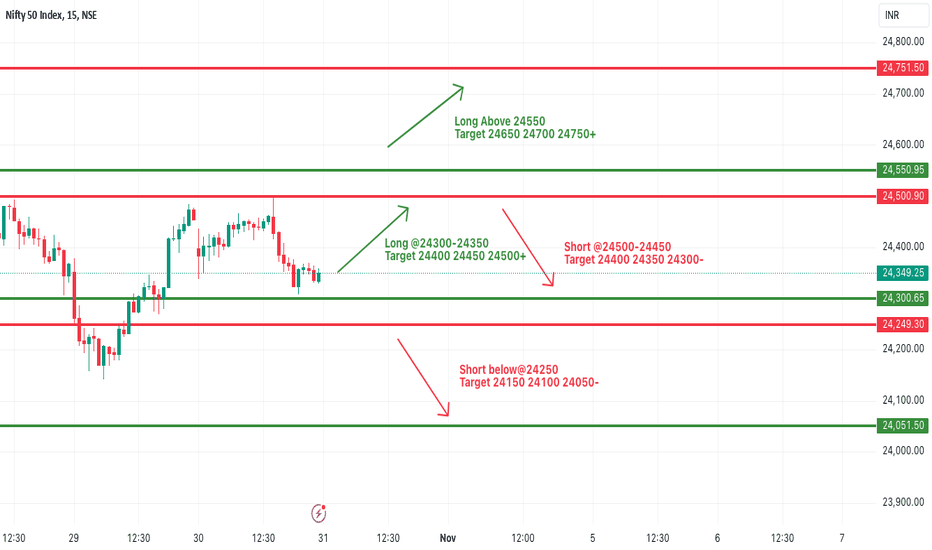

#NIFTY Intraday Support and Resistance Levels - 31/10/2024Gap down opening expected in nifty. After opening if nifty starts trading below 24250 level then possible downside rally upto 24050 level in today's session. 24300-24500 range is consolidation zone for nifty. Strong bullish rally expected if nifty starts trading above 24500 level.

Niftytradesetup

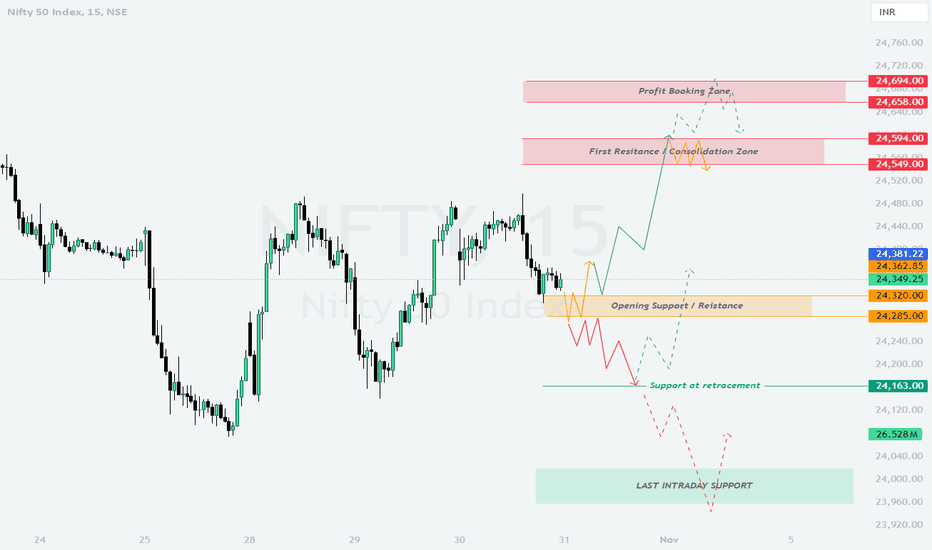

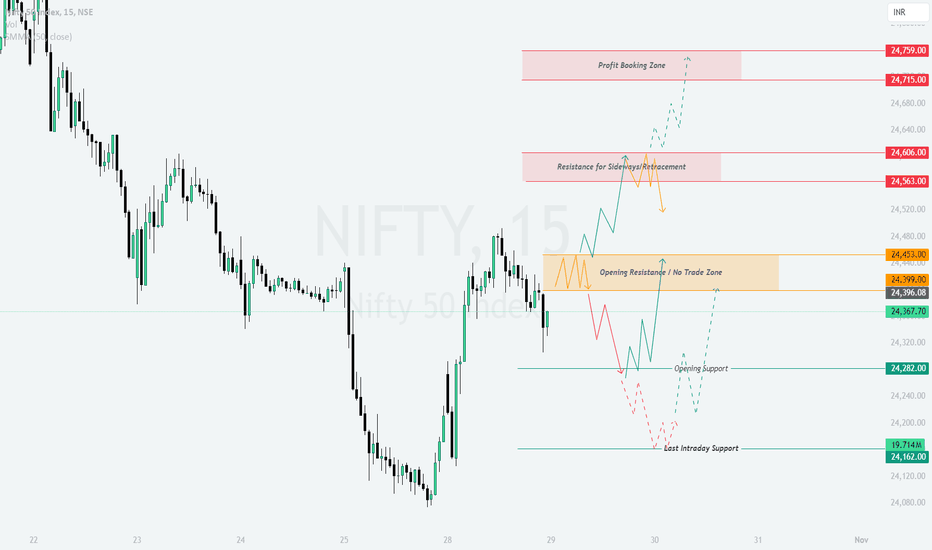

NIFTY : Trading Levels and Plan for 31-Oct-2024

Intro:

On the previous trading day, Nifty exhibited a mix of consolidation and upward momentum, with notable resistance zones tested near 24,594 . Key levels for 31-Oct-2024 have been identified, with trends marked as follows: yellow for sideways movement, green for bullish momentum, and red for bearish sentiment. This plan provides strategies for different opening scenarios.

Trading Plan for 31-Oct-2024

Gap Up Opening (100+ points above)

If Nifty opens 100+ points above the previous close, it may test the First Resistance/Consolidation Zone near 24,594 . If the index sustains above this level, we may see a push towards the Profit Booking Zone at 24,694 . However, if it struggles to hold above 24,594 , expect a retracement towards the Opening Support/Resistance level at 24,320 .

– A reversal from the resistance levels could prompt a move back to the Support at Retracement at 24,163 .

Flat Opening (within 50 points of the previous close)

For a flat opening, the key level to watch is 24,349 . Sustaining above this point could lead to a breakout, targeting 24,594 and possibly extending towards the Profit Booking Zone at 24,694 . Conversely, if momentum fails above 24,349 , Nifty might move sideways around 24,320 or even test the lower support at 24,285 .

– A downside break below 24,285 could increase bearish pressure, with potential support found at 24,163 .

Gap Down Opening (100+ points below)

In a gap-down scenario, initial support may be found near 24,285 . A rebound from this level could bring the price back toward 24,349 . If the index sustains above 24,349 , bullish momentum could retest the resistance at 24,594 . However, if 24,285 fails to hold, a decline towards Support at Retracement near 24,163 is likely.

– Persistent weakness below 24,163 might drive further downside towards the Last Intraday Support at 24,040 .

Risk Management Tips for Options Trading

Manage your position sizes wisely, especially when volatility is high.

Consider deploying trailing stops near major resistance/support levels to protect gains.

Options spreads can limit risk exposure, which is particularly useful in a choppy market.

Summary and Conclusion

The primary focus for 31-Oct-2024 remains on the resistance at 24,594 and support at 24,163 . Traders should stay flexible with these levels and use disciplined stop-loss strategies to manage risks. Observing the price action after the opening will provide better insight into the day’s trend.

Disclaimer:

I am not a SEBI-registered analyst. This analysis is based on technical levels and reflects my personal view. Please perform your own analysis or consult a financial advisor before trading.

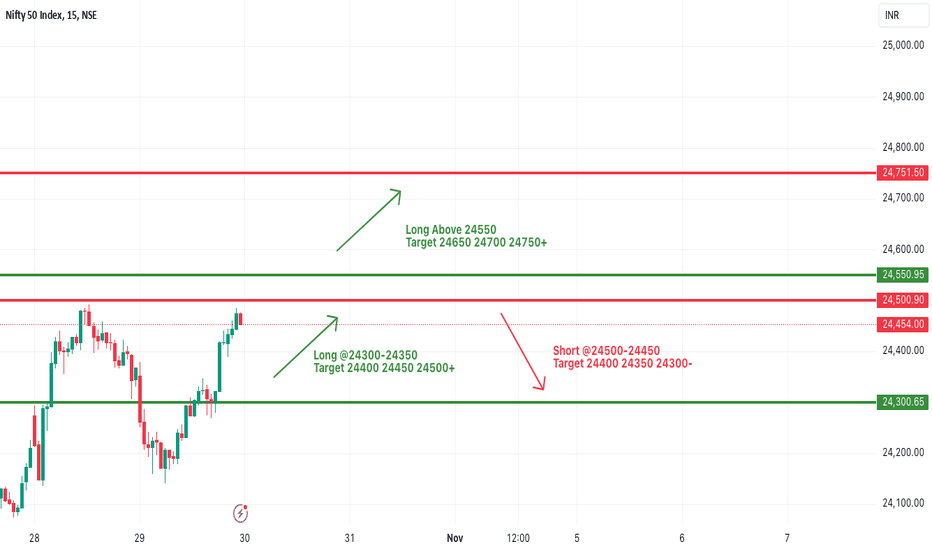

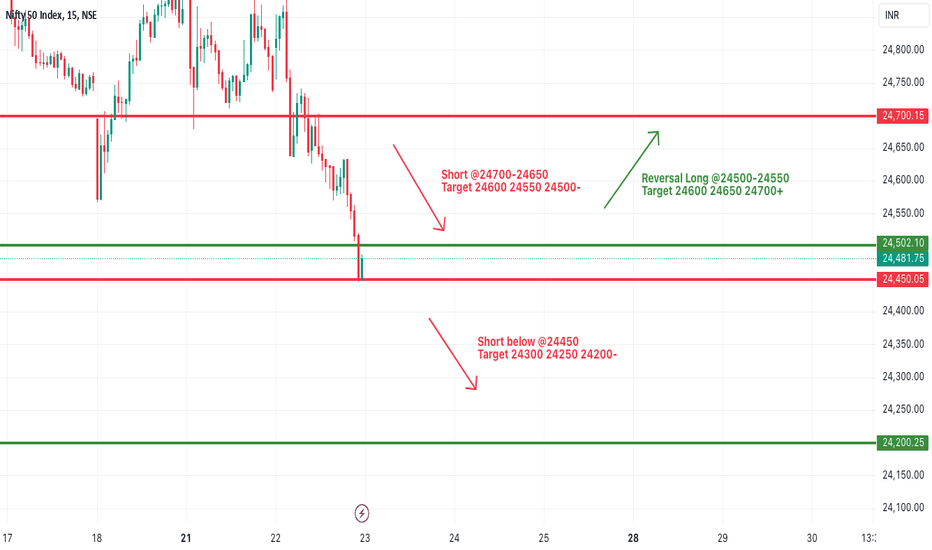

#NIFTY Intraday Support and Resistance Levels - 30/10/2024Flat opening expected in nifty. After opening if nifty starts trading above 24550 level then possible strong upside rally upto 24750+ in today's session. 24300-24450 zone will act as a consolidation range for nifty. Any major further downside only expected below 24300 level.

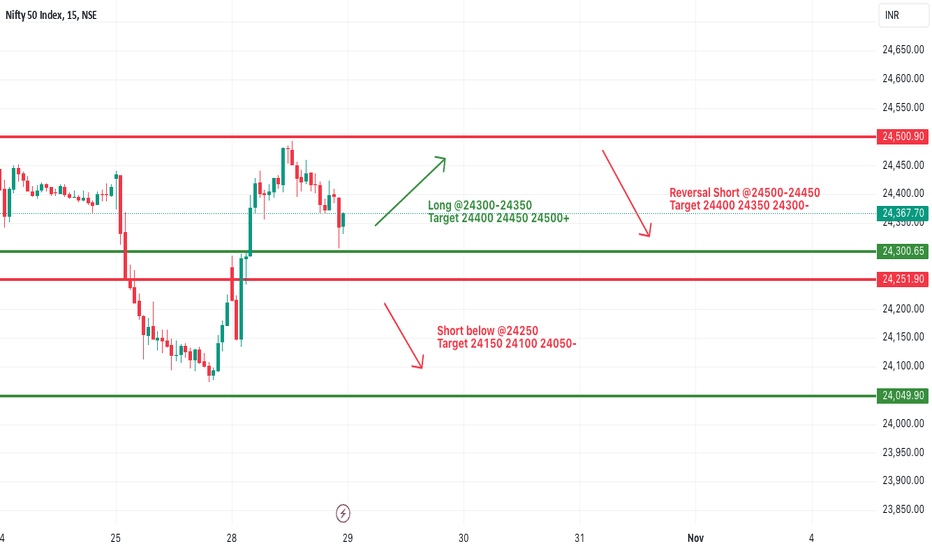

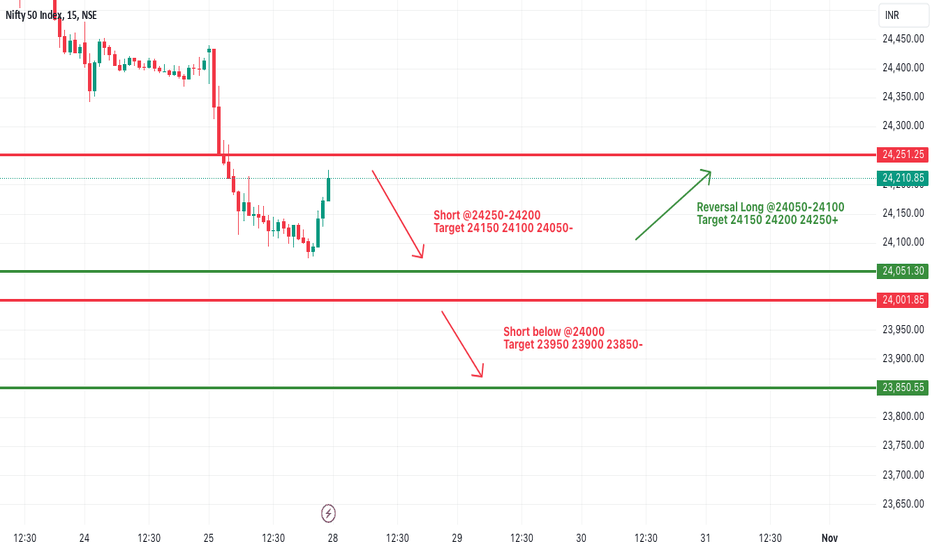

#NIFTY Intraday Support and Resistance Levels - 29/10/2024Today nifty will open flat or slightly gap down near 24300 level. After opening if it's sustain above 24300 level then possible upside rally upto 24500 but in case nifty starts trading below 24250 level then possible further downside upto 24050 level in today's session.

NIFTY : Trading Levels and Plan for 29-Oct-2024

Intro:

On the previous day, Nifty displayed a upward movement from the provided levels in yesterdays trading plan and minor fluctuations within key levels. The chart illustrates potential sideways movement in yellow , an expected bullish trend in green , and a bearish trend in red . For today's trading, we will observe various opening scenarios and outline strategies accordingly.

Trading Plan for 29-Oct-2024

Gap Up Opening (100+ points above)

If Nifty opens with a 100+ points gap up, it is likely to face resistance near the 24,453 - 24,563 range, which is marked as the Opening Resistance / No Trade Zone . Observe price action here. If Nifty sustains above 24,563 , it may target the Profit Booking Zone around 24,715 - 24,759 . However, if it fails to break above the resistance, expect a potential retracement towards the Opening Support at 24,282 .

– In case of strong selling pressure, Nifty could pull back further, aiming toward 24,162 as a potential support.

Flat Opening (within 50 points of the previous close)

With a flat opening, focus on the initial 30 minutes to gauge market sentiment. If prices sustain above the 24,453 level, we may see a push toward 24,563 . A breakout above 24,563 will likely lead to a bullish trend targeting Profit Booking Zone at 24,715 - 24,759 . However, if it fails to sustain above the No Trade Zone , expect sideways movement or a dip toward 24,282 .

– Any move below 24,282 could potentially extend towards 24,162 , testing the Last Intraday Support level.

Gap Down Opening (100+ points below)

In a gap-down opening, monitor the 24,282 level as the immediate support. If it holds, Nifty may attempt to retest the Opening Resistance Zone around 24,453 . A breakout above this level could bring sideways or bullish momentum up to 24,563 . Failure to reclaim 24,282 may lead to further downside pressure, potentially pulling prices to the Last Intraday Support at 24,162 .

– Watch for price stability around 24,162 if it is reached, as this may serve as a potential reversal point.

Risk Management Tips for Options Trading

Consider setting a defined stop-loss for each options position based on volatility levels; hourly candle closes can be useful for managing intraday risk.

Avoid over-leveraging. In options trading, position sizing should reflect the inherent risk and potential for quick price changes.

Utilize trailing stops to lock in profits if Nifty moves favorably. This is particularly effective in highly volatile sessions.

Summary and Conclusion

Today, focus on the key zones: 24,453 - 24,563 as resistance and 24,282 as support. A break above or below these levels could set the day's trend. Use a balanced approach, aligning with the prevailing sentiment indicated by the chart structure.

Disclaimer:

I am not a SEBI-registered analyst. This analysis is based on personal views and technical parameters. Please conduct your research or consult a financial advisor before making any trading decisions.

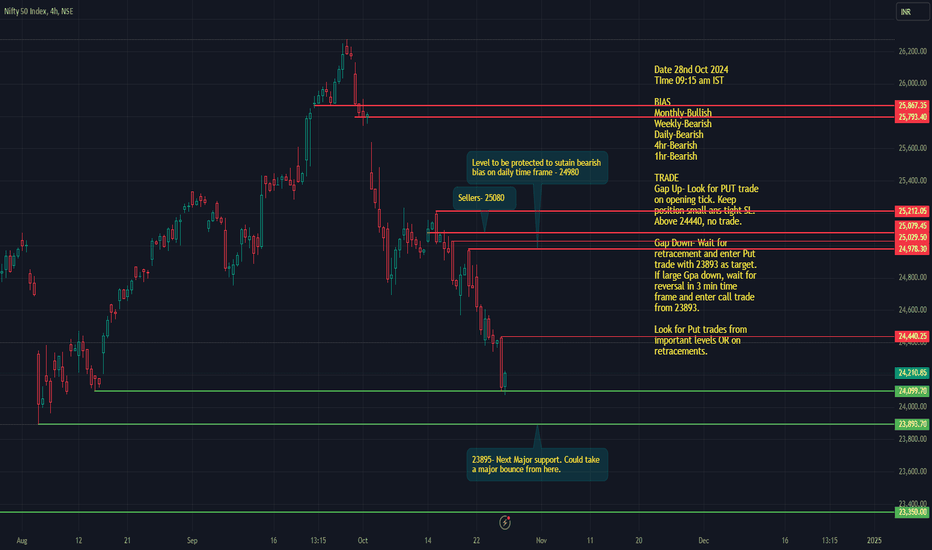

#NIFTY Intraday Support and Resistance Levels - 28/10/2024Today gap down opening expected in nifty. After opening expected downside upto 24050 level in today's session and this downside rally can extend for further 100-150 points in case nifty starts trading below 24000 level. Downside 23850 level expected in today's session. Any upside rally only expected if nifty sustain above 24050 level and give reversal from this level.

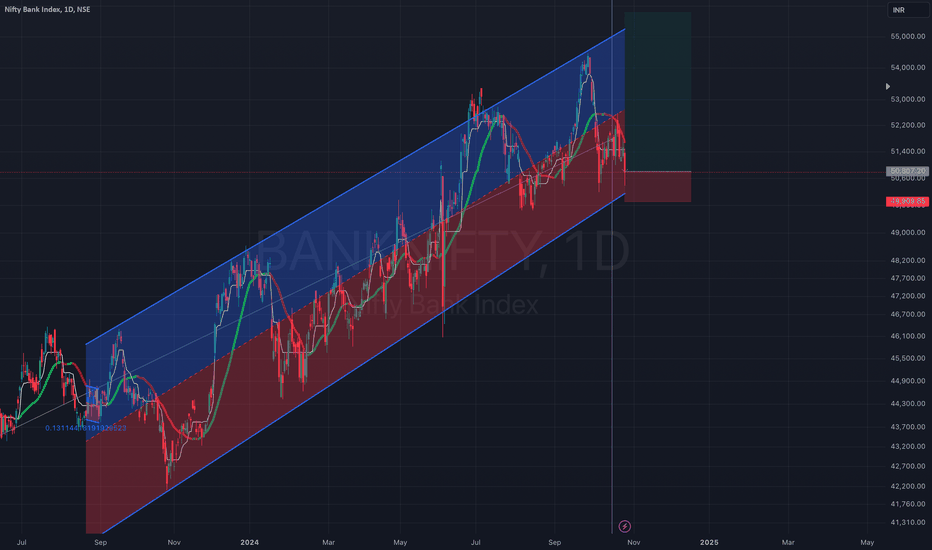

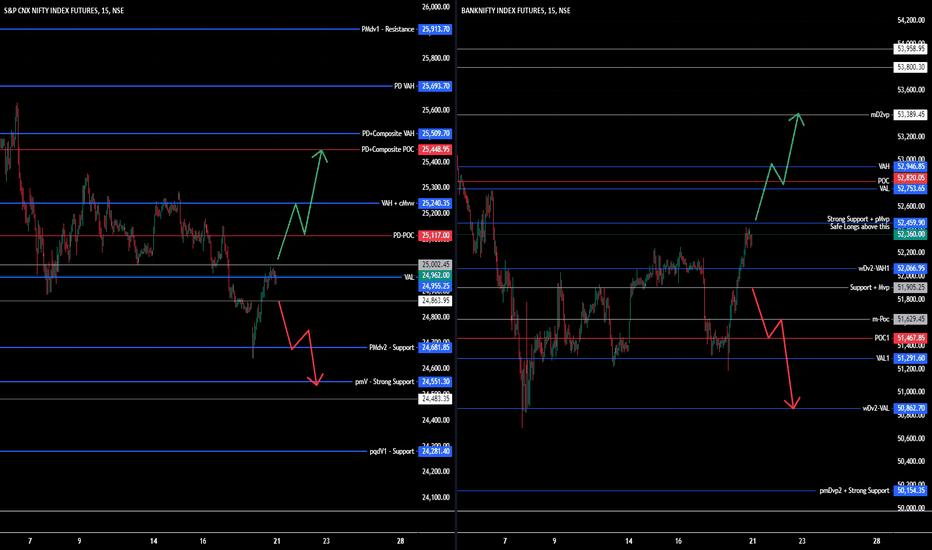

Bank Nifty Long - Riding the Wave • Technical Analysis:

• Trend Analysis: The Bank Nifty has been showing a robust upward trend, consistently forming higher highs and higher lows over the past month.

• Support Levels: The index recently bounced off a significant support level, confirming strength in the ongoing trend.

• Moving Averages: Bank Nifty is trading above both its 50-day and 200-day moving averages, a strong indicator of continued bullish momentum.

• RSI & MACD: Both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) show bullish divergences, indicating that the upward movement has room to continue.

The decision to go long on Bank Nifty was driven by strong technical signals and positive economic fundamentals. This position is intended to capitalize on the potential upward trajectory forecasted by both market sentiment and statistical indicators. I will be monitoring this position closely and plan to adjust my stop-loss and take profit points as the market evolves.

#BankNifty #LongPosition #TradingView #MarketAnalysis

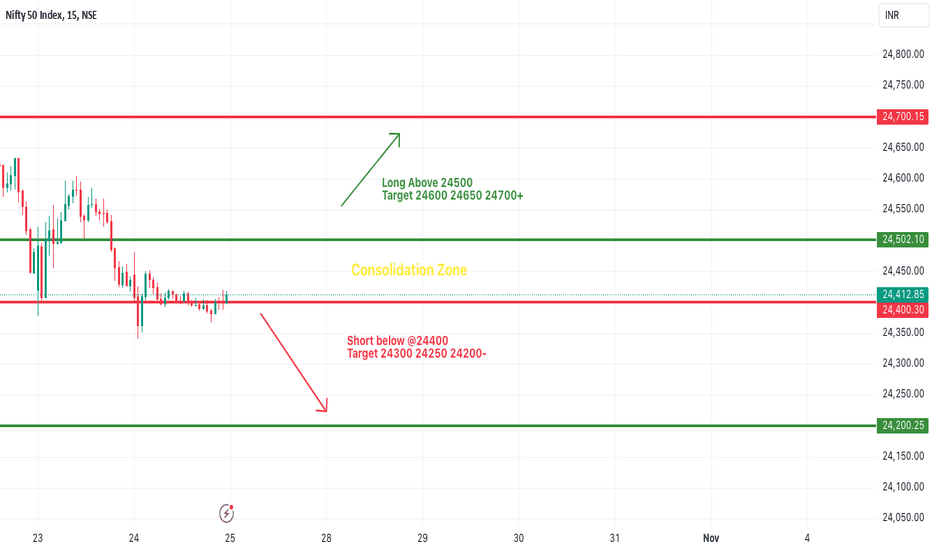

#NIFTY Intraday Support and Resistance Levels - 25/10/2024Flat or slightly gap up opening expected in nifty. After opening expected nifty will consolidated between 24400-24500 zone. Bullish rally only expected if nifty gives breakout of 24500 level and sustain above this level. Downside expected if nifty starts trading below 24400 level.

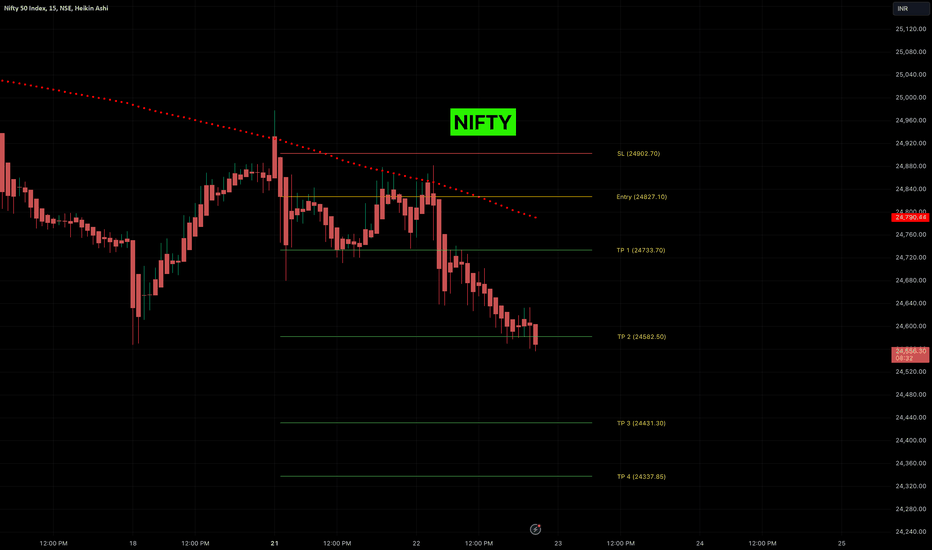

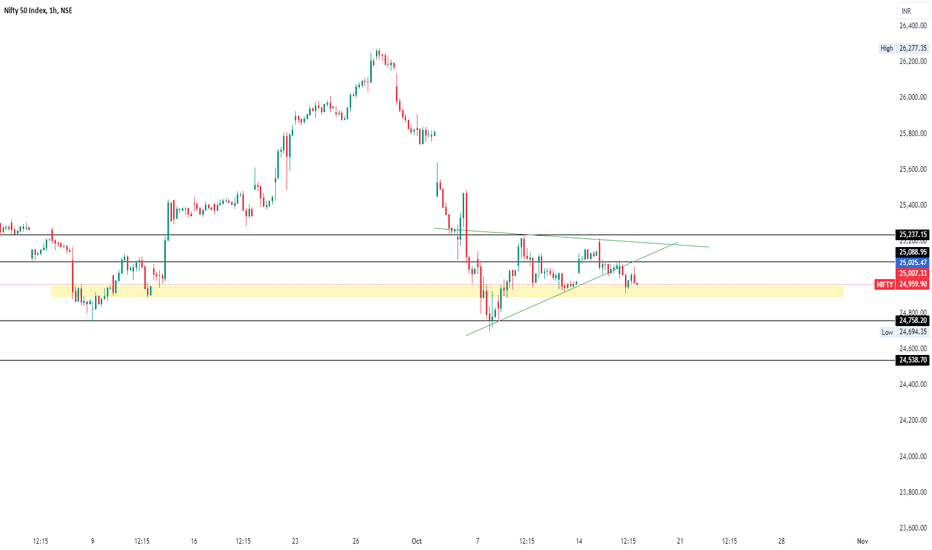

NIFTY Bears Roar! TP2 Hit, Momentum Building for More!NIFTY 15m time frame Short Trade

Entry: 24,827.10

Current Price: 24,565.50 – TP2 completed, moving closer to TP3 and TP4

Key Levels:

Stop-Loss (SL): 24,902.70 – Protecting against reversals above resistance.

Take Profit 1 (TP1): 24,733.70 – Hit, confirming downtrend initiation.

Take Profit 2 (TP2): 24,582.50 – Hit, trend acceleration seen.

Take Profit 3 (TP3): 24,431.30 – Approaching the next key target.

Take Profit 4 (TP4): 24,337.85 – Final target for this move.

Trade Outlook:

NIFTY continues its downward journey, with TP2 successfully hit. Bearish pressure remains strong, and we anticipate the next targets being met as the market sustains its downtrend.

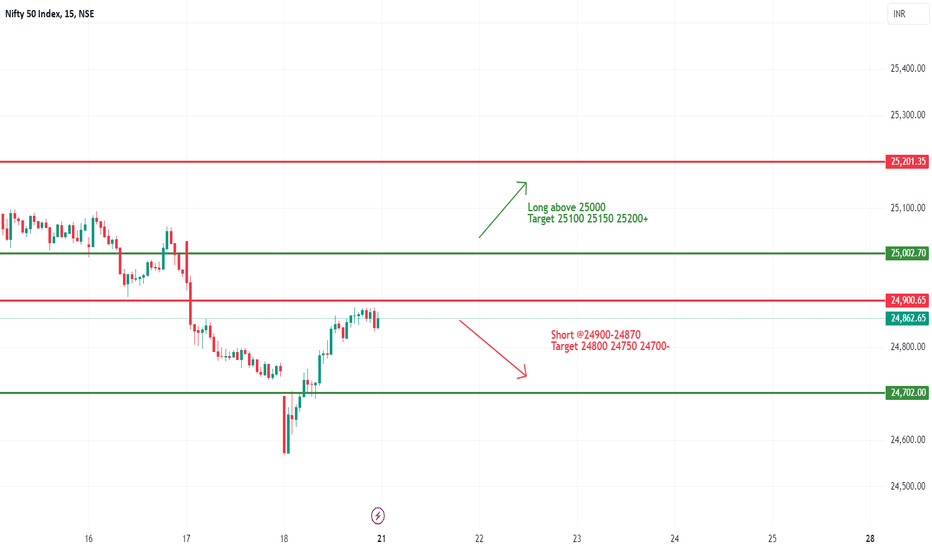

#NIFTY Intraday Support and Resistance Levels - 23/10/2024In today's session, Expected nifty will open near 24500 level. After opening if it's sustain above 24500 level then expected correction movement upto 24700. Upside 24700 will act as a strong resistance for today's session. In case, Nifty gives breakdown of 24450 level then possible strong downside upto 24200 level in today's session.

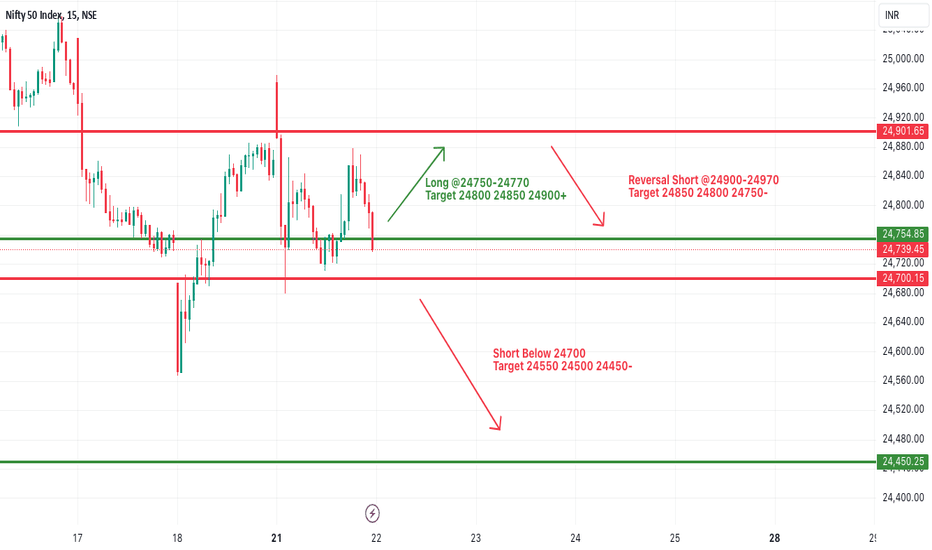

#NIFTY Intraday Support and Resistance Levels - 22/10/2024Flat opening expected in nifty. After opening if nifty nifty will face resistance at 24900 level and expected downside from this level. If nifty gives breakdown of 24700 level then possible strong downside fall upto 24450 level. Any major upside only expected above 25000 level.

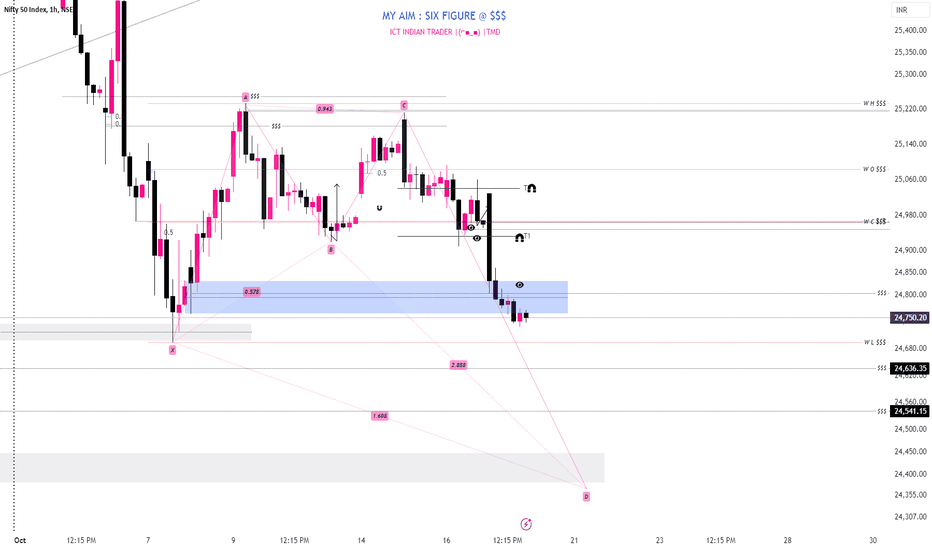

Nifty Next MoveNifty have formed harmonic pattern

we can expect a small down trend and after Rally

also the area is above 70% of the trend line formation so we can expect buyers in Discount area

📌 Please support me with your likes 🤞🏻 and comments 💬 to motivate me to share more analysis with you and share your any opinion about the possible trend of this chart with me !

Best Regards , Davis 🥰

Hit the like 🤞🏻 button to !! Motive some energy !!🥇

📌 Note :

⨻ Check the live market updates and analysis yourself before buy 📈🔺 or sell 📉🔻

⨺ Am not giving any advisory or signals its just my idea for upgrade my knowledge 📚 in trading

⨹ This is my pre and post market analysis to improve my trading journey 🚀

⨂ Am Not suggesting anyone to buy or sell ❌ am just giving my views 👀

⫸ You are responsible for your trading ✅ not me ❌ ⫷

HAPPY TRADING 🥰

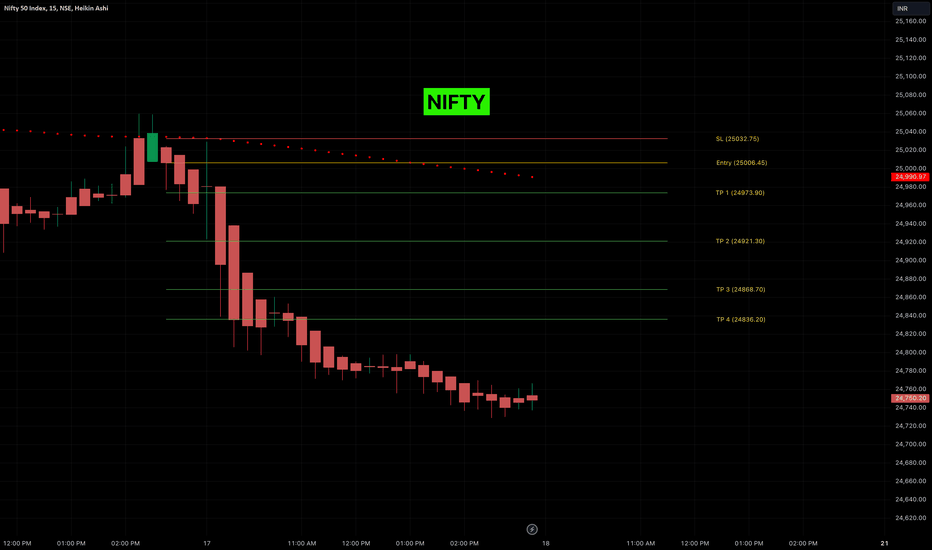

Nifty Plummets! All Targets Achieved in 15-Minute Short TradeTechnical Analysis: Nifty – 15-Minute Timeframe (Short Trade)

Nifty provided a clear short trade setup with an entry at 25006.45 on 16th October at 2:45 PM. The trade has been highly successful, with the price reaching all designated profit targets.

Key Levels

Entry: 25006.45 – The short position was initiated here following a strong bearish signal.

Stop-Loss (SL): 25032.75 – Placed above recent resistance to manage risk against a potential reversal.

Take Profit 1 (TP1): 24973.90 – The first target was quickly reached, confirming the initial bearish momentum.

Take Profit 2 (TP2): 24921.30 – Further downside pressure pushed the price to this level.

Take Profit 3 (TP3): 24868.70 – The bearish trend continued, achieving this target.

Take Profit 4 (TP4): 24836.20 – The final target, marking a complete and successful trade.

Trend Analysis

The price stayed firmly below the Risological Dotted trendline, affirming the strength of the bearish trend. The sustained selling pressure helped achieve all targets, indicating strong market momentum in favor of sellers.

The short trade on Nifty has concluded successfully, hitting all targets, with the final target at 24836.20. The precision of the entry and the guidance of the Risological Dotted trendline ensured a profitable trade.