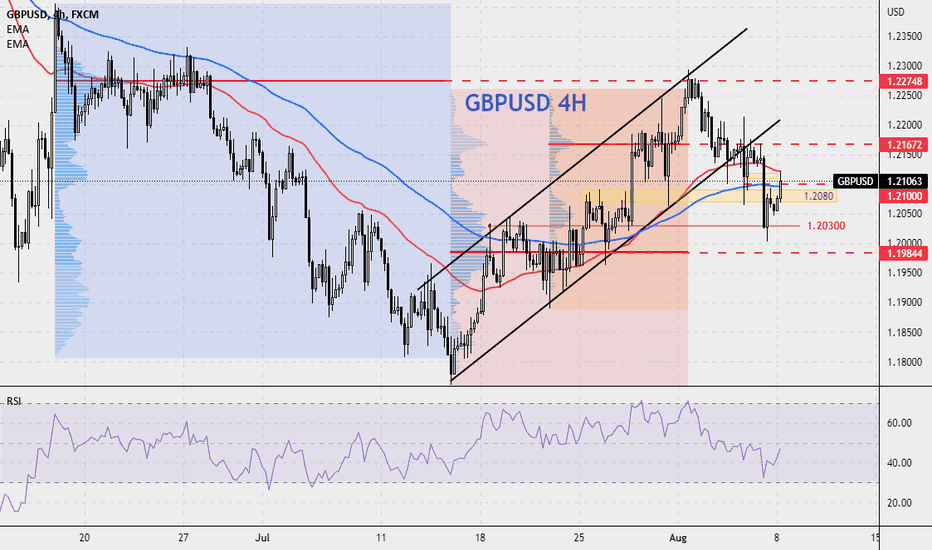

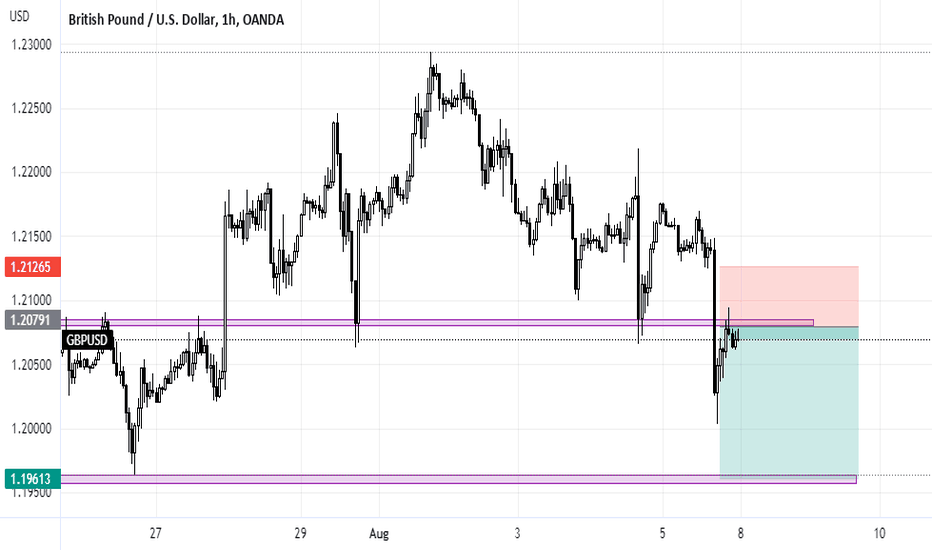

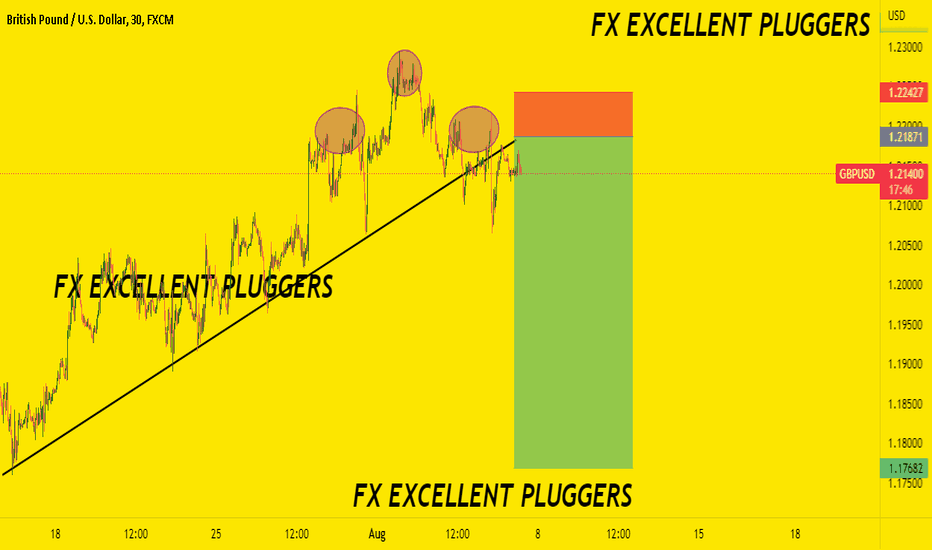

GBPUSD receives support from 1.2030 GBPUSD receives qualitative support from 1.2030 levels after Friday's drop caused by US employment data

And it regains part of its losses by returning above the pivotal 2080 range

This is not enough to go up

Today's close above 2125 indicates that the current selling pressure has calmed

2165 with positive momentum announces strong entry for buyers

Nfp

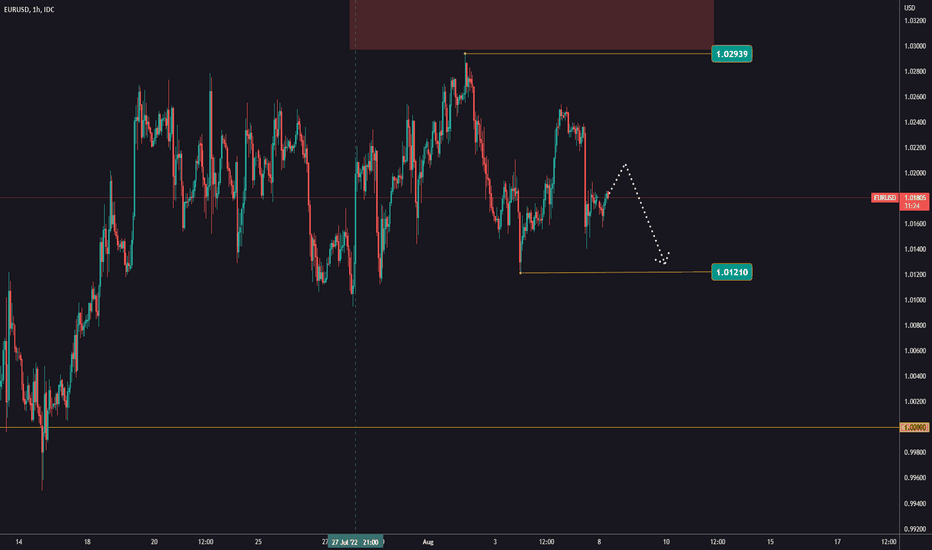

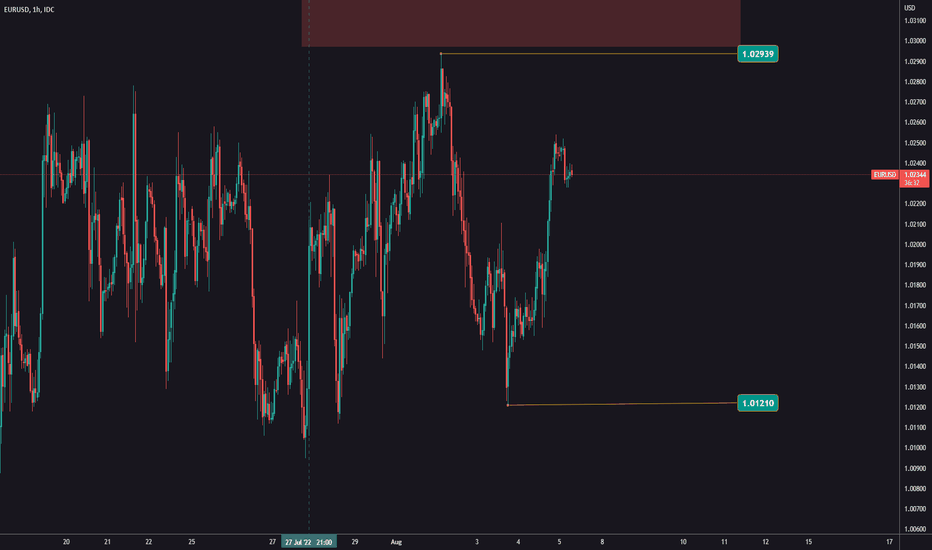

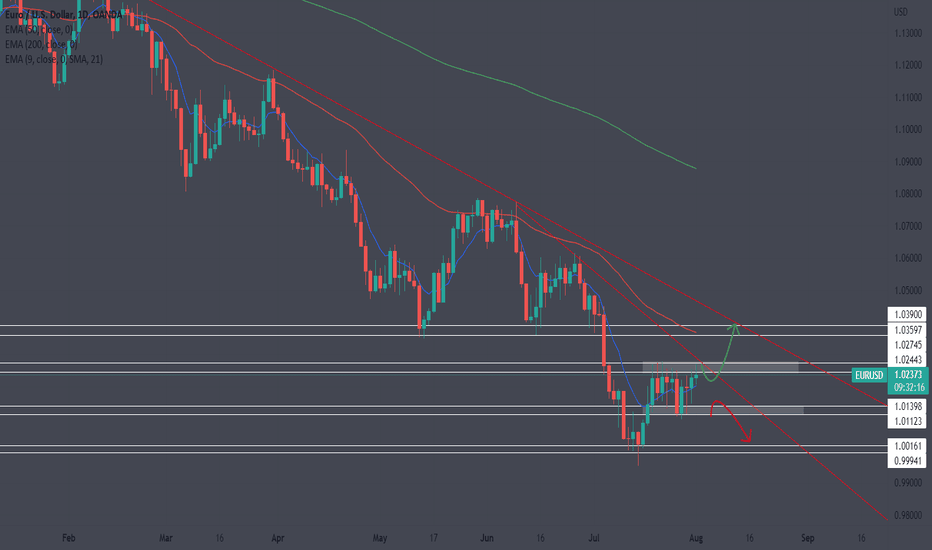

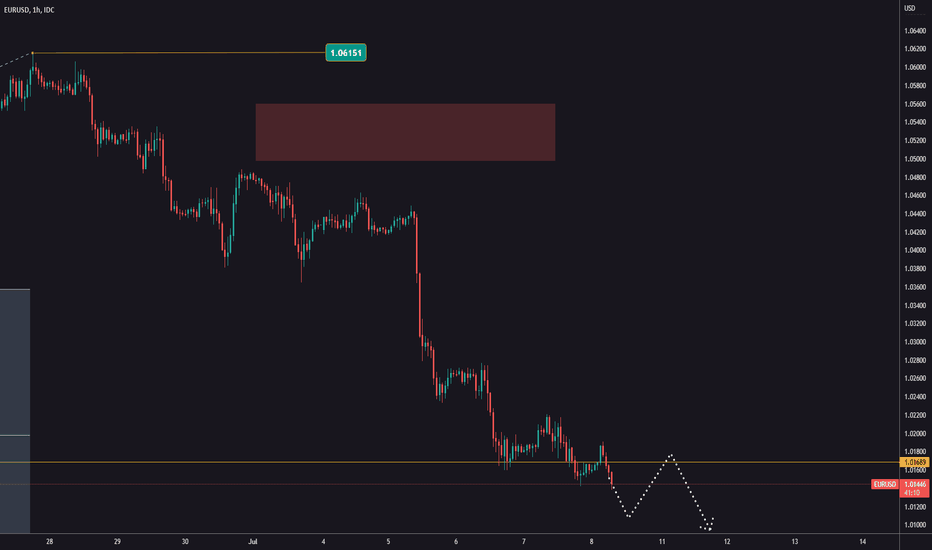

EURUSD still trading sidewaysEURUSD is still trading without a clear direction. After the last impulse during NFP, we now expect to see price testing the support.

Until we see a breakout in either direction outside of the range, EURUSD isn't the best pair to trade right now.

There is a higher probability that we will see the market testing 1,0121 and in case of a breakout we will be looking for a continuation of the downtrend!

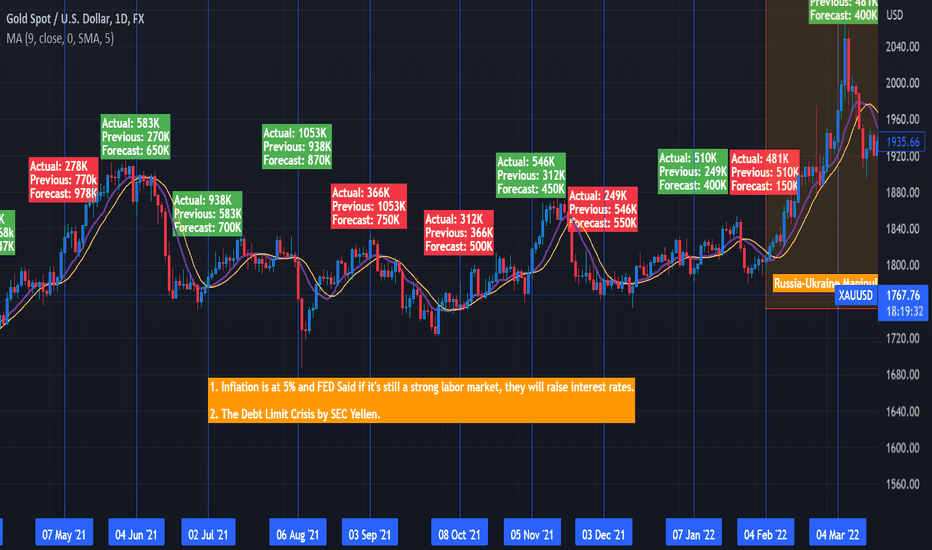

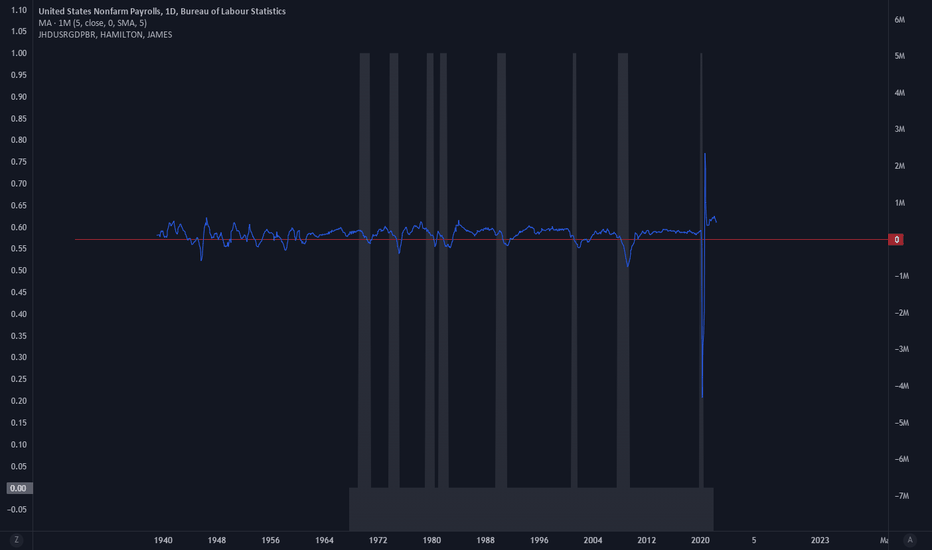

How did the market react after July’s Non-Farm Payrolls? The Non-Farm Payrolls (NFP) for July 2022 surprised many as it reported that the US economy added 528,000 jobs, more than twice the consensus forecast. Total NFP employment has now returned to the pre-pandemic level, when 20 million jobs were lost.

At the same time, the US Unemployment Rate decreased to 3.5%, the lowest rate since February 2020. Additionally, US Average Hourly Earnings MoM for July jumped by 0.5% for the month and 5.2% over the year ending in July.

US stocks ended last week mixed after the strong NFP. While the Dow Jones Industrial Average increased by 0.2%, the S&P 500 and NASDAQ 100 fell by 0.2% and 0.5% respectively. The weekly closing, however, shows that NASDAQ 100 gained 2.2%, the S&P 500 gained 0.4%, and the Dow Jones lost 0.1%.

Gold and silver finished sharply lower, as metal traders took in the jobs and employment reports. XAU/USD fell by almost 0.90%, closing at $1,774 per ounce, while XAG/USD slipped by nearly 1.40% to 19.88 last Friday.

The data releases sent the US Dollar Index (DXY) to the upside, helping combat the decline it has experienced over the past few days. The DXY jumped 0.88% to above 106.60.

With individual forex pairs, the USD made significant gains, including:

EUR/USD fell by 0.67% to 1.01803

GBP/USD fell by 0.75% to 1.20703

AUD/USD fell by 0.84% to 0.69116

NZD/USD fell by 0.91% to 0.62260

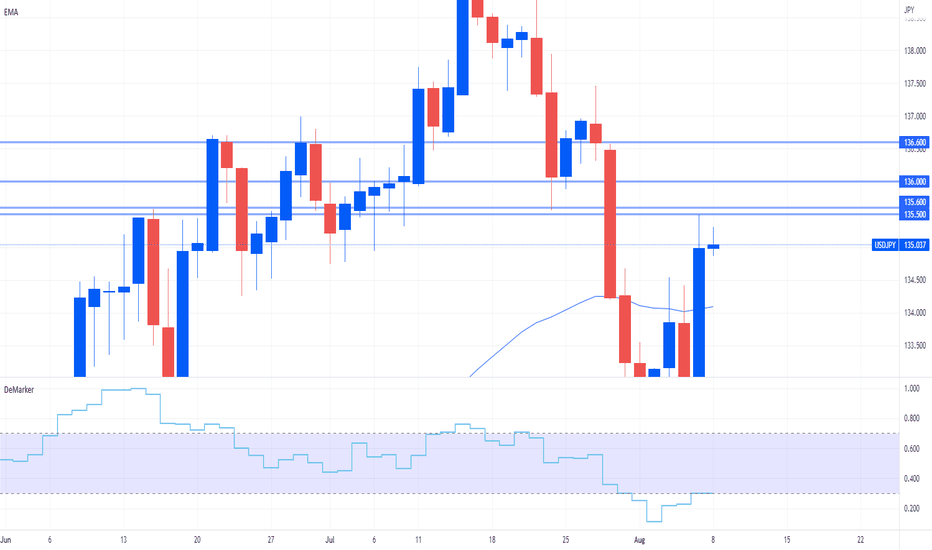

The USD/JPY was the biggest mover, booking a 1.57% gain to 135.03. Technical analysis anticipated this move in the USD/JPY, with the DeMarker Indicator below 30, suggesting an oversold bias and prime conditions for a reversal. This uptrend might also continue as the price closed above the 50-EMA. Key areas to the upside might include 135.50, 135.60, 136.00, and 136.60.

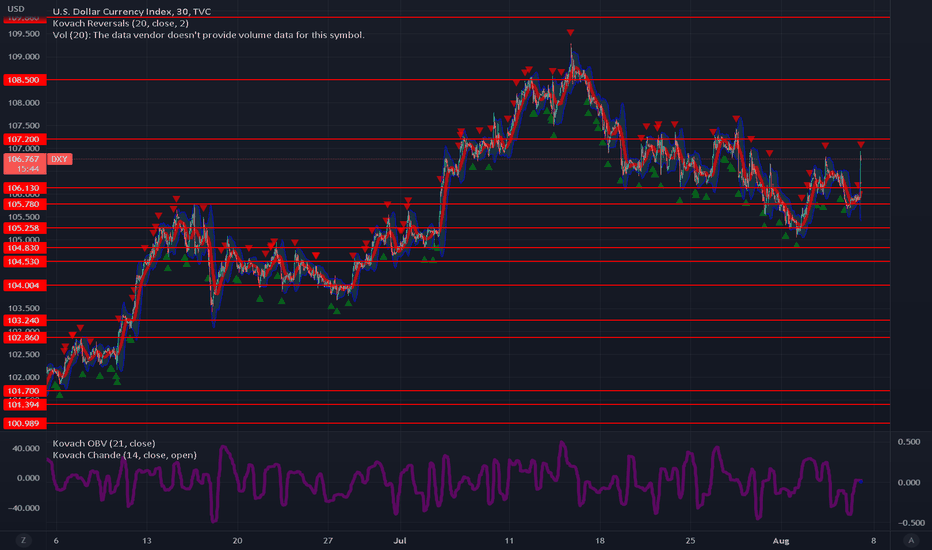

Dollar Strengthens on NFP DataThe US dollar has gained incredible strength off of the Non Farm Payroll numbers, which came at a headline beat with employment at 3.5%. This suggests that the markets feel that the Fed is now more emboldened to hike rates even further at their September meeting. The DXY is still holding the range established when it started its sideways corrective phase after the pull back from the low 109's. We dipped down into the 105's, and subsequently pivoted back to the 106's, with 107.20 still an upper bound. If we retrace this rally, then expect support at 106.13 or the 105's.

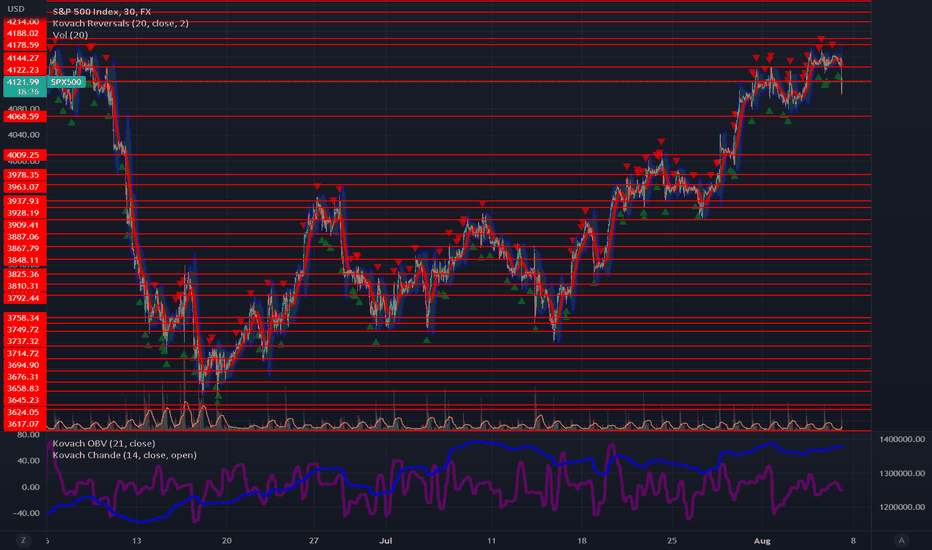

What Today's Employment Data Means for Stocks and the FedNon Farm Payrolls introduced some volatility in stocks. The numbers came in hot, with a headline beat and unemployment at 3.5% . The S&P 500 had already edged higher, reaching our target of 4178, and establishing value between 4144 and 4178. The NFP data release introduced some volatility, with a small selloff extending past 4122 into the vacuum zone down to 4068. It appears the figures were priced in already, and stocks may be correcting because of that. Also, the strong numbers give the Fed more justification to hike rates in September. If stocks fall further watch for support at 4068, but be mindful of the vacuum zone below to 4009.

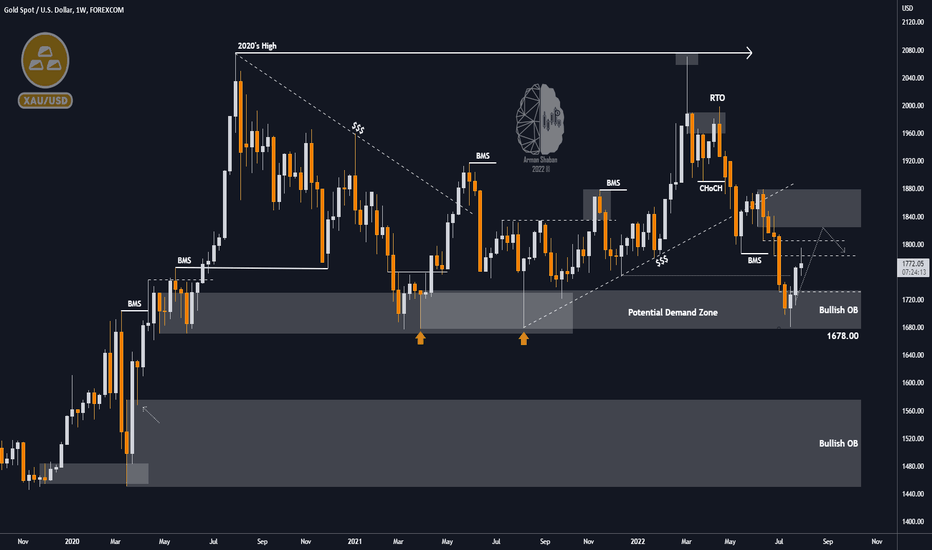

⚠️ XAUUSD 1W TF : NFP ⚠️ 08.05.22By analysing the gold chart in Weekly and 4H TF , we can see that currently the important short-term resistance is the price range of $1,783 to $1,810, and the price entered this zone twice this week, and both times faced strong pressure from the bears.The important support ranges are 1755$ to 1765$ and 1717$ to 1725$ respectively, this analysis complements the previous analysis!

Follow us for more analysis & Feel free to ask any questions you have, we are here to help.

⚠️ This Analysis will be updated ...

👤 Arman Shaban : @ArmanShabanTrading

📅 08.05.2022

⚠️(DYOR)

❤️ If you apperciate my work , Please like and comment , It Keeps me motivated to do better ❤️

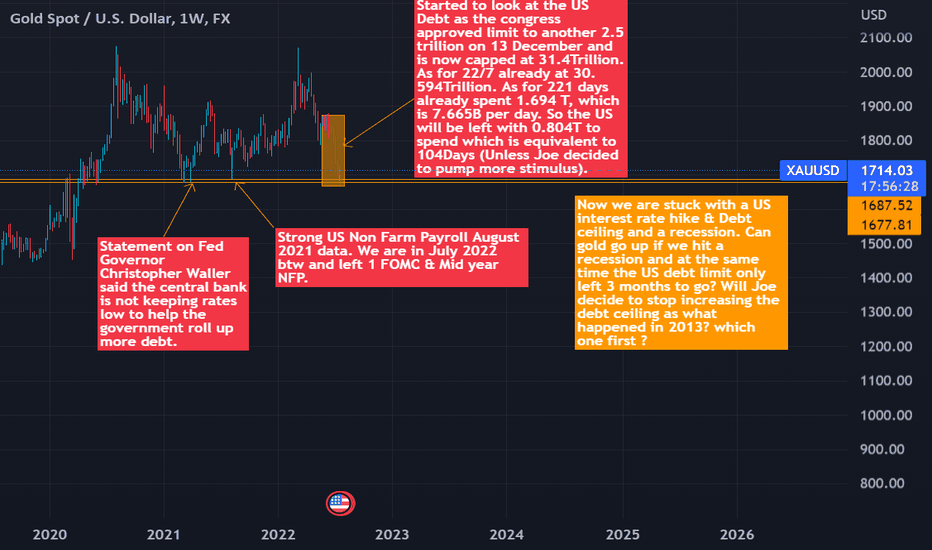

2Q US Non Farm Payroll record for GoldHi,

For those who are seeking US NFP data to enter on Friday tomorrow, you can see my chart to do the analysis for your direction. I will remain neutral for now. Please help me by liking my idea if you already get what you want. I really appreciate it.

Thank you very much.

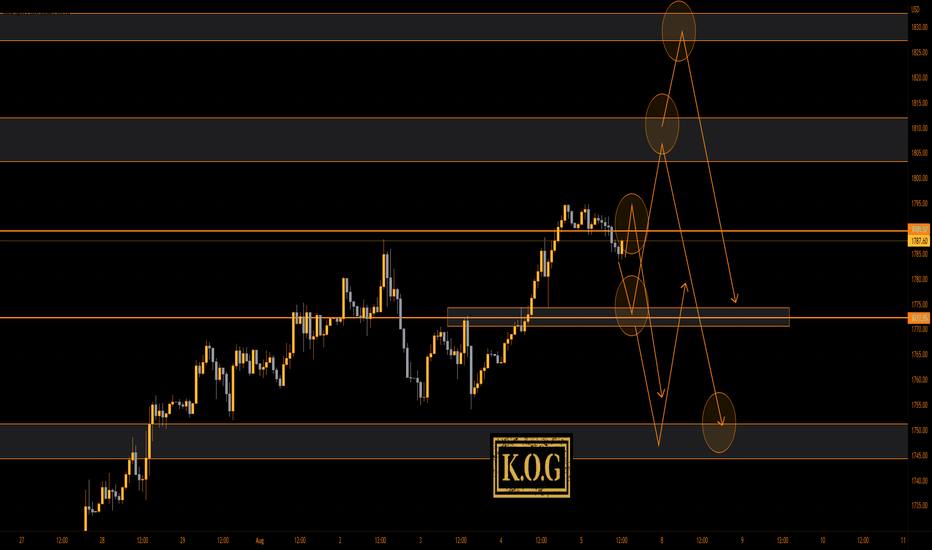

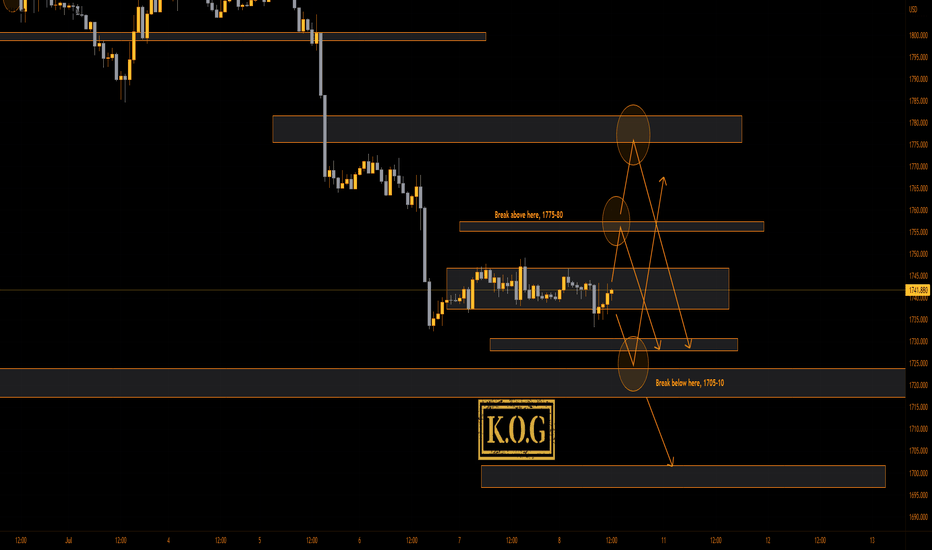

XAUUSD - KOG REPORT - NFP!KOG Report – NFP

This is our view for NFP today, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile and can cause aggressive swings in price.

We’re going to keep this short this time as we don’t really want to get stuck around this price point if there is a move to come during NFP and the US session. We’ve done well this month so far with most of our targets being hit and the move on Gold that was illustrated in our reports now being completed.

For us this is a short region, however, we have NFP so it’s thrown a bit of a spanner in the works. For that reason we have plotted the higher levels on the chart that we feel would represent price regions to short from and the lower levels we feel would represent an opportunity to long from.

The key resistance here is that 1795-1806 level which has been used previously to propel the price in either direction so there is a possibility of a spike into that area before then coming down and then coming back up at some point. A break of this level and you can see the higher levels that we have illustrated, the highest one around 1825-35 is our preferred choice to short if it goes there!

When it comes to the lower levels, we’re looking for the price point of 1775 as a key region which if broken should take us down into that lower level shown where, based on strong support we feel an opportunity to take the long trade back up could be on the cards.

Please note, this chart is for NFP only at the moment, and that’s if the price moves. Lately, we’ve seen most NFP’s and FOMC are priced in and we don’t get much of a chop in the markets.

In summary, we’ve been following the same plan for a few months now and will remain with it. We can see a push to the upside at some point into that 1825-35 price point, so please keep this level in mind!

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

USD/CAD eyes Canada, US job reportsIt's a busy day in both Canada and the US, with both countries releasing July employment reports. It wasn't so long ago that US nonfarm payrolls was eagerly anticipated and was the most important event of the week. The NFP often had a significant impact on the movement of the US dollar. That has changed in the new economic landscape of red-hot inflation and central banks raising interest rates practically every month. The NFP has been overshadowed as the media breathlessly reports new inflation records and the threat of a recession. Still, the NFP remains an important indicator and a surprise reading can still shake up the markets.

The July NFP is expected at 250 thousand, following a surprisingly strong June release of 372 thousand. A weak reading will raise concerns about a recession, which would likely see US yields and the US dollar fall. Conversely, a stronger than expected number would probably boost yields and the US dollar, as a stronger labour market would allow the Fed to remain hawkish regarding rate policy.

The markets have priced in an inflation peak and the Fed winding up its rate-tightening cycle, which has sent the US dollar on a hasty retreat. Fed policy makers have been pushing back, sending out the message this week that there are more large hikes on the way as inflation is not yet under control. A strong NFP reading would reinforce the Fed's message and provide some support for the US dollar.

Canada will also publish employment data later today. The economy is expected to have created 20.0 thousand jobs in July, after a decline of 43.2 thousand in May. A stronger-than-expected reading should boost the Canadian dollar, while an underperformance could result in the currency losing ground. As well, Canada releases Ivey PMI. The indicator slumped to 62.2 in June, down from 72.0, and is expected to slow to 60.3. A surprise reading could have an impact on the direction of USD/CAD in the North American session.

USD/CAD is putting pressure on 1.2899. Above, there is resistance at 1.3002

USD/CAD has support at 1.2741 and 1.2686

EURUSD before NFP EURUSD is still trading sideways after breaking above 1,0210 yesterday and basically showing no strength for a downside move.

It's now heading towards the main resistance below 1,0300. Every next time we see a test of that it will be much likely to actually see a breakout as well.

Today, NFP will be published. This is an important economic event for the market and we should see some reaction.

We will be looking how this pairs will behave around the resistance but right now we don't have any entries here on EURUSD!

There are better opportunities on the JPY cross pairs!

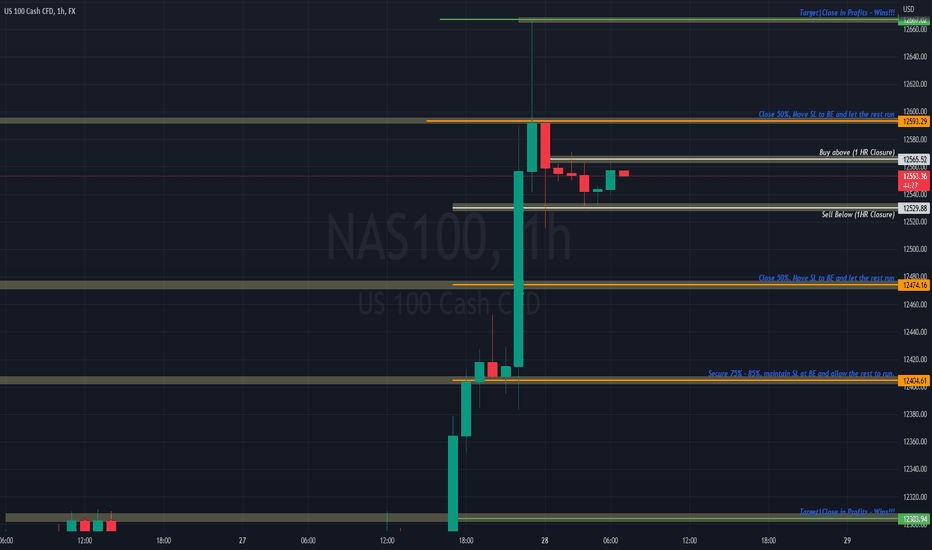

NAS100 Daily Outlook | July 28Hi All,

After FOMC news drive yesterday, WHAT ELSE?

Here are my thoughts;

1. There is a lot of noise to the left hand side so am capping my profit target for buys from 12565 to 12667 zones.

2. Buying mostly today is also confirmed by my WICK FILL play (join my live session to access my 90% winrate playbook) but traders must not expect price to move aggressively to 12900 rather focus on the closest resistance level

3. There are chances that price can drop up until 12303/12174 levels in near term and this is because;

a. We have a strong support level around 12303

b. Previous day's bar does not have a bottom wick hence has the tendency to draw price back to itself.

Let me know what you think about my analysis in the comment session.

To learn more about my favorite setups and how to perfectly harness pips using them, join my live streaming today.

Daily Live Trading session at 8:45AM EST/ 4:45PM GST

Pairs: EURUSD / NAS100 / GER30

-Kings.

Euro breaks below 1.01 - is parity next?It continues to be a miserable July for EUR/USD, which has declined 3.12%. The euro continues to deliver fresh 20-year lows, dropping to 1.0071 late in the Asian session. The euro has since recovered most of today's losses, but the psychologically-important parity line is getting closer by the day, as the euro continues to stumble. On the economic front, US nonfarm payrolls outperformed, with a reading of 381 thousand, well above the consensus of 240 thousand.

The ECB released the minutes of its June meeting on Thursday, with investors hunting for clues about the lift-off hike at the July meeting. The minutes didn't provide any new insights, which could be a disappointment but shouldn't really be all that surprising. The July 21st meeting will be live, with a modest 25bp increase being the most likely scenario, with another rate hike to follow in September. Still, the ECB has not shut the door on a larger hike at the upcoming meeting, and we have recently seen higher-than-expected moves by the Federal Reserve and other central banks.

Lagarde & Co. will be keeping a close eye on next week's inflation reports out of Germany and France, the two largest economies in the eurozone. If inflation remains unchanged or dips lower, it will provide ammunition for the doves who are content with a 25bp move. Conversely, a rise in inflation will put pressure on the ECB to respond with a 50bp increase.

Another factor in the rate decision could be the exchange rate. A weak euro is attractive for exports but also contributes to inflation. The euro hasn't been at parity with the US dollar since 2002, and some ECB members may feel that the central bank's credibility is on the line if the euro continues to slide and falls below parity.

EUR/USD tested support at 1.0124 and 1.0075 in the Asian session

There is resistance at 1.0221 and 1.0324

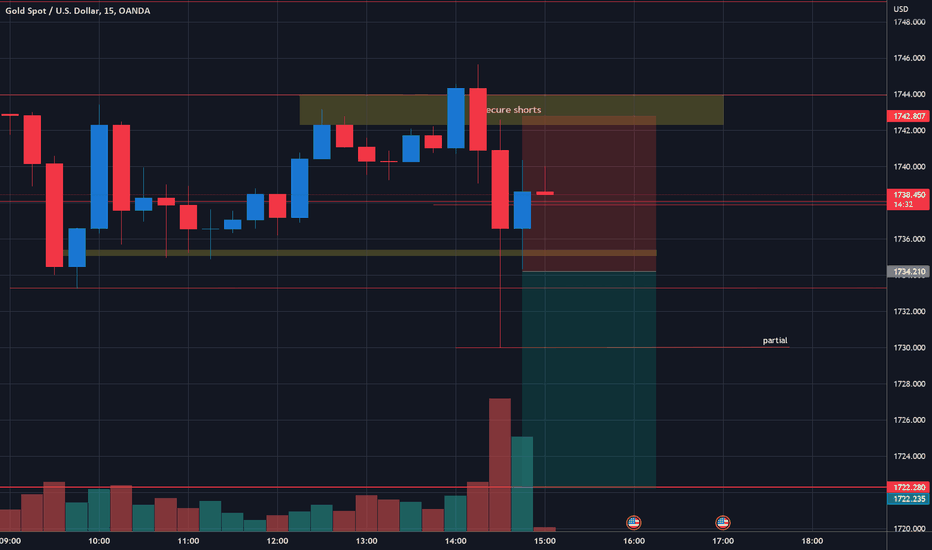

XAUUSD - KOG REPORT - NFP!KOG Report NFP:

This is our view for NFP today, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile and can cause aggressive swings in price.

After the bearish pressure we’ve seen on Gold this week we’re not seeing the price range tight and start to accumulate orders in this range. We can see the price needing to go up but being supressed so we suggest caution with this NFP. The levels above are limited if there is to be more downside on this but shorting the market here isn’t a great idea! We’re in the same level as the previous short squeeze which has been used to propel the price in either direction. For that reason we would say wait out the NFP move, don’t get involved in trying to trade it unless you see the extreme levels targeted. They will take the price to where they want to buy or sell, so control the FOMO and look for the extreme high or lows on the chart. We’re going to illustrate the immediate moves but we’re not likely to be trading this event.

Levels below:

1730-25 below that 1705

Levels above:

1745-55 above that 1775-80

Its a short on today, no scenarios as we've still got the FOMC report layout in play so please use that as reference if you need more clarification.

Hope this helps in preparation for NFP, we will update you as we go along as we usually do. Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

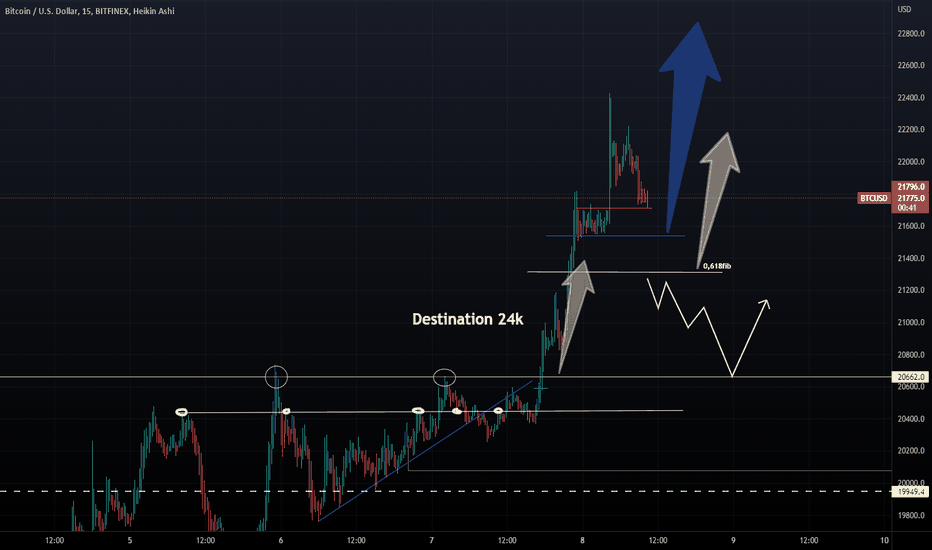

BITCOIN - Intraday Chart: Waiting for the NFP!NFP - employment data coming out in 5 hours and it WILL be MASSIVE!

FXPROFESSOR is the well-earned nickname but Bitcoin enthusiast is the identity here.

Yes, we do trade Bitcoin as a Forex trade these days, both technically and fundamentally (as well as sentimental too).

SENTIMENT:

NFP i would guess will be Positive, just a well calculated 'feeling' based on what i read and how i 'read' the situation

FUNDAMENTALLY:

Positive for the next 2 weeks (NFP+CPI inflation data releases), very complicated after that (GDP release will show recession or not).

TECHNICALLY:

Bullish, find my levels on my updated chart. 21300 and then higher would be my 'wild guess' but don't ever count on it.

Wait for the volatility at NFP time (13:30 London time).

One Love,

the FXPROFESSOR

EURUSD before NFPToday NFP is being published!

We're expecting more fluctuations at that moment.

We're also at a good levels to see a pullback and that could be the chance.

Right now, we're not looking for entries on this pair.

Anyone who's holding short trades, it's probably best to reduce the risk by moving your stops to breakeven or even in profit.

We will be looking to sell again, only after the pullback which probably means next week!

Canadian dollar eyes job data in Canada, USThe Canadian dollar is back below the 1.3000 line today. USD/CAD is trading at 1.2987 in the North American session, down 0.37%. On the economic calendar, Canada's Ivey PMI was a major disappointment, slowing to 62.2 in June from 72.0 in May (74.0 exp.).

Friday's focus will be on job numbers, with both Canada and the US releasing employment reports for June. Canada is expecting a modest gain of 23.5 thousand new jobs, down from the 39.8 thousand gain in May. With the unemployment rate forecast to remain unchanged at 5.1%, the US numbers could prove to be more interesting to investors. US nonfarm payrolls used to be hotly anticipated as one of the most important indicators, but NFP has taken a step back as inflation and Fed rate policy have become the main focus of the markets. Still, tomorrow's NFP could be a market-mover, as investors may rely on it for guidance on the health of the US economy.

Investors are hearing the "R" word bandied around more often, as fears of a recession in the US are rising. The economy showed negative growth in the first quarter, and another quarter of contraction would officially signify a recession. If NFP misses expectations, investors could view it as a sign that the economy is losing steam. That could well make the Fed ease up rate hikes and push the US dollar lower. The consensus for NFP stands at 275 thousand, after a gain in May of 390 thousand.

Canada has not been immune from soaring inflation, as headline CPI rose to 7.7% in May, its highest level since January 1983. Similar to the Federal Reserve, the Bank of Canada has scrambled to tighten policy in order to wrestle down inflation, which has become the central bank's public enemy number one. There are expectations that the BoC may follow the Fed's lead and deliver a super-size 0.75% rate hike at its July 12th meeting. Inflationary pressures are broad-based across the economy, which raises the risk of inflation and inflation expectations becoming entrenched, something the BoC is keen to avoid.

1.3038 is a weak resistance line. Above, there is resistance at 1.3109

USD/CAD has support at 1.2961 and 1.2813

MEDIUM TERM OUTLOOK ON THE DOLLARFor the longest time, I have been debating whether or not to begin posting my trading sentiments since the trading community I look after & am a part of is a very private one. That said. we are in unprecedented times, a lot of people do not know what is coming their way. nevermind how to protect themselves/ take advantage of relevant opportunities. So I have decided to help those who are looking to understand financial markets not only from a trading perspective but from an actual investing perspective. So as my first post, let's take a look at a currency that impacts the rest of the global & emerging market currencies & that can help you plan your trading approach over the next 3 - 6 months. But before we do that kindly understand the following:

As a former investment bank trading analyst. There is absolutely noway you can incorporate technical analysis without fundamental analysis. When I see retail traders/people just speak about technical analysis and understand nothing about fundamental dynamics & how it affects trading pairs/executions/decisions as a whole, not only do I laugh but it also makes me understand why there is truly only 5-10% of retail traders globally that are consistently profitable. But enough about that, let's get to the charts!

DOLLAR INDEX OUTLOOK:

Fundamental ( DOWNSIDE ): If another rate hike takes place & MONKEYPOX cases cross the 10K margin in the US &/or employment numbers (NFP) drop.

Technical ( DOWNSIDE ): Should the above fundamental case happen, trading opportunities can be taken advantage of through the WXY scenario, where X represents the entry-point.

Fundamental ( UPSIDE ): A rate hike & more stimulus money will see the dollar go up. Mid-term elections being favourable would also send the dollar much higher.

Technical (UPSIDE ): The above fundamentals taking place would allow scenario ABC to take effect with point B representing the optimal entry-point for relevant trades.

Let us see how it plays out, as for exact entry points and iterations to this post as time goes on, that will be given to members only. However, that said, I am willing to do analysis on different pairs/derivatives' on behalf of those who would appreciate an informed opinion on both the technical and fundamental sides.

At the end of the day I want to see traders progressing and doing much better but the truth is you need to understand the markets from a technical & fundamental perspective in order to truly be successful as a trader & ultimately become an active investor in financial markets. If all you have been doing at this point in time is trading only incorporating technical analysis then all you are/have been doing is donating money to the market, your broker/s and my former employers in the investment banking/hedge fun world. :)

Don't forget to like & comment, I look forward to beginning this new journey with all of you!! :)))