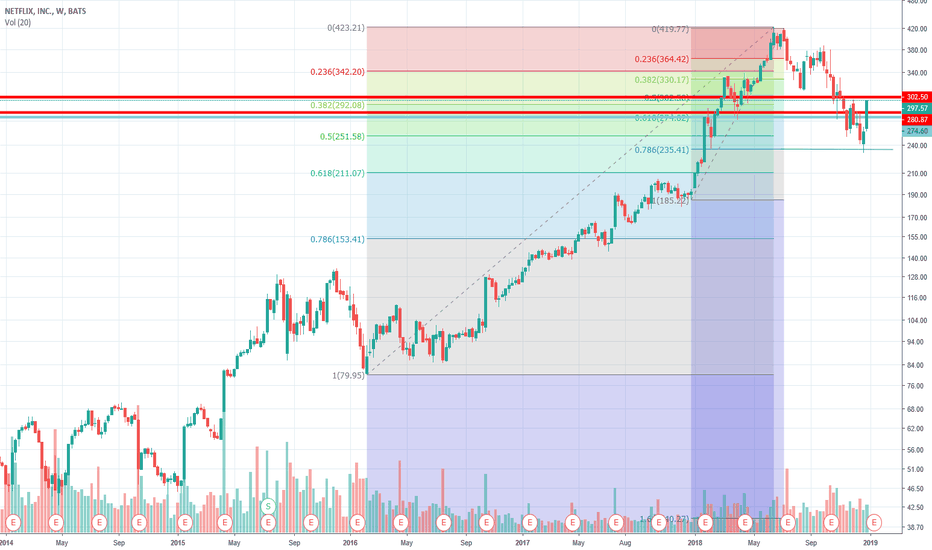

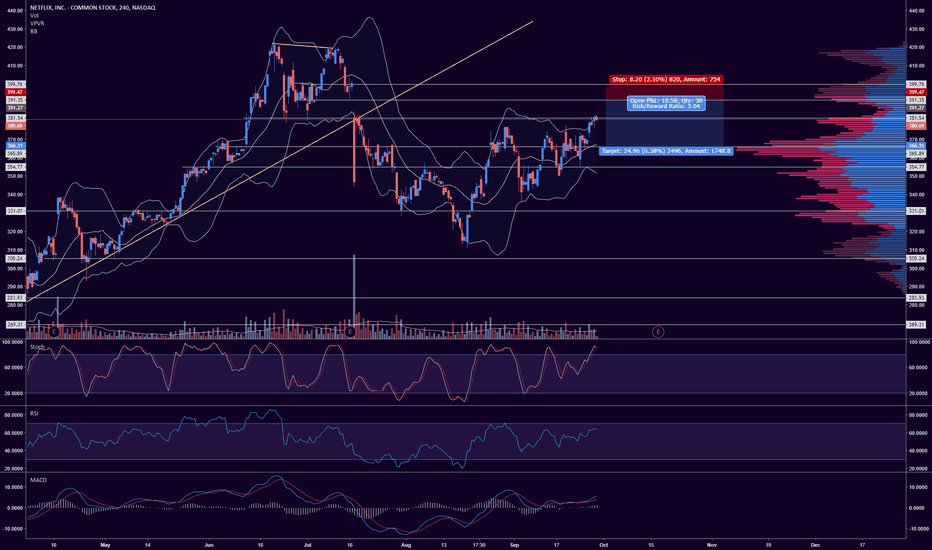

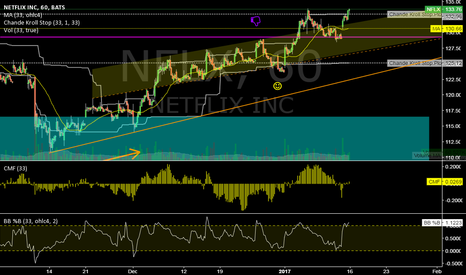

OMFG - Shorting NFLX Ruins Weekends for BearsOk, so GS ramps its NFLX price target and I think shorting NFLX pre-market (while on the toilet) because its up 3% is a good idea. Add to the short at $291, even better. This SOB is moving up and if it blows the next Fib resistance at $302.50, probably not a ton of resistance until the next 10% at $335-$340ish. Frankly, I wouldn't be surprised if we got there in the run up to earnings.

So I'm bagholding NFLX on the short side so that every single waking minute of my weekend can be spent contemplating what a moron I am. Should be fun. Longer term, I believe in the trade. This is a heavily indebted media company with an eye popping multiple that AAPL isn't buying because AAPL is a prude when it comes to content. Nevertheless, I have to see this ill-timed trade every time I log into my account eating up my YTD gains for the foreseeable.

Thankfully, for those who saw my morning chart, I pointed out the danger here and hopefully prevented a few bears from getting trapped in this pain trade from hell.

Lesson: Even big cap stocks that pop 5% premarket on BS research can close 10% higher.

Nflxshort

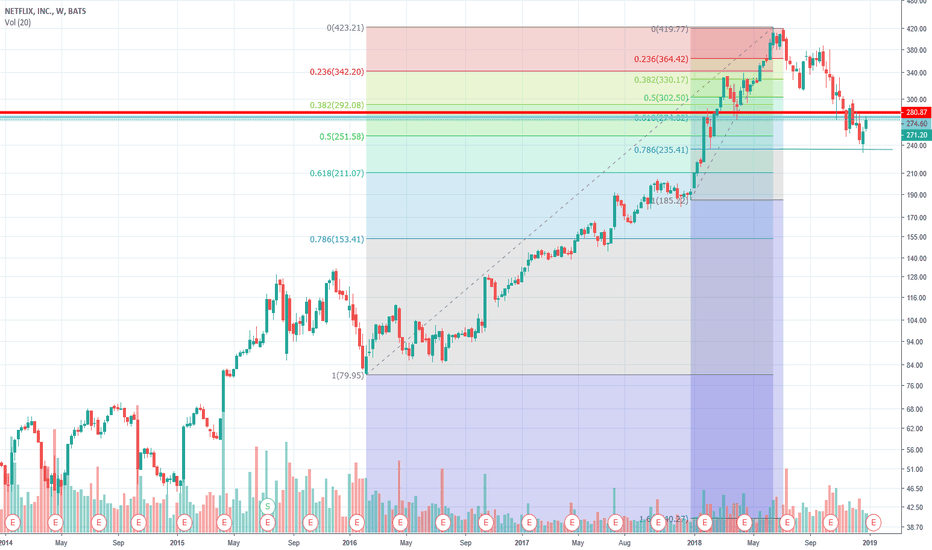

Follow Up - WTF is up with NFLX - GS Upgrade RampSo NFLX was ripping yesterday, somehow immune to price drops despite my shorting of a massive 1k shares:). Why? Goldman upgrades them this morning with a $400 price target because why the hell not upgrade a company when the PE falls below 100!

Today's morning gap lines up with recent resistance around $281 and while sitting on the toilet I took a semi-fun size 500 share short to play at least a partial gap fill but mainly because I hate myself and want to put on a bad trade with this POS to ruin my weekend.

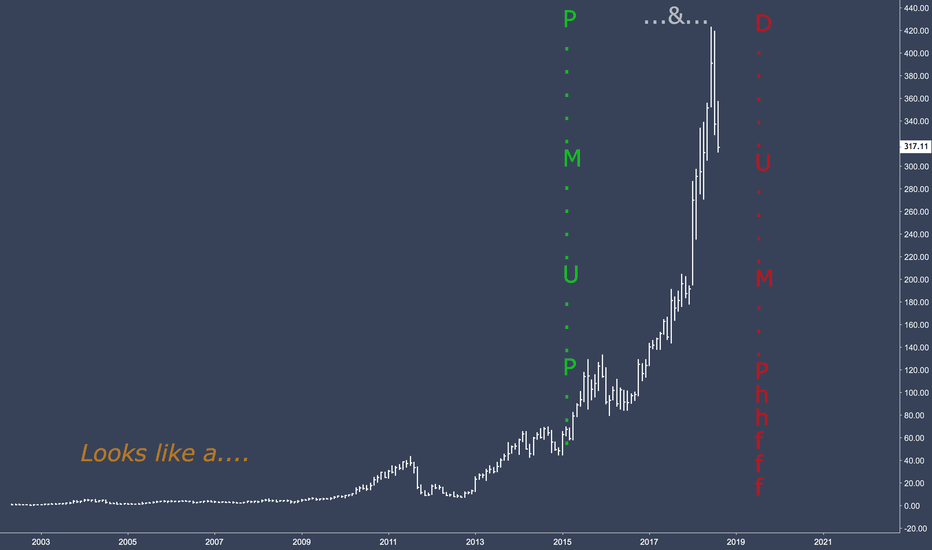

As I said before, NFLX warrants caution here because people think its immune to the trade war so it could run up into earnings. Nevertheless, this is a dog and it will eventually go full bitcoin because its just a media company trading with a multiple 5X Disney which is a real diversified entertainment company with better assets.

Careful trading today. Powell up at 10:15.

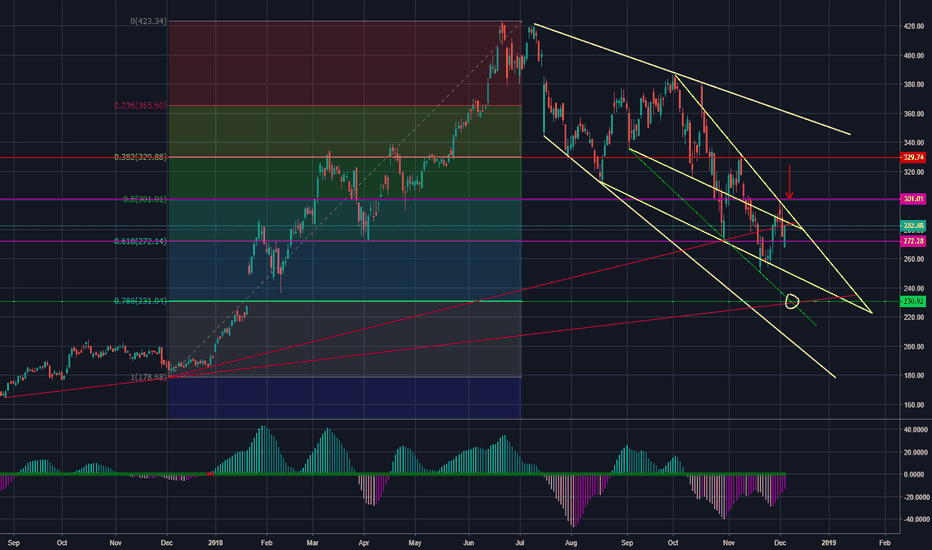

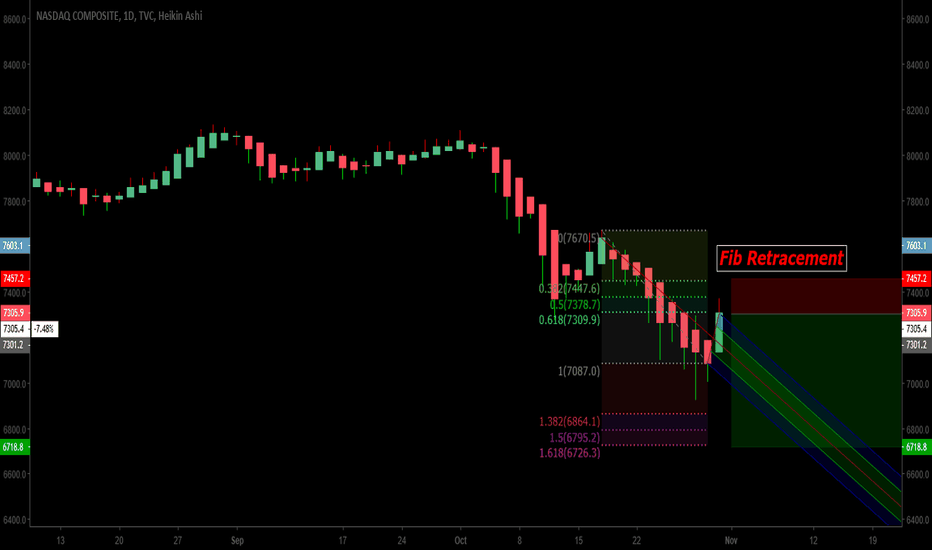

WTF is up with NFLX todayAnyone trying to short NFLX today is bitter as hell based on the fact this ticking time bomb of a bubble refused to give up gains today. Someone is clearly buying shares and there are a ton of shorts that can be squeezed. Nevertheless, the 61% Fib from 2018 kept it from breaking out. I'd be cautious here on the short side because if the market face rips higher, this overpriced dog will easily rip 1.5 or 2X the Nasdaq. My advice, let this bad boy run up and short it to death ahead of earnings.

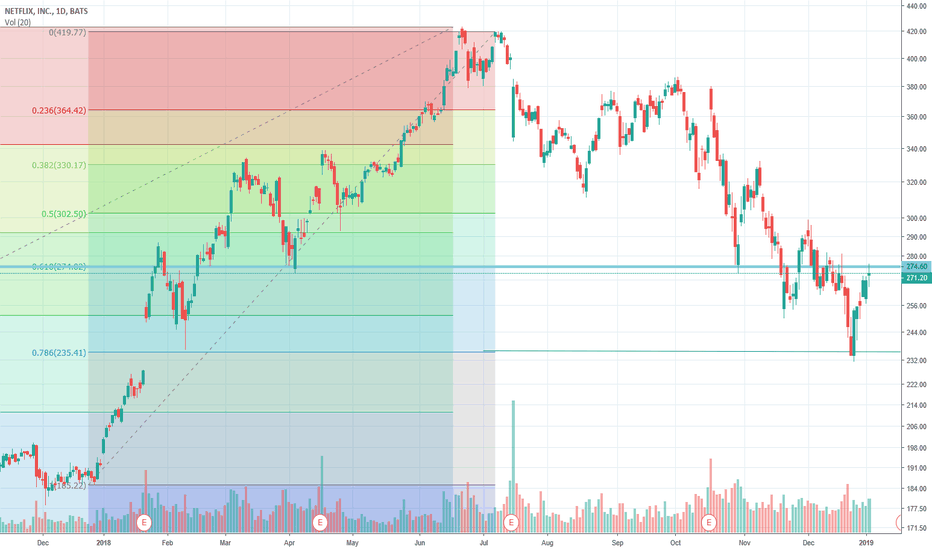

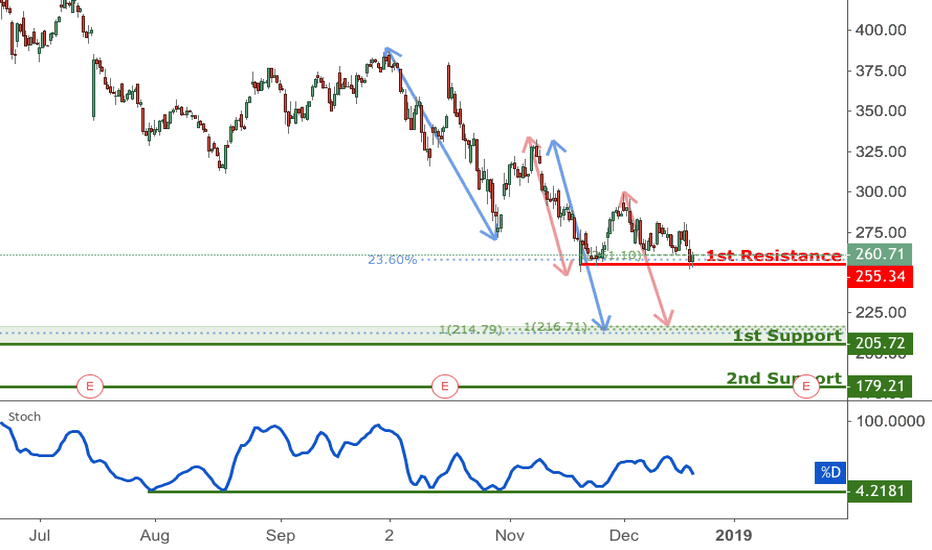

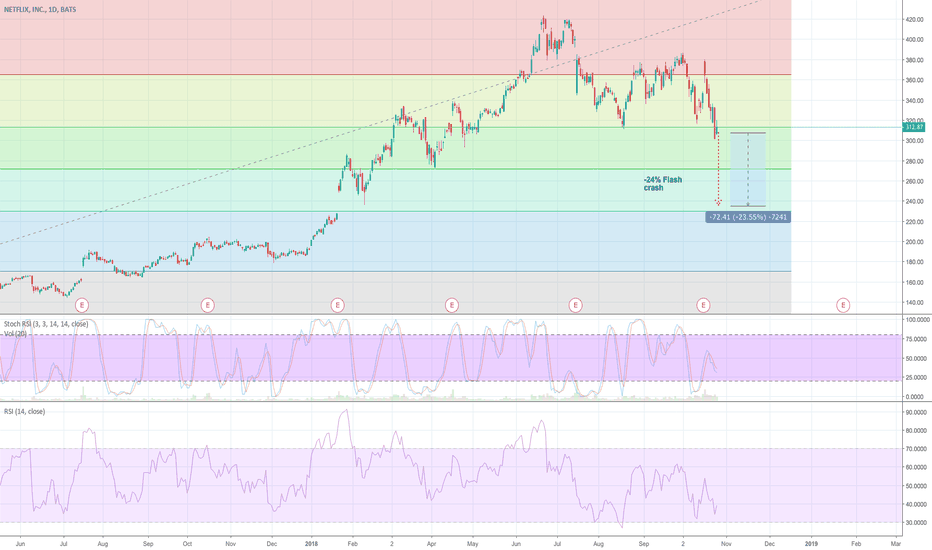

NFLX Approaching Support, Potential Bounce! NFLX is approaching our first support at 205.72 (horizontal pullback support, 50% fibonacci retracement, 100% fibonacci extension) where a strong bounce might occur above this level pushing price up to our major resistance at 255.34 (horizontal pullback resistance, 23.6% fibonacci retracement, 100% fibonacci extension).

Stochastic (34,5,3) is also approaching support and we might see a corresponding bounce in price.

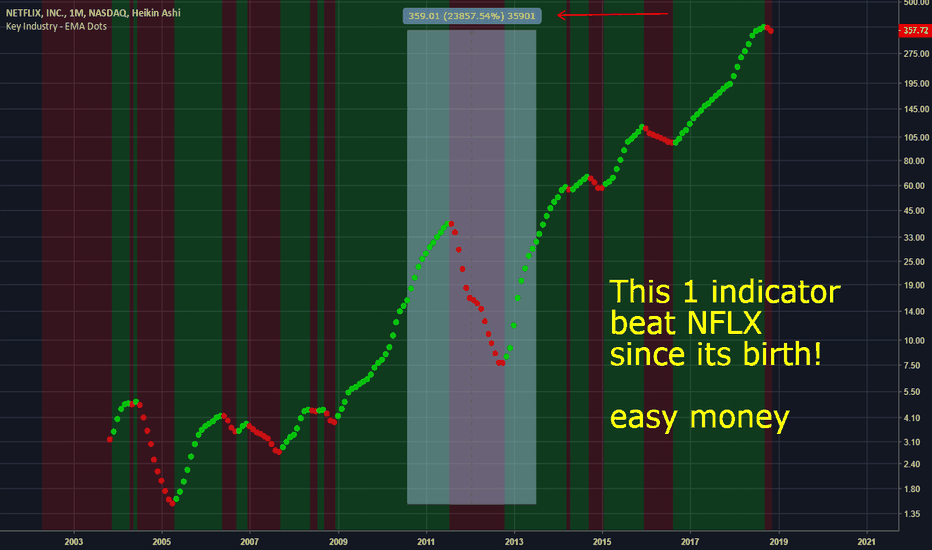

Beat NFLX easily.it's mainly for swing trading, i use the 3 day / 15 day / monthly charts with it and it works perfectly,

it works good for stocks and cryptocurrency.

you will use heiken ashi chart style and turn on the EMA DOTS indicator.

once the indicator is on you will hide the heiken ashi so you only see the dots.

when a green dot appears you buy, if a green dot appears after that green dot you hold your investment.

if a red dot appears you sell your position. easy as that.

shorter time frames will be choppy.

larger time frames will be smooth.

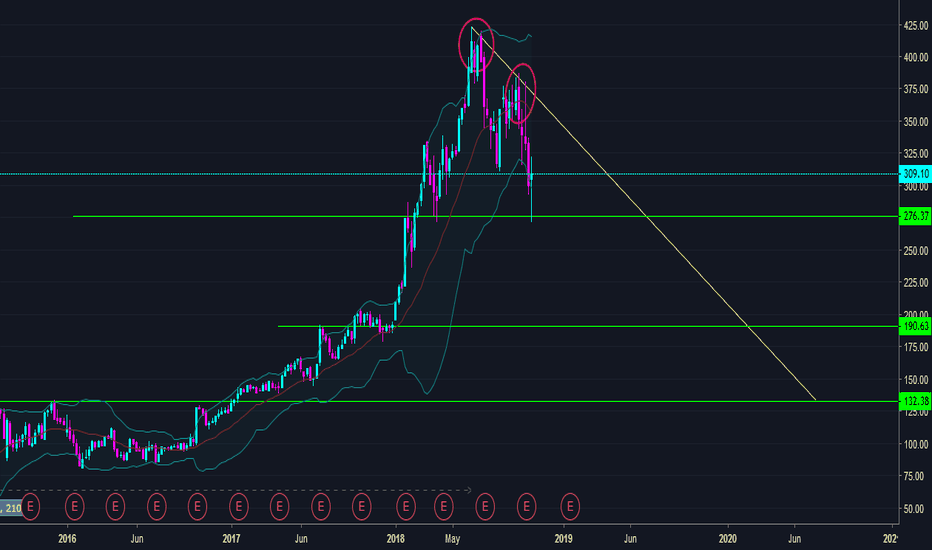

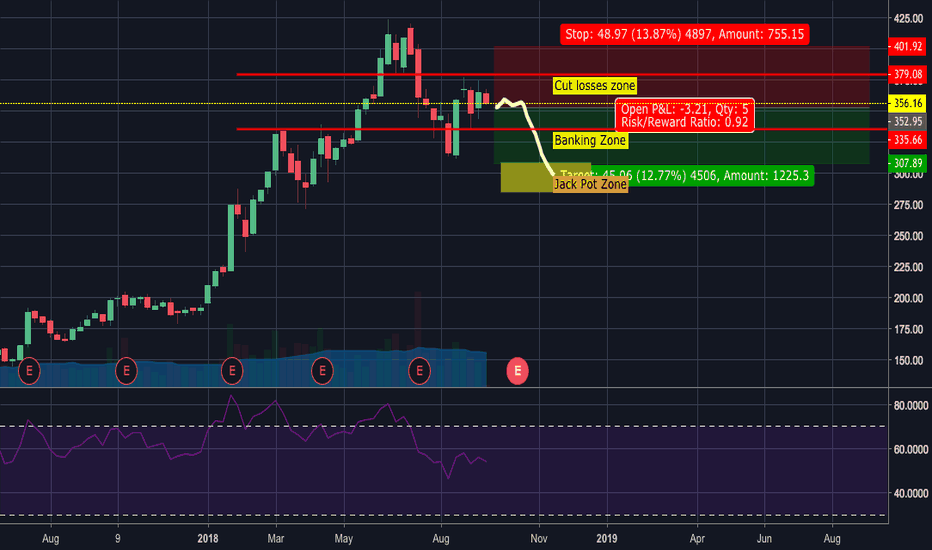

$NFLX INC DOUBLE TOP, BEARISH TRENDI think that we need to look after what will happen in general towards the world economy at the moment before to look specifically towards certain company or you know, the whole sub industry.

I got some issues that it might be happening for crisis in 2019. It's quite terrifying but I can't wait to see what happen towards cryptosphere!

At the moment the chart of Netflix is kinda bearish, which is already seen it touched $276. Dead cat bounce and right now at the moment sitting above $300, $309 to be exact.

This one is not gonna hold as I see it'll play around $200ish. My scary scenario it will go to $190 as the nearest strong support and start longing from there.

*************************************************************************

If all of these ideas I posted helps you, give them thumbs up, shares, comments and follow me. If you have a suggestion, just fill in the comment sections or message me. Looking forward to hear from you all. Thanks a lot!

-------------------------------------------------------------------------

tradingview.sweetlogin.com Rules:

#1 Always obey tradingview.com house rules

#2 Always read the description

#3 Don't spam on the comment section

#4 If you wanted to request my opinions about a coin/token just give 10 likes on my published charts and I will do it the day or two after

#5 My opinions are not financial advice, follow it at your own will and your own risk

#6 Together, let's build a better community on this platform

-------------------------------------------------------------------------

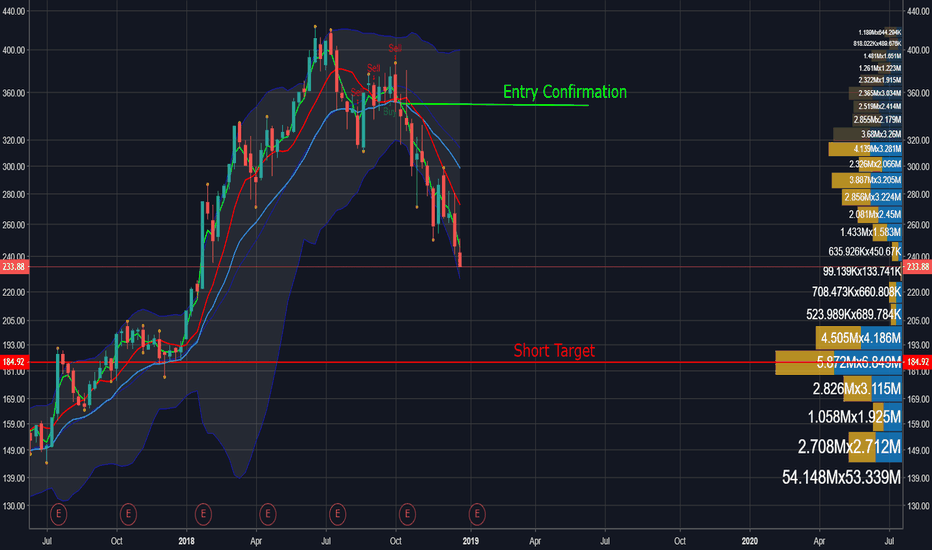

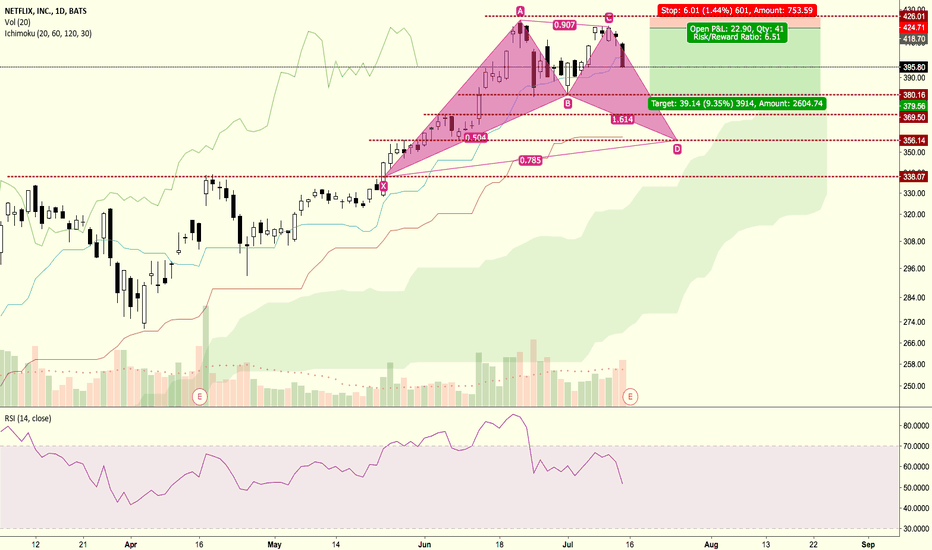

Netflix Correction by Price ActionActually i have short position from 420 which is starting point of C in my Bullish Bat Pattern. However, i took my position because of daily price action. As you can see A and C points are closing points of daily candle and it clearly says us to short it.

I will close most of my position at 380 but short position can continue till reach 356.

In a nutshell, i am going to close my positions at 380, 370 and 365.

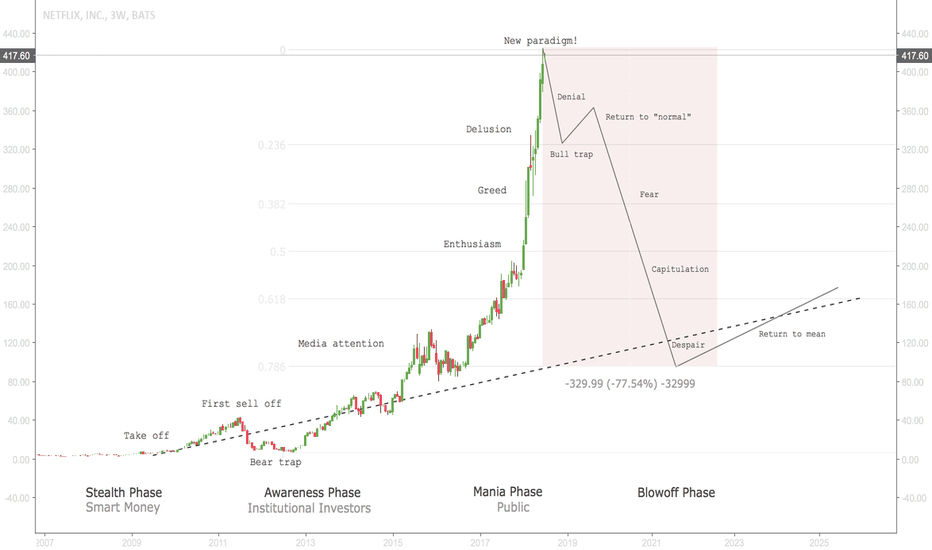

Macro Netflix correctionsNetflix is great. I love the company, service, etc. It's over-valued.

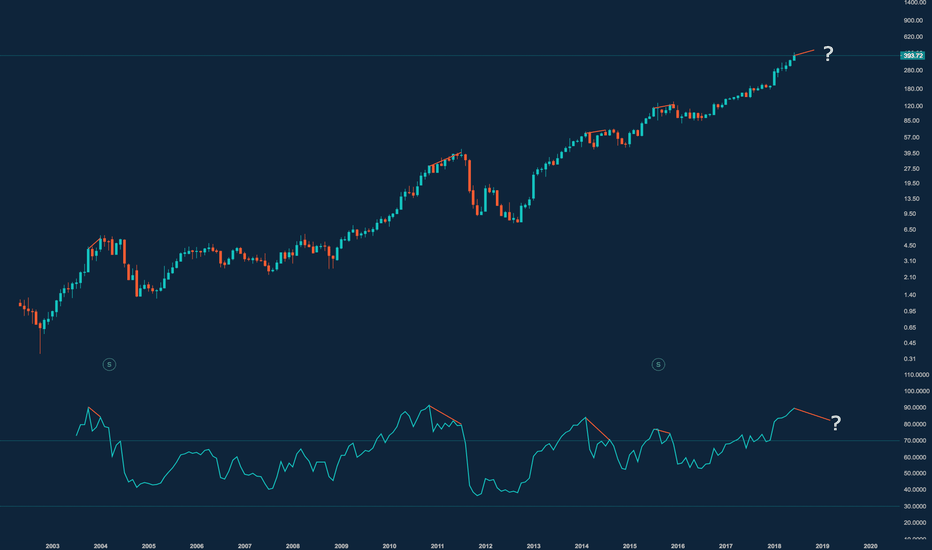

Several major corrections to Netflix have shown very clear bearish divergences on a monthly chart that can aid one when trading on a macro scale. There is no current divergence on this scale -- and while I actually think we could see further correction here, the better "tell" would be for Netflix to continue to rise in price over the coming months while monthly RSI cools -- to offer us a divergent setup that could be quite fruitful. I'll be watching.

Also, a bullish divergence on this scale could help us ride Netflix's next great wave, whenever that may be.