NZD/USD Analysis for October 28, 2024: Slight Bullish Bias Amid NZD/USD Analysis for October 28, 2024: Slight Bullish Bias Amid Mixed Economic Signals

---

Introduction

The NZD/USD currency pair shows signs of a slight bullish bias today, October 28, 2024, with underlying fundamental and technical factors driving the sentiment. We’ll analyze key drivers impacting the New Zealand Dollar and the US Dollar and explain why these elements may be positioning NZD/USD for potential upward momentum.

Key Drivers of Bullish Bias in NZD/USD

1. New Zealand Economic Data

- Recent economic releases out of New Zealand have provided some strength to the Kiwi dollar. Last week’s inflation rate showed resilience, slightly beating forecasts and giving the Reserve Bank of New Zealand (RBNZ) room to maintain a balanced policy stance.

- New Zealand’s Trade Balance, also recently reported, showed minor improvements, supporting the notion of a stable economic environment. This data can be a short-term positive factor for the NZD against a backdrop of uncertain global growth conditions.

2. US Dollar Weakness Amid Interest Rate Concerns

- The USD has faced challenges amid mixed economic data in the United States. As investors await the Federal Reserve’s upcoming policy statement, speculation about the potential halt or slowdown of rate hikes could add pressure on the USD.

- Recent softening in US consumer confidence and labor market data raises expectations that the Fed may take a more dovish approach, which may weaken the USD and offer NZD/USD pair some bullish support.

3. Global Sentiment and Risk Appetite

- The current global risk sentiment also influences the NZD, a traditionally risk-sensitive currency. With global markets showing resilience and stocks rebounding, there is a slight increase in demand for riskier assets, such as the NZD. Should this risk-on sentiment continue, NZD/USD could benefit from increased interest in the Kiwi.

- Commodity prices, particularly dairy—New Zealand’s largest export—have remained relatively stable, offering support to the Kiwi and enhancing its attractiveness in the current environment.

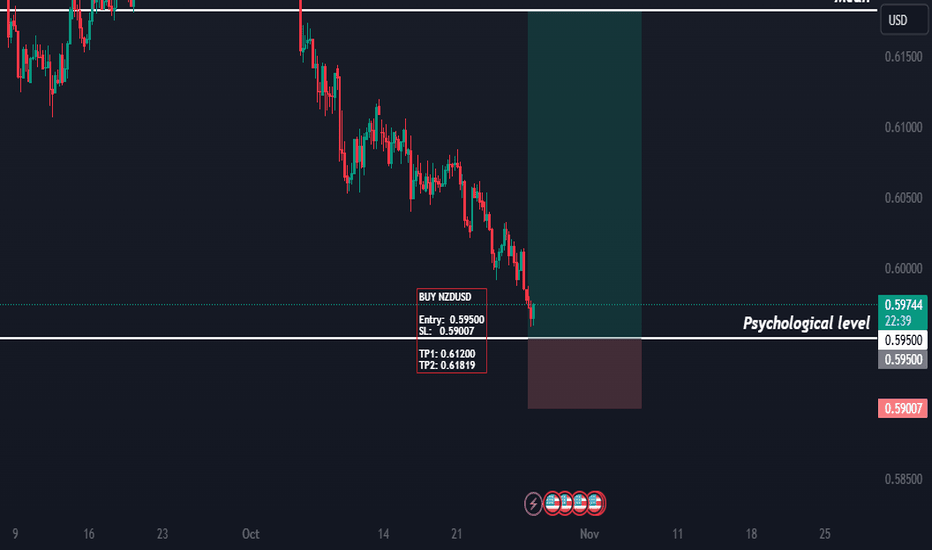

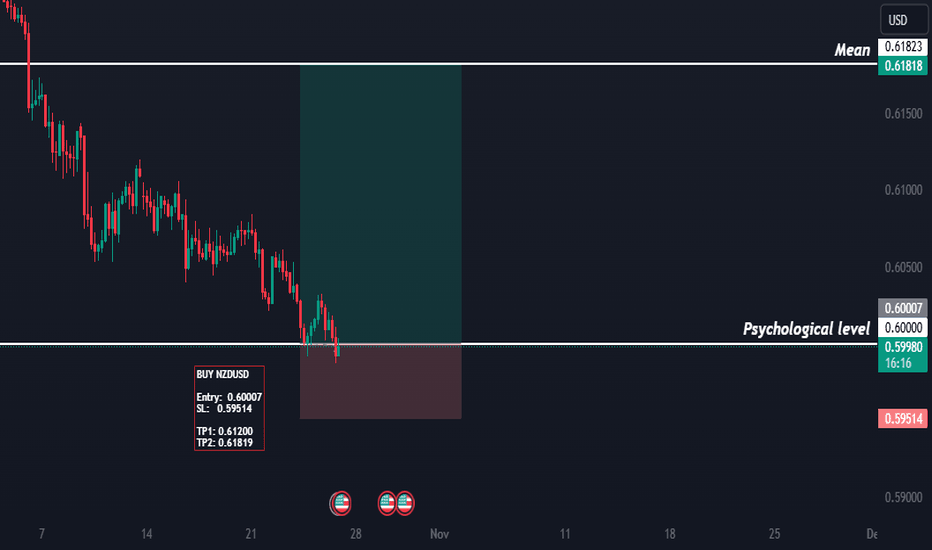

4. Technical Analysis: Support and Resistance Levels

- Support Level: The 0.5800 level appears to be a strong support for NZD/USD. Should this level hold, it could provide a basis for further upward movement.

- Resistance Level: A key resistance level is near 0.5950. If the NZD/USD pair breaks through this resistance, it could signal additional bullish momentum and further gains.

- Moving averages and momentum indicators are showing a neutral to slightly positive sentiment, reflecting a minor upward trend.

Conclusion

Given these factors, NZD/USD may show a slight bullish bias today as it finds support in New Zealand's economic resilience, potential Fed rate decisions, and stable risk sentiment. However, traders should monitor any upcoming news and economic data for changes in sentiment, as global financial markets remain highly reactive.

Keywords for Seo:

1. NZD/USD forecast

2. New Zealand Dollar analysis

3. US Dollar outlook

4. NZD/USD today

5. forex trading NZD/USD

6. NZD/USD technical analysis

7. fundamental analysis NZD/USD

8. NZD/USD support and resistance

9. New Zealand economic data

Newzealanddollaranalysis

NZDUSD: Potential for Slight Bullish Bias Amid Key Fundamental !NZDUSD: Potential for Slight Bullish Bias Amid Key Fundamental Drivers (25/10/2024)

Today, the NZDUSD currency pair shows potential for a slight bullish bias, influenced by a blend of fundamental factors and evolving market conditions. Let's dive into the primary drivers impacting the New Zealand Dollar to US Dollar (NZDUSD) pair today and assess whether the bullish sentiment could hold.

1. New Zealand's Economic Data and RBNZ Stance

The Reserve Bank of New Zealand (RBNZ) has maintained a balanced tone on interest rates amid recent economic data. Despite slower-than-expected growth figures, the New Zealand economy demonstrates resilience in key sectors like exports and services, which might provide support for the NZD. Market expectations for RBNZ’s neutral-to-hawkish stance add a slight bullish outlook for the NZD, as investors anticipate steady policy moves that avoid aggressive tightening while also signaling confidence in the economy’s fundamentals.

2. US Dollar Moderation Amid Potential Fed Pause

The US Dollar Index (DXY) has shown signs of consolidation as Federal Reserve officials continue to weigh the potential for a pause in rate hikes. Recently, the USD’s bullish momentum has softened, with investors focusing on US inflation data that suggests a gradual cooling, potentially easing pressure on the Fed to maintain a tight monetary policy stance. This development could limit the USD’s strength, lending support to a slight upside for NZDUSD as investors look for alternative assets.

3. China’s Economic Resilience and Impact on NZD

China, as New Zealand's primary trading partner, influences the NZD through commodity prices and trade flows. Recent signs of resilience in China’s economy, particularly in industrial production and retail sales, may boost market sentiment for currencies like the NZD, as stronger demand for New Zealand’s exports could improve trade dynamics. This positive external factor indirectly supports the NZD, making NZDUSD slightly more appealing in today’s trading landscape.

4. Technical Levels and Market Sentiment for NZDUSD

On the technical analysis front, NZDUSD has shown support near the 0.5850 level, with a potential resistance zone around 0.5950. Should the pair break above the 0.5900 mark, we could see momentum strengthening, bolstered by the factors discussed. RSI indicators are also neutral, suggesting room for upward movement without immediate overbought concerns. A slight bullish bias may prevail, provided these technical and sentiment indicators remain supportive.

Summary: Slight Bullish Bias for NZDUSD

In summary, NZDUSD could hold a slight bullish bias today, with influences from New Zealand’s resilient economy, a softer USD, and supportive technical indicators. Traders might find opportunities if bullish momentum strengthens, keeping an eye on US Dollar trends, RBNZ announcements, and China's economic performance for additional cues.

Keywords:

1. NZDUSD forecast

2. New Zealand Dollar analysis

3. US Dollar impact

4. RBNZ policy stance

5. NZDUSD technical levels

6. Forex trading insights

7. Federal Reserve impact

8. China economy influence

9. NZDUSD bullish bias