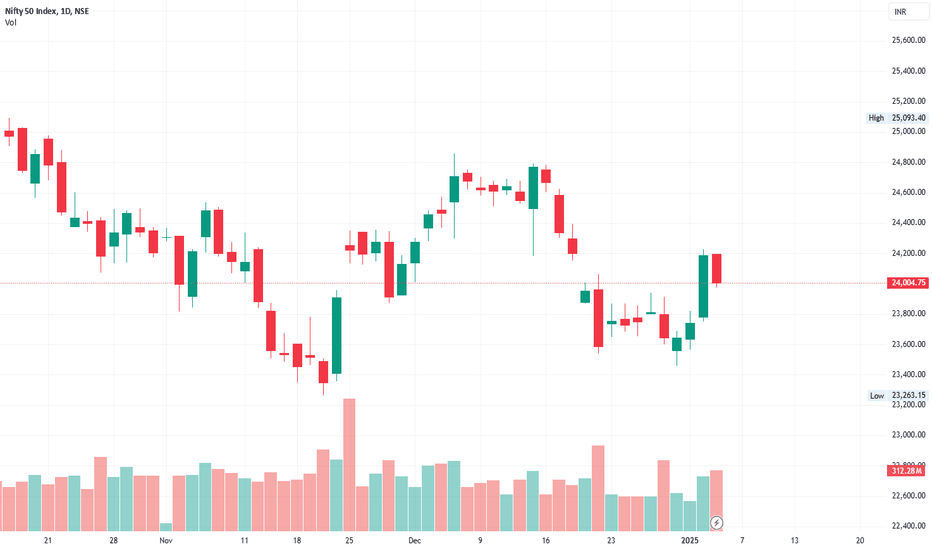

Nifty Review & Analysis - Daily

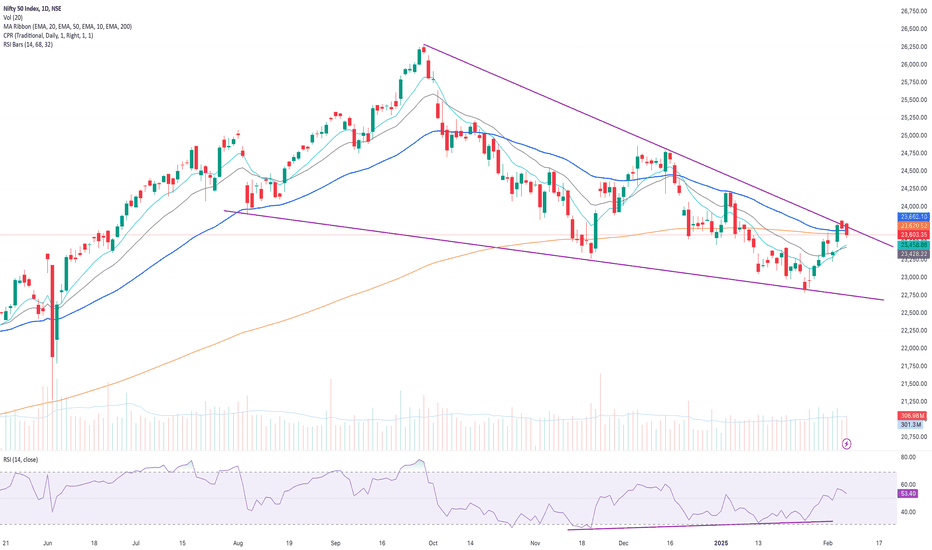

Price Action :

Nifty saw selling from the opening to close just above 23600

Technicals:

Nifty opened flat and saw selling from opening and found support around 23550 levels and managed to close above 23600 levels forming a Bearish Candle . A small profit booking was seen above 23700 levels but over all looked strong and stable Nifty closed below 50 and 200 DEMA but above 10&20 DEMA

The momentum indicators, RSI - Relative Strength Index was down to 53

FII Sold Rs. 3550 Cr in cash market

Support/Resistance

Major Support 23400

Immediate Support 23500

Immediate Resistance 23650

Major Resistance 24000

Trend:

Overall Trend is Bearish but short term Nifty is bit positive till it trades above 22300

Options Data:

Highest CE OI was at 24000 followed by 23600 - Resistance

Highest PE OI was at 23600 followed by 23500 and 23000 - Support

23700CE 23600CE saw major addition signaling Shorts added & 23700 is Resistance

PCR is 0.82 which indicates neutral

Futures Data:

FII Long/Short ratio improved to 16.5%/83.5%

FII exited 4K Longs in Future at 38K and Shorts intact at 1.9L contracts

Nifty Futures price was in negative, a slight decrease in price alongside slight increase in Open Interest (OI) typically indicates slight Bearishness

Outlook for Next Session:

Nifty in Strong above 23500

Approch:

Maintain Long positions with 23500 SL

avoid shorts

Wait for today’s High or Low to break and sustaines for further direction

My Trades & Positions:

still holding Long in Feb Series CE waiting for a big Short covering above 24100

Niftytomorrow

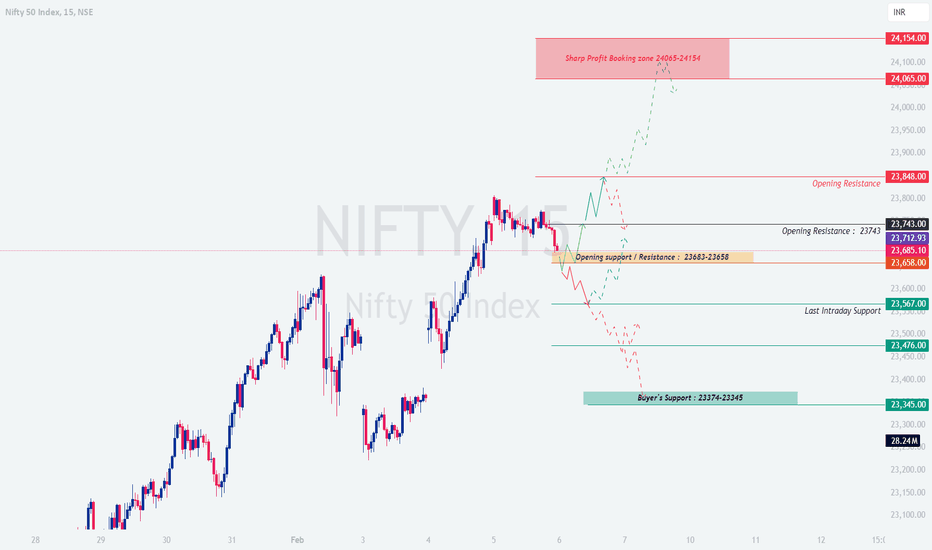

NIFTY - Trading Levels and Plan for 06-Feb-2025📌 NIFTY TRADING PLAN – 06-Feb-2025

🔹 Previous Close: 23,685.10

🔹 Important Zones Identified:

🟥 Sharp Profit Booking Zone: 24,065 - 24,154🟥 Opening Resistance: 23,848🟧 Opening Support / Resistance: 23,683 - 23,658🟩 Last Intraday Support: 23,567🟢 Buyer's Support: 23,374 - 23,345

📈 Scenario 1: Gap-Up Opening (Above 100+ Points)

If NIFTY opens with a strong gap-up above 23,785, it will move toward the Opening Resistance (23,848) and may attempt to test the Profit Booking Zone (24,065 - 24,154).

🔹 Bullish Strategy:

If NIFTY sustains above 23,848, expect a continuation towards 24,065 - 24,154.

An ideal entry can be on a pullback towards 23,848, with a stop-loss below 23,750.

🔻 Bearish Reversal Plan:

If NIFTY shows rejection around 24,065 - 24,154, a short trade can be initiated.

Target for shorts: 23,848 - 23,685.

Stop-loss for short trades: Above 24,200.

📝 Pro Tip: If NIFTY opens directly in the Profit Booking Zone, avoid aggressive long positions. Wait for a breakout or a reversal setup.

📊 Scenario 2: Flat Opening (Between 23,683 - 23,658)

A flat opening means NIFTY is near the Opening Support / Resistance Zone (23,683 - 23,658). Patience is required to confirm the direction.

🔹 Bullish Plan:

If NIFTY breaks above 23,685 with strong volume, a long trade can be considered.

Targets: 23,743 - 23,848.

Stop-loss: Below 23,650.

🔻 Bearish Breakdown:

If NIFTY breaks below 23,658, expect a decline towards 23,567.

Short trades can be initiated with a stop-loss above 23,700.

📝 Pro Tip: Flat openings often result in choppy movement for the first 15-30 minutes. Let the market establish direction before entering trades.

📉 Scenario 3: Gap-Down Opening (Below 23,567)

If NIFTY opens below 23,567, it enters the Last Intraday Support Zone and may attempt to test the Buyer's Support (23,374 - 23,345).

🔹 Buying Opportunity:

A strong bullish reversal from 23,374 - 23,345 can provide a long opportunity.

Target: 23,567 - 23,685.

Stop-loss: Below 23,300.

🔻 Further Breakdown Plan:

If 23,345 is broken, expect further downside towards 23,200.

Short trades can be initiated with SL above 23,400.

📝 Pro Tip: If NIFTY gaps down but quickly recovers above 23,567, it could be a bear trap—watch for bullish confirmations.

⚠️ Risk Management & Options Trading Tips

✔ For Option Buyers: Select ATM (At-the-Money) strikes to avoid time decay. Enter only when price action confirms the trade.

✔ For Option Sellers: If IV (Implied Volatility) is high, consider selling OTM (Out-of-the-Money) options near key resistance/support levels.

✔ Always use SL: Protect capital! A good Risk-to-Reward (R:R) ratio is essential for long-term success.

✔ Avoid Overtrading: Stick to planned setups—don’t force trades.

📌 Summary & Conclusion

🚀 Bullish above: 23,685 (Target 23,848+)📉 Bearish below: 23,658 (Target 23,567 - 23,345)⚠️ Watch Key Zones: No Trade Zone & Profit Booking Area📊 Expect Volatility: Let the first 15-30 minutes settle before aggressive trades.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Always do your own research before taking any trades. 📢📊

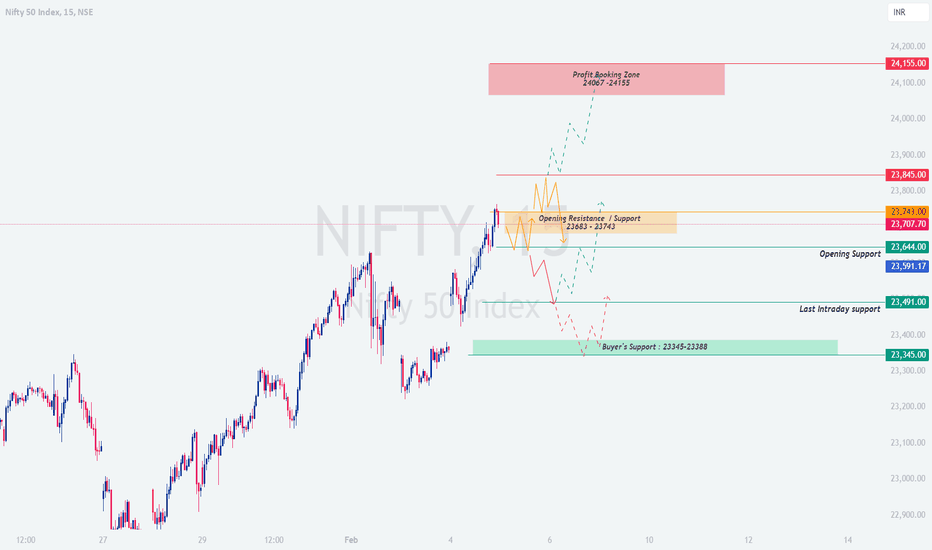

NIFTY - Trading levels and Plan for 05-Feb-2025🔹 NIFTY TRADING PLAN – 05-FEB-2025 🔹

📍 Previous Close: 23,707.70

📍 Key Levels to Watch:

🔸 Resistance Zone: 23,743 - 23,845

🔹 Opening Support Zone: 23,591 - 23,644

🟢 Last Intraday Support: 23,491

🟩 Buyers’ Strong Support: 23,345 - 23,388

🎯 Profit Booking Zone: 24,067 - 24,155

🔵 POSSIBLE OPENING SCENARIOS & TRADING STRATEGY 🔵

📈 Gap Up Opening (100+ Points Above 23,807) – Bullish to Cautious Approach

📌 If Nifty opens with a gap-up above 23,807+ , traders should wait for initial price action.

📌 A sustained move above 23,845 can trigger bullish momentum towards 24,067 - 24,155 (Profit Booking Zone).

📌 If Nifty struggles near 23,845 , expect sideways movement or a potential reversal to test 23,743 - 23,707 .

📌 Trade Setup:

✅ Buy on retracement if 23,743 acts as support after a pullback.

🚨 Avoid aggressive buying near resistance without confirmation.

↔️↔️↔️

📊 Flat Opening (Between 23,683 - 23,743) – Key Zone for Decision Making

📌 A flat opening within 23,683 - 23,743 keeps the market in a neutral-to-bullish zone.

📌 If Nifty holds above 23,707 , we can see a push towards 23,845 .

📌 Failure to hold 23,707 might bring weakness towards 23,644 - 23,591 (Opening Support) .

📌 Trade Setup:

✅ If Nifty stays above 23,707 for 15-30 minutes, a breakout trade towards 23,845 is possible.

🚨 If it breaks below 23,644, avoid longs and wait for a deeper support test.

↔️↔️↔️

📉 Gap Down Opening (100+ Points Below 23,607) – Caution Required

📌 A gap-down below 23,607 will bring pressure on support levels.

📌 23,591 - 23,491 is a key demand zone; a strong bounce from here can offer buying opportunities.

📌 If selling continues and Nifty breaks below 23,491 , the next major support is 23,345 - 23,388 .

📌 Trade Setup:

✅ Look for reversal signs near 23,491 - 23,345 before entering long trades.

🚨 If Nifty breaks and sustains below 23,345, expect further downside.

⚠️ RISK MANAGEMENT & OPTIONS TRADING TIPS ⚠️

🔹 Use strict stop-losses based on an hourly close.

🔹 Avoid chasing trades at extreme levels; wait for pullbacks.

🔹 For options trading, consider ATM/ITM contracts for better liquidity.

🔹 Time decay will impact weekly options—exit early if momentum slows.

🔹 Hedge positions if volatility spikes unexpectedly.

📌 SUMMARY & CONCLUSION 📌

✅ Bullish Bias above 23,743 targeting 23,845 - 24,067.

❌ Bearish Break below 23,591 may push towards 23,491 - 23,345.

📊 Key Zone: 23,707 - 23,743—market reaction here will decide the trend.

📌 Wait for confirmation at crucial levels before entering trades!

⚠️ DISCLAIMER ⚠️

🔹 I am not a SEBI-registered analyst. This trading plan is for educational purposes only.

🔹 Please do your own research or consult with a financial advisor before making trading decisions.

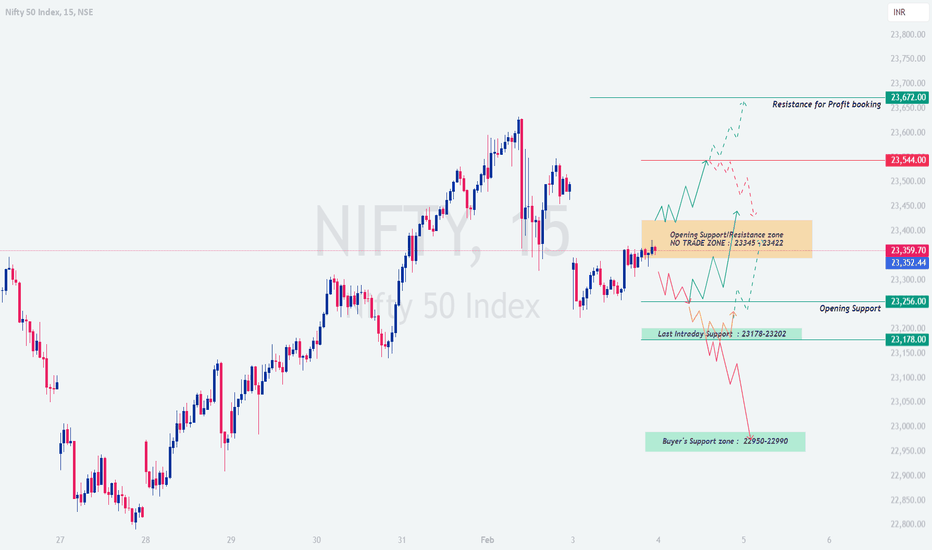

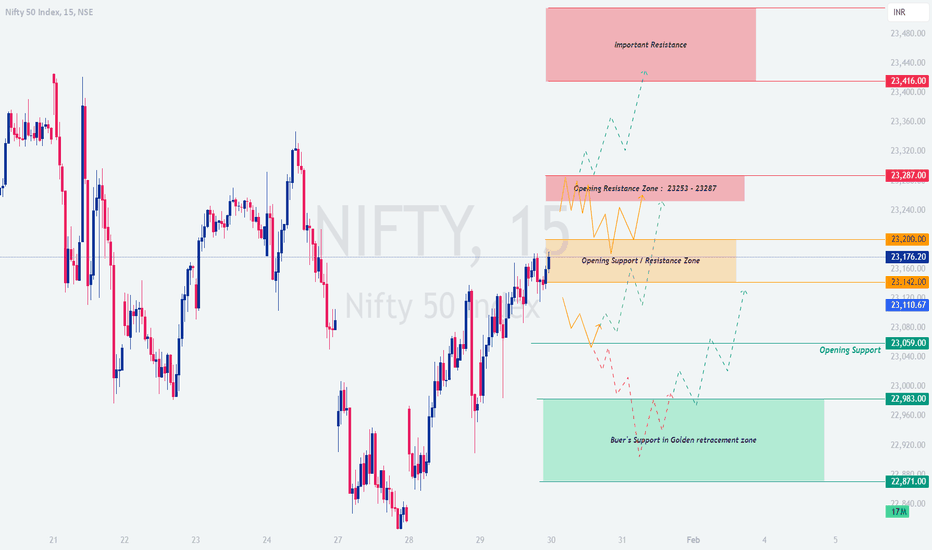

NIFTY : Trading levels and Plan for 04-Feb-2025📌 NIFTY Trading Plan for 04-Feb-2025

📍 Key Levels:

Resistance for Profit Booking: 23,672

Resistance Zone: 23,544

No Trade Zone (Opening Support/Resistance Zone): 23,345 - 23,422

Opening Support: 23,256

Last Intraday Support: 23,178 - 23,202

Buyer's Support Zone: 22,950 - 22,990

🚀 If NIFTY Opens with a Gap-Up (100+ Points)

A gap-up opening near 23,500+ means price will be closer to the resistance zone. In this case:

If NIFTY faces rejection near 23,544, look for a shorting opportunity with a target of 23,345-23,422.

A strong breakout above 23,544 with good momentum and volume can push NIFTY towards 23,672 (profit booking zone).

If NIFTY consolidates around 23,500 and holds, look for buying opportunities after a retest with a stop-loss below 23,422.

📌 Pro Tip: If you are trading options, watch for IV (Implied Volatility) spikes. Avoid buying options at the open when IV is high. Wait for a pullback or confirmation before entering.

📊 If NIFTY Opens Flat (± 30 Points)

A flat opening means price will likely be inside the No Trade Zone (23,345-23,422). This zone can act as both support and resistance.

Avoid aggressive trades in this zone and wait for a clear direction.

A breakout above 23,422 can push NIFTY towards 23,544.

A breakdown below 23,345 can lead to 23,256 first and then towards 23,178-23,202.

📌 Pro Tip: When trading inside a range, avoid taking large positions. Instead, use Iron Condors or Credit Spreads in options for range-bound profits.

📉 If NIFTY Opens with a Gap-Down (100+ Points)

A gap-down near 23,178 - 23,202 can bring initial buying support. However, if this level breaks, we can see a quick move towards 22,950-22,990.

If NIFTY finds support around 23,178 and reverses, we can go long with a target of 23,256-23,345.

If it struggles near 23,256, this can be a sell-on-rise opportunity for a downward move.

📌 Pro Tip: For put buyers, ensure there is confirmation of weakness before entering. If the market shows strength after the gap-down, avoid holding puts for too long.

📌 Risk Management & Option Trading Tips 🛡️

✅ Keep Stop Loss Tight – Markets can be volatile, and a fixed SL helps in capital protection.

✅ Avoid Trading Inside the No Trade Zone – Let the price break out clearly.

✅ Hedge Your Positions – Use spreads instead of naked options to minimize risk.

✅ Don't Chase the Market – If you miss an entry, wait for the next setup.

📌 Summary & Conclusion 📢

🔹 Bullish Above: 23,422, targeting 23,544 → 23,672.

🔹 Bearish Below: 23,345, targeting 23,256 → 23,178.

🔹 No Trade Zone: 23,345-23,422 (Wait for confirmation before trading).

🎯 Always stick to the plan, manage your risk, and follow the levels carefully.

⚠️ Disclaimer: I am NOT a SEBI registered analyst. This is for educational purposes only. Trade at your own risk.

This plan ensures structured decision-making across all scenarios. Let me know if you need modifications! 🚀📊

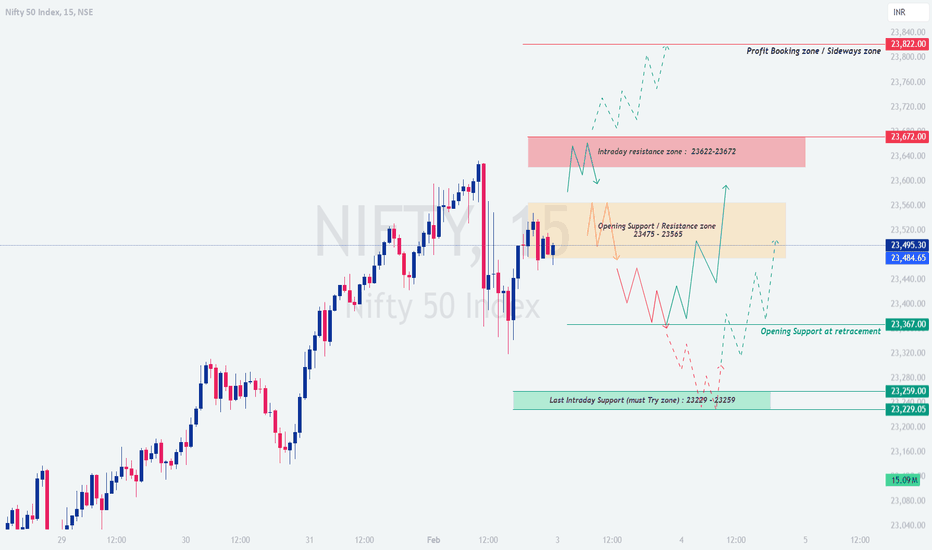

NIFTY : Trading levels and Plan for 03-Feb-2025NIFTY Trading Plan for 03-Feb-2025

Key Levels to Watch: Resistance Zones: 🔴 Intraday Resistance Zone: 23,622 - 23,672🔴 Profit Booking / Sideways Zone: 23,822

Support Zones: 🟠 Opening Support / Resistance Zone: 23,475 - 23,565🟢 Opening Support at Retracement: 23,367🟢 Last Intraday Support (Must Try Zone): 23,229 - 23,259🟢 GAP-UP Opening (100+ Points) (Typically above 23,600 region)

➡️ If NIFTY opens above 23,565 and sustains, we need to observe price action at 23,622 - 23,672 (intraday resistance zone).

Bullish Scenario: If price consolidates above 23,672 and breaks out with volume, expect a rally towards 23,822 (profit booking zone). 📈📌 Entry: Above 23,672🎯 Target: 23,750 - 23,822❌ Stop Loss: Below 23,600

Bearish Rejection: If price rejects from 23,672 and fails to sustain, expect a pullback towards 23,500 - 23,475 .📌 Entry: Below 23,620 after confirmation🎯 Target: 23,500 - 23,475❌ Stop Loss: Above 23,680

📝 Educational Tip: In strong gap-up scenarios, avoid chasing the market immediately. Let the price consolidate near key resistance levels before taking a trade.

↔️ Sideways Possibility: If NIFTY stays between 23,565 - 23,672 , it may remain range-bound. Wait for a breakout.

⚖️ FLAT Opening (Near 23,470 - 23,500) ➡️ A flat opening would indicate market indecision and a need for further confirmation.

Bullish Bias: If price takes support at 23,475 - 23,500 and starts moving up, it can retest 23,622 , then 23,672 .📌 Entry: Above 23,500 after bullish confirmation🎯 Target: 23,622 - 23,672❌ Stop Loss: Below 23,450

Bearish Breakdown: If NIFTY breaks below 23,475 , expect a move towards 23,367 or even 23,259 (last intraday support).📌 Entry: Below 23,475🎯 Target: 23,367 - 23,259❌ Stop Loss: Above 23,525

📝 Educational Tip: Flat openings require patience. Let the market establish a clear direction before entering. Avoid overtrading in a choppy market.

🔴 GAP-DOWN Opening (100+ Points) (Typically below 23,375)

➡️ If NIFTY opens below 23,367 , it indicates weakness and possible downside towards 23,259 - 23,229 .

Bearish Continuation: If price sustains below 23,367 , expect selling pressure towards 23,259 and 23,229 .📌 Entry: Below 23,367🎯 Target: 23,259 - 23,229❌ Stop Loss: Above 23,400

Bounce Back Scenario: If NIFTY takes support at 23,259 and shows strong reversal, we may see a move back towards 23,367 or even 23,475 .📌 Entry: Above 23,275 after confirmation🎯 Target: 23,367 - 23,475❌ Stop Loss: Below 23,220

📝 Educational Tip: In gap-down scenarios, watch for institutional buying or aggressive selling. Avoid counter-trend trades without confirmation.

📌 Risk Management Tips for Options Traders ✅ Trade with Defined Risk: Always set a stop loss before entering a trade.✅ Avoid Overleveraging: Keep position sizes within your risk tolerance.✅ Watch for Volatility: Sudden spikes in IV (Implied Volatility) can impact options pricing.✅ Exit at Key Levels: If a trade reaches resistance/support, book partial profits.✅ Use Spreads for Safety: Instead of naked options, consider spreads to minimize risk.

📊 Summary & Conclusion Gap-Up: Watch for resistance at 23,672 ; breakout targets 23,822 . Flat Opening: Key support at 23,475 ; break above 23,500 can lead to bullish movement. Gap-Down: Below 23,367 , expect 23,259 - 23,229 ; bounce possible from support.

🛑 Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Trade at your own risk.

🚀 Happy Trading & Stay Disciplined! 💰

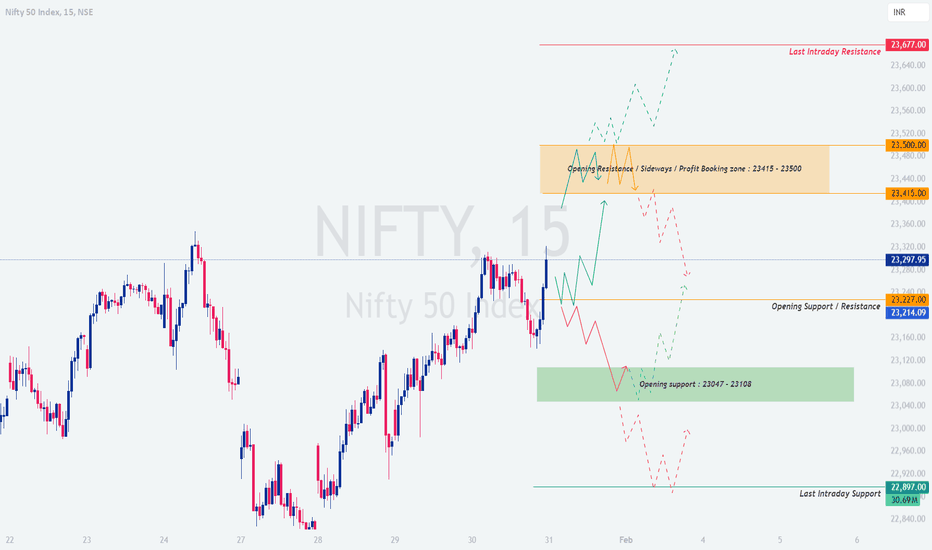

NIFTY : Trading levels and Plan for 31-Jan-2025📌 Nifty Trading Plan – 31st January 2025 📈🔥

A structured trading plan is essential for navigating market movements with confidence. Let's analyze Nifty for 31st January 2025, incorporating key levels and different opening scenarios to optimize trade entries and exits.

📍 Key Levels:

Opening Resistance / Sideways / Profit Booking Zone: 23,415 - 23,500

Last Intraday Resistance: 23,677

Opening Support / Resistance: 23,227 - 23,214

Opening Support Zone: 23,047 - 23,108

Last Intraday Support: 22,897

🚀 Scenario 1: Gap-Up Opening (100+ points above 23,400)

If Nifty opens above 23,400 , it will enter the profit booking zone of 23,415 - 23,500 , where resistance may come into play. A cautious approach is required to avoid getting trapped in a false breakout.

If Nifty sustains above 23,500 , a move towards 23,677 (last intraday resistance) is possible.

If price faces rejection at 23,500 , expect a pullback to 23,415 . Failure to hold this level may lead to further decline toward 23,297 .

Avoid chasing long positions immediately; wait for a retest of support zones for better risk-reward trades.

👉 Pro Tip: If 23,500 is decisively broken with strong volume, it may trigger a fresh rally, offering buying opportunities on dips.

📊 Scenario 2: Flat Opening (23,250 - 23,400)

A neutral start within this range suggests the market is waiting for direction. Here’s how to approach it:

If Nifty holds 23,227 - 23,214 , it could attempt a gradual rise towards 23,400+ .

A breakout above 23,400 will open doors for an upside move toward 23,500 .

A failure to hold 23,214 may push the index down to test the 23,108 - 23,047 support zone.

Traders should watch for price action near 23,227 , as it could act as an intraday pivot for directional moves.

👉 Pro Tip: In a sideways market , consider using options scalping strategies rather than directional trades.

📉 Scenario 3: Gap-Down Opening (100+ points below 23,200)

A weak opening below 23,200 could indicate short-term bearishness. It’s important to assess whether Nifty finds support at lower levels or continues declining.

If Nifty holds 23,108 - 23,047 , expect a pullback rally toward 23,214 - 23,227 .

A breakdown below 23,047 can accelerate selling pressure toward 22,897 (last intraday support).

Look for bullish reversal signs near 23,047 - 23,000 before considering long positions.

If the market forms a lower high after a gap-down, follow the trend rather than trying to catch a falling knife.

👉 Pro Tip: If Nifty struggles to reclaim 23,214 after a gap-down, selling on rise could be a better approach.

🛑 Risk Management & Options Trading Tips: 🎯

Always define a stop-loss before entering a trade to protect your capital.

Avoid overleveraging in uncertain market conditions—risk management is key! 💰

In case of high volatility , wait for confirmation instead of chasing trades impulsively.

Consider hedging strategies (like spreads) to limit losses in options trading.

Check Open Interest (OI) data before trading options to gauge market sentiment.

📌 Summary & Conclusion:

✅ Nifty is at a critical juncture, with 23,227 - 23,214 acting as an opening pivot zone.

✅ Bullish Bias above 23,500 , targeting 23,677 .

✅ Bearish Outlook below 23,047 , targeting 22,897 .

✅ Discipline & patience are crucial—wait for confirmation before taking positions! 🚀

⚠️ Disclaimer: I am not a SEBI-registered analyst. This plan is for educational purposes only . Trade at your own risk and manage capital wisely! 📊🔥

NIFTY : Trading levels and plan for 30-Jan-2025📊 Nifty Trading Plan for 30-Jan-2025

This trading plan covers all possible opening scenarios (Gap-Up, Flat, and Gap-Down) along with crucial resistance and support levels. Follow these levels carefully to maximize your trades.

📈 Scenario 1: Gap-Up Opening (100+ points above 23,176)

If Nifty opens with a gap-up, it will likely test the resistance levels. Key focus points:

🔹 Opening Resistance Zone: 23,253 – 23,287 – If price sustains above this level, it can move towards 23,416. Consider call option trades if momentum remains strong with stop-loss at 23,200.

🔹 Major Resistance Zone: 23,416 – This is a crucial level where sellers might become active. Avoid chasing longs here and book profits.

🔹 If Nifty rejects from 23,253, watch for a retracement towards 23,176 before taking fresh trades.

💡 Pro Tip: Always wait for a retest and confirmation before entering a trade in a gap-up market.

📉 Scenario 2: Flat Opening (Near 23,176)

A flat opening means price action will revolve around the Opening Support / Resistance Zone: 23,176 – 23,200. Key levels to monitor:

🔹 If price sustains above 23,200, expect bullish movement towards 23,253, followed by 23,287. Enter call options only after a breakout confirmation.

🔹 If price rejects from 23,176, it may slip towards 23,142, and if this breaks, expect a drop to 23,059. Put options can be considered here.

🔹 Avoid trading in the Opening Support / Resistance Zone unless a clear breakout/breakdown happens.

💡 Pro Tip: Flat openings often create a trap in the first 15 minutes. Let the market settle before taking a position.

⬇️ Scenario 3: Gap-Down Opening (100+ points below 23,176)

A bearish gap-down could test support levels. Here’s how to trade it:

🔹 Opening Support Zone: 23,059 – If this zone holds, expect a pullback to 23,176. A strong reversal from this level can provide a good call option opportunity.

🔹 If 23,059 breaks, expect further downside towards 22,983, followed by 22,871 (Golden Retracement Zone). Look for put options with SL at 23,059.

🔹 If price sustains below 22,871, expect high volatility. Avoid aggressive long positions.

💡 Pro Tip: In gap-down markets, avoid catching falling knives. Look for proper support confirmation before entering long trades.

🛡️ Risk Management Tips for Options Trading

🔹 Keep a fixed risk per trade (1-2% of capital) to avoid big losses.

🔹 Use ATM (At-the-Money) or slightly OTM (Out-of-the-Money) options for better liquidity.

🔹 Don't overtrade. If your first 2 trades fail, step back and analyze the market.

🔹 Follow proper stop-loss levels to protect capital.

📊 Summary and Conclusion

Resistance Zones: 23,200, 23,253-23,287, 23,416

Support Zones: 23,176, 23,142, 23,059, 22,983, 22,871

Opening Support / Resistance Zone: 23,176 – 23,200 (Wait for breakout/breakdown)

📌 Stick to the plan and manage risk wisely. Market structure matters more than emotions!

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Trade at your own risk. 😊

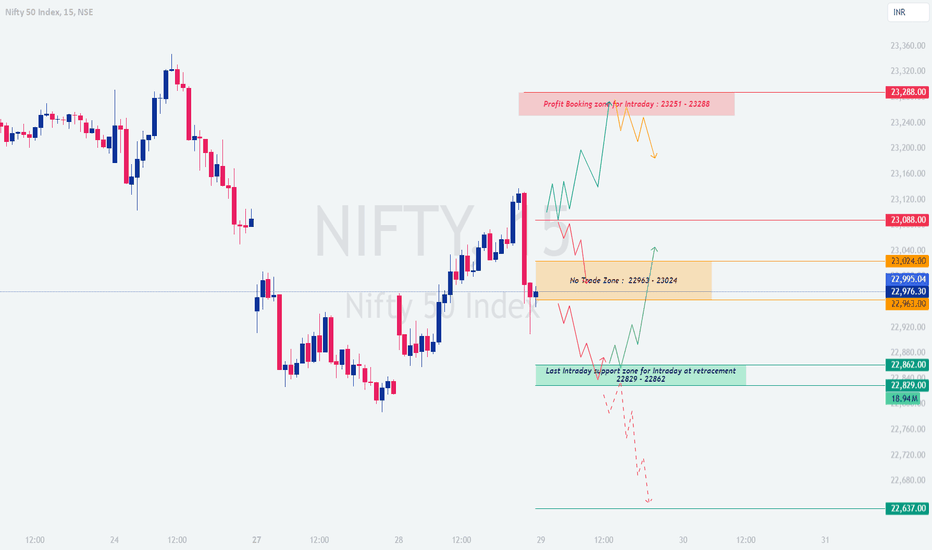

NIFTY : Trading Levels and Plan for 29-Jan-2025Here's your detailed trading plan for NIFTY on 29-Jan-2025, covering all possible opening scenarios with actionable insights.

📈 Scenario 1: Gap-Up Opening (200+ points above 23,088)

If Nifty opens with a gap-up, watch for resistance levels around 23,231-23,288:

🔹 Resistance Zone: 23,231-23,288 – Wait for confirmation before initiating a put option trade, targeting 23,088-23,024 if the level holds.

🔹 If 23,288 breaks with volume, expect a rally towards 23,350+. Look for call option trades with a strict stop-loss below 23,231.

🔹 Avoid overtrading near 23,088-23,231 without clear signals.

💡 Pro Tip: Wait for a 15-minute candle close above/below key levels for confirmation.

📉 Scenario 2: Flat Opening (Near 22,976-23,024)

A flat opening brings the market closer to the No Trade Zone (22,963-23,024). Breakout confirmation is crucial:

🔹 If Nifty sustains above 23,024, it may test 23,088 and later 23,231 – Ideal for call option trades.

🔹 If Nifty breaks 22,963, expect weakness towards 22,862-22,829. Look for put option trades with a stop-loss above 23,024.

💡 Pro Tip: A breakout from the No Trade Zone often leads to strong directional moves. Let the market decide the trend.

⬇️ Scenario 3: Gap-Down Opening (200+ points below 22,963)

A bearish gap-down will test buyer strength at crucial support zones:

🔹 Support Zone: 22,862-22,829 – Look for reversal signs. If the price holds, call options targeting 22,963-23,024 can be considered.

🔹 If 22,829 breaks decisively, expect further downside towards 22,637. Plan for put option trades, keeping SL above 22,862.

🔹 Be cautious near 22,637 as it might act as a reversal zone.

💡 Pro Tip: After a gap-down, monitor institutional activity before taking a trade. Avoid bottom fishing too early.

🛡️ Risk Management Tips for Options Trading

🔹 Use a fixed percentage of capital per trade (1-2%) to manage risk effectively.

🔹 Avoid chasing trades—let the market confirm levels.

🔹 Always use stop-loss and avoid averaging losing positions.

🔹 Prefer at-the-money (ATM) or slightly out-of-the-money (OTM) options for liquidity.

📊 Summary and Conclusion

🔹 Key Resistance Zones: 23,088, 23,231, 23,288

🔹 Key Support Zones: 22,963, 22,862, 22,829, 22,637

📌 Follow the plan, avoid emotional trading, and stick to defined levels. The market rewards discipline and patience!

⚠️ Disclaimer: I am not a SEBI-registered analyst. This plan is for educational purposes only. Trade responsibly. 😊

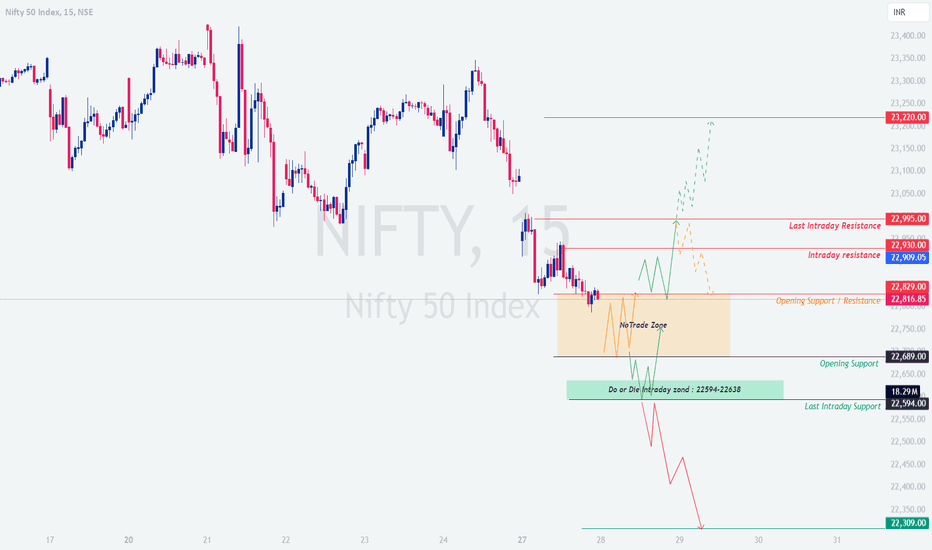

NIFTY : Trading levels and Plan for 28-Jan-2025📊 NIFTY Trading Plan for 28-Jan-2025 📊

📈 Key Levels to Watch:

Opening Support/Resistance Zone: 22,816-22,829

Intraday Resistance Zone: 22,909-22,930

Last Intraday Resistance Zone: 22,995

No Trade Zone: 22,816-22,829

Do or Die Intraday Zone: 22,594-22,638

Final Support Zone: 22,309

🌟 Scenario 1: Gap-Up Opening (100+ points above 22,909) 🌟

If NIFTY opens significantly above 22,909:

✅ Wait for Retest: Do not jump into trades immediately. Allow the index to retest the 22,909-22,930 zone for confirmation of strength.

📈 Action Plan: If the price holds above 22,930, initiate long trades targeting 22,995 (last resistance) and further extending to 23,220. Keep a stop-loss below 22,900.

🚫 Caution Zone: If resistance is observed near 22,995, consider profit booking or tightening stop-loss. Avoid fresh longs unless a breakout above 22,995 is confirmed.

💡 Pro Tip: Use bull call spreads to manage risk while capturing potential upside gains.

📉 Counter Strategy: If a bearish rejection candle forms near 22,995, short trades targeting 22,909 can be considered with a tight stop-loss.

🔄 Scenario 2: Flat Opening (Near 22,816) 🔄

If NIFTY opens flat or within the No Trade Zone: 22,816-22,829:

⚪ Avoid Immediate Trades: This range is indecisive. Wait for a breakout above 22,829 or a breakdown below 22,816.

🔼 Breakout Strategy: If the price breaks and sustains above 22,829, go long targeting 22,909-22,930. Use a stop-loss below 22,800.

🔽 Breakdown Strategy: If the price breaks below 22,816, initiate short trades targeting 22,689. Maintain a stop-loss above 22,850.

💡 Pro Tip: In a flat market, time decay in options can work against you. Use directional trades or hedged strategies.

🚦 Options Strategy: Consider a straddle or strangle strategy around the no-trade zone to capitalize on a potential breakout or breakdown.

🌧️ Scenario 3: Gap-Down Opening (100+ points below 22,816) 🌧️

If NIFTY opens below 22,816:

📉 Key Zone to Watch: The Do or Die Zone: 22,594-22,638 is critical. Look for bullish price action (e.g., hammer or bullish engulfing candles) for a potential reversal.

✅ Action Plan: If the price holds above 22,594, initiate long trades targeting 22,816. Use a stop-loss below 22,580.

🔥 Aggressive Selling Levels: If the price sustains below 22,594, further downside towards 22,309 is possible. Short trades can be initiated with strict risk management.

💡 Pro Tip: During gap-down scenarios, volatility spikes. Use hedging strategies (e.g., protective puts) to limit losses.

🚫 Avoid Overtrading: Gap-downs can lead to whipsaws. Wait for confirmation before entering trades.

🛡️ Risk Management Tips 💡:

🎯 Always follow your stop-loss and avoid emotional decisions.

🔥 Never risk more than 2% of your trading capital on a single trade.

🧘 Stay patient and disciplined. Avoid trading in the No Trade Zone .

📊 Utilize options strategies to hedge risk and protect your capital.

📝 Summary & Conclusion:

Key Zones to Monitor:

Resistance: 22,909-22,930 , 22,995 , and 23,220 .

Support: 22,816 , 22,689 , and 22,594-22,309 .

Gap-ups favor long trades above 22,909 , while gap-downs focus on supports like 22,594 .

Stick to your plan and avoid trades in the No Trade Zone unless a breakout or breakdown occurs.

⚠️ Disclaimer:

I am not a SEBI-registered analyst . All information shared is for educational purposes only. Please consult with a financial advisor before making any trading decisions.

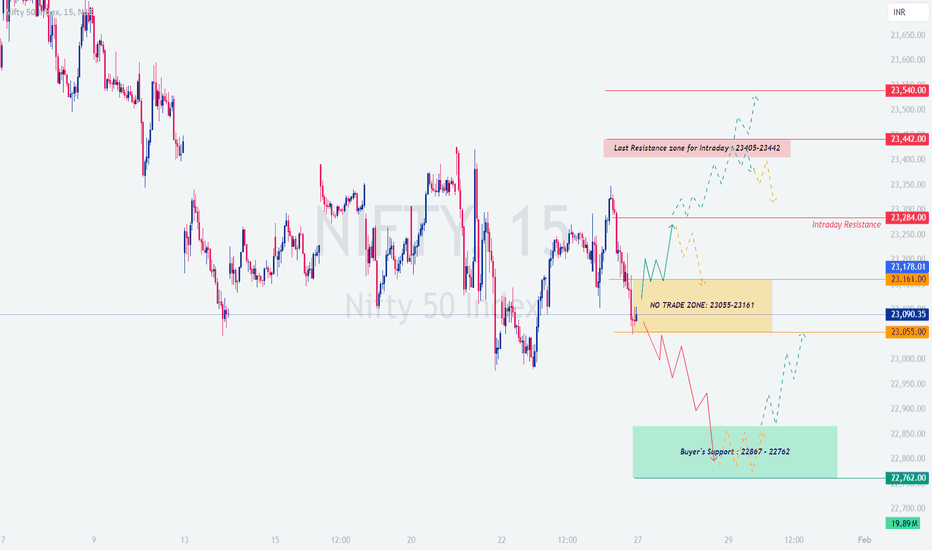

NIFTY: Trading levels and Plan for 27-Jan-2025📈 NIFTY 50 Trading Plan for 27-Jan-2025 📈

📊 Key Levels to Watch:

Opening Support Zone: 23,055-23,161

Intraday Resistance Zone: 23,178-23,284

Last Intraday Resistance: 23,405-23,442

Final Profit Booking Zone: 23,540

Buyer’s Strong Support Zone: 22,867-22,762

🌟 Scenario 1: Gap-Up Opening (100+ points above 23,178) 🌟

If NIFTY opens significantly above 23,178:

✅ Wait for Retest: Avoid rushing into trades after a gap-up. Allow the index to retest the 23,178-23,161 support zone for confirmation of strength.

📈 Action Plan: If a bullish candle forms during the retest, initiate a long trade targeting 23,284 initially and extend to 23,405-23,442 . Keep a stop-loss below 23,150.

🚫 Caution Zone: If the index stalls near 23,405-23,442, it might indicate profit booking. Avoid fresh longs in this area unless there’s a breakout above 23,442.

💡 Pro Tip: Use a bull call spread strategy to capture the upside while managing risk effectively.

🚨 Risk Note: Avoid over-leveraging after a significant gap-up. Monitor the price action closely.

🔄 Scenario 2: Flat Opening (Near 23,090) 🔄

If NIFTY opens flat or within the No Trade Zone: 23,055-23,161:

⚪ Avoid Immediate Trades: This range is a no-trade zone due to indecision. Wait for a breakout above 23,178 or a breakdown below 23,055.

🔼 Breakout Strategy: If the price breaks above 23,178, go long targeting 23,284 and extend to 23,405. Use a stop-loss below 23,150.

🔽 Breakdown Strategy: If the index drops below 23,055, short trades can be initiated targeting 22,867-22,762. Maintain a stop-loss above 23,100.

💡 Pro Tip: Use a trailing stop-loss to lock in profits during trending moves.

🚦 Options Strategy: Consider selling straddles near the no-trade zone to take advantage of time decay, but hedge positions to avoid unlimited risk.

🌧️ Scenario 3: Gap-Down Opening (100+ points below 23,055) 🌧️

If NIFTY opens below 23,055:

📉 Focus on Buyer’s Support Zone: The 22,867-22,762 zone is critical for potential reversals. Look for bullish price action in this area.

✅ Action Plan: If a reversal pattern (e.g., hammer or bullish engulfing) forms near 22,867, enter long trades targeting 23,055. Use a stop-loss below 22,740.

🔥 Aggressive Selling Levels: If the price sustains below 22,762, further downside to 22,700 or lower is possible. Initiate shorts with tight risk management.

⚠️ Avoid Overtrading: Gap-down scenarios can be volatile. Wait for clear patterns and don’t rush into trades.

💡 Pro Tip: Use long straddle strategies to benefit from increased volatility in gap-down scenarios.

🛡️ Risk Management Tips 💡:

🔥 Never risk more than 2% of your capital on a single trade.

🎯 Stick to stop-loss levels and avoid emotional trading.

📈 Use option strategies (e.g., spreads, straddles) to limit risk in uncertain market conditions.

🧘 Stay patient. Avoid forcing trades if setups don’t align with your plan.

📝 Summary & Conclusion:

Key Zones to Watch: 23,055 (support) and 23,178 (resistance).

Gap-ups favor longs above 23,178 ; gap-downs focus on support zones like 22,867 .

Strictly adhere to risk management principles.

Use options wisely to hedge your positions and reduce exposure to volatility.

⚠️ Disclaimer:

I am not a SEBI-registered analyst . All views shared are for educational purposes only. Please consult your financial advisor before making any trading decisions.

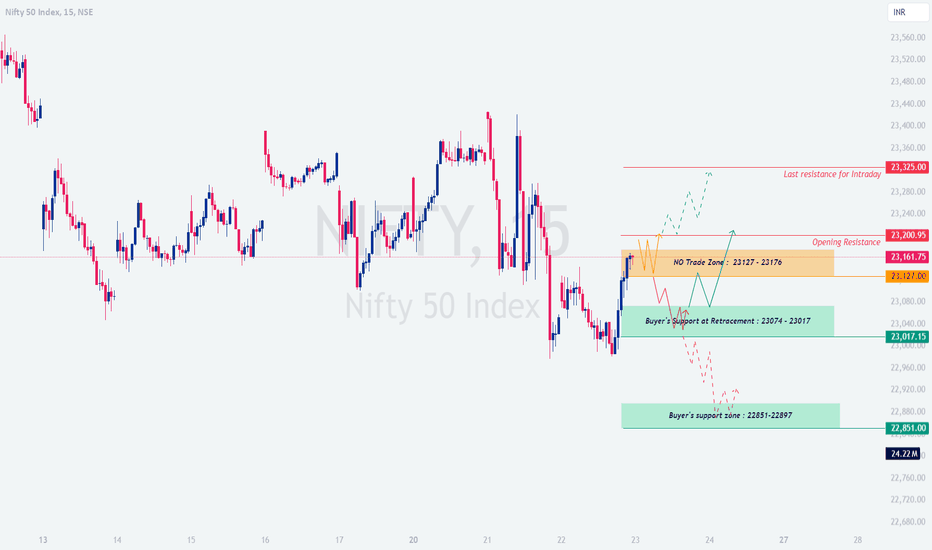

NIFTY : Trading Levels and Plan for 23-Jan-2025Trading Plan for NIFTY: 23-Jan-2025

📌 Educational Trading Plan for All Opening Scenarios

This plan considers various market opening scenarios with 100+ points gap. Be prepared to adapt to changing trends and price levels with a disciplined approach. Let's analyze:

1. Gap-Up Opening (100+ Points)

If NIFTY opens near the 23,200–23,325 zone (Opening Resistance and Intraday Resistance) :

Monitor price action around 23,200 . If a rejection occurs, look to short with targets at 23,127 and 23,074 .

A breakout above 23,325 with strong bullish candles could lead to further upside. If sustained, consider long trades targeting 23,400+ .

Keep a stop-loss just above 23,325 for shorts or below 23,200 for longs.

📈 Pro Tip: Gap-up days can trap traders; wait for 15–30 minutes of price action confirmation before entering a trade.

2. Flat Opening

If NIFTY opens between 23,127–23,200 :

Observe the movement within this NO Trade Zone (23,127–23,176) . Avoid trades until a breakout or breakdown is clear.

A breakout above 23,176 can signal bullish momentum toward 23,200 or 23,325 . Go long if strength persists.

On the flip side, a breakdown below 23,127 could lead to bearish momentum toward 23,074 or 23,017 .

📉 Pro Tip: Stick to smaller lot sizes when trading within tight ranges or zones.

3. Gap-Down Opening (100+ Points)

If NIFTY opens near the 23,017–22,851 zone (Buyer’s Support Zones) :

Watch for a bounce around 23,017–23,074 . If a bullish reversal forms, consider long trades targeting 23,127 and 23,200 .

If this zone is breached and NIFTY moves below 22,851 , expect further downside with targets near 22,800 and 22,700 . Initiate shorts cautiously.

📈 Pro Tip: Volatility in gap-down scenarios can be high. Trade with stop-losses and avoid revenge trading.

💡 Tips for Risk Management in Options Trading

Trade only with a defined risk-reward ratio (1:2 or better).

Avoid over-leveraging. Use a maximum of 10–15% of your capital for a single trade.

In volatile markets, stick to ATM (At-The-Money) strikes for better liquidity and lower premiums.

Use trailing stop-losses to lock profits in trending markets.

Don’t hesitate to stay out if levels aren’t clear or if the market is choppy.

Summary & Conclusion

Key levels to watch: 23,200 (Resistance) , 23,127 (Critical Zone) , and 22,851 (Support) .

Stick to the plan and avoid emotional trading.

Be patient and wait for clear confirmations before initiating positions.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Trade responsibly and consult with a financial advisor.

✨ Happy Trading!

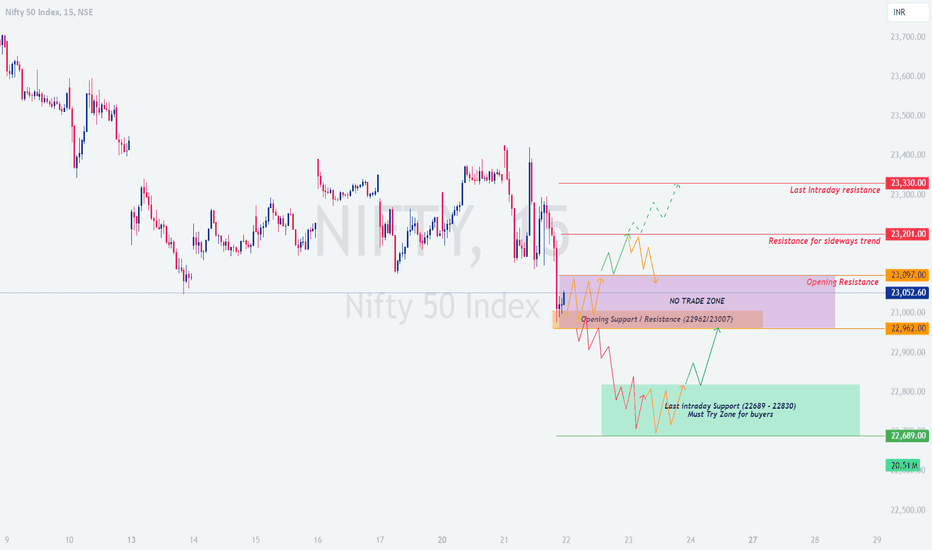

NIFTY : Trading Levels and Plan for 22-Jan-2025🔖 Nifty Trading Plan for 22-Jan-2025

📊 Key Levels:

Resistance Zones: 23,097–23,201, Last Intraday Resistance: 23,330

Support Zones: 22,962, 22,689 (Last Intraday Support)

1️⃣ Gap-Up Opening (100+ points)

If Nifty opens above 23,201:

Watch for price action near the Last Intraday Resistance (23,330). A rejection from this level could offer a short trade opportunity with a target towards 23,201.

A sustained breakout above 23,330 can signal strong bullish momentum, and a long trade with a trailing stop-loss could be beneficial to ride the trend higher towards the next possible profit-taking zone near 23,435.

📌 Educational Insight: Gap-ups above resistance zones can often trigger profit booking or reversal patterns. Always wait for a confirmation candle before entering any trades.

2️⃣ Flat Opening (Within 22,962–23,097)

Focus on the reaction at the Opening Resistance Zone (23,097). If Nifty fails to sustain above this zone, shorting the market with a target towards 22,962 could be favorable.

Conversely, if Nifty holds above 23,097, a long trade targeting 23,201 may be considered, with a tight stop loss below 23,052.

A breakdown below 22,962 may signal bearish momentum, opening short trades towards the Last Intraday Support at 22,689.

📌 Educational Insight: Flat openings provide the best opportunity for observing market sentiment. Let the market settle for the first 15–30 minutes for better clarity before making any trade decisions.

3️⃣ Gap-Down Opening (100+ points)

If Nifty opens near 22,689 or below:

Look for a reversal near the Last Intraday Support (22,689–22,830). A strong bounce here could provide a long trade targeting 22,962 or higher.

However, if Nifty sustains below 22,689, it might indicate further bearishness, and shorting the market with a target toward 22,600 could be considered.

📌 Educational Insight: Gap-down openings often lead to panic or aggressive buying at support levels. It is essential to wait for confirmation through price action and volume before entering trades.

📌 Risk Management Tips for Options Trading:

Use defined stop-loss levels and avoid over-leveraging during volatile market conditions.

Trade spreads (like bull/bear spreads) to limit potential losses during high implied volatility (IV) conditions.

Keep an eye on hourly candle closures for added confirmation of trend direction.

Avoid entering trades within the first 15 minutes of the market opening. Let the market settle to avoid false breakouts or breakdowns.

🔍 Summary & Conclusion:

Gap-Up: Watch for action near 23,201–23,330. Focus on rejection or breakout opportunities.

Flat: Key action zone around 23,097; observe for potential breakouts or breakdowns.

Gap-Down: Look for buying opportunities near 22,689, but be cautious of further bearish trends if support is broken.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This plan is for educational purposes only. Please consult a financial advisor or conduct your own analysis before trading.

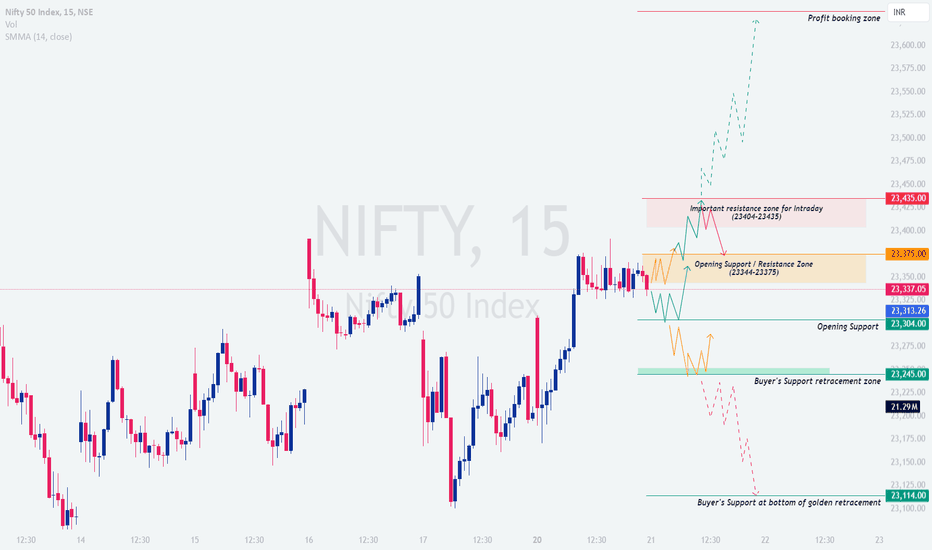

NIFTY : Trading levels and Plan for 21-Jan-2025🔖 Nifty Trading Plan for 21-Jan-2025

📊 Key Levels:

Resistance Zones: 23,404–23,435 (Important Intraday Resistance), Profit Booking Zone: 23,525+

Support Zones: 23,375 (Opening Support/Resistance Zone), 23,245 (Buyer’s Support Zone), 23,114 (Golden Retracement Support)

1️⃣ Gap-Up Opening (100+ points above 23,435)

📍 Analysis: A gap-up above 23,435 signals strong bullish sentiment. However, the profit booking zone above 23,525 can lead to selling pressure.

📌 Action Plan:

If Nifty consolidates below 23,525, look for rejection signs. A reversal from this zone provides a short trade opportunity targeting 23,435.

If Nifty breaks and sustains above 23,525 with strong volume, initiate a long trade, targeting 23,600 or higher. Use a trailing stop-loss to lock in profits.

Avoid trading immediately after the opening; observe the market's behavior for at least 15 minutes to confirm direction.

📚 Educational Insight: Gap-up openings often trigger profit booking near key resistance levels. Always wait for rejection or breakout confirmation to reduce risk.

2️⃣ Flat Opening (Within 23,344–23,375)

📍 Analysis: A flat opening suggests indecision in the market. The range between 23,344–23,375 will act as a critical zone for direction.

📌 Action Plan:

If Nifty struggles to hold above 23,375 and shows signs of rejection, consider a short trade targeting 23,304 or 23,245.

If Nifty sustains above 23,375, initiate a long trade targeting 23,404 and then 23,435. Ensure confirmation through volume and price action.

A decisive breakdown below 23,344 may indicate bearish sentiment, providing a shorting opportunity toward 23,304.

📚 Educational Insight: Flat openings provide the best opportunity to analyze market sentiment. Allow the first 15–30 minutes to settle before entering trades for better clarity.

3️⃣ Gap-Down Opening (100+ points near or below 23,245)

📍 Analysis: A gap-down near the Buyer’s Support Zone (23,245) or Golden Retracement Support (23,114) can trigger either panic selling or strong buying interest.

📌 Action Plan:

Look for reversals near 23,245 or 23,114. A strong bounce from these levels can provide a long trade opportunity targeting 23,304 or 23,375.

If Nifty sustains below 23,114 with high selling volume, initiate short trades targeting 23,050 or lower.

Avoid rushing into trades during a gap-down; wait for clear signs of reversal or breakdown for better risk management.

📚 Educational Insight: Gap-down scenarios often create volatility. Support zones like 23,245 and 23,114 can act as reversal points, but their failure may amplify bearish momentum.

⚠️ Risk Management Tips for Options Trading:

✅ Use strict stop-loss levels to minimize losses in volatile markets.

✅ Avoid trading in the first 15 minutes after the opening, as it often exhibits unpredictable price movements.

✅ Consider using strategies like spreads (bull/bear spreads) in high-IV conditions to cap potential losses.

✅ Monitor hourly candle closures for confirmation before entering high-risk trades.

✅ Never over-leverage; trade with an amount you are comfortable risking.

🔍 Summary & Conclusion:

Gap-Up: Watch price action near 23,525; trade rejections or sustained breakouts.

Flat: Observe the reaction within 23,344–23,375; trade breakouts or breakdowns accordingly.

Gap-Down: Look for buying opportunities at 23,245 or 23,114, but respect bearish momentum if these levels fail.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please consult a financial advisor or conduct your own research before trading.

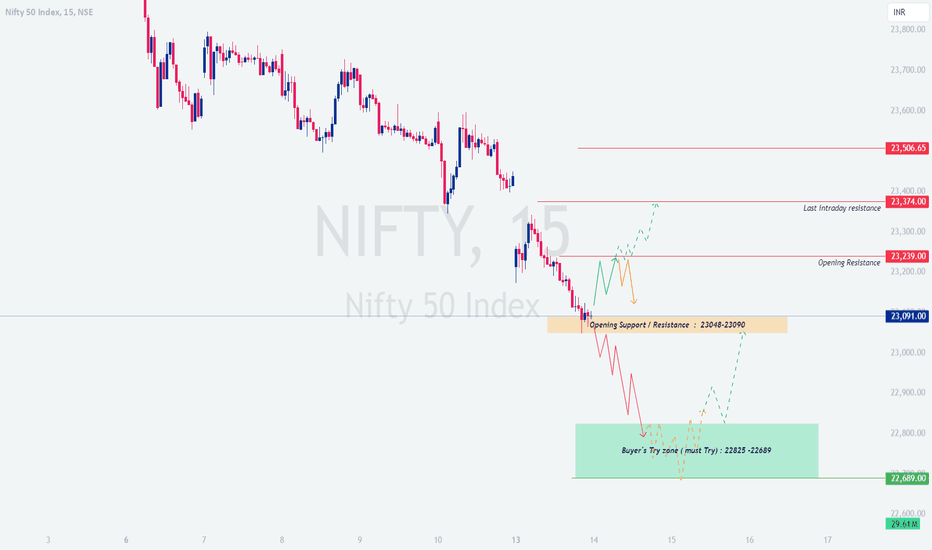

NIFTY : Trading Levels and Plan for 14-Jan-2025Trading Plan for 14-Jan-2025

This structured plan outlines potential strategies for different opening scenarios. Follow it step by step to make informed decisions and manage risk effectively.

Scenario 1: Gap-Up Opening (100+ Points Above 23,091)

🟢 A gap-up opening often indicates strong bullish momentum, but it’s crucial to watch for resistance at key levels.

Key Levels: Focus on 23,239 (Immediate opening resistance) and 23,374 (Last intraday resistance).

Plan of Action:

If Nifty opens near 23,239 and shows signs of rejection, wait for a bearish confirmation candle. Enter a short trade targeting 23,091 .

If it sustains above 23,239 , consider a long trade with a target of 23,374 . Place a stop loss below 23,239 .

Risk Management Tip: For options, use call spreads instead of naked call buying to reduce time decay losses.

Scenario 2: Flat Opening (Near 23,091)

🟡 Flat openings indicate neutral sentiment, often requiring more patience for market direction.

Key Levels: Monitor the No-Trade Zone (23,048 - 23,091) .

Plan of Action:

Avoid trading within the No-Trade Zone unless a breakout above 23,091 or a breakdown below 23,048 occurs.

Above 23,091 : Initiate a long trade with a target of 23,239 . Place a stop loss below 23,091 .

Below 23,048 : Go short with a target of 22,900 . Stop loss above 23,048 .

Risk Management Tip: Avoid impulsive trades. Let the market establish direction first.

Scenario 3: Gap-Down Opening (100+ Points Below 23,048)

🔴 A gap-down opening suggests bearish sentiment. Look for opportunities near strong support levels.

Key Levels: Focus on 22,825 - 22,689 (Buyer’s Try Zone).

Plan of Action:

If Nifty approaches the Buyer’s Try Zone and shows a bullish reversal, initiate a long trade with a target of 23,048 . Stop loss below 22,689 .

If it sustains below 22,689 , consider a short trade targeting 22,600 .

Risk Management Tip: Use option strategies like put spreads to limit risk in highly volatile markets.

Tips for Risk Management in Options Trading:

✔️ Avoid trading aggressively during the first 15 minutes of market opening. Let volatility settle.

✔️ Focus on spreads (e.g., bull call spread or bear put spread) to control risks better.

✔️ Use proper position sizing: Limit risk to 2-3% of your total capital per trade.

✔️ Adjust positions dynamically as levels are tested or broken.

Summary and Conclusion:

The market is poised for volatile movement on 14-Jan-2025. Stick to the plan and respect the No-Trade Zone for flat openings. Use the Buyer’s Try Zone for potential reversals in case of a gap-down opening. Patience, discipline, and effective risk management will be your key to success.

Disclaimer:

I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please do your research or consult a financial advisor before making any trading decisions.

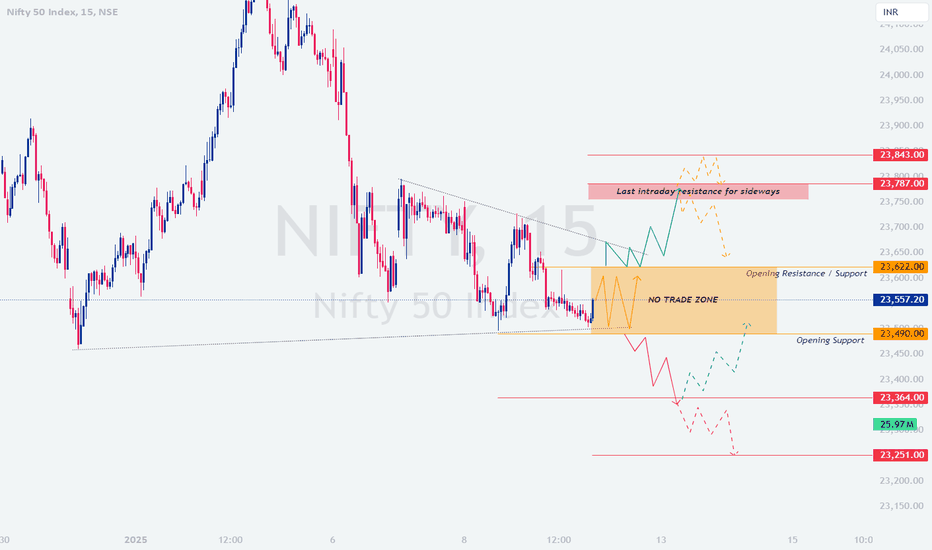

NIFTY : Trading Plan and Levels for 10-Jan-2025

Introduction:

Nifty has been consolidating within a defined range, with 23,622 acting as immediate resistance and 23,490 providing opening support. The "No Trade Zone" marked around 23,557-23,622 highlights areas of indecision where price movement lacks clarity. This trading plan evaluates different opening scenarios, including gap-up, flat, and gap-down openings, considering a gap of 100+ points.

Scenarios for 10-Jan-2025:

Gap Up Opening (100+ Points Above 23,622):

If Nifty opens above 23,622:

Monitor Retest of 23,622: A retest and hold of this level can be a potential opportunity to go long, with the first target at 23,787 and a stretch target at 23,843. Place a stop loss below 23,600 to protect capital.

Failure to Hold 23,622: If the price fails to sustain above 23,622, expect a correction toward 23,557. Wait for a reversal signal before taking any fresh positions.

Options Trading Tip: For a gap-up opening, consider buying call options close to the money if 23,622 holds as support. Avoid buying options with low liquidity.

Flat Opening (Near 23,557):

If Nifty opens near 23,557:

Focus on Breakout or Breakdown: Let the price action settle for the first 30 minutes. A breakout above 23,622 offers a long opportunity, with targets at 23,787-23,843.

Break Below 23,490: A breach of 23,490 could lead to a bearish move toward 23,364. Avoid long positions unless there’s a recovery signal around 23,490.

Risk Management Tip: Use proper position sizing. Avoid risking more than 2% of your capital on any single trade.

Gap Down Opening (100+ Points Below 23,490):

If Nifty opens below 23,490:

Watch for Reversal at 23,364: This support zone may attract buyers. Look for bullish reversal patterns to go long, targeting 23,490.

Break Below 23,364: A breach below 23,364 could lead to a significant downside toward 23,251. Aggressive short positions can be taken only after confirmation with a stop loss above 23,364.

Options Trading Tip: For a bearish gap-down, consider buying put options near resistance levels or selling call spreads for a safer risk-reward ratio.

Summary and Conclusion:

Nifty’s price action around 23,622 and 23,490 will determine the market’s trend for the day. Avoid trading within the "No Trade Zone" (23,557-23,622) unless a clear breakout or breakdown is visible. Risk management is key, especially in volatile conditions. Always use stop losses and stick to your trading plan.

Disclaimer:

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please consult your financial advisor before taking any trades. Trade responsibly.

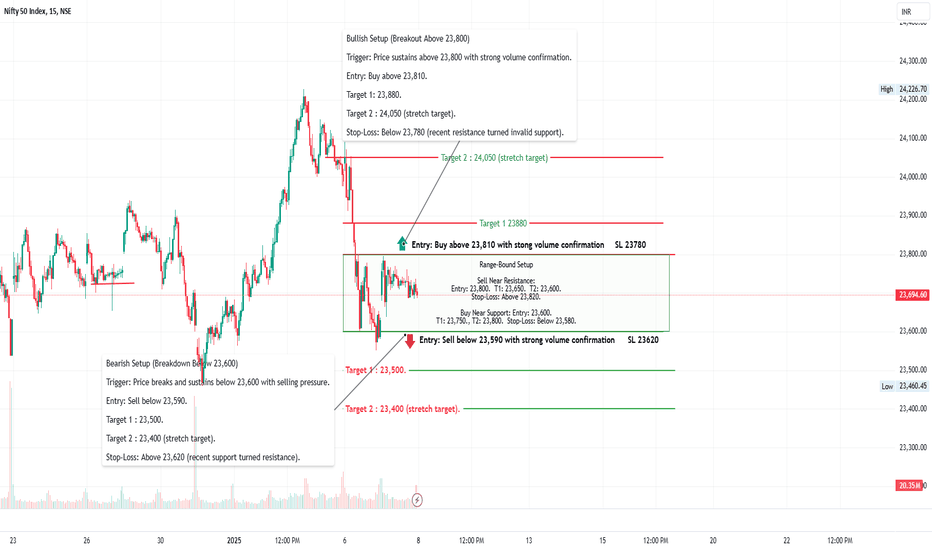

Nifty's Key Levels & Trade Plan for 08/01/25

Hi Guys,

Here’s the breakdown of my Nifty analysis for today:

Resistance Levels:

23,800: Immediate resistance.

23,880: Strong selling zone; breakout could lead to 24,050.

Support Levels:

23,600: Key support with high Put OI.

23,500: Psychological level; a breakdown could take us to 23,400.

My Trade Plan:

Buy Above 23,810:

Target 1: 23,880

Target 2: 24,050

Stop-Loss: 23,780

Sell Below 23,590:

Target 1: 23,500

Target 2: 23,400

Stop-Loss: 23,620

View:

The market looks range-bound between 23,600 and 23,800 unless we see a breakout or breakdown with strong volume. Stay cautious of false moves!

Disclaimer:

This is purely my personal analysis and not financial advice. Please trade based on your own research and risk management.

What’s your view on today’s price action? Let’s discuss!

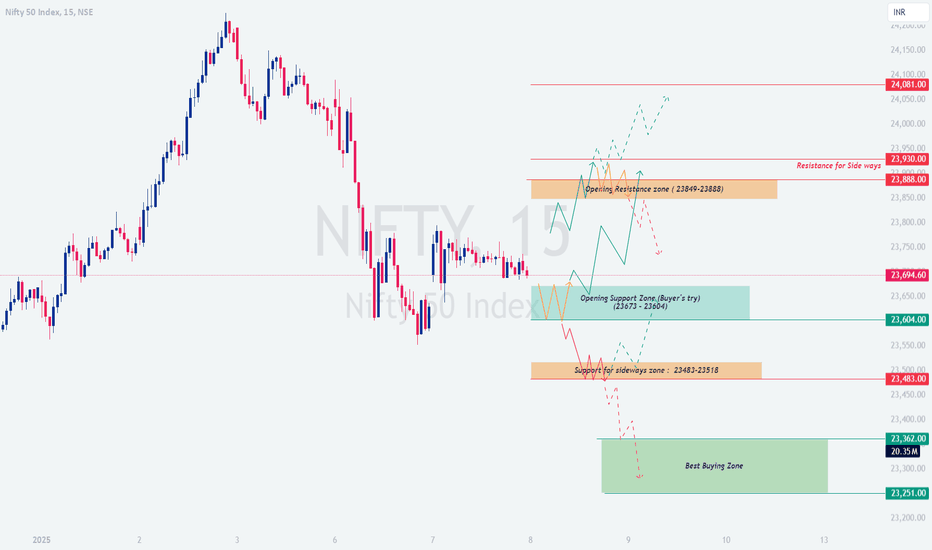

NIFTY : Trading levels and Plan for 08-JAN-2025Nifty Trading Plan for 08-Jan-2025

Intro: Review of 07-Jan-2025 Plan

Yesterday's trading plan accurately highlighted the Opening Resistance Zone (23,849-23,888) , which acted as a cap for bullish momentum, and the Opening Support Zone (23,673-23,604) , which provided a bounce. The market respected these levels with a predominantly sideways movement (Yellow Trend). The Best Buying Zone (23,251-23,362) remained untouched, keeping the downside potential intact.

For 08-Jan-2025, we focus on three opening scenarios: Gap-Up, Flat, or Gap-Down, with actionable strategies and clear risk management guidelines.

Opening Scenarios:

Gap-Up Opening (100+ points above previous close):

If Nifty opens above 23,888 , the Opening Resistance Zone (23,849-23,888) will likely act as a critical area.

A breakout above 23,888 with volume could push Nifty toward the next resistance at 24,081 . Go long on confirmed breakout candles with small retracements.

A rejection near 23,888 could result in a pullback to test 23,673-23,604 . Wait for reversal confirmation before entering short positions.

less

Copy code

Risk Management Tip: Avoid aggressive CE buying after a large gap-up; instead, use intraday dip-buying strategies or spreads for better risk control.

Flat Opening (Near previous close):

A flat opening around 23,694 could lead to a range-bound session (Yellow Trend). This scenario requires patience and precise execution:

A bullish breakout above 23,849 could lead to upside momentum, targeting 23,888 and 24,081 .

On the downside, a breakdown below 23,604 could initiate bearish momentum, with targets at 23,483-23,518 .

vbnet

Copy code

Risk Management Tip: Use option straddle strategies to benefit from potential sideways movements. Avoid overtrading in choppy market conditions.

Gap-Down Opening (100+ points below previous close):

If Nifty opens below 23,604 , focus on the Opening Support Zone (23,483-23,518) for potential reversals.

A bounce from 23,483-23,518 can provide a buying opportunity, targeting 23,604 and above.

A breakdown below 23,483 may trigger a bearish trend (Red Trend) toward the Best Buying Zone (23,251-23,362) . Wait for proper confirmation before initiating short trades.

less

Copy code

Risk Management Tip: For gap-down scenarios, use PE options or bear put spreads with defined risks. Be cautious of sharp reversals after a gap-down.

Key Levels to Watch:

Support Zones: 23,673-23,604, 23,483-23,518, and 23,251-23,362.

Resistance Zones: 23,849-23,888 and 24,081.

Summary & Conclusion:

Nifty is trading within a structured range, offering clear opportunities for intraday trades based on levels. Stick to disciplined execution, and do not chase trades without confirmation. Use options strategies to manage risk and maximize returns in volatile conditions.

Disclaimer: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please consult your financial advisor before making any trading decisions.

Nifty Intraday and Swing Trade Analysis For 06/01/25 And weekly

In this post, I’m sharing my detailed analysis of Nifty 50’s recent price action, focusing on intraday and swing trades. This setup incorporates technical patterns, volume confirmation, and Smart Money Concepts (SMC) to identify high-probability trade opportunities.

Key Observations

Bearish Momentum Across Timeframes: Both daily and intraday charts show strong bearish trends validated by supply zones and volume spikes.

Critical Levels Identified:

Resistance: 24,200 - 24,400 (Supply Zone).

Support: 23,950 (Intraday) and 23,700 - 23,500 (Swing Levels).

Volume Profile: Volume spikes on breakdowns confirm institutional involvement.

Trade Plan: Intraday

Scenario 1: Sell Below 23,950

Entry: Below 23,950 (confirmed breakdown).

Stop Loss: Above 24,050.

Target 1: 23,900.

Target 2: 23,850.

Rationale: Break below 23,950 signals bearish continuation with strong seller dominance.

Scenario 2: Buy Above 24,050

Entry: Above 24,050.

Stop Loss: Below 23,950.

Target 1: 24,100.

Target 2: 24,150.

Rationale: Reclaiming 24,050 indicates a potential bullish reversal.

Confidence Level: Moderate (requires strong buying volume).

SWING TRADING

Scenario 1: Swing Sell Below 23,900

Entry: Below 23,900.

Stop Loss: Above 24,150.

Target 1: 23,700.

Target 2: 23,500.

Rationale: A breakdown below 23,900 aligns with the long-term bearish structure and supply rejection.

Scenario 2: Swing Buy Above 24,200

Entry: Above 24,200.

Stop Loss: Below 24,000.

Target 1: 24,400.

Target 2: 24,600.

Rationale: Clearing the supply zone at 24,200 would confirm a trend reversal.

Confidence Level: Moderate.

Advanced Concepts Used

Smart Money Concepts (SMC):

Supply Zone: 24,200 - 24,400.

Demand Zone: 23,700 - 23,500.

Liquidity Trap: Below 23,950.

Volume Confirmation:

Selling volume spikes during breakdowns confirm bearish moves.

Low-volume retracements suggest weak buying interest.

Indicators:

RSI: Below 50 on daily charts, supporting bearish momentum.

MACD: Bearish crossover on daily charts aligns with the trend.

Moving Averages: Price below the 20 EMA and 50 EMA reinforces bearish bias.

Why This Trade Setup Stands Out

This analysis combines the best of price action, volume confirmation, and advanced SMC tools. Each level and decision is backed by data and market behavior, ensuring a methodical approach to trading.

Disclaimer

The views and trade ideas shared in this post are for informational and educational purposes only. They are not financial advice and should not be construed as a recommendation to buy, sell, or hold any securities or financial instruments. Trading involves significant risk, and you should carefully consider your financial situation, objectives, and risk tolerance before making any trading decisions.

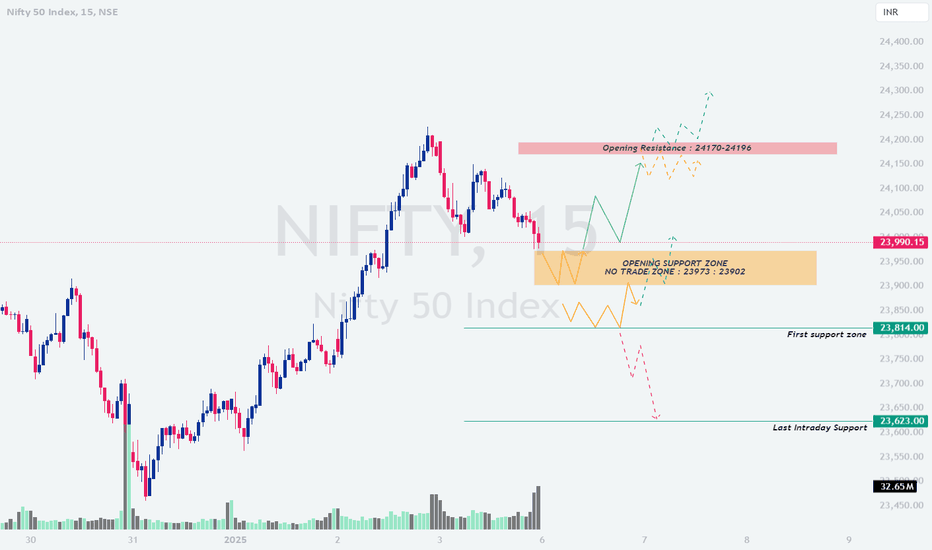

NIFTY : Trading Levels and plan for 06-Jan-2025 Nifty Trading Plan for 6-Jan-2025

Introduction

The chart shared yesterday highlighted key zones and potential movements. The Opening Resistance Zone of 24,312 acted as a strong supply area, while the Support Zone between 23,970-24,016 was well respected. Actual price movement closely aligned with the predicted Yellow (Sideways) and Green (Bullish) trends, allowing traders to capitalize on the directional moves.

Today’s chart brings us new levels and strategies for varying opening scenarios. Let's dive into the details for 6-Jan-2025!

Trading Plan for 6-Jan-2025

Gap-Up Opening (100+ Points Above 24,016):

If Nifty opens with a significant gap-up:

Immediate resistance lies at 24,170-24,196. Wait for price action near this level.

Bullish Scenario: If prices sustain above 24,196 for 15 minutes, enter a long position with targets at 24,312 and 24,550. Use a stop-loss below 24,170.

Sideways Possibility: If price struggles near 24,170, expect a sideways trend, as shown in Yellow. Avoid overtrading here.

Flat Opening (Near 23,990):

If Nifty opens flat:

The key Opening Support Zone is at 23,973-23,902. This area serves as a no-trade zone unless there is a clear breakout or breakdown.

Bullish Scenario: Look for sustained buying above 24,016, targeting 24,170 initially and then 24,312.

Bearish Scenario: If prices fall below 23,902, expect a move toward the next support zone at 23,814. Use a tight stop-loss above 23,902.

Gap-Down Opening (100+ Points Below 23,970):

If Nifty opens with a gap-down:

Immediate focus should be on the First Support Zone at 23,814.

Bearish Scenario: If prices fail to hold 23,814, expect a sharp move toward 23,623 (Last Intraday Support).

Bullish Reversal Opportunity: If prices recover quickly and reclaim 23,970, consider going long for a target of 24,016. Stop-loss below 23,814.

Avoid aggressive shorting unless price action confirms weakness below 23,814.

Risk Management Tips for Options Traders:

Use smaller lot sizes to manage risk during volatile openings.

Focus on ATM (At the Money) options to reduce premium decay in uncertain conditions.

Avoid trading during the first 15 minutes unless clear trend confirmation is seen.

Always maintain a stop-loss and adhere to it.

Summary and Conclusion:

Today’s plan focuses on the key zones of resistance and support. The Opening Resistance Zone at 24,170-24,196 will be crucial for bullish continuation, while the Support Zones at 23,814 and 23,623 must be monitored for bearish breakdowns. Follow the Yellow, Green, and Red trends for guidance, and remember to prioritize risk management over aggressive trades.

Disclaimer: I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Traders are advised to conduct their analysis or consult a financial advisor before executing any trades.

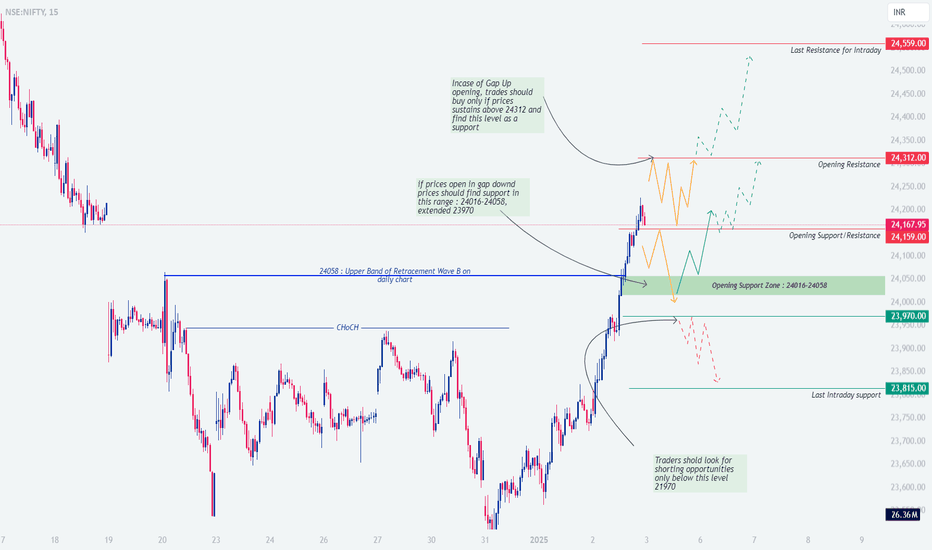

NIFTY : Trading levels and Plan for 03-Jan-2024

Intro: Previous Day's Plan vs. Actual Chart Movement

In the trading plan for 2-Jan-2025, key levels worked exactly as predicted in plan

Price movement respected these levels, The bullish structure remained intact for the day, with significant opportunities for intraday gains.

Trading Plan for 3-Jan-2025

If Market Opens Gap Up (100+ Points Above Previous Close):

A gap-up opening above the Opening Resistance Zone (24,312) signals strength. Monitor price behavior for consolidation or sustained trading above this level. Sustaining above 24,312 could lead to a move towards the Last Resistance for Intraday (24,559) .

If prices fail to hold above 24,312 and retrace, expect a pullback toward the Opening Support/Resistance Zone (24,159-24,167) .

📈 Action Plan:

Look for long positions above 24,312 after a 15-minute candle close. Use stop loss at 24,167.

Avoid short positions unless there’s clear rejection with bearish confirmation.

📊 Trend Indicators:

Green: Bullish Move Expected.

If Market Opens Flat (Near Previous Close):

Observe price action near the Opening Support/Resistance Zone (24,159-24,167) . Sustained trading above this zone could trigger a move toward 24,312 .

A breakdown below 24,159 would indicate weakness, and prices could test the Opening Support Zone (24,016-24,058) .

📈 Action Plan:

For long trades, wait for price to break above 24,167 and confirm with volume. Use stop loss at 24,016.

For short trades, consider entry below 24,159 with a target of 24,016 and a stop loss at 24,167.

📊 Trend Indicators:

Yellow: Sideways Trend Expected.

If Market Opens Gap Down (100+ Points Below Previous Close):

A gap-down opening near 23,970 or the lower end of the Opening Support Zone (24,016-24,058) might provide a recovery opportunity. Monitor price action for a bounce back to 24,159.

If prices fail to sustain above 23,970, expect further downside toward the Last Intraday Support (23,815) .

📈 Action Plan:

For long positions, wait for recovery above 23,970 with bullish confirmation. Use stop loss at 23,815.

For short trades, consider entry below 23,970 with a target of 23,815 and a stop loss at 24,016.

📊 Trend Indicators:

Red: Bearish Move Expected.

Risk Management Tips for Options Trading:

Always calculate position sizing based on risk tolerance.

Use stop-loss orders to minimize losses, especially in high-volatility scenarios.

Avoid overtrading; wait for clear confirmation of price action before entering trades.

For intraday options, consider exiting positions by 3:15 PM to avoid overnight risk.

Summary and Conclusion:

The key levels for Nifty on 3-Jan-2025 are:

Resistance: 24,312 and 24,559.

Support: 24,016-24,058 and 23,815.

Use price action and trend behavior (Green for bullish, Yellow for sideways, and Red for bearish) to guide your trades. Stick to the plan, and prioritize risk management.

Disclaimer:

This trading plan is for educational purposes only. I am not a SEBI-registered analyst. Please consult your financial advisor before making any trading decisions.

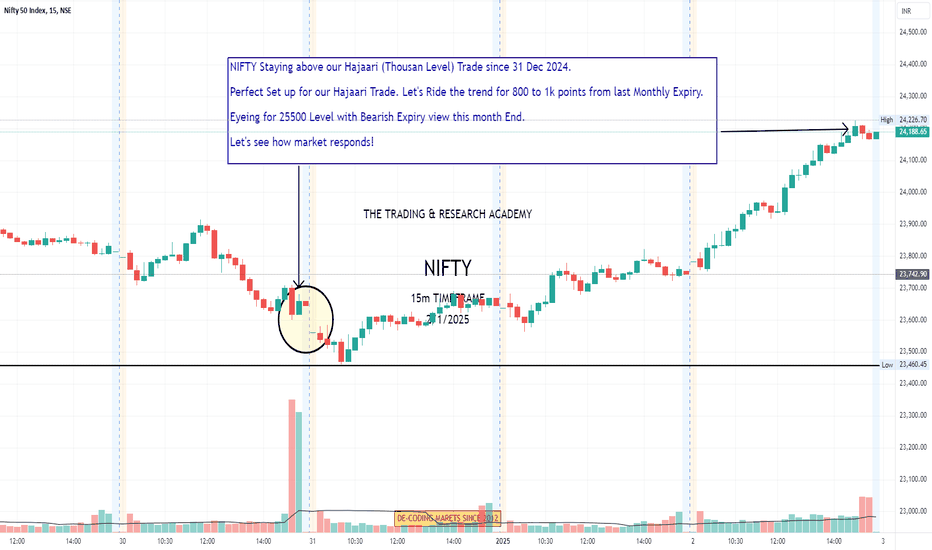

NIFTY - Hajaari TradeHajaari Trade in Nifty seems active , provided it remains above 24K Level for next 3-4 Days!

NIFTY Staying above our Hajaari (Thousan Level) Trade since 31 Dec 2024.

Perfect Set up for our Hajaari Trade. Let's Ride the trend for 800 to 1k points from last Monthly Expiry.

Eyeing for 25500 Level with Bearish Expiry view this month End.

Let's see how market responds!

This Chart is for educational purpose & not a buy/sell recommendation.

Nifty may remain Bullish this month till 15 Jan, we may see a reversal basis Budget Movements. This is a Big yearly event which result in throwing Technical out of the window.

Technical Analysis may not work on Event Days like Budget, Election, Monitory Policy Review, RBI/ FED Interest Rat Decisions, etc. It is advised to check out Economic Calendar before planning a Trade!

Thank You

NIFTY : Trading Levels and Plan for 02-Jan-2025WISH YOU ALL A VERY HAPPY NEW YEAR 2025

Introduction

In the previous trading session, we analyzed Nifty's key support and resistance levels for 1-Jan-2025. The chart provided a clear view of potential price movements under various scenarios. Yellow trends indicated sideways movement, green trends represented bullish behavior, and red trends highlighted bearish trends. Based on the chart for 1-Jan-2025, the actual price action unfolded as expected, staying within the highlighted zones and offering valuable insights for traders.

Trading Plan for 2-Jan-2025

Gap-Up Opening (100+ points)

If Nifty opens with a gap-up above 23,837 (No Trade Zone's upper band), observe the first 15-minute candle for confirmation.

If the price sustains above 23,837, expect a bullish trend targeting the Resistance Zone at 23,998 and further towards 24,068 for profit booking.

Place a stop loss just below 23,837 to manage risk and protect capital.

If the price fails to sustain above 23,837, expect a potential pullback towards the No Trade Zone. Monitor closely for any reversals within the zone.

Avoid taking positions inside the No Trade Zone unless a clear breakout or breakdown is visible.

Flat Opening

If Nifty opens flat near 23,758 (current market price), observe the price action for the first 15 minutes.

A breakout above 23,837 indicates bullish momentum towards 23,998 and 24,068, following the same plan as the gap-up scenario.

A breakdown below 23,699 (No Trade Zone's lower band) may signal a bearish move towards the Opening Support Zone at 23,617–23,640 and further towards 23,537.

Place a stop loss just above the breakdown or breakout levels to manage risk.

Wait for a confirmation candle (closing basis) before entering trades to avoid false signals.

Gap-Down Opening (100+ points)

If Nifty opens with a gap-down below 23,699, observe the first 15-minute candle for confirmation.

If the price sustains below 23,699, expect a bearish continuation targeting the Opening Support Zone at 23,617–23,640 and further towards the critical support at 23,537 (reversal zone).

Place a stop loss above 23,699 to manage risk.

If the price fails to sustain below 23,699, anticipate a pullback towards 23,837 and monitor for potential reversals in this region.

Avoid taking impulsive trades at open; let the levels guide your entries and exits.

Risk Management Tips for Options Trading

Always use stop losses to minimize potential losses.

Avoid over-leveraging; trade within your capital limits and risk tolerance.

Monitor implied volatility and time decay when trading options.

Diversify your trades to reduce exposure to single-direction risks.

Stick to your plan and avoid emotional decisions.

Summary and Conclusion

The trading plan for 2-Jan-2025 revolves around identifying key levels and understanding price behavior under various opening scenarios (Gap Up, Flat, or Gap Down). The No Trade Zone highlights areas to avoid unless clear trends are visible. Follow the highlighted trends: yellow for sideways, green for bullish, and red for bearish movements. By employing proper risk management and adhering to this plan, traders can make informed decisions and navigate market conditions effectively.

Disclaimer : I am not a SEBI-registered analyst. This trading plan is for educational purposes only and should not be construed as financial advice. Always conduct your research and consult a professional financial advisor before making trading decisions.

Nifty Review & Analysis - DailyPrice Action :

Nifty opened at previous day's close and tested pivot level finding buying around 23565 levels and rallied almost 200 points till 23775 levels and saw small profit booking. Post noon saw buying around 23700 levels and tested above 23800 and saw small profit booking towards end of the day loosing momentum. If sustained below 23800 can again test 23700-23730 levels and above 23820 if sustained can test 23950 levels.

Trend:

Nifty formed Higher High and Higher Low suggesting Long Trend

Options Data:

23700-800 Puts added Open Interest showing support. 23700 and 23900 CE shedded OI, don't have much resistance till 24050-100 levels.

Futures Data:

Nifty Futures closed positively with Increase in Open Interest suggesting Bullish

Outlook for Next Session:

Nifty looks Bullish above 23800 for tgt 24000-24050. (for next wkly expiry)

Positons:

Wait for 30min candle close above 23800 to go long for tgt 24000.