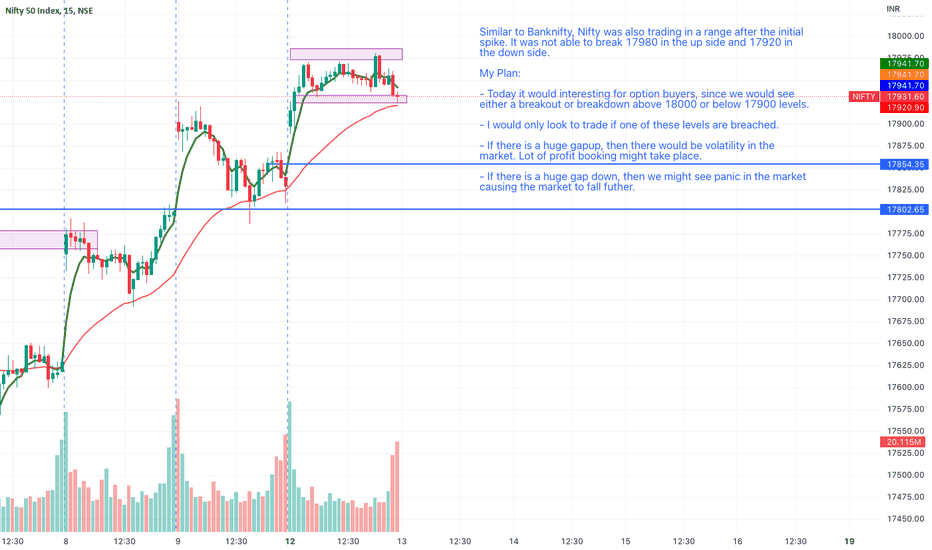

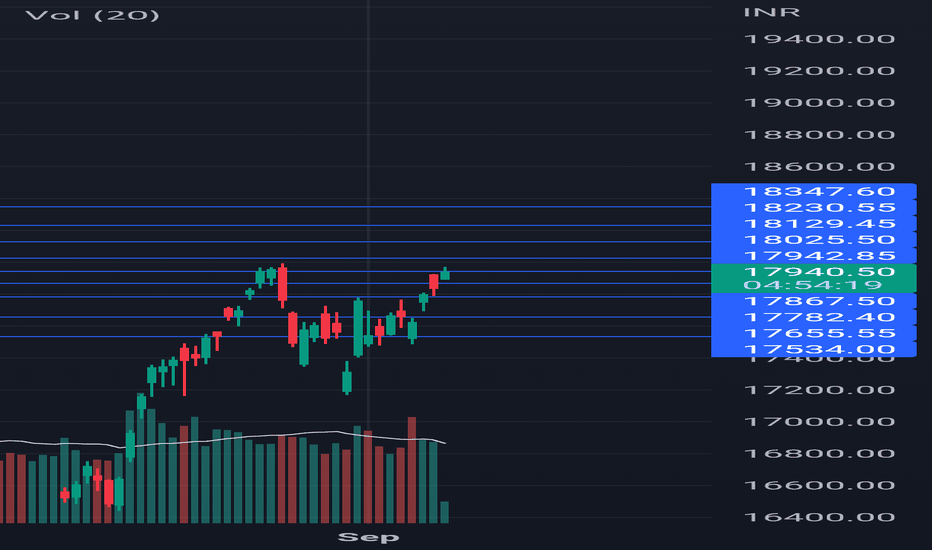

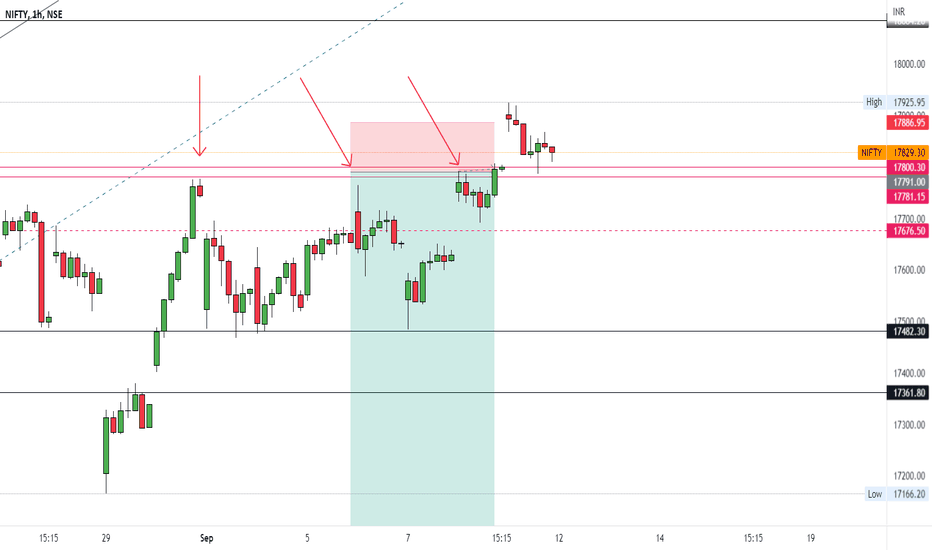

Nifty Trade setup Idea - 13 september 2022Similar to Banknifty, Nifty was also trading in a range after the initial spike. It was not able to break 17980 in the up side and 17920 in the down side.

My Plan:

- Today it would interesting for option buyers, since we would see either a breakout or breakdown above 18000 or below 17900 levels.

- I would only look to trade if one of these levels are breached.

- If there is a huge gapup, then there would be volatility in the market. Lot of profit booking might take place.

- If there is a huge gap down, then we might see panic in the market causing the market to fall futher.

Niftyanalysis

Nifty in strong position to gain further.NIFTY has started the week on solid footing and current global positivity can help nifty scale new heights. For gaining further ground tomorrow Nifty will have to close the day above 18000 levels. Failing to do so we can see little bit of consolidation too. Support and resistance levels are as under:

Supports for Nifty: 17800, 17659, 17424 and finally 17204 (in very unlikely circumstances).

Resistances for Nifty: 17996, 18100, 18365 and finally ATH 18606.

Nifty levels & strategy for 13/Sep/2022Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please don’t trust me or anyone for trading/investment purpose. Focus on learning how to fish, trust your own skills and please do consult your financial advisor before trading.

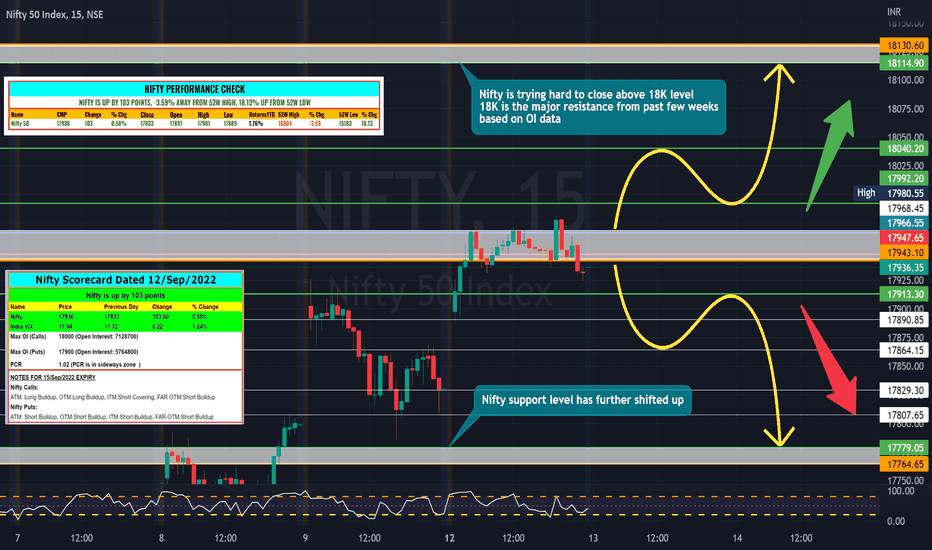

NIFTY

Nifty is up by 103 points. Nifty is successfully trading above major resistance zone. PCR is up from 0.89 (bullish zone) to 1.02 (sideways zone). Nifty is trying hard to cross the 18K level. If inflation data is next major trigger. If data comes positive and then we may see a new lifetime high in Nifty.Certainly, support zone in Nifty has shifted up. Important resistance levels became new support levels. Max open interest has jumped up significantly which means big players are looking at expiry on higher levels near lifetime high. Overall, Indian market data is looking good.

Highest open interest on call side at 18000 (Remained at same level)

Highest open interest on put side at 17900 (Shifted up from 17000 to 17900)

BANK NIFTY

Bank Nifty is up by 158 points. Bank Nifty is really performing well and closed above 40500 level which is a new lifetime weekly high. Extra ordinary performance by Banking stocks amid ongoing global issues. Any dip Bank Nifty due to US inflation data in next few days should be buying opportunity. However, trader should work level by level. Max open interest has jumped up significantly. Please do make a note of it.

Highest open interest on call side at 40500 (Remained at same level)

Highest open interest on put side at 40500 (Shifted up from 39000 to 40500)

Shall we continue look for buy on dips opportunities near major support? Yes, I think so. What do you think?

Please do share your comments. Have a very happy, healthy & profitable day ahead!

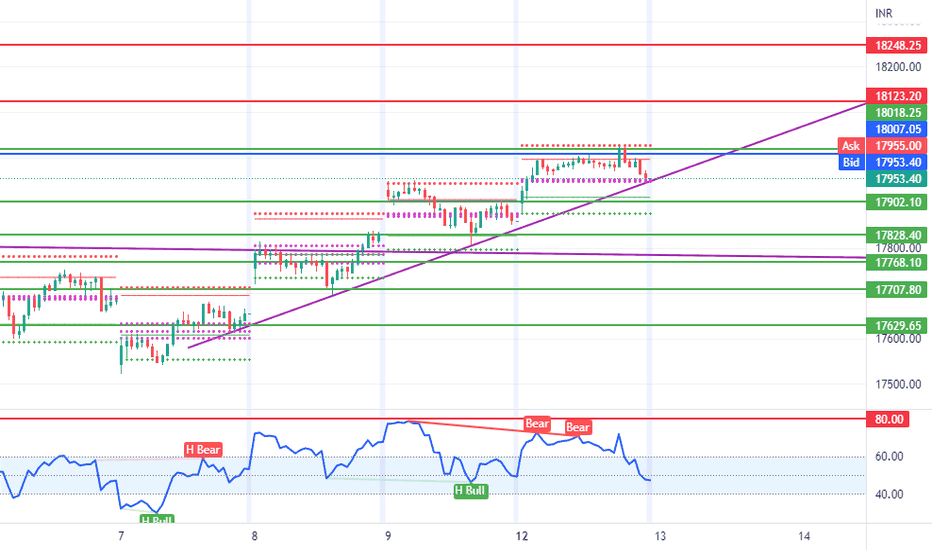

Nifty Important levels and trade plan for Tuesday, 13.09.22(Levels and study done in Nifty future)

On daily time frame Nifty is bullish, but with current price action in lower time frame, tomorrow we may expect a little correction. Tomorrow, the range between CPR (which is a narrow one) and today’s high (17945 to 18020) will avoid directional trading. If Nifty opens between these two levels, we will wait, and will enter into bullish trade after Nifty crossing 18020, but here price action is must. For upside move 18123 will be the target level. If opens above no trade zone, then we may witness a sudden spike in upside, and here in this kind of opening also we will wait for a price action and then will enter into a trade. For opening inside no trade zone, and with a slow move towards downside, will enter into a bearish trade, after getting confirmation from breaking of first five-minute candle in downside. However, a gap down opening of more than 70 to 100 points well wait for the price to take a decision. For huge gap down opening, we may consider for bullish reversal trade, but depending upon the conditions.

From OI chart, 18000 is still having highest OI in CE side and in PE side it is 17900 with maximum OI present.

*All support and resistance plotted are based on PDH/PDL. For any reversal after breaking PDH/PDL, support and resistance levels will be different*

**Time of plotting the levels and planning 11th September, 11:40 AM**

***Personal opinion, not a trading advice***

#NIFTY50

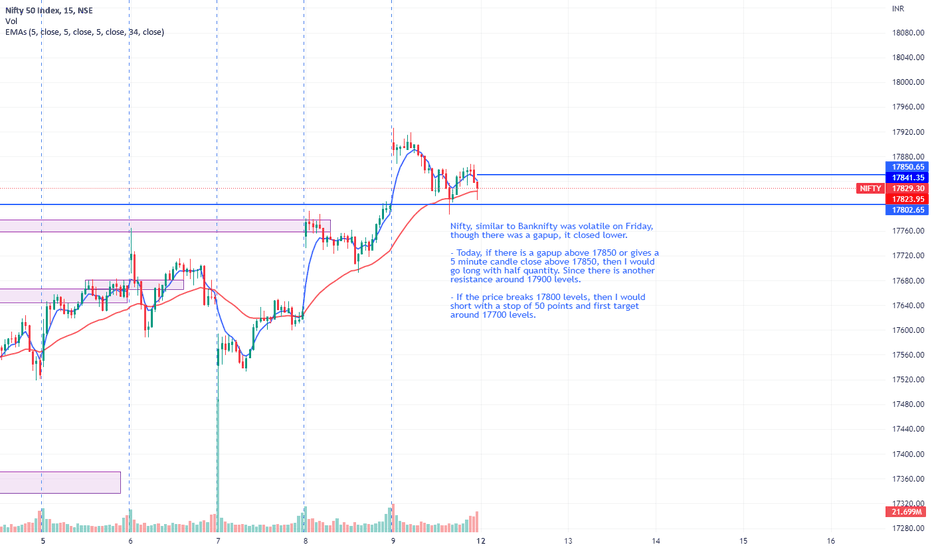

Nifty Trade Setup idea for 12-September-2022Nifty, similar to Banknifty was volatile on Friday, though there was a gapup, it closed lower.

- Today, if there is a gapup above 17850 or gives a 5 minute candle close above 17850, then I would go long with half quantity. Since there is another resistance around 17900 levels.

- If the price breaks 17800 levels, then I would short with a stop of 50 points and first target around 17700 levels.

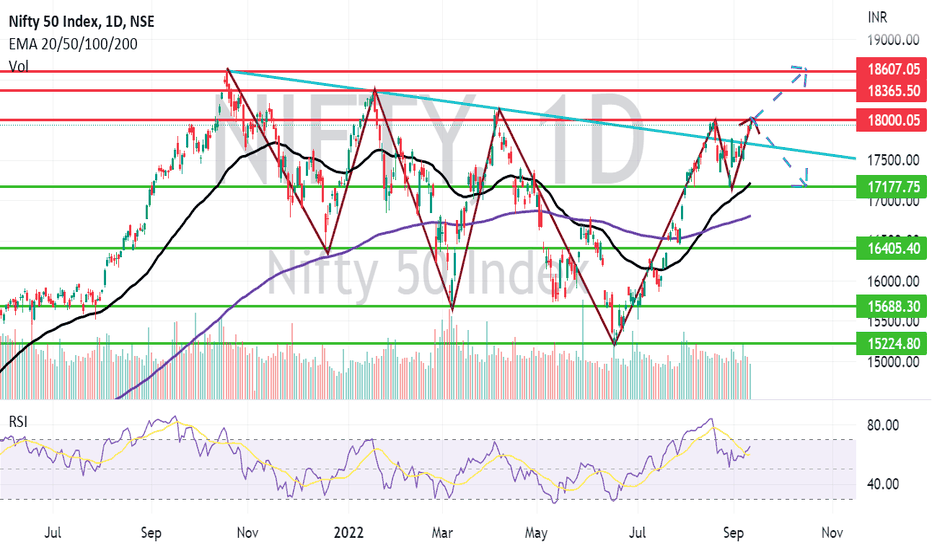

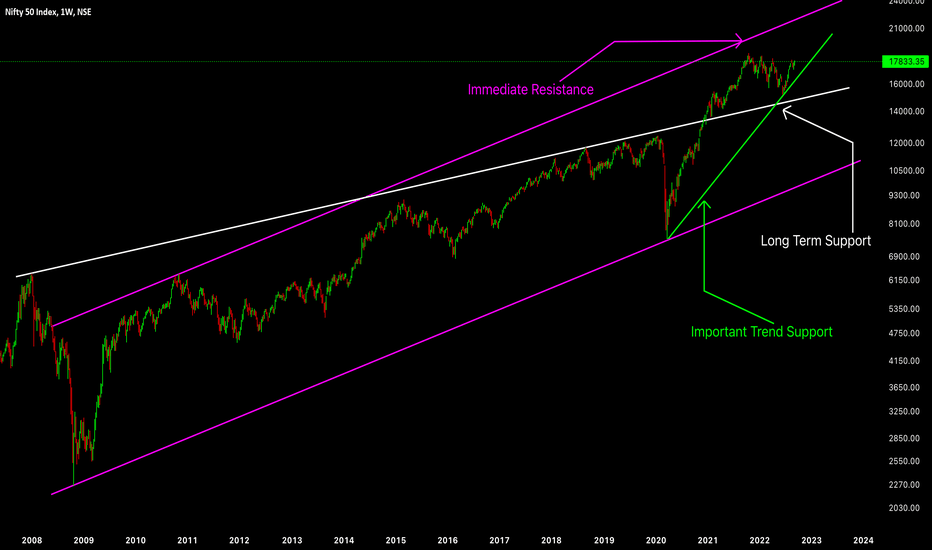

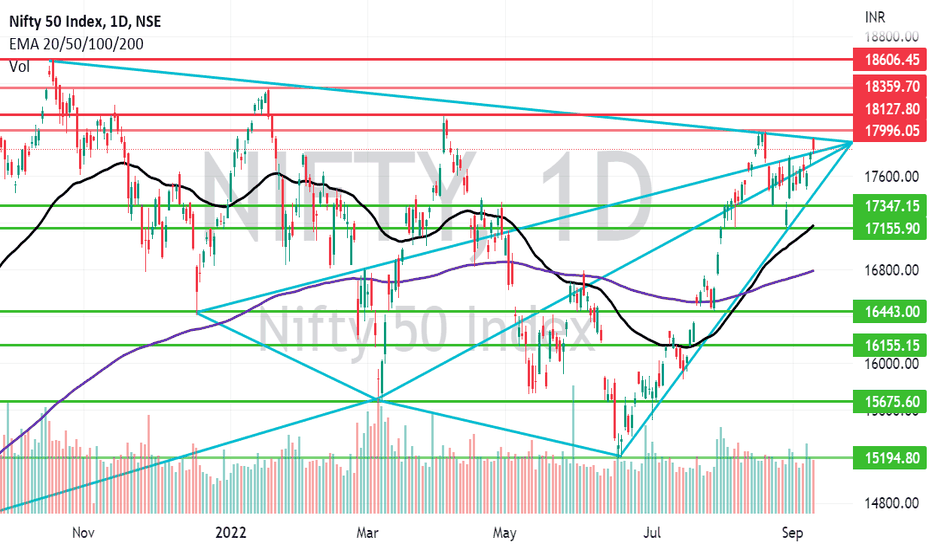

Nifty Important Chart For Further MoveOn the daily chart the index is trading near resistance and closing above 18040 will trigger further buying.

A small correction will give good up side momentum the the index.

On the flip side closing below 17000 will change the direction and 15600 will be potential zone to reach.

Pink - Channel

Green - Immediate support

White - Long term support

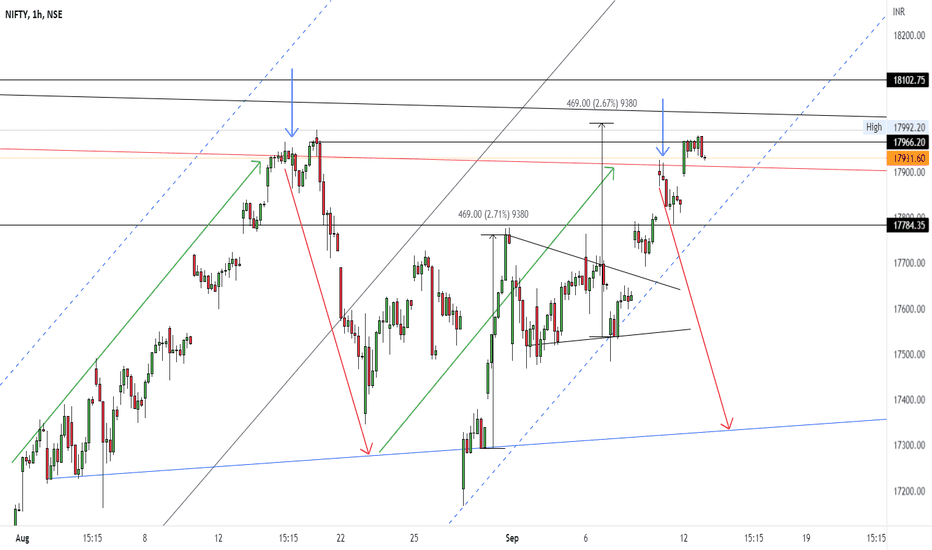

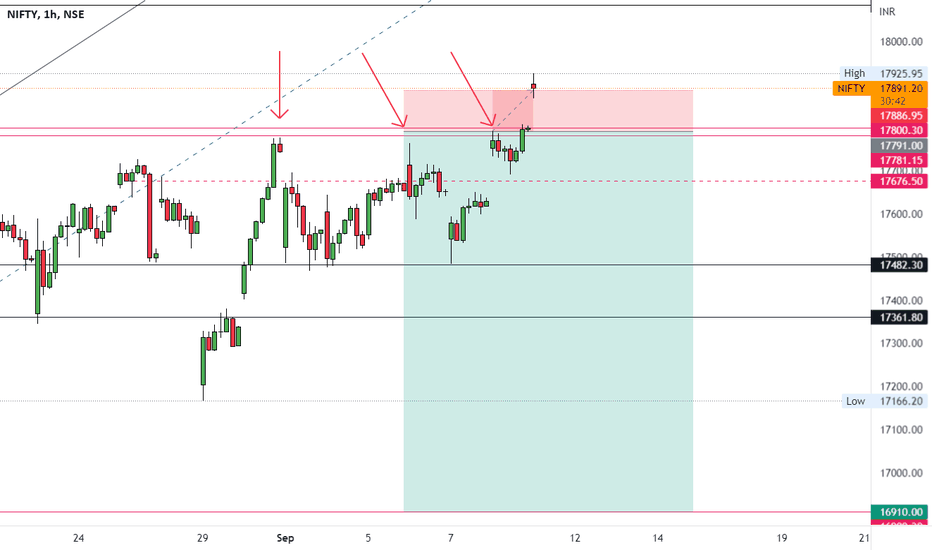

Nifty Important levels and trade plan for Monday, 12.09.22If we see SGX Nifty, it is at an important resistance zone and RSI is over level 60 in 15-minute time frame. And we may expect it to breakout the resistance zone and then by tomorrow morning it may reach the next resistance zone almost 70 points above the current level and in that case, we may see a gap up opening of almost 100 points, in Nifty tomorrow. But if SGX nifty respects the first resistance zone then we may expect a reversal form here and then we may see a gap down opening of 60 points in Nifty tomorrow. So, without any big event, there will be no possibility for nifty to open huge gap up or down. (it is my expectation, based on conditions, not prediction)

On daily time frame Nifty is in correction of an upward trend, and it will be considered as bullish until over 17645. Now in case of flat opening, we will enter into sell trade if nifty breaks the low of first five-minute candle, below 17859, 17803, 17742 and 17695 will be the target levels in downside. For opening near 17803, we will wait for initial profit booking and after nifty forming a proper lower low, will enter into a trade. Will avoid bullish trade in this scenario. However depending upon the conditions, if Nifty reaches near 17695, then we may consider a bullish trade.

Nifty opening flat and then after crossing 17902 level with a price action, will enter into bullish trade. 17947, 18007 and 18069 will be the important resistance levels. For any opening near and above 17907 level also, we may witness an upside spike at the opening and after initial settlement, may enter a bullish trade. Range between 17859 and 17902 will be considered as no trade zone for directional traders. and depending upon the option IV we may enter a long straddle or strangle in this zone.

OI data looks little bearish having huge OI present in 17900 and 18000 levels in CE side, compared to no significant OI in PE side.

*All support and resistance plotted are based on PDH/PDL. For any reversal after breaking PDH/PDL, support and resistance levels will be different*

**Time of plotting the levels and planning 11th September, 11:40 AM**

***Personal opinion, not a trading advice***

#NIFTY50

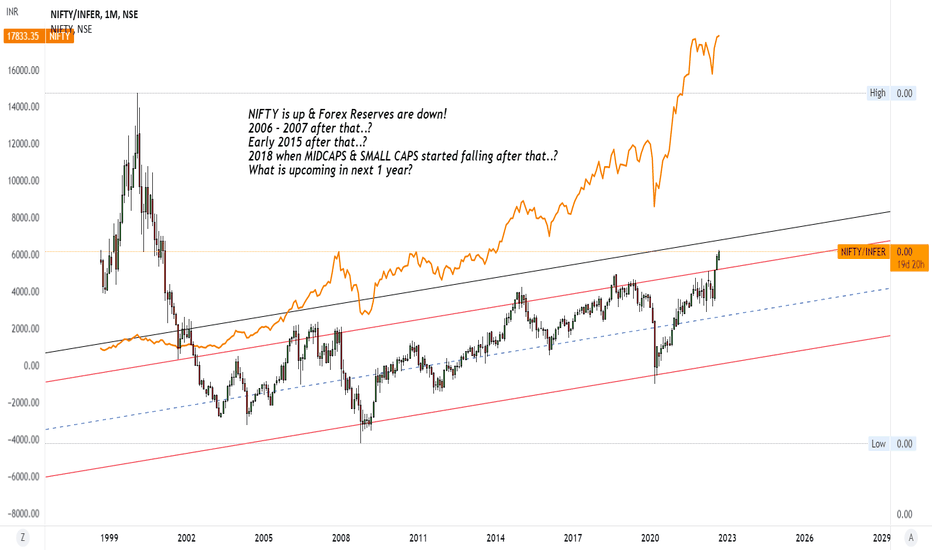

NIFTY/INFER - NIFTY Indian Forex Reserve ratio saying it all!NIFTY is up & Forex Reserves are down!

2006 - 2007 after that..?

Early 2015 after that..?

2018 when MIDCAPS & SMALL CAPS started falling after that..?

What is upcoming in next 1 year?

Please do like, share & subscribe!

Also do comment your views for upcoming days, weeks months & year!

Weekly Market Outlook

Nifty this week has given bullish signals. Indications for the next week or so are positive. For NIFTY to crossover to the bullish zone it needs to cross the most important resistance zone of 17925 to 17996. If this zone is crossed we can see the levels of 18127, 18359 or higher.

Most Important Resistance zone: 17925 to 17996.

Other Resistances: 18127, 18359 and 18606.

Support levels: 17786, 17561, 17416 and 17347.

Nifty Levels & Strategy for 12/09/2022Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please don’t trust me or anyone for trading/investment purpose. Focus on learning how to fish, trust your own skills and please do consult your financial advisor before trading.

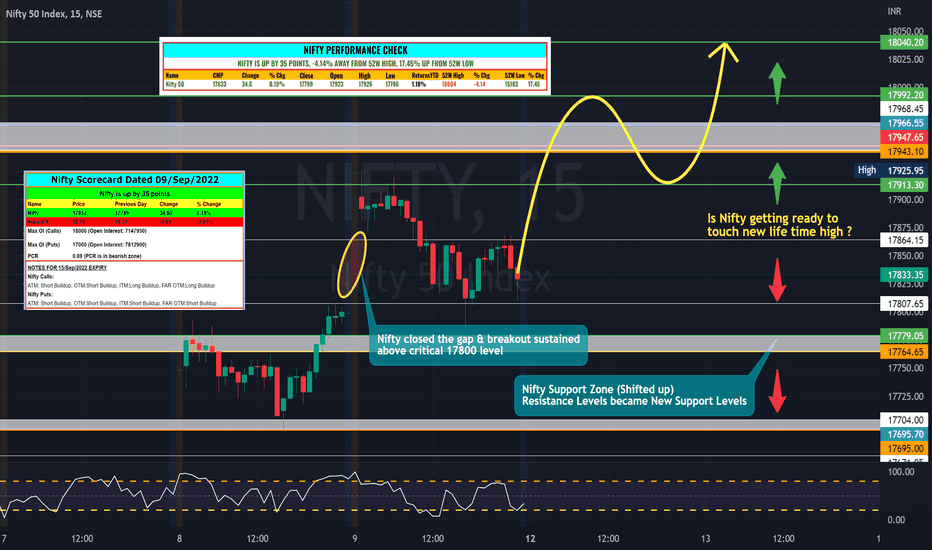

NIFTY

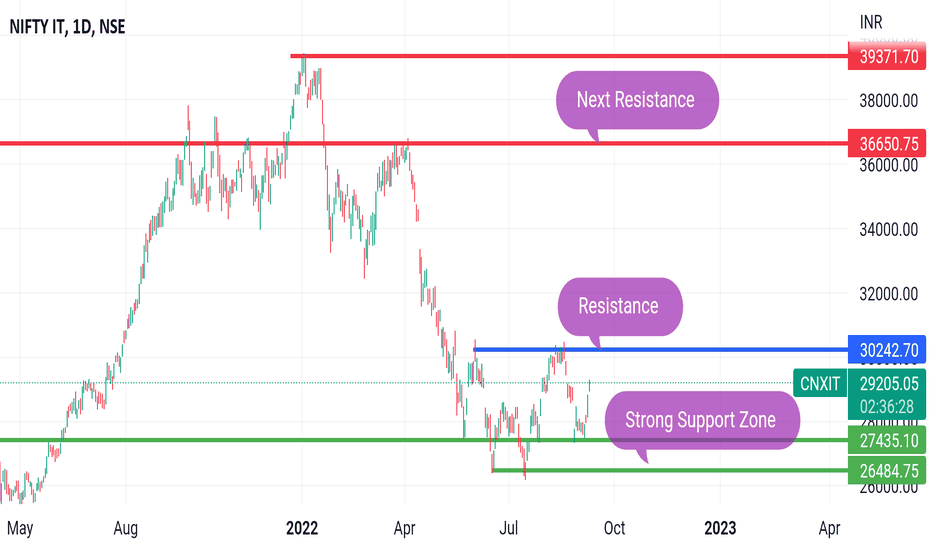

Nifty is up by 35 points. It’s really important to understand that Nifty has sustained 17800 plus critical make or break levels amid global issues & profit booking by big traders. PCR is down from 1.17 (bullish zone) to 0.89 (bearish zone). Overall, Nifty performed well and hit the majority of the targets as expected. It's really difficult for option writers to manager gap-ups & gap-downs. These days, we are having higher swings in both the direction due to high liquidity and better retail traders participation. Support Zone in Nifty is shifted up. Important resistance levels became new support levels. IT sector has started performing now. Hoping, it will lift Nifty to new lifetime high.

Will Break out in Nifty sustain amid global issues? Answer is yes, breakout is sustained.

Is Nifty getting ready to touch new lifetime high?

If Nifty crosses & sustained above 18000 level, then shall we expect Nifty to move further up?

Highest open interest on call side at 18000 (Remained at same level)

Highest open interest on put side at 17000 (Shifted down from 17500 to 17000)

BANK NIFTY

Bank Nifty is up by 207 points. Bank Nifty performed well and closed above 40K level which should be considered really good amid ongoing global issues. Bank Nifty comfortably traded above 40K even after significant rate hike of 75 basis points by ECB.

Highest open interest on call side at 40500 (Shifted down from 41000 to 40500)

Highest open interest on put side at 39000 (Shifted down from 39500 to 39000)

Shall we continue look for sell on rise opportunities? I don’t think so. What do you think?

Shall we continue look for buy on dips opportunities near major support? Yes, I think so. What do you think?

Please do share your comments. Have a very happy, healthy & profitable day ahead!

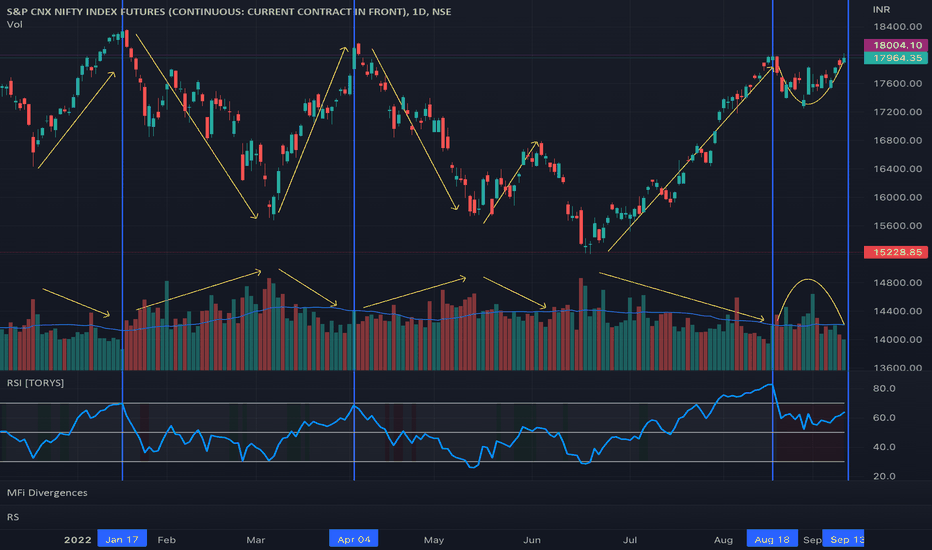

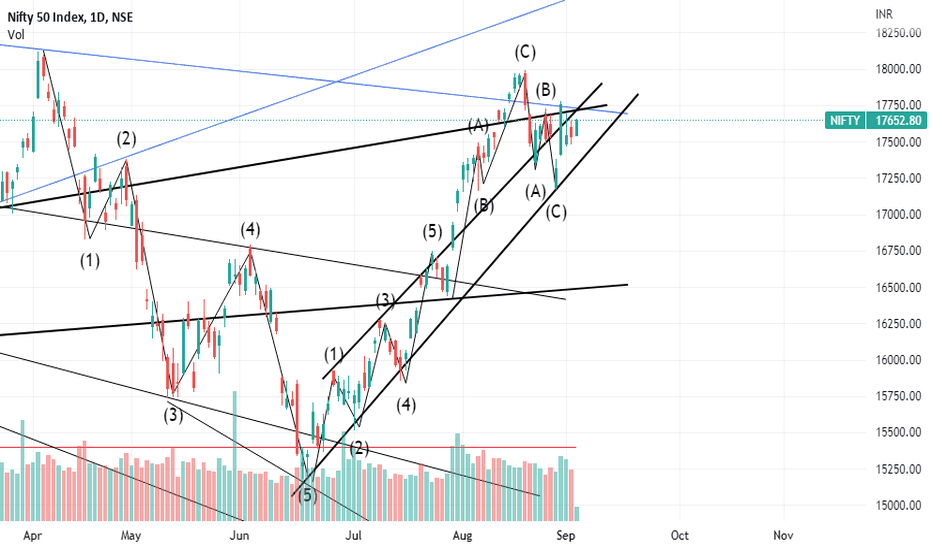

update on nifty 50 analysisi had previously posted the same analysis of nifty 50, and here i have brought you an update.

markets are in bull rally, and i guess a sort of bull rally is gonna over after going up by 50-100 points.

after that if the markets rise further(which has a good chance because fii are entering), so that will not carry the bull rally, it will just be a bullish nature, i believe such because the market had got its impulse movement from this rally. and on top of that, nifty chart has covered all the international news as such. plus, fii have sold there stakes and made there profits, now they are re- entering the markets.

and if the markets falls, then it will say, people have yet to make out the profits, and they will realise there profits by selling.

Nifty Levels & Strategy for 09/09/2022Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please don’t trust me or anyone for trading/investment purpose. Focus on learning how to fish, trust your own skills and please do consult your financial advisor before trading.

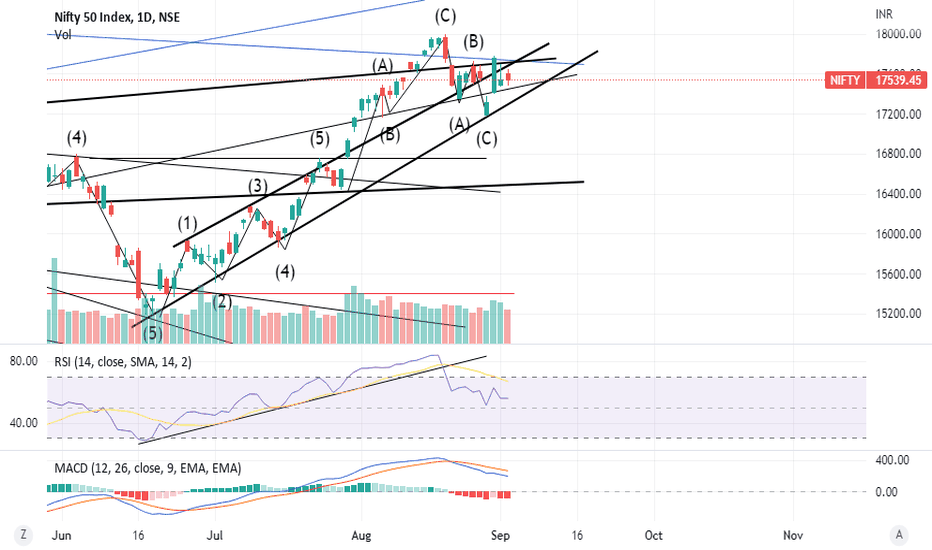

NIFTY

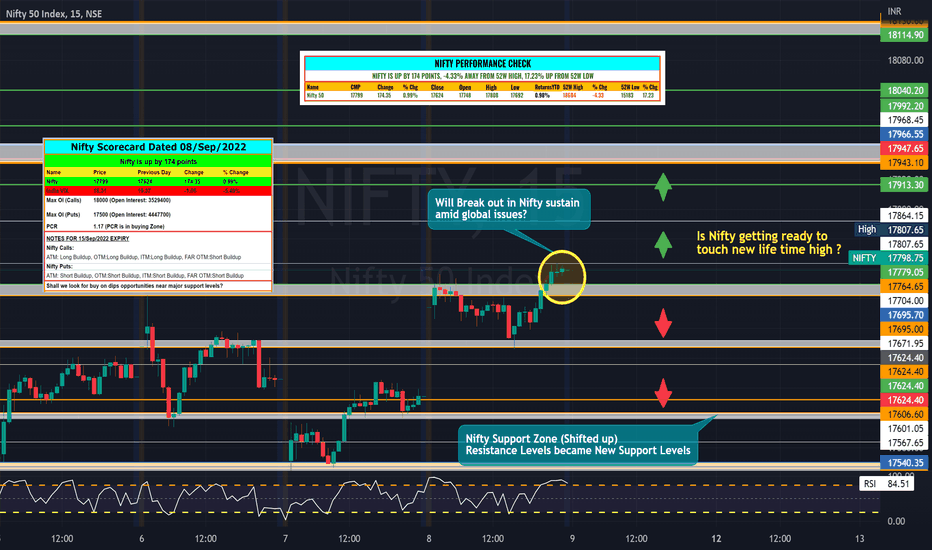

Nifty is up by 174 points. Steller performance by Nifty. PCR shifted up from 0.92 (bearish zone) to 1.17 (bullish zone). Nifty performed beyond expectation and hit all the targets. Option writers also made good money as most of them timely close CE leg and PE writing continued through the trading session. Today we had a very nice trending day and retail traders could make good money based on their huge overnight buy position in F&O contracts. Support Zone in Nifty is shifted up. Resistance Levels became New Support Levels.

Highest open interest on call side at 18000 (Remained at same level)

Highest open interest on put side at 17500 (Shifted up from 17000 to 17500)

BANK NIFTY

Bank Nifty is up by 753 points. Extra ordinary performance by bulls lifted up Bank Nifty beyond the major resistance zone. It will be interesting to watch whether breakout will sustain amid global issues and after ECB hike by 75 to 100 basis points today or it will get back into previous trading range.

Highest open interest on call side at 41000 (Shifted up from 40000 to 41000)

Highest open interest on put side at 39000 (Shifted up from 39000 to 39500)

Will Break out in Nifty sustain amid global issues? Is Nifty getting ready to touch new life time high ?

Shall we continue look for buy on dips opportunities near major support levels?

My view is neutral with positive bias. However let us see how global markets reacts overnight after ECB hike. Please do review & analyze EOD closing data for preparing tomorrow's trade plans.

Please do share your comments. Have a very happy, healthy & profitable day ahead!