Niftylevels

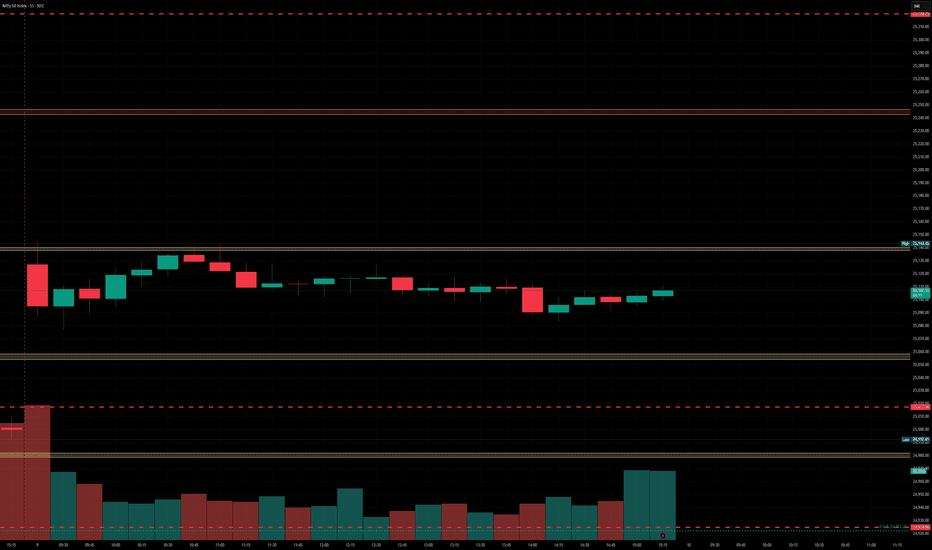

Nifty levels - Jun 16, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

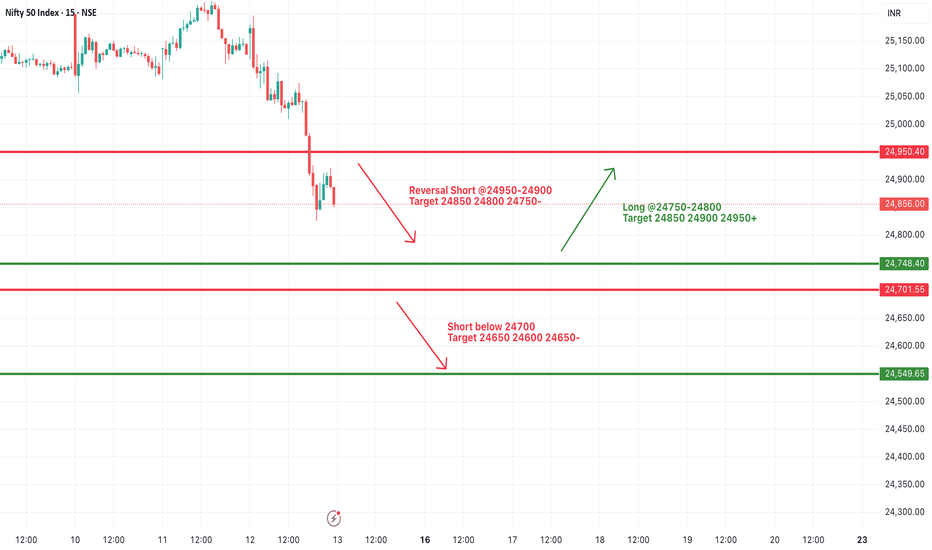

#NIFTY Intraday Support and Resistance Levels - 13/06/2025Today, a gap-down opening is expected in Nifty near the 24,700 level. If Nifty sustains below the 24,700 mark after opening, a continuation of the bearish trend may take place with potential downside targets at 24,650, 24,600, and even 24,550+.

On the other hand, if Nifty manages to reclaim the 24,750–24,800 zone and starts trading above it, we could see a short-term pullback or recovery rally towards 24,850, 24,900, and 24,950+ levels.

However, the 24,950 level will act as a strong resistance for today’s session — any upside attempt may see rejection or profit booking from this zone.

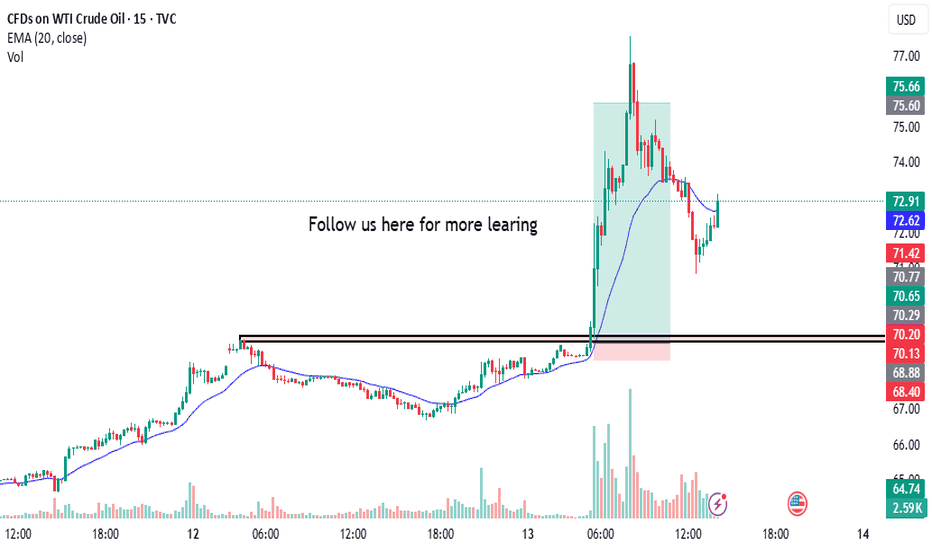

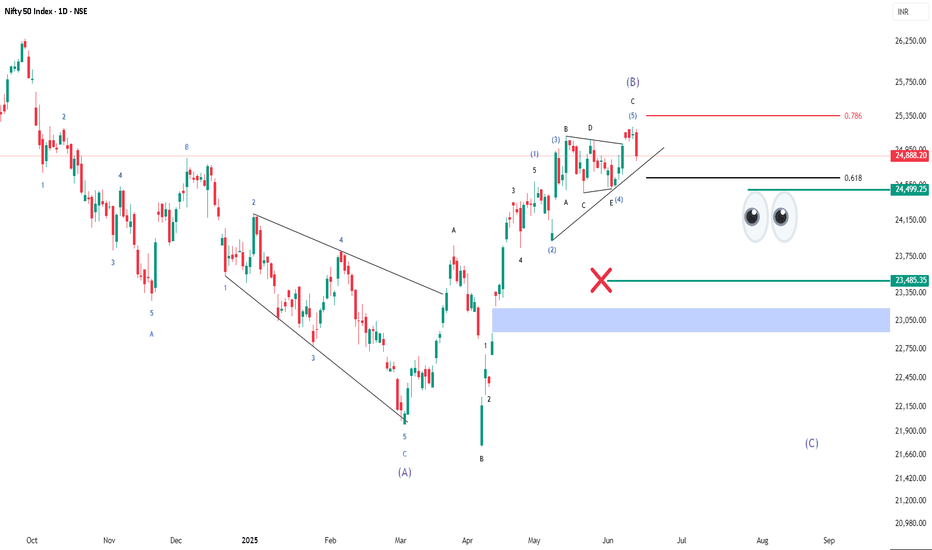

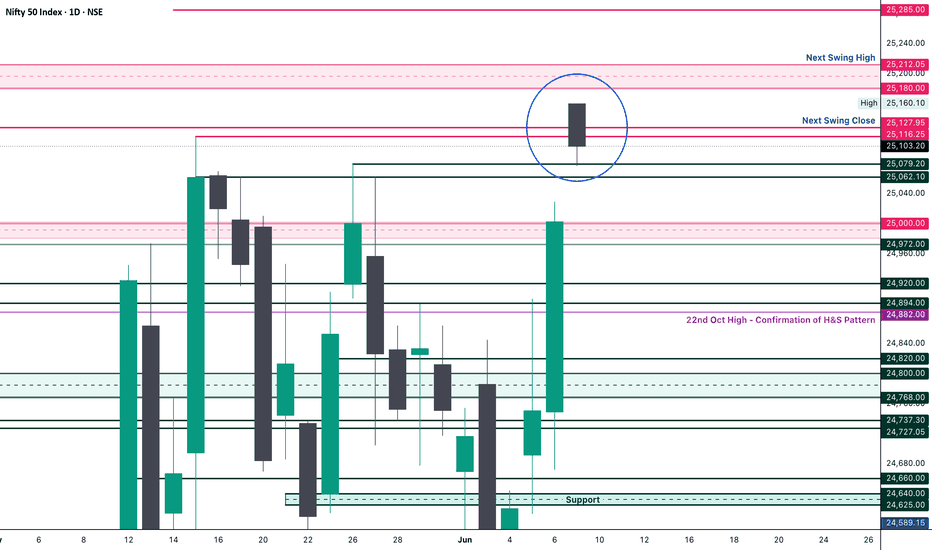

Things heating up between Iran and US. Market takes a nose dive.There is a news of things heating up between Iran and US with regards to Nuclear negotiations. It seems US has asked for reduction of staff at few embassies across the Middle East. In addition to the tragic plane crash in Ahmedabad also might have affected the sentiment. Market had already nosedived before the tragedy struck so it is hard to say it had any effect. Only logical explanation seems to be the Iran related escalation. On the technical Nifty was not able to hold above 25200 levels even after multiple attempts. This suggests upside-down there were currently no takes for the upside such scenario only leads to a correction and market diving to find a concrete bottom before beginning the next upward movement. The geo-political developments should be closely watched to speculate about further moves of market.

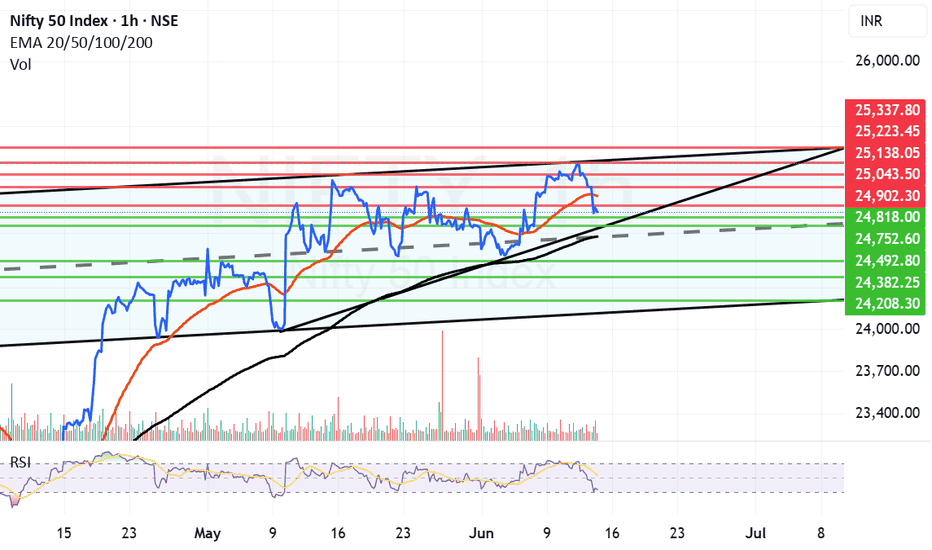

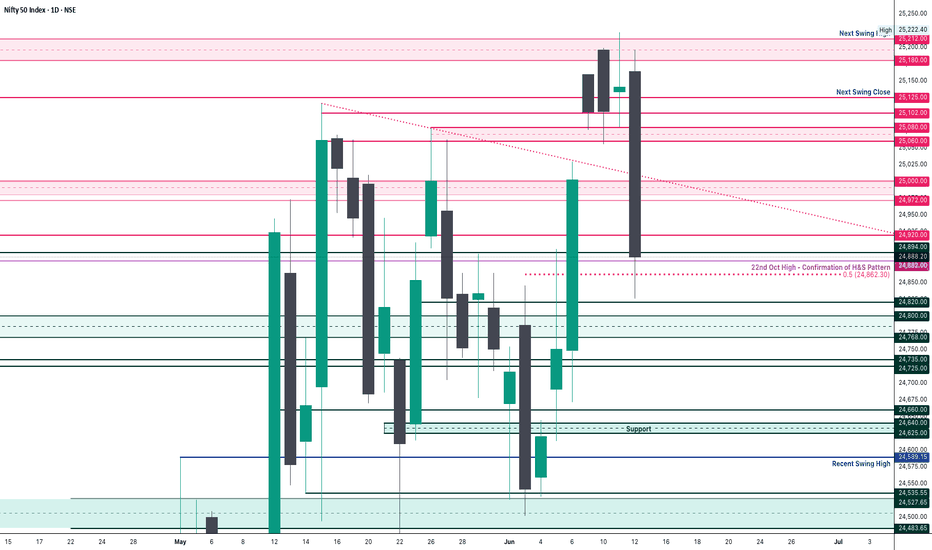

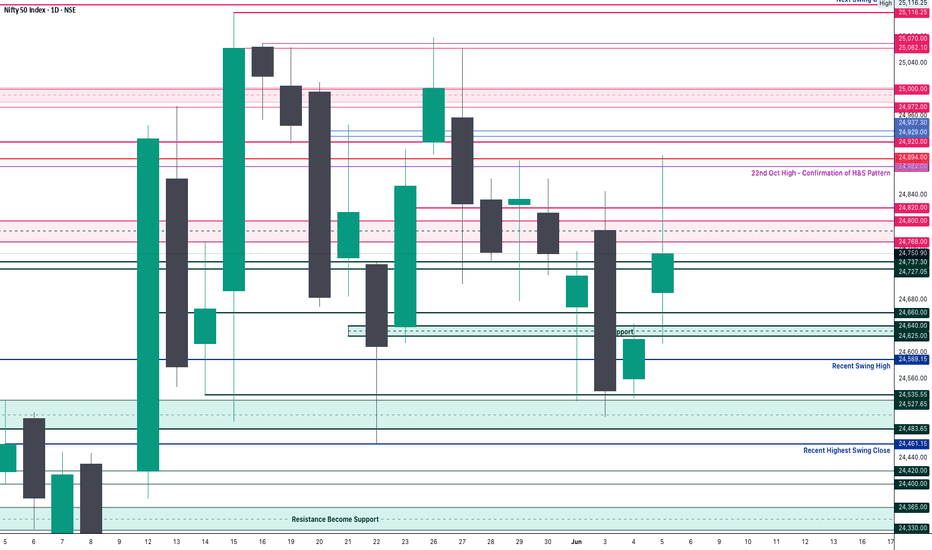

The zone between 24818 to 24672 has multiple supports including trend line support and mid-channel support and Father line support at 24672 as it can be seen in the chart. A closing below 24672 will only give the advantage to the bears who can further drag the Nifty towards 24492, 24382 or 24208 (Channel bottom support). Things get worse beyond this point but we will only talk about it if we get a closing below this level.

Resistance on the upside remain at 24902, 24974 (Mother line Resistance), 25043, 25138 and 25223. If we get a closing above 25223 then the channel top will be around 25337. Regarding the levels above 25337 we will post once we reach that stage.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

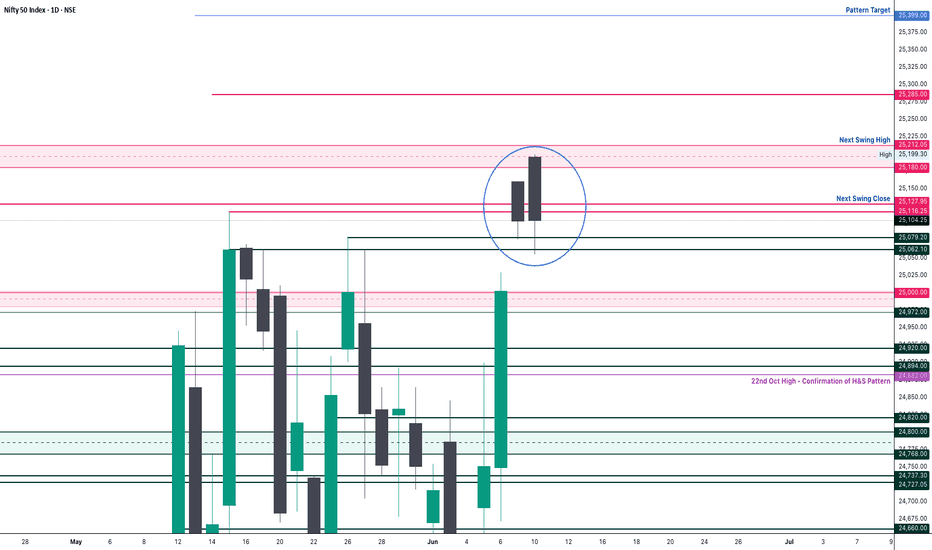

Nifty Analysis EOD – June 12, 2025 – Thursday🟢 Nifty Analysis EOD – June 12, 2025 – Thursday 🔴

📉 Range Breakout on Expiry – Bears Steal the Show

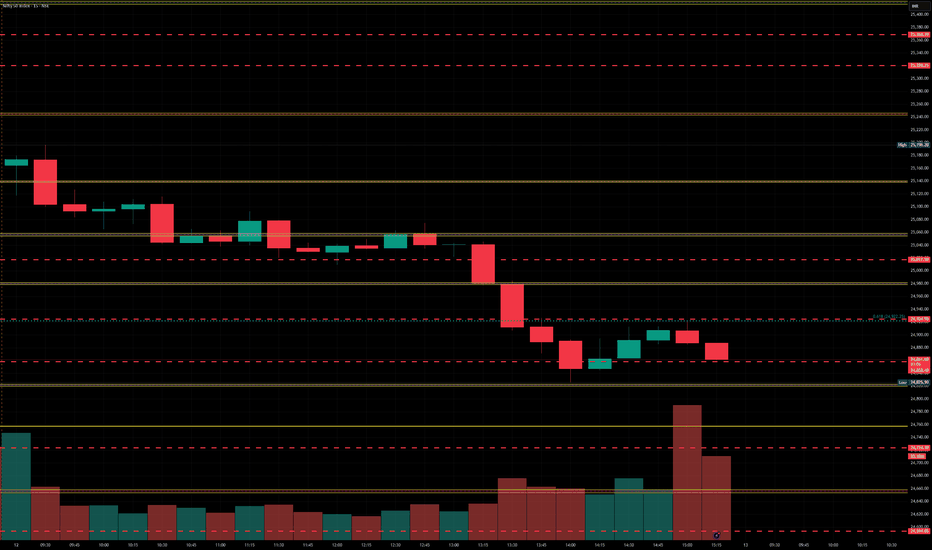

As highlighted in yesterday’s note — “Watch 25,222 on the upside and 25,080 on the downside for breakout” — Thursday’s expiry session decisively broke the range to the downside, unleashing a sharp bearish move.

Nifty opened strong at 25,164.45, briefly tested 25,196, but once again failed to challenge 25,200. The rejection triggered a slide to 25,083, and shortly after, the critical support of 25,080 gave way. This breakdown triggered long unwinding and fresh shorts, accelerating the fall all the way to 24,825.90 — a sharp 197-point drop.

Though there was a brief 90-point retracement, that too was sold into, and the index closed at 24,888.20 (adjusted), very close to the day’s low. This fall filled the Gaps created on June 6 and 9, and settled around the 0.5 Fibonacci retracement level (based on June 3 low to June 11 high).

With such a close, the market signals a strong shift in sentiment. Going ahead, 24800–24768 becomes a critical support zone. Bulls now need to reclaim and close above 25,020 to regain any strength. Until then, bias remains bearish.

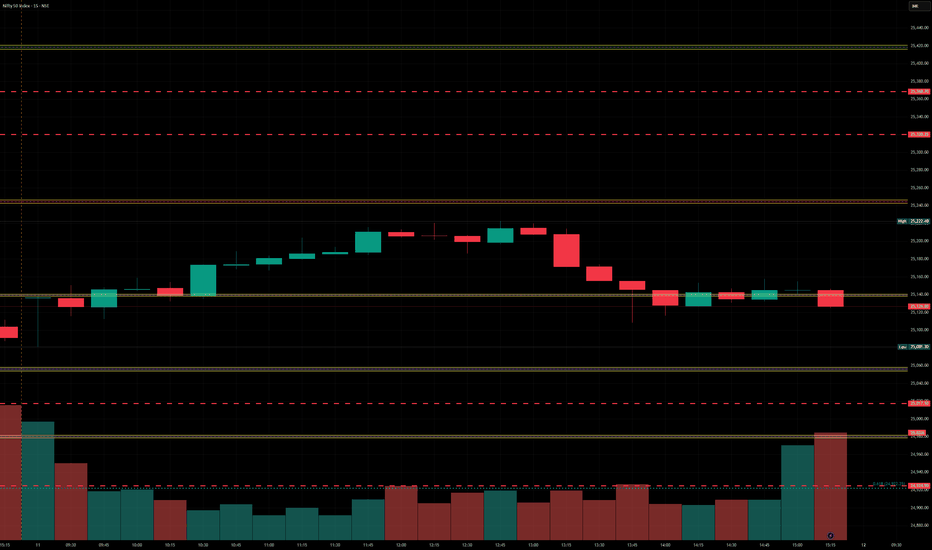

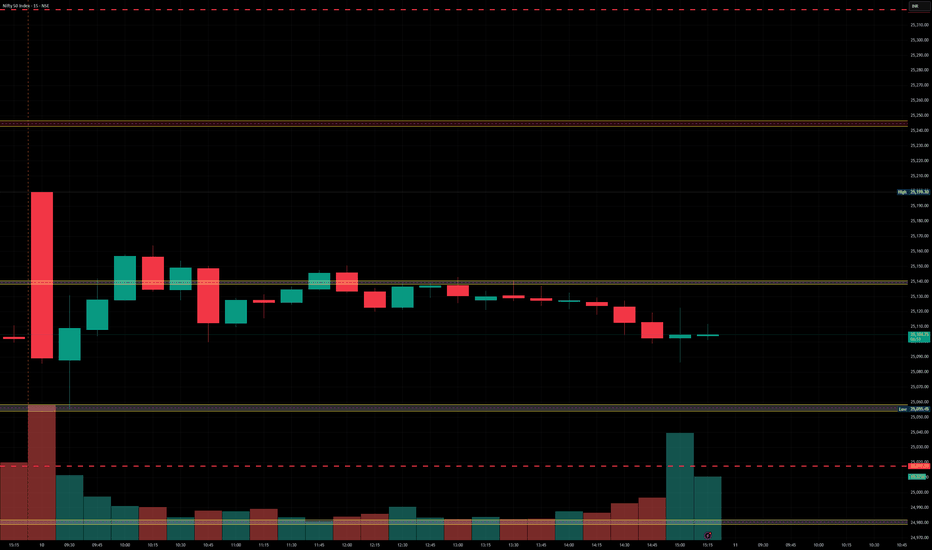

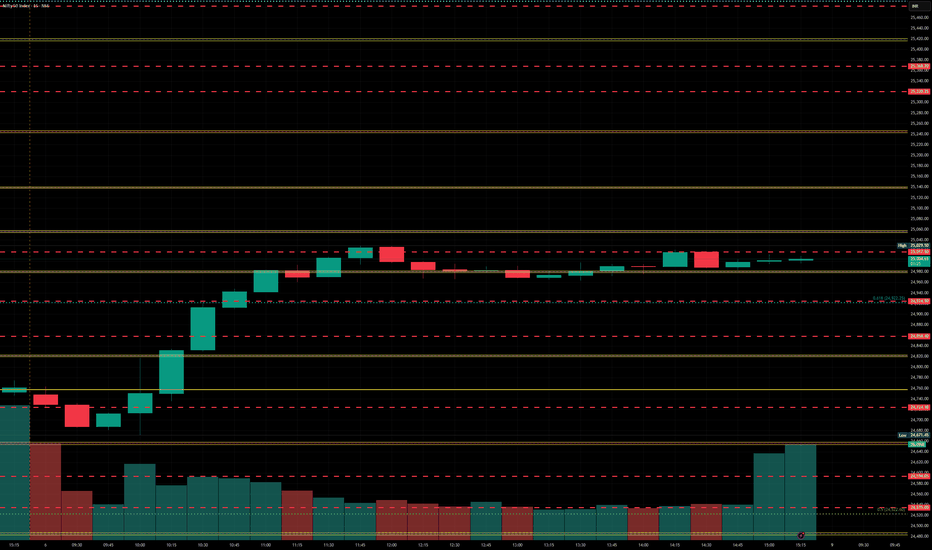

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 25,164.45

High: 25,196.20

Low: 24,825.90

Close: 24,888.20

Net Change: −253.20 (−1.01%)

📊 Candle Structure Breakdown

Real Body: 276.25 pts → 🔴 Strong Red Candle

Upper Wick: 31.75 pts

Lower Wick: 62.30 pts

🔍 Interpretation

Bears dominated from start to finish, with hardly any resistance from the bulls.

The close near the day’s low reinforces strong bearish sentiment.

The lower wick is minimal — buying interest was absent post-selloff.

🔦 Candle Type

🔥 Bearish Marubozu–like Candle– Reflects powerful downside momentum and strong seller conviction.

📌 Key Insight

The candle wipes out 3 sessions of buildup — textbook bearish breakdown.

Support at 24,820–24,850 is critical. A breakdown from here could invite deeper correction.

Only a close above 25,020 can negate this bearish tone. Otherwise, weakness may persist.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 252.81

IB Range: 131.4 → Medium IB

Market Structure: Balanced

Trades:✅ 11:10 AM – Short Triggered → Target Achieved, Trailing SL Hit (RR: 1:4.65)

📌 Support & Resistance Zones

Resistance Levels

24,920

24,972 ~ 25,000

25,060 ~ 25,080

25,102

25,125

25,180 ~ 25,212

Support Levels

24,820

24,800 ~ 24,768

24,735 ~ 24,725

24,660

24,640 ~ 24,625

💭 Final Thoughts

With a decisive range breakdown and expiry volatility behind us, the battle zone shifts to 24,800–25,000. Expect more pressure if bulls fail to reclaim 25,020.

🧠 “Markets don’t wait forever at the edge of range—they break, and break hard.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty levels - Jun 13, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

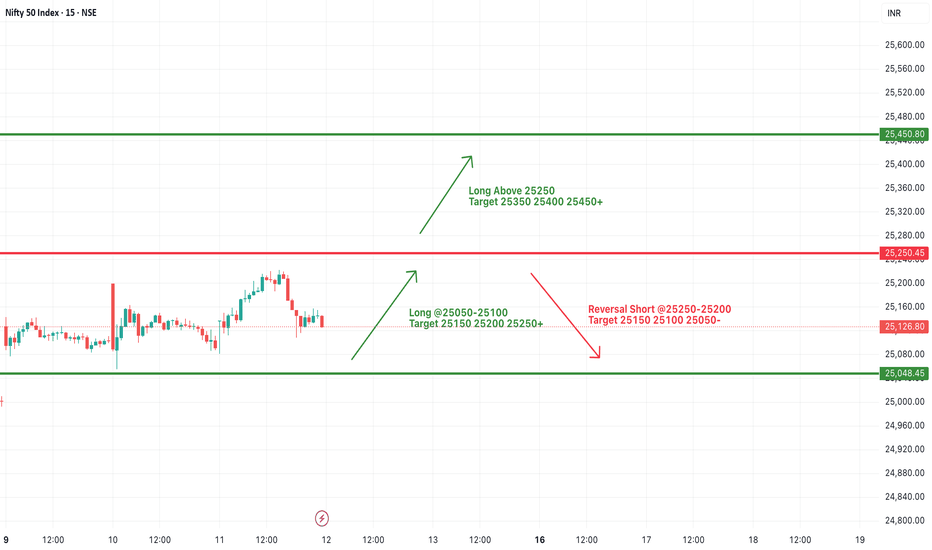

#NIFTY Intraday Support and Resistance Levels - 12/06/2025Today, a gap-up opening is expected in Nifty near the 25250 level. If Nifty sustains above this zone, we may see bullish momentum extending toward the targets of 25350, 25400, and potentially 25450+ during the session.

However, if Nifty fails to hold above 25250 and begins reversing below 25200, it could trigger a pullback move. A reversal short opportunity may arise in the 25250–25200 range with potential downside targets of 25150, 25100, and 25050.

Overall sentiment remains bullish above 25250, but volatility is likely near resistance levels. Traders are advised to keep tight stop-losses and trail profits cautiously, as the market may remain range-bound with occasional spikes.

Nifty Facing resistnace above 25200 zoneToday Nifty closing above 25141 is a positive sign but it is evidently facing resistnace above 25200 zone. Nifty made a high of 25222 today but could not sustain at those levels and fell but eventually closed in the positive. The daily candle formed is an indecisive Doji.

IT Sector seems to be on the verge of a Reverse Head and Shoulder Breakout. If this breakout happens and Nifty gets support from other heavy weights we can see it growing further.

The resistances for Nifty now are at 25222, 25270 and 25310.

The supports for Nifty are at 25104, 25044, 24977 (Mother line support of Daily chart and 24953 Channel bottom. Things are in balance with shadow of the candle slightly positive.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

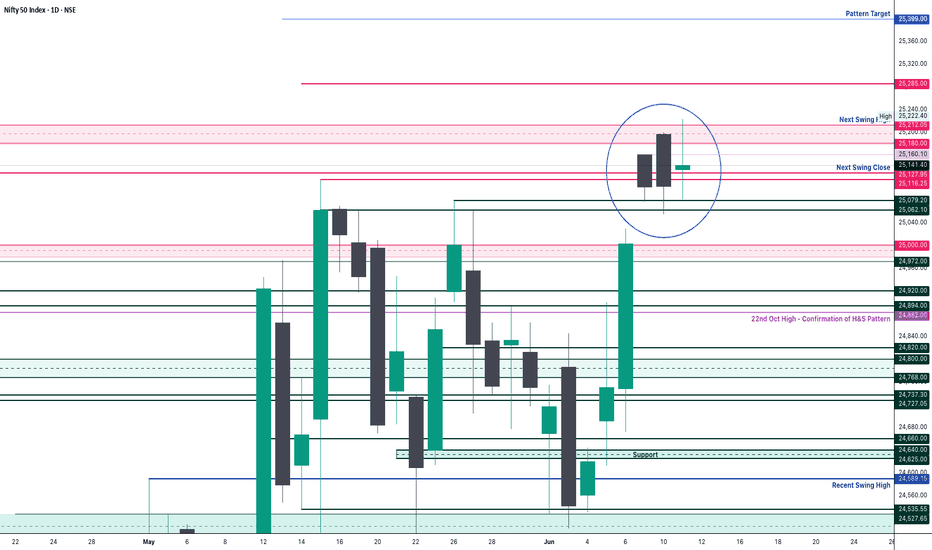

Nifty Analysis EOD – June 11, 2025 – Wednesday🟢 Nifty Analysis EOD – June 11, 2025 – Wednesday 🔴

♻️ Déjà vu Day – Bulls Attempt, Bears Resist

For the third consecutive session, Nifty started on a positive note with a 45-point gap-up at 25,134.15, but as has been the pattern lately, early optimism was wiped out instantly, with the index hitting the day’s low of 25,081 within the first 5 minutes.

What followed was a gradual climb as bulls gained some momentum, pushing Nifty to test the 25,200 zone. However, resistance in the 25,200–25,222 band proved too strong. Despite multiple attempts, bulls gave up the level around 13:20, triggering a sharp fall to 25,100.

Post-fall, the market struggled to recover and closed at 25,141.40, up just 37 points from the previous close. It was yet another rangebound, indecisive session, showing that the index is coiling for a potential breakout—but the direction remains uncertain.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 25,134.15

High: 25,222.40

Low: 25,081.30

Close: 25,141.40

Net Change: +37.15 (+0.15%)

📊 Candle Structure Breakdown

Real Body: 7.25 pts → 🟢 Small Green Candle

Upper Wick: 81.00 pts

Lower Wick: 52.85 pts

🔍 Interpretation

Strong intra-day swings in both directions signal high volatility with no control on either side.

Bulls failed at resistance (25,222); bears couldn’t break support (25,081).

The tiny real body with long shadows reflects market indecision.

🔦 Candle Type

⚖️ Spinning Top– Neutral structure with no clear directional conviction.

📌 Key Insight

The market is clearly taking a breather after recent moves.

Watch 25,222 on the upside and 25,080 on the downside — a breakout from either could set the next directional tone.

Bias stays mildly bullish as long as 25,080 holds, but it’s hanging by a thread.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 239.75

IB Range: 72.9 → Small IB

Market Structure: Balanced

Trades:✅ 10:30 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:1.65)

📌 Support & Resistance Zones

Resistance Levels

25,116 ~ 25,128

25,180 ~ 25,222

25,285

Support Levels

25,062 ~ 25,070

24,972

24,920 ~ 24,894

24,800 ~ 24,768

💭 Final Thoughts

Market is in a tight tug-of-war. No clear winner yet, but momentum can build quickly once a side gives in.Patience will pay—wait for the range breakout.

🧠 "Pressure builds silently before an explosion—so does the market before a breakout."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty levels - Jun 12, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

Nifty Analysis EOD – June 10, 2025 – Monday🟢 Nifty Analysis EOD – June 10, 2025 – Monday 🔴

🔄 Fallback From the Top – Another Rangebound Day

Nifty began the session on a bullish note with a Gap-Up of 97 points at 25,199.30, but that turned out to be both the Open and High of the day.

Within the first 20 minutes, the index plunged 144 points, even breaking below the previous day’s low, signaling a swift sentiment shift. However, just a few minutes later, it rebounded sharply and tested the previous day’s high — not surprising, given the narrow range of the prior session.

But after 11:00 AM, the action dried up. The rest of the day saw tight, sideways movement within just 35 points, eventually closing at 25,104.25, barely 1 point above the previous close.

On paper, it looks like a neutral session, but price action reveals weakness and distribution near the top. Bulls need to reclaim control quickly, or the door opens for a short-term dip.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 25,196.05

High: 25,199.30

Low: 25,055.45

Close: 25,104.25

Net Change: +1.05 (0.00%)

📊 Candle Structure Breakdown

Real Body: 91.80 pts → 🔴 Red Candle (Close < Open)

Upper Wick: 3.25 pts (Very Small)

Lower Wick: 48.80 pts

🔍 Interpretation

Price opened at the top, immediately reversed, and closed near the lower end of the day’s range.

Despite the flat close, the intraday structure is weak, showing signs of profit booking or early distribution.

The small upper wick reflects no follow-through buying.

🔦 Candle Type

🟥 Bearish Candle with Long Body and Lower Wick– Often seen during pullbacks or trend pauses.

📌 Key Insight

Support near 25,050–25,070 is critical—if it breaks, expect further downside pressure.

Bulls must reclaim 25,200 to keep the uptrend intact.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 250.71

IB Range: 143.85 → Medium IB

Market Structure: Balanced

Trades:❌ No Trade Triggered by the system

📌 Support & Resistance Zones

Resistance Levels

25,116 ~ 25,128

25,180 ~ 25,212

25,285

Support Levels

25,062 ~ 25,070

24,972

24,920 ~ 24,894

24,800 ~ 24,768

💭 Final Thoughts

Market is playing inside a box, testing patience on both sides.Expansion is near, but which way? Keep risk defined and emotions in check.

🧠 “Don't mistake silence for weakness. The market is coiling—ready to snap.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty facing trendline resistance and RSI cooling down. Nifty had come close to overbought zone. Not that it was immensely overbought. It is also facing a trendline resistance which is hampering it's further progress. Bears are trying their best to bring it down while Bulls are trying to pull it above the trend line. The trade is in perfect balance right now. Once during the day Nifty had broken the trendline resistnace too as it made a high of 25199 but could not sustain the levels and was pulled down immediately. 25055 provided support and kept it Flat.

Supports for Nifty now remain at 25052, 24957, 24917 (Mother line of hourly chart), 24846 is another trend line support. Father line support is at 24614. Below this level bears will take over.

Resistances for Nifty remain at 25118, 25199 (Trend line resistance), A closing above 25199 will enable and empower bears as this will be a closing above mid channel resistance too. In such a scenario Bulls can further full Nifty upwards towards 25298 and 25387 levels.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Nifty levels - Jun 11, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

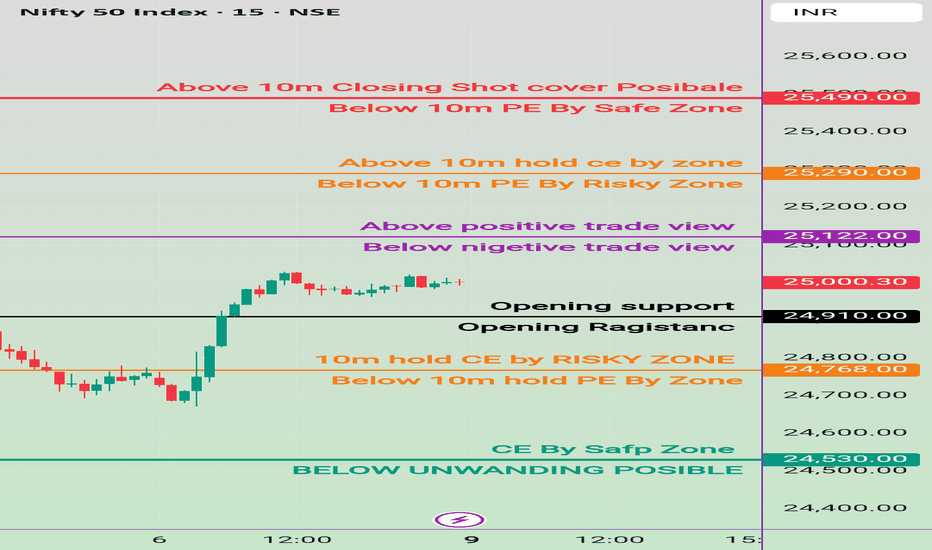

10 june Nifty50 brekout and Breakdown leval

🔼 Call Option (CE) Buy Levels:

Above 25,030 (Risky Zone)

"10m hold CE by RISKY ZONE"

Above 25,190 (Positive Trade View Zone)

Confirm bullishness and enter CE trades cautiously.

25,270"Above 10m hold CE by zone" – Strong confirmation.

25,390"Above 10m Closing Shot cover Possible" – Higher breakout level.

🔽 Put Option (PE) Buy Levels:

Below 25,030

"Below 10m hold PE by Zone"

Below 25,190

"Below nigetive trade view" – Sentiment turning bearish.

25,270 Below 10m PE by Risky Zone" – Confirmation of downward pressure.

Below 25,390 10m PE By Safe Zone" – Strong PE entry.

✅ Extra Key Zones:

Opening Support: 25,070

Opening Resistance: 25,030

CE Safe Zone: Above 24,970

Below 24,970: Possible unwinding (strong downside)

Nifty Analysis EOD – June 9, 2025 – Monday🟢 Nifty Analysis EOD – June 9, 2025 – Monday 🔴

🎯 Stuck at the Top – Expansion Coming Soon?

Nifty opened with a strong Gap-Up of 127 points at 25,127, landing right at the upper resistance cap. But from the very first candle, it was clear that the market was unsure—price action showed indecision, and the index could barely add another 16 points before hitting the day’s high of 25,143.45.

From there, the index retraced about 66 points, marking a low at 25,077.15, before attempting a gradual recovery toward the high. But that breakout attempt was unsuccessful, and Nifty drifted back to the mean and closed the day at 25,103.20—essentially wrapping the entire session within a tight 65-point range.

Buyers fought hard to defend 25,100, while sellers tried to fill the morning gap. The narrow range and mean reversion hint at consolidation, setting the stage for a possible expansion in the coming sessions. Stay patient—the coil is tightening.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 25,160.10

High: 25,160.10

Low: 25,077.15

Close: 25,103.20

Net Change: +100.15 (+0.40%)

📊 Candle Structure Breakdown

Real Body: 56.90 pts → 🔴 Red candle (Close < Open)

Upper Wick: 0 pts (Open = High)

Lower Wick: 26.05 pts

🔍 Interpretation

Price opened at the high and failed to push any higher – showing no strength above the open.

Despite a positive close versus the previous session, the candle is bearish intraday.

The lower wick shows some support, but not enough to flip the bias.

🔦 Candle Type

🟥 Red Inverted Hammer / Bearish Pin Bar– Typically signals weakness or potential reversal, especially when forming near resistance zones.

📌 Key Insight

The structure shows exhaustion or profit booking.

A move below 25,077 could open the door to further downside.

However, holding above 25,100–25,130 will keep bullish hopes alive.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 262.59

IB Range: 66.3 → Small IB

Market Structure: imBalanced

Trades:❌ No Trade Triggered by the system

📌 Support & Resistance Zones

Resistance Levels

25,116 ~ 25,128

25,180 ~ 25,212

25,285

Support Levels

25,062 ~ 25,070

24,972

24,920 ~ 24,894

24,800 ~ 24,768

💭 Final Thoughts

Today was a pause, not a pullback—yet.With price compressed in a tight band, volatility expansion is likely ahead.

🧠 “Markets don't stay quiet for long. Silence often precedes a scream—watch which direction the breakout takes.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty levels - Jun 10, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

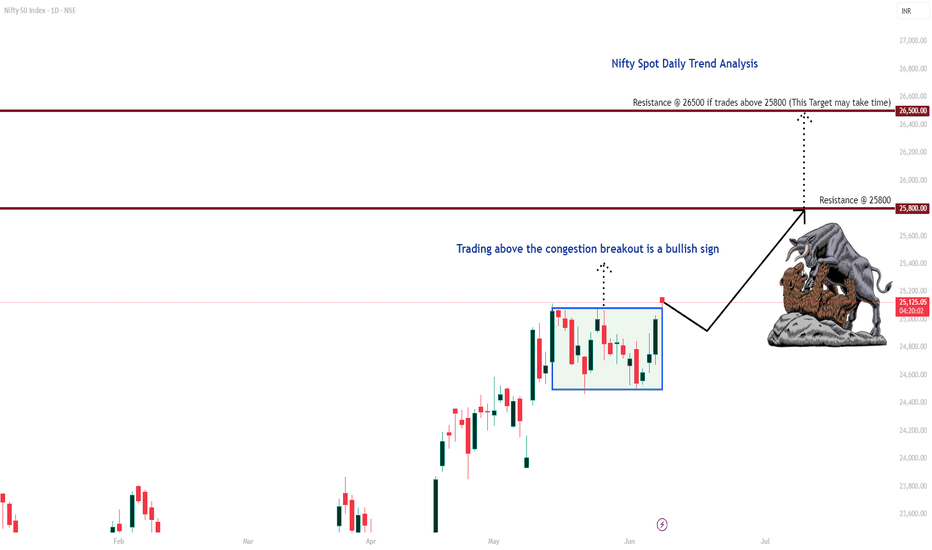

Nifty Daily Trend AnaysisMy Observation:

Nifty Spot had been consolidating within a range for 16 consecutive trading sessions. Today, it broke out decisively and is now trading above that range. If it sustains this breakout, it indicates bullish momentum and the index could potentially rally towards the targets of 25,800 and 26,500.

However, if the market slips back into the previous range, I anticipate support around 24,600—although this scenario seems less likely given the strength of today’s breakout.

Disclaimer: This is purely my personal view and is shared for educational purposes only. Please do your own analysis before making any trading decisions.

#NIFTY Intraday Support and Resistance Levels - 09/06/2025Nifty is opening with a gap-up above the 25050 level, continuing the recent bullish momentum. The index has broken out of its previous range and is now hovering near a key breakout zone.

If Nifty sustains above 25050–25100, we could see further upside toward 25150, 25200, and 25250+. A clean breakout above 25250 may unlock extended targets at 25350, 25400, and 25450+.

However, if the index fails to hold above 25000 and slips back below 24950, it could lead to a short-term pullback. In that case, expect downside toward 24850, 24800, and 24750.

9 june Nifty50 brekout and Breakdown leval

🔵 Call (CE) Buy Levels:

24,768 – Above 10m hold CE by Risky Zone

25,122 –Above 10m hold CE Zone

25,290 – Above 10m hold CE by Zone

25,490 – Above 10m closing, short covering possible

🔴 Put (PE) Buy Levels:

25,290 – Below 10m PE by Risky Zone

25,490 – Below 10m PE by Safe Zone

24,768 – Below 10m hold PE by Zone

🟢 Other Key Zones:

24,530 – CE by Safe Zone

➤ Below this: Unwinding Possible

25,122 – Above: Positive Trade View

➤ Below: Negative Trade View

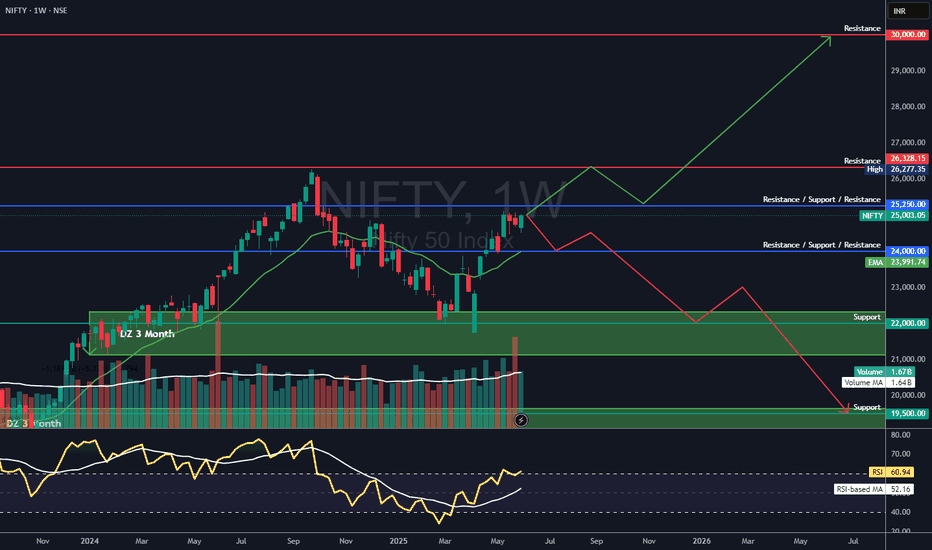

NIFTY 50 Long term Analysis I had a VIew in September 2024 that NIfty Should Fall from Its Life time HIgh to the levels of 22000 which is a strong Support and Monthly EMI 20 in Sept 2024 was nearing 22000 levels.

Now as nifty has taken support from 22000 and have relied till 25000 now. in HTF it is sideways. Important levels above is 25250 and then 26000 (LTH) and on lower side 24000 & 22000.

US after trump is very volatile and now after trump and elon musk issue and off course trade war with mostly china may drive the US market down as it is already overvalued and effects could be seen here in India market

Market Cap to GDP ratio of US (190%) & India (125%) is very High Still.

Nifty 50 analysis :

If Nifty from here if breaks 25250 level and sustain there it will face resistance @ 26000 (LTF) and if it is able to break it and sustain over it. It should zoom to 30000 levels in next 10-12 months

if nifty is not able to hold 25250 and gets rejection from here it should get it support @ 24000 but if it is not able to hold on to it. The Next Level will be 22000 again which is a very strong support but it is been tested already twice.

I have view here that Economic Conditions, US Market, Wars & Other Factors if not favourble at that time Nifty can Test 19500 Levels and curruntly 3 Month EMA 20 also is Calling the market to hand shake once @ 19500 Very Strong 3 Months Demand Zone.

This should also take 10-12 months from here.

Lets see where nifty 50 takes us 30000 or 19500.

;)

Nifty levels - Jun 09, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

Nifty Analysis EOD – June 5, 2025 – Thursday🟢 Nifty Analysis EOD – June 5, 2025 – Thursday 🔴

🎭 Trap and Manipulation on Expiry Day

As discussed in yesterday’s note—a calm before the storm—today delivered the volatility, but not in the form anyone truly expected. Nifty opened with a 53-point gap-up, filled the gap in the first 5 minutes, and then marched upwards to hit a day high of 24,761.

But that wasn't the end…

Within just 20 minutes, Nifty spiked to 24,899—a sharp and unexpected move that defied recent technical context. Why?Because just two sessions ago (June 3), the 24,800 level was a clear rejection zone, yet today the price cut through that zone like butter, crossing the highs of the past 6 sessions—only to fall just as sharply.

📉 That’s not strength—it’s classic expiry day manipulation.

The past 16 sessions have shown candles with unusual shadows, and today added another one to the list. For swing traders, this market structure has been offering no clean entry triggers. The message is loud and clear: focus only on intraday setups and stay cautious.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,691.20

High: 24,899.85

Low: 24,613.10

Close: 24,750.90

Net Change: +130.70 (+0.53%)

📊 Candle Structure Breakdown

Real Body: 59.70 pts (Green)

Upper Wick: 148.95 pts

Lower Wick: 78.10 pts

🔍 InterpretationThe candle paints a story of early optimism followed by profit booking or supply absorption near 24,900. Though the day closed green, the long upper shadow shows sellers dominating higher levels, leaving buyers with little to celebrate by the close.

🔦 Candle Type

🟢 Green Spinning Top with Long Upper Wick

Indicates indecision, with a bullish undertone that lacks conviction at higher levels.

📌 Key Insight

24,900 remains a psychological and technical barrier.

A bullish close above 24,900 might invite momentum traders, but until then—suspicion stays.

A breakdown below 24,600 may trigger downside interest again.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 265.01

IB Range: 148.4 → Medium IB

Market Structure: imBalanced

Trades:✅ 11:00 AM – Long Triggered → Target Achieved (1:1.5)✅ 11:50 AM – Long Triggered → Trailing SL Hit, but Target Achieved (1:4.8)

📌 Support & Resistance Zones

Resistance Levels

24,768 ~ 24,800

24,820

24,882

24,894 (Strong Resistance)

Support Levels

24,727 ~ 24,737

24,660

24,625 ~ 24,640

24,600

24,530 ~ 24,480

24,460

💭 Final Thoughts

A day of deception more than direction.This expiry session was less about trend and more about clearing premiums, trapping both sides, and faking strength in the middle of a boxed consolidation.

📌 “Not every green candle is bullish. Some are just well-disguised traps.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.