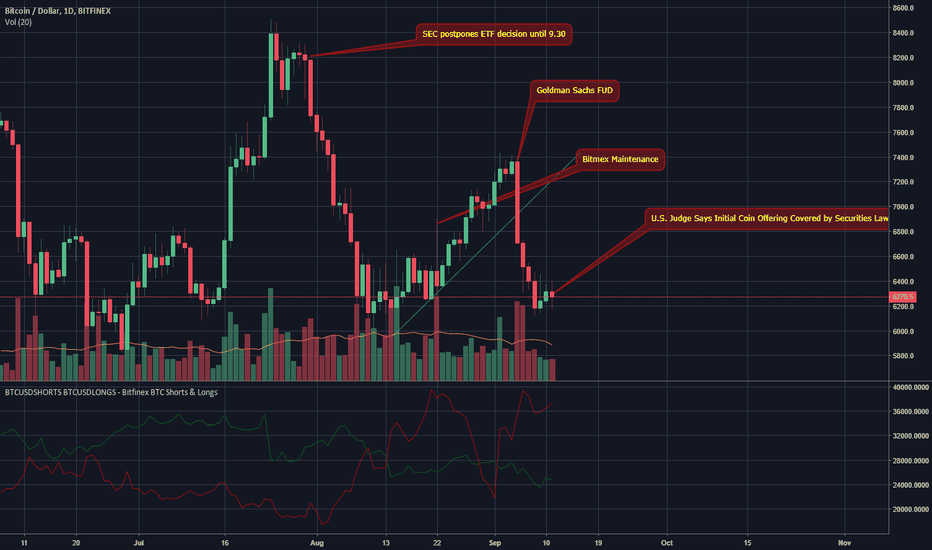

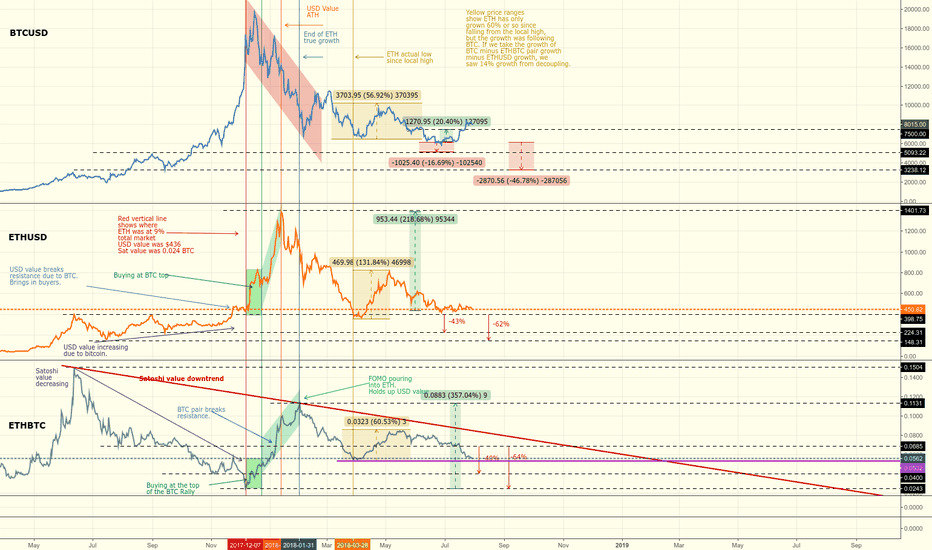

ETH Analysis July UPDATE: Bubble Deflation Is Just Get StartedSo far my ETH/BTC prediction is playing out quite well. ETH/USD losses have been offset by the 32% increase in BTC’s value up from $6400 to the $8000-$8500 range. This has kept ETH/USD from falling to $350 or so from the 20% loss in true value.

Read the rest:

medium.com

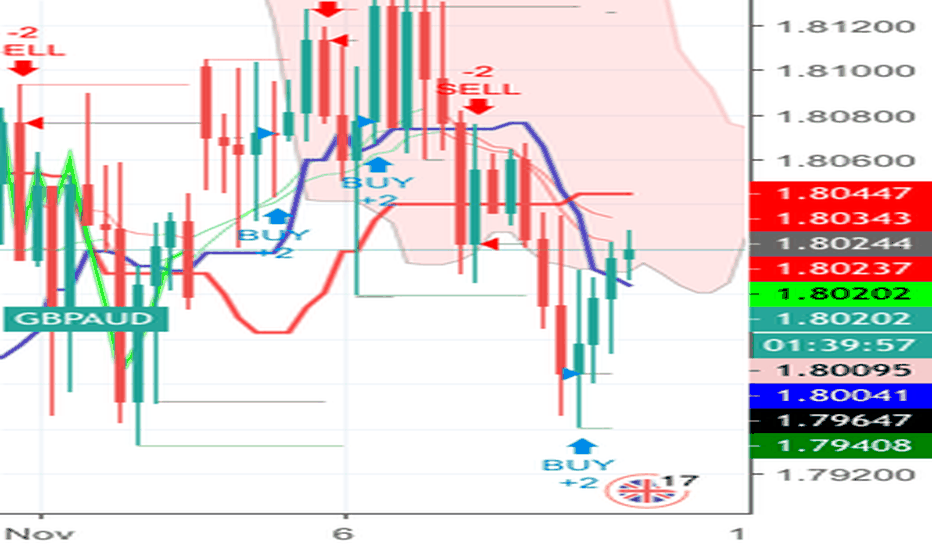

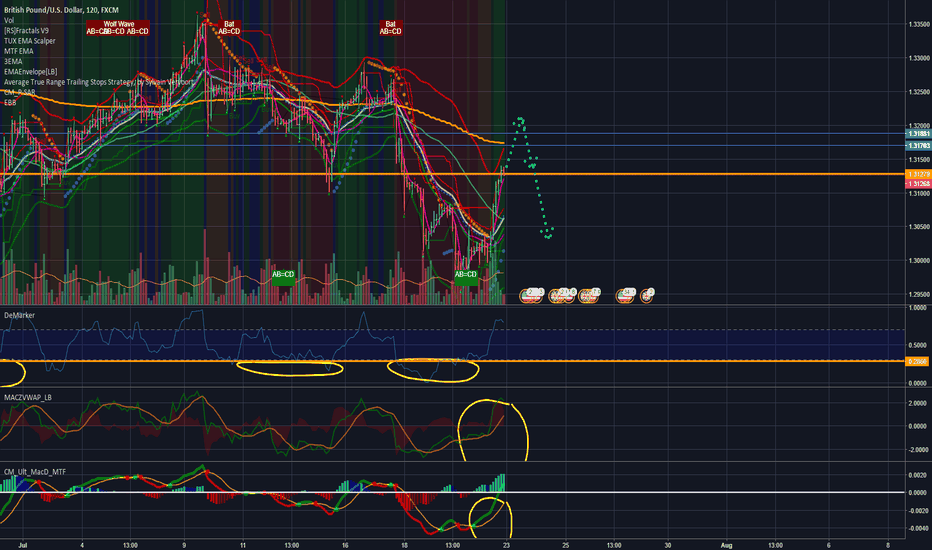

[b]Catching the PIP's with my sonar radar Setup[/b]

FX:GBPUSD

Description:

GBP/USD shows strong support within DeMarker indicator (DeMarker was used to replace RSI and Slow Stoch)

MACD and MACz Vwap shows continuation of the bullish uptrend for hourly and daily chart high time-frames

Within opening bell wait for Fractals v9 TUX EMA Scalper and CM_PSAR EM Envelope confirmation for the entry positions.

Put your S/L within the EMA BB and use MTF EMA and 3EMA as the support and resistance of your positions.

Look at the different time-frames to minute, hourly and daily for trends and patterns

This is good for intraday/swing trades not scalping short time frames. If you want to scalp look for Fractals v9 TUX EMA Scalper and CM_PSAR EM Envelope confirmation .

Good for traders sitting at the desk waiting for the trend confirmation. Very High expected PIPs return when the strategy followed the trend.

Good luck traders and happy hunting !!

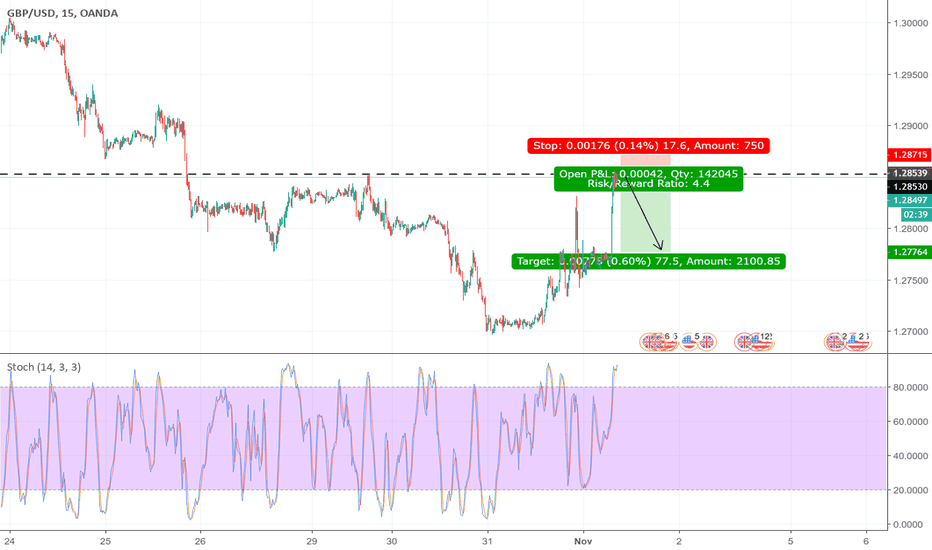

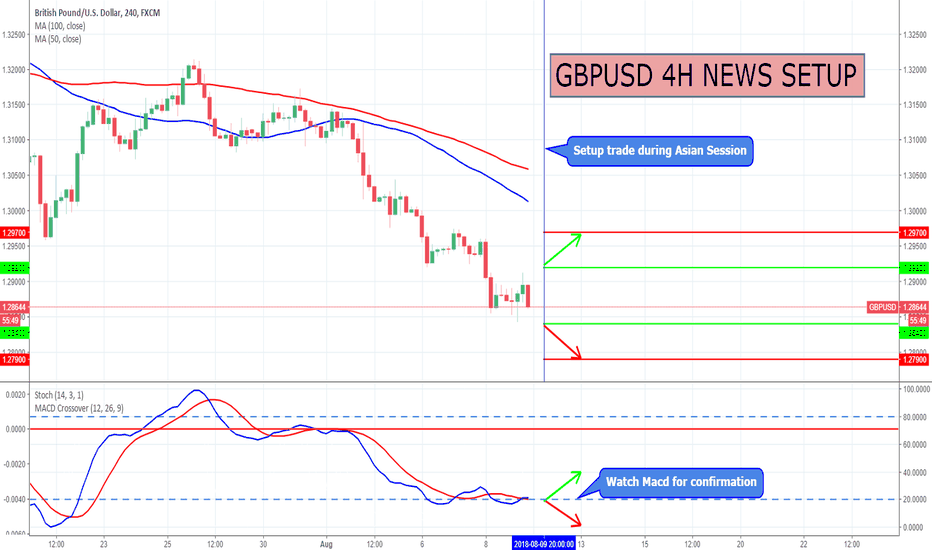

EURUSD Revised Entry In lew of the Interest rate decision here is a new tactical entry for those who want to trade on the surprise factor.

A hike is already priced in so no confusion there. The Euro shall decline a bit but not significantly.

So the idea of going against the grain and buying up the euro before the hike has a much better potential in terms of RRR.

Please I appreciate all comments even if you hate this analysis let me know.

All feedback is good feedback.

Trade safe trade well.

Thank you.