NZD/USD Analysis for October 28, 2024: Slight Bullish Bias Amid NZD/USD Analysis for October 28, 2024: Slight Bullish Bias Amid Mixed Economic Signals

---

Introduction

The NZD/USD currency pair shows signs of a slight bullish bias today, October 28, 2024, with underlying fundamental and technical factors driving the sentiment. We’ll analyze key drivers impacting the New Zealand Dollar and the US Dollar and explain why these elements may be positioning NZD/USD for potential upward momentum.

Key Drivers of Bullish Bias in NZD/USD

1. New Zealand Economic Data

- Recent economic releases out of New Zealand have provided some strength to the Kiwi dollar. Last week’s inflation rate showed resilience, slightly beating forecasts and giving the Reserve Bank of New Zealand (RBNZ) room to maintain a balanced policy stance.

- New Zealand’s Trade Balance, also recently reported, showed minor improvements, supporting the notion of a stable economic environment. This data can be a short-term positive factor for the NZD against a backdrop of uncertain global growth conditions.

2. US Dollar Weakness Amid Interest Rate Concerns

- The USD has faced challenges amid mixed economic data in the United States. As investors await the Federal Reserve’s upcoming policy statement, speculation about the potential halt or slowdown of rate hikes could add pressure on the USD.

- Recent softening in US consumer confidence and labor market data raises expectations that the Fed may take a more dovish approach, which may weaken the USD and offer NZD/USD pair some bullish support.

3. Global Sentiment and Risk Appetite

- The current global risk sentiment also influences the NZD, a traditionally risk-sensitive currency. With global markets showing resilience and stocks rebounding, there is a slight increase in demand for riskier assets, such as the NZD. Should this risk-on sentiment continue, NZD/USD could benefit from increased interest in the Kiwi.

- Commodity prices, particularly dairy—New Zealand’s largest export—have remained relatively stable, offering support to the Kiwi and enhancing its attractiveness in the current environment.

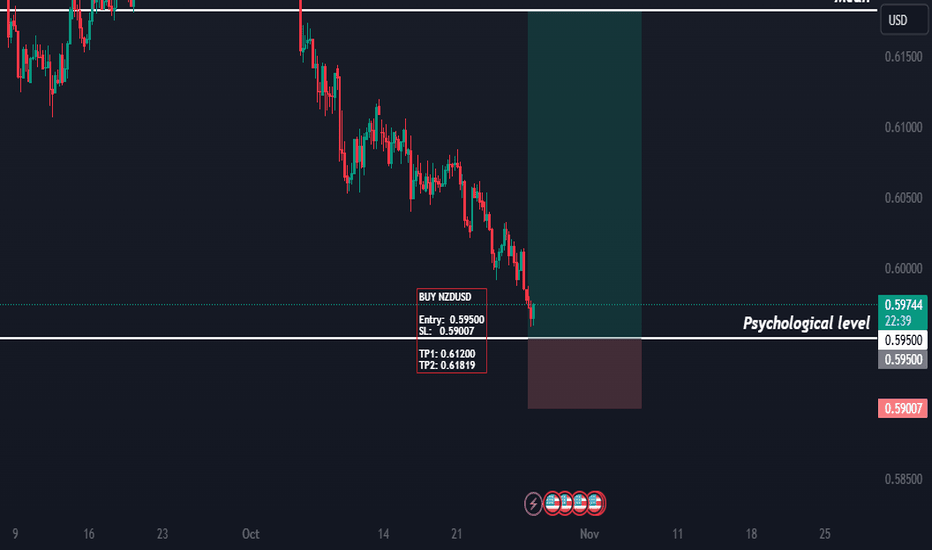

4. Technical Analysis: Support and Resistance Levels

- Support Level: The 0.5800 level appears to be a strong support for NZD/USD. Should this level hold, it could provide a basis for further upward movement.

- Resistance Level: A key resistance level is near 0.5950. If the NZD/USD pair breaks through this resistance, it could signal additional bullish momentum and further gains.

- Moving averages and momentum indicators are showing a neutral to slightly positive sentiment, reflecting a minor upward trend.

Conclusion

Given these factors, NZD/USD may show a slight bullish bias today as it finds support in New Zealand's economic resilience, potential Fed rate decisions, and stable risk sentiment. However, traders should monitor any upcoming news and economic data for changes in sentiment, as global financial markets remain highly reactive.

Keywords for Seo:

1. NZD/USD forecast

2. New Zealand Dollar analysis

3. US Dollar outlook

4. NZD/USD today

5. forex trading NZD/USD

6. NZD/USD technical analysis

7. fundamental analysis NZD/USD

8. NZD/USD support and resistance

9. New Zealand economic data

Newzealandeconomicdata

Potential Bullish Bias Amid Key Fundamental Drivers | NZDUSDNZDUSD Analysis: Potential Bullish Bias Amid Key Fundamental Drivers | 21 October 2024

Introduction

As of 21st October 2024, the NZDUSD pair is showing signs of a slightly bullish bias, driven by various fundamental and market conditions. In this article, we explore the key factors impacting the NZDUSD forecast today and provide an in-depth look at what traders should be aware of when positioning for potential upward movements in the pair.

---

Key Drivers Influencing NZDUSD Today

1. Hawkish RBNZ Expectations

The Reserve Bank of New Zealand (RBNZ) is expected to maintain a hawkish stance in its upcoming meetings due to persistent inflationary pressures in the New Zealand economy. The central bank has consistently reiterated its commitment to controlling inflation, leading to expectations of potential interest rate hikes. This hawkish outlook is providing support for the NZDUSD currency pair, attracting buyers as they anticipate higher yields in New Zealand's markets.

2. Weakening US Dollar

The US Dollar has been under pressure due to mixed economic data out of the US and uncertainty surrounding the Federal Reserve’s next moves. While inflation in the US remains high, there are signs of economic softening, with recent data pointing to a slowdown in manufacturing and services sectors. This has led to market expectations of a pause or moderation in the Fed’s tightening cycle, weakening the USD across the board. A softer USD provides tailwinds for NZDUSD bulls, as the kiwi can take advantage of reduced strength in the greenback.

3. Positive New Zealand Economic Data

New Zealand recently released stronger-than-expected economic data, particularly in the areas of GDP growth and employment figures. This has bolstered confidence in the economy’s resilience, even amidst global uncertainties. As a result, the New Zealand dollar (NZD) has gained support, enhancing the likelihood of a continued bullish momentum in NZDUSD.

4. Improved Global Sentiment

The global economic outlook has been somewhat bolstered by positive developments in international trade and easing geopolitical tensions, which tend to favor risk-sensitive currencies like the NZD. The improvement in risk appetite globally has also encouraged inflows into the New Zealand dollar, which is viewed as a high-beta currency.

---

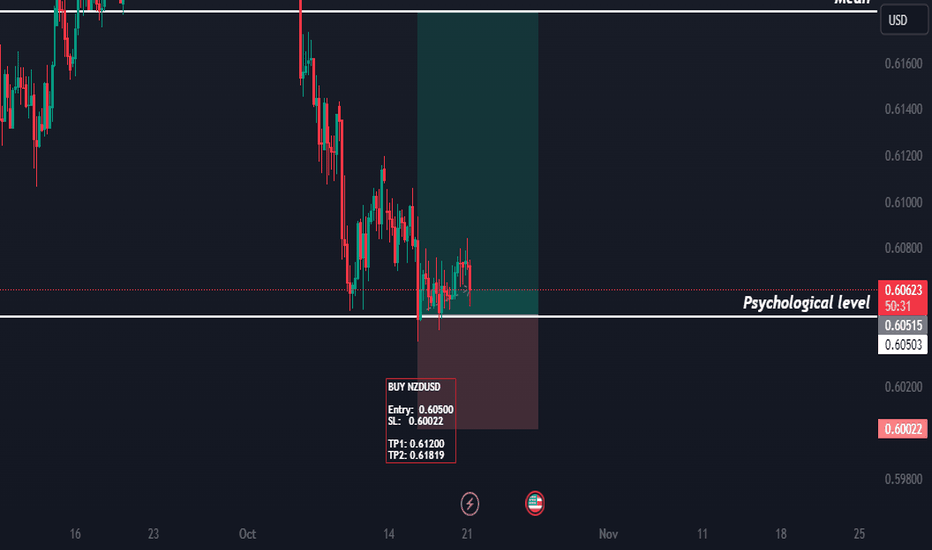

Technical Outlook

From a technical analysis perspective, NZDUSD has recently tested key support levels near 0.5800, and a bounce from this level suggests potential further gains. The pair is trading above its 50-day moving average, indicating a bullish trend in the short term. Additionally, the Relative Strength Index (RSI) is hovering near the neutral zone, leaving room for further upside without reaching overbought conditions.

---

Conclusion

In conclusion, NZDUSD shows a slightly bullish bias today, 21st October 2024, driven by a mix of positive domestic factors for New Zealand and a weaker US Dollar. Key factors like hawkish expectations from the RBNZ, positive economic data from New Zealand, and a weakening greenback contribute to the pair's upward potential. Traders looking to capitalize on this move should keep an eye on upcoming economic releases and RBNZ commentary, which could further solidify the bullish momentum for the kiwi.

---

Keywords for SEO:

NZDUSD analysis, NZDUSD today, NZDUSD forecast, bullish bias NZDUSD, Reserve Bank of New Zealand hawkish, RBNZ interest rate hike, US Dollar weakness, NZD technical analysis, New Zealand economic data, global risk sentiment, NZDUSD key drivers, NZDUSD 21 October 2024.

NZDUSD Outlook: Slight Bullish Bias on October 18, 2024Key Drivers Behind the Bullish Sentiment on the New Zealand Dollar (NZDUSD)

The NZDUSD pair is showing a slight bullish bias on October 18, 2024, driven by a combination of fundamental factors and the latest market conditions. The New Zealand Dollar (NZD) has been gaining ground against the US Dollar (USD) in early trading, supported by improving domestic economic data and a shift in global risk sentiment. Below are the key drivers contributing to the upward momentum in NZDUSD today.

1. Improved New Zealand Economic Data

One of the primary factors supporting the NZDUSD’s bullish bias is the release of stronger-than-expected New Zealand economic data. Recent GDP figures and labor market reports have indicated a healthier-than-expected recovery, particularly in sectors like agriculture and tourism, which are critical to the country’s economy. The positive data has boosted investor confidence in the New Zealand economy, leading to increased demand for the NZD.

2. Risk-On Sentiment in Global Markets

A risk-on sentiment in global financial markets has also contributed to the NZD's strength. As a high-beta currency, the New Zealand Dollar tends to perform well in periods of risk appetite. Global equity markets have been relatively stable, and there has been a broad move towards riskier assets, reducing demand for safe-haven currencies like the USD. This has allowed the NZD to benefit from higher risk tolerance among investors today.

3. Weaker US Dollar (USD)

The US Dollar has been under pressure today as traders reassess the Federal Reserve’s monetary policy outlook. Recent commentary from Fed officials has indicated a potential slowdown in the pace of interest rate hikes as inflation shows signs of cooling. The prospect of a more dovish Fed has weakened the USD, giving the NZDUSD pair room to rise. Additionally, a softer dollar makes NZD-denominated assets more attractive, providing further upside for the pair.

4. Commodity Prices Supporting the NZD

New Zealand’s economy is heavily reliant on commodity exports, particularly dairy and agricultural products. Today, commodity prices are showing some resilience, further supporting the NZD. As a commodity-linked currency, the NZD often follows the price movements of key exports, and recent strength in these markets is bolstering demand for the currency. This is a positive factor in today’s market conditions, giving the NZDUSD pair a slight bullish edge.

5. Technical Analysis: NZDUSD Holding Above Key Support Levels

From a technical perspective, NZDUSD is holding above key support levels near 0.5850, signaling a potential continuation of the upward trend. The pair has formed higher lows, and the bullish momentum is supported by the Relative Strength Index (RSI), which indicates a slightly bullish bias. If the pair manages to stay above this support level, traders could see further gains toward the next resistance around 0.5900.

Conclusion: NZDUSD Faces Slight Bullish Bias Today

With stronger New Zealand economic data, global risk-on sentiment, a weaker US Dollar, and resilient commodity prices, NZDUSD is expected to maintain a slight bullish bias on October 18, 2024. Traders should monitor key resistance levels and any potential shifts in market sentiment that could alter the dynamics of the currency pair.

SEO Keywords:

NZDUSD, New Zealand Dollar forecast, NZDUSD outlook, NZDUSD analysis, New Zealand economic data, NZDUSD technical analysis, bullish NZDUSD, October 18 2024 NZDUSD, forex trading strategy, New Zealand Dollar vs US Dollar, NZDUSD price prediction, risk-on sentiment NZDUSD, commodity-linked currencies, US Dollar weakness NZDUSD, forex market outlook.