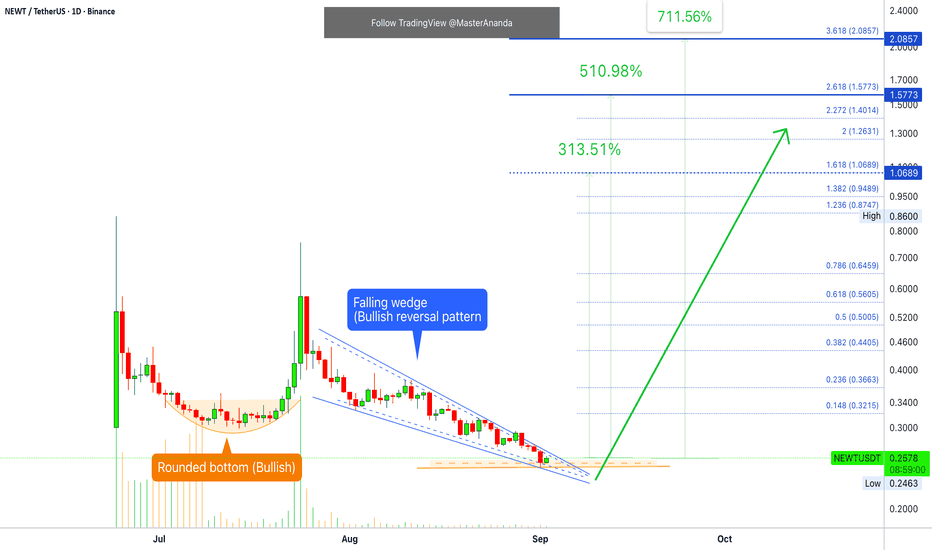

Newton Protocol · Catching A Falling Knife While Earning 511%What do you do if things go wrong, keep trying or give up?

Personally, I never give up. What about you?

NEWTUSDT went beyond the previous low. Seeing this, I decided to buy more at the new low rather than selling at support. In this way I can a build a strong position and profit when the market turns. Will the market turn?

See how Bitcoin is doing today. There has been lots of sideways, lots of bearish action, but support continues to hold long-term. Today Bitcoin is moving above $110,000, already trading above $111,500, a strong bullish development short-term.

When Bitcoin grows, the altcoins soon start to follow.

Since Bitcoin is growing, recovering, we can expect NEWTUSDT to do the same.

A new all-time low was hit yesterday.

Do you prefer to buy when prices are high or when prices are low?

I am aiming at a new all-time high. The easy target at $1.57 can produce more than 500% growth.

Plan before buying.

Study.

Prepare before trading.

Learn to wait.

Buy when everybody is gone.

It is easier said than done but it works.

It feels strange to buy with dropping prices; but I already bought when prices were going high and the result was a crash. If I buy again when prices are low, the chances are...

Thanks a lot for your continued support.

How you approach this and other pairs will depend on you capital, your trading strategy, your risk tolerance and your goals.

This chart shows the opportunity but the market can do whatever it wants.

It can move higher but it can also continue lower. The highest profits potential appear when we get the bottom.

Namaste.

NEWT

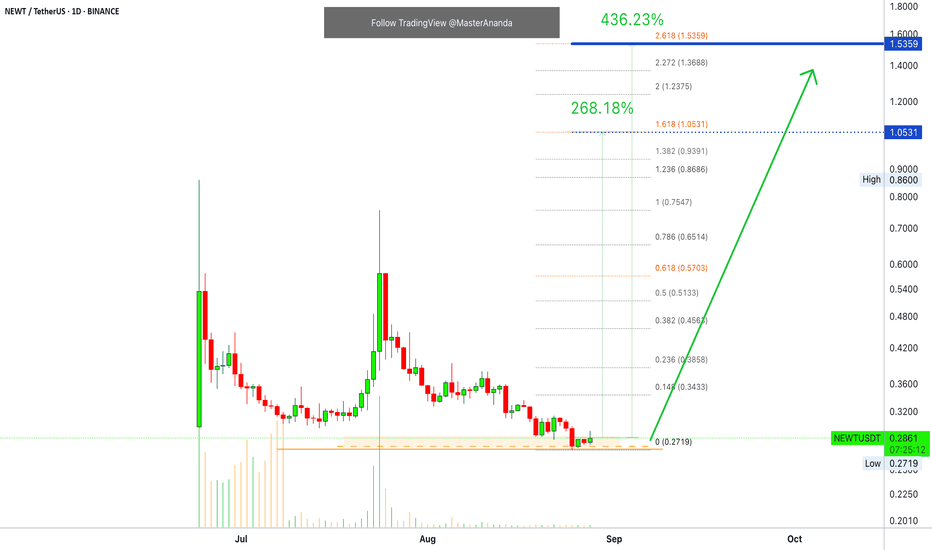

Newton Protocol Update · Futures Trading Trade-NumbersLast time didn't go that well and that's ok, we take the loss. The nice part is that this is a spot trade so we simply wait. I made the mistake of jumping in too early on the retrace. This position I let sleep and put my focus on something else; eventually, it recovers.

When we make a mistake with a spot position, we can take a small loss and make sure not to repeat the same mistake again; or, we can turn the mistake into a wait. Since we know the market is going up but the only thing off was my timing, I can simply wait.

Ok, enough of that.

Here we have Newton Protocol, NEWTUSDT. The low is still not confirmed, it can be early again. There is no volume and these things are tricky.

NEWTUSDT and we have a lower low now vs mid-July. This means that the previous jump was corrected by more than 100%. All stop-loss orders activated, all weak hands removed. All buy orders filled. Total reset.

When this happens, we have less risk and an even higher potential for reward. It is the same project, but the chart setup is becoming stronger.

With that said, the signals here are early and weak but the market tends to move in unison. Also, seeing how strong the previous jump was, catching a breakout here can produce good results.

________

LONG NEWTUSDT

ENTRY: 0.2720 - 0.2940 (STOP: 0.2700)

TARGETS: 0.3433, 0.3858, 0.4563, 0.5133, 0.5703

________

Thanks a lot for your continued support.

Feel free to leave a comment if you have any questions.

You can get superior content in this platform if you choose to follow me.

Namaste.

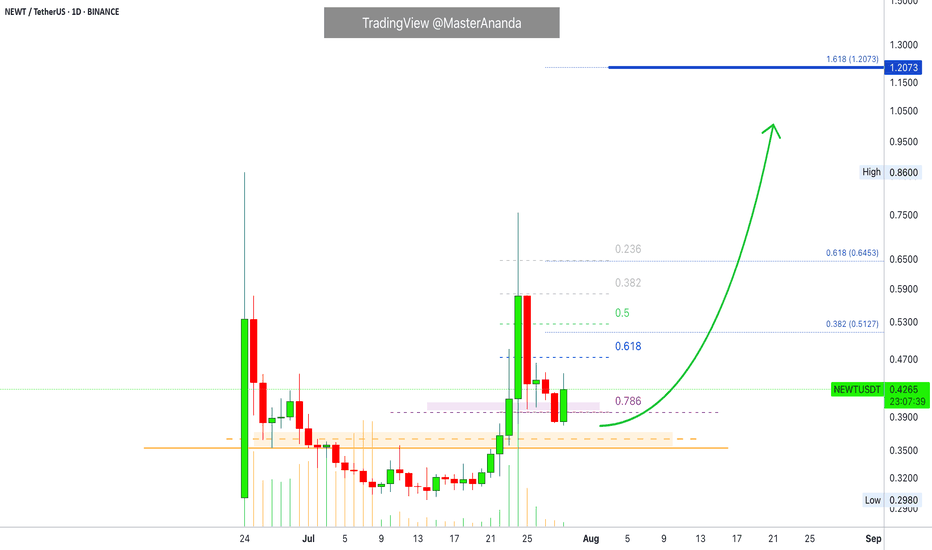

Newton Protocol · Round 2 Goes Easy To $1.20The higher low is in now and the strong bullish breakout we witnessed just a few days ago reveals the massive force behind this pair. Traders are ready to trade.

The high volume is good because volume is needed for growth. The first jump was only a small taste of what is possible, and seeing the action as it is now, NEWTUSDT is already preparing to produce a higher high.

This is good news for a buyer now and also for the rest of the market. If NEWTUSDT is ready to move forward with strength, this means that the current retrace is over and we will see a resumption after just 4 days.

Let's get to the chart.

Notice the rounded bottom pattern. Notice the recent bullish wave and the correction that followed. The action went below 0.786 Fib. and as soon as this level hit there was a recovery. Now the day is full green and the action is happening above this strong support zone. This can mean that NEWTUSDT is ready to move short-term. A higher high move would require days and days of sustained growth to be achieved. Getting the bottom can make for a very entertaining ride.

Patience is key. Market conditions can always change.

Be ready to wait and you should do great. You have great timing for reading this now, the altcoins market is just starting a major advance and bullish phase.

Namaste.

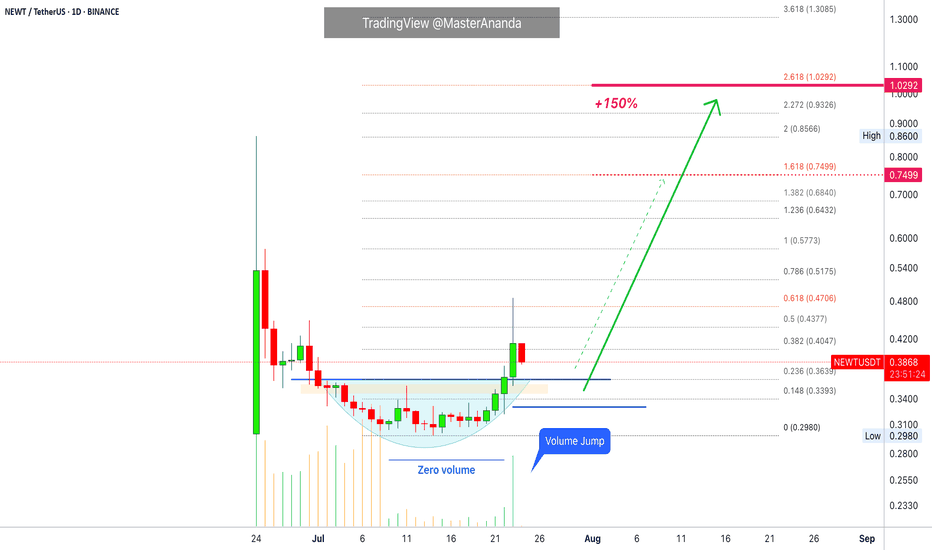

Newton Protocol · Volume Signal · 150% PP Short-TermI will show you now a successful choice on a volume signal as we look at Newton Protocol (NEWTUSDT) on the daily timeframe.

Notice how trading volume is flat while NEWTUSDT is producing a rounded bottom with the daily candles. It reads "zero volume" on the chart.

Now notice the strong "volume jump" today, 23-July, as soon as the action moves outside the rounded bottom, also a Fib. extension resistance. The strong jump confirms the start of a bullish advance. Our short-term target gives us 150% profits potential.

I will end this series soon and go back to our usual schedule.

These charts show the altcoins market being full of opportunities at this point in time. There is something for all types of market participants, active or passive traders. Risk lovers or risk averse. We are only getting started.

Your support is appreciated and all feedback is welcome.

Do you enjoy short-term trades?

Did you know, you can hold these pairs long-term once the bullish trend develops. Selling for profits is only optional, the market is set to grow until late 2025 or maybe into Q1 2026 or beyond.

The things that are happening worldwide in relation to Crypto are a first in the history of humanity. It is the first time that money is free from a tiny controlling monopoly. It is the first time in our history that you can create your own money. Decentralized finance. No middle men. The greatest financial and technological development in our history.

Namaste.

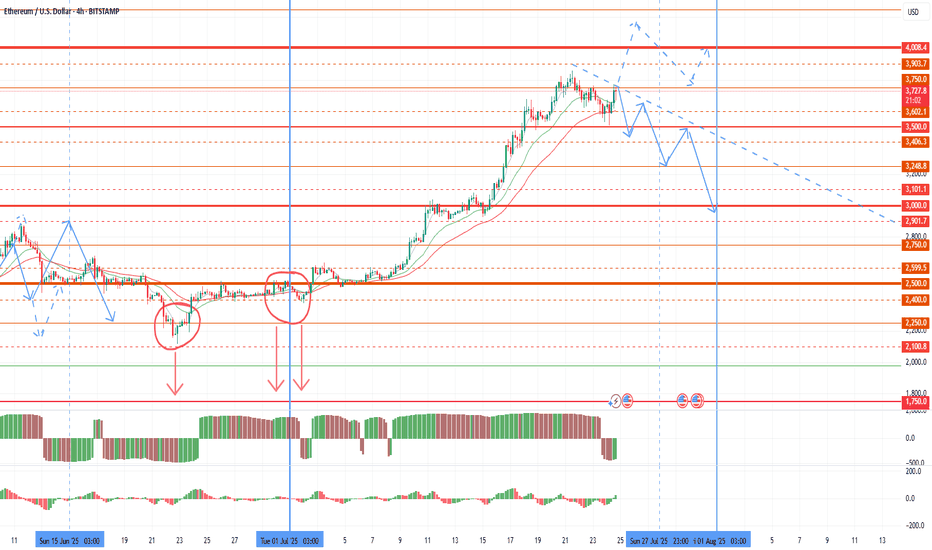

Possible market drawdown before the end of the monthToday I want to review the market and give a warning on further purchases. Since the last review, as expected, volatility in the market began to grow with a flat of about 2500 on ether until the half-year change. The growth of the euro and oil gave rise to a 4k retest in the new half of the year. However, the half-year has opened below 2,500, which is a technical selling signal that bears will use at the end of each major period. A large volume of sales was also left before the half-year change, which can be retested up to 2100-2250. The first pullback is already possible for the current monthly candle, with its pinbar reversal up to 2750-2900 on ether. This pullback started yesterday and is likely to accelerate in the last weekly candle of the month. Further sales are highly likely to continue in the first half of the new month as part of the shadow drawing for the new monthly candle. In an optimistic scenario, the bulls will be able to take 4,000 by the end of the week, in which case the pullback on the current monthly candle will be compensated.

Given the increased likelihood of sales in the market, I recommend fixing profits by the end of the week and reducing the number of coins in operation. The current rollback for some coins will also end with the assignment of the monitoring tag at the beginning of the month and a further collapse, which puts pressure on the coins.

Most of the coins that I considered for work provided good opportunities for making money, especially the growth impulses of pivx and data with sharp breakouts stood out. Adx fio chess cos token also showed growth, but at a smoother pace. The most negative dynamics was given by slf, which eventually received the monitoring tag, and I will not consider it in the future.

Despite the pleasant impulses of 50%+ for individual fantokens, this group as a whole shows extremely negative dynamics relative to the market, and remains in the most oversold position, even relative to coins with the monitoring tag. In an optimistic scenario, fantokens will become interesting to speculators against the background of the general decline of altcoins that has begun, and we can expect a good bull run on them before the end of the month. In a negative scenario, binance may be preparing to assign the monitoring tag to some tokens of this group or chz. In this regard, I leave such tokens as atm acm city porto Lazio as the most undervalued in a small lot. But at the beginning of the month, I also recommend keeping short stops on them in the first half of the day of the first week of the new month to insure against assigning the monitoring tag. Or temporarily sell them for a given period.

In addition to fan tokens, I will choose new coins for operation after assigning the monitoring tag in the new month.

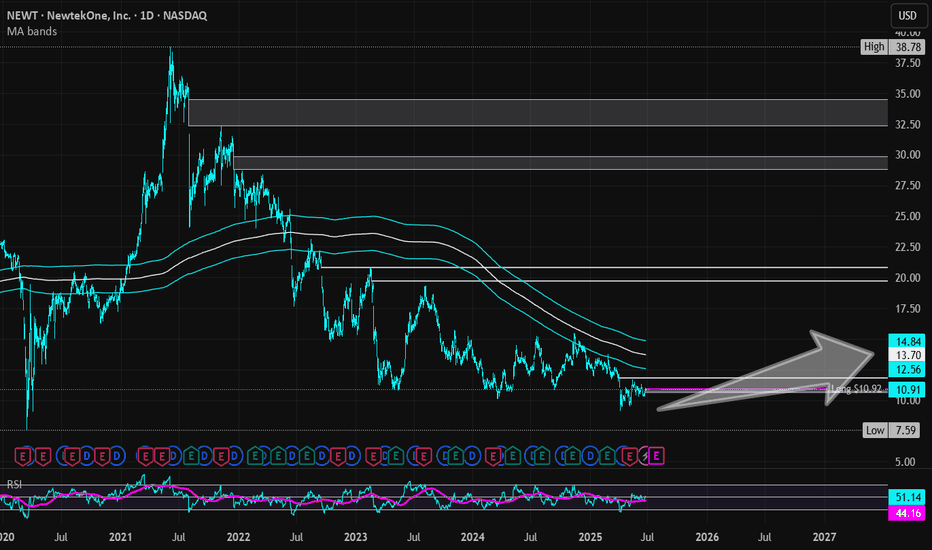

NewtekOne | NEWT | Long at $10.92NewtekOne NASDAQ:NEWT is a financial holding company providing business and financial solutions to small- and medium-sized businesses across the U.S. Services include Newtek Bank, business lending, SBA loans, electronic payment processing, payroll and benefits, insurance, and technology solutions. While the stock has taken a major hit recently, insiders have scooped up over $1 million in shares with an average price of $11.70. Currently trading at a P/E of 5.6x, forward P/E of 6.6x, and near book value, the stock may be poised for a move up soon with the anticipation of interest rates dropping. Revenue is up 24.93% from $271.15M (2023) to $338.73M (2024) and earnings are forecast to grow 11.63% per year, but the company does have a high debt-to-equity ratio (over 5x).

Tariffs could indirectly impact NASDAQ:NEWT by increasing costs for its small- and medium-sized business clients, particularly in industries reliant on imports (e.g., manufacturing, retail). Higher costs may reduce client profitability, increasing loan default risks or reducing demand for Newtek’s lending and payment processing services. But an interest rate reversal may greatly limit the impact (longer-term).

So, at $10.92, NASDAQ:NEWT is in a personal buy zone.

Targets into 2027:

$12.00 (+9.9%)

$14.00 (+28.2%)

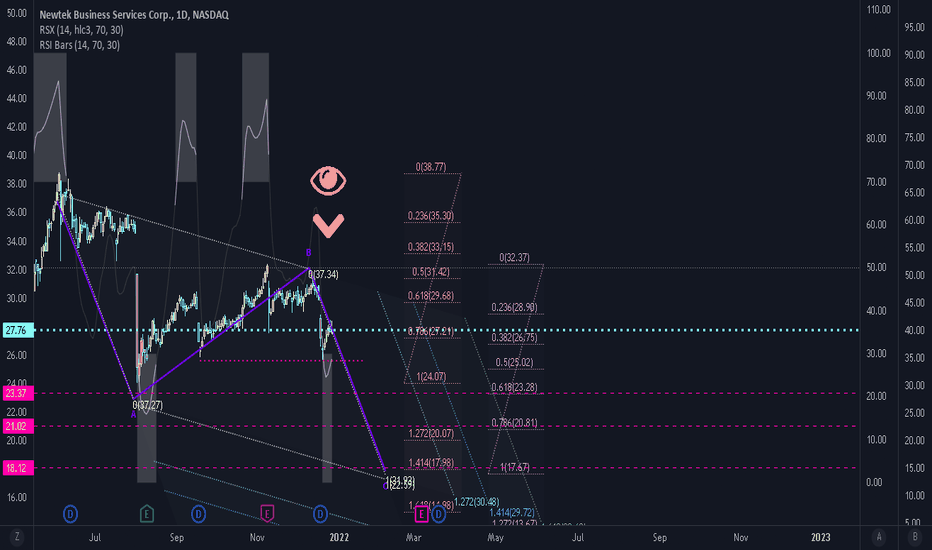

Newtek Business out of business. NEWTFurther drops almost guaranteed as we approach pivot on this one on what is already progressing Wave C. Momentum drops are also evident. Keltner channels, and no doubt, and any other oscillator that we can pull up on this TradingView will give more evidence to the fractal picture we are observing here.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

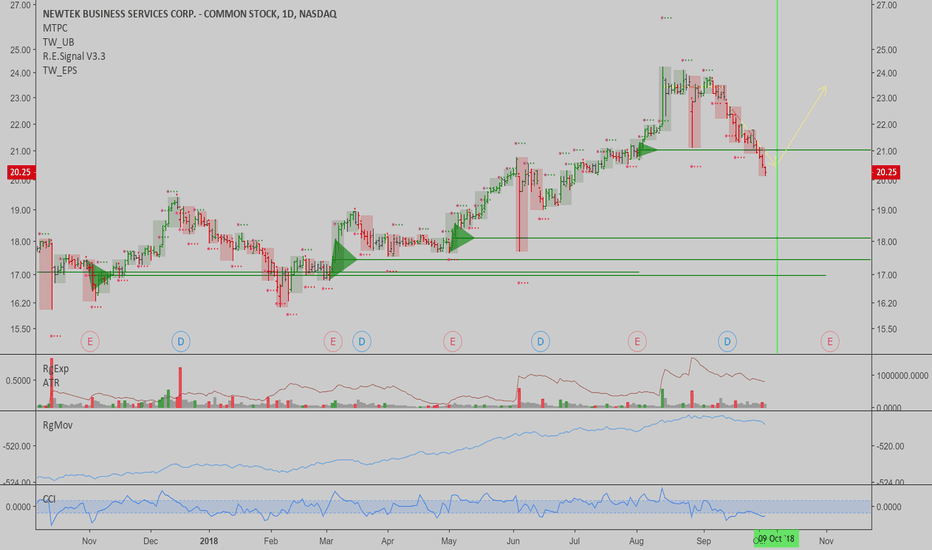

NEWT: Downtrend target hit, time expires soon...$NEWT is one of the stocks we monitor in our income stock watchlist. I like how it's setting up for a buy here, normally it falls after going ex-dividend, since investors leg into it ahead of the dividend being paid, and exit after receiving it. This is a reliable pattern in this stock.

Technicals show price met a downtrend target slightly ahead of time, and as soon as it turns up over a previous day high, it will be safe to be long this stock. Additionally, we could wait for time to expire, by the date shown with the green vertical bar on chart.

I estimate price will act as per the yellow arrow on chart, if it follows 'Time @ Mode' rules by the book (which is likely overall).

Best of luck,

Ivan Labrie.