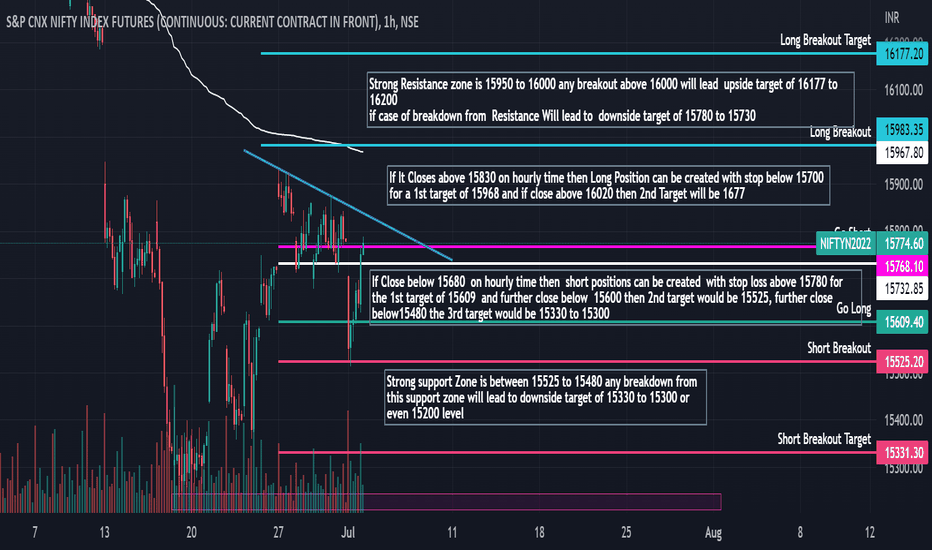

NiftyFutures Key Trading Levels Weekly 4th July to 8th July#Nifty50 Futures Key Trading Levels Weekly 4th July to 8th July.

Strong Resistance zone is 15950 to 16000 any breakout above 16000 will lead upside target of 16177 to 16200.

if case of breakdown from Resistance Will lead to downside target of 15780 to 15730.

If It Closes above 15830 on hourly time then Long Position can be created with stop below 15700 for a 1st target of 15968 and if close above 16020 then 2nd Target will be 1677.

If Close below 15680 on hourly time then short positions can be created with stop loss above 15780 for the 1st target of 15609 and further close below 15600 then 2nd target would be 15525, further close below15480 the 3rd target would be 15330 to 15300

Strong support Zone is between 15525 to 15480 any breakdown from this support zone will lead to downside target of 15330 to 15300 or even 15200 level.

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Niftyexpiry

Nifty 50 Intraday Trade Setup for 07h July Expiry sessionThe Index rally in yesterday's trading session was excellent, with More than a 1% gain after the 21st of June. Global sentiment is Positive. Crude oil is trading below 100$ after may month, and now waiting for DXY to cool off to keep the momentum on.

On the daily chart, the Index is trading on the trend line resistance with a long bullish candle but still needs to sustain above 16,000 and close above it.

ABCD pattern activated, and the PRZ area is 16,344

XABCD pattern also triggered, and the Harmonic PRZ area is 16,610 for the short-term swing

Intraday

============

Used 30-minute TF to calculate the Intraday levels for the weekly Expiry. The lower Time frame also has a Positive Price structure for the target of 16,268.

Intraday Resistance : 16,030

Intraday Support : 15,900

Trade Accordingly

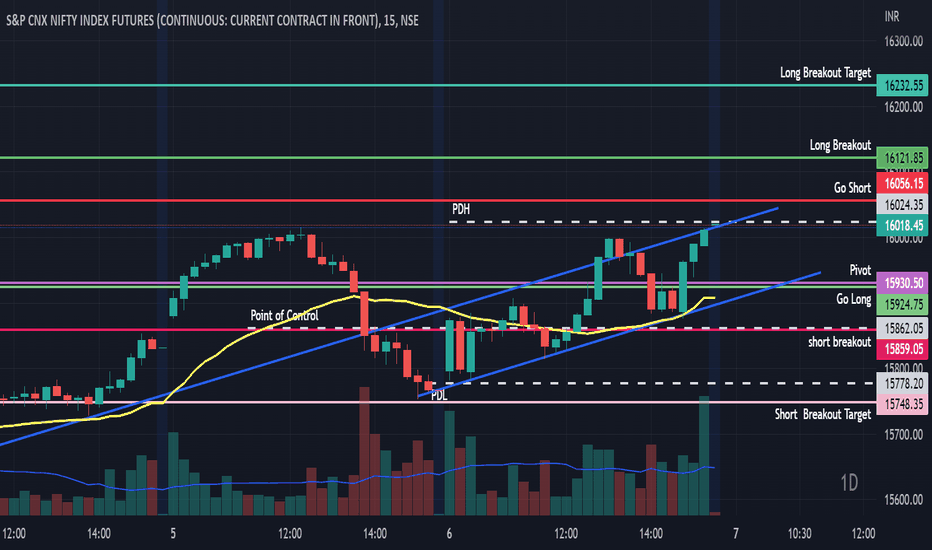

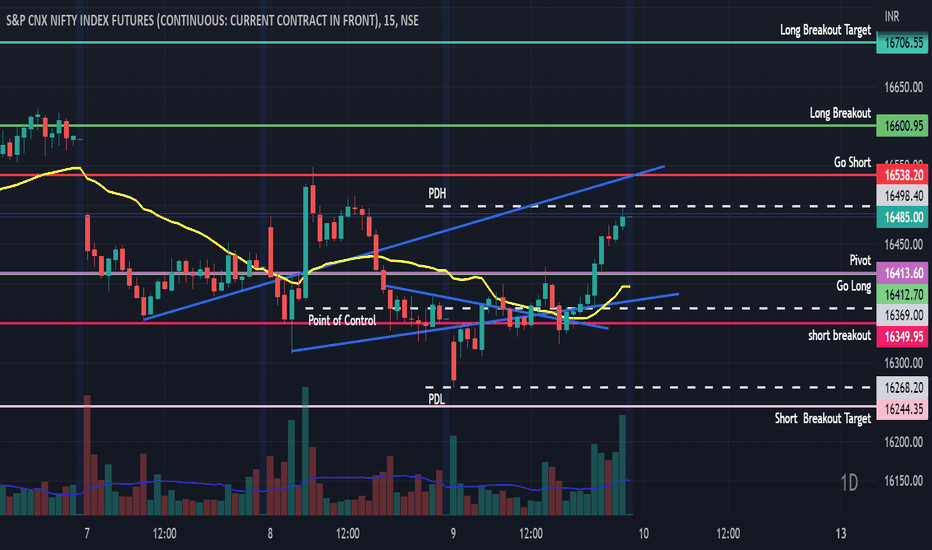

NiftyFutures Key Trading Levels 7th July 2022_Expirly LevelNiftyFutures Key Trading Levels 7th July 2022_Expirly Level.

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

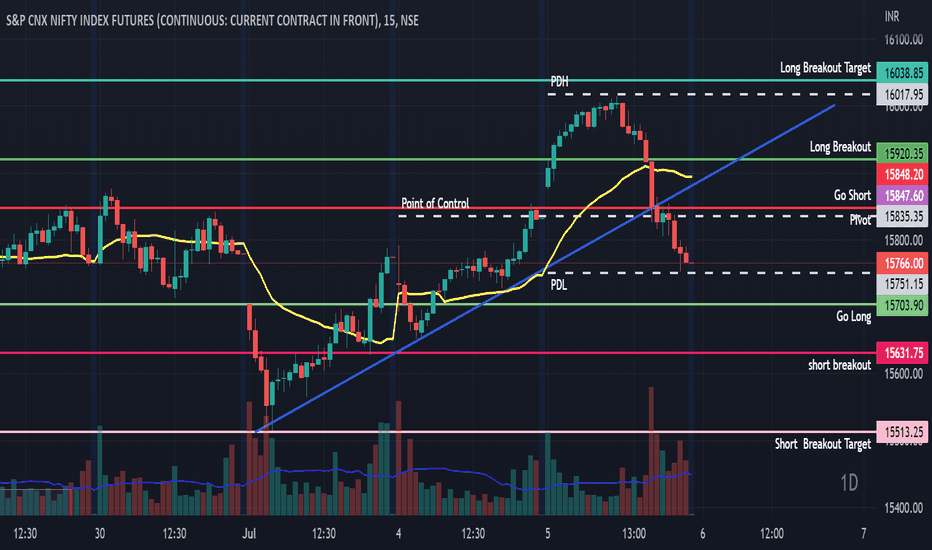

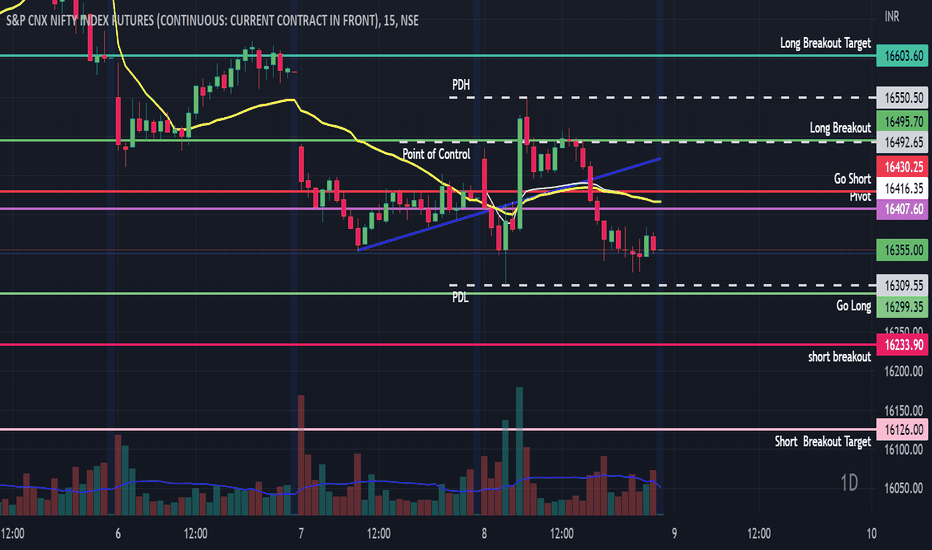

NiftyFutures Key Trading Levels 6th July 2022#Nifty50 Futures Key Trading Levels 6th July 2022.

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

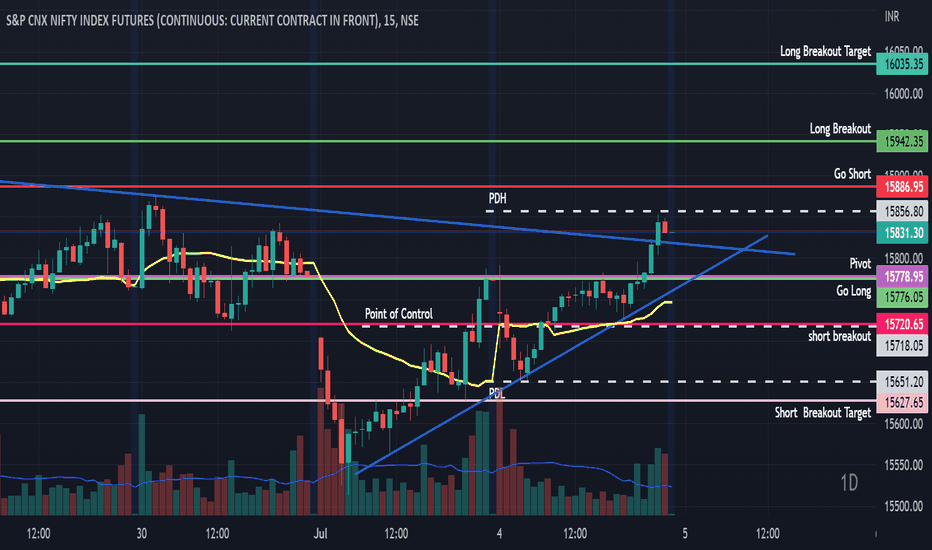

NiftyFutures Key Trading Levels Weekly 5th July 2022#Nifty50 Futures Key Trading Levels Weekly 5th July

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

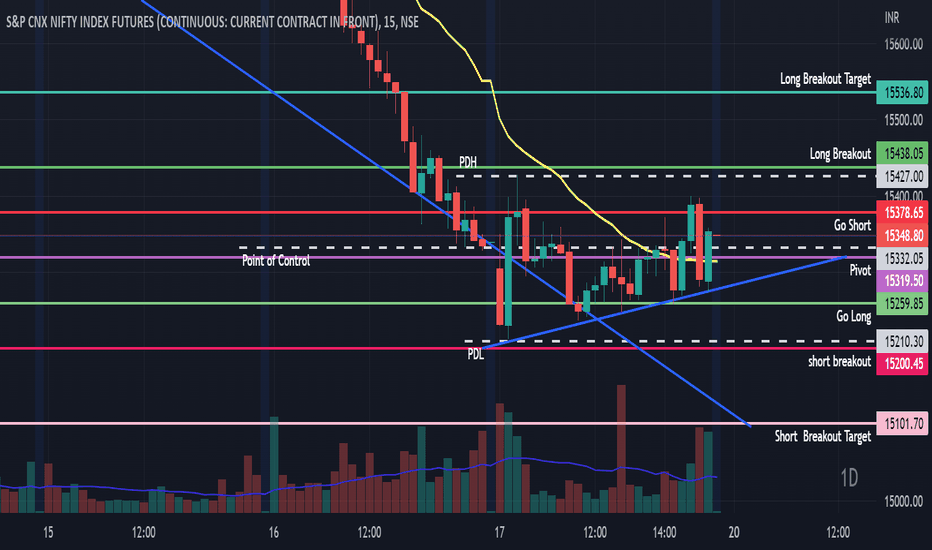

NiftyFutures Key Trading Level for 1st July 2022#Nifty50 Futures Key Trading Level for 1st July 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

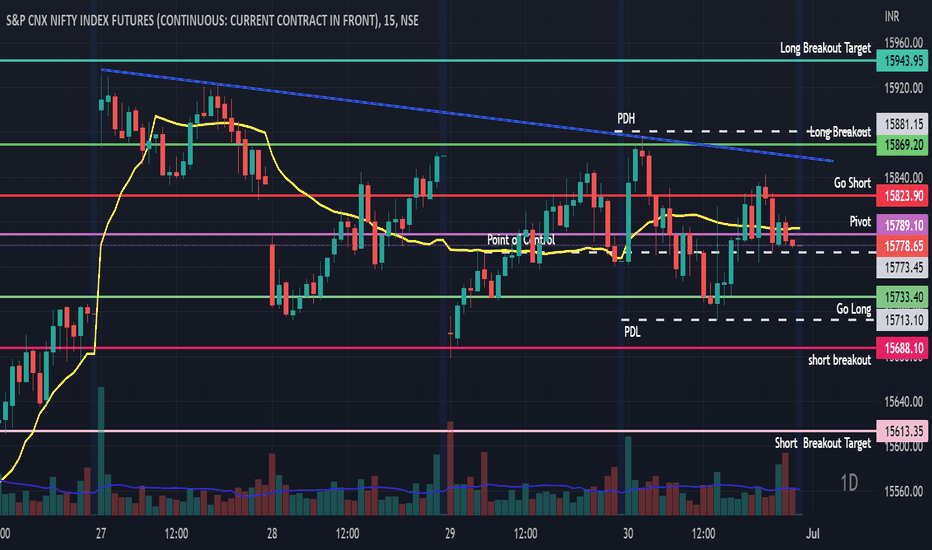

Nifty Futures Key Trading Levels for 30th June 22_monthly expiry#Nifty50 Futures Key Trading Levels for 30th June 22

Mostly Nifty May remain range bound to volatile

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

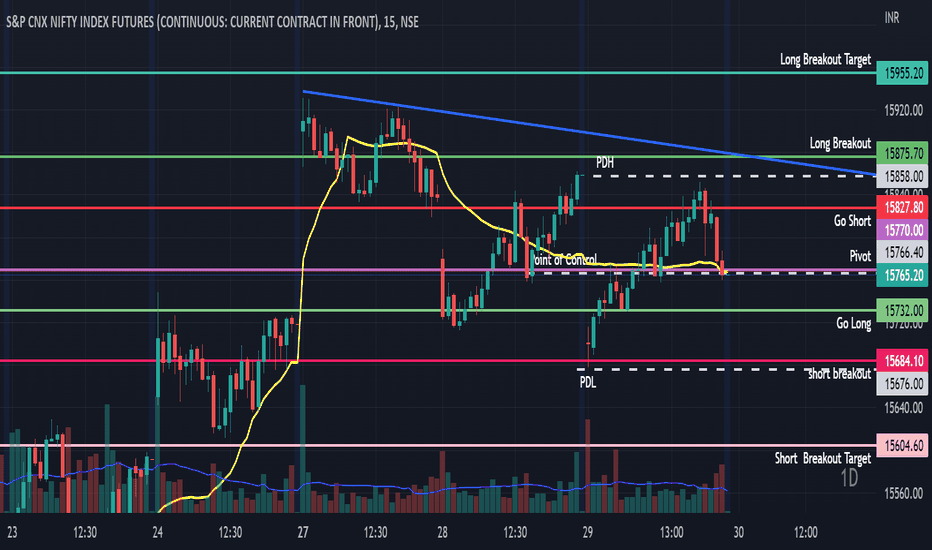

Nifty Futures Key Trading Levels for 29th June 22#Nifty50Futures Key Trading Levels for 29th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

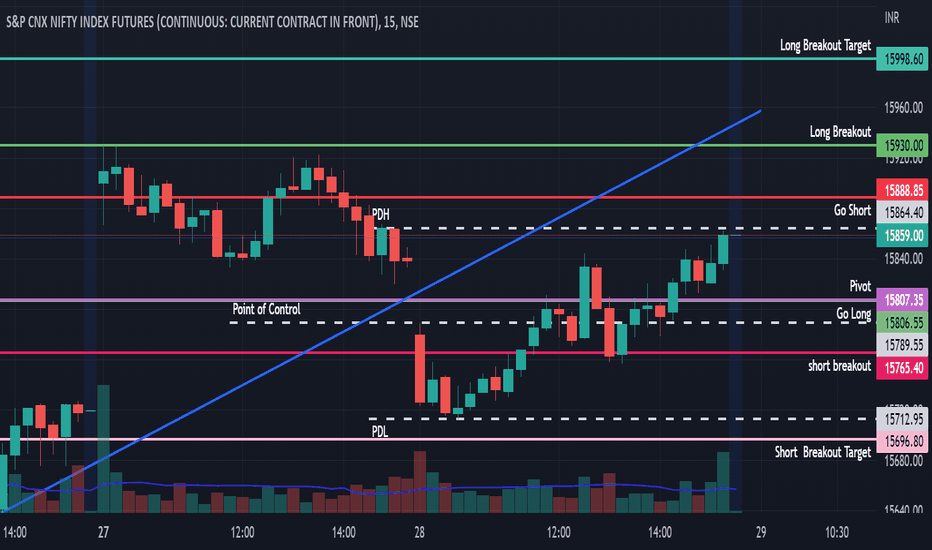

Nifty Futures Key Trading Levels for 28th June 22#Nifty50 Futures Key Trading Levels for 28th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

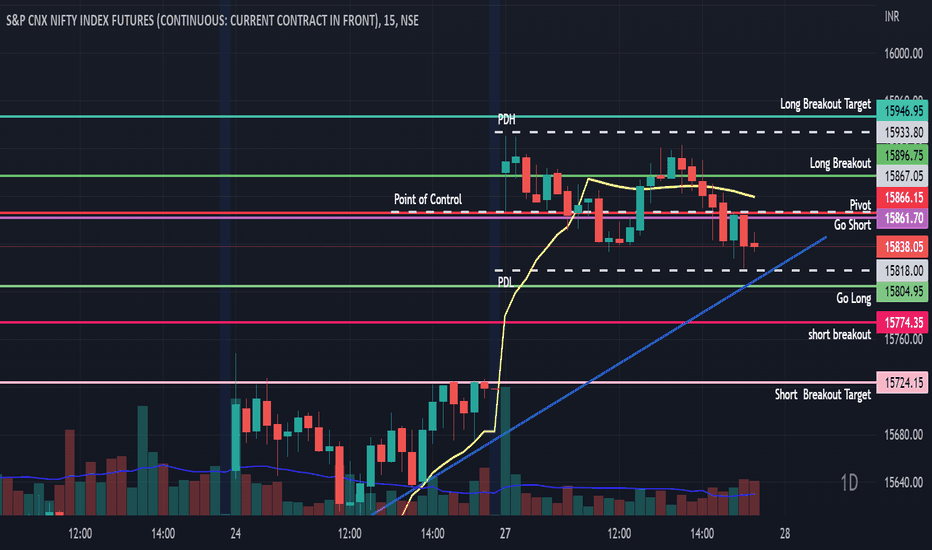

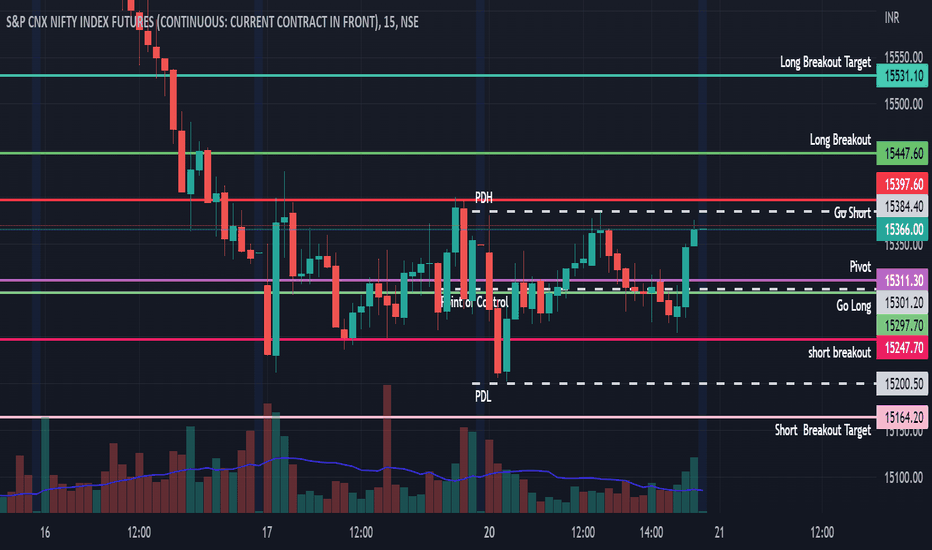

Nifty Futures Key Trading Levels for 27th June 22#Nifty50 Futures Key Trading Levels for 27th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

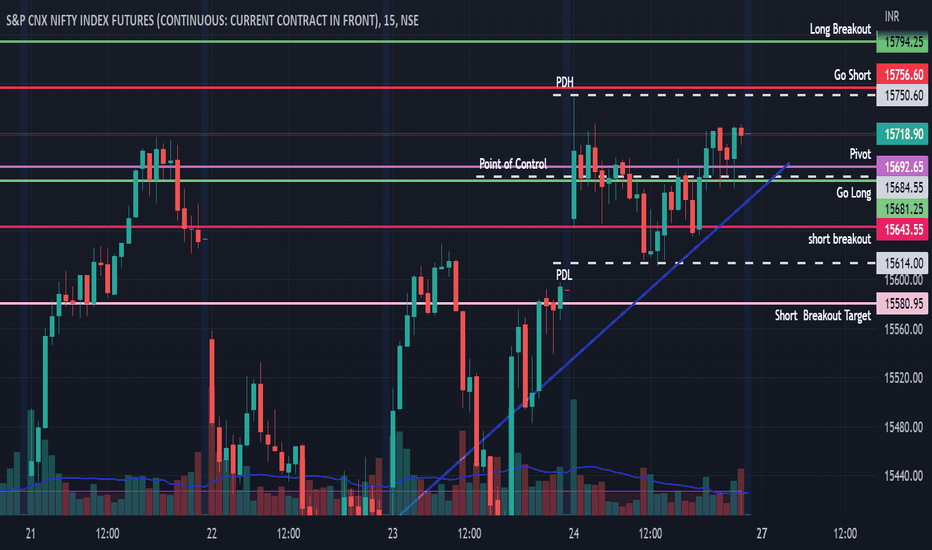

Nifty Futures Key Trading Levels for 23rd June 22#Nifty50 Futures Key Trading Levels for 23rd June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

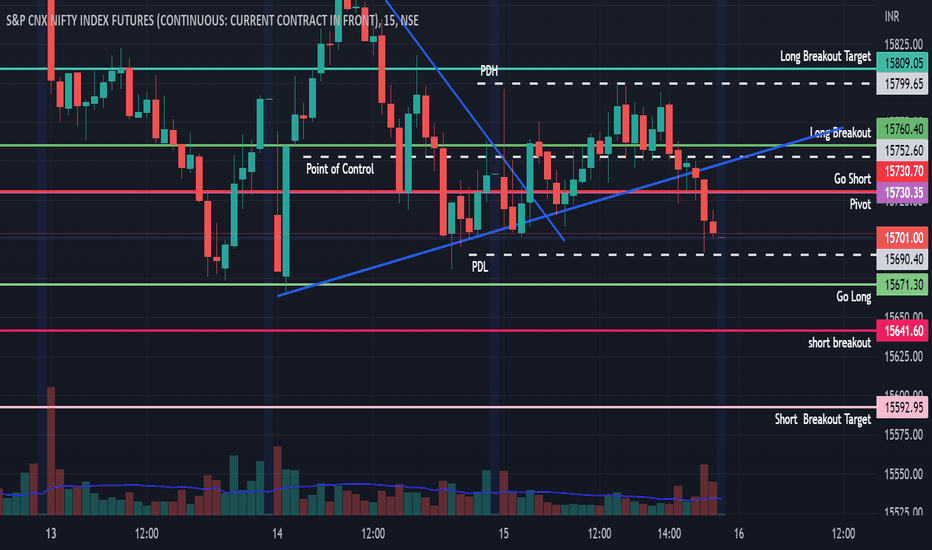

Nifty Futures Key Trading Levels for 22nd June 22Nifty Futures Key Trading Levels for 22nd June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

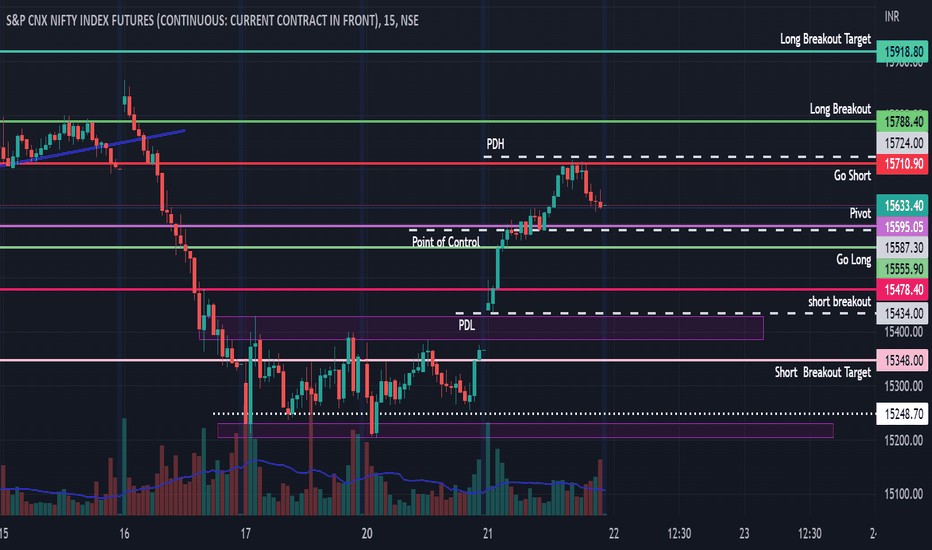

Nifty Futures Key Trading Levels for 21st June 22Nifty Futures Key Trading Levels for 21st June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Nifty Futures Key Trading Levels for 20th June 22#Nifty50 Futures Key Trading Levels for 20th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

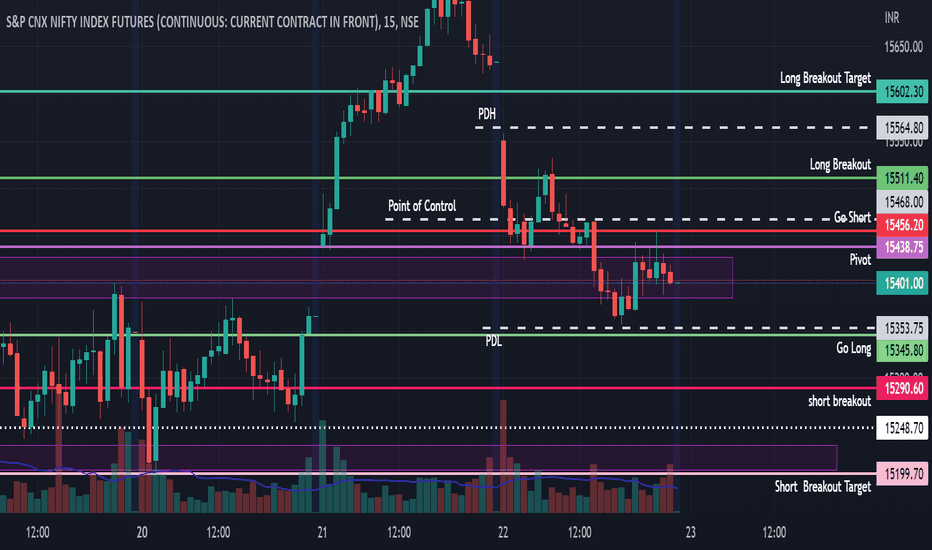

Nifty Futures Key Trading Levels for 16th June 22_Expiry#Nifty50 Futures Key Trading Levels for 16th June 22_Expiry

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

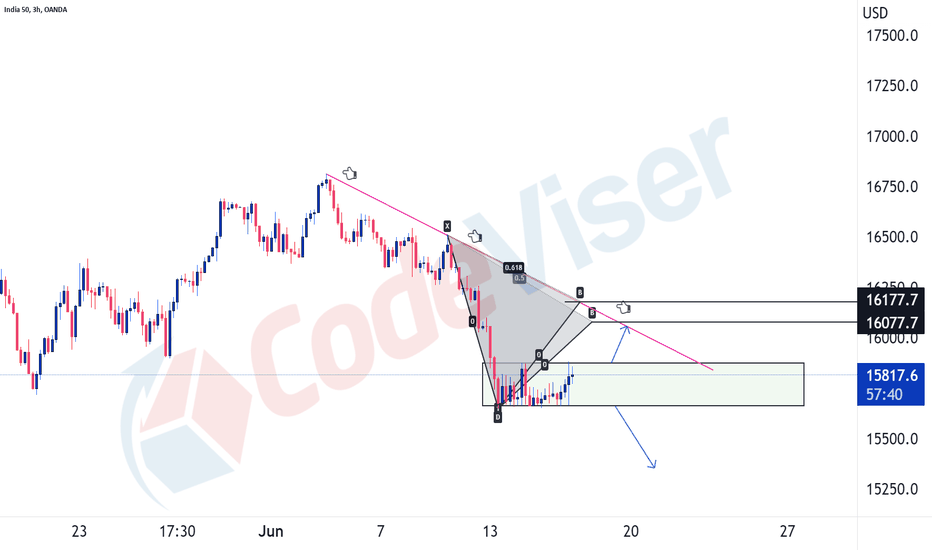

Nifty Trade Setup for 16th June - Expiry day Trade SsetupThe US Federal Reserve announced a 75-basis point rate hike on Wednesday, leaving the doors open for another rate increase of that magnitude, and US Markets rallied as investors looked favourably on the central bank’s tougher stance against inflation. The rate hike is in line with the expectations and has already been factored in and we can expect VIX to go down today.

Intra-day

After a sharp fall on expectations of a rate hike by the Fed, Index took support at 15,650 and is trading in the range of 15,650 – 15,850 with high volatility and a range break is required for a good move with momentum in either direction, else we may see a rangebound expiry today. The index is currently in the pullback phase after an impulsive down-move and can face resistance at 16,080 and 16,180 (Half Bat Pattern). Index is likely to open with a gap up around resistance and we will wait for 30-45 minutes before making any positions.

Nifty Futures Key Trading Levels for 15th June 22#Nifty50 Futures Key Trading Levels for 15th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Nifty Futures Key Trading Levels for 14th June 22#Nifty50 Futures Key Trading Levels for 14th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

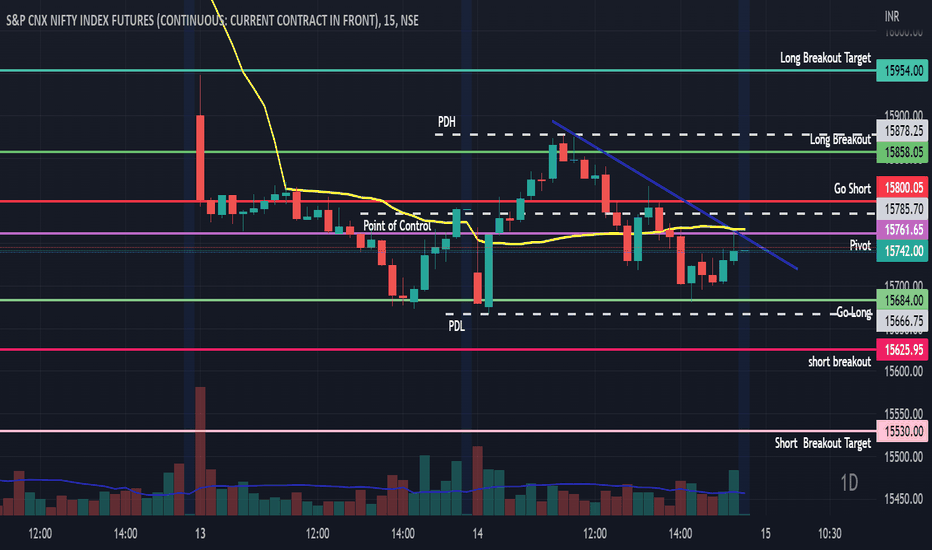

Nifty Futures Key Trading Levels for 13th June 22#Nifty50 Futures Key Trading Levels for 13th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Nifty Futures Key Trading Levels for 10th June 22Nifty Futures Key Trading Levels for 10th June 22

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

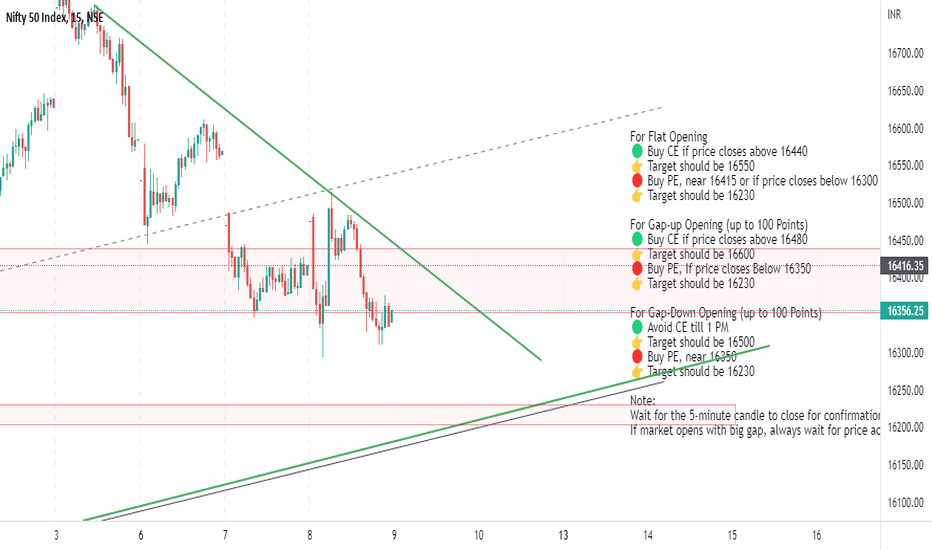

Nifty50 Analysis/Prediction for Expiry 09-06-2022 (Thursday)NSE:NIFTY Analysis/Prediction for Expiry 09-06-2022 (Thursday).

For Flat Opening

🟢 Buy CE if price closes above 16440

👉 Target should be 16550

🔴 Buy PE, near 16415 or if price closes below 16300

👉 Target should be 16230

For Gap-up Opening (up to 100 Points)

🟢 Buy CE if price closes above 16480

👉 Target should be 16600

🔴 Buy PE, If price closes Below 16350

👉 Target should be 16230

For Gap-Down Opening (up to 100 Points)

🟢 Avoid CE till 1 PM

👉 Target should be 16500

🔴 Buy PE, near 16350

👉 Target should be 16230

Note:

Wait for the 5-minute candle to close for confirmation.

If market opens with big gap, always wait for price action.

Nifty Futures Key Trading Levels for 9th June 22_Expiry#Nifty50 Futures Key Trading Levels for 9th June 22_Expiry

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

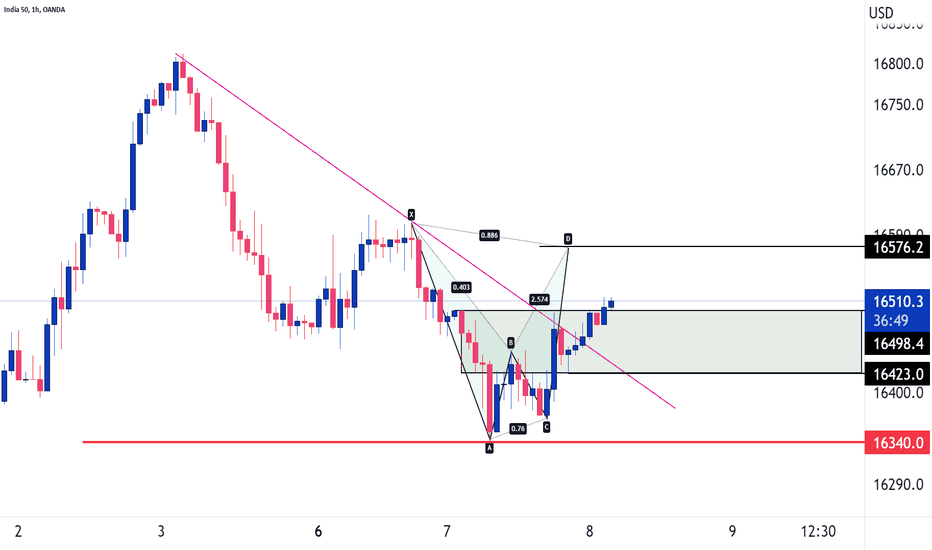

Nifty Trade Setup for 08th June. 2022The Nifty50 index extended losses for the third day to close a percent down yesterday, on caution ahead of the Reserve Bank of India’s monetary policy committee meeting outcome. As per our live trade set-up shared yesterday, Index made a dot reversal from ABCD PRZ level (16,346) but lacked momentum and traded in a range throughout the day thereafter. Even though the index reversed, only an option seller would have made money. That is why it’s important to choose the right segment.

Intraday

On a close-to-close basis, Index once again defended its strong support at 16,400/450 levels. The index has stopped making lower lows and broke the downward trendline resistance, activating the XABCD pattern with a potential target of 16,580 (if 16500 is broken and sustained). We will consider a short position only if the index sustains below 16,350 levels with a target of 16,270 (ABCD pattern on hourly TF). The index can also retest 16,000/50 levels if the negative sentiment continues.

Volatility is likely to persist and a clear direction may only emerge after the RBI policy outcome.