Newzealand

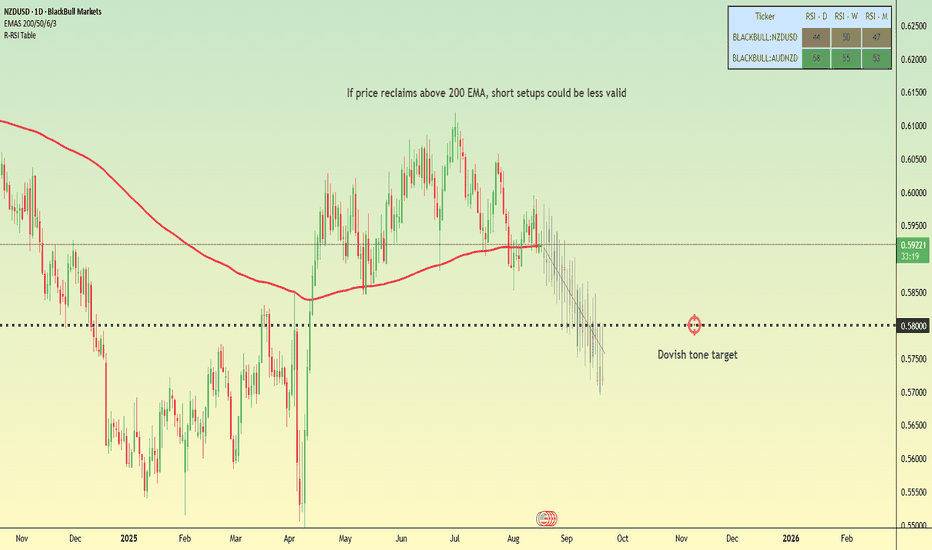

Kiwi outlook: key zone for Kiwi bears This week’s Reserve Bank of New Zealand (RBNZ) policy decision will help shape trading ranges for the next quarter.

Kiwibank’s economists expect the RBNZ to deliver a 25-basis point cut, lowering the Official Cash Rate (OCR) to 3.0%. According to Kiwibank, another reduction is on the cards, though the pace of easing may not be aggressive enough to provide the stimulus the economy needs.

They argue that a more supportive stance is required to stimulate the lagging economy, suggesting 2.5% would be closer to the right level. A dovish tone from RBNZ Assistant Governor Christian Hawkesby could reinforce this view, and the Kiwi currency could fall towards 58c, giving a bit of relief to exporters.

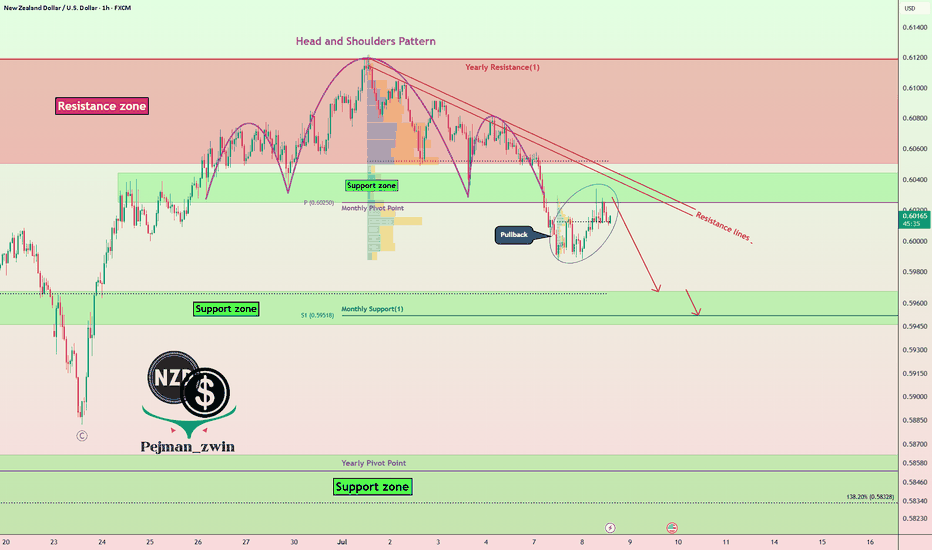

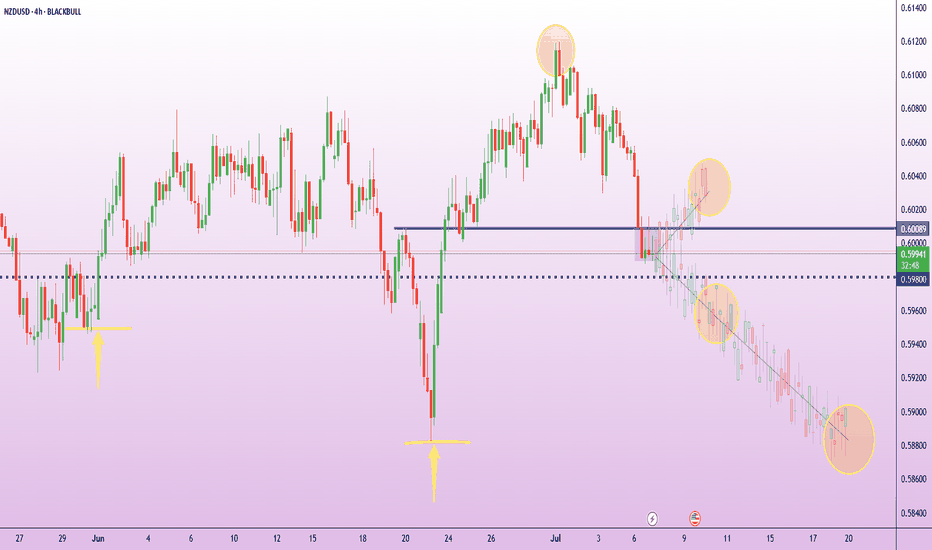

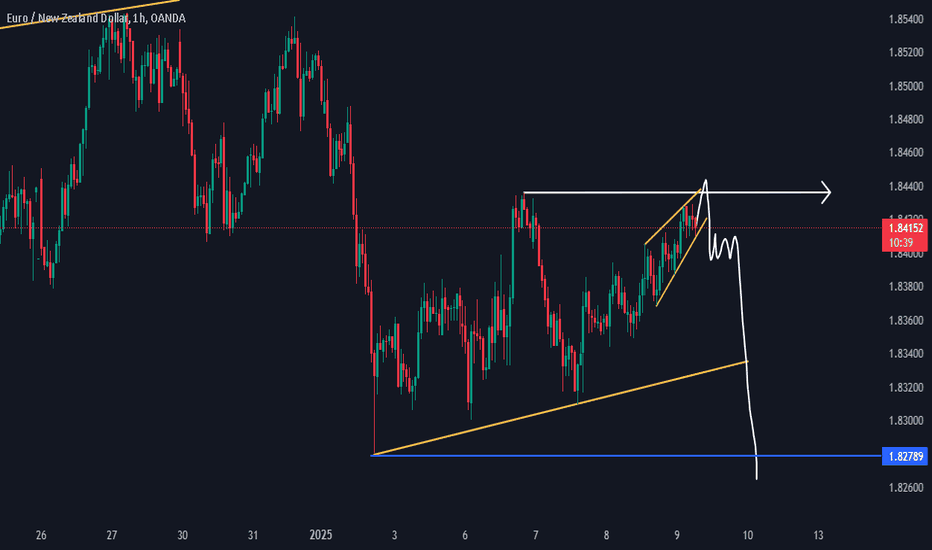

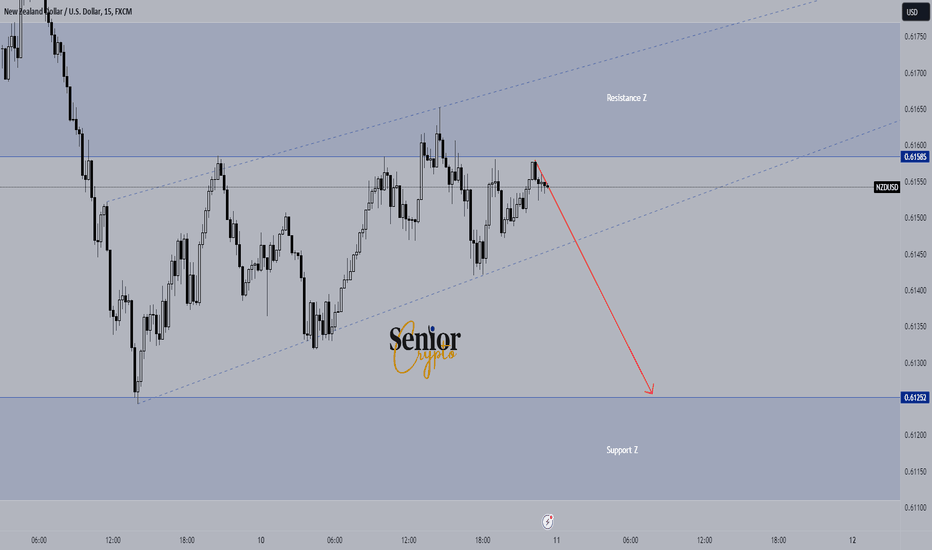

NZDUSD Pullback in Play – Head & Shoulders Signals More DownsideNZDUSD ( OANDA:NZDUSD ) is currently trading near the Resistance zone($0.612-$0.605) and has also managed to break the Support zone($0.604-$0.602) . We consider the Support zone as the neckline of the Head and Shoulders Pattern .

In terms of classic technical analysis , NZDUSD has managed to form a Head and Shoulders Pattern .

I expect NZDUSD to decline towards the Support zone($0.5968-$0.5946) after completing the pullback .

Note: Stop Loss(SL): $0.6062

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ U.S. Dollar Analyze (NZDUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

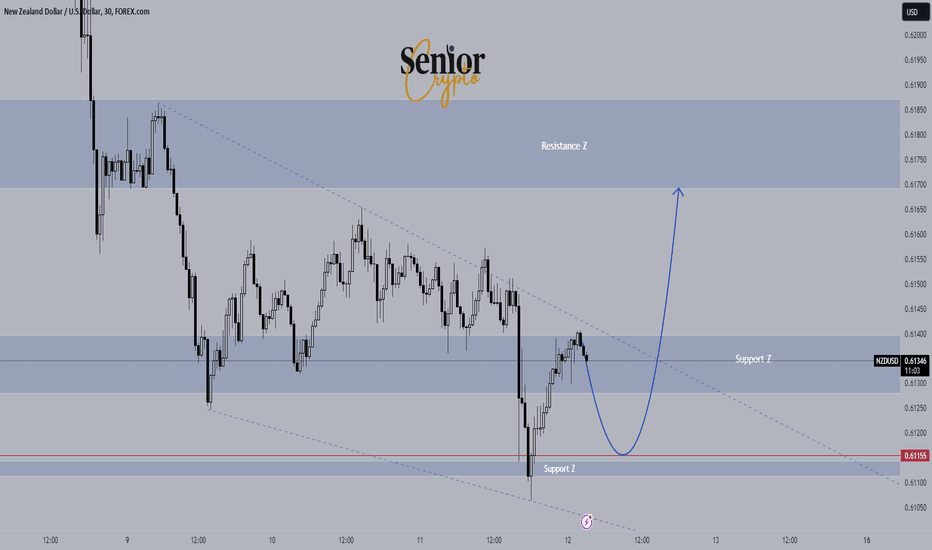

NZD/USD 2 moves away from wiping out June’s rallyThe RBNZ is widely expected to hold the Official Cash Rate at 3.25% this Wednesday.

NZIER’s Shadow Board advises against a cut, noting the economy remains weak but inflation pressures are mixed. Markets see just a 10–15% chance of a cut this week but still price for further easing by October.

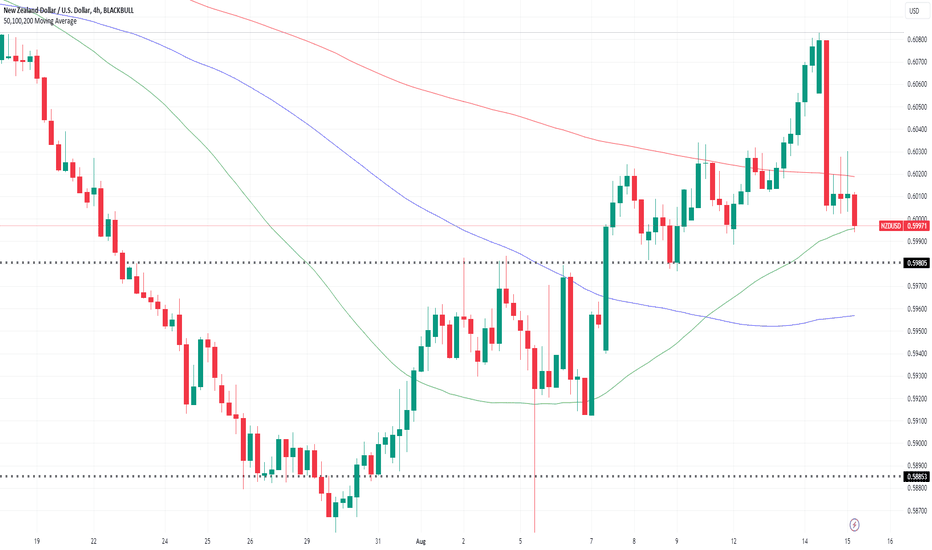

NZD/USD has pulled back sharply from 0.6100, with price now possibly consolidating around 0.6000. This area coincides with a key support-turned-resistance level that capped price action in mid-June.

If the pair breaks below 0.5980, the next support sits near 0.5935 – a level that triggered a strong bounce on June 21. A break below that could open the way toward 0.5900 and 0.5860.

On the upside, if the 0.6000 handle holds, short-term resistance lies at 0.6030, with stronger pressure at 0.6065.

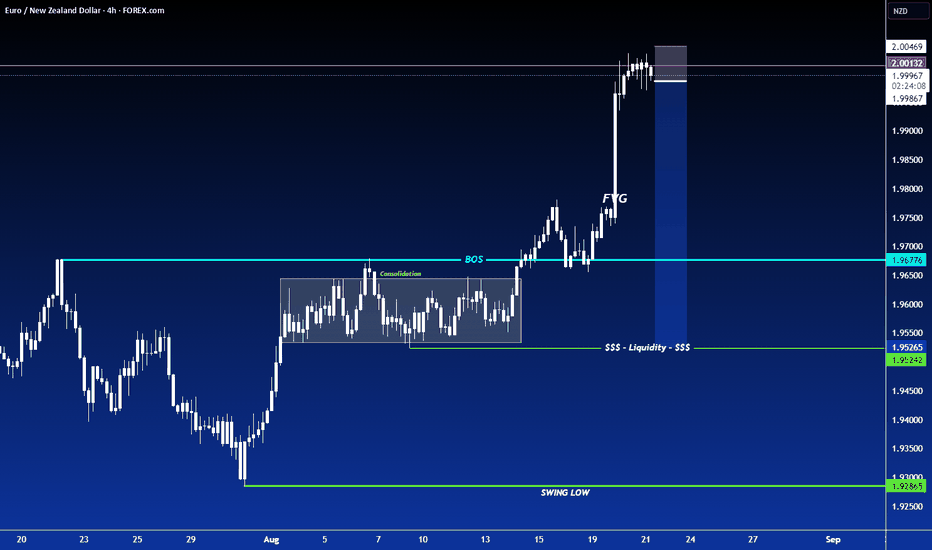

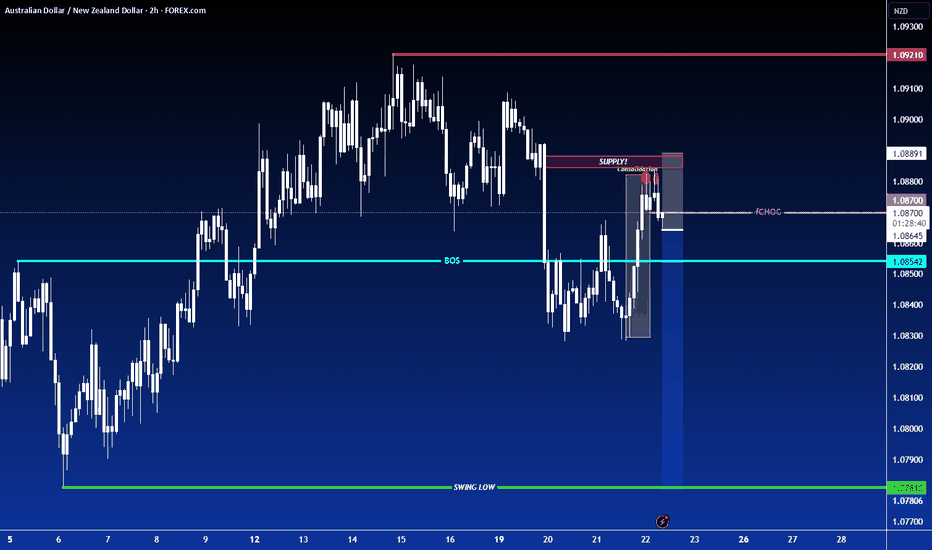

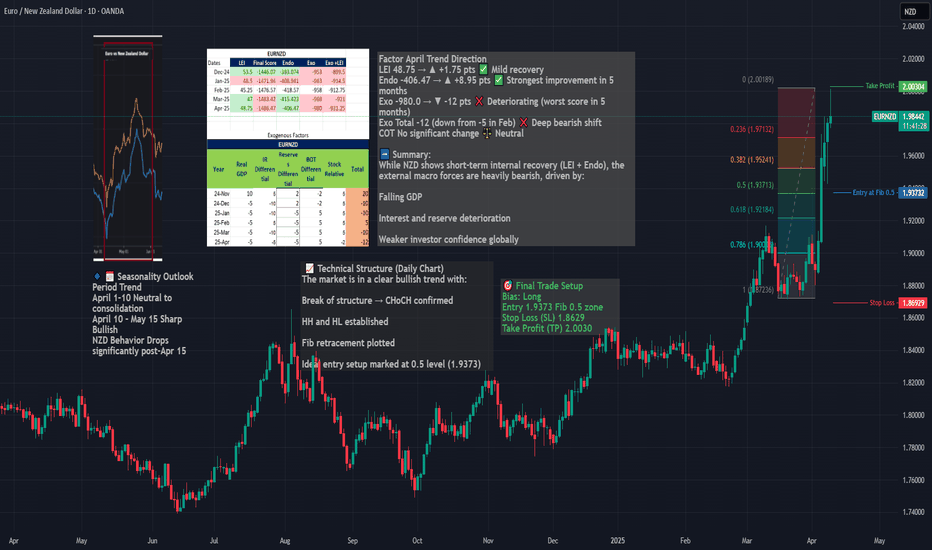

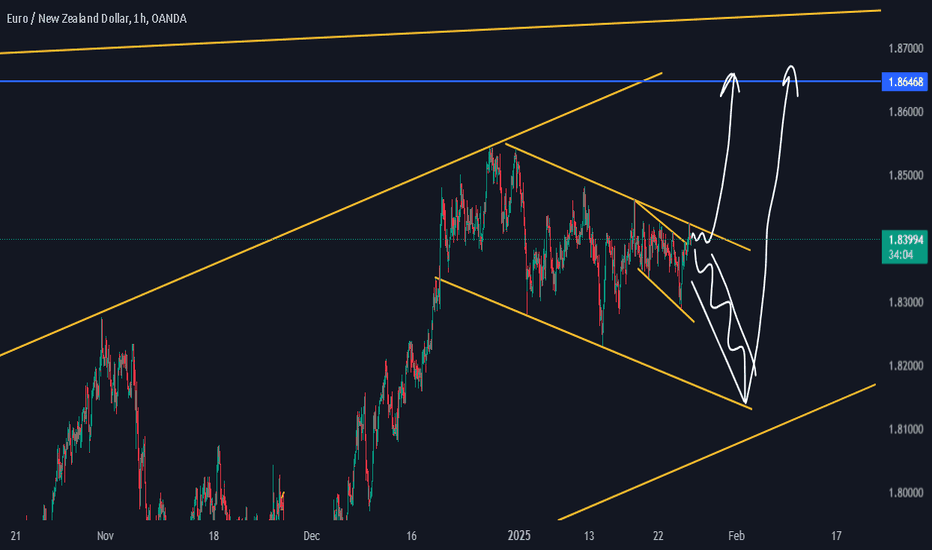

Long EURNZD – Seasonal, Fundamentals & Technical ConfluenceWe are entering a long position on EURNZD, capitalizing on a powerful confluence of:

Seasonal EUR strength + NZD weakness (April 10 – May 15)

A clear bullish market structure (CHoCH, HH/HL)

A clean Fibonacci retracement entry at 0.5

Strong macro divergence, with NZD exogenous conditions deteriorating

Macro & Seasonal Context

EUR enters a strong seasonal uptrend from April 10 to end of month

NZD shows seasonal weakness from April 15 onward

NZD’s exogenous model score worsened to -12 in April

While NZD LEI and endo improved, it remains structurally weak

Timing

Best execution: on pullback to 1.9373 zone, ideally between April 10–15, aligned with seasonal entry window.

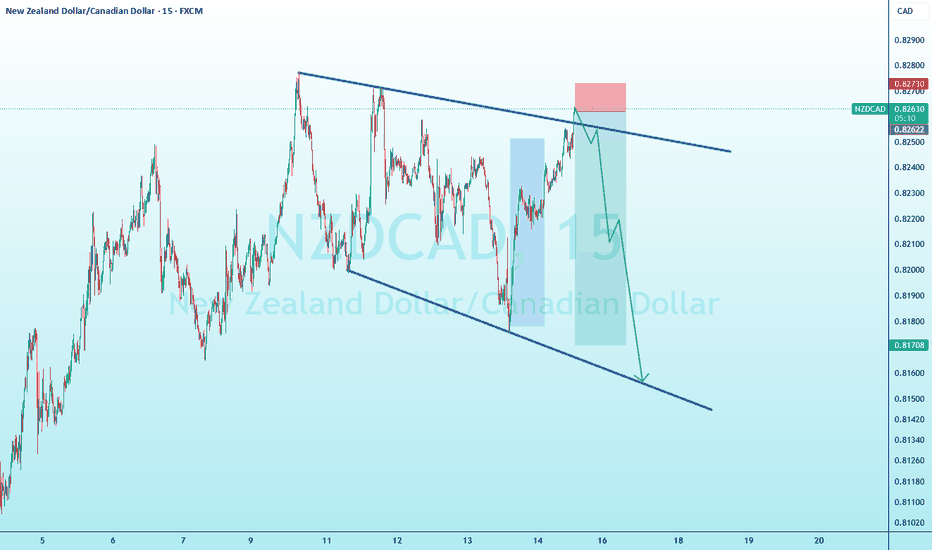

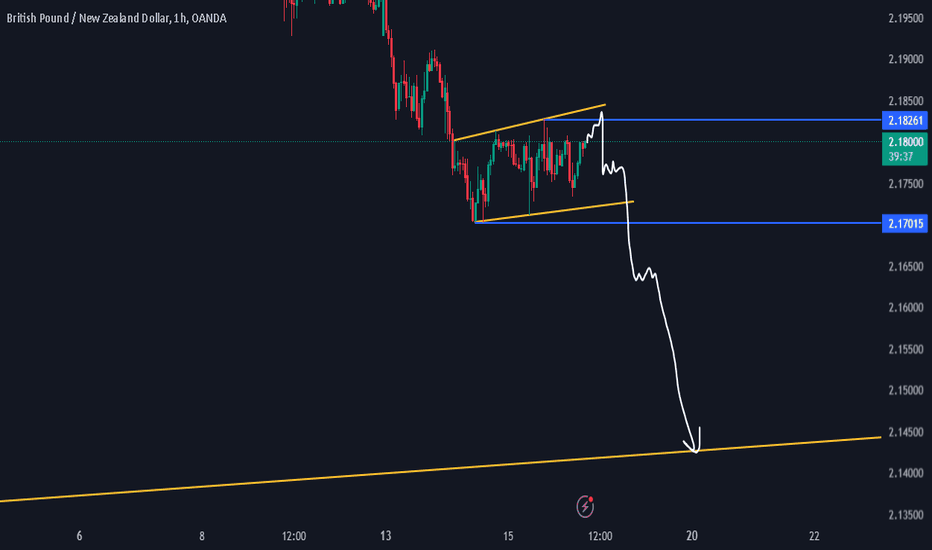

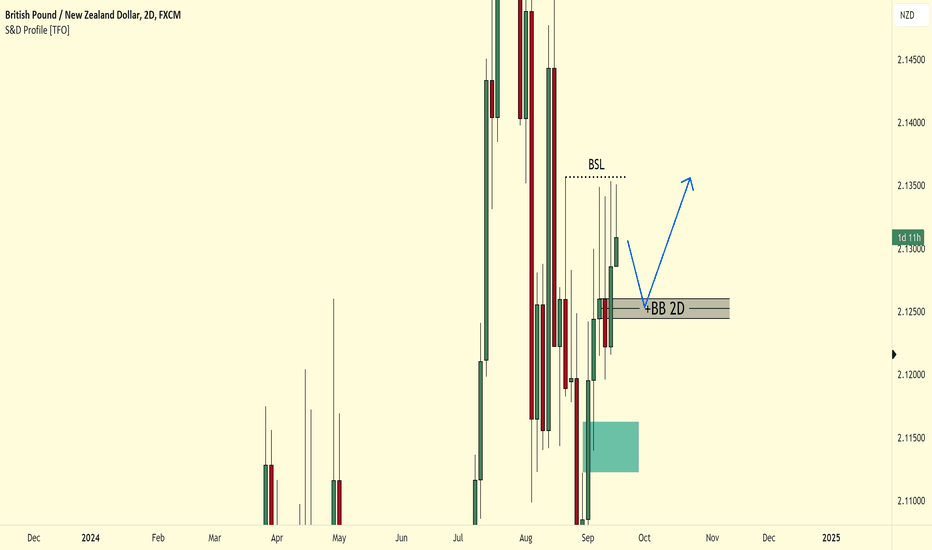

GBPNZD SHORTS MOREGBPNZD have been bearish for a while and I am looking forward to continue with the trend. I expect a third touch to the top trendline or a double top formation as an override depending on how reacts on the zone. The third touch will be more preferable for me, with 2.17015 as first target and 2.14440 as the second target.

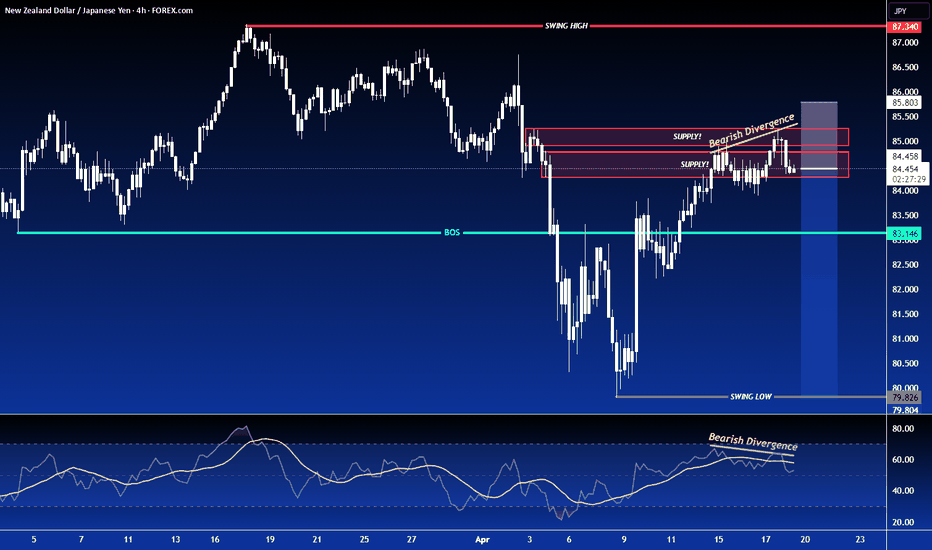

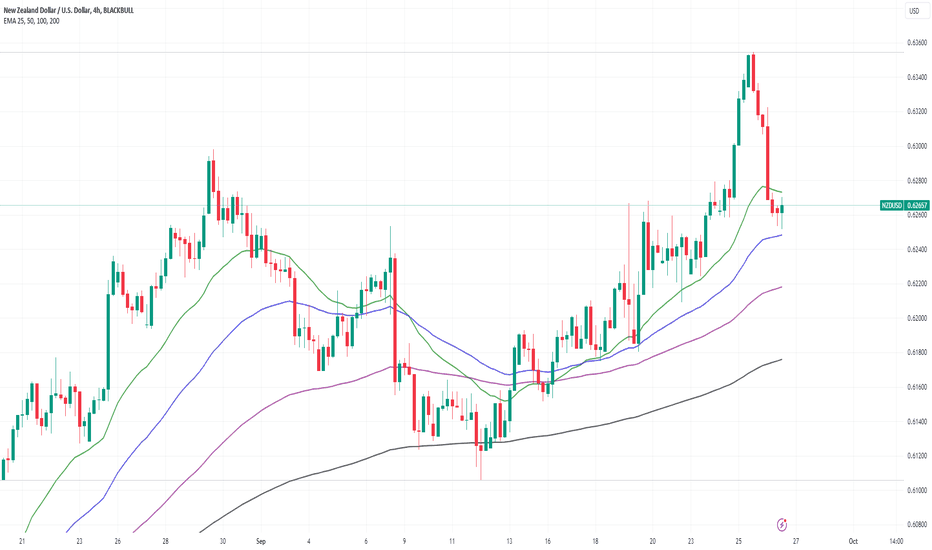

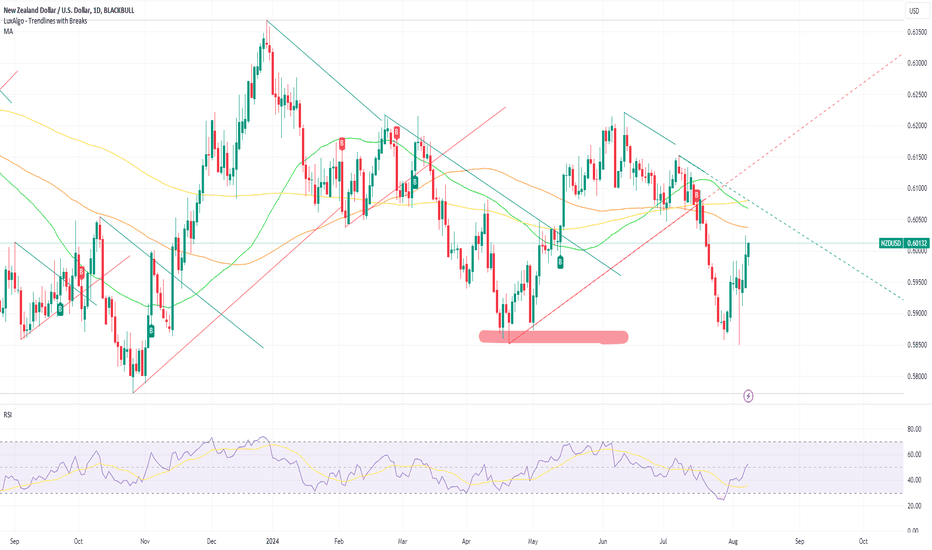

Kiwibank Lowers Kiwi ForecastThe New Zealand dollar (NZD/USD) has slipped below its 25-day exponential moving average (EMA) and could potentially test the 50-day EMA next. But, can sellers maintain the momentum and push further into bearish territory?

Kiwibank is betting on more downside due to faster and deeper rate cuts from the Reserve Bank of New Zealand (RBNZ). However, their initial bearish outlook has softened somewhat.

"In our previous FX Tactical, we anticipated the Kiwi heading towards the 0.5700 mark. But given its reluctance to trade down to that level, we've adjusted our expectations. While we still believe the Kiwi should be lower, it's clear the 0.5700 target is less likely. At this point, 0.5900 seems a more reasonable level," the bank stated.

Further complicating the outlook is China’s influence. Like the Australian dollar, the Kiwi can find support from economic developments in China. Talks of a potential stimulus package from Beijing had initially buoyed market sentiment, but UBS remains unimpressed. The investment bank noted that the scale of China's recent measures falls short of previous stimulus efforts, which historically triggered strong market rallies. Economists cited by The Wall Street Journal share this view, pointing out that borrowing costs are already low, yet demand for credit remains sluggish. Consumer confidence, dragged down by concerns over jobs and the ongoing property market meltdown, remains near historic lows.

Did you miss out on the surprise NZD/USD trade? The Reserve Bank of New Zealand unexpectedly cut interest rates by 25 basis points, sending the New Zealand dollar plunging by 1% against the U.S. dollar. The move caught markets off guard, as most analysts had anticipated the central bank would hold rates steady until at least its next meeting. Today wasn’t supposed to be the day, but these are the moments traders eagerly anticipate to capitalize on sudden market shifts.

The RBNZ's decision underscores a growing trend among central banks, signaling a potential global shift in monetary policy. This early rate cut hints that central banks may be increasingly focused on fostering economic growth and ensuring a soft landing amid weakening economies. The big question now: Will the Federal Reserve follow suit?

The NZD/USD had been on an upward trajectory for nearly two weeks, but that rally has now reversed. The pair has broken above the 200-day moving average and is nearing the 50-day as well. The key support zone around 0.5850, which has held since last September, could now be in play, with a closer pivot point near 0.5980.

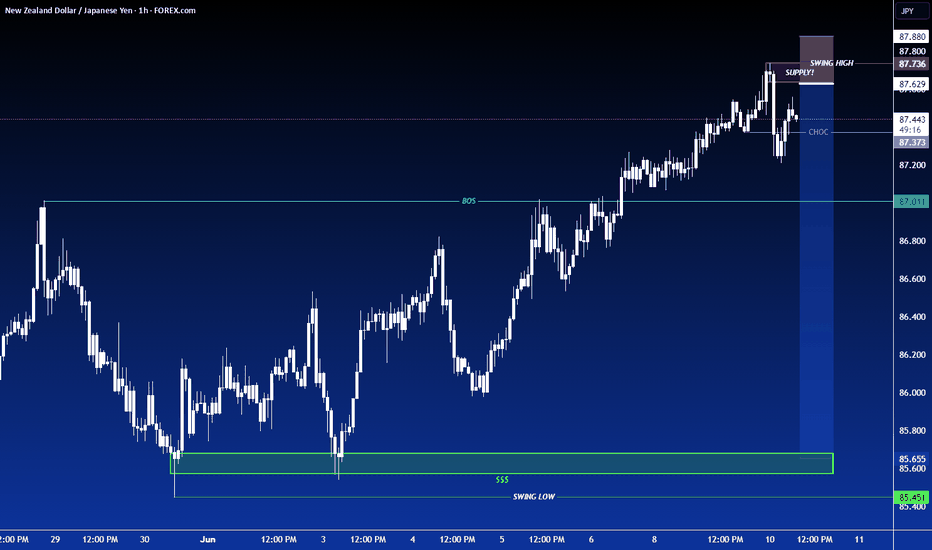

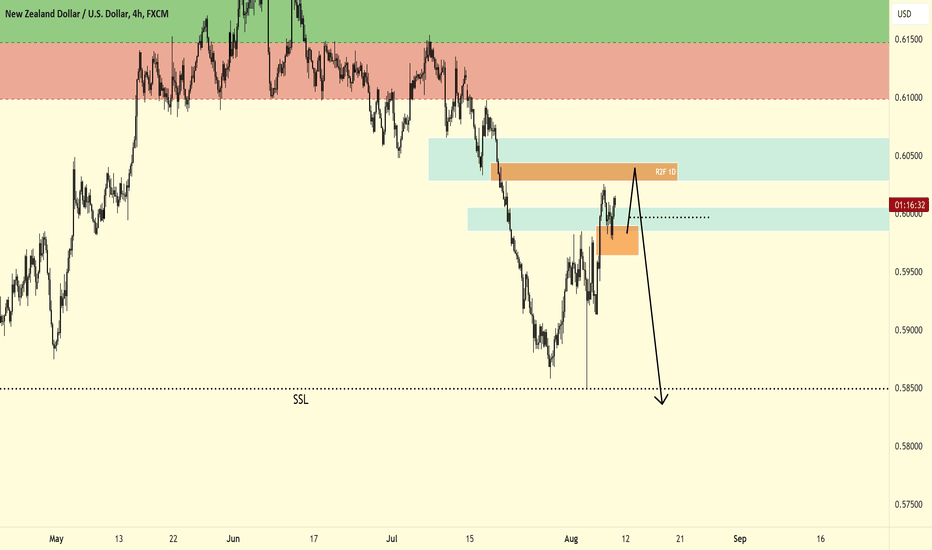

NZDUSD - Top Down Analysis (ICT)Quite interesting chart on NZDUSD. I give my analysis and opinion on what is likely to transpire next. Let's see what happens today (Friday) as I'm expecting the weekly to close below certain levels if I am correct in price coming for the SSL first. However, it may not happen today as there is no high impact news offering a catalyst for a manipulative move lower. We could see a weak close lower and then more aggressive action on PPI and CPI next week. Again, this is under the assumption that my bias of price wanting to go for the SSL first is correct.

- R2F

NZD Outlook: ANZ’s Forecast for Next Week NZD Outlook: ANZ’s Forecast for Next Week

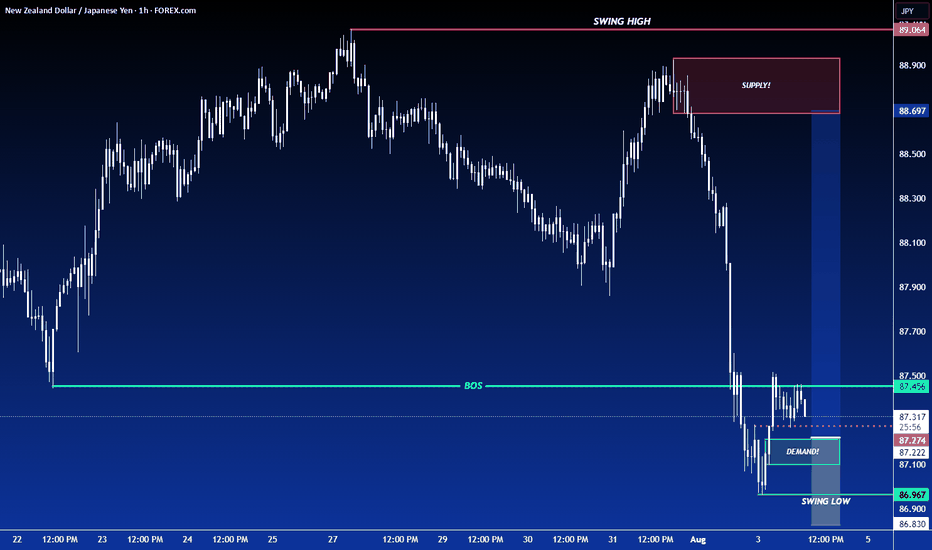

ANZ anticipates that the Reserve Bank of New Zealand (RBNZ) will maintain its current interest rates at the August 14 meeting but may signal potential rate cuts before the year ends. Although ANZ estimates a small 10-15% chance that the RBNZ might shift to an easing bias during this coming meeting.

Markets are currently pricing in 89 basis points of cuts by November 2024 and 222 basis points by November 2025. However, ANZ is cautioning against expecting such drastic moves and that markets could be disappointed with this reflected in market volatility if the RBNZ doesn't deliver.

A key level to watch on the downside is April’s low which has twice served as a support level in recent weeks, rebuffing sellers.

NZD/USD is currently moving higher, nearing the 100 SMA on the daily chart. The Relative Strength Index (RSI) suggests that momentum remains strong, with the potential for a softer unemployment claim report from the US influencing the pair’s short-term direction.

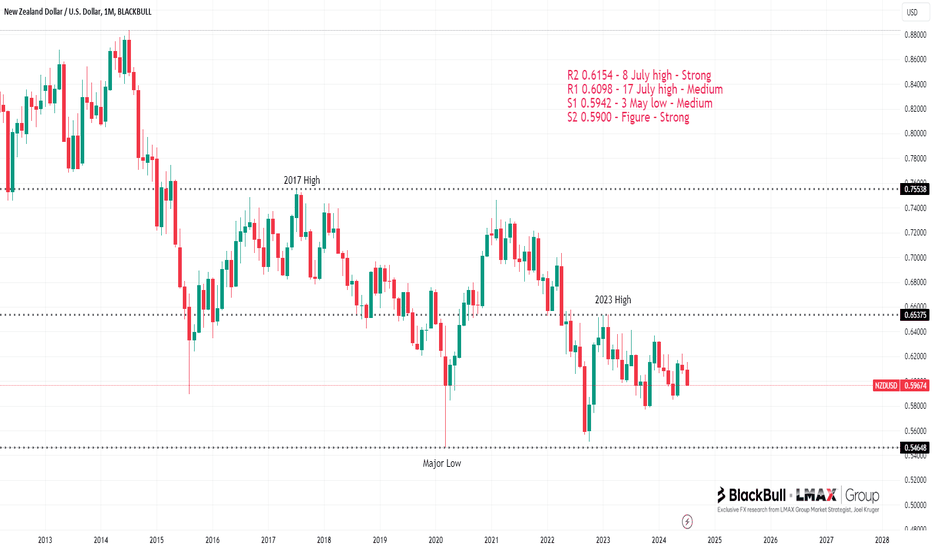

NZDUSD: Technical Pressure Mounts Amid Weak Trade DataNZDUSD – technical overview

Overall pressure remains on the downside with the market continuing to stall out on runs up into the 0.6500 area. At the same time, there are some signs of the market wanting to put in a longer-term base. Ultimately, a break back above 0.6500 would be required to take the medium-term pressure off the downside and encourage this prospect. A monthly close below 0.5800 will intensify bearish price action.

R2 0.6154 – 8 July high – Strong

R1 0.6098 – 17 July high – Medium

S1 0.5942 – 3 May low – Medium

S2 0.5900 – Figure – Strong

NZDUSD – fundamental overview

On the surface, New Zealand trade data produced a solid headline reading. However, at closer glance, the underlying components were distressing, with both imports and exports declining outright. This along with an ongoing slide in commodities prices proved to be a big weight on the New Zealand Dollar. Key standouts on Tuesday’s calendar come from Eurozone consumer confidence, US existing home sales, and Richmond Fed manufacturing.

Exclusive FX research from LMAX Group Market Strategist, Joel Kruger