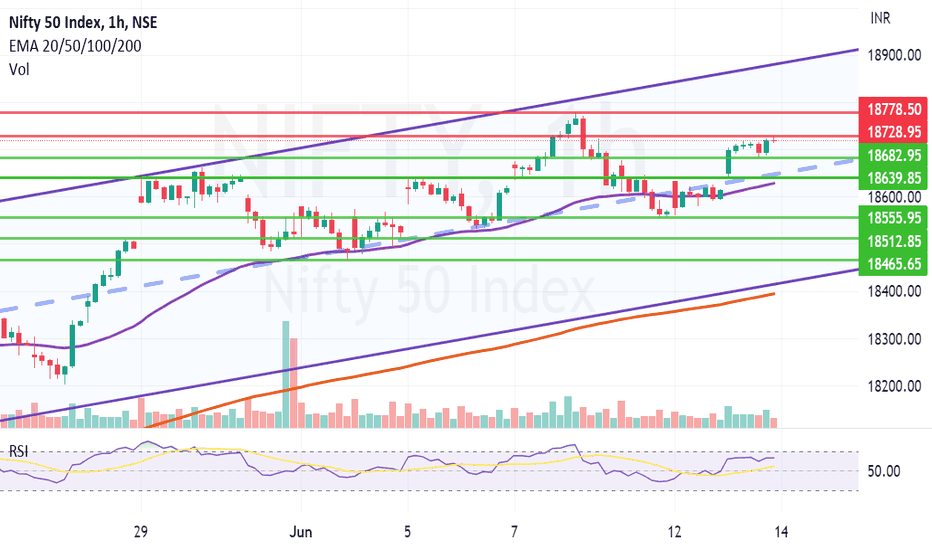

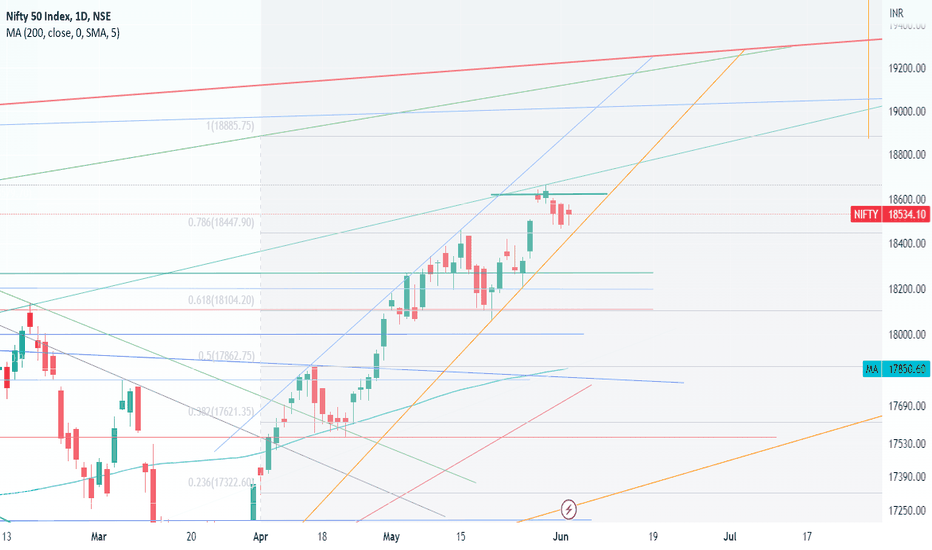

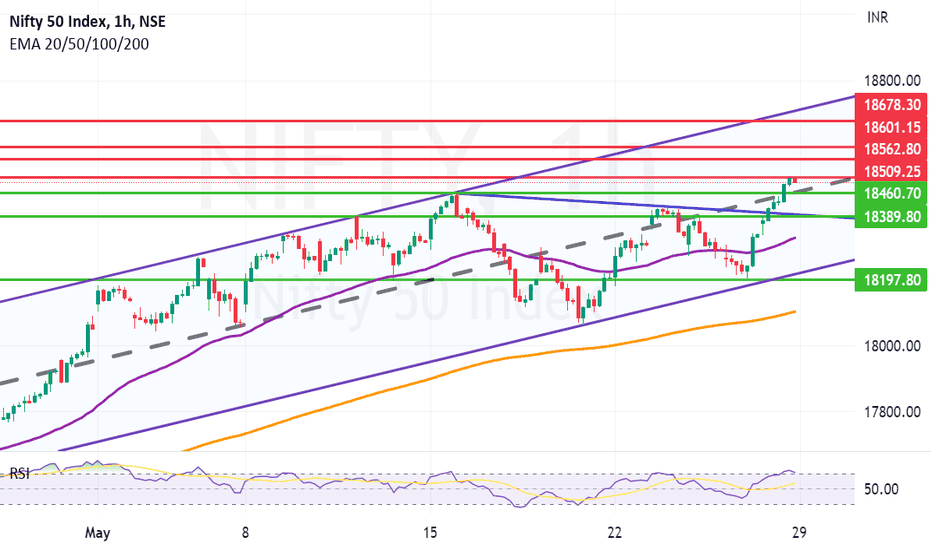

Gap-up above Mid-Channel line & sustaining above it is a big +veGap-up above Mid-Channel line & sustaining above it is a big positive which most probably will take is to the channel top or near the channel top. Right now the resistances in front of NIFTY are at 18728 and 18778. Supports for Nifty are now same Mid-Channel line 18639, 18555 and 18465. Things look Bullish, positive and vibrant as of now...Looks like Nifty will try to give it a shot to reach All Time High...

Niftyanalysis

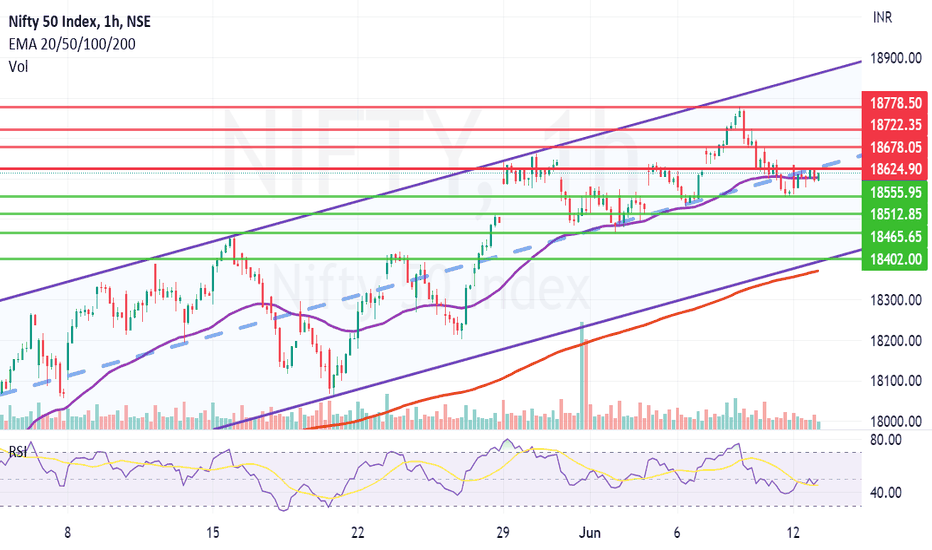

Importance of mid channel line in parallel channel tool. Last 3 weeks or so we saw the Importance of mid channel line in parallel channel tool. Thrice Mid channel line supported the Nifty and Nifty bounced from there. When a support is taken multiple times mostly it becomes weak. This led to fall of Nifty below Mid channel line. Once the price is below the line which was a support. The line becomes a resistance. Mid channel line is now a resistance and the same line is stopping Nifty from going ahead since couple of sessions. It was an important lesson hence explaining at depth.

Nifty Resistance remain at: 18624, 18678, 18722 and 18778.

Nifty Supports present at: 18555, 18512, 18465, 18402 and finally 18371.

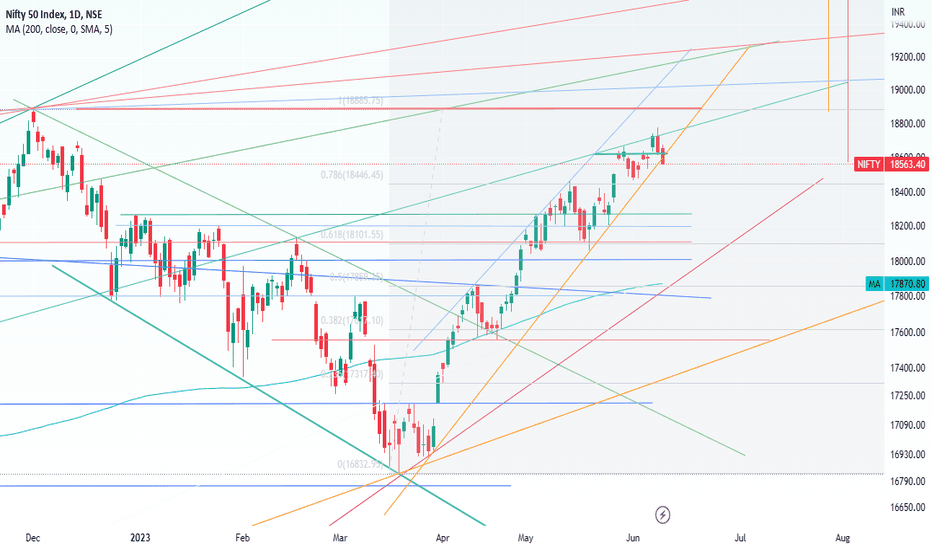

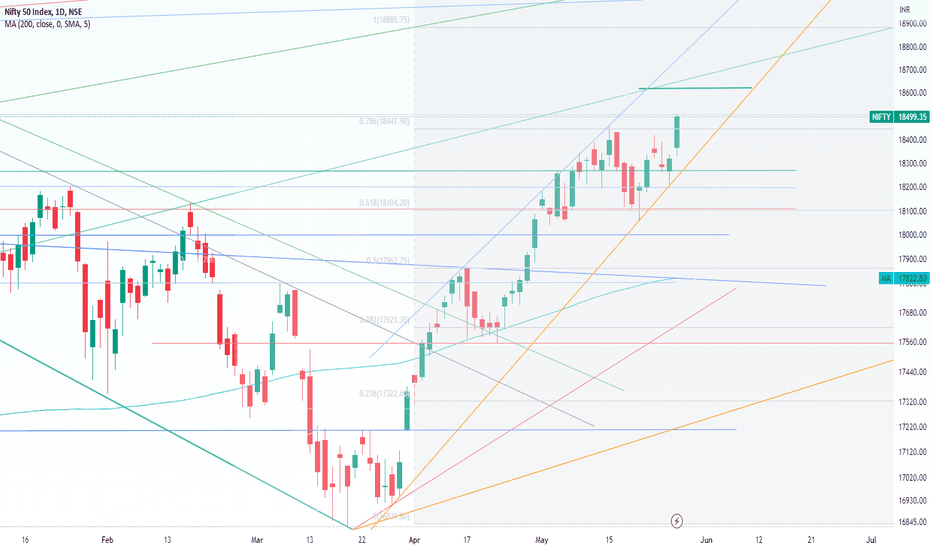

Nifty 12 Jun 23 to 16 Jun 23 Short ,Medium and Long TermNifty 12 Jun 23 to 16 Jun 23 Short ,Medium and Long Term

Nifty closed at 18563 ( 18535) and touched low & high of 18537 and 18772.

Buy call was given on dip on 21-May-23 at 18181.

The stiff resistance provided (inclined trend line ) for the week 18689 to 18734 acted well.

nifty faced that resistance as expected.

RSI and Stochastic lowered to 60% level from 72-75%.

Nifty- short term is sideways/ short dip.

Nifty support at 18446 ( Fibonacci) / Previous highs at 18274 /18204/18111

Nifty Resistance is at 18620 and inclined trend line (Resistance 18745 to 18786 ) as shown in the chart.

Buy on Dip

Nifty Medium Term -

Nifty expected to break 18620 and to touch previous high of 18890 /19000 in medium term.

Nifty have multiple support for Medium Term - 17865/18000/18111

Long term-

Need to decisively close above 18890 ( Previous Dec22 High) and also the very important resistance ( Red Inclined line shown 19200- 19350)to reach targets of 19500/20000

Support at 17850 /17550 /17200

Long term Investors can accumulate following Mutual Funds

NIFTY 50 & Nifty Equal weight ( 50%)

Nifty Bank & IT (20%)

Nifty Mid Cap ( 20 %)

Nifty Small Cap (10%)

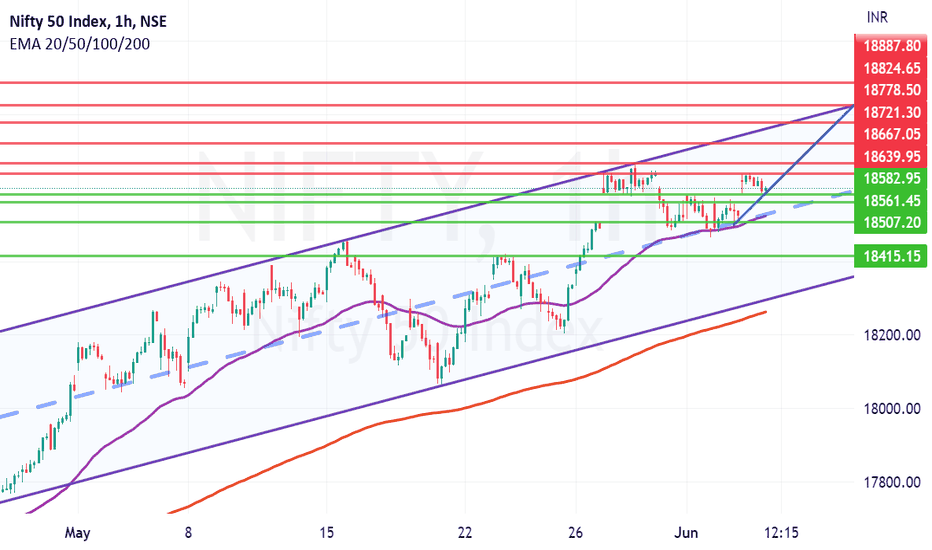

Nifty retreated after coming within touching distance of ATHNifty retreated after coming within touching distance of All time high. Perhaps it will check the box after one more push or rally within rally. Within every Bull run there are phases where Index or a stock cools down its RSI (relative strength index). Similarly Within every bear run there will be phases when market will be oversold and stock rises to balance RSI.

This particular fall of Nifty can be considered one such pullback within the bear run. The Bull run reverses or bears take over if Nifty gives a daily closing below 18169.(This will be key major support). Other than that support and resistances are as under:

Nifty Supports: 18555, 18512, 18465, 18402 and 18354.

Nifty Resistances: 18601, 18649, 18721 and finally 18778.

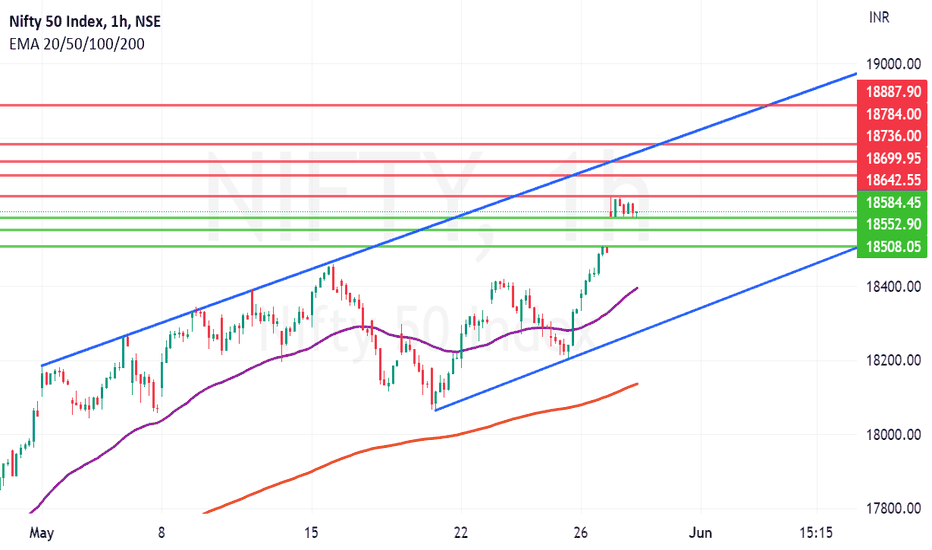

Again Mid-Channel Line and 50 hours EMA rescue Nifty again.Again today 'Mid-Channel Line' coming to rescue Nifty on hourly chart. Mid channel line and 50 hours EMA where both near each other and formed a dual support for Nifty and rescued it from falling further. Falling below 18581 will decrease the strength of rally and in this case the Nifty can fall more towards 18495 and 18433. it looks line Final support for ongoing bull run is near 18336. Resistances for Nifty are near 18649, 18690, 18721 and 18778.

Nifty Closed above imp resistance, holding above it important. Yesterday we had given 18721 as an important resistance for Spot nifty. Today it has closed just above it which is a good sign. It was not a strong close but it was a good close. Key Resistances now are 18778, 18824 and previous All time high of 18887.6. Supports for the Nifty will be at 18721 it is a weak support as of now. 18683, 18639 and 18572. Relative Strength Index of Nifty is above 73 and the chart is going in the area again where Nifty will soon if not tomorrow require a little bit of consolidation or cooling down.

Mid Channel Line providing a moderate support to NiftyMid Channel Line providing a moderate support to Nifty in the second half of the day in last trading session. As you can see from the chart Mid-Channel line drawn on the hourly chart provided a solid support to the nifty as the Nifty jumped from 18531 to close near 18599. Supports nearby are now at 18531 and 18507. Resistance zone will be 18639 and 18667. Above 18667 the next resistance is near 18721

Nifty Trapped between strong support and strong resistance zonesNifty is trapped between strong support and strong resistance zones right now. Resistance zone is between 18639 to 18667. Support zone is between 18561 to 18582. Other supports if this zone is broken will be near 18522, 18507 and 18415. If the Nifty breaks the upper side resistance of 18667 the next resistance levels will be at 18721, 18778 and finally 18887. Trend changes to negative below 18262 closing.

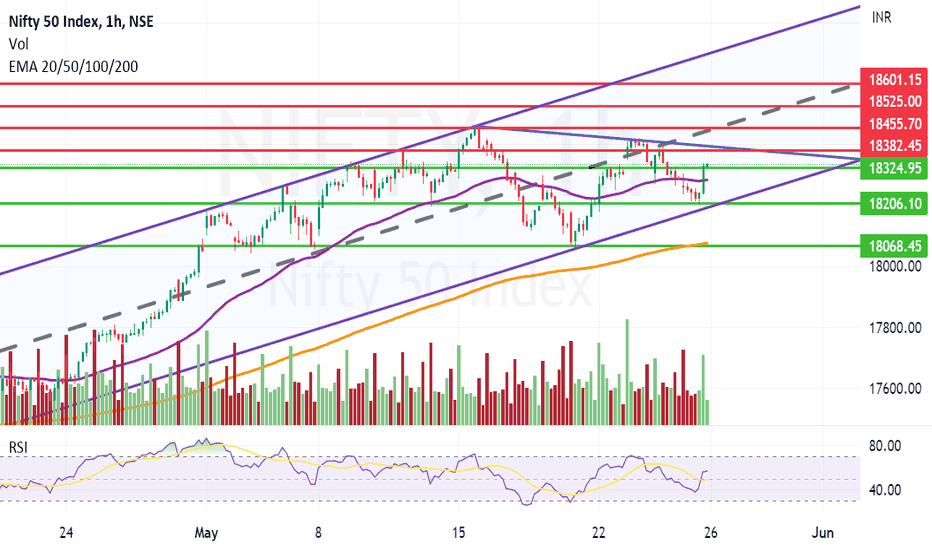

Nifty 5 Jun 23 to 9 Jun 23 Short ,Medium and Long TermNifty 5 Jun 23 to 9 Jun 23 Short ,Medium and Long Term

Nifty closed at 18534 ( 18495) and touched low & high of 18464 and 18664.

Nifty closed marginally higher than previous week.

Buy call was given on dip on 21-May-23.

Last week there was a stiff reistance was given at 18620 and shown with Thick green Horzontal line.

nifty faced that resistance as expected.

RSI ,MACD and Stochastic have crossed the signals and at peak with Further room to move upwards.

Nifty- short term is Long.

Need to decisively close above 18620

Nifty Resistance is inclined trend line ( for the week 18689 to 18734 )

Nifty support at 18111/18204/18274

Buy on Dip

Nifty Medium Term -

Nifty expected to break 18620 and to touch previous high of 18890 /19000 in medium term.

Nifty have multiple support for Medium Term - 17865/18000/18111

Long term-

Need to decisively close above 18890 ( Previous Dec22 High) and also the very important resistance ( Red Inclined line shown 19200- 19350)to reach targets of 19500/20000

Support at 17850 /17550 /17200

Long term Investors can accumulate following Mutual Funds

NIFTY 50 & Nifty Equal weight ( 55%)

Nifty Mid Cap ( 20 %)

Nifty Small Cap (15%)

Nifty IT (10%)

Nifty Closed well on a testing day, another test awaits tomorrowNifty Closed well on a testing day, another test awaits tomorrow as the world awaits result of Voting in US Parliament to resolve Debt ceiling crisis. Global indices are down and awaiting the result eagerly. Support that spot Nifty has is today' low of 18483 from where the Nifty managed to recover today. The support may be tested tomorrow again. Just below it we have 50 Hours EMA at 18467 which might also be tested. Below these levels important supports remain at 18416 and 18379. Below 18379 Bear cartel can get activated. When Nifty has found a strong support and if result of Debt Ceiling crisis by raising the ceiling the resistances will be near 18576, 18600, 18637 and 18662. We still live in a world where if US sneezes the World catches cold. (Indian GDP numbers were great and can provide support to Nifty 50 and many other stocks.)

Channel of Nifty leads to 19K but there are lot of hurdles. Channel of Nifty that leads to 19000 but there are lot of hurdles now. Some of the immediate resistances are near 18642, 18699, 18736, 18784 and finally 18887. Supports for Nifty are at 18584, 18552, 18508 and finally 18383. Things are evenly poised now.

Nifty 29 May 23 to 02 Jun 23 Short ,Medium and Long TermNifty 29 May 23 to 02 Jun 23 Short ,Medium and Long Term

Nifty closed at 18499 ( 18203) and touched low of 18183.

Nifty touched high of 18509.

Nifty clearly moved up decisively above resistances mentiomed below though it bottomed out to 18061 in the previous week.

Buy call was given on dip on 21-May-23.

nifty followed the band resistance provided for last three- four weeks ( as mentioned below) and 3-4 days the resistance acted as support.

18111/18204/18274 ( Prev Highs Shown in thick red , blue and green horizontal lines).

Nifty broke resistance of 18274 and clearly moved above and closed near to 18500.

RSI ,MACD and Stochastic have crossed the signals and at peak with Further room to move upwards.

Nifty- short term is Neutral to Long.

Need to decisively close above 18620

Nifty support at 18111/18204/18274

Buy on Dip

Nifty Medium Term -

Nifty expected to break 18620 and to touch previous high of 18890.

Nifty have multiple support for Medium Term - 17865/18000/18111

Long term-

Need to decisively close above 18890 ( Previous Dec22 High) to reach targets of 19000/19500/20000

Support at 17850 /17550 /17200

Long term Investors can accumulate following Mutual Funds

NIFTY 50 & Nifty Equal weight ( 55%)

Nifty Mid Cap ( 20 %)

Nifty Small Cap (15%)

Nifty IT (10%)

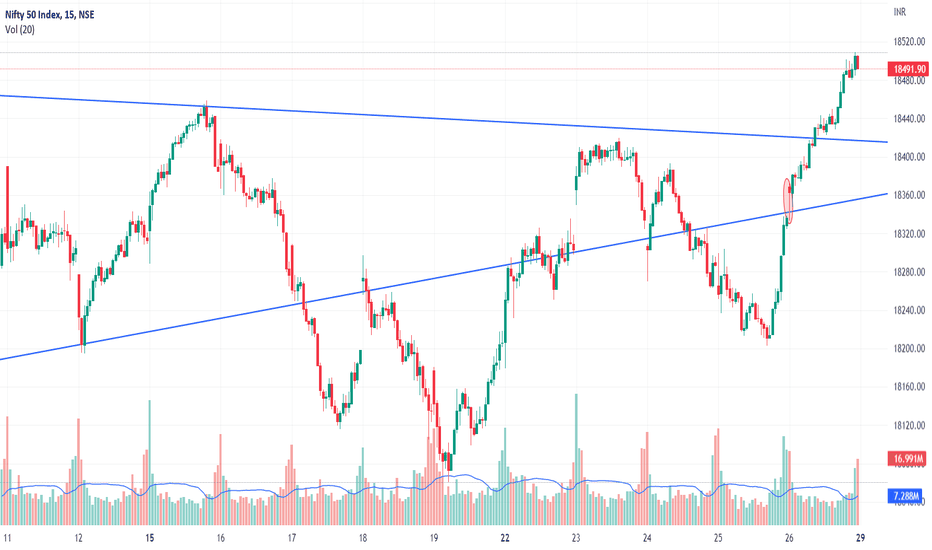

NIFTY |NIFTYPREDICATIONTOMMROW|NIFTYANALYSIS FOR MONDAYIf Nifty sustain the level of 18500 and spend time and break 18515, then 18550-1875-18600

If Nifty break down of 18500 spend time and break down 18450, then Nifty 18400-18375-18350

This video is for educational purpose and my personal view .We are SEBI registered Advisor,we only give the level on our practical trading experience.

Kindly take the trade according to your risk and reward position and consulting your advisor.

Strong Close by Nifty on Friday.Nifty has given a strong closing on Friday by closing above the Mid Channel line. The nifty has given a close just below a strong resistance of 18509. 18509 was high of Friday above which the Nifty could not close. One way to avoid this resistance would be to open gap up on Monday. If we open gap up on Monday above 18509 levels, the next resistance will be at 18562, 18601 and 18678. Supports on the lower side will be at 18460, 18389, 18324 (50 Hours EMA) and 18197. Below 18197 Final support will be 200 Hour EMA at 18101. Below 18101 Bears will regain the control. If by chance during the week or later this month or next month we get a closing below 18101 trend can change into negative.

Good end to the day but lot of resistances to conquer The end of the day was good for Nifty as the Nifty bounced from the support given earlier which was at 18206. (Nifty went just below it 18202 Low of the day and bounced back substantially to end at 18321).

The major resistances to conquer remain: 18324, 18382 and 18455.

Supports on the lower side remain at: 18202, 18190 and the zone between 18075 and 18068. (Below 18068 Bears will become very active).

Nifty Not sustaining above mid channel support not a good omenNifty Not sustaining above mid channel support not a good omen for the Bull run. Somehow Nifty has to make a comeback in next 2 or maximum 3 days and sustain above Mid channel line which is around 18413 mark.

Right now Nifty als faced a trend line resistance which emancipates from previous top. The zone was too hot for Nifty to handle and it leaped back towards the support of 18323.

Supports for Nifty Will be at: 18323, 18275, 18206 and finally 18068 to 18040 zone. (Major buffer Support). Below 18K Bears start to loose control.

Resistances for Nifty: 18413, 18455, 18525 and finally 18601 (Major Resistance).

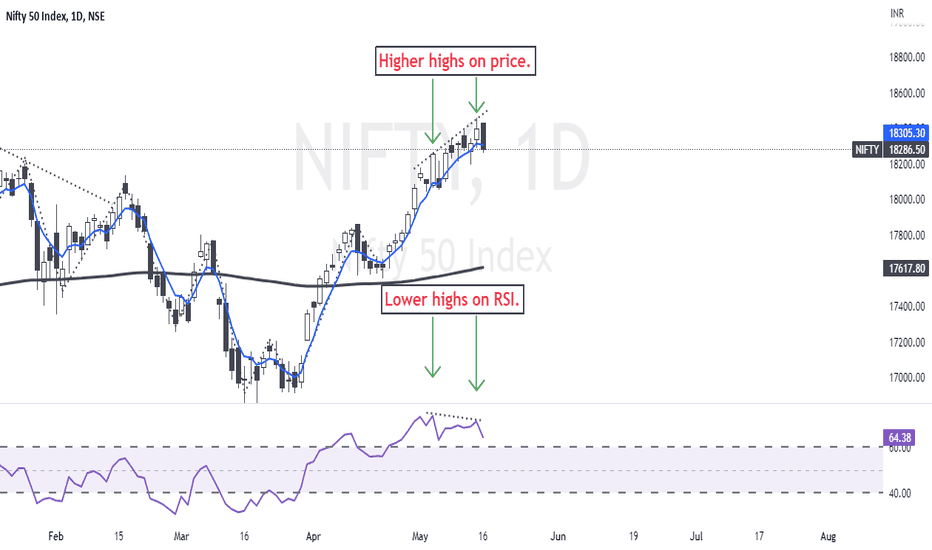

Bearish divergence explained in NIFTY & BANK NIFTY.DIVERGENCE is when the price of a scrip is moving in opposite direction of an indicator, usually an oscillator. It acts as a warning that the price trend may be getting weaker. It does not necessarily mean that the trend will reverse. It could signal an exhaustion of the current trend, the beginning of a period of consolidation or a medium to long term reversal.

_________________________________________________________________________________

Divergences are classified according to their levels of strength. Type A divergences are the strongest, Type B divergences show lesser strength and Type C divergences are the weakest. Type A divergences usually present the best trading opportunities, whereas Type B and Type C mostly lead to choppy price movement or consolidation.

_________________________________________________________________________________

TYPE A: Type A bearish divergences occur when price rises to a new high but the oscillator is only able to rise to a high that is lower than the previous high of the oscillator. The divergences of this type often indicate a reversal towards a downtrend.

TYPE B: Type B bearish divergences are formed when the price makes two equal highs or a double top and the oscillator makes a lower second top.

TYPE C: Type C bearish divergences occur when price rises to a new high but the indicator stops at the same level it reached during the previous rally.

_________________________________________________________________________________

Divergences are important signals which can be used to book profits on existing positions or pulling up your trailing stop losses. NIFTY and BANK NIFTY both, are displaying bearish divergences on the daily timeframe.

Which type of bearish divergence do you see in NIFTY?

Comment below.

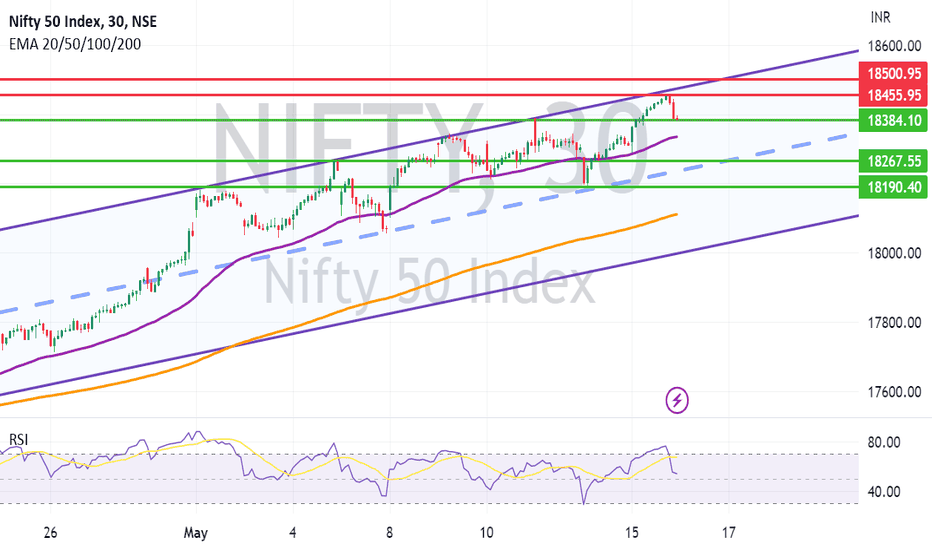

Nifty Flowing confidently in the 30 minute channel. Nifty on a 30-minute chart is looking very confident of staying in the upper half of the channel in which it is travelling. On last 3 occasions Nifty has jumped upon reaching the mid channel support of the mid channel line. Indicating that strength of the rally is intact so far.

However, on the last 4 occasions when Nifty tried to cross the Channel top it was made to retreat indicating a strong channel top resistance.

Nifty Resistances going further will be: 18455 and 18500.

Nifty Supports going further will be at: 18384, 18284, 18267 (Very Strong Support).

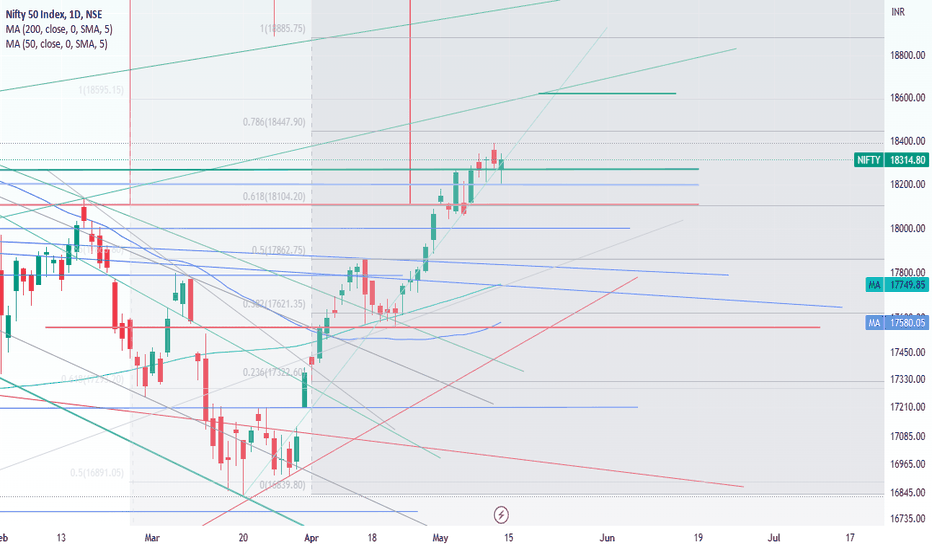

Nifty 15May23 to 19May23 ST,MT & LT-Chart Cleaned for VisibilityNifty 15 May 23 to 19 May 23 Short ,Medium and Long Term

Nifty closed at 18314 ( 18069) and touched low of 18100.

Nifty touched high of 18389.

Mainly followed the band resistance provided for last two weeks ( as mentioned below) and 3-4 days the resistance acted as support.

Nifty support at 18111/18204/18274 ( Prev Highs Shown in thick red , blue and green horizontal lines)

RSI ,MACD and Stochastic are at 69%, 210 and 92%

KN Election results will play small setback in the indices, might drop to the the support level provided in the coming week in initial trading sessions.

However after small consolidation it will again try to attempt to surpass 18465/ 18600 /18900 in the Medium term.

Nifty- short term is Neutral to Long.

Need to decisively close above 18274 to reach targets ext target at 18437/18465 ( fibonacci resitances) .

Nifty support at 18111/18204/18274

Buy on Dip

Nifty Medium Term -

Nifty need to break decisively above first target 18274 to reach next target of 18437 ( Fibonacci 0.786 Retracement)/ 18640/ followed by prev high 18890.

Nifty have multiple support for Medium Term - 17865/17741 ( Previous Highs) and 17560 ( April Low)

Below that 17387- 17340/ 17252

Long term-

Need to decisively close above 18890 ( Previous Dec22 High) to reach targets of 19000/19500/20000

17208/17180//17000

long term support at 16746 ( Sep22 Low)

Long term Investors can accumulate following Mutual Funds

NIFTY 50 Equal weight

Bank Nifty

Nifty IT (Buy on dip)

Nifty 15 May 23 to 19 May 23 Short ,Medium and Long TermNifty 15 May 23 to 19 May 23 Short ,Medium and Long Term

Nifty closed at 18314 ( 18069) and touched low of 18100.

Nifty touched high of 18389.

Mainly followed the band resistance provided for last two weeks ( as mentioned below) and 3-4 days the resistance acted as support.

Nifty support at 18111/18204/18274 ( Prev Highs Shown in thick red , blue and green horizontal lines)

RSI ,MACD and Stochastic are at 69%, 210 and 92%

KN Election results will play small setback in the indices, might drop to the the support level provided in the coming week in initial trading sessions.

However after small consolidation it will again try to attempt to surpass 18465/ 18600 /18900 in the Medium term.

Nifty- short term is Neutral to Long.

Need to decisively close above 18274 to reach targets ext target at 18437/18465 ( fibonacci resitances) .

Nifty support at 18111/18204/18274

Buy on Dip

Nifty Medium Term -

Nifty need to break decisively above first target 18274 to reach next target of 18437 ( Fibonacci 0.786 Retracement)/ 18640/ followed by prev high 18890.

Nifty have multiple support for Medium Term - 17865/17741 ( Previous Highs) and 17560 ( April Low)

Below that 17387- 17340/ 17252

Long term-

Need to decisively close above 18890 ( Previous Dec22 High) to reach targets of 19000/19500/20000

17208/17180//17000

long term support at 16746 ( Sep22 Low)

Long term Investors can accumulate following Mutual Funds

NIFTY 50 Equal weight

Bank Nifty

Nifty IT (Buy on dip)

Nifty Short Term Outlook NIFTY is approximately 3% away from the top. Question on minds of most investors is: When will Nifty make a new high by crossing this Crossing this 3% hurdle. Crossing this 3% hurdle will not be easy in my opinion, unless all FII, DII and Retail investors participate in the ongoing rally. Rally has hit the resistance zone now.

It was a good week but going ahead Nifty will have to conquer 4 major resistances. These 4 Resistances are at 18393, 18474, 18609 and 18715. In case these resistances are not crossed there are chances of rally to fizzle out with supports at 18185 and 18053. 18053 is a major support.

Below 18053 bears will start calling shots. If we get a weekly closing below 18053 the next support zone will be between 17793 and 17529 (Final Major support). Below 17529 bears will be in full control again.

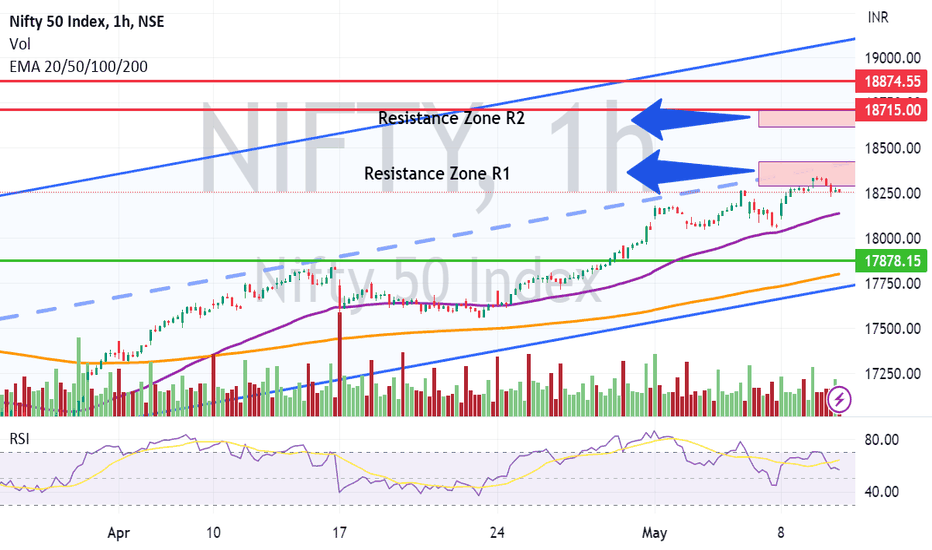

Nifty Facing Resistance Zones.Nifty had a fantastic rally which might hit couple of hurdles in the form of upcoming resistance zones.

Resistance Zone R1 which is between 18283 and 18427. If this major hurdle is crossed there is another Resistance Zone R2 to be crossed which is between 18608 and 18715.

Support for Nifty will be at 18130, 18049, 17966, 17848 and finally 17794.

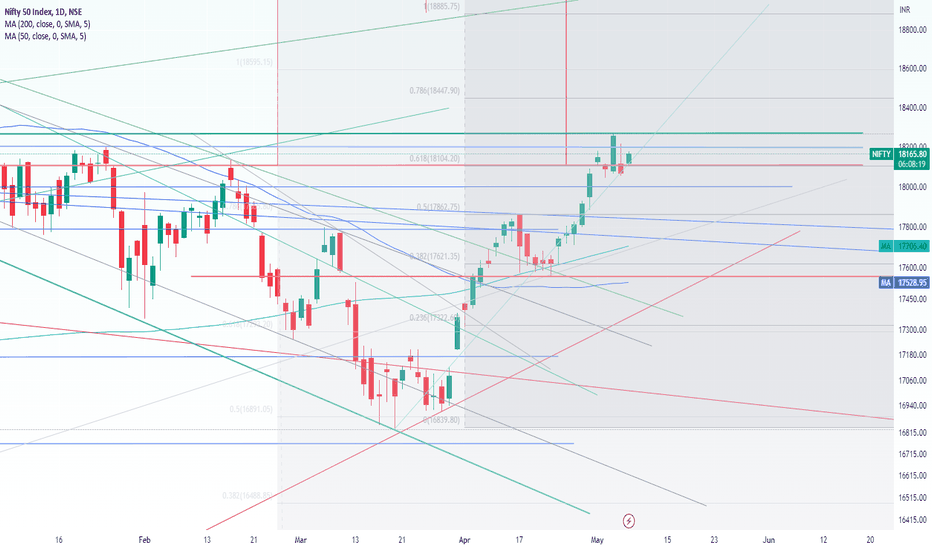

Nifty 08 May 23 to 12 May 23 Short ,Medium and Long TermNifty 08 May 23 to 12 May 23 Short ,Medium and Long Term

Nifty closed at 18069 ( 18090) and touched low of 18042

Nifty touched high of 1827.

Mainly followed the band resistance provided last week ( as mentioned below) due to awaiting of FED decision and followed by drop on last day due to HDFC stocks.

Nifty small Resistances at 18111/18204/18274 ( Prev Highs Shown in thick red , blue and green horizontal lines)

RSI ,MACD and Stochastic are at 62% fall from 75%

So far Q4 have mixed results.

Nifty- short term is Neutral to Long.

Need to decisively close above 18274 to reach targets ext target at 184372/18465 ( fibonacci resitances) .

Nifty small Resistances at 18111/18204/18274

Nifty support at 17869/177741 ( Previous Highs) and 17570/17530 (Inclined two trend line)

Nifty Medium Term -

Nifty need to break decisively above first target 18274 , next target of 18437 ( Fibonacci 0.786 Retracement) followed by prev high 18890.

Nifty Support at 17387- 17340/ 17180/17200/17252

Long term-

Need to decisively close above 18890 ( Previous Dec22 High) to reach targets of 19000/19500/20000

long term support at 16746 ( Sep22 Low)

Long term Investors can accumulate following Mutual Funds

NIFTY 50 Equal weight

Bank Nifty

Nifty IT ( Buy on dip)