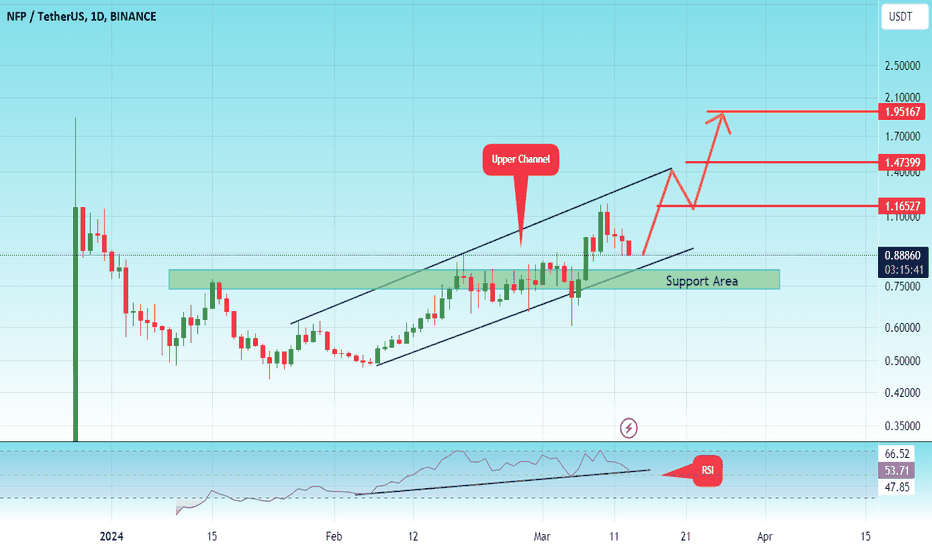

#NFP/USDT#NFP

The price is moving in an upward channel on a 1-day frame and we have a support area in green at the level of 0.8100.

We have a higher stability moving average of 100

We have a contact with the minimum channel

Our RSI indicator has a well reliable uptrend

Entry price is 0.8933

The first goal is 1.165

The second goal is 1.47

The third goal is 1.95

Nfpnews

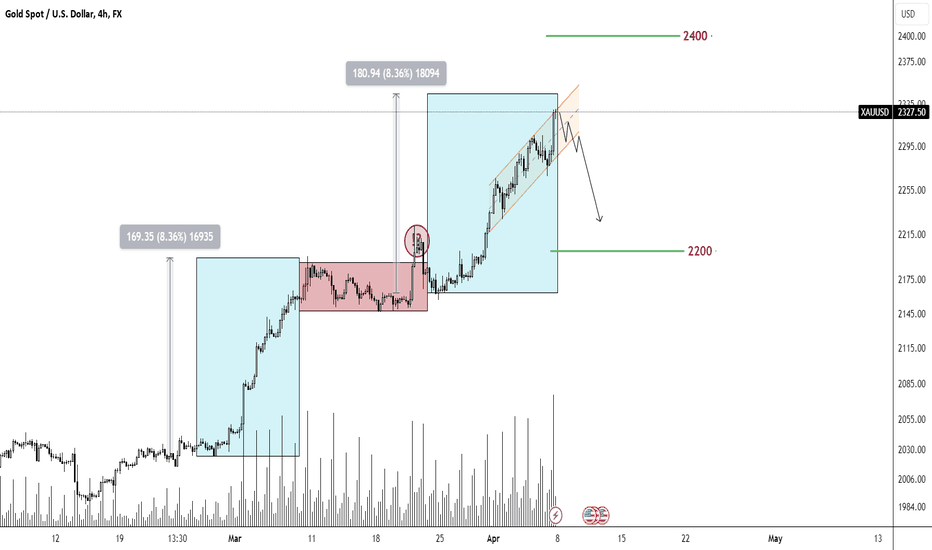

Let me see the chart a little easier!Hi everyone ! After many years I'm back :)

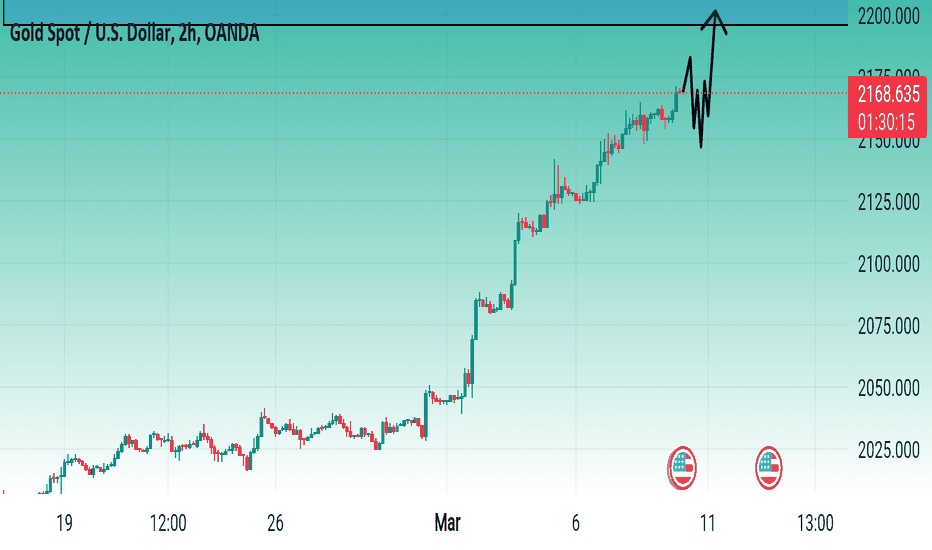

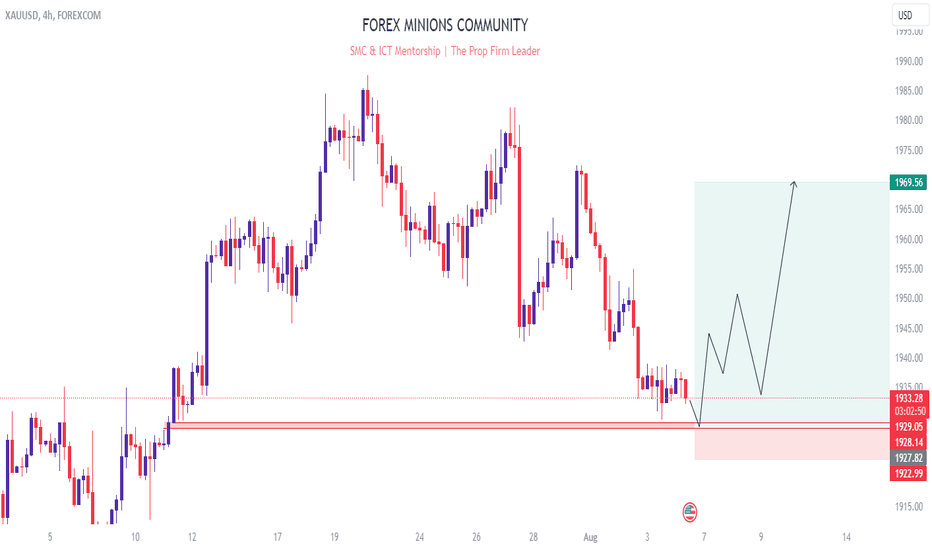

And After a wild week for gold, it is still impossible to guess its trend with certainty!

But after the publication of employment statistics and the unemployment rate of the United States, strengthening the dollar next week is not far from expected.

This will help the trend of gold and perhaps its correction...

XAUUSD:NFP trading strategy

Regarding yesterday's data, my view is to go short, with the target near 2269, and we finally succeeded in making a profit.

After the market fell sharply, there was a small rebound. When it was near 2270, I also reminded everyone that there will be a rebound, and the resistance level is 2279-2286.

As I expected, it was blocked near 2279. Now I continue to observe the resistance, and the trading idea is to maintain high short selling.

Now the technical indicators show that the rebound is not over yet, so there should be a chance to touch around 2286. In this range, if you want to go long, you can do a small amount and close it in time when there is profit. I am still bearish on the general direction.

At the same time, there is NFP data today, which has a great impact on gold. I think the probability of eventual decline today is greater than that of rise, so regarding data trading, my thinking is mainly short selling.

Because the impact of data is relatively large, market fluctuations will also be correspondingly large. If your account does not have much funds, try not to gamble before the data is released. If you do, you should also pay attention to risk control, trade in small quantities, and set SL.

Otherwise, once the market finally does not match our expectations, your account may not be able to withstand it and will be directly blown. This is not what I want to see, and I believe you must not want to see this happen.

If the data is in line with expectations, then there is a high probability that it will fall to around 2233 today. This space is still relatively large, and the profits it can bring us will also be very good.

If you can grasp it, try to grasp it. If the actual situation does not allow it, do not force the transaction. Everything is based on account safety. There are many trading opportunities later.

At all times, please put risk management first. Our profits must be based on the fact that the account will not be blown away.

good luck!

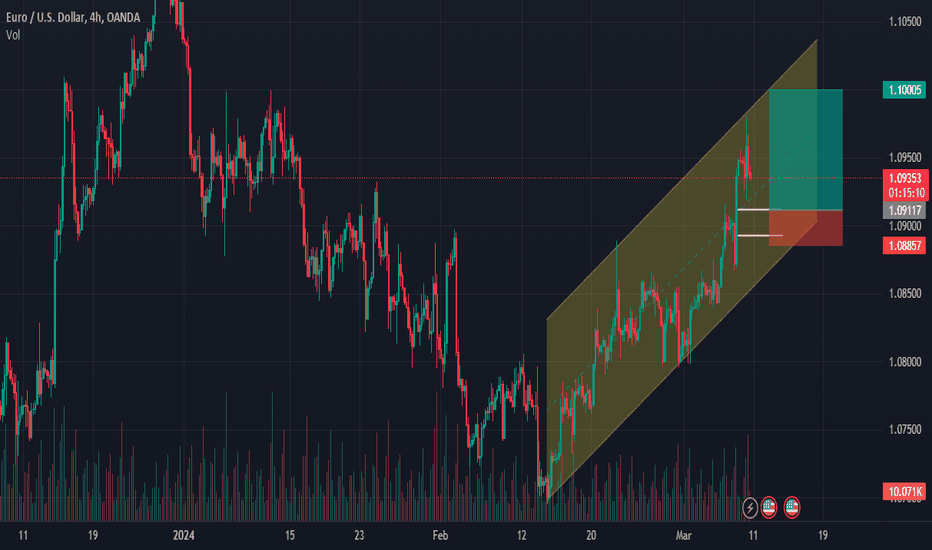

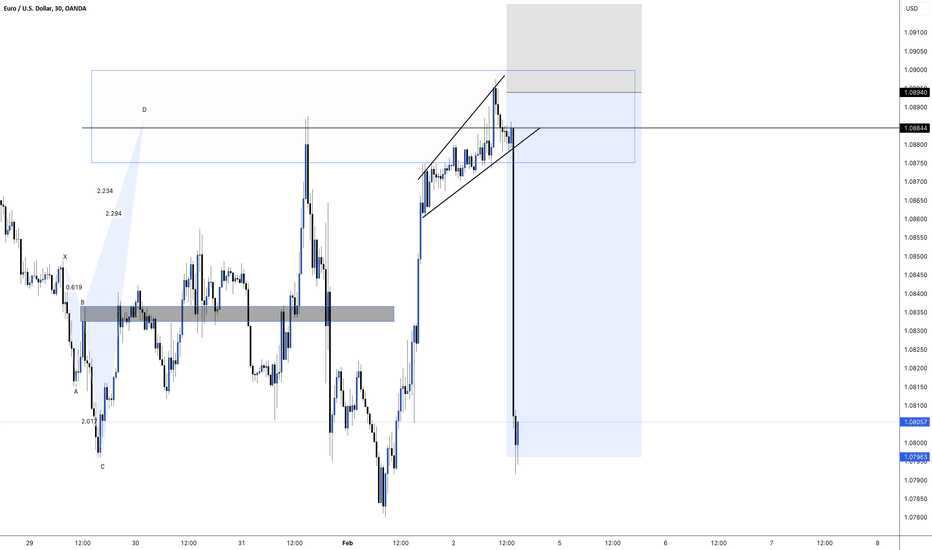

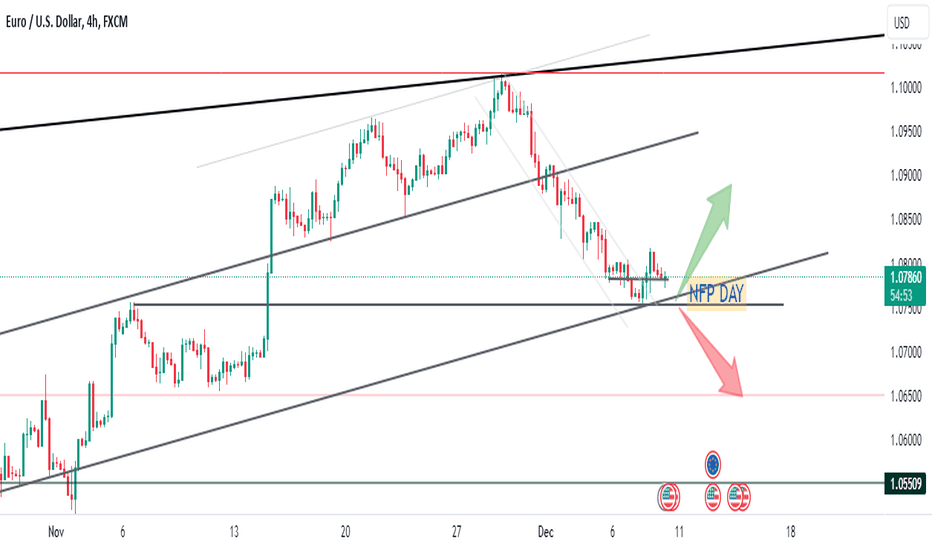

EURUSD BUYas we have seen a good move in EURUSD and it has taken a fly high after NFP brought in so we will be seeing a drop to this volume candle retracement and we will be buying this pair after it completes 68% or 78% retracment to this level and we will be intrested in buying this pair as this pair is also moving in a parallel channel so it seems like it will continue going upward this time too

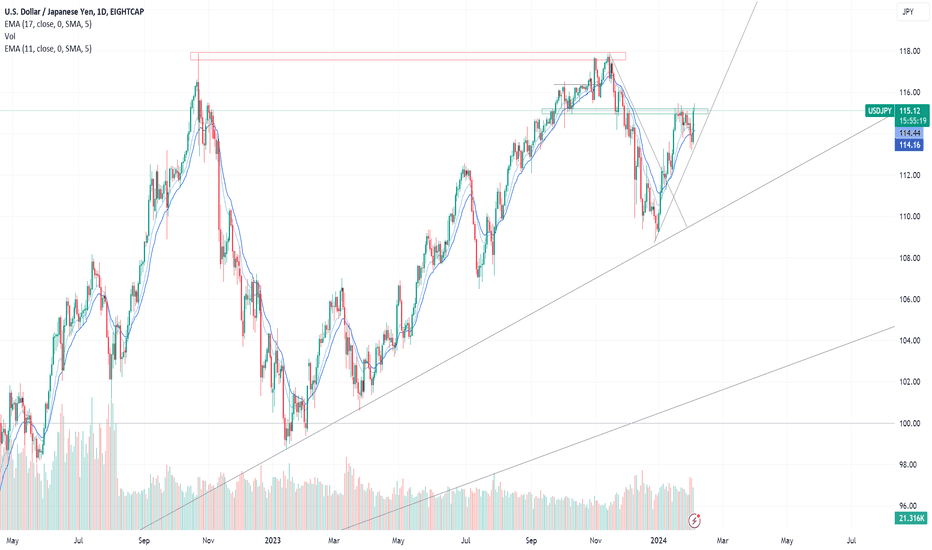

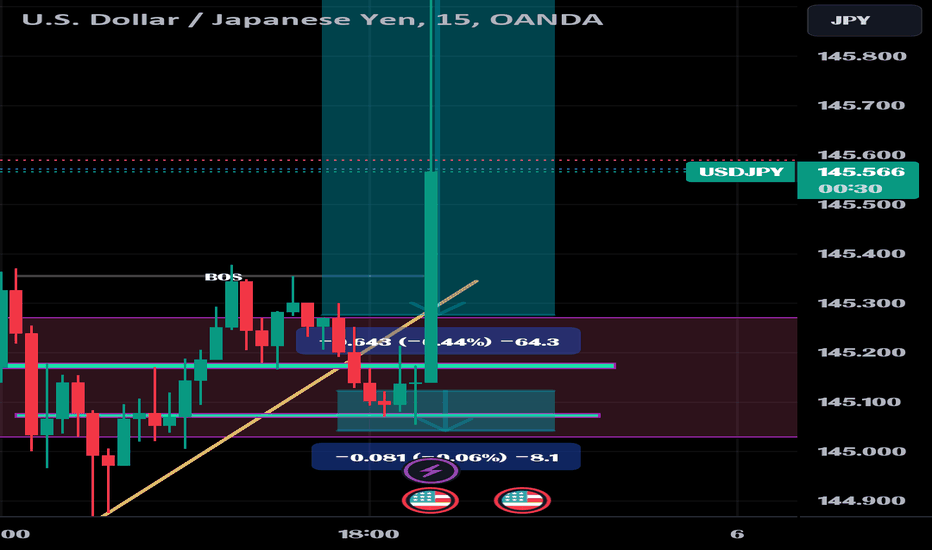

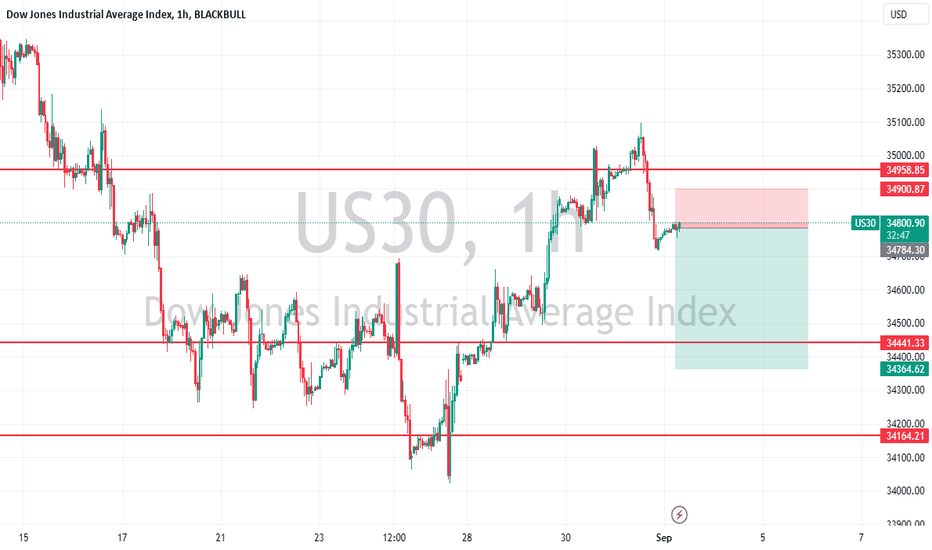

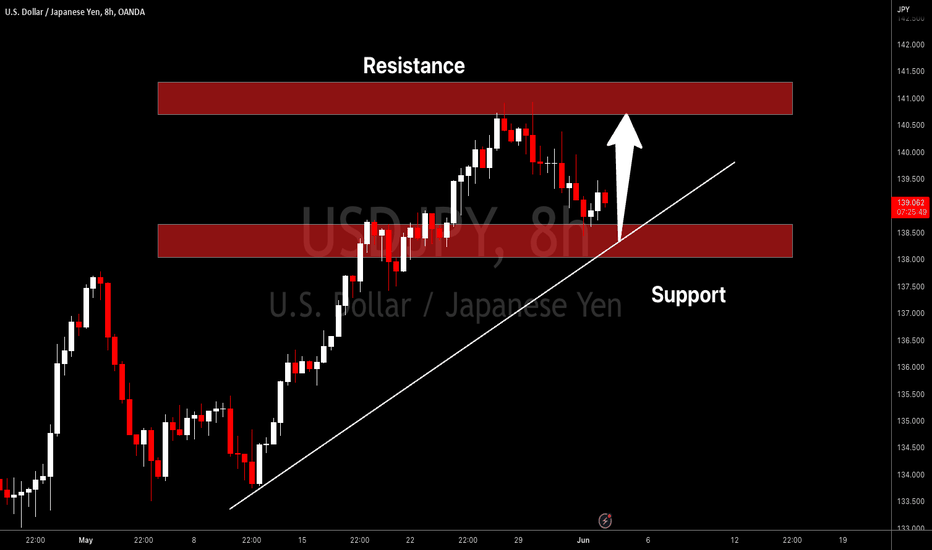

USDJPY: Thoughts and AnalysisToday's focus: USDJPY

Pattern – Consolidation Watch

Support – 146.20

Resistance – 148.50, 151.70

Hi, traders; thanks for tuning in for today's update. Today, we are looking at the USDJPY.

After US employment data shocked on Friday and lifted the USD, we are wondering if we will see trend continuations on the USDJPY. So far, the price continues to travel on its uptrend after breaking the last downtrend in December.

The key for buyers now is a break of 148.50 resistance. If we see that break, we will be waiting to see if buyers can retest 151.70 resistance. A close below 146.20 would be a worry for buyer momentum.

Good trading.

NPF shark pattern Bearish #eurusd DONT TRADE NEWS BUT LOOK AT ITHONESTLY

WOW!!!! THIS IS THE REASON WHY I DON'T TOUCH NEWS... i trust my analysis but its usually a 50% odd that a trade will go in my favour with high impact news lol

Still this eurusd trade would have been sweet, if i had the balls to trade news lol

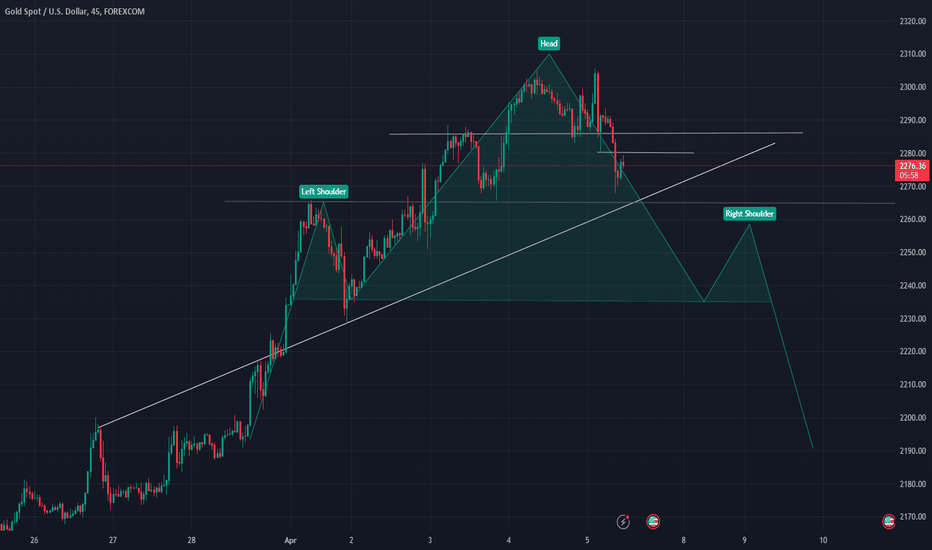

Non-Pay Form | Gold Expected to be drop Non-Pay Form | Gold Expected to be drop

Hey Traders .. Welcome back !

Todays after 2 hours Big news going to happen

We Structured data from past history gold expected to move 50 pips above then probably hit the targets and touched our trend line which were seen in charts

we are waiting for break out of support 2051-2050.00

then next point at 2042-2041-2040.00

if you guys knew how to trades you will catch up our idea

tight target sets dropping 100+ pips

cheers for the next update..

Binance Launches $NFP Perpetual Contract Amid $NFP Price RallyBinance Futures launched the USD-M NFP Perpetual Contract on December 27, 2023, providing traders with the opportunity to engage in perpetual trading with up to 50x leverage. The underlying asset, NFPrompt (NFP), would be settled in USDT via this perpetual contract. The update comes after NFP’s listing on Binance after it made its market debut on Wednesday.

NFP Price Today

The recent developments marked a turning point for the NFPrompt team and propelled the NFP crypto price to gain. The NFP price added 1.39% to its value and traded at $1.188369 at press time. The crypto registered a high of $1.23 during the trading session.

Moreover, the NEWCONNECT:NFP market capitalization increased by 0.58% to $294.38 million. Whilst, the day’s trade volume was recorded at $277.39 million, which is an impressive figure for a new entrant in the crypto space. The current circulating supply of NFP stands at 250 million tokens, which is 25% of the total supply of 1 billion tokens.

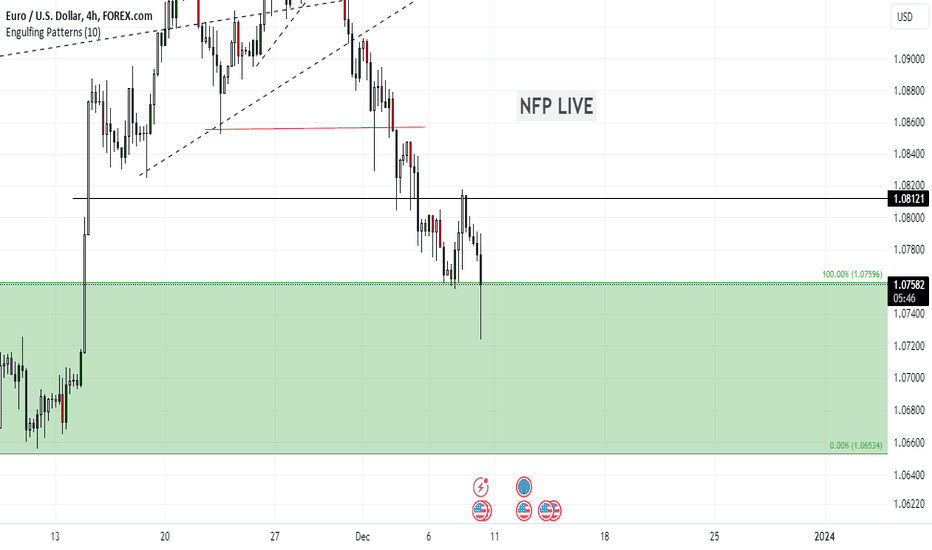

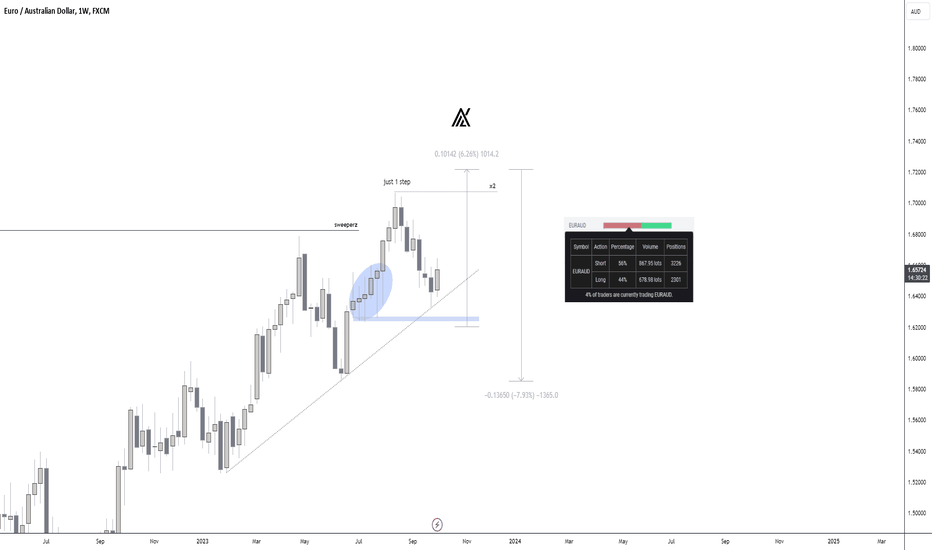

EURUSD The trend will be determined after the news (NFP).Hello traders. The trend will be determined after the news (NFP).

There are many fluctuations, I think anything can happen. before the news is released and even half an hour after that. If the data is as expected, the dollar will gain strength and the euro can touch 1.066. If the data is weak, everyone is betting on an interest rate cut in the first quarter of next year and even sooner, and the euro could touch 1.1 in next weak. What do you think?

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

Check out my latest analysis on the dollar index.

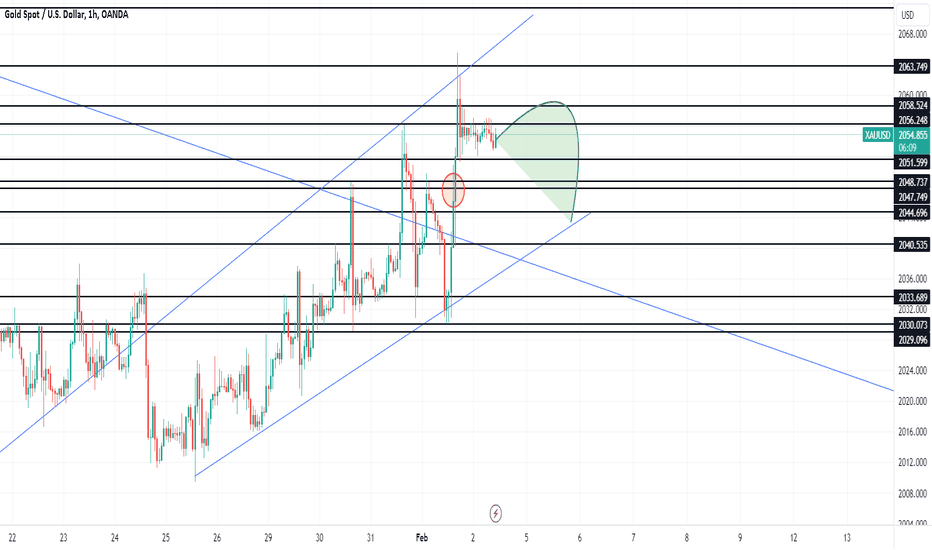

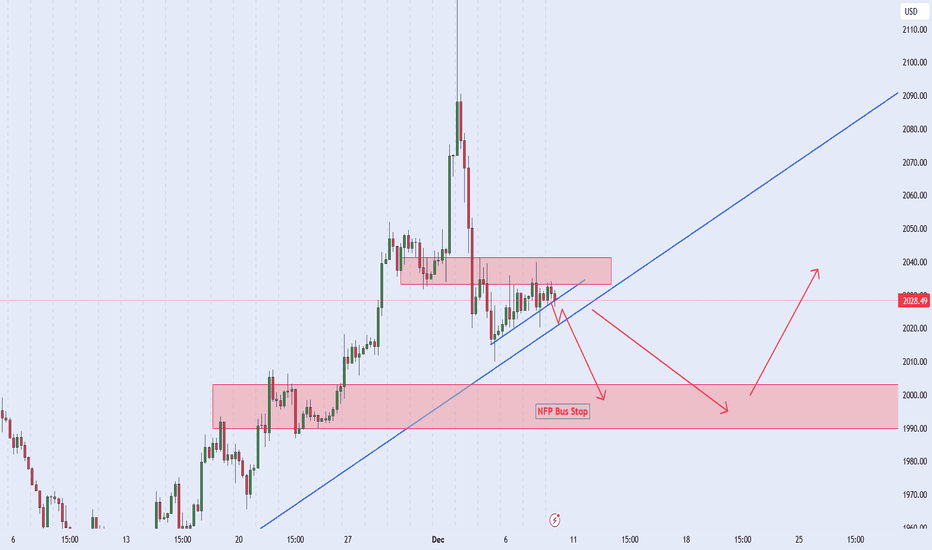

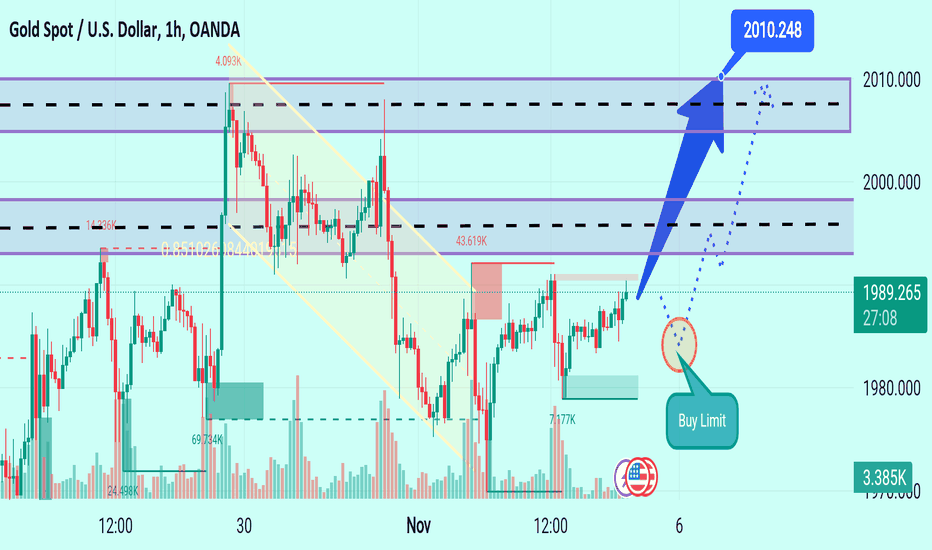

GOLD CONFIRM TARGET FOR TODAY NFP NEWSThe Bureau of Labor Statistics (BLS) is due to release the highly-anticipated Nonfarm Payrolls (NFP) report from the United States (US) on Friday, which could have major ramifications for US Federal Reserve (Fed) policy outlook. The US Dollar (USD) is poised for a big reaction to the labor market data, as NFP data tends to infuse intense volatility across the FX board.

The Fed on Wednesday kept the policy rate steady in its current 5.25%-5.50% range, as widely expected. The US Dollar, however, succumbed to the sell-off in the US Treasury bond yields after Fed Chair Jerome Powell remained non-committal on the need for further tightening. Although Powell did not rule out another hike, markets perceived his words as not-so hawkish as they expected. Powell acknowledged tighter financial conditions while adding that taming inflation will most likely require a slowdown in growth and dampening in the labor market.

Gold Buy : 1989

TP. : 1997

TP. : 2005

TP. : 2010

SL. : 1976

THE KOG REPORT - NFPNFP – KOG Report:

This is our view for NFP tomorrow, please do your own research and analysis to make an informed decision on the markets. It is not recommended you try to trade the event if you have less than 6 months trading experience and have a trusted risk strategy in place. The markets are extremely volatile, and these events can cause aggressive swings in price.

We’ve done well with Gold so far with our bias and targets to the downside being completed. We suggested on the KOG Report that we’re a bit low in a region here to attempt shorting, unless scalping using the red box strategy which has done well. For NFP, we’re likely to sit out as we want to see where they take the price and close the daily and weekly candle. This we feel will determine whether to start longing the lows temporarily, or, to continue with the bias to the downside looking for a temporary bottom before an aggressive push up. Our Monthly, and weekly charts still show lower targets, but we’ll have to play it how we see it.

For this NFP, we’ll be looking at order regions and extreme levels only. If we don’t get them we’re happy to sit out and wait until next week where better setups are sure to arise. For new traders, we would suggest you don’t trade the event, rather wait until next week and then look for a good set up to get in.

We have the levels above order region 1830-35 which if held could represent an opportunity to short the market down into the lower levels below 1800 as illustrated on the chart. Please note, breaking below 1790 and we will suffer further losses before a technical retracement, breaking above the order region will take us in the next level above.

Above the first order region we have 1850-55 and 1860-8 in extension, these are the first resistance levels we will be looking at for a reaction in price to take this down. Again, breaking that level and the next region above which is preferred is 1880-85 which would represent an opportunity to short the market.

The reason they’re stretched is because the price is stretched, and unless we get a good return on our trade, we’re not interested in the noise. Please members, don't try and trade this up and down! Look for one level which fits with your analysis and strategy, wait for it and test it with a risk strategy in place. Those who think they will be able to long into one level, then short it back usually fail, unless they're experienced traders.

Please do support us by hitting the like button, leaving a comment, and giving us a follow. We’ve been doing this for a long time now providing traders with in-depth free analysis on Gold, so your likes and comments are very much appreciated.

As always, trade safe.

KOG

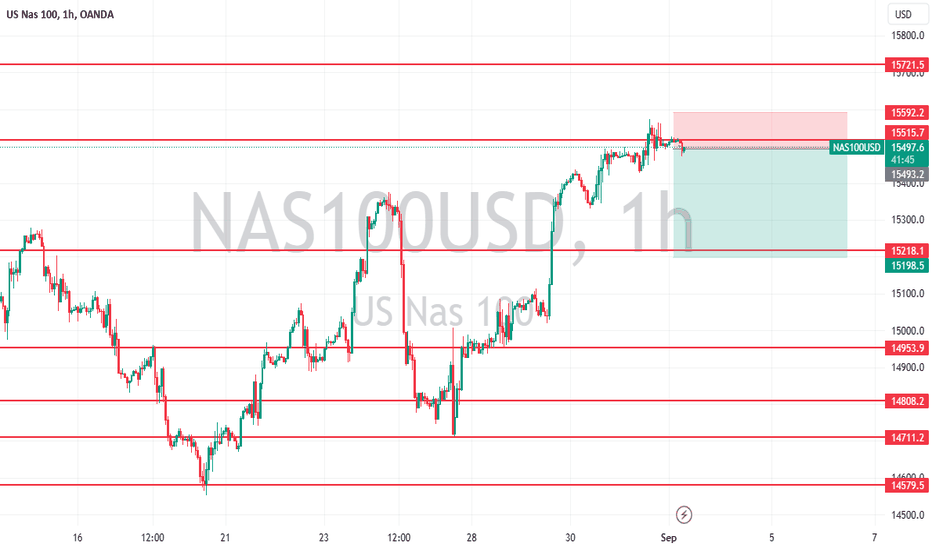

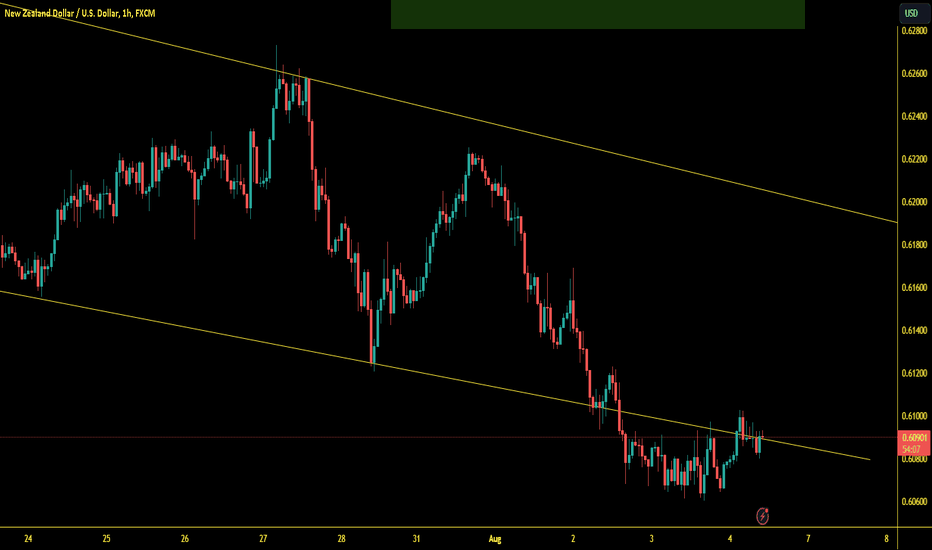

NZDUSD Struggling to break 0.61Hello Traders,

today the FX:NZDUSD pair in struggling to break the 0.61 level and re-enter in the local channel (highlighted by yellow trendlines).

Today operativity will be to monitor 2 things :

1. A break of 0.61 that wil give the possibility to re-enter the channel and target the 0.62 levels probably the coming week

2. If prices stay below the 0.61 level the sentiment could turn bearish targeting the 0.598 level that represent the bottom of the mail descending channel.

I'm expecting big volatility due to NFP and Uneployment Rate at 14.30 UTC+2

Levels to watch and trade:

- 0.6125 200 MA on 30M chart that represent the resistance

- 0.6065 we have the support

So, a break and close above 0.6125 will be considered as a bullish sign targeting 0.62+ levels and a break below 0.6065 a bearish one targeting 0.6020 and further.

In my opinion the best thing to do is to trade according to the mentioned levels and avoid trade the news because you might break your account.

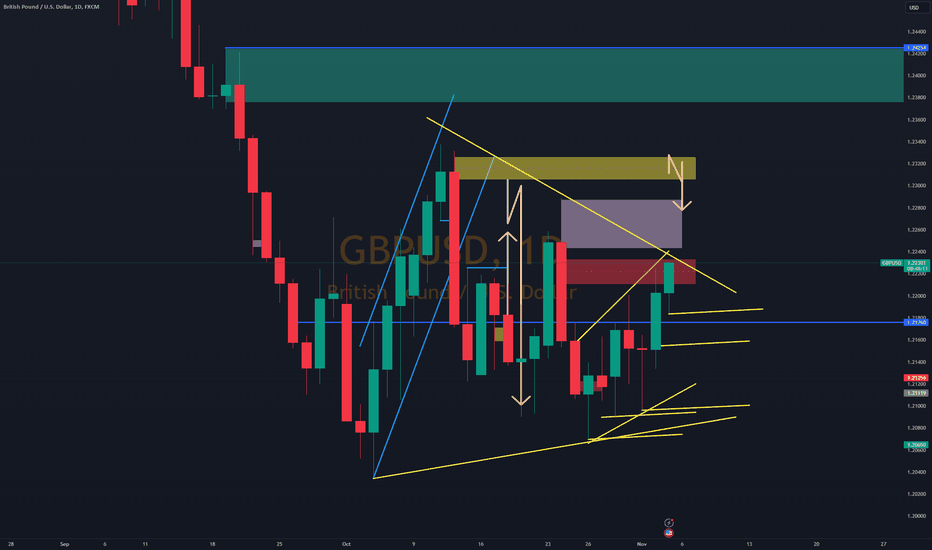

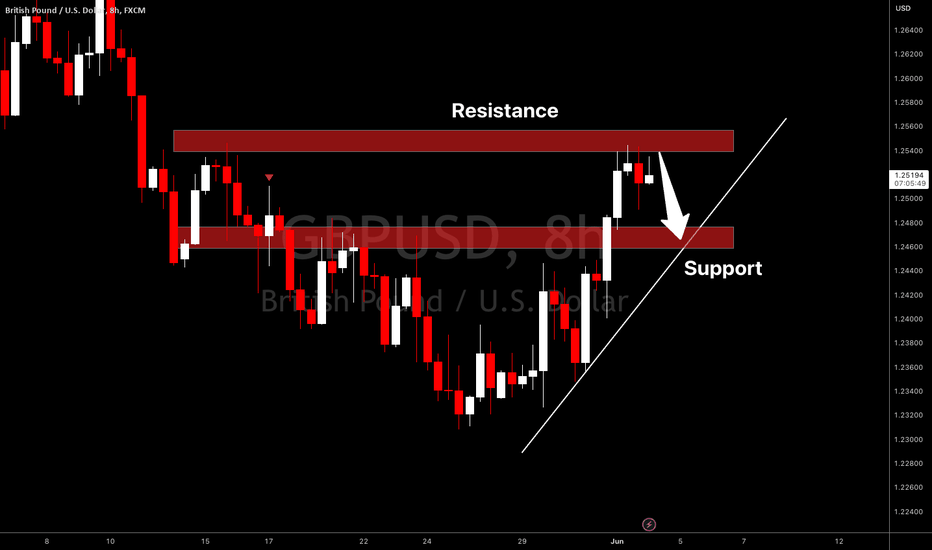

GBPUSD I It will be heading downward Welcome back! Let me know your thoughts in the comments!

** GBPUSD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

USDJPY I Expect to rise after 339K May NFP report Welcome back! Let me know your thoughts in the comments!

** USDJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!