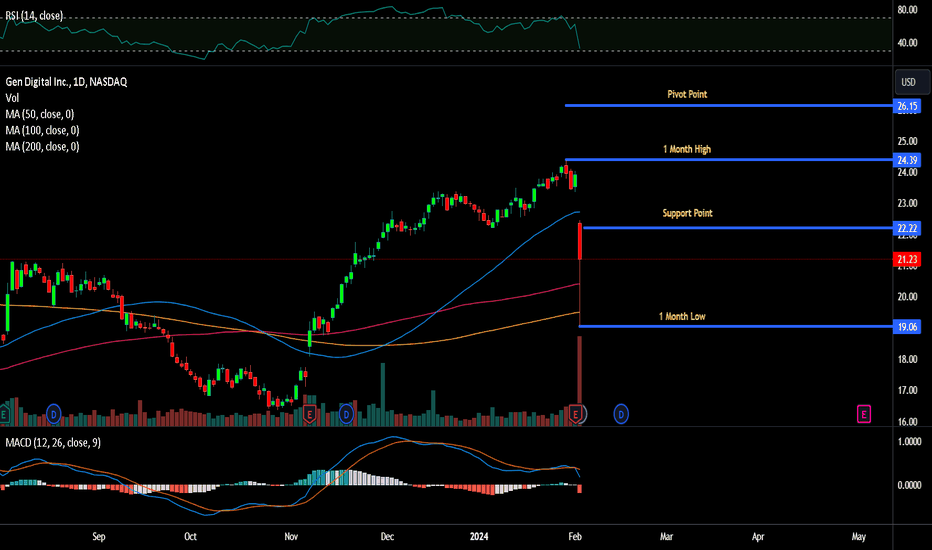

Gen Digital's Struggle to Secure Cybersecurity DominanceIn the fast-evolving world of cybersecurity, Gen Digital (NASDAQ: NASDAQ:GEN ), a key player renowned for its Norton and Avast services, recently faced a turbulent ride on the stock market. The company witnessed an 11.2% drop in its stock price during the latest trading session, leaving investors and analysts disappointed. This decline was attributed to Gen Digital's (NASDAQ: NASDAQ:GEN ) third fiscal quarter results, released on December 29, 2023, which fell short of market expectations.

Quarterly Results Recap:

Despite achieving its 18th consecutive quarter of annual sales growth, with a 1.6% increase compared to the previous year, Gen Digital's (NASDAQ: NASDAQ:GEN ) revenue growth missed the mark. The company reported non-GAAP earnings per share of $0.49 on revenue of $951 million, slightly below the average analyst estimate of $0.50 per share on sales of approximately $956.6 million. This underperformance suggests that Gen Digital (NASDAQ: NASDAQ:GEN ) may be struggling to capitalize on the robust growth opportunities within the cybersecurity industry.

Looking Forward:

As investors seek clarity on Gen Digital's (NASDAQ: NASDAQ:GEN ) trajectory, the company provided guidance for the fourth quarter, projecting sales between $960 million and $970 million. However, this outlook still falls significantly below the average analyst estimate of $974.3 million. The company's adjusted earnings guidance of $0.52 to $0.54 per share aligns closely with Wall Street's expectations of $0.53 per share. Despite trading at a relatively low valuation, with a price-to-earnings ratio of under 11 times this year's expected earnings, the recent quarterly results and guidance have cast a shadow on Gen Digital's (NASDAQ: NASDAQ:GEN ) long-term growth outlook.

Challenges and Opportunities:

The cybersecurity landscape is fiercely competitive, and Gen Digital's (NASDAQ: NASDAQ:GEN ) struggles raise questions about its ability to navigate this challenging terrain. The company's disappointing quarterly results underscore potential difficulties in capitalizing on industry growth, posing a considerable challenge to its market dominance. Investors are left pondering whether Gen Digital can overcome these hurdles and regain momentum.

Conclusion:

As Gen Digital (NASDAQ: NASDAQ:GEN ) grapples with disappointing quarterly results and unmet market expectations, caution should be exercised by potential investors. While the stock may appear attractively valued, the competitive cybersecurity landscape demands a close watch on Gen Digital's (NASDAQ: NASDAQ:GEN ) future performance. The company's ability to adapt, innovate, and regain market confidence will be pivotal in determining its long-term success.

Nextgen

$NXE Unveiling the Untapped Potential

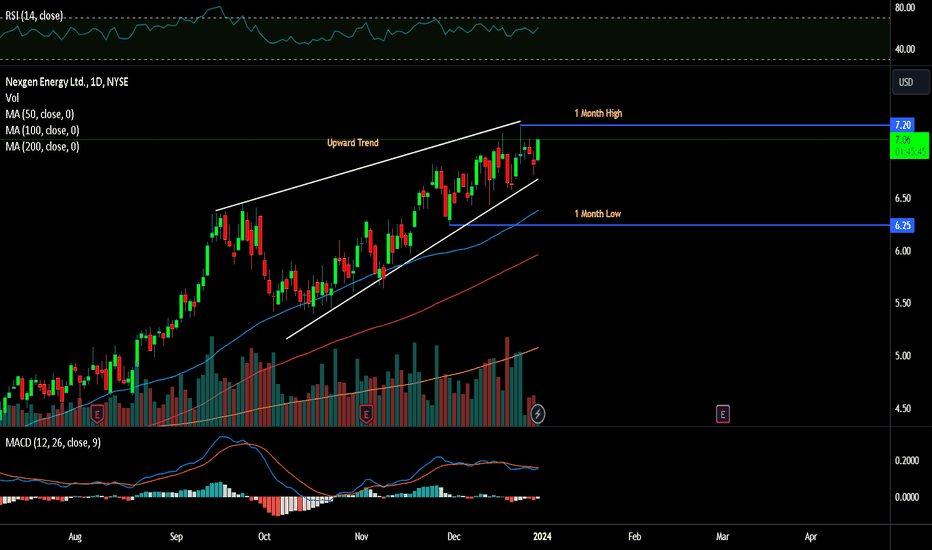

In the dynamic world of stock markets, finding a hidden gem can be a game-changer for investors seeking lucrative opportunities. One such gem that has been making waves lately is NYSE:NXE , and there's a compelling case for investors to consider it as a prime addition to their portfolios. As we delve into the intricacies of NYSE:NXE 's recent performance and future prospects, it becomes evident that now is the opportune moment to seize the potential gains that this stock has to offer.

1. A History of Value Appreciation:

NYSE:NXE has consistently demonstrated its ability to command higher prices over time. This upward trajectory is indicative of a company experiencing positive development. Investors who have been part of this journey have seen their investments appreciate in value, and the trend suggests that there's more growth on the horizon.

2. Riding the Rising Trend:

The stock is currently nestled comfortably within a rising trend channel in the medium to long term. This is a powerful indicator of sustained positive sentiment and increasing buy interest among investors. Riding on this rising trend, NYSE:NXE has not only met but exceeded the objective at 6.86, signaling a break of the rectangle formation. Despite a recent dip, the formation strongly suggests that further ascent is imminent.

3. Technical Analysis Points Towards Potential Upside:

Technically speaking, there is no discernible resistance in the price chart. This absence of significant roadblocks further amplifies the case for potential upside. The recent price correction should be viewed as a temporary setback rather than a cause for concern, especially when the overall chart pattern points towards a continuation of the upward trajectory.

4. Supportive Foundations:

In the event of a negative reaction in the market, NYSE:NXE boasts solid support at approximately $6.37. This provides investors with a safety net, ensuring that even in the face of short-term fluctuations, the stock has a foundation to bounce back from.

5. Future Growth Prospects:

Beyond the immediate trends, NYSE:NXE 's business fundamentals and growth prospects add another layer of attractiveness. The company's strategic positioning, innovative initiatives, and industry trends suggest that it is poised for robust growth in the coming months and years.

Conclusion:

In the world of investing, timing is everything, and the current scenario paints a compelling picture for $NXE. The historical value appreciation, the ongoing rising trend, and the absence of significant resistance in the chart all point towards a stock that is ready to soar.

As with any investment, it's crucial for investors to conduct thorough research and consider their risk tolerance. However, for those looking to capitalize on an emerging opportunity, NYSE:NXE stands out as a stock with tremendous potential. The recent dip is not a red flag but a green light for buyers to take advantage of an opportune entry point.