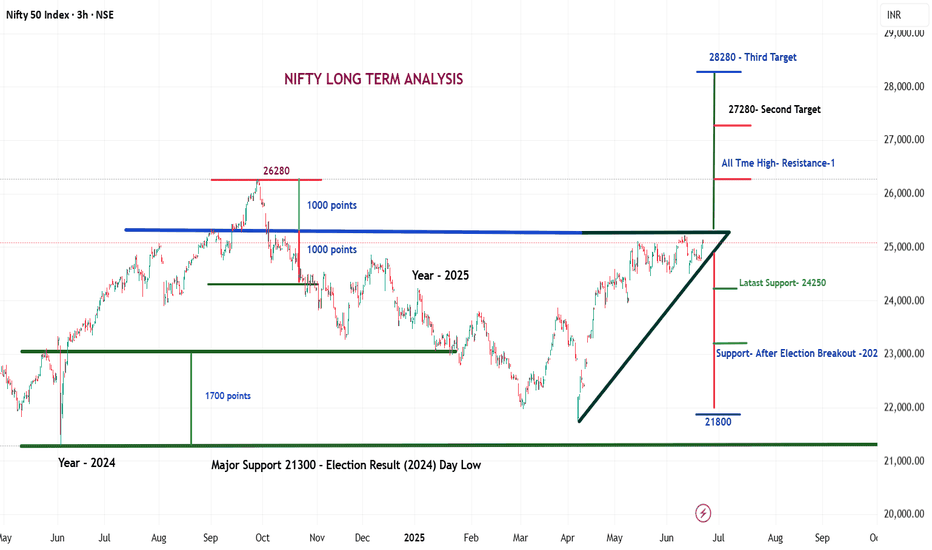

Nifty Chart Analysis – Major Breakout or Breakdown Ahed

Assending Triangle Chart pattern in Nifty- Breakout Possible ?

As of June 21, 2025, the Nifty 50 index is showing a strong and potentially decisive Ascending Triangle Pattern on the 3-hour time frame.

This formation typically indicates a bullish breakout if confirmed with volume. Let’s dive deep into the technical outlook and key levels that traders and investors should watch.

Current Market Overview

Current Nifty Level: ~25,080

Pattern Identified: Ascending Triangle

Time Frame: 3H (Medium-Term to Long-Term Insight)

An Ascending Triangle is a bullish continuation pattern formed by a horizontal resistance line and a rising trendline of higher lows.

Key Levels to Watch

Resistance Zone:

Immediate Resistance: 26,280 (All-Time High)

Breakout Target 2: 27,280

Breakout Target 3: 28000 (Long-Term)

If Nifty breaks above the 26,280 level with strong volume confirmation, the next upward targets will be 27,280 and possibly 28000 , based on the measured move from the triangle height.

Support Levels:

Latest Support: 24,250

Post-Election Breakout Support: 22,800

Major Support (Election Result Day Low): 21,300

If any major negative trigger (geopolitical or macroeconomic) occurs, a sharp correction can’t be ruled out. The levels mentioned will act as key demand zones.

Potential Global Risks

While the technical setup is bullish, external risks could spoil the party:

Geopolitical Conflicts:

Iran vs. Israel

India vs. Pakistan

China vs. US tensions

Macro-Economic Triggers:

Spike in Inflation or Crude Oil Prices

US Fed Rate Hike Surprises

Global Recession Fears

In such cases, a steep fall toward 22,800 or even 21,300 may occur.

✅ Conclusion & Strategy

The current Nifty setup presents a classic high-reward-low-risk opportunity for long-term traders if a breakout is confirmed. However, caution is advised if global uncertainties increase. Investors should:

Wait for a decisive breakout above 26,280 with volume.

Maintain a stop-loss around 24,250 on long positions.

Consider booking partial profits near resistance levels and re-entering on pullbacks.

How Traders Can Prepare for the Next Move

Whether a breakout or breakdown happens, traders must:

Use proper stop-loss and risk management

Wait for volume confirmation

Watch for FII/DII activity

Combine price action with Data Analysis

Important Note:

This analysis is based on current chart patterns and known global events. Always use proper risk management and consult with a financial advisor before taking investment decisions.

💬 Like the chart if you found it useful

🗣 Comment your views or questions

👤 Follow us for regular breakout updates

🔁 Share this chart with your trading community and friends who follow Nifty!

✅ Let’s grow together with smart chart analysis and technical strategies.