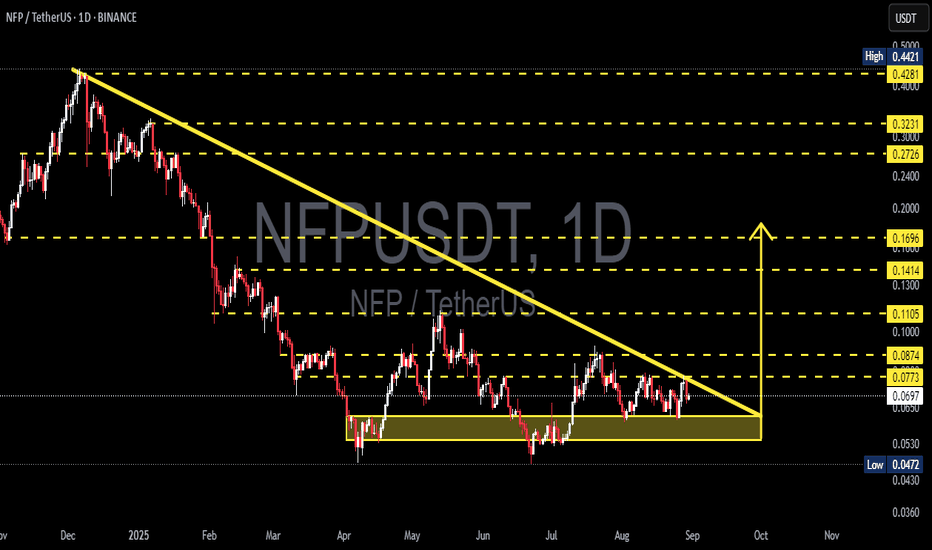

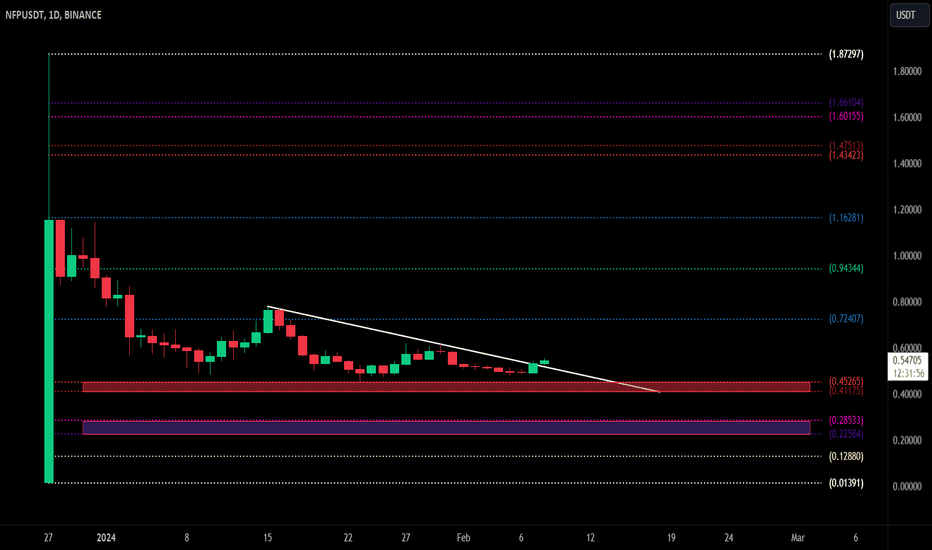

NFP/USDT — Descending Triangle, Watch for Breakout or Breakdown?The pair NFP/USDT is currently at a critical juncture. The chart shows a clear Descending Triangle pattern: a series of lower highs (seller pressure) aligned with a falling trendline, while a strong horizontal support zone around 0.047 – 0.062 continues to hold as buyers defend it.

Typically, this formation suggests a bearish continuation, but as the price approaches the triangle’s apex, the probability of a bullish breakout also rises if supported by strong volume. In other words, NFP is now in a “do or die” position — preparing for its next major move.

---

🔎 Technical Structure & Key Levels

Main Pattern: Descending Triangle → generally bearish bias, but breakout upside is possible.

Current Price: ~ 0.0697, very close to the apex, signaling an upcoming strong move.

Strong Support Zone: 0.047 – 0.062 (demand area repeatedly tested).

Key Resistance near trendline: 0.077 – 0.087 (bullish breakout confirmation zone).

Next Resistances: 0.1105, 0.1414, 0.1696, then 0.2726 – 0.3231, and 0.4421 (major historical resistance).

---

📈 Bullish Scenario — Breakout Potential

If NFP breaks above the descending trendline and closes a daily candle above 0.077 – 0.087 with strong volume, a medium-term reversal could be underway.

🎯 Short-term target: 0.1105

🎯 Next targets: 0.1414 – 0.1696

🎯 Extended targets: 0.2726 – 0.3231, up to 0.4421 if momentum sustains

🔑 Additional confirmation: successful retest of the breakout zone, proving buyer strength.

---

📉 Bearish Scenario — Breakdown Continuation

If price breaks below the strong support 0.0472, the descending triangle confirms as a bearish continuation pattern.

🎯 First target: 0.036 – 0.030 (next historical support zone).

🎯 Deeper targets possible if selling pressure accelerates.

🔑 Additional confirmation: failed retest of the broken support, turning into resistance.

---

⚖️ Key Takeaways

NFP/USDT is at a decision point. The descending triangle is tightening and a big move is near.

Bias: Slightly bearish due to the pattern, but bullish reversal remains possible with a breakout above 0.087 and strong volume.

Conservative traders: Wait for confirmation before entry. False breakouts/breakdowns are common without volume.

Risk management is crucial: set stop-loss below the support zone for longs, or above breakout levels for shorts.

---

As price approaches the apex of the triangle, volatility usually spikes. That means a decisive move is coming soon — either a breakout rally or a bearish continuation. For now, NFP/USDT is a must-watch: will buyers flip the script, or will sellers win the battle?

#NFP #NFPUSDT #Crypto #TechnicalAnalysis #DescendingTriangle #SupportResistance #Breakout #BearishOrBullish #CryptoTrading

Nfpusdtperp

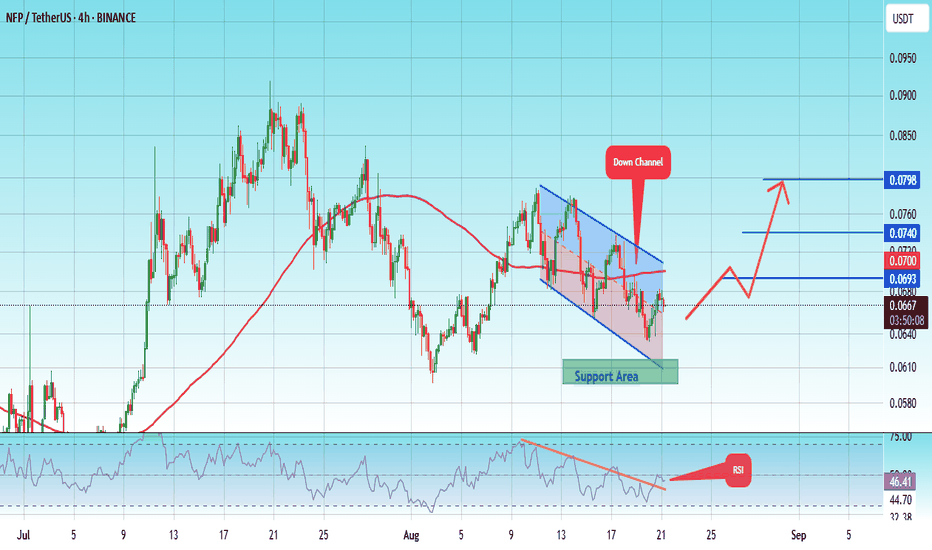

#NFB/USDT Forming Descending Channel #NFB

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area (marked in green) at 0.0600, which represents a strong basis for the upside.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.0665

First target: 0.0693

Second target: 0.0740

Third target: 0.0798

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

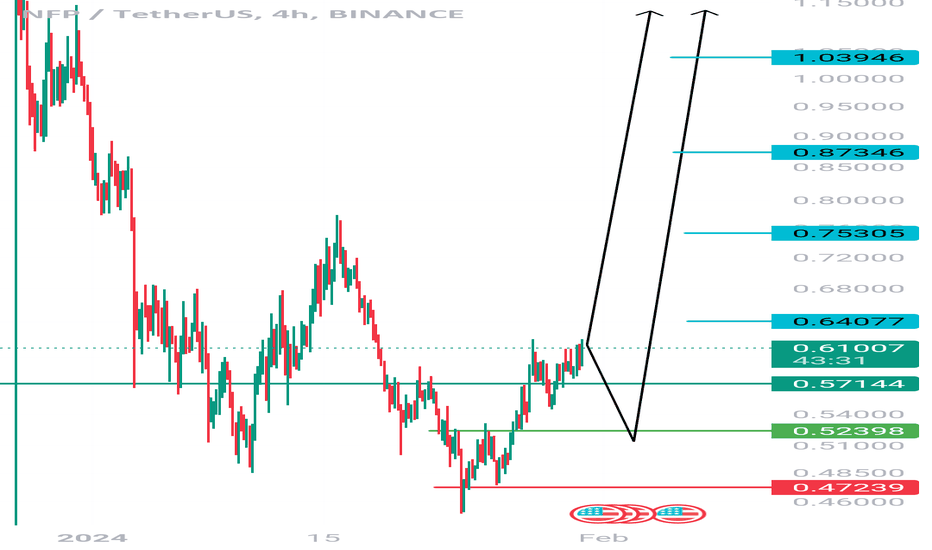

#NFP/USDT#NFP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0700.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0714

First target: 0.0726

Second target: 0.0744

Third target: 0.0763

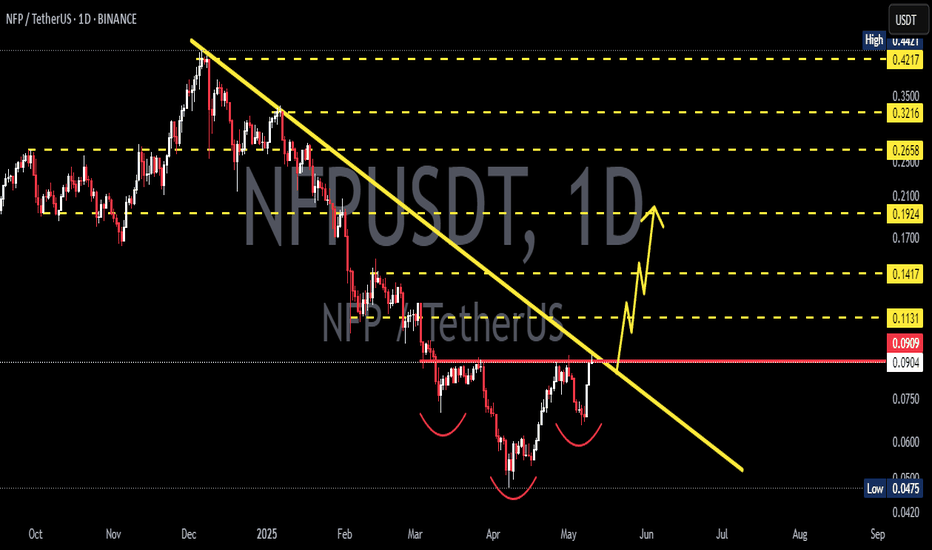

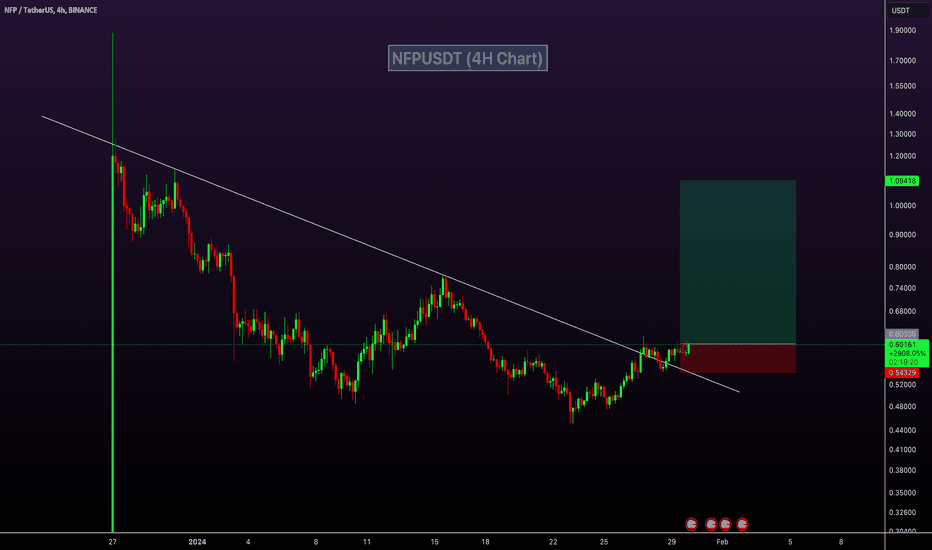

NFP/USDT PLAN NFP/USDT appears promising for a potential bullish advancement. The price is currently surpassing the trendline resistance on the 6-hour time frame. A successful breakout could indicate a forthcoming bullish move of around 50-80% in the coming days. Please note that this is not financial advice; always conduct your own research (DYOR).

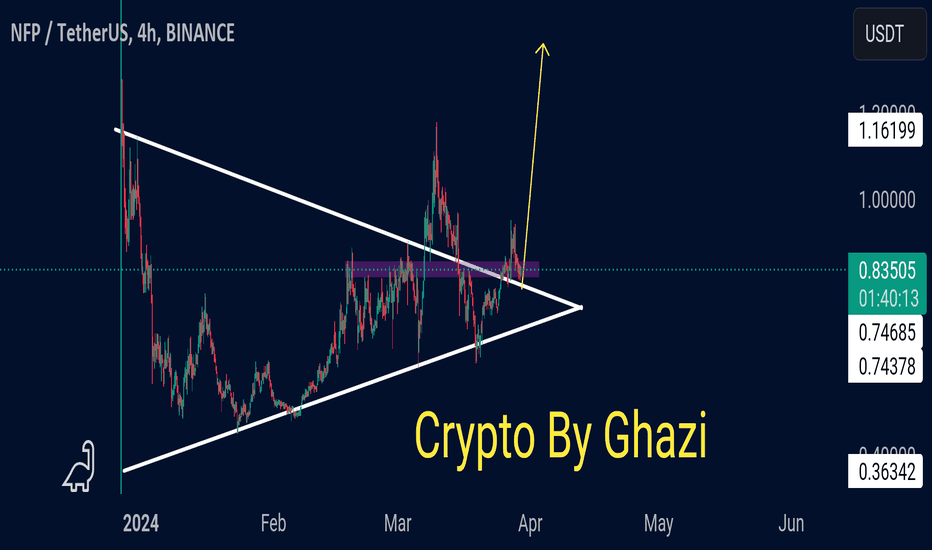

NFP/USDT BIG BREAKOUT IS COMING NFP/USDT Analysis:

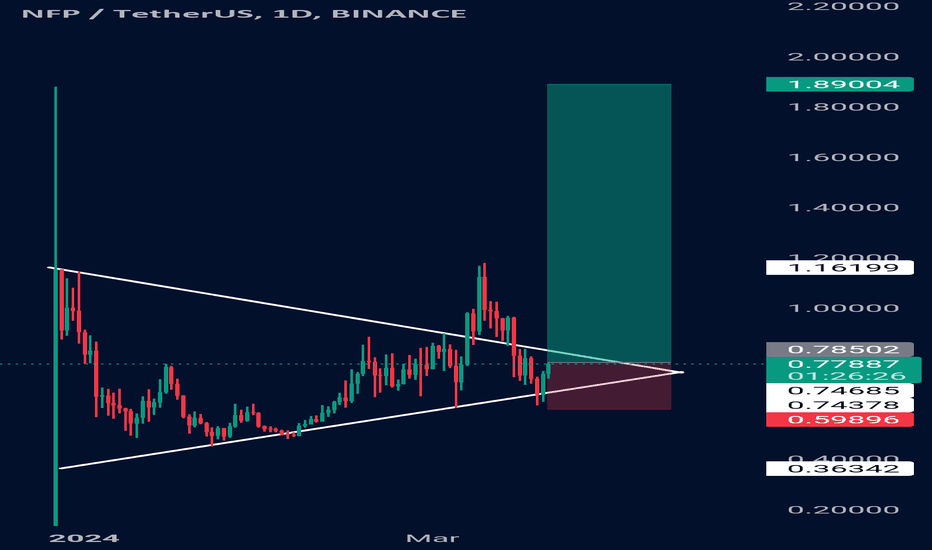

Anticipation is mounting for a potential significant upsurge in the NFP/USDT trading pair. Currently entrenched within a symmetrical triangle pattern, all indicators suggest an imminent breakout towards the upside. With a high confidence level of approximately 95%, the price is expected to breach this pattern in the near future.

Considering the mid-term outlook, price targets are set at a range of $1 to $2. It is crucial to underline that this assessment is rooted in technical analysis and observation and should not be deemed as financial advice. Traders and investors are advised to conduct their own due diligence before making any investment decisions based on this information.

Are you bullish on NFPrompt (NFP)NFP/USDT Daily Chart. Are you Bullish? It's time to make a decision.

................................................................................................................

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature.

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

NFP/Usdt Looking Good For Short Term NFP/USDT market appears to be showing positive signs for the short-term. The market structure seems to be turning bullish, indicating a potential price increase of approximately 25-50% in the near future. However, it is important to note that this information is not to be construed as financial advice. I encourage you to conduct your own thorough research before making any investment decisions.