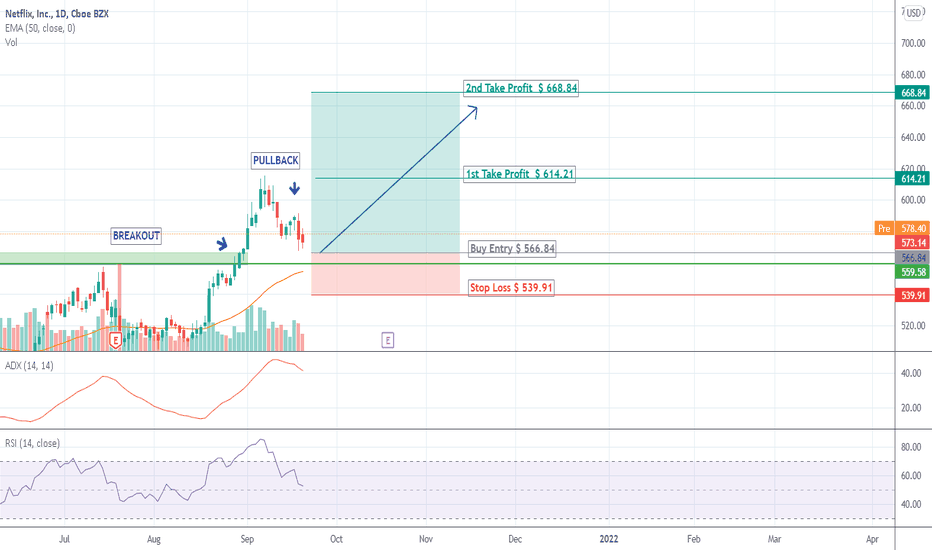

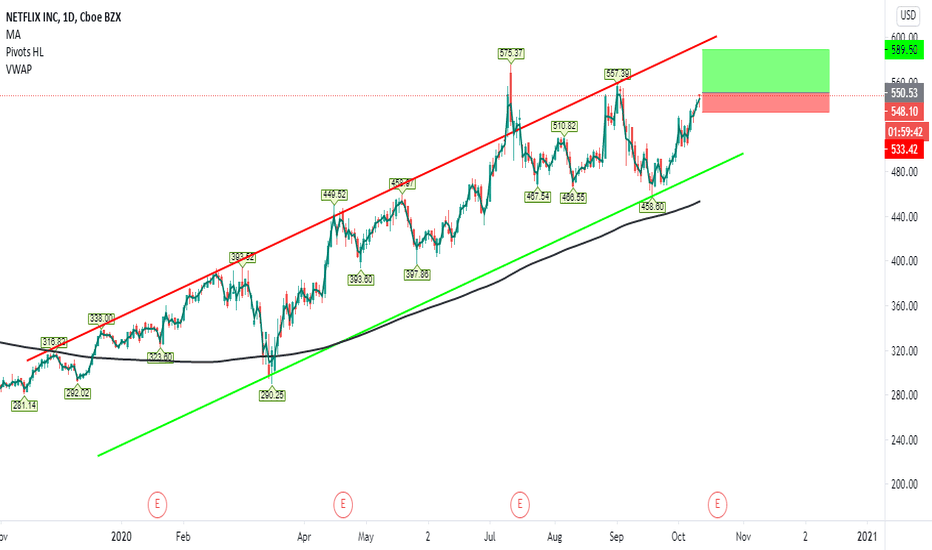

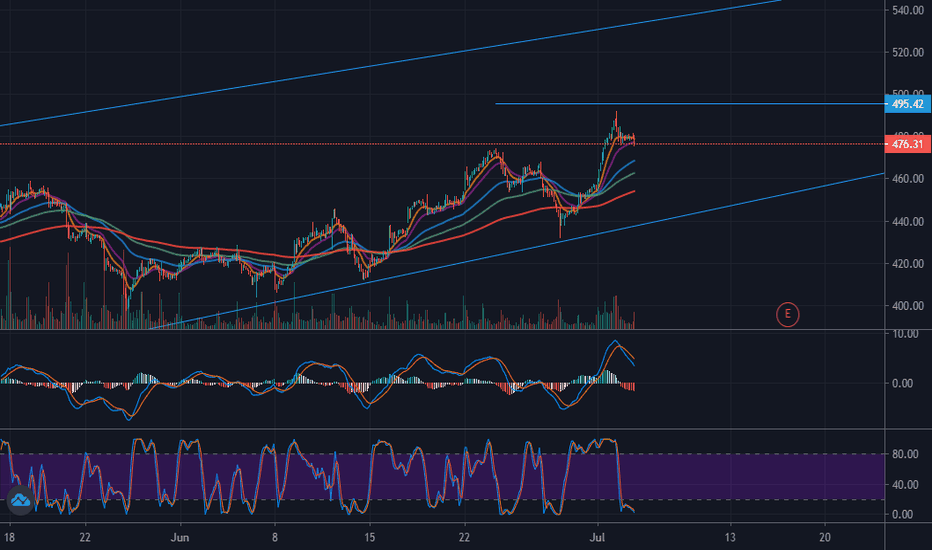

NFLX LONG Bullish trend of Netflix, started in April 2020, seems to continue after the breakout of the channel formed in the last months. RSI shows us that is not overbought or oversold and ADX is above 40 indicating a very strong trend. Entry price would be close to previous support formed after breakout. Moreover, support coincides with 50 % Fibonacci suggesting a probably inversion of retracement formed in these days.

BUY ENTRY: $ 566.84

TAKE PROFIT: $ 614.21

TAKE PROFIT 2: $ 668.84

STOP LOSS $ 539.91

__________________________

NOT FINANCIAL ADVICE

Nflxbuy

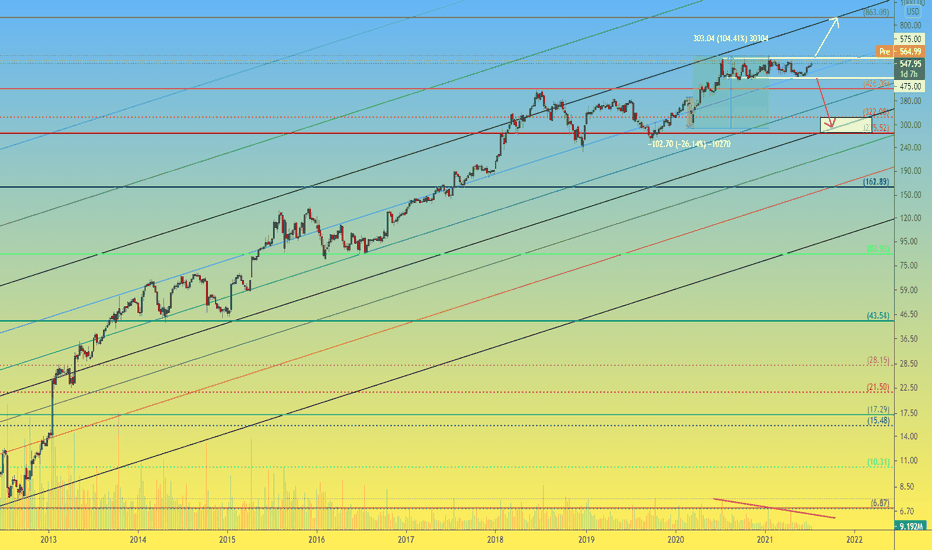

NFLX 1W Is the price of $860 per share real in the near future?Today, we will write down our expectations regarding the value of Netflix shares in the future, as well as a little bit tackle of the history of the company's development.

If you love reading business literature to inspire yourself for future achievements, then we strongly recommend that you read the story of "getting on your feet" once a small company Netflix that has been renting and selling VSH cassettes and DVDs by mail since 1997.

One year after founding, the owners stopped selling VSH and DVDs to focus on the initial idea of renting discs and cassettes.

Their entire history is based on the "super flexibility" of executives who sensed the future trend of their market and acted ahead of the curve.

Here's an example of how a small then Netflix beat the giant of their segment — Blockbuster

The heyday of Blockbuster dates back to 2004, when the company employed about 60 thousand people, and the company owned 9 thousand points of rent and stores. In the late 2000s, Blockbuster faced strong competition from online video service Netflix and filed for bankruptcy in 2010.

Meanwhile, Netflix has expanded its business since 2007 by introducing online media streaming, while not closing the DVD and Blu-ray rentals.

Since 2010, the company has expanded from the United States and expanded internationally.

And since 2013, Netflix has entered the industry of its own content with the debut of its first series.

Now, there are plenty of competitors to Netflix, and we all know them and use their services, but the price of NFLX shares confirms their strength in the market.

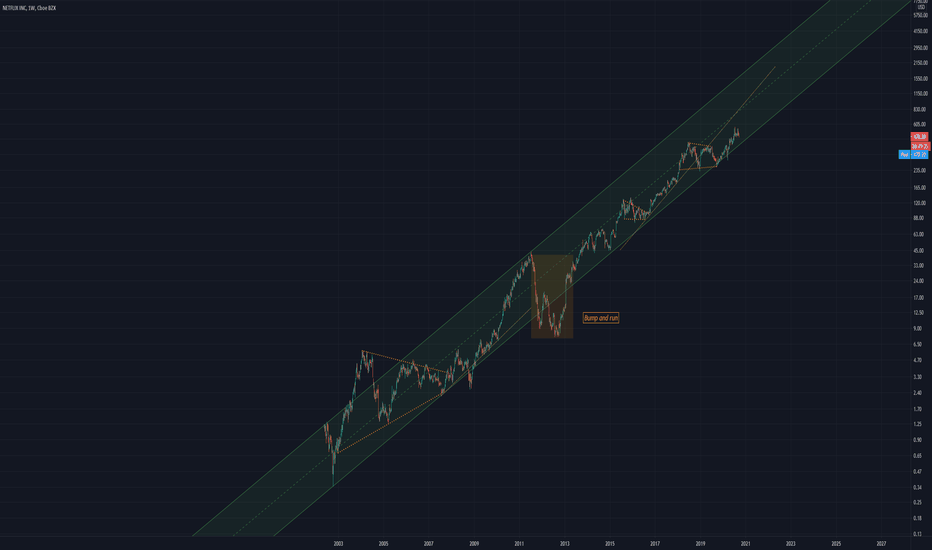

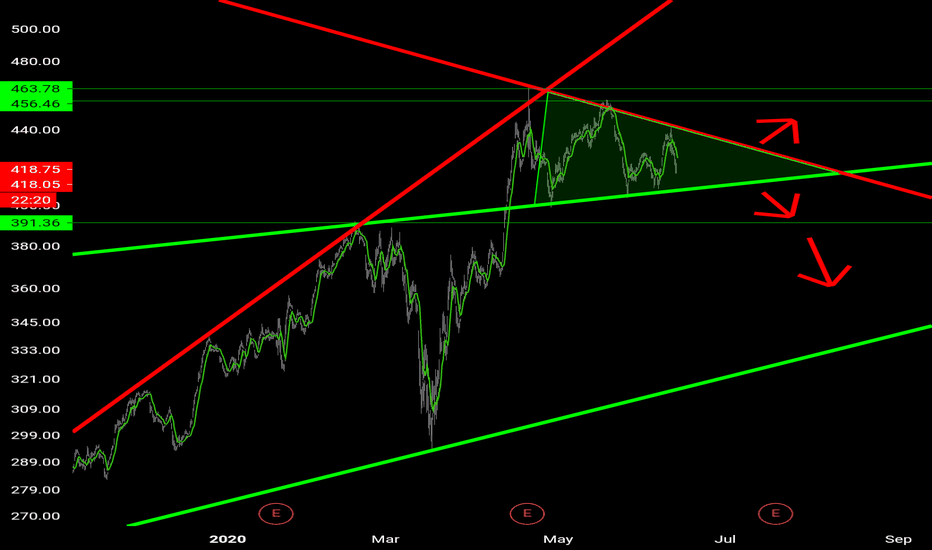

If you narrow the chart, you will see that the NFLX share price has been moving in a dynamic channel upward since 2004.

In 2012, the share price bounced off the lower boundary of the channel and t he $8 mark and began an upward trend that continues to this day.

In February-March 2020, when the entire market fell by 30-35%, or even more, NFLX shares fell in value only by -26%

However, the CoviD crisis was good for the company. Everyone sitted home and bought subscriptions to their services, and Netflix's stock doubled.

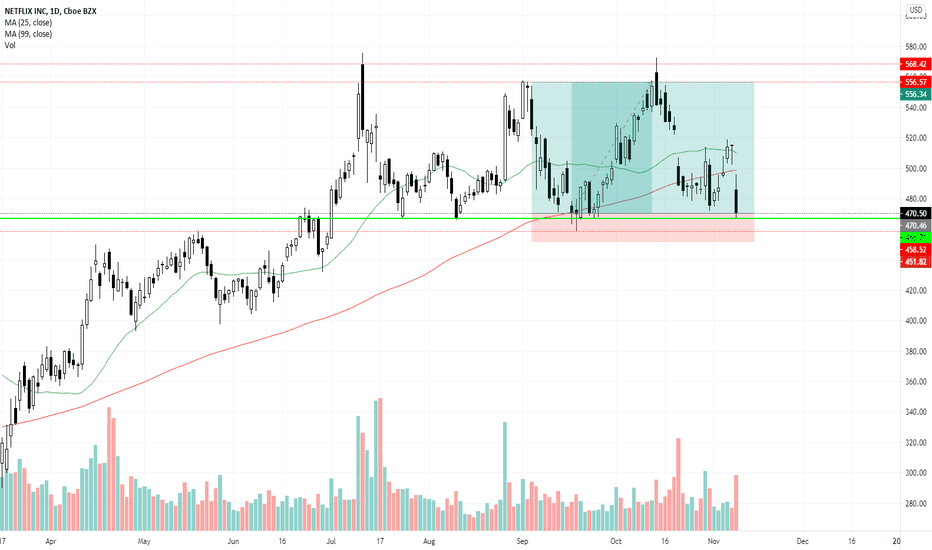

In fact, for the last 12 months, the price of NFLX shares has been in consolidation in the corridor of $475-575

Trading volumes are decreasing, which means that in the near future, the price will have a strong impulse.

There is a high probability that the momentum will be up , the price will break up and consolidate above $575 , and the next target from above will be $860 per NFLX share.

An alternative scenario is a fall in the NFLX price to the $275-325 zone. This scenario will activate when the price breaks and consolidates below $475 , and the first bell that it is worth refraining from longs will be the price approaching $500.

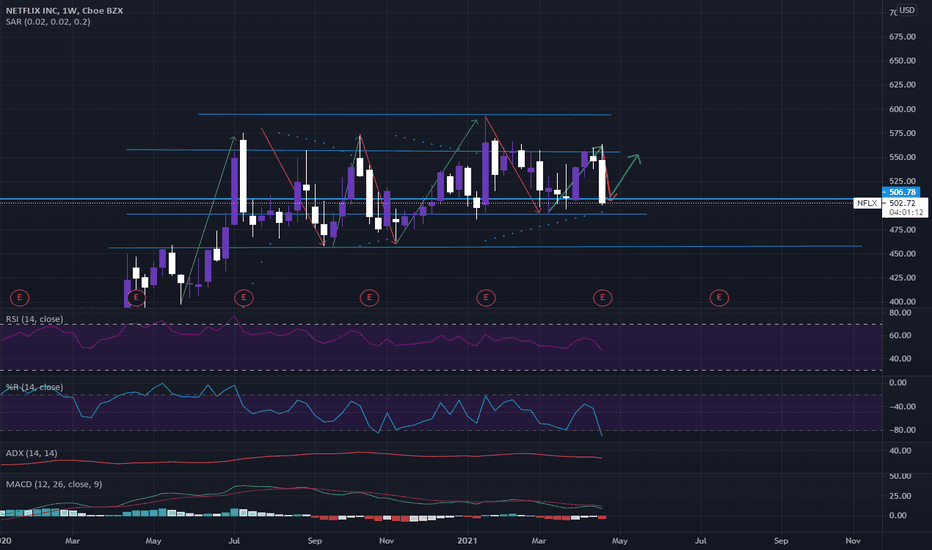

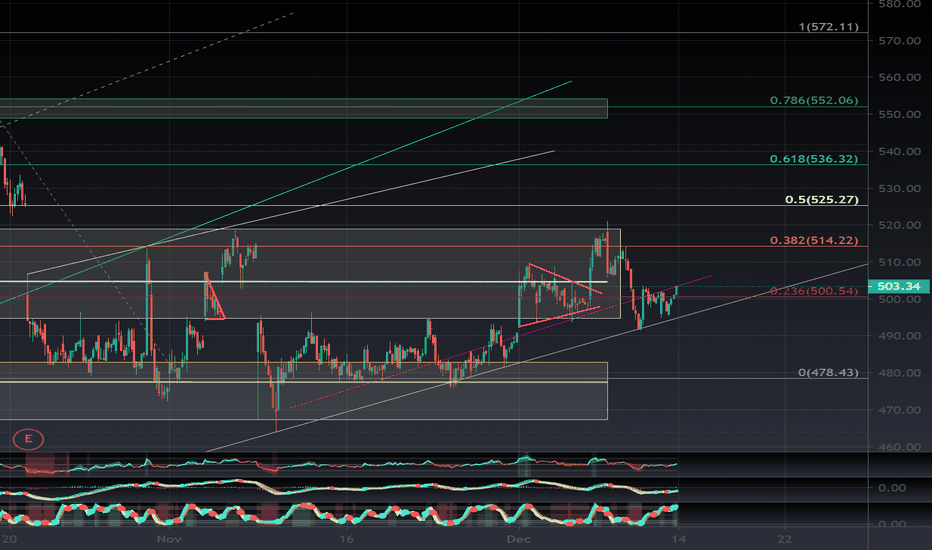

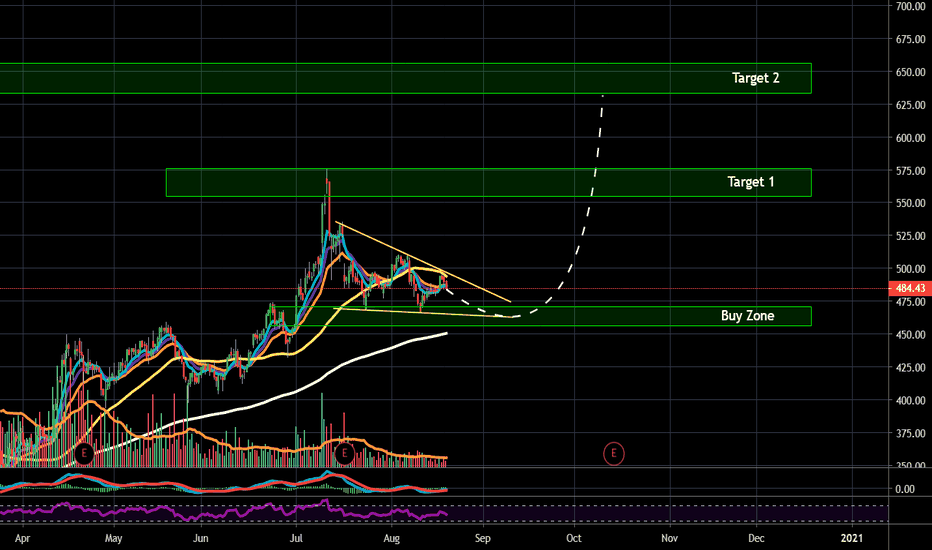

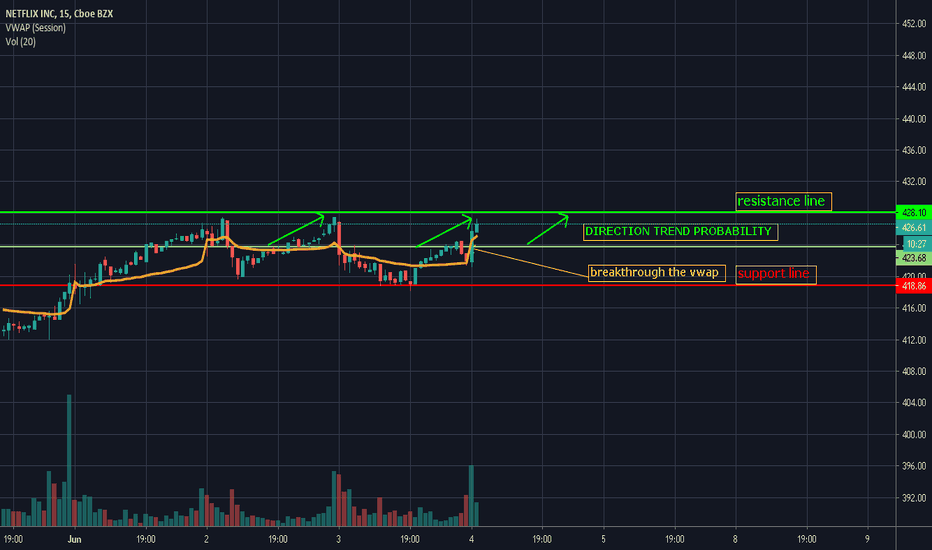

NFLX Long/Short?NFLX been having the same pattern for a long while now. But let the market pick the direction before entering a trade.

Bullish over 509, PT 520-525

Bearish under 491, PT 478.43-470

Still stuck in that channel wait for a break of the purple trendline for long, grey trendline for short. Also its tricky with vaccine and stim news. Who cares about NFLX now?!

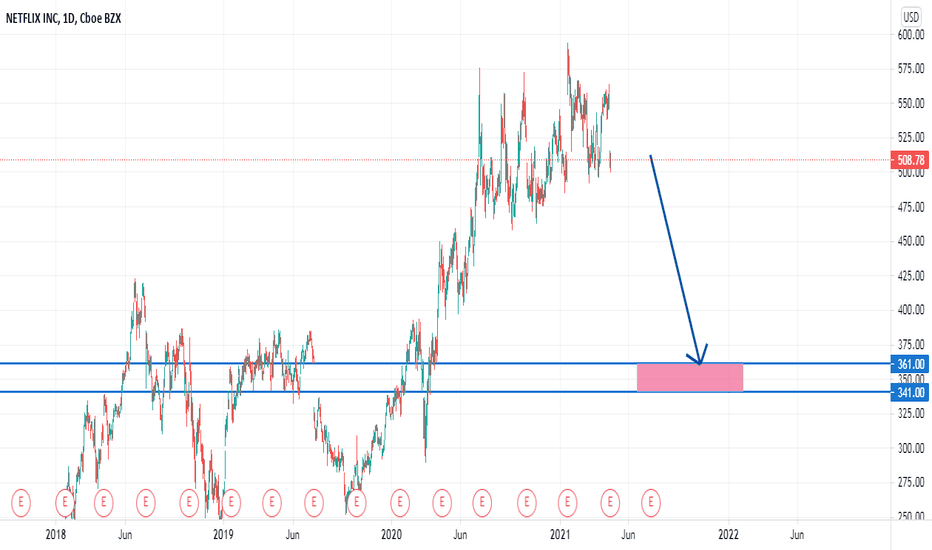

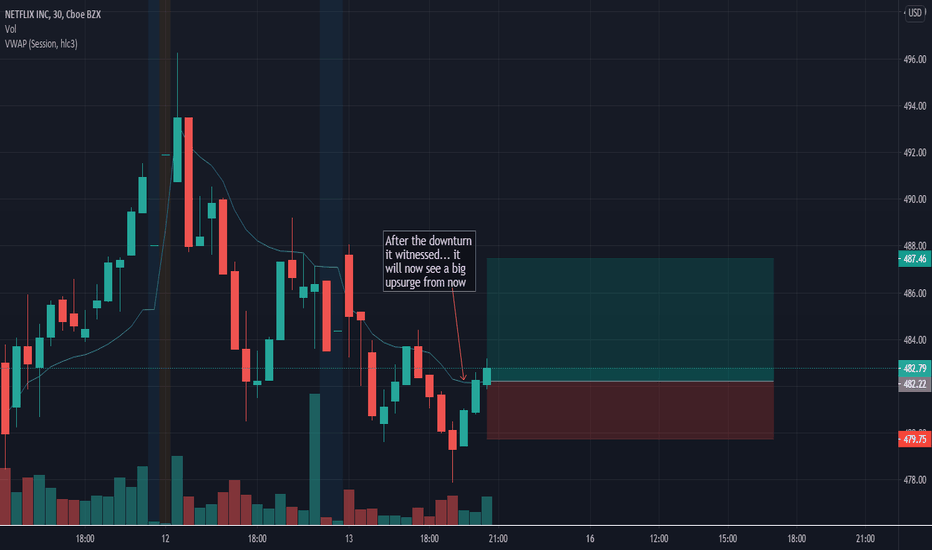

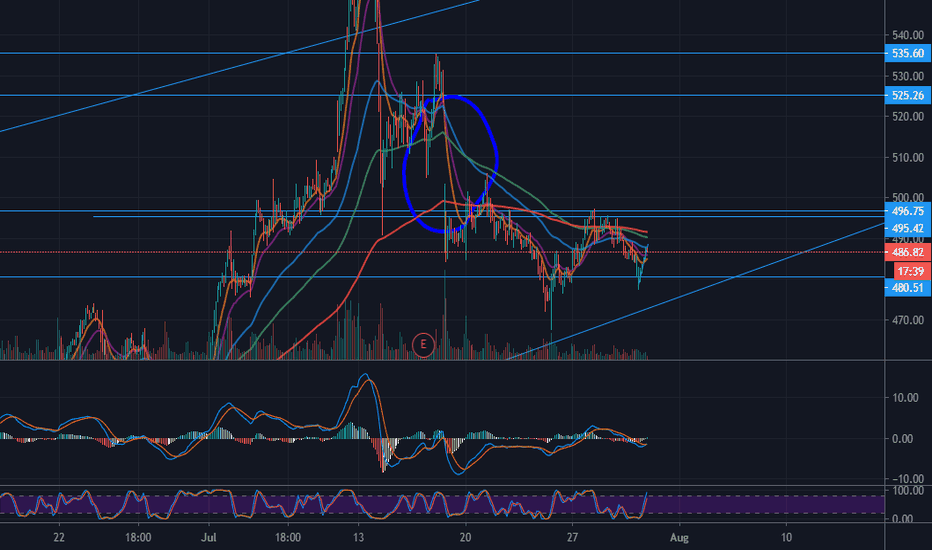

NFLX Long 4:1 R:RNFLX is at support, which has held a few times already.

Although the recent news about Pfizer's vaccine had a negative impact, the company did benefit from subscriber growth during the pandemic and is in overall a good spot.

I see this trade as worth taking, considering the R:R ratio but will nevertheless be cautious, as tech might continue to trend down heavily duo to the vaccine news.

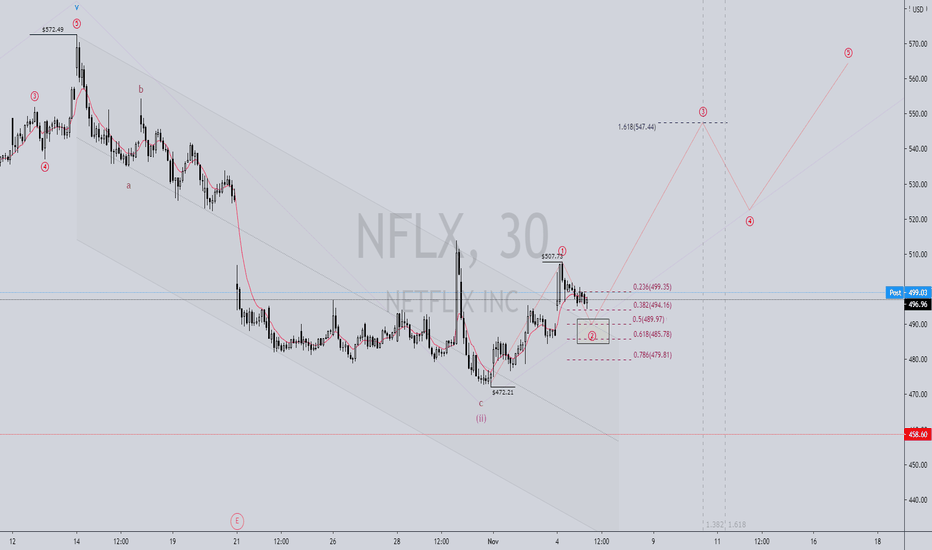

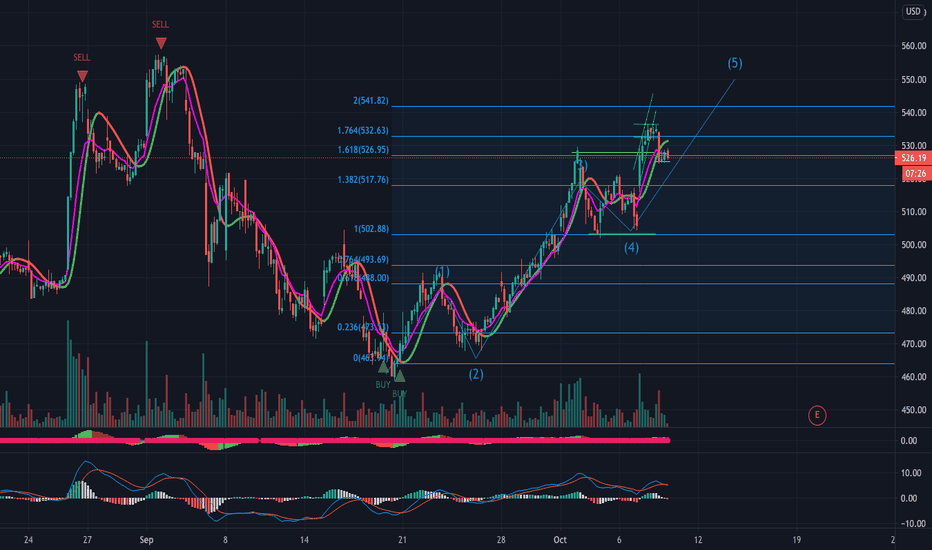

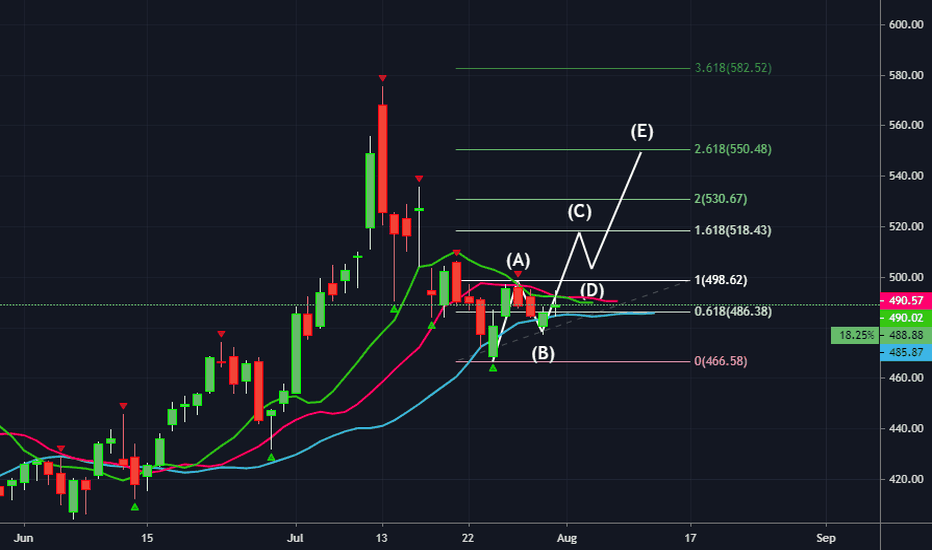

$NFLX Long Strategy for Short Term Options Swing TradeMy analysis has NFLX in a wave 2 correction for a micro wave following a minuette wave 2 correction and subsequent bull flag breakout. I expect this micro wave 2 to retest the channel at the 0.5 to 0.618 retracement level. Once I see confirmation that the correction has ended, I will purchase an in the money Call Option with an expiration of 11/13. The 0.618 extension for the micro wave 3 is based on a retracement in wave 2 to the 0.5 fib level. I will need to adjust the fib extension once there is a definitive bottom.

Please like, share, and follow for more of my analysis and trade ideas....

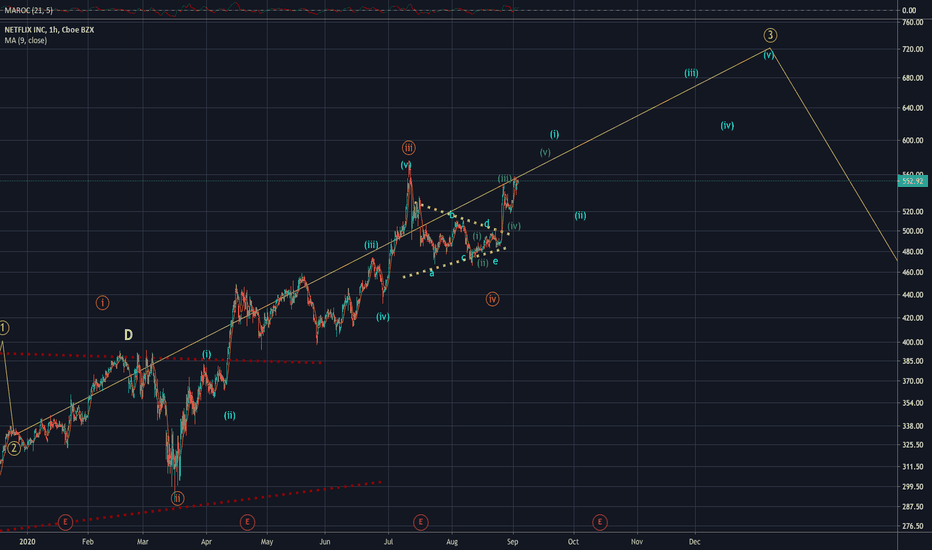

NFLX wave (v) increase NFLX is setting up for a wave (v) increase into the 600-620 upside target. Wave v rally in progress as the current bullish triangle pattern has been completed yesterday. If this is the case bulls are setting up targeting the potential 760-770 wave v upside target. Check video update on trade management and profit maximization on NFLX existing bullish vertical spreads.

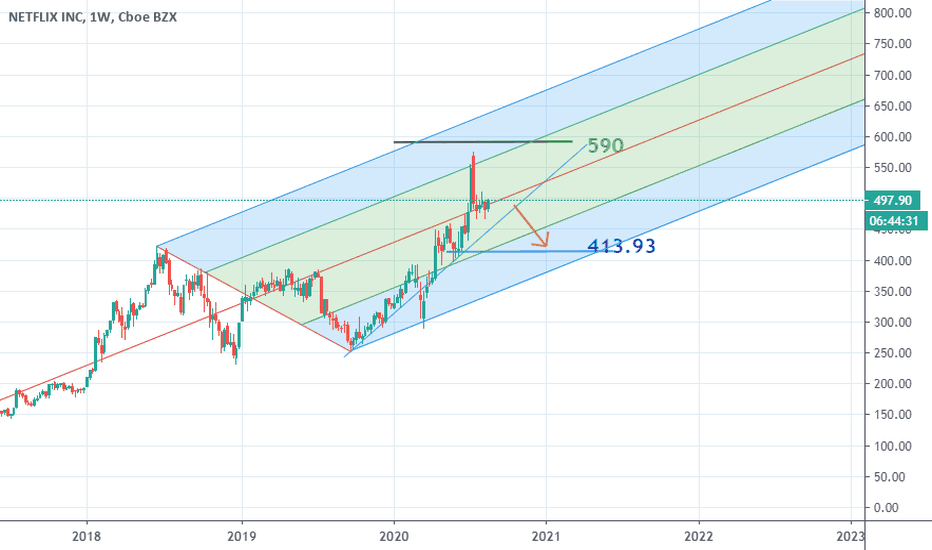

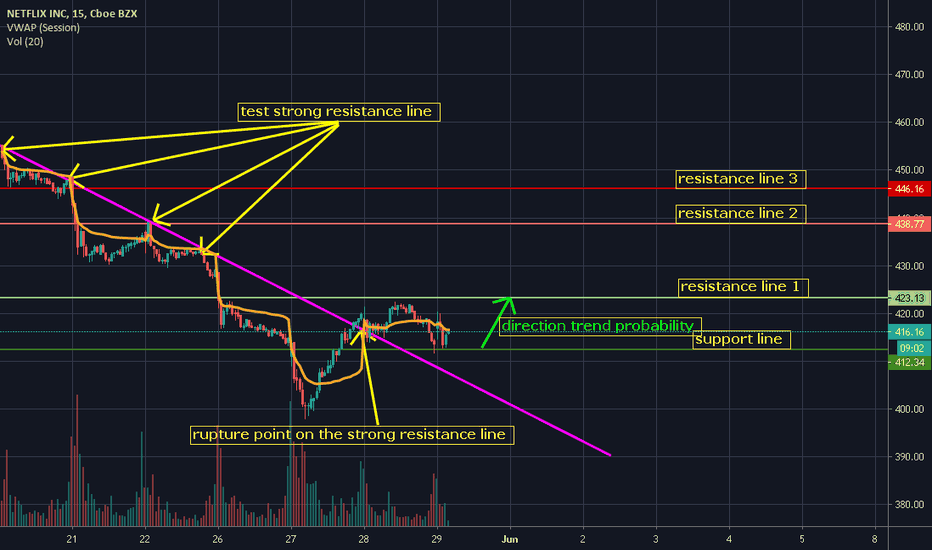

NETFLIX INCThe market is generally always bullish. but he lost a bit of that strength. at the moment he is creating a trading range in the weekly chart. if he ever breaks the (465) with power. there is a probability that he can reach around (413.93)

but if he ever breaks 522 with power there is a probability that he will reach around ( 590 )

NFLX CallsIm still in on NFLX calls, the chart is looking great dont mind all my trend lines, I like to use them to show support resistances and rice targets on multiple time frames, the main target for NFLX is 525 to fill that MASSIVE gap which is a great opportunity for all of us.

I got into Aug 7 525 calls if it doesnt hit 525 by next week ill sell the aug 7 and buy into 2 weeks out.

Feel free to direct message me if your interested in joining a trading group, or if you would like me to answer some questions.

Good luck trading everyone!

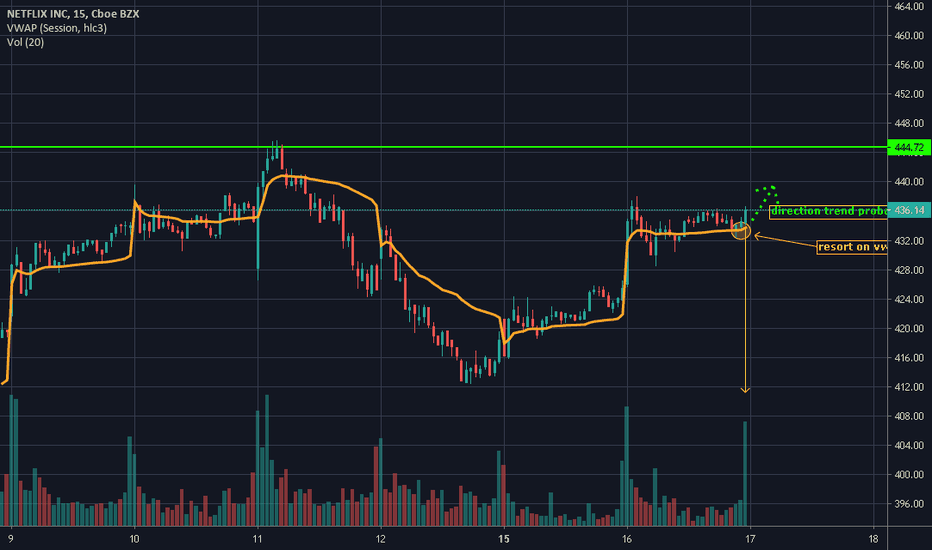

NFLX SignalCalled this on the group chat at about 400, and the gaol is 495, its almost hit already and will soon go back down to the bottom of support retest and hopefully bounce back up and easily hit my target of 495

If youd like to join the paid group chat just DM me, and we can bank together with more opportunity to bank.

Questions just DM me

Netflix Compression. (NFLX)🤔 Two patterns taking place as we hit major level of Resistance.

Bull Pennant or Inverse Head And Shoulders.

Price is being compresses in the green pennant formation.

Safest bet is to play the pennant breakouts to the up or the down / avoid the noise for now.

Once the break happens, next you will look to play those positions towards the green horizontal support and Resistance levels to test for trend continuation.

Cheers! 🍺

🥇MLT | MAJOR LEAGUE TRADER